Ignore The Noise

I thought with Election Day upon us, and the fate of the White House for the next 4 years here, now would be a good time to talk about something extremely important: ignoring the noise.

What is “noise”, exactly?

Pretty much everything out there that’s trying to distract you from reaching your long-term goals. It’s almost everything that’s short-term in nature, that will really have minimal net effects on your success over the long haul.

The election is noise, the euro issues are noise, media is certainly noise.

Does it really matter who gets elected? Doesn’t the President have a lot to do with national policy like taxes and regulations which can certainly impact the companies we dividend growth investors own a percentage of? Yes, they do.

But, what you must keep in mind is that Presidents come and go…every 4-8 years like clockwork since that is national policy. Taxes and regulations in turn, too, come and go. Over the last 100 years taxes have gone up and down, regulations have been imposed and removed. Oil crises have been here, we’ve been through major wars and technology and medicine have drastically changed. There have been many, many elections like the one we have upon us where the nation was captivated by the nature of it, wishing for change and clamoring about how businesses and the stock market would be affected.

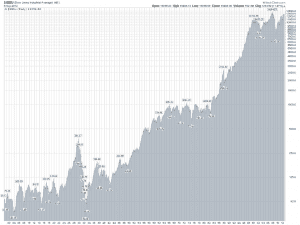

Let’s take a look at how the Dow Jones Industrial Average has done over this last 100 year stretch:

|

| Courtesy: stockcharts.com |

Hmm, that’s quite a run! You can see some major dips in there, most notably the crash of 1929. But, what really stands out is the epic march upward.

What does that chart tell me? It tells me what an investor needs to do is ignore the noise. Whether Obama is re-elected or Romney wins the White House won’t really matter when you’re investing in high quality companies for the next 50 years or so. Will I suddenly stop investing in world leading companies that raise their dividends annually over the rate of inflation and sell products or services that society deems worthwhile enough to pay premiums for because someone I wasn’t rooting for wins the Presidency? Hell no.

So if the election is just noise, and doesn’t really matter…what does matter?

What matters is company fundamentals like cash flow, earnings growth and debt loads. I think management matters. Wide economic moat qualities like economies of scale, brand name products, global reach and the ability to raise prices over time to meet or exceed inflation matter. Innovation and the ability to change matters as well. These things matter because they will affect how well a company does over time.

What also matters is valuation. Valuation matters because it will affect how well you perform as an investor over time. Buy even a high quality company at too high of a price and your total returns will suffer, and you will also receive less yield on your money than you otherwise should have had you purchased at a more attractive price. Quality is extremely important, but does not trump valuation. Both should be considered for the intelligent investor. Would you rather have 49 shares or 50 shares of the same high quality company for the same amount of money?

I can tell you what doesn’t really matter. Who wins the election. Do you really think who wins the Presidency will affect how many people buy Coca-Cola (KO) products around the world over the next 50 years, or whether or not Johnson & Johnson (JNJ) will continue to innovate new products in health care over the course of many decades? Will Obama or Romney really impact whether or not Philip Morris International (PM) is exponentially more profitable 30 years from now? Of course not!

So what I do is ignore all the noise. I don’t really pay attention to the election, much like I don’t pay attention to what talking heads on CNBC are saying about the news du jour. I just continue to invest in high quality companies that have strong fundamentals and reward me as a loyal shareholder with rising dividend payouts year after year. I continue to reinvest those dividends back into these high quality companies, along with fresh capital from my day job. I consider valuation strongly and most importantly I hold for the long-term, while still monitoring the companies for major shifts in business models or deterioration.

Noise is nothing more than a distraction, or even worse a roadblock, to my long-term ability to build wealth.

Full Disclosure: Long KO, JNJ, PM

How about you? Do you ignore the noise?

Thanks for reading.

Photo Credit: FreeDigitalPhotos.net

That’s just inflation though.

Anonymous,

Thanks for stopping by!

I’m not sure what your comment means.

Best regards.

My day job forces me to deal with noise and filter a great deal of EMI just to even see the signal, so I’ve grown accustomed to “ignoring the noise”.

When it comes to investing, I agree with you that the short-term noise shouldn’t cause an investor to make rash decisions. That is, stick to the plan and keep investing in the right companies, provided the fundamentals don’t change.

I think this is the logical, albeit slow and steady approach to amassing wealth. However, sometimes, I do wish the noise would reach critical mass as to create another golden buying opportunity (2008-2009). I wasn’t prepared for that one, but I keep telling myself I’ll be ready next time. Hopefully, it’ll just be a case of Mr. Market over-reacting to trivial noise. Those of us with our headphones on won’t miss a beat.

