What Have We Really Lost?

And that’s because much of this is noise. I’ve discussed many times how important it is to ignore this noise, so I try to make sure this blog is bit of a sanctuary away from all the needless media commotion. I don’t want to tell you to ignore the noise, then spout off a bunch of noise of my own. I’d be a hypocrite and I’d also be taking time away from what matters.

What matters?

Keeping your eye on the long term. Focusing on what you can control. Keeping track of companies’ fundamentals. And going about your life.

You know what doesn’t matter?

Interest rate changes. The day-to-day stock market fluctuations. The latest quote by a talking head.

However, I thought I’d take some time today to discuss the recent broader stock market pullback. And the reason why I’m choosing to do so is to perhaps put things in perspective here and show why it’s so important to focus on high-quality companies over the long haul.

Let’s get into it!

Stocks Fluctuate

So the S&P 500 index is down 4.34% from the start of the month.

Ouch, right?

Not really.

What have we lost? Have we actually lost anything at all?

Well, I haven’t lost anything. In fact, I’ve won. And I’ll show you how that works.

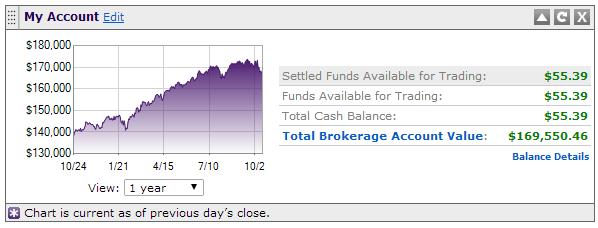

My portfolio value was $170,704.39 at the start the month. That was the value of the Freedom Fund on October 1.

If you factor out some of my recent stock purchases, my portfolio value would be $165,889.97 today. That’s a drop of 2.82% since the beginning of the month. Now, I’m not going to go on about the benefits of investing in low-beta blue chip dividend growth stocks that are defensive holdings whereby they tend to drop less than the broader stock market during pullbacks or corrections, but you can kind of see how that works here.

And I’m not really going to go on about that because it’s really not important.

What is important is that I haven’t actually lost anything at all. The market value of my securities fluctuate from day to day; I know this as an investor in stocks. Stocks fluctuate. Grass is green. The sky is blue.

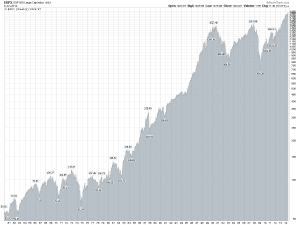

Stocks fluctuate up. They fluctuate down. However, over the long haul they tend to rise. A lot.

Source: StockCharts.com

I Still Own What I Own

But while the market value of my holdings have depreciated, I haven’t lost a dime. I’m not selling anything. I still own the same percentage of every company that I owned before this small pullback. I haven’t “lost” almost $5,000 since October started. I’ve actually “lost” $0.

I owned 100 shares of Johnson & Johnson (JNJ) before the market started to swoon. Guess what I still own? Those same 100 shares of JNJ.

That means my ownership stake in the company is still the same. A such, I still have the same claim to all future earnings and dividends.

So when JNJ pays out $0.70 per share in December, I’ll still collect the same $70.00 I was going to before Mr. Market became moody. My dividend income remains unchanged, and I consider my dividend income the true barometer of my success. If financial independence was a bar graph, my expenses would be the the entire bar and my dividend income would be the shaded area that shows how complete my journey to financial independence is. The value of my securities doesn’t factor into that at all.

And this exercise can be extrapolated out for all 51 stocks I own in my portfolio. None have cut their dividends. None have experienced any massive operational problems. They are basically the same as they were a month ago. Perhaps an argument could be made that some of the companies in the energy sector have experienced changing fundamentals over the last month or so as oil prices have dropped, but these aren’t the only stocks that have dropped in value lately.

Stocks are stocks. But businesses are businesses. Stocks may fluctuate up and down in price, but the ownership stakes these shares represent and the value of those stakes do not. Furthermore, large multinational companies worth hundreds of billions of dollars don’t fluctuate up and down like that on a daily basis in regards to their intrinsic value. The real value of businesses do in fact change over long periods of time, but not in the way the stock market would have you believe. And that’s because price and value are not one and the same.

Volatility Is A Synonym For Opportunity

I’d like to think that dividend growth investing is a win-win. So losing is actually winning. All this volatility is simply an opportunity.

I most recently purchased 30 shares of Unilever Plc (UL) after the stock tumbled more than 7% during the month prior to my purchase. Unilever is still pumping out butter, ice cream, soap, shampoo, and deodorant to billions of customers around the world. Nothing has changed. Yet an ownership stake in the company became more than 7% cheaper over the course of a month. And we’re talking about a company with a market cap north of $115 billion.

What happened with Unilever to where they were all of the sudden worth ~$8 billion less over the course of a month? Nothing. Which means an investor has an opportunity to buy into a world-class business for substantially less than just a month ago.

Of course, a stock’s yield rises as its share price falls. So a cheaper stock simply allows someone who’s aiming to live completely off of the dividend income their portfolio generates to get even closer to where they want/need to be. Cheaper stocks means my current capital can buy more shares, which means more dividend income to fund my dream. So while others might think a volatile stock market is a nightmare, it’s all a dream to me because I’m closer to my dream.

So this “loss” was actually a “win”. UL’s price goes down, yet I’m able to score shares at a cheaper price with a higher yield. How do you lose in that scenario?

For some reason, stocks seem to be the only thing in life that bothers people when they go down in value. If the grocery store has bread and milk on sale, nobody complains.

And stocks seem to have this unique characteristic where falling prices somehow triggers an emotional response which convinces people they must sell. You don’t sell your house immediately out of fear simply because your local real estate expert knocks on your door and tells you your house is worth 5% less today than it was last month. No, you’re going to slam the door in their face and promptly go back to whatever it was you were doing.

When stocks are cheaper, the opportunity is there for you to buy more. World-class businesses tend to sell more products and/or services, earn more money, and pay out more dividends over long periods of time. After all, you don’t build up track records of five decades or more of consecutive annual dividend raises (like Johnson & Johnson sports) if you’re not doing these things.

After all, one share of JNJ was priced at $56.59 10 years ago, and was paying out a $0.2850 dividend. The stock price has fluctuated in that 10-year time frame, and any fluctuations downward were simply opportunities to buy into one of the world’s largest healthcare companies that had already had decades upon decades of dividend raises under its belt.

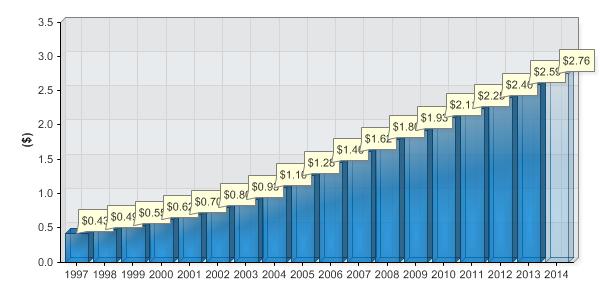

But you know what isn’t volatile? Its dividend payout history:

Source: Johnson & Johnson Investor Relations

Taking Advantage Of The Opportunity

Of course, opportunity is wasted if it’s not taken advantage of. I talk all the time about deploying capital when stocks are cheap, and enjoying the opportunity to average down on stocks I already own.

And I’ve done just that since October began.

I started the month off by purchasing 110 shares in American Realty Capital Properties Inc. (ARCP). I then followed that up shortly thereafter by averaging down on my position in the world’s largest miner – BHP Billiton Plc (BBL). I waited for more than a year to add to my position in the miner, but when opportunity knocks I answer. I then completed the aforementioned acquisition of shares in Unilever.

Where does this leave me? Right about where I started.

