Make Your Portfolio Work Harder: Add Real Estate for Stability

If you want to maximize your investment potential, adding real estate to your portfolio is a great way to do it. Property values in some markets are always going to be higher than others, so by investing in multiple markets you’re able to take advantage of this fact. Additionally, real estate provides stability for your portfolio in the event that the stock market goes down.

Even if the stock market falls, real estate will usually go up. This gives you some stability in your portfolio.

Why Invest in Real Estate?

There are a number of reasons why people may choose to invest in real estate. Firstly, real estate is a tangible asset that typically maintains or increases in value over time. This makes it a relatively stable investment, which can be appealing to investors looking for stability and security in their portfolio. Additionally, real estate can offer investors a number of tax benefits, such as depreciation and tax-free capital gains. Also have a look, how to invest in real estate.

Some people invest in order to generate passive income, while others invest in order to build long-term wealth. Real estate is a unique investment because it offers both stability and potential for growth. In addition, real estate investments tend to be less volatile than other types of investments, making them a more stable option for investors.

Types of Real Estate

Types of real estate can be classified according to their physical and legal characteristics. The most common classification of real estate is by its use: residential, commercial, or industrial. Real estate can also be classified by its ownership: public, private, or cooperative. Finally, real estate can be classified by its stage of development: raw land, underdeveloped land, developed land, and built property. Each type of real estate has unique features and benefits that make it appropriate for certain purposes.

Category 1

a. Residential Real Estate

Residential real estate encompasses the buying and renting of homes. It can be a complex process, with many legal and financial considerations to take into account. The most important factor to consider when buying or renting a home is your budget. You need to make sure you can afford the monthly mortgage or rent payments, as well as other associated costs, such as homeowners’ insurance and property taxes.

When buying a home, you also need to think about the location and size of the property.

b. Commercial Real Estate

Commercial real estate generally refers to the renting of office and retail space for business purposes. This can include anything from a small local business to a large corporation. Commercial real estate can be a very lucrative investment, but it is also important to do your research before making any commitments. There are a number of factors to consider when looking at commercial properties, such as the location, the size of the building, and the availability of parking.

c. Industrial Real Estate

Industrial real estate is an investment in buildings that are used for industrial purposes. This can include renting warehouses and factories. It is a type of real estate that is used for businesses that need a lot of space to operate. This can include things like manufacturing or storage. Industrial real estate is often in areas that are zoned for industrial use, which means that there are specific rules about what can be done there.

