Pros and Cons of Dividend Stocks

Stocks that pay dividends are often considered a desirable investment because they offer a monthly, quarterly, bi-annual, or an annual return on investment (ROI) and the potential to grow your money over time. However, there are also pros and cons to dividend stocks, so it’s important to understand what you’re getting into before making a decision.

In this article, we will show you the also some pros and cons to consider before choosing this type of stock.

What Are Dividend Stocks?

A dividend stock is a type of security that pays out a portion of its earnings to shareholders in the form of dividends. The dividends are typically paid on a quarterly or annual basis, and the amount paid out depends on a number of factors, including the company’s earnings and the amount of cash on hand.

Dividend stocks can be a great way to generate income, especially in today’s low bank interest rate environment. They can also be a good way to build wealth over time, as they typically provide steady returns and tend to outperform other types of investments over the long term.

There are a number of different ways to invest in dividend stocks, including buying individual shares or investing in mutual funds or exchange-traded funds (ETFs) that focus on this asset class.

Why Many Investors Prefer Dividend Stocks

The most common reason investors prefer dividend stocks is the belief that they offer more stability and security in comparison to non-dividend paying stocks. Many people believe that companies that pay dividends are less risky because they are more likely to have a steady stream of cash flow coming in.

Another benefit of dividend stocks is that they can be a sign of financial stability for a company. Dividends can be paid out only if the company has strong cash flow and is profitable. Therefore, investors may see dividends as a sign that the company is in good financial shape and is likely to continue paying dividends in the future.

Additionally, dividends regular income stream that can help smooth out volatility in a portfolio. Furthermore, reinvesting can help turbocharge an investor’s returns over time.

