Freedom Fund Update – June 2015

I’m extremely fortunate that I’m able to post these updates every single month, which shows the power of monthly contributions to investments because of the high savings rate I maintain. It shows how a relatively large sum of money can be built through the power of time, patience and perseverance.

It’s important to keep in mind that while updating the overall value of my portfolio is important for historical reference and for purposes of keeping track of total return, my main focus is on the rising dividend income stream the Fund provides.

May was just more of the same, more of what I’ve come to believe will unlock financial independence and freedom. More saving and more buying high-quality dividend growth stocks with the excess capital that comes from that saving. If consistency is my superpower, I try to leverage it as often as possible.

On the buying front, I remained as busy as I possibly could, bound less by imagination and opportunity as I was by capital. And most of that capital was exchanged for equity in great businesses fairly early in the month. As such, I’ve been more or less passively watching stocks since then.

Since the last update, I first added to my position in Omega Healthcare Investors Inc. (OHI) after a slide of about 18% over the prior three months. The valuation, quality, yield, and growth prospects all seem incredibly appealing here. In fact, it’s quite likely I’ll add a bit more to OHI in June.

I then shortly thereafter initiated a position in Union Pacific Corporation (UNP), which I subsequently added to a week later. The built-in competitive advantages for railroads are incredible, and UNP complements my position in Norfolk Southern Corp. (NSC) very nicely, now giving me exposure to track on both sides of the country. UNP is another stock that I’ll likely be buying more of over the coming weeks.

Just before the end of the month, I received shares in South32 Ltd. (SOUHY). SOUHV is a spin-off from BHP Billiton PLC (BBL), which I discussed a bit when I last averaged down on BBL. As such, I’ve accounted for the spin-off shares in the portfolio as a new position.

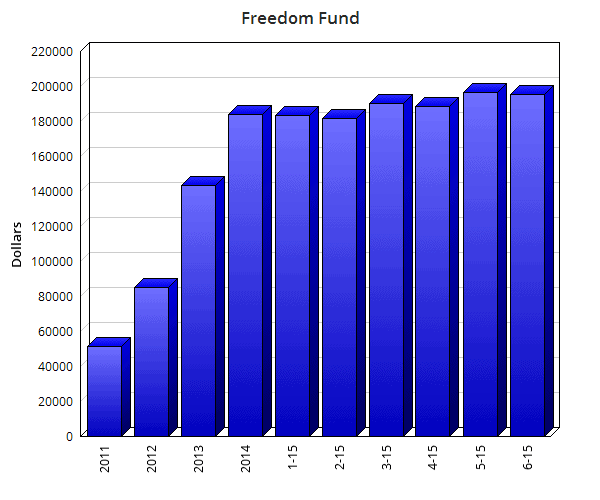

The current market value of the Freedom Fund stands at $195,305.61, which is a decrease of 0.7% since last month’s published value of $196,596.75. The S&P 500 declined a bit since the last update, and my capital additions weren’t enough to offset the broader declines across the portfolio. Nonetheless, I’m actually hopeful that we see greater declines in the market – cheaper stocks means higher yields, which means my future capital would be more effective in terms of helping me achieve my short-term and long-term dividend income goals.

I remain exceedingly pleased with how the portfolio is shaping up. It’s a collection of really wonderful businesses across all areas of the economy, selling products and/or services to billions of customers around the world. These products and/or services are mostly ubiquitous, and these companies, as a whole, have substantial competitive advantages that should ensure growing dividend income (on the back of growing profits) for years to come. Even better, I continue to add to the collection every month, increasing its quality, breadth, and diversification, while at the same time further limiting the risk of substantial dividend income loss as a percentage of total dividend income.

Looking forward, I expect to be quite busy in June. Quarterly estimated taxes have to be paid, so that’ll constrain me a bit. But I think I’ll still be able to make a few sizable purchases. I’m very excited about the possibilities for capital deployment over the coming month. I remain as aggressive as ever in regards to turning cash into cash flow. I still have a few free trades remaining in my Scottrade account, so I’ll look for opportunities to use those even as I continue to build out the new TradeKing account.

The Fund has positions in 58 companies. This is an increase since last month. UNP is a new position that I initiated over the course of May. And the SOUHV spin-off shares are now a new position as well.

These updates are mainly designed to show the increase or decrease in the value of the underlying equities I’m invested in, but the main purpose of investing in dividend growth stocks is for the rising stream of dividends over time. Thus, I don’t put too much emphasis on these monthly updates. I think it is a good idea, however, to keep track of the rising (or falling) value of one’s securities and be aware of where they are in terms of the marketplace and whether or not certain stocks are attractively priced. It find it a helpful exercise to update the values monthly. It gives me fresh perspective on which equities are performing well and which aren’t, and from there I can make educated decisions (based on further due diligence) on which stocks I’d like to add fresh capital to (while considering portfolio weight as well).