The value of my portfolio has almost completely recovered via these recent purchases and a slightly less moody Mr. Market toward the end of last week.

However, what I tend to focus on is that chart. Over the course of one year it’s mainly up. Furthermore, when the chart drops, I’ve noticed the snap back is even more aggressive – you’ll notice that after the drop at the beginning of the year. And that’s because I own more equity in high-quality companies during the drop than I did before, right? I’m buying through these drops, which means my underlying equity ownership stakes are even larger. Moreover, these ownership stakes are bought on sale. Thus, when Mr. Market’s mood invariably improves, these stakes are perhaps revalued at a more appropriate rate, causing my portfolio’s value to correspondingly rise.

But the value of my portfolio isn’t really important. What is important is fundamentals and value of the equities I’m holding and purchasing, and the dividend income they produce.

ARCP dropped over 8% in the month preceding my purchase. Was the company worth 8% less? Had the fundamentals significantly deteriorated enough to warrant that valuation change? I believe no and no, which is why I purchased shares on sale. This one purchase alone added $110.00 to my annual dividend income. Bam!

BBL dropped almost 17% in the month preceding my purchase. This is a company with a market cap north of $150 billion. With a B. Shaving 17% off a company that large is no chump change. Was it intrinsically worth 17% less because iron ore had dropped on the back of supply/demand concerns? Is BBL somehow unlikely to be producing more iron, copper, oil, potash, and coal 10, 20, or 30 years from now? Are these natural resources, which are slowly depleting, going to be worth less three decades from now? I don’t have a crystal ball, but I like the odds this buy works out to my favor. Furthermore, this purchase added another $49.60 to my annual dividend income.

Then there’s the aforementioned UL purchase. A 7% drop on a company that produces innocuous products like soap and deodorant? Because people are all of the sudden going to stop washing their bodies and putting on deodorant? Nah, I don’t think so. This added yet another $45.50 to my annual dividend tally.

You see where I’m going here. Mr. Market gets moody and I add more than $200 to my annual dividend war chest. He might be in a bad mood, but I’m certainly not!

Conclusion

The stock market is an emotional roller coaster. Don’t let it get you sick.

Enjoy the view when it’s on the way up, and try to be more aggressive when it’s dropping.

But remember that dividend growth investors are winning either way. When stocks are up, our portfolios are humming along and all is good. When stocks are down, our capital goes further and buys more dividends with the same dollar. All along the way we’re increasing our ownership stakes by buying stocks with the capital we’re able to generate from our savings by living below our means, reinvesting our increasing dividend income back into high-quality businesses and further increasing that income, and slowly marching toward financial freedom.

If that’s not uplifting and inspiring I don’t know what is. Mr. Market can be bipolar, but I’m about as happy as a human being can be when I keep my perspective on the long term.

Keep your eye on the long term. Ignore the noise. Enjoy the ride, but take advantage of the drops when they occur. Remember that price and value are indeed different. Stick to quality.

Those chasing after financial independence are getting a helping hand when the market drops like this. Grab it.

Full Disclosure: Long JNJ, UL, ARCP, and BBL.

What do you think? Is dividend growth investing a “win-win”? Taking advantage of Mr. Market’s moodiness?

Thanks for reading.

Photo Credit: Stuart Miles/FreeDigitalPhotos.net

Dividend Mantra,

When cashflow is the goal, a market pullback or recession is a good thing when accumulating investments. If a person is able to hold on to their job, if they do not run a business, you can make great strides in the amount of dividends that will hit your account.

If you invest for capital gains, then a market drop is a totally different ball game.

Well said! As I read your article I was putting in a buy order for UL myself. I liked it at $45 and I’m loving it at around $40! Thanks for keeping us inspired DM!

Great Article Mr. Mantra.

As always, Much love to you bro. I have visited your site everyday for a year straight. Sometimes twice a day to read the comments as well.

See how much love you get from the dividend growth community Jason! Keep it up bud.

We gonna reach financial independence together!

IP,

Thanks for dropping by.

It’s all about cash flow. Cash flow, cash flow. I just love the sound of that. 🙂

“If you invest for capital gains, then a market drop is a totally different ball game.”

I don’t know if I’d necessarily agree with that. Even if you’re after capital gains only, drops in the market still provide you an opportunity. Even if you buy nothing but BRK.B shares, cheaper BRK.B shares still serve a great purpose.

Now, if you were saying, “If you’re no longer in the asset accumulation phase, then it’s a totally different ball game.” – that I would agree with.

Best regards!

The Kechi One,

It’ll be great to have you on board! I’m actually thinking of adding to my UL position next month. If it stays where it’s at or drops further the odds are good I’ll add.

I’m with you. I also liked it in the $45 range. Love it at $40. I’d be ecstatic at $38 or less. 🙂

Cheers!

Tyler,

Thanks so much. Really appreciate the support.

As you know, I do my best to create great and inspirational content here. And the encouragement/support I get in return is absolutely worth all the hard work. I’m honored and blessed to be a part of this great community.

To our success! Onward and upward. Financial independence is out there in the future waiting for us to catch up and reach it. 🙂

Best wishes.

Good points here! I’m a long term investor that is building my wealth over time, so I love these major dips, especially those tied to unrelated events to the company. It just allows us small timers to get a little larger piece of pie in the grand scheme, as the professionals start selling to lock in their gains. Gotta love the clearance sale!!

Stock market declines less than 10% and everyone freaks out. I guess everyone is a long term “investor” until crap hits the ceiling fan haha. Thanks for the post, cheers!

I watch the business news for entertainment. 90% of it is just garbage. Everyone has an agenda and everybody is biased in some way. Markets dip. Its what happens. OH well. If dividends start getting cut then its time for concern but volatility in a stock price due to the broader market conditions is not a worry for the long term investor.

What gets on my nerves is the the market taking a good dip but coming up with some bs excuses like ebola fears and they are pumping it as the reason for all these declines. Then again you gotta be greedy when others are fearful!

I’ve always considered the ups and downs of the stock market part of a roller coaster. Going up is great because of the anticipation, but going down is where all the real fun is. 🙂

Good article. This one feels particularly inspirational!

Over here in Europe the economy is nowhere near as good as in the US. In fact, latest numbers suggest that Europe is on its way into the next recession. The ECB is just about to kick off QE. The USD will get much stronger because of this and the interest rate divergence.

I suspect that you will be able to buy some quality European business for much lower prices soon.

Personally, I do not want to own cyclicals at this stage.

Hi Jason,

Nice to read article.

The value of my portfolio is down 5% after I started this journey back in July.

However, thanks to your continued optimism as well as common sense, I’m not worried at all.

Previously when I was trading stocks in order to make a profit, this situation of falling stocks was pretty stressful.

But knowing the dividends will still come, is a very calming thought!

Keep up the good work.

Best wishes, DfS

Just discovered your blog. Love your clarity and inspired by your background story. Look forward to following progress over the coming months/years! Thanks.

I came across your blog on a Investing/Finance group on Facebook. After reading your blog, it makes it more possible for me to establish a nice financial cushion for when my son gets old enough for college (he’s currently 6 months old).

I have a blog too and have mentioned you in my recent post, you are truly an inspiration for anyone that really wants to get a grasp on their financial situation.

Thank you for putting this together for people to follow.

Now I gotta ask, do you plan on adding Apple to your freedom fund? Or Microsoft?

Jason,

I hear you. Prices don’t matter, dividends do.

As long as there is no severe crisis they will rise anyway.

And the best of the best like JNJ raise their dividends even through turmoils.

Rising interest rates might be a factor at some point since I am looking to add some points at reasonable return expectations. But it seems to be a long way to get there.

Greetings

Also hoping to find JNJ in the lower 90s at some point. Though I may have to just pony up in the upper 90s.There’s something satisfying about buying in at a 3% yield, and it’s just barely lower than that right now!