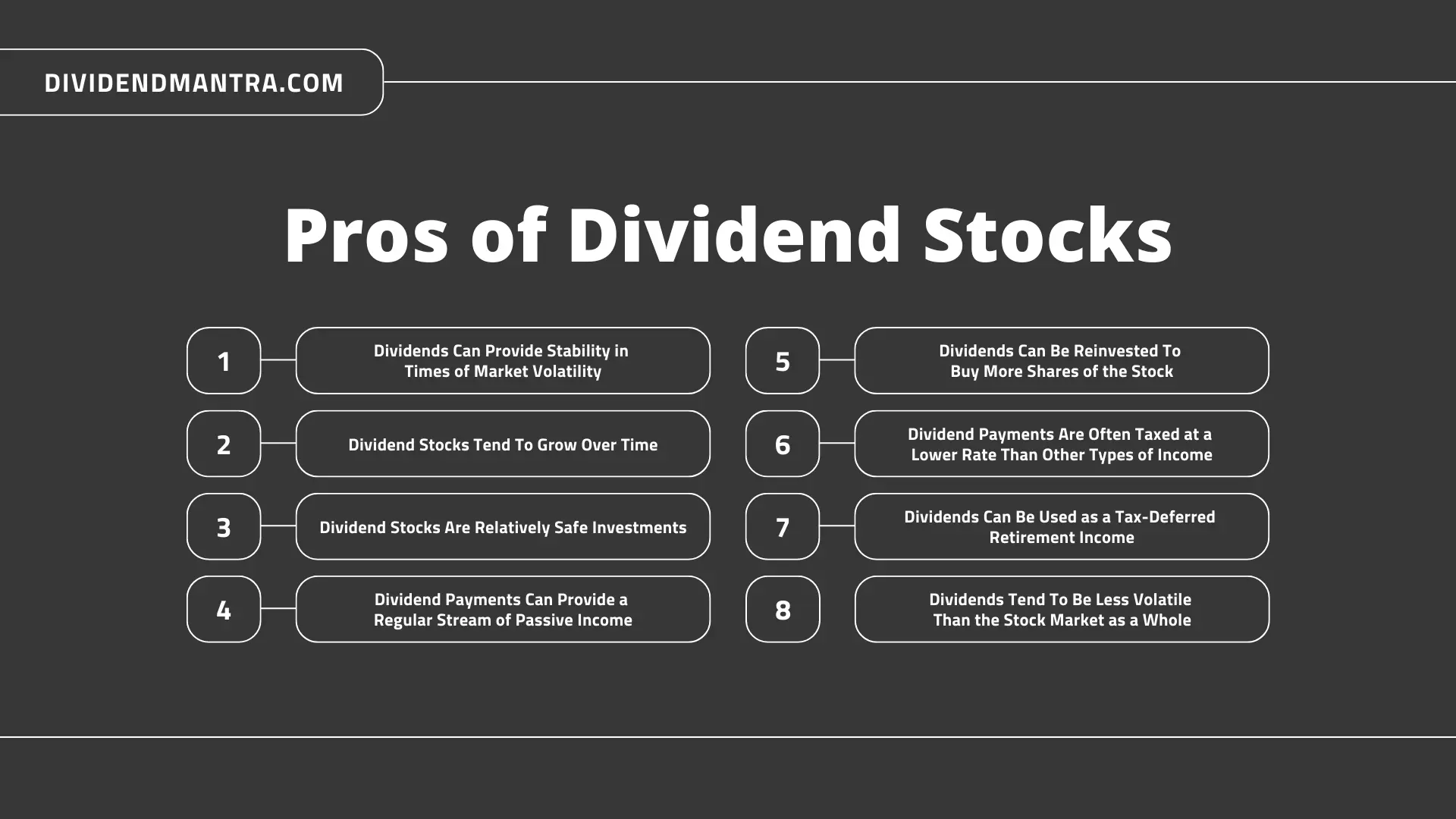

Pros of Dividend Stocks

There are a number of reasons why dividend stocks can be a wise investment. They are listed below:

1. Dividends Can Provide Stability in Times of Market Volatility

When the stock market is volatile, some investors turn to dividend stocks for stability. Dividends can provide a consistent income stream, which can help reduce volatility in one’s portfolio. In times of market turmoil, dividend-paying stocks may be less likely to decline in value than non-dividend stocks. This is because dividend payments are a sign of a company’s financial stability and health. Additionally, many dividend-paying stocks offer attractive yields, which can provide further stability to one’s portfolio.

2. Dividend Stocks Tend To Grow Over Time

There is a great deal of evidence to suggest that dividend stocks tend to grow over time. Historically, companies that have paid dividends have outperformed those that have not. This may be because investors see dividends as a sign of financial stability and are more likely to invest in companies that offer them. Additionally, research shows that companies that increase their dividends tend to outperform those that do not. All of this suggests that dividend stocks are a good investment choice for long-term growth.

3. Dividend Stocks Are Relatively Safe Investments

Dividend stocks are a relatively safe investment. Companies that offer dividends typically have strong balance sheets and are able to generate consistent cash flow. This allows them to pay out cash to shareholders while still investing in their businesses. As such, dividend stocks are typically seen as safer, more reliable investments than those that do not offer dividends. As mentioned earlier, this is because dividend-paying companies generally have a stronger financial position and are seen as less risky by investors.

4. Dividend Payments Can Provide a Regular Stream of Passive Income

