What Causes Stock Prices To Change?

Stock prices change for a variety of reasons. Some of these reasons are intrinsic to the stock, such as its earnings and dividends, while others are extrinsic, such as changes in the market’s expectations about the company’s future performance.

In order to protect your investments, we have listed all of the intrinsic and extrinsic factors that influence stock prices. Knowing this, you will be able to make better-informed decisions with respect to your portfolio.

12 Reasons Why Stock Prices Change

1. Corporate Announcements

The stock market reacts to corporate announcements in a variety of ways, but one of the most predictable is that stock prices will rise or fall depending on the news. For example, if a company announces positive earnings results, the stock price will likely increase. Conversely, if the company announces a negative outcome, the stock price will likely fall.

This reaction is largely due to renewed interest or a loss of interest. When more people are interested in buying more of a particular stock, its price will go up. When people lose interest and sell off existing shares that they hold, the price will go down. Have detailed look at, why do stocks drop after earning.

2. Regulatory Changes

As the government imposes new regulations, it can have a direct impact on stock prices. The new regulations could change how an industry operates, what products are available, or how expensive they are. This can all lead to changes in the stock price. In some cases, the change may be small, while in others it could be significant.

It is important to remember that stock prices are always affected by many factors other than government regulation. However, when looking at a particular company or industry, it is worth considering the potential regulatory changes that could affect its performance. Keeping up with regulatory changes is an ongoing process, so vigilance is key to success in this regard.

3. Economic Conditions

Economic conditions can affect stock prices in a number of ways. They can affect the amount of money that is available to invest in stocks, the rate at which companies are able to borrow money, and how many people are selling stocks. All of these things can lead to changes in stock prices.

Some people believe that stock prices are always based on fundamentals, which means that they are always accurate reflections of a company’s true value. However, sometimes stock prices can be influenced by an extrinsic factor such as economic conditions. This is an example of an event outside of the company’s control.

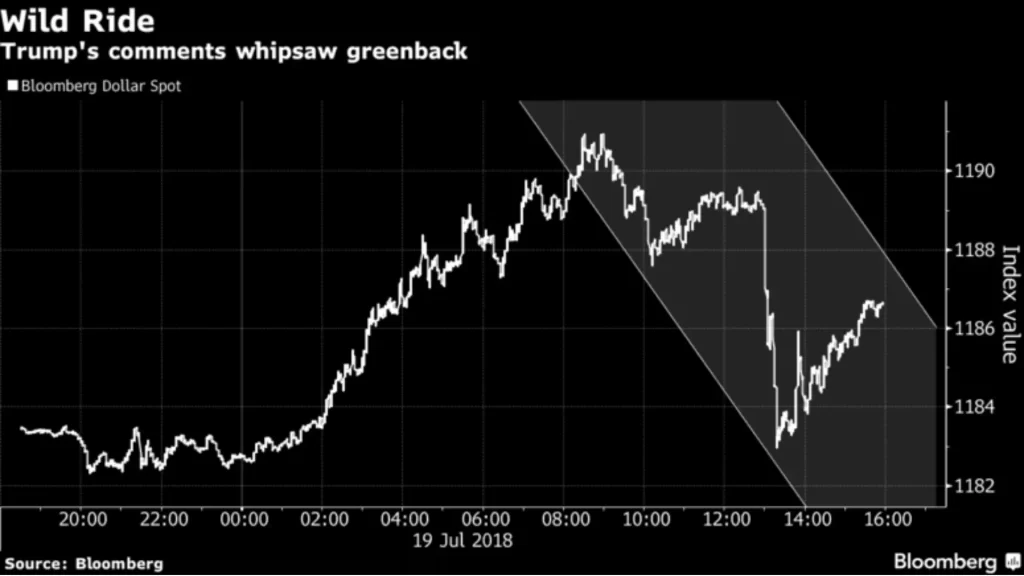

4. Political Factors

Political factors can have a significant impact on stock prices. For example, the release of economic data can influence stock prices by influencing the expectations of investors. Additionally, political events such as elections or referendums can cause stock prices to change dramatically. Political factors also play a role in the way companies are perceived by investors.

For example, if a country is experiencing political instability, its stock price may decline even if there is no actual change in the company’s performance. When there is uncertainty in the political environment, investors may not only sell stocks and but the political party may make buying stocks less accessible to buyers. Similarly, when there is a change in government, this can lead to changes in financial regulations that could affect companies’ bottom lines.

5. Company Performance / Company Earnings

When analyzing the stock market, it is important to look at company performance and company earnings. These two factors affect stock prices in a number of ways. For example, if a company is performing poorly, its stock price may be affected as investors sell off shares. Conversely, if a company is doing well, its stock price may rise. In addition, when earnings are released by one company, this information can affect the share prices of those companies that are reporting their results late. This is because investors will sell off shares of companies or groups of investment categories that have negative earnings news and buy shares of companies that have positive earnings news.