Very nice post, DM. I love how you break “complex” things down in articles like this into common sense thoughts. That’s the way I try to look at things. It’s amazing how the longer I invest, learn and engage in the market that the simpler concepts continue to be reinforced.

Volatility is opportunity. I have a plan in place and an end-game in sight, so all I need to do is stay the course. Consistent, diligent.

Keep up the good work!

Warrior

Anybody with brain could predicted 2008 crash. It was inevitable. I heard that thousands of jobs going overseas on a daily basis for 15 years. Everything I predicted to happen, it has always happened 5~8 years later. Kick the can down the road or delaying inevitable type strategy really works for a while. Pretty soon, Mr. Robot will take so many jobs away from us, actually it is already happening. Too many people too few jobs on the earth. Watch out for the currency. Stock market really do not like US dollar going up–this used to be the #1 factor moving the market on a dally basis before 2008. We all know, what has to happen to euro zone soon. Best thing, I can hope for the market is `stagnant’ at this point.

Agent,

I’m with you. I don’t know if I’d agree we’re seeing any “clearance” sales, but certainly stocks are now a bit cheaper than they were recently. I’d love to see stocks maybe 20% to 30% cheaper from here, which would really allow some “clearance” sales. 🙂

Cheers!

Henry,

Absolutely. This isn’t even a blip. I was hesitant to even write this article, but I’ve gotten some really weird/funny emails lately basically asking me if I was worried and perhaps thinking of selling out of stocks or something. I just shake my head.

Take care!

A-G,

Better you than me. I don’t even watch it for entertainment. I used to watch CNBC in the break room while I’d eat lunch back when I was still working in the auto industry. But I don’t get CNBC or anything like it at home, which simply makes it easier to ignore the noise. 🙂

I did occasionally enjoy their content for its the “entertainment” aspect, but found little real value.

Cheers!

Seraph,

Going down is definitely where the real fun is. Just like a real roller coaster. Might make you a bit queasy, but that’s where the value is. 🙂

Thanks for dropping by. Hope you found some value in the post!

Best regards.

Francois,

I’ve heard Germany (your biggest single economy over there) is slowing down. So you might be right there.

I wouldn’t mind picking up some high-quality businesses for cheaper prices. I just started a position in UL, so I’d love to buy more at a lower price. Short-term problems create long-term opportunities.

Thanks for stopping by and sharing. 🙂

Cheers.

DFS,

Dividends definitely allow me to sleep well at night. I slept like a baby right through all of this recent volatility. I’m actually hoping the volatility picks up from here, which would allow me to simultaneously test my mettle while also providing better long-term values. I guess we’ll see what we get.

I’m glad my constant optimism has allowed you to stick to the plan. 🙂

Best wishes!

diy investor,

Thanks so much! Glad you found the blog!! 🙂

I hope you stick around. And I wish you luck with your DIY portfolio over there. To our success!

Take care.

Sjlarowe,

Hey, that’s fantastic! Your son will surely thank you one day for the foresight you displayed. 🙂

Appreciate spreading the message. I try my best to create valuable and inspirational content here on a regular basis, and that’s because I truly believe in my heart that financial independence is possible for almost anyone. And so I’m out to get as many people on board as possible, because I can’t imagine most people really want to work until they’re in their 60s. I simply prescribe a way to freedom.

I don’t have any active plans to add Apple or Microsoft to my portfolio. I don’t know if I can realistically envision where either company might be 10 years from now. That being said, both have done incredibly well over the last 5-10 years. Perhaps I made a mistake not buying into either one (or both) a few years back, but hindsight is 20/20. I have to make the best decision for my future with all known information at the time, and I felt like I just couldn’t really predict their futures. I bought into Intel a while back because the stock was cheap, the yield was high, and I thought they could scale into mobile fairly quickly. They weren’t able to, and that made me realize I know a lot less about tech than I thought. Apple and/or Microsoft could be great investments, but I don’t believe I need either one to succeed. We’ll see. I could change my mind there, but I don’t see myself investing in either one over the next few months.

Best regards!

DM

Today is the time to load up some IBM stocks 🙂

I love it. When things are on sale, whether socks or stocks, people should get excited, not scared. The thing of course is finding the capital to take advantage of those opportunities. If stock prices go down further, that would be awesome!

If JNJ drops to $70/share, almost everyone else will be running around scared. But smart dividend investors would see they are still earning that $2.80 annual dividend, (which is growing) and will start buying up more. The lower the price you pay, the more dividend income your will earn and the better your returns will be. It is so simple in theory, yet so tough in practice. If you are patient and invest for years from now, it doesn’t matter what stock prices do this month or this week.

Best Regards,

Dividend Growth Investor

Stef,

Exactly. The best companies tend to increase their dividends right through major turmoil. And that’s why most of my portfolio is concentrated on high-quality companies. 🙂

We’ll see what happens with interest rates, but I’m honestly not concerned. Any fear mongering that occurs because of rising rates will just be an opportunity for me to put more capital to work.

Thanks for stopping by! Hope all is well over there.

Take care.

Ravi,

Yeah, I didn’t plan on adding to my JNJ position anytime soon. I’m trying to balance the rest of the portfolio out around JNJ. But I definitely wouldn’t mind adding here. I don’t see how JNJ isn’t paying out substantially higher dividends 10 years from now, and thus isn’t also trading at a higher price.

Cheers!

DW,

Stay the course, indeed. That’s what it’s all about. 🙂

I once wrote an article about how consistency is my superpower, and I aim to leverage that superpower for the next 8-10 years. Seeing the end goal become more realistic day after day makes it a lot easier to stick to the plan.

Thanks for stopping by!

Best regards.

Young,

I’m not sure what to think about the future of “jobs”. Is it really a bad thing that people will no longer be forced to work menial jobs for menial pay? I don’t know, but we’d have to rethink money and how the current economy works. Keep in mind that “jobs” are a very modern invention. They didn’t really exist 200 years ago. Of course, economic mobility didn’t exist like it does now back then either.

I linked to an excellent article on this concept/prediction/phenomenon a while ago. I believe the writer was predicting a near future where most work is mechanized/automated, and so money/income would take on a new meaning. I believe he was prescribing a “living wage” that was automatically paid out by the government, and anyone who could work or wanted to work in a function that still required human input could and would make additional income that way. But he was predicting a new normal where unemployment would stay permanently high because there just aren’t enough jobs to go around, especially on the low end of the education/labor scale. Interesting stuff.

I’ll see if I can find it.

Cheers!

Beat me to it. Big J, you adding to IBM on the open?

Well written post here Jason. At the end of the day investors who stay the course and stick to their investment mantra, be it DG or otherwise, will be the ones who prosper in the end.

Let’s hope some more “sale” prices pop up over the next few months as we all look to bolster our portfolios and increase our passive income.

Sharon,

I was just reading their earnings announcement. I thought it was cheap before the announcement. I can only imagine what it’ll look like after today. It’s down 8% before the market opens, but it could be all over the place today. Looks like fun. 🙂

Cheers!

Have you heard of Motif Investing? I created a motif with 30 of the stocks from your Freedom Fund, for those that are looking to start and not have to worry about the commission fee’s for each stock. Instead they just buy $9.99 to buy into a motif. The only downside is there isn’t dividend reinvestment

http://trader.motifinvesting.com/motifs/side-income-M8wrqj27#/overview

Hope to see many more people become financially savvy like you, the chain of debt is nothing fun and you have been paving the way for so many people. Thank you for your insite and for sharing your journey with dividend investing.

Also here is the link to my post that I mentioned you –

http://theroadoflife86.blogspot.com/2014/10/motif-investingdividend-investments.html

I pulled the trigger for 4 stocks – that the money I have for now, Iwish I could have more 🙁

DGI,

Absolutely. Stocks appear to be the one thing in life that people hate to see on sale.