Good Post DM. Being able to adapt to change is the best way to handle things like political election results.

What are your thoughts on the upcoming fiscal cliff?

Hello DM,

I have been following your blog since last year, I must admit that your post and messages have become more and more thought provoking.

Thank you!

good post! Media is full of noise, Mr Market place a big focus on the monthly macro data.

One can find comfort and calm in the dividend streaks of the likes of Coca-Cola.

Well said. I couldn’t believe that the media were talking about Obama stocks and Romneystocks. As if some stocks were going skyhigh and others were going to nose dive.

Good post. I become a political junkie for about a month once every four years and quit the habit the day after the election. I’m glad to be able to ignore the noise once more and resume regular life.

Couldn’t agree more with this article! We as investors need to quit worrying about the short term and the frequent ups and downs of the market and focus more on what our individual companies are doing. As you said as long as the fundamentals (sales and profits) keep going up then our companies are doing fine and will reward us (the owners) over the long term.

After December 31, 2012, all dividends will be taxed as ordinary income, and ordinary income tax and Capital Gains rates return to those in effect in 2000.

10% ordinary income tax rate goes to 15%.

15% ordinary income tax rate goes to 28%.

25% ordinary income tax rate goes to 31%.

28% ordinary income tax rate goes to 36%.

33% ordinary income tax rate goes to 39.6%.

Meaning $2,000 in non-foreign dividends will be taxed 15% (-$300) instead of 10% (-$200) after December 31st, 2012.

$34,500 in non-foreign dividends will be taxed 31% (-$10,695) instead of 15% (-$5175) after December 31st, 2012.

$5,520+/year is quite a lot of Money/passive income to those with these kinds of dividend payouts or higher! Compared to a $100 difference, or $1500 difference with those trying to achieve $12,000 in annual dividends/passive income.

Those holding millions in quality American dividend growth stocks may just withdraw a few million shares from American taxed companies and invest in quality dividend foreign growth stocks with taxes of a max 15% (like Canada stocks) due to current policies. Further cascading the “Fiscal Cliff” that billionaires are worried about, and they usually never get emotional.

We will have to see what Congress and Obama do, if they desire to do anything. (I don’t hope and wait, i take action!)

From the last four year in term, it appears they hate Financial Independents, EREs, MMMs because after skyrocketing true inflation costs and raising taxes on investments, it makes it harder to retire early and/or be financially independent then it will have been this last decade.

Yes 1/2 of growing dividends is still better then 0 dividends.

But the Elections and Men of POWER can control your investment returns and your food prices, if you are dependent on the $ for passive income and the grocery companies, restaurant companies, gas companies, utility companies, infrastructure companies, consumer companies, Real Estate Companies, etc for needed expenses.

I highly recommended not depending your vital needed items in life on these companies and any government/kings. Get off the grids as best as you know how, and spend less/ work a lot less for others/ Enjoy your earned Freetime by saving and investing.

Also remember Currency is Controlled by Men in Power whom are supposed to be “of the People, by the People, and for the People”; but instead are mostly “of the money, by the money, and for the money/power”

Hey, you know what’s the most impressive thing about that 100 yr chart you posted? that isn’t even the total return! which as dividend investors is what we are worried about. the dow adjusted for total return on that same chart would be north of 300,000!!! as opposed to the 13,000 it sits at today.

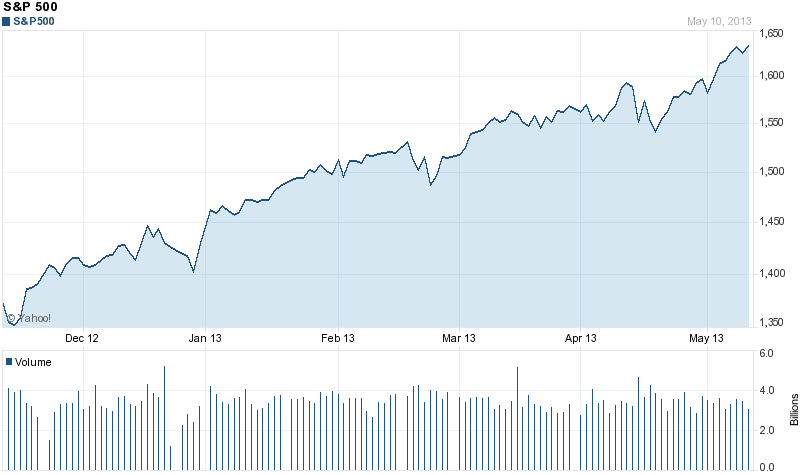

I love reading the comments on Yahoo Finance, especially today. Everyone’s talking about how the market is going to crash now that Obama was elected for 4 more years, and everyone should get out immediately and keep all their savings in cash because our economy is doomed. It’s very entertaining.