Dividend payments can provide a regular stream of passive income, which can be helpful for retirees or others who are seeking to supplement their income. Dividend-paying stocks tend to be less risky than those that don’t pay dividends, and they can offer a steady income even in tough markets. In addition, dividends can provide a hedge against inflation. While stock prices can go up and down, dividend payments typically remain stable, providing investors with a reliable source of passive income.

5. Dividends Can Be Reinvested To Buy More Shares of the Stock, Which Can Lead to Increased Earnings Over Time

When you receive a dividend payment from a stock you own, you have the option of reinvesting that payment to buy more shares of the same stock. This can be a good way to increase your earnings over time, as the dividends you earn on those additional shares will also be paid back to you. When dividends are reinvested, the shareholder buys more shares of the company’s stock with the dividend money. This can lead to increased earnings over time as the shareholder owns more shares of the company and participates in its growth. Additionally, companies often offer a discount on shares purchased through dividend reinvestment programs, which can further increase earnings. In addition, if the company’s stock price rises over time, your earnings will rise as well.

6. Dividend Payments Are Often Taxed at a Lower Rate Than Other Types of Income

Dividend payments are often taxed at a lower rate than other types of income. This is a pro of dividend stocks, as investors can keep more of their money if they earn dividends. The lower tax rate on dividends can be especially beneficial for retirees, who may be in a higher tax bracket than other investors. It is widely believed that the reason why dividend payments are often taxed at a lower rate is that the government wants to encourage people to invest in these stocks. This tax benefits of dividend payments have made them increasingly popular among investors in recent years.