I honestly pray we see JNJ at $70/share. I was able to build the position I have in the company because it was much cheaper than it is today. Would love to have an opportunity to buy even more.

I think people assume that the price of a stock automatically represents the intrinsic value of the business that respective stock represents ownership in. So when the price drops, they believe the value of the business is dropping as well. That disconnect is what gets people in trouble.

Let’s see what we get over the next few months!

Best wishes.

Dave,

Not sure. Probably not. I already invested more than $3,000 over the last couple of weeks, which for me is a lot of capital.

I don’t intend for IBM to be a major investment for me, but we’ll see. If it gets stupid cheap here I might have to scrounge up some capital.

Cheers!

W2R,

Exactly. No matter what investment strategy you have, you need to stick with it. Letting others bully you around with noise and opinions is a surefire recipe for failure.

Let’s indeed hope for continued sales over the next few months! 🙂

Best regards.

sjlarowe,

Hey, how cool! A miniature Freedom Fund. I’ll have to go back and visit and see how it’s doing. 🙂

Appreciate the kind words on your blog. I hope others stop by and check out what I’m doing here. I don’t make a ton of money, yet I’m solidly on my way to financial freedom. The old cliché of “If I can do it, anyone can.” is alive and true here.

Cheers.

Sharon,

So many stocks, so little capital. There’s never enough money. You could give me $100,000 right now and it wouldn’t be enough. 🙂

I’m re-reading Warren Buffett’s biography and it’s funny how his desire for money was insatiable. He was managing millions of dollars in his early 30s and he kept trying to find more money. It was never enough for him.

Keep your eye on the long term. Every great decision today reverberates for the rest of your life.

Best regards.

Just added to GPS, VFC, MSFT, CSCO, LMT and INTC on the open. Never pulled the trigger on IBM because of their debt issues, still not interested.

Good attitude mate. It’s only money anyway!

I would suggest folks diversify into hard assets and keep their net worth balanced among various asset classes. Having over 50% of one’s net worth in stocks is a risky proposition IMO.

Don’t forget 2008-2009 and 2000-2003 if you were investing then!

Sam

Hi Jason,

Good article.

What do you make of the earnings miss due to low revenue from IBM? Is this causing you to take another look at being an owner in the business?

-Mike

Hi DM,

No matter I bought stock at what price, I always wish price going down. Why? Almost all stocks I currently own spend a lot of money on stock repurchase. For example, our shared business “V” which returns all its cash to shareholders by dividend and stock repurchase. Another example “CCE” which bought back about 35% outstanding shares and retired them in the past 3.5 years (it means my stake increased 35%) and its current dividend yield is about 2.4%. It works like a machine BB gun.

Most companies in your portfolio (so do I) spend a lot of money on stock repurchase. As long as the company’s fundamentals are unchanged, we should always wish price keeps low for a long period of time even I don’t spend money to buy more shares.

Mr. Buffett also mentioned this logic in 2011(or 2012) BRK,A shareholders letter.

Enjoy the downturn.

Joseph Chu

DM,

You echoed my thoughts to a tee. I was disappointed when the Fed opened their mouths last week and stopped the correction, and thus cut the stock sale short. I felt like the guy standing in line for an item on Black Friday only to learn that the person in front of me got the last one.

As you say; markets go up and markets go down. There is always opportunity to add another brick somewhere.

The hunt continues.

– DWC

Dave,

Nice buys there.

I can’t blame you on IBM. I’ve been a bit disappointed in the company, not the stock. I don’t mind the stock trading sideways or worse, as that allows me opportunities to get in. But the more I’m reading this recent report, the more it seems like the company is not moving fast enough into growth areas. The GlobalFoundries deal seems like a short-term pain for long-term gain maneuver, but only time can tell how that turns out.

LMT is interesting. I wish I would have bought in a while ago, as that was one of my big misses. I don’t find it particularly appealing right now, but would definitely like to buy in after a substantial pullback (if we get one).

Cheers!

I put some money into IBM over the weekend, thus initiating a position. I had wanted to do so months ago when it was $183/share, but I didn’t have the capital and the price skyrocketed, so it fell off my radar. I checked it a few days ago and boy was I surprised.

It’s really the only tech stock i will touch. Unlike Apple, which has to appeal to consumers to purchase a non-necessary product (into which it sinks millions of dollars into R&D just to get things like aesthetics down), IBM’s products are necessary for many business’ day to day operations. As a matter of fact, I sometimes refer to it as a “business staples” company, sort of like how consumer staples sell products that take care of our everyday needs (food, soap, shampoo). If a second Great Depression hit us tomorrow, people would cut down on the Apple products, but businesses will still buy IBM products in the same way that we need to buy food and detergent.

Speaking of consumer staples, I just added to my position in JNJ. How it wasn’t a core holding before is beyond me, but it is a top holding now!

Good luck everybody! This “volatile” market is awesome, and I’m hoping everyone else is enjoying the discounted prices!

I bought a few shares of Armanino this morning, right after reading that they had their most profitable quarter ever!!

Unfortunately, I bought at 2.09, and within an hour or so, it dropped to 2.02. No biggie though- like you said, I haven’t lost anything until I sell, which I won’t be doing any time soon. If anything, I’ll buy more shares once/if the price drops below 2.00 again. This will lower my average cost basis for this stock, and increase my personal dividend yield % for this stock.

I’m looking forward to all the future dividends, and success of this company.

Sam,

I don’t mind having almost 100% of my net worth in stocks, and that’s because there is no asset class that measurably comes close over the long haul in terms of performance. Plus, dividends provide cash flow that is about as passive as it gets. I wouldn’t mind owning fixed-income at some point, but bonds just aren’t attractive right now, in my view.

Rental properties can be quite lucrative if you’re game for it, which I’m not. You’re then left with stuff like precious metals and art, which provide no cash flow at all. And they’re hard assets to properly value. No, thanks.

Another 2008-2009 is certainly possible, and I wouldn’t mind at all. If we see panic like that you can come back to this comment and check in on me to see how I’m doing. If it’s within the next 8-10 years I’ll be giddily buying. 🙂

Cheers!

Hot damn DM,

That was a well written article. And it drives home the point without confusing people who are newer to dividend growth investing. It is a sale, and I tell you I love a good sale. Example, if I am doing the grocery shopping (which is 90% of the time) and I see something we use on sale, like say buy 2 get 3 free (i’ve actually seen this on cheese and pita chips). I will go and buy 2 and grab 3 more even if we have 2 at home. Its not going to go bad before we use it. Same is true of stocks, except they are more like Twinkies in how long they last.

Hopefully the market hems and haws enough to open up opportunities, even if there is an overall stabilization. And lets hope we have the cash to claim our stake.

– Gremlin

Mike,

Hmm, good question. I briefly read it this morning and was mixed. I’ve become more disappointed as the day has gone on (and I’ve woke up). It takes time to shift a large business like IBM, and I’ve been so far pretty pleasantly patient about it. The GlobalFoundries deal seems to be a more aggressive move by management to shift things quicker, which I applaud. But you have to wonder when the dawn is on the horizon. Plus, software sales were sluggish, which has been a great area for the company.

That being said, the stock is cheap. Is it cheap enough to take on the risk? It seems like it to me. Would I want IBM to be a major position? No. And that goes for any tech company.

Best regards.

I’ve been eyeballing GSK for what its worth.

Joseph Chu,

Absolutely. That’s great logic there, and happens to be logic I enthusiastically share.

I actually wrote about that logic last year:

https://www.dividendmantra.com/2013/10/three-reasons-i-enjoy-watching-stocks-i/

As stated in the article, I enjoy watching stocks I own decline in price. That’s not only because of share repurchases, but also because I’m able to increase my ownership stakes for less money. That’s part of the win-win I was referring to in the article.

I think we’ll both enjoy whatever downturn we get. 🙂

Cheers!