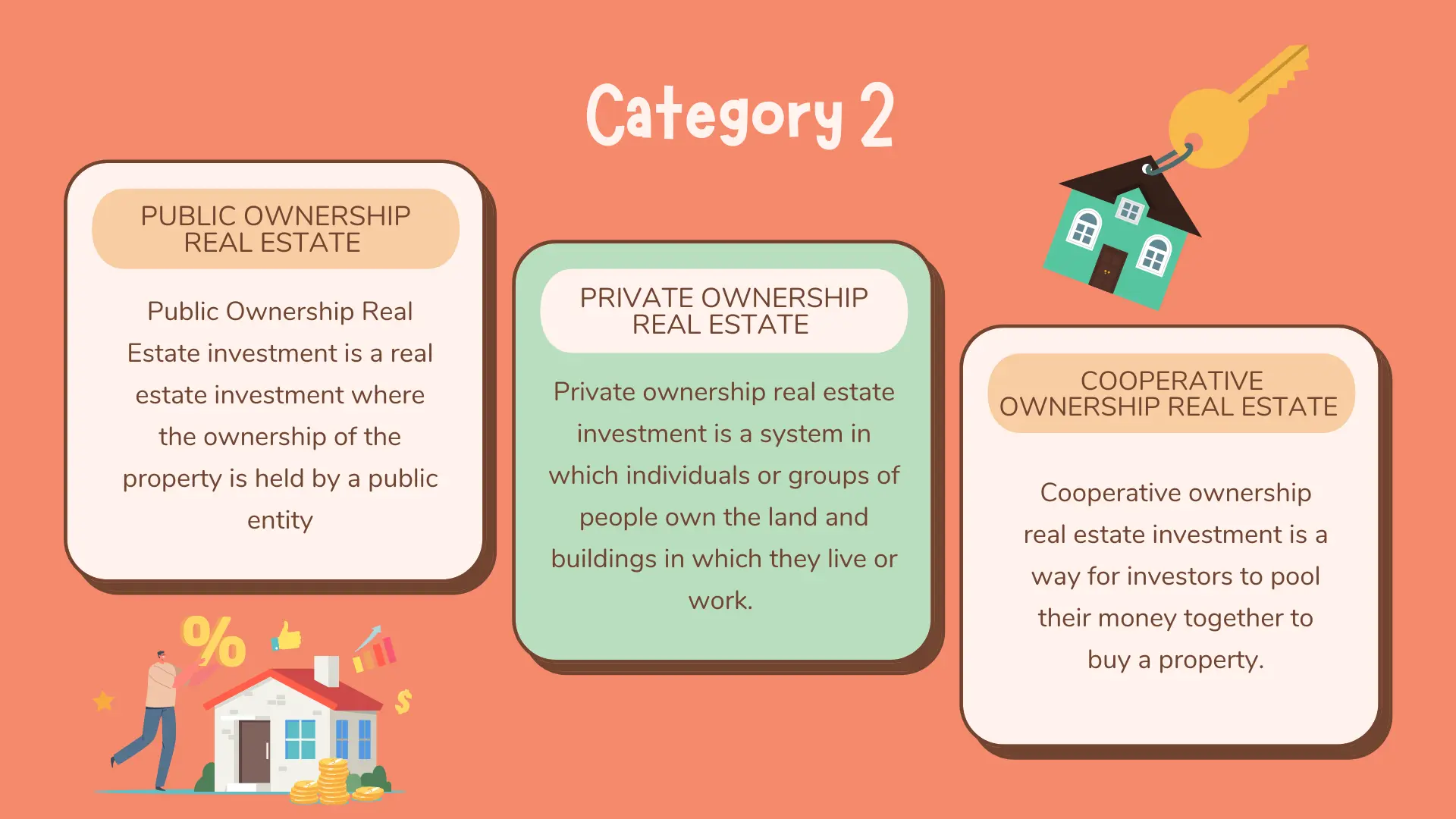

Category 2

a. Public Ownership Real Estate

Public Ownership Real Estate investment is a real estate investment where the ownership of the property is held by a public entity, such as a government body or state-owned enterprise. This differs from private ownership real estate investment, where the ownership of the property is held by a private entity, such as a company or individual. Public ownership real estate investment can be used to achieve a number of different goals, such as creating affordable housing, stimulating economic growth, or generating revenue for the government.

This type of investment is usually made through a government agency or a public trust. Individuals can tap into these and get long-run benefits.

b. Private Ownership Real Estate

Private ownership real estate investment is a system in which individuals or groups of people own the land and buildings in which they live or work. This system contrasts with public ownership, in which the government owns the land and buildings. Private ownership is thought to promote economic efficiency by providing an incentive for owners to manage their property well and to make investments that will improve its value. It also allows people to use their property as they see fit, within the bounds of the law.

c. Cooperative Ownership Real Estate

Cooperative ownership real estate investment is a way for investors to pool their money together to buy a property. This type of investment allows investors to share in the profits and losses of the property, and it can be a way to get into the real estate market without having to invest a lot of money. Cooperative ownership investments can also provide tax benefits for investors.

This type of investment can be a good option for investors who want to pool their resources to purchase a property, but it can also be more complicated to manage than other types of real estate investments.