7. Dividends Can Be Used as a Tax-Deferred Retirement Income

When it comes to saving for retirement, there are a few different options to choose from. One of those options is dividend stocks. These dividend stocks can be used as a tax-deferred retirement income. When a company pays dividends to its shareholders, those dividends are taxed as regular income. However, shareholders can elect to have those dividends reinvested in the company, and that reinvestment is not taxed as income. In addition, any capital gains realized when the shares are sold are also not taxed as income. This makes dividends a valuable way to save for retirement, since both the regular income and the capital gains are deferred until the shares are actually sold. Dividends can also be reinvested, which can help boost the overall value of your retirement nest egg over time.

8. Dividends Tend To Be Less Volatile Than the Stock Market as a Whole

Dividends have a tendency to be less volatile than the stock market as a whole. For example, between 2007 and 2017, dividends remained stable while the S&P 500 Index had a total return of negative 2%. This is because dividends are paid out of after-tax profits, so they are less susceptible to swings in the company’s fortunes. In addition, cash dividends provide a steadier income stream for investors than price appreciation alone. So, investors looking for lower volatility should consider dividend stocks.

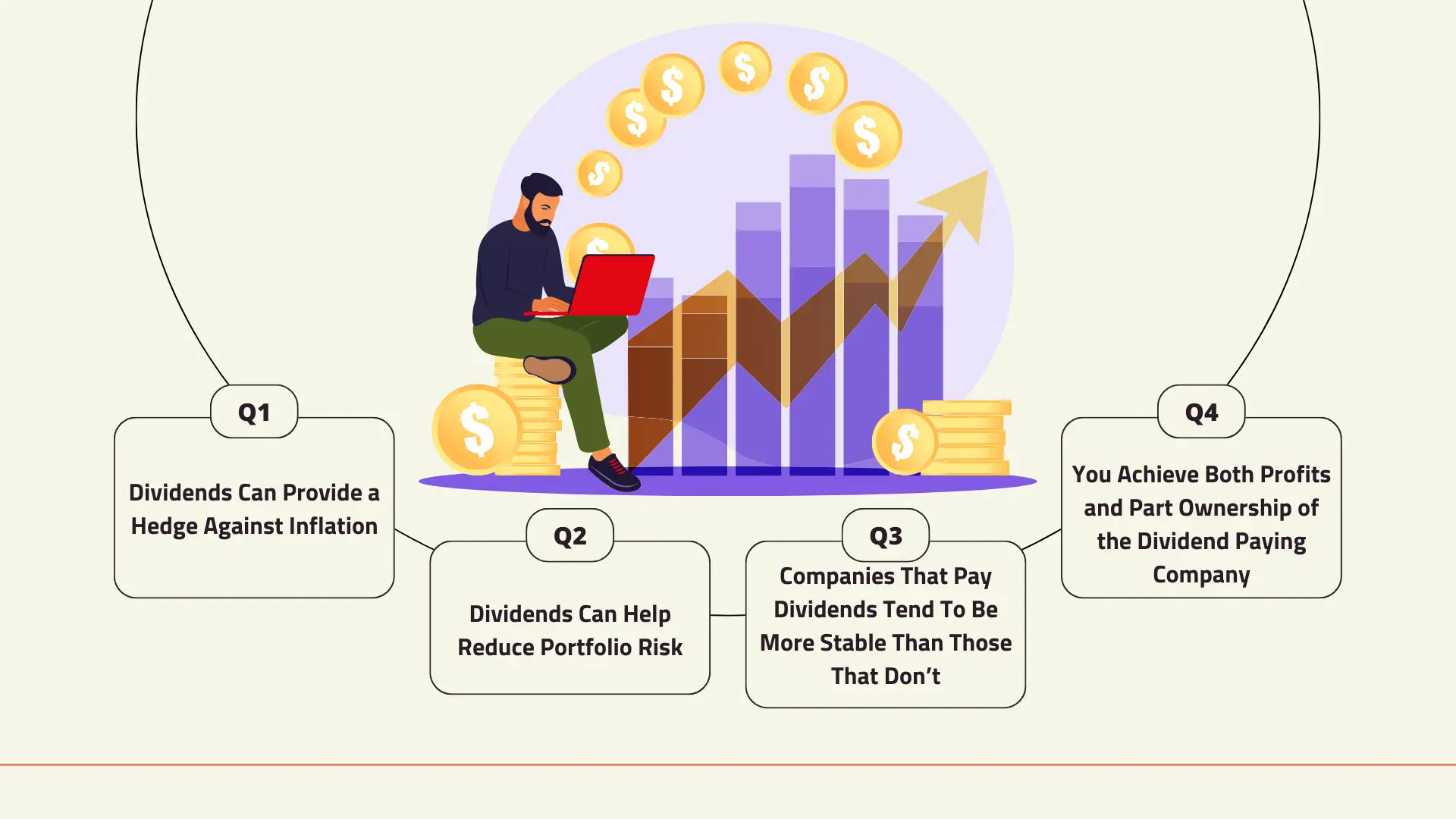

9. Dividends Can Provide a Hedge Against Inflation

Inflation is always a risk for investors, as it can erode the value of their holdings over time. However, dividends can provide a hedge against inflation, as they offer a regular stream of income that can help to preserve purchasing power. As we mentioned above,dividend stocks tend to be less volatile than other types of securities, and they can also be a source of long-term growth potential. For these reasons, dividend stocks can be a valuable part of any investment portfolio.

10. Dividends Can Help Reduce Portfolio Risk

When you’re looking to reduce the risk in your portfolio, adding dividend stocks can be a great way to do it. Dividends can help cushion your portfolio against market downturns, since they provide a regular stream of income even when the stock market is falling. Additionally, dividend stocks tend to be less risky than non-dividend stocks, meaning they’re less likely to lose value in a down market. This is because dividend stocks are typically more established and have a lower beta, or volatility, than other types of stocks. This makes them a more stable investment option that can help you weather choppy markets.

11. Companies That Pay Dividends Tend To Be More Stable Than Those That Don’t

A study by the National Bureau of Economic Research (NBER) found that dividend-paying stocks suffered less during the financial crisis of 2008 and 2009 than non-dividend payers. The NBER study also found that dividend-payers are less likely to default on their debt. Other studies have shown that dividend-paying stocks outperform non-dividend payers over the long term. For example, a study by Dimensional Fund Advisors (DFA) found that, from 1972 to 2011, dividend-payers outperformed non-payers by 2.5 percentage points per year.

12. You Achieve Both Profits and Part Ownership of the Dividend Paying Company

When you buy a dividend paying company, you achieve both profits and part ownership of the company. You can think of it as receiving two benefits for the price of one investment. The first benefit is the profits you earn from the company’s operations. The second benefit is the periodic payments, or dividends, that the company pays to its shareholders. For these reasons, dividend stocks should be a part of any long-term investment plan.