DWC,

“I felt like the guy standing in line for an item on Black Friday only to learn that the person in front of me got the last one.”

That’s too funny. I know how you feel. I generally deploy capital every month, so I try to get a good spot in line all the time. That being said, there never seems to be enough cash for all the stocks I want to buy. But that’s a first world problem, right? 🙂

I see you started your blog. Good luck with it. I wish you as much success as I’ve had!

Best regards.

I want to go back to the first comment posted on the subject with your responding quote ” if you are in the asset accumulation phase, then that is a totally different ball game” That brought to mind two questions. Are you planning on just being a dividend stock investor 100% for life or do you have a plan in place to incorporate bonds etc in your portfolio over time as interest rates rise? Second question is, since you have a wide range of readers & commentators of different ages, countries and are in different stages of their investment life, it might be prudent to write an article at some point of what you see as the priorities & specific suggestions, for the new investor, the accumulating working investor, and the retiree who now relies on his investments to live on. In other words, how your portfolio changes ( if any) over time. Thanks & best of luck.

Joey Batz,

I hear you on Apple. I just haven’t come around to it yet. How long will people continue to pay up big for a slightly newer/larger/faster smartphone? I have no clue.

IBM is on the enterprise side, so you have to like their odds as long as they provide relevant and cutting edge services/software. They are all over Big Data, but their cloud services still remain a rather small part of the business. It takes time to shift from low-margin hardware to high-margin software and solutions, and this is no spring chicken. It’s a $180 billion company.

I like JNJ quite a bit. Great results and the stock still drops with the broader market. It’s my largest position by dollar weight, and I definitely wouldn’t mind adding even more here.

Thanks for stopping by! Sounds like you’re having fun. 🙂

Take care.

Joel,

I’m loving AMNF. I’m strongly considering doubling my position here. Their growth is extremely strong, and the valuation is quite compelling. I don’t really see much of anything to dislike here. It’s a value/growth/high-yield stock all rolled into one. Glad I could bring it to the attention of other investors. 🙂

I also like my investment in TIS. It’s positioning itself well for future growth, although the dividend coverage has weakened considerably since I initiated a position in the company.

Glad to have you on board with AMNF. To the company’s (and our) success!

Best regards.

Gremlin,

Yeah, it’s funny how people look at stocks differently when a sale rolls into town. A stock sale is actually better than a grocery sale because dividend stocks pay you to own them. My loaf of bread doesn’t crap out a penny or two while it’s sitting in the pantry.

Let’s indeed hope volatility continues. I was pretty aggressive at the beginning of October, so I’m trying to rebuild the cash position through positive cash flow so I can go on a spending spree once again in November. 🙂

Appreciate the support. I’m glad you found the article to be written well and easy to understand. That is exactly what I was going for.

Cheers!

Zol,

I just haven’t been able to get behind GSK yet because it’s still mostly a pharma play. Their consumer segment is a relatively small part of the business. But I understand the value/yield to be pretty compelling here. Although, I’d have to look into their dividend growth in their native currency.

Wish you the best of luck with it if you decide to invest there. 🙂

Cheers.

Brian,

Great suggestion there in regards to writing about investors in different phases. I actually plan to incorporate that into the blog naturally over time, as I’ll be transitioning from a novice investor, to a seasoned asset accumulator, and then eventually to someone living off of investments while the blog is still up and live. So it’ll be great to see the writing transition over time as well. That being said, I’d definitely like to explore more content for those that are perhaps already living off of dividend income.

I’m not specifically planning on having 100% of my assets in stocks for my entire life. I simply play the game with the best tools I’m given, and right now stocks are far more attractive than bonds. It might not always be that way, so I remain open-minded. I wouldn’t mind having up to 10% or so of my assets in bonds, but that would probably be about it. And I likely wouldn’t be interested until the 10-year crosses 5%. Stocks are the far better asset class over the long haul, so investing in bonds seems like simply a way to smooth out volatility once you’re already living off dividend income and no longer need that volatility as an opportunity.

Thanks for the suggestion!

Cheers.

Great article, we all need to ignore the white noise. Over the long term, stock markets return about 6-7%. Unless you’re in need to using your portfolio, just keep marching on and execute the investment strategy. The markets go up and down and if you get emotional about it you’ll be in an emotional train rack all the time….

DM

I immediately put AMNF on my watch list after your article on it. My only hesitation is the lack of volume that might lead to difficulties unloading if things went south in a hurry. With volume as low as it is, your article might have influenced the stock price a little (it did jump into the 1.90s after your article hit).

It’s definitely positioned as a dGi stock with the emphasis on growth and I’m going to continue to watch it. We have to be picky with limited capital to employ each month 🙂

Very timely article. I’m not sweating the market retreat one bit after pulling the trigger. I’d hate to be a total return guy right now!

We’re moving to the Pacific Northwest this week, wish us luck!

Yea you’re right for sure, a 20-30% would be awesome and truly a clearance! I’d love that opportunity but I think earnings season will drive stocks back up some until we get some more negative world events to bring it down.

Good read, DM.

You echoed my sentiments exactly with the section about owning what you own. What the general public don’t seem to realize and what the financial media don’t convey is that regardless of fluctuating valuations, ownership stake remains the same so long as we hold our shares (subject to stock issuance, etc., of course)

I was having a laugh earlier this morning as the media were pumping out snippets about how Buffett has lost over a billion dollars with IBM’s poor earnings causing their stock to swoon. You and I both know what Buffett is probably doing with shares down ~7%, right? So long as he still likes the story, I’m sure he’s been active.

– Ryan from GRB

Jason,

Very good post. My girlfriend doesn’t like investing, she’s afraid of losing money she worked so hard for. If more people would share your view, investing would not be so scary.

I’m not frightened at all, because of a longer term view. And I have to say your blog helps me as well. It sure make the nights more relaxed, sleeping like a baby!

Keep up the good work!

Another good article and thank you for sharing. I think your logic and approach are both sound. Investing in a down market does require cash, so could you please share with us how you can find the cash to create those additional dividends? What should someone who is nearly fully invested to do?

Thanks…..enjoyingthemantra!!!!

Tawcan,

Absolutely. Ignore the noise and keep your eye on the long haul. Stocks offer excellent long-term total returns, but they don’t offer it in a uniform fashion. As such, you have to be willing to ride out the lows to experience the highs. And collecting a rising stream of passive dividend income certainly smooths things out, in my opinion.

Thanks for stopping by.

Best regards!

DWC,

I’m not sure if the volume is really an issue or not. My order for 800 shares went through instantly, just like any other stock order. Now, if you own thousands of shares in the company and need to offload it all in one shot that might be different. I guess it really depends on what kind of scale you’re looking for here. I would probably limit my investment to around $5k or so with AMNF, which means low volume probably won’t impact me. If you’re investing substantially more than that then you might have an issue.

Cheers!

Spoonman,

Oh, man. Good luck!! That’s fantastic.

I’ll have to head over to the ERE forums and see what you’ve been up to. Haven’t been over there in at least a week now. I’m sure you guys will really love it. That’s one area of the country I’d love to check out sometime. Colorado and Hawaii as well.

Best wishes!

Ryan,

Too funny. I guess they forgot you don’t actually lose any money unless you sell at a loss. Furthermore, Buffett didn’t “lose” a billion anyhow. Berkshire saw its book value decline today, and that decline is reverberated throughout the company (of which Buffett is a major shareholder). But media needs something to talk about. 🙂

I would be interested to know what Buffett is thinking with IBM here. I often talk about buying more on dips when the fundamentals remain sound, but I suppose an argument could be made that IBM’s fundamentals are deteriorating. I was surprised to see them retract their 2015 $20 EPS goal. We’ll see where it goes. I never planned on IBM being a major position for me, but I’m tempted to buy a little more here and see where management takes things. I think the company is due for some serious improvement, however. The turnaround story has been playing out for quite a while, and I’m patient. But I would expect to see something improve on the top line at some point here.