However, it’s not always easy to tell which companies will perform well and which will not. For example, a company may have good earnings but its stock price might still decline because there is competition from other companies with better performing stocks. Or a company may have poor earnings but its stock price might still increase because investors think the company has a lot of potential for growth. So it’s important to be patient when investing in stocks.

6. The Amount of Available Supply and Demand

The amount of available supply and demand affects stock prices in two ways. First, when there is more available supply, the price of a stock will go down because there are more shares of stocks competing for buyers. Conversely, when there is less available supply, the price of a stock will go up because there are fewer stocks competing for buyers.

The second way that available supply and demand affects stock prices is through its effect on interest rates. When interest rates are low, people are more likely to borrow money to buy stocks because the return on investment is higher than when interest rates are high. When interest rates rise, stock prices tend to fall because people become less willing to borrow money to invest in stocks.

7. Investor Sentiment

Investors often make investment decisions based on their assessments of the stock market’s outlook. This is especially true for day-traders and other inexperienced investors. In any case, regardless of what type of investor you are, it is important to understand the effect that investor sentiment has on stock prices.

When investors are optimistic about the future of a company, they are more likely to buy its shares. Conversely, when investors are pessimistic about a company’s prospects, they are less likely to buy its shares. The impact of investor sentiment on stock prices is often called ‘the mood effect.’ The mood effect can be magnified by technical indicators, which are statistical measures of a stock’s price movement. When these indicators show positive momentum (i.e., rising prices), positive investor sentiment may cause more people to invest in the stock, which further boosts prices. When it shows negative momentum, negative investor sentiment may cause more people to dump the stock, further letting it crash.

8. Economic News

Economy news can affect stock prices in a variety of ways. For example, if there are rumors of a recession, stock prices may go down because investors may believe that the company’s profits will be lower. Conversely, if the economy is doing well, stock prices may go up. Other factors that can influence stock prices include government actions (such as raising or lowering taxes) and international events (such as wars).

Economic news can have a significant impact on stock prices, as investors make decisions about whether or not to buy or sell shares based on what they believe the future holds. It is important to note that stock prices are always dynamic and will fluctuate based on a number of different factors, including economic news. Consequently, it is important for investors to stay up-to-date with the latest economic developments in order to make sound investment decisions.

9. Insider Leaks

When an insider leaks information to the public, it can have a big impact on stock prices. It is typically when a company’s executives or directors know about upcoming bad news before the rest of the public, and choose to disclose it to their family, who may, in turn, post on social media about it. Insider leaks are thought to be relatively rare occurrences, but when they do occur they can have a big impact on the market.

For example, when verified insiders leak information to the press or other interested parties, this triggers a “flash crash” in stock prices as traders rush to sell before the news makes its way to mainstream media. This is because traders generally assume that any negative leaked news about a company will lead to a sharp decrease in stock prices. They are often right. The market reaction to insider leaks can be unpredictable and often chaotic, which can have far-reaching consequences for both individual investors and entire industries.

10. Analyst Ratings / Financial Analysts’ Predictions

In the financial world, analysts are a big deal. The more positive ratings they predict, the higher the stock prices will tend to be. Conversely, if an analyst’s rating for a stock is downgraded, it can have a negative impact on the stock price. So far, so standard. However, what happens when analysts begin issuing predictions?

The answer to this question is one of the main reasons why stock prices are so closely correlated with analyst ratings and predictions. When an analyst issues a prediction for a particular company or security, it becomes part of the public record and other investors will start to weigh in on whether or not they believe that prediction. And since analysts generally rate stocks based on their own expectations and judgments – not on objective factors like future earnings – their assessments can easily become self-fulfilling prophecies.

11. Inflation

The stock market is sensitive to inflation. When prices increase, the value of a company’s shares may become less valuable. Conversely, when prices decrease, the value of a company’s shares may increase. Inflation affects stock prices by changing the amount of money that people are willing to spend on goods and services.

When inflation is high, people are more likely to spend their money on items such as food and gasoline, which will drive up the prices of these items. This will then cause businesses to raise their prices, which will in turn affect the value of stocks. Conversely, when inflation is low, people are more likely to save their money instead of spending it on items such as food and gasoline. This will drive down the prices of these items, which will in turn have little effect on the stock market. This will also leave spare cash on the table for investors to buy more stock.

12. Recession

When the economy enters a recession, businesses and consumers pull back on spending, which can lead to a decline in economic activity. This can cause companies to lay off workers or reduce production. In turn, this can lead to an overall decline in stock prices as investors sell off assets that are seen as less valuable.

The effects of a recession on stock prices vary from company to company and from country to country. However, overall it is generally true that stock prices will decline during a recession and take longer to recover than they would if the economy were expanding.

Conclusion

In conclusion, the factors that cause stock prices to change are many and complex. However, there are some key drivers that can affect stock prices, including economic indicators, company performance, and global events. Understanding these factors can help you better predict when and how stock prices will change.

Whatever the reason for the price change, it’s important to stay up to date and always keep track of what’s going on in the market so you can make informed investment decisions.