FI Fighter,

It sounds like the noise was definitely at a fever pitch today, and I’m so excited that I receive my monthly commission check tomorrow. My list is made and checked twice!

All of the people running for the exits now that Obama has been re-elected is giving us with long-term vision quite an opportunity.

Best wishes!

Investing Early,

I’m not too concerned about the fiscal cliff. I really doubt the government is going to just let things fall off like that.

However, change needs to occur. Taxes need to go up and spending needs to be curbed. It’s not fun, but it needs to happen. I can see DOD budgets shrinking, which will hurt defense firms like Raytheon, General Dynamics and Lockheed Martin.

We’ll see how it all plays out!

Best regards.

Anonymous,

Thanks for stopping by, and I appreciate you following the blog. It’s the readers that make the blog possible.

Stay in touch.

Take care!

defensiven,

I agree. Mr. Market loves monthly, or even weekly, macroeconomic data which is really so short sighted that it’s comical.

I definitely sleep well at night with many of many defensive holdings while Mr. Market is going through bi-polar mood swings. Works for me!

Best regards.

Average Dividend Yield,

Yeah, “Obamastocks” and “Romneystocks” is definitely a prime example of media noise. The media needs to fill hours and hours of coverage with something…so you usually get low quality material.

I can see certain industries being hit based on policy changes, but overall if you’re keeping a keen eye on fundamentals you’ll spot which companies are thriving and which ones aren’t.

Best wishes!

Headed Home,

I never really get caught up in the hysteria of politics. I look at policy and see which candidates align with my personal beliefs and that’s pretty much about it. I’m always witnessing a lot of really angry and bitter arguments between people when it comes to politics and it amuses me. It’s reminiscent of people fighting over religious beliefs. I don’t view myself as right or wrong in any particular belief system, whether political or other, so I simply believe what I believe and I don’t really mind if others disagree with me.

Glad you enjoyed the post!

Take care!

Dan Mac,

Absolutely. The short-term noise that can deafen an investor is only going to provide you a disservice if you try and listen to it.

Rather, put those headphones on and look at long-term fundamentals and you (and your ears) will be thankful for it!

Best wishes.

Freeyourchains,

Thanks for stopping by!

A lot of information there. I do agree that individuals are well served by becoming self-reliant to a degree.

I’m not particularly concerned about long-term dividend tax rates as I plan on retiring with a relatively low amount of annual dividend income anyway. Even if dividends are taxed at ordinary income tax rates I’ll be okay because my total income will still be low.

Thanks for adding that!

Take care.

Took2Summit,

Wow! I’ll have to look into that. 300,000? I was not aware it would be that high. You’re including reinvested dividends in that number, I’m guessing? That still sounds really, really high.

Pretty cool stuff!

Best regards.

Gen Y Finance Journey,

Yeah, comments on news sites are pretty funny most of the time. I remember MMM had quite a comment stream going when his story was published on a mainstream site (MSN I believe). There were a number of people who called him an outright liar, like he made everything up because it’s impossible to do what he did.

The blind shall never see.

Best wishes!

grox01,

Absolutely. When the market reacts to noise, that presents the long-term intelligent investor plenty of opportunity to take advantage of that.

Noise, in cases like today, can be wonderful indeed as long as you don’t let it deafen you.

Best wishes!

The Dow down 312 points, that noise is music to my ears. Attention shoppers we may have a sale soon.

Anonymous,

The Dow is down over 300 points because there are a lot of people out there listening to the noise.

Definitely music to my ears as well! I’m very excited to start off my November stock shopping tomorrow!

Best regards.

Excuse my ignorance but who is MMM and what did he do?

Anonymous,

MMM is Mr. Money Mustache. He retired at 30.

He runs a blog at:

http://www.mrmoneymustache.com

I visit there often. He has a pretty unique perspective and he writes some great articles.

Take care!

since th dow started in 1896, this article claims from 1896-2012 the dow with reinvested dividends would be 1,339,410!!

my 300,000 number was from another article I found which was actually referring to starting around 1940

http://online.wsj.com/article/SB10001424052970204571404577257373285657442.html

I like noise… I sometime wish for it!

This last 2 days, the noise and all it’s insecurity brought me some deals.

Noise = opportunity

Great article DM! I really like living abroad sometimes as I get to listen to the noise when I want to but I don’t have to get over taken by it.