Best regards.

Dutch Guy,

It’s a shame that financial matters aren’t discussed more in school. I think a basic personal finance class in high school should be mandatory, with perhaps as much as a semester discussing investing. Specifically, it should be pointed out that not investing guarantees you a loss, since inflation will invisibly eat your money by reducing your purchasing power.

Glad the blog helps. I’m here to keeps us all focused on the long term. 🙂

Cheers.

Bipin,

Well, I’m assuming that investors are regularly investing. Contributing capital regularly through up and down markets – avoiding market timing – ensures that you’ll have capital available when the market inevitably turns sour. I may hold a little cash on the side here and there, but we’re talking a thousand or two. I’m not sitting on massive sums of cash because cash has a negative rate of return. In addition, my regular investing over the past 4+ years has now created a source of regular cash flow, which further ensures capital availability during all market periods.

See this most recent article:

https://www.dividendmantra.com/2014/10/create-your-own-miniature-berkshire-hathaway/

The key is to get your snowball rolling by creating a cash flow machine. Once you do that you won’t have to worry about where the money comes from. 🙂

Best wishes!

Hi DM,

GSKs consumer segment is about to get much bigger. 2nd only to JNJ in fact.

http://www.bloomberg.com/news/2014-04-22/novartis-to-buy-glaxo-cancer-drugs-sell-animal-health.html

Been loving the new content lately. Keep up the great work.

Great article! This pullback certainly has been a win. I saw it as the perfect time to add to a position. With this addition, my passive dividend income is now over $365. It is such a great feeling to know that since June I have increased my daily pay by $1. My friends ask me how I am doing it and I tell them it takes time, patience, homework, and I send them to your blog.

Hi DM

Great mentality to have that’s the way to build wealth. I miss your podcast wondering if now with your free time you will start your podcast ? I sure hope so. Thanks

I hear everything negative during this 9% pull back and also earlier in the year. I actually bought a lot this year.

I hear no one eats at MCD, smoking rate is declining, people are drinking less and less soda, no one buy at WMT due to salary increases with minimum wages, oil prices are declining so oil companies will have problems covering dividend, IBM having hard time making money, TGT having issue in Canada, data breach everywhere with all department stores etc.

But I keep on buying during all this bad headline and build my top 10 holding this year.

Bought MCD, IBM, KO, PEP, PM, WMT, TGT, UL, CVX, XOM etc. all this year during big pull backs in each of this securities.

Basically bought whatever market gave each time.

wes,

Hey, thanks for sharing that. Had no idea about that JV with Novartis. Looks very interesting, and potentially provides a lot of upside for both players. I still prefer JNJ to a large degree, but I can see how GSK is more attractive with that JV.

Thanks so much for the kind words. Appreciate the support. Glad to continue putting out the best content I can. 🙂

Cheers!

Daniel,

That’s fantastic! $1 a day is the start of something beautiful. I know that firsthand, as it wasn’t that long ago I was earning similar dividend income. Keep at it. 🙂

Appreciate spreading the message. I hope those you’re sending my way actually take the time to check it out. A little change goes a long way.

Best regards.

Oscar,

I miss the podcast as well. It was a lot of fun, but incredibly time consuming. Now that I have more time on my hands – though, not as much as you might think – I would like to expand things a bit. I was actually thinking a video series, but I need some nice video/sound equipment. We’ll see. 🙂

I’ll try to keep everyone updated on that. Would love to offer something really unique in our community.

Best wishes!

AJ,

I hear you, my friend. I was also buying many of those stocks myself. TGT was one in particular I chased down, and I’m generally happy with it thus far.

The difficult task is separating temporary blips with true deteriorating fundamentals. But diversifying your portfolio out and sticking to high-quality companies means you’re going to get it right far more often than you’re going to get it wrong. 🙂

Keep up the great work over there!

Cheers.

I have motified the motif using the cheapest valued stocks, that balance out to 10 dividend payments each month, compared to the original motif, this one is about 1k cheaper, meaning more dividends on the dollar. It also increased the rate of return by 5% which is a nice extra bonus!

http://trader.motifinvesting.com/motifs/side-income-M8wrqj27#/overview

I picked up some IBM and SAP yesterday. The numbers after all where not that bad.

Curious what KMB, MCD + KO earnings will look like today. Please, Mr. Market, freak out + give us a little correction.

Hello Jason,

So a DGI would not fear a downturn of the market, even if it would lose let’s say half the value of your portfolio. Instead they would use the opportunity to buy stocks at much cheaper price. But I was thinking, ideally a DGI would not save a big buffer of cash because each dollar that you do not invest means missing additional dividend income. So in this scenario a DGI does not have the power (cash) to make use of the cheap stock prices. He can only put in the regular monthly new cash he can save. Or do you have such a buffer in a bank savings account for such occasions?

Am I missing something here? Thanks in advance for your opinion!

Greetings,

JJ

Hi Jason

Great article, share your sentiments entirely, but I thought I’d jump in on the GSK discussion, as this was one of the stocks I bought on the dip over here in the UK last week.

With reference to their Novartis consumer tie-up, what might also be of interest is the fact that they intend to pay back around £4 billion to shareholders (as a result of the sale of their oncology division), by way of a special dividend payment in the first half of next year, see link below:

http://www.gsk.com/en-gb/media/press-releases/2014/gsk-plc-announces-major-three-part-transaction-with-novartis-to-drive-sustainable-sales-growth-improve-long-term-earnings-and-deliver-increasing-returns-to-shareholders/

This works out at around 80p per share, equivalent to around 6% at today’s price, and that’s not including the further 6% annual dividend that they currently pay (and which has grown by at least 5% for the last 8 years that I’ve been recording it)! I think there’s great value here long term, but it may still be a choppy ride in the short term (believe quarterly results are out tomorrow 22nd), as the company has had several issues to deal with this year, that have been well documented..

super post. Just what the doctor ordered! Keep the eye on the long term and take advantage of this market situation! Just what we need to hear,

Thanks!

Good day to think about buying KO, MCD and LMT. Stronger USD is starting to take a bite into overseas profits.

A general question from north of the boarder:

Is it wise to invest into US stocks as a Canadian (vs strong Canadian dividend stocks) with the exchange rate being so high? When purchasing a U.S stock we are also charged the conversion fee which, is always in favor of the banks/trading account. The dividend is then paid out in U.S dollars which are then converted to Canadian dollars(TD Waterhouse will be changing this soon)…with a conversion fee which again favour’s the bank. Am I essentially paying a premium or is it all a wash and strong investment? Thanks!

Thanks

sjlarowe,

I’ll keep an eye on it and see how it does. Sounds like this version is better than the first. 🙂

Cheers!

Francois,

You’re getting what you asked for. 🙂

KO is currently down 5.82%. MCD is down 0.66%. IBM is down another 3.6%.

IBM is getting mighty cheap here. It wasn’t really on my radar, but it’s firmly there now. I wasn’t a big fan of the report yesterday, but it seems like they’re accelerating some changes so that they’re better positioned to serve their customers. I may add to my small position next month if it stays like this.

Best regards!

JJ (or is it Jimmy?),

Not all dividend growth investors operate the exact same way. I can’t speak for millions of other investors out there. What cash buffers you may have on hand will vary from the next guy to the next guy. Furthermore, means vary. $5k in cash may be chump change for you. For the next guy, that might be six months of savings.

I was just having a discussion with another investor the other day who said he had $100k in cash set aside for a pullback. Obviously, $100k is a lot of money for me and probably a lot of other people. And then you hear people discuss how Buffett has billions of dollars in cash. Well, he runs a company worth hundreds of billions of dollars, and also has substantial insurance operations which require cash set aside. So comparing Warren Buffett to your average retail investor is like comparing apples to oranges.