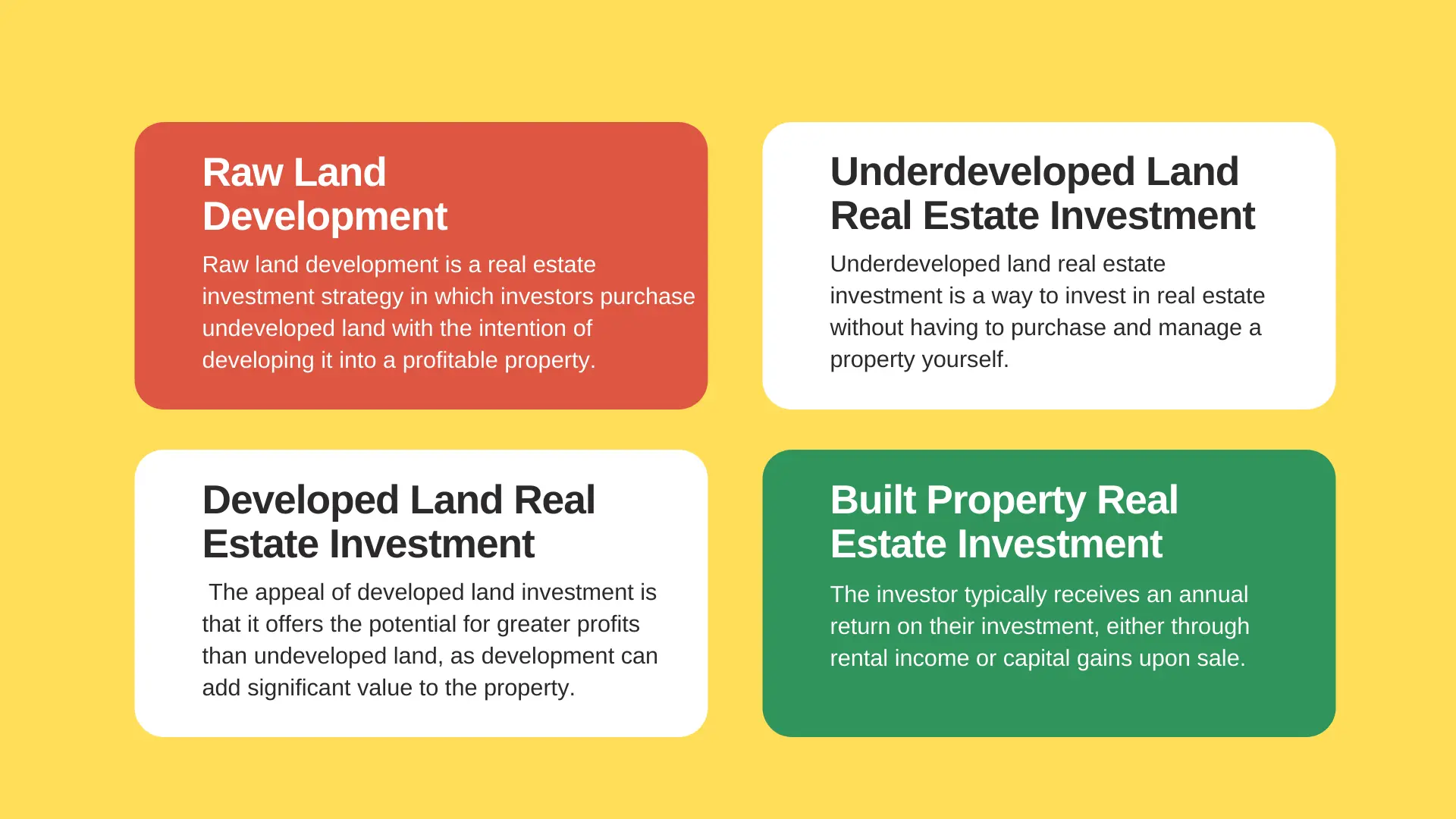

Category 3

a. Raw Land Development

Raw land development is a real estate investment strategy in which investors purchase undeveloped land with the intention of developing it into a profitable property. This can involve anything from constructing new homes or businesses to simply marketing and selling the land for a higher price than what was paid. Raw land development can be a very profitable venture, but it also carries a high level of risk, as there is no guarantee that the land will be successfully developed or that it will sell for a profit.