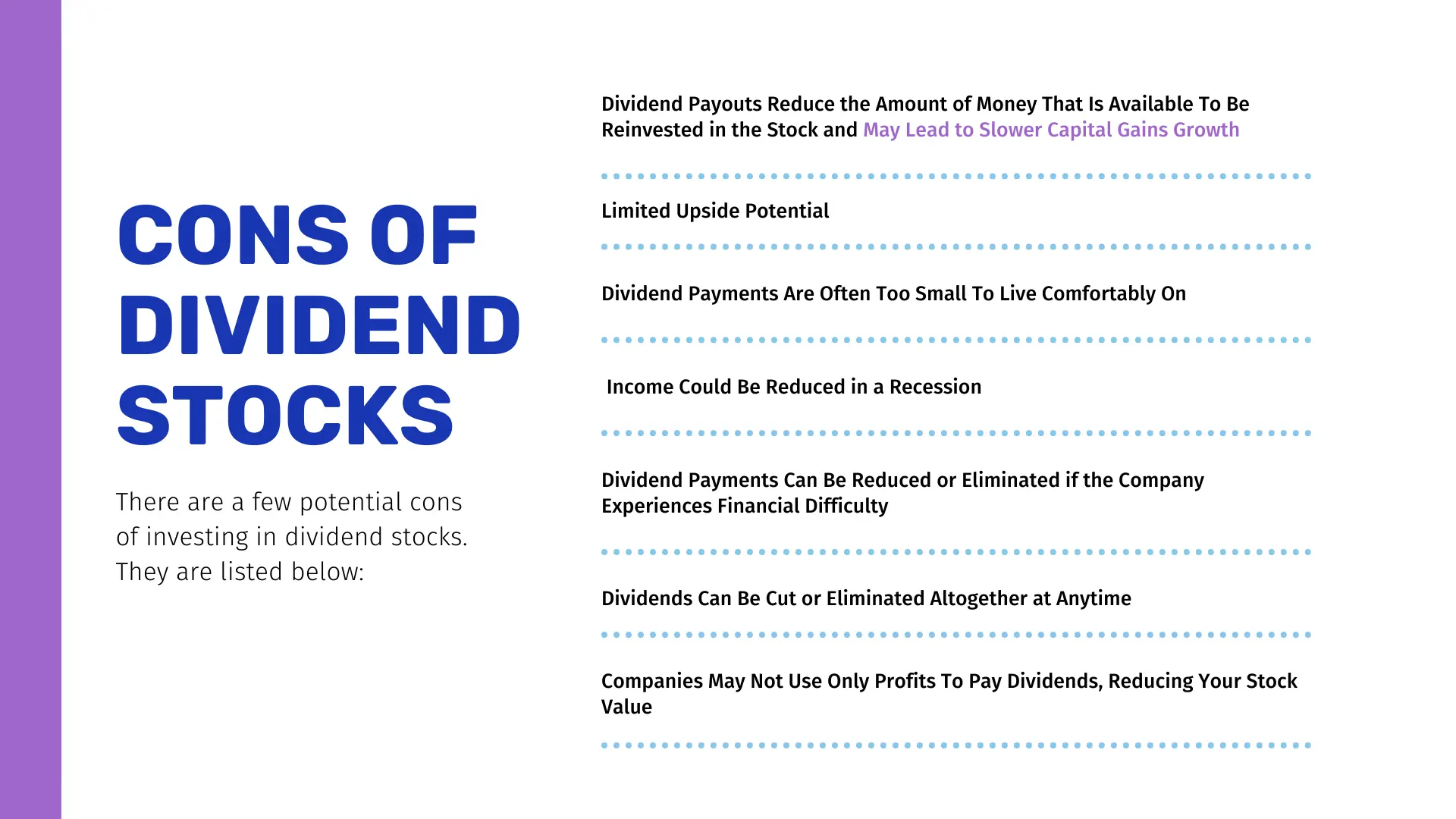

Cons of Dividend Stocks

There are a few potential cons of investing in dividend stocks. They are listed below:

1. Dividend Payouts Reduce the Amount of Money That Is Available To Be Reinvested in the Stock and May Lead to Slower Capital Gains Growth

When a company pays dividends to its shareholders, it reduces the amount of money that is available to be reinvested in the stock. This can lead to slower capital gains growth and may make it more difficult for a company to increase its stock price. Some investors believe that this is a disadvantage of dividend stocks.

2. Limited Upside Potential

When it comes to dividend stocks, one key thing to remember is that the dividend payment is usually tied to the stock price. In most cases, if the stock price increases, the dividend payment will also increase. However, there is a limit to how much the dividend can increase. For example, if a company has a policy of only increasing the dividend by 0.3% each year, no matter how high the stock price rises, then the upside potential for that particular investment is limited.

3. Dividend Payments Are Often Too Small To Live Comfortably On

Dividend payments from stocks are often too small to live comfortably on, especially when you factor in the cost of living increases over time. This can be a con of dividend stocks for investors who are looking for a reliable stream of income. In addition, many dividend payments can be sporadic, and the amount paid out from these kinds of dividend stocks can vary from year to year. This makes it difficult to plan for retirement or other long-term financial goals.

4. Income Could Be Reduced in a Recession

When the markets are booming, dividend stocks outperform. However, when the economy goes into a recession, income from dividend stocks could be reduced. This is because a recession causes companies to cut their dividends to preserve cash. As a result, investors in dividend stocks may see their income decline during a recession.

5. Dividend Payments Can Be Reduced or Eliminated if the Company Experiences Financial Difficulty

This is a con of dividend stocks because it’s not guaranteed that you’ll receive the dividend payments that you expect. If the company is in financial trouble, it may have to reduce or eliminate its dividend payments in order to save money. This can be frustrating for investors who are counting on those payments.

6. Dividends Can Be Cut or Eliminated Altogether at Anytime

When a company declares a dividend, that payment is a contractual obligation to shareholders. However, the company can always choose to reduce or eliminate its dividend payments altogether. This leaves investors out of pocket and at the mercy of the company’s management. Such a move, although unlikely, can have a significant impact on investors. For one, it can erode their share value since a key attraction of dividend stocks is the regular payment of dividends. It can, as such, also leave investors with less money to reinvest in other stocks or businesses.

7. Companies May Not Use Only Profits To Pay Dividends, Reducing Your Stock Value

When you buy a dividend stock, you are buying a piece of the company that pays you back in the form of regular, quarterly payouts. These payments can be a great way to generate income and build your wealth over time. However, there is a downside to dividend stocks: companies may not use all of their cash to pay dividends, reducing your dividend value. For example, in 2018 General Electric paid out $4.5 billion in dividends, but only generated $3.2 billion in free cash flow (FCF). This means that the company had to use $1.3 billion from its cash reserves to finance its dividend payments. This isn’t an isolated case; many companies pay out more in dividends than they generate in FCF. This erodes stock value rather rapidly in most cases.