I absolutely agree with you. Obama will not be running KO, INTC, MCD, JNJ, or any other of the quality companies on the stock market. He really has very little to do with it.

I was thinking about the same exact thing yesterday when I saw the market dropping post-election. So much noise and interference going on that doesn’t really matter, long term.

Great post!

I would not be so sanguine about the election if I were you, DM. I agree, the selloff brings oppurtunities, but the implications of defense cuts arent just about how it affects our dividends, it is also about men and women overseas at this very moment dodging bullets and IEDs. Dont mean to be rude, and hope its not taken that way, but get real on that score. DOD cuts means less money for R&D which means less research into all sorts of things that help save lives and limbs for our soldiers…Im not saying there shouldnt be cuts, there should be cuts, because we have way too many bases in way too many countries, and the military like any huge organization is very bloated. But I am suprised the military is the first place the government is latching onto to cut. Really? Out of all the bloated programs in the government, lets choose the military to cut, even though the military is one of the few institutions left in this country that actually still does the job it was designed to do, and usually does it pretty well. I also think the fiscal cliff, and more importantly the massive debt this country is building up–which isnt all the Presidents fault by any means–is a bigger problem than many people realize. If anyone can see the fallacy of continued borrowing with no plan or ability to stop spending, it should be us, the people who advise daily living below your means, saving and investing. I am not preaching doom and gloom here, bc I think everything will work out ok, but there are some serious issues ahead, in my opinion.

Well said High Yield Soldier! You make a lot of good points.

Some of our missions around the globe may make sense, but we do have way too many military bases. I am not a “dove”, but we need to close some of the bases and bring out men & woman back home. Time for Europe, Japan, South Korea and others to foot thier own military bills.

I agree that there is a lot of noise out there. I am planning on being around for another 30 years at least so these little blips are nothing. In 50 years, the US will be an entirely different country anyway.

I think he means that if you plot inflation over the same time frame, you’d see similar numbers. What you need is a graph that shows inflation-adjusted numbers, not raw ones. This graph distorts the benefit of investment. Not not saying that investment is not a good idea, just that this graph oversells the point.

– Another anonymous

Took2Summit,

Wow, that’s pretty incredible. Very cool article. Thanks for sharing!

So, factoring in reinvested dividends AND inflation the DOW should be at almost 47,000. Amazing stuff.

I saved that article in my favorites list.

Best wishes!

The Kechi One,

That’s a great benefit of living abroad! You get to watch the circus from afar, laugh, and then invest for the long-term amid the chaos. Definitely an advantage to listen from a distance!

Thanks for stopping by.

Best regards.

Rising Returns,

Yeah, the noise is now at a fever pitch after the last couple days. If you want a larger ownership stake in a high quality business, now is the time to initiate that.

I love days like yesterday and today. My shopping list was already made and I made two buys today…and left enough capital for another purchase.

Best wishes!

High Yield Soldier,

I meant no disrespect in my earlier comments. I simply believe that the DOD can definitely stand a reduction in its bloated budget, and that’s coming from someone who has a vested interest since I’m long GD and RTN.

I also believe that a reduction in the defense budget doesn’t necessarily have to put anyone in harm’s way. I could pick apart that budget and trim fat before anyone’s lives would be at risk. Just my take on it.

I agree with you that the DOD budget shouldn’t be the only budget that gets a serious look. There are many areas of spending at the Federal and State level of governments that are so wasteful it’s sickening.

It’s unfortunate that it’s the world we live in. I hope serious change is on the way.

I appreciate your service, and again I meant no disrespect.

Best regards!

JT,

Yeah, it’s interesting to think exactly where this country, and the world, is going. In many ways it’s likely going to be a much better place in terms of medicine and technology. In some ways it may be worse. Who knows.

Either way, I like to hedge my bets and invest in assets that will appreciate in value over time so that I’m in a good position to deal with whatever the world becomes. Investing in high quality companies, right now, is one of the best ways to accomplish that in my opinion.

Take care!

Anonymous,

Ah, thanks for adding that. That clarifies things a bit.

I don’t really agree that the graph “oversells” anything, as even when you include inflation you’d still be realistically much further ahead over that 100-year stretch.

Inflation has averaged right about 3% over the last 100+ years, while the stock market typically returns somewhere between 7-8%.

And there is a really cool article linked in a below comment that shows the DJIA would actually be around 47,000 points if you were to include reinvested dividends and inflation. Pretty cool stuff!

Best wishes!

I was probably a bit too sensitive on this subject, so sorry about that, hope I didnt come off the wrong way. I totally agree with you there is plenty of fat to cut.