You’ll have to find your own comfort level. That being said, I’ve already discussed at length how cash loses value over time (a negative return) and how you should build up a steady source of cash flow that can be reinvested. I’ve built up a portfolio that’s spitting out hundreds of dollars every month that continually gets reinvested, thus adding to my cash position on a regular basis. Cash flow is just about as good as cash when it’s coming in regularly:

https://www.dividendmantra.com/2014/10/create-your-own-miniature-berkshire-hathaway/

Best wishes.

Phil,

Thanks for sharing that. Although, that’s not a special cash dividend payment in the fact that it’s not a cash payout. At least, not how they’re explaining it in that press release:

“GSK plans to use net after tax cash proceeds of $7.8 billion to fund a capital return of £4 billion to shareholders following completion of the transaction. This return is expected to be implemented through a B share scheme in 2015, subject to approvals.”

There’s obviously some value in that return, however, through additional shares in the company. Whether or not that works out better than cash remains to be seen. I’ll have to take a look at GSK here. That yield is awfully juicy. 🙂

Cheers!

optimaal vermogen,

Just what the doctor ordered, indeed! 🙂

Looking forward to continuing to take advantage of some of these deals. Happy shopping.

Take care.

The only thing we really lost was the option to sell a stock(s) at a higher price and the ‘feel good’ feeling of having our portfolio current returns nice and high. 🙂

Dave,

I think LMT could still fall a bit from here, but KO and MCD both seem like decent values. I don’t think either one is a steal, but if I were looking to initiate a position in either/both this seems like a good time to do so. I prefer KO right now out of the two. I’ve actually been looking for an opportune time to add to my KO position, and that time looks to be coming. I’ve found 3% yield to be a marker for a good time to buy KO, and we’re there now.

Cheers!

Picked up some LMT today around 167, and also added to Caterpillar and Cummins over the last 3 weeks….looked at my portfolio and realized I was light on Industrials….I’m trying to keep up with you Jason, but you set such a high bar! Right now I should receive about $4k this year in dividends, hoping to make that 5k in 2015….

Canadian,

You’ll find a different answer for this depending on who you ask. I can tell you that I don’t really worry too much about currency conversion rates. I think this stuff tends to even out over long periods of time. That being said, it was a slightly better time for you to buy US stocks not long ago, as the US dollar has strengthened recently.

I personally hold positions in two Canadian banks. The currency conversion goes up and down, but I just don’t really worry about it that much.

I will say that you have some excellent investment choices in your native currency. If you haven’t already maxed out your opportunities there, that might be something you want to think about. The Canadian banks, some of the major integrated oil companies (like Suncor), and some natural resource plays are there for you. However, the Canadian economy isn’t nearly as large or diversified as the US economy. Thus, I think the currency issue is a rather small inconvenience/price to pay to enter a position into some excellent global companies.

Best regards!

Personally, I’m depressed I missed the thing. Not because I procrastinated mind you, but because transfering funds took a week. Now I’m sitting on a bigger chunk of cash and feel left out. I was gearing up to start several positions, most notably JNJ, UTX and GE. I know it’s first world problems but I’m really bummed.

Great, I look forward to your well thought out articles, as well as reading what your comment section says, since there are investors reading you from every stage of investing. Would be very informative to everyone, including yourself to get as much feedback as possible, since you are admittedly in the early stages yourself.

DW,

Absolutely. If I could perfectly time the market’s ups and downs to the penny I would no doubt take that opportunity. But it’s impossible to do so, so I don’t worry about it.

Reminds me of the old analogy to the guy with the yo-yo climbing the stairs. I don’t focus on the yo-yo. I focus on the stairs. 🙂

Cheers!

Tom,

$4k in dividends is very, very solid! No need to worry about keeping up with me, as there are many out there with far more progress. It’s all about making sure your progress is in tune with your goals. 🙂

I do like CAT and CMI to varying degrees. I wish I would have picked up CMI quite a while ago. Big miss on that one, but you can’t win them all.

Keep up the great work!

Best wishes.

Like you; I’ve sat and watched my investments lose nearly all of their 1-year gains over the past month. The UK stock market index is down a similar % as yours. Fortunately I also know that a loss is only a loss if you actually sell.. otherwise it’s just an opportunity to buy more at a discount!

I really shouldnt watch my stock values so closely given that its all on automated monthly investment, but I cant help myself sometimes.

Hi Dividend Mantra,

I definitely agree that you should focus on the long term, especially during these times. It was especially hard for me because I kept watching my portfolio drop X% everyday for the last 2 weeks! Luckily I didn’t panic and sell because my goal was long term. Instead, I bought more stocks while market sentiment was down.

I’m glad to read you bought UL because I increased my position in UL during the “correction”. I also started a position in Glaxosmithkline (GSK) and wanted to know your thoughts on this pharmaceutical giant?

cheers!

Young Income

Well, If you wait too long, the prices might continue to go up, and you’ll miss out on even more. If you buy and prices drop, you can buy additional shares(if you have the money), which will bring down your cost basis.

Tom,

A week to transfer funds? How did that happen? I’m usually able to transfer funds in less than 10 seconds, from my bank to Scottrade. Was this being transferred from a different country or something?

Although, I don’t think you really missed out on too much. JNJ, for instance, is only a few dollars higher than it was toward the end of last week. That’s not really going to make a huge difference over the next 10-20 years. It’s always nice to buy in cheaper, but I don’t squabble over a couple of percentage points.

Cheers!

ERG,

Exactly. It’s just an opportunity to buy more at a discount. 🙂

I honestly don’t watch stock prices all that closely…unless I have a fistful of cash and I’m hunting for a target. But if my BB gun isn’t loaded, then I’m not out hunting. I sometimes actually log into my brokerage account just to check on dividends, completely forgetting to go through and skim the numbers. But it takes time to really get that comfortable with things. Even I sometimes find myself logging in here and there just to check numbers, especially after big drops to see how I held up and whether or not I might be able to pounce on something.

Now, I do follow fundamentals a bit closer. I’m set up on email alerts for all of my companies. So when major news hits, a dividend is declared, or earnings announcements come out then I generally do some light reading.

Best regards!

In a perfect world you are able to purchase all of your stocks/dividends at a discount while working and investing, only to have them rise to the sky while you are in retirement, as I write that for the most part that does happen assuming you have a long time horizon and don’t sell because the wind messed up your hair.

Young Income,

It’s difficult to focus on the future (which isn’t here yet) when the present is sprawling red across your portfolio. However, that chart of the broader stock market (which obviously contains quite a few stocks we all invest in) ought to perk you up. 🙂

I spoke about GSK briefly in previous comments above. I’ll have to take a broader look at it. I haven’t been a fan of the company in the past because it’s primarily been a pharma play. However, it looks like the JV with Novartis is going to really expand their consumer offerings and diversify the business a bit. I like that. I’ll try to get back to you when I have a better idea of the company.

Thanks for dropping by!

Take care.

DM

Today KO takes the dive…. No money to pull the triger, Buffet lost Over $1B in 2 days with IBM and KO.

To be honest I’m now a bit paralyzed now as I don’t know where the best value is. I’ve fairly small portfolio, so diversification is no huge issue, but I’ve sinned with my recent buys, not really quality, more high-yield, so I definetly want high quality, or a broad ETF.

The transfer was from a internet-bank account that pays interest (1 day), then (2 days) from my regular bank account to my internet stock broker. I realize now that 3 days WAS procrastination. Kind of feel better, then I can do better next time 🙂

I added to what marketing is giving. Added small to KO and IBM today. KO is my #1 position and IBM is my #8 position.

I didn’t want IBM to be too high in my portfolio but this happens time to time when you keep on adding to a company during market opportunities.