Full Disclosure: Long OHI, UNP, NSC, SOUHY, and BBL.

How did May treat you? Able to deploy capital advantageously? Your portfolio growing as expected?

Thanks for reading.

Photo Credit: BimXD/FreeDigitalPhotos.net

Note: Affiliate links included.

Edit: Corrected stock ticker.

Hey Jason,

Nice Update, my portfolio would have also gone down if it wasn’t for adding about $1,300 in fresh capital. Finding quality stocks that aren’t overvalued right now is pretty difficult. I’m going to take a look at your previous OHI reviews, maybe even pick up a few shares.

Cheers,

-Rich (27)

Hi DM,

Looking good although your portfolio value

decreased somewhat. Maybe stoplos is a good

way too protect your assets.

Good work man.

Regards,

DV

Jason,

As always an excellent month full of smart purchases. The market really has been a bit of a basketcase now for a little while, and though the price of your fund has decreased, its value continues to grow. Congrats, hopefully we see a big May dividend output in your next post and we will see a large gain in your June dividends too.

– Gremlin

Hi DM

Sell in May and go away? Probably a contradiction for dividend investors like us 😉

Dividend Mantra,

I am with you as I would welcome a pullback in the markets. I have not tallied my numbers yet for the month but I expect the portfolio value to be near the same as last month. My money from paying myself first also went towards both savings and investing this month instead of the usual 100% into the investing accounts.

Trying to decide on which investment to make is a problem I do not mind dealing with .

I just did a quick look at my financial securities decreased as well. As a result, my change in net worth for the month was much smaller than I had anticipated.

On months like this, I find it important to remind myself of the core principles of financial independence and acknowledging whether I followed them or not.

Have I controlled my expenses? Did my savings rate remain the same or even increase? If so, then keep chugging along and in the long-term the principles will prevail.

Thanks for sharing!

Congrats on steady progress. Even though the value decreased you still added to some excellent companies. I’m looking at adding UNP myself because the company is excellent and their rail network reinforces their moat. You should be crossing over the $200k mark over the coming months. Although I know you’d be fine if that got pushed back some because the markets retreated and you got to keep making purchases at lower prices. Any plans with the South32 shares?

It seems that it is possible that we will get a falling market. At the moment we have a market which is doing at the end not so much. Hopefully we will get lower courses.

Today I got as well the SOUHV and this is now my smallest position with around 300 € for 40 shares. I don´t think I will sell them as this doesn´t make any sense.

I can imagine that the reach of the target getting the 200k is tougher as you have expected at the beginning of the year. But I assume you will get the rest of 5000 $ over the time by investing new money. As you wrote this figure is not that important. Getting more dividents is what we are looking for. And for this you are on a good way.

Solid update, love the good use of links so I can catch up on what I’ve missed. The chart is very cool looking too!

DM,

I was wondering how you catagorize your spinoff shares of South32. Is there a cost basis for that even though you didn’t have to purchase those shares you received? I just got some shares of South32 as well, and didn’t know how I should keep track of them since they’re the first spin off shares I’ve ever gotten. Thanks!

Would you agree with Charlie Munger that the first $100K is the hardest to reach? At what monetary level can one start to feel the effect of compounding?

Jason,

The freedom fund continue to grow at nice pace with new companies entering the fund… Like all of us, we are waiting June with some fears and a lot of things could happen, like market correction, the Greek issue, and others.

What is your view for the next 4 months?

Cheers,

RA50

Rich,

The broader market continues to march upward, which is something that I think a lot of people (including myself) are surprised about. I’ve been hearing about a major correction for years now, and I know some investors out there stopped investing a while ago, choosing to go in cash and wait for cheaper stocks. But that’s why I don’t bother timing the market. It’s not possible. But it’s also not necessary. The market generally goes up – a lot – over long periods of time, so trying to dance in and out is foolish, in my view.

Best of luck finding the right opportunities for your capital. 🙂

Cheers!

DV,

I don’t find any value in using stop losses. You could also refer to using them as “stop gains”, since that’s really what you would have been doing by using them at any point over the last five years for most of the stocks I discuss and invest in. Focusing on the day-to-day or even month-to-month movements of stock prices ends up putting you in a position where you’re missing the forest for the trees. The trees might temporarily shrink in size, but