b. Underdeveloped Land Real Estate Investment

Underdeveloped land real estate investment is a way to invest in real estate without having to purchase and manage a property yourself. Investors buy undeveloped land, often in rural areas, and wait for the value to appreciate before selling. This type of investment can be risky, as the appreciation rate for undeveloped land varies greatly depending on the location and the current market conditions. However, if done correctly, undeveloped land can be a very profitable investment.

c. Developed Land Real Estate Investment

Developed land is a form of real estate investment in which the investor purchases land that has been or is planned to be developed into something else, such as a residential or commercial property. The appeal of developed land investment is that it offers the potential for greater profits than undeveloped land, as development can add significant value to the property. A developed property mostly has an unfinished building on it.

Many developed land investments offer tenants or buyers who are already lined up, which minimizes the risk associated with developing the property oneself.

d. Built Property Real Estate Investment

Built property real estate investment is an investment in commercial or residential property that has been constructed by a developer for the purpose of generating a return on investment. The property may be leased, rented, or sold to a tenant or buyer. The investor typically receives an annual return on their investment, either through rental income or capital gains upon sale.

The best type of real estate investment depends on your goals and circumstances.

How to Add Real Estate to Your Portfolio

One way to add physical real estate to a portfolio is by investing in property. Property can be acquired through direct purchase, or through a pooled investment such as a real estate investment trust (REIT). Real estate offers the potential for both income and capital appreciation, making it a desirable investment. Additionally, real estate is a tangible asset that can offer portfolio stability during times of market volatility.

What Is a Real Estate Investment Trust (REIT)

A real estate investment trust (REIT) is a company that owns and manages commercial properties. REITs are required to pay out at least 90% of their taxable income to shareholders, which makes them attractive to income-oriented investors. REITs are traded on stock exchanges, and many offer investors the ability to buy shares directly or through an ETF. Have a look, how to invest in real estate investment trust.

What Are the Different Types of REITs?

There are three types of REITs: equity, mortgage, and hybrid. Equity REITs own properties and generate income from rent paid by tenants. Mortgage REITs hold mortgages on property and generate income from the interest paid on those mortgages. Hybrid REITs own properties and hold mortgages on property.

Should You Go with Physical Real Estate or a REIT?

There are a few advantages of owning physical real estate over a REIT. Firstly, with physical real estate, you get the opportunity to customize the property to your specific needs, which a REIT may not be able to do. Secondly, you have more control over the property and its management if you own it yourself. Thirdly, you can potentially earn more money from rent if you own the property outright than if you were to invest in a REIT.

Conversely, there are also a few advantages of a REIT over physical real estate. One is that a REIT offers liquidity, meaning that an investor can sell their shares in the trust at any time. This is not the case with physical real estate, which can take months or even years to sell. Another advantage is that a REIT is much more tax efficient than owning physical real estate.

As such, there are a few things to consider when deciding if you should go with physical real estate or a REIT. The first is what your goals are for your investment. Are you looking to invest in property and have a hands-on role in managing it, or are you looking for stability and income? Do you have enough money to spare?

If you have a lot of extra cash to spare, you may invest in physical real estate. This will very likely appreciate over time, but it may take up to a decade to do so. If you are just starting out, and may need to pull out invested funds now and then, then, you may go with a Real Estate Investment Trust.