WB is not worried about KO and IBM being his #2 and #3 position.

Lot of people on the financial radio say buy IBM if you are short technology or short innovation, but IBM is mostly software and services company.

Anyway my buy is small so its like a drop in a full glass.

I may keep adding to KO and IBM if they continue to slide. I am thin on capital but I might rich out to emergency fund.

I did the same last couple week with keep on adding to CVX, XOM, UL and DEO.

I hope things work out for me and my kids when I pass it to them with this blue chip companies and I hope they keep on increasing their dividend because I am very patient with my holding and probably the last one to sell (I am not good at selling).

Sharon,

KO took a dive today, but it appeared to be close to fair value or slightly higher from the beginning. Back into the area where I’d consider adding, but it still trades at a P/E ratio above 21 even after the drop. So I don’t think it’s a steal here. That being said, it’s a great company. I might be interested in adding to my position next month. We’ll see.

Buffett didn’t actually lose $1 billion. Berkshire’s book value declined after the drops for KO and IBM. Buffett is the largest shareholder in Berkshire, so Berkshire’s share price is what affects his net worth. And it appears unfazed over the last few days. Now, that’s not speaking to his personal account, which isn’t publicly tracked.

Make sure to read past the media noise. 🙂

Best regards!

Tom,

A small portfolio means the entire market is an opportunity for you. You just have to take that leap. I’ve been active buying lately, and you can also see what everyone else is buying. Whether or not you’re comfortable with parting with cash or not is really up to you.

Some values I see right off the top of my head include BAX and JNJ in the healthcare sector. You’ve got CVX, XOM, and KMI in energy. I just bought UL, and I think that’s a great play right now. IBM has dropped like a rock. If you believe in the long-term story, MCD is sitting just above its 52-week low.

Values abound, my friend.

Best regards.

AJ,

Nice moves there. IBM appears particularly cheap, especially after that rough third quarter. I also don’t intend for IBM to be a large position for me, and would probably feel comfortable with it somewhere around 1%. However, I am thinking of adding a little bit here. IBM is a little different from what I’m normally talking about, where you try to buy more on pullbacks when the fundamentals are still sound. And that’s because their fundamentals are deteriorating a bit. Are they deteriorating to the point where the company is worth ~$20 billion less now than it was five days ago? Seems a bit much to me.

Take what the market is giving. When Mr. Market wants to dispose of high-quality assets on the cheap, then you simply have to stand in line with the cash. 🙂

Cheers!

evensteven,

Well, the stock market doesn’t exist in the perfect world. It’d be nice if it did, however. 🙂

As that long-term chart shows, it mostly marches upward over long periods of time. Booms and crashes are in there, and day-to-day volatility can be all over the place. But I’d rather have a zigzag line that allows me 8% annual returns than a straight line up that only allows me 6% returns. Volatility is opportunity. Furthermore, the risk and volatitliy we take on in equities is the reason why they have higher long-term returns than bonds, residential real estate, etc. In that regard, I suppose a perfect stock market would return much less than our imperfect one.

Thanks for stopping by.

Cheers!

A bit off topic, but your thoughts on BP given the recent decline. At this point I can resist the idea of going back in based on the price drop alone.

That’s the position I added to and am curious about this as well. Currently it is the only international stock I own.

Love when Mr. Market gives us a gift like we have had recently. Love tweaking our holdings and making another $1400 a year in dividends while taking advantage of gains in value!

Great article and reminder to “Don’t Panic!” Down turns are money making opportunities.

Curious about your thoughts on CTL…I bought 100 shares back in February but I am slightly concerned about the yield and previous drop in dividend. Are these serious warning signs to you?

Sunny,

BP is trading at right about my cost basis here, so I like it. However, a couple of things have changed since I bought it. Namely, Brent has declined quite a bit, and that has a direct effect on profitability (most oil companies anticipate $100 oil for their forecasts). Second, tensions in Russia have picked up due to sanctions. Thus, I’d prefer to buy in even cheaper to compensate for the additional risk. If BP falls substantially below $40 I’d be very interested in adding to my position. That being said, if I didn’t already have a position in the company I don’t think this is a bad price at which to initiate one.

I hope that helps! 🙂

Cheers.

I have given up trying to time the market but I do use temporary downturns to buy more. I can see how it would be stressful if someone needed the money in a short period of time but my timeline is so long that the temporary dips don’t bother me – if they did I wouldn’t invest money in the stock markets

itsme,

“Down turns are money making opportunities.”

Absolutely! I try to make money by increasing my dividend income through all cycles, but the pullbacks are when I try to amplify my progress a little bit. I hope things stay this way for a while. 🙂

Best regards!

Scubatoad,

I don’t really know if I can give you an informed opinion. I’ve never really taken a good look at the company’s financials. I took a quick look at CTL a long time ago and concluded it wasn’t a good stock for me. The dividend payout ratio exceeded 100% at the time, the dividend stopped increasing, and earnings were pretty rough. I see now that the company registered negative earnings last year, so that’s obviously not a good trend, especially when you look back over the last 10 years.

The warning sign for me isn’t the yield. 5.44% isn’t obscenely high, and that’s quite an easy yield to fetch from a number of stocks. However, the trend in earnings (and now negative earnings) is. That’s just speaking to the fundamentals. Qualitatively, you have to ask yourself if you believe in this business model over the long term? I thought they’re primarily a wireline carrier. Is that where you want to be invested?

Best wishes.

Dan,

Great point there. You should be honest with yourself. Some people just aren’t really ready to invest in stocks, or aren’t comfortable with the volatility. Nothing wrong with that; however, you should be honest with yourself. Don’t invest in stocks if you can’t stomach it, because you’re just going to lose money.

Thanks for adding that!

Cheers.

IBM revenue is flat in last ten years so there is nothing new here. They have decreased their share count a lot and improve their earning per share. They also have improved their profit margin big time in last decade.

2.7% is the highest current yield for IBM as far as I remember and their payout ratio is like in mid 20’s. This will continue to benefit dividend growth investors like us.

If they ever improve their growth and revenue it can be great for big time dividend payments in future.

IBM is not much of a technology company. It is more like service provider.

Like WB said he is been reading their earning statement from last sixty years and most recently pull the trigger to buy for the long term.

IBM is probably the best buy in market as of today.

AJ,

Keep an eye out for an article I’ve been working on for the latter part of the day. It should go live here pretty shortly. 🙂

Cheers!

Ha, good September. Most of my investments got taken out back to the wood shed and taught a lesson. But none of them fell for reasons that changed my view of the business so I’m just holding where I’m at. Surprisingly in the last 4 trading days or so a lot of my investments had a nice bounce. I hope it just evens out for a little while, I just prefer not to have drastic movement.

Zee,

“I just prefer not to have drastic movement.”

I think that’s where a lot of people find themselves. Although, that’s also what sometimes gets people into trouble with stocks because they obviously drastically move from time to time. However, I find in this drastic movement the most opportunity. Bonds don’t have drastic movements, but you obviously get what you get with fixed-income. Stocks offer almost unlimited upside at the cost of volatility. Seems like a fair trade-off to me. 🙂

Cheers!

I really appreciate you taking your time replying to mine (and others) specific situations. I want you to know how helpful that is to me, I really have noone in real life to discuss investments with. Thank you.

I part with cash every month, just like you. Bought UL this month. This chunk of money that I transfered is essentially half of my BB gun, reserved for special situations. Now that it’s in my stock account I can’t withdraw it without tax penalty, so I’ll just have to bite the bullet. 🙂 I might take you up on JNJ, KMI and XOM. Already got small positions in BAX and IBM.

Curious – what do you use to track your investments and your expenses?

Dee,

I use Mint.com to track my income and expenses.

As far as my investments go, my brokerage – Scottrade – tracks them for me.

I hope that helps! 🙂

Cheers.

Thanks!