8. Dividend Payments Can Be Increased by Dividend Holders With Voting Rights, Which May Not Be in the Best Interest of the Company

The dividend payments that a company makes to its shareholders can be increased by the shareholders who hold the voting rights. As in the example above, this may not be in the best interest of the company, as it could lead to a decrease in the value of its stock. When a company pays a dividend, it is essentially saying that it is not reinvesting its profits back into the business and that it is giving up some of its ownership in order to pay out these dividends. If the dividend payments are increased by the shareholders with voting rights, this could lead to a situation where the company is no longer able to invest in its own growth and could see its stock price decline as a result.

9. Dividend Stocks May Not Provide the Growth Potential of Other Types of Stocks

One disadvantage of dividend stocks is that they may not provide the same growth potential as other types of stocks. For example, a technology stock may grow much faster than a dividend stock, simply because the technology sector is growing at a faster pace. Similarly, a growth stock may have more potential for capital appreciation than a dividend stock. This means that investors who are looking for rapid growth may be better off investing in other types of stocks rather than dividend stocks.

10. Dividends May Not Be As Reliable as Interest Payments From Bonds

While dividends may be a more reliable form of income than the sporadic payments made by most businesses, they are not as reliable as the steady interest payments received from bonds. For one, dividend payments can be reduced or eliminated altogether if the company experiences financial difficulty. In addition, even if a company does continue to pay its dividends, they may not keep up with rising prices, which can erode the purchasing power of your investment over time. Finally, because stock prices fluctuate more than bond prices, you may end up selling your shares for less than you paid for them – and miss out on any potential price appreciation.

11. Dividend Stocks May Be More Sensitive to Interest Rate Changes Than Other Types of Stocks

Dividend stocks may be more sensitive to interest rate changes than other types of stocks. This is because when interest rates rise, the dividend payments that these companies make become less valuable to investors. In addition, when interest rates rise, it can become more difficult for these companies to borrow money, which can lead to a decline in their stock prices.

12. Dividend Stocks Are Usually Sector Concentrated in Utilities, Banks, and Old-Line Industry

Dividend stocks are usually sector concentrated. This is a con of dividend stocks. The three sectors that have the most dividend-paying stocks are utilities, banks, and old-line industry. These sectors make up more than two-thirds of all dividend-paying stocks. As a result, investors in dividend stocks may be overexposed to these sectors and their corresponding risks. For example, utilities are highly regulated and may not be able to increase their dividends as much as investors would like. Banks may be exposed to interest rate risk, and old-line industry may face secular challenges.

Other Things to Keep in Mind When Investing in Dividend Stocks

Dividend stocks can be a great investment choice, but there are a few other things to keep in mind when investing in them.

For one, it’s important to make sure the company is healthy and profitable enough to pay dividends consistently.

Additionally, it’s important to research the stock market and find dividend stocks that are undervalued relative to their peers.

Finally, it’s also important to have a long-term investment plan that balances many investment options and not rely too heavily on dividends for income.

How to Choose the Right Dividend Stock for You

There are a few things you should consider when choosing a dividend stock. The first is what type of investor you are. Are you looking for stability and income, or do you want to take on more risk in order to potentially earn higher returns?

Once you know what type of investor you are, you can start narrowing down your choices. Consider the company’s financial stability and its growth potential. You’ll also want to make sure the dividend payout is sustainable and that the stock is priced fairly.

Finally, always do your own research before investing in any stock, including dividend stocks. Read the company’s financial reports and listen to conference calls to get a better understanding of its business and where it’s headed.

Tips for Maximizing Your Returns from Dividend Stocks

Investing in dividend stocks is a great way to generate consistent income and maximize your returns. However, it’s important to be strategic in how you invest in dividend stocks in order to get the most out of them. Here are a few tips for maximizing your returns from dividend stocks:

Firstly, focus on high-quality companies with a history of paying dividends and increasing them over time.

Secondly, make sure the stock is trading at a fair price relative to its earnings and dividend payout ratios.

And finally, reinvest your a part of your dividends back into the stock to compound your gains over time.

Conclusion

In conclusion, dividend stocks can be a great investment for those looking for regular income and stability in their portfolio. However, it is important to do your research to find the right company and stock that fits your needs. Always consult with a financial advisor if you are unsure about what to do.

Thanks for reading!