Benefits of a Real Estate Investment

The benefits of a real estate investment are many. Below are some of them:

1. Cash flow: The cash flow generated through a real estate investment is one of the main benefits of investing in this asset class. The cash flow can be used to pay for expenses such as property taxes, insurance, and repairs, as well as to provide a stream of income for the investor. In addition, the appreciation of the property over time can provide a significant return on investment.

2. Tax benefits: When a person invests in real estate, they are able to take advantage of certain tax benefits. These benefits can include things such as the ability to write off losses on the investment, the ability to deduct interest paid on a mortgage, and the ability to exclude gain from the sale of a property from taxable income. All of these benefits can help to reduce the amount of taxes that an investor pays, which can make investing in real estate more profitable.

3. Appreciation: When an individual invests in a piece of real estate, they are able to benefit from appreciation. Appreciation is the increase in the value of a property. When the property is sold, the investor will earn a profit based on the difference between the purchase price and the sale price. This profit can be used to reinvest in additional properties or it can be distributed to the investor as dividends.

4. Diversification: One benefit of investing in real estate is diversification. This means that your investment is not tied to the success or failure of a single company or industry. Instead, by owning a variety of different real estate investments, you can spread your risk and protect yourself from downturns in any one market. Additionally, real estate tends to be a stable investment that delivers consistent returns over time, making it a valuable addition to any portfolio.

5. Liquidity: Liquidity is a benefit that comes with investing in real estate. It means that an investor may be able to quickly convert their investment into cash, which is not always the case with other types of investments. This liquidity can be helpful if the investor needs to access their funds quickly or if they want to take advantage of an opportunity that arises.

6. Control: The benefits of owning real estate are many and varied, but one of the most important may be the control it gives investors over their financial future. Real estate is a physical asset that typically appreciates in value over time, providing a predictable stream of income and potential capital gains. It is also a relatively safe investment, with a low correlation to the stock market, making it a desirable addition to any portfolio. In addition, real estate can offer tax advantages and deductions that can further improve returns.

7. Increased income: The increased income derived from a real estate investment is a direct result of the appreciation in value of the property. The investor stands to gain from both the rental income generated by the property as well as any increase in the value of the property. This increased income can be seen as a benefit of investing in real estate.

8. Leverage: Leverage is the use of borrowed money to increase the potential return on an investment. In real estate, investors can use leverage to purchase a property with a small down payment and then borrow the remaining money from a lender. This allows investors to buy more property with less money out of pocket, which can lead to higher profits if the property increases in value. Additionally, using leverage can help investors achieve a higher rate of return on their investment since they are not risking as much money.

9. Savings: When an individual invests in real estate, they are able to accrue a number of benefits, one of which is the ability to save money. By owning property, the individual is able to reduce their monthly expenses, as they no longer need to pay rent or a mortgage. Additionally, the individual can often earn income from the property, through rent or other means, which can further offset costs. Thus, real estate investments provide a number of benefits that can help the individual save money.

10. Amortization: When an individual or company buys a property and leases it to a tenant, they will generally begin to see profits right away. However, the full benefits of owning the property may not be realized until the mortgage on the property is paid off. This process of gradually paying down a loan using a portion of each month’s rent payments is called amortization. Amortization is one of the main benefits of owning real estate, as it allows investors to steadily increase their income over time.

Conclusion

Invest in real estate for stability, diversify your assets, keep your portfolio balanced, don’t put all your eggs in one basket, and make your portfolio work harder.

When it comes to personal finance, a well-diversified portfolio is key. This means having a variety of assets in order to protect your money against market fluctuations. One way to bolster your portfolio is by adding real estate investments. Real estate is a stable asset that has historically held its value even during times of economic turmoil.

There are a number of ways to get involved in the real estate market, from buying property outright to investing in real estate funds or trusts.

Whatever route you choose, be sure to do your research and talk to an expert about the best way to add real estate to your portfolio.

By adding real estate, you can give your portfolio the stability it needs to weather any storm. By implementing a real estate strategy, you can improve the performance of your entire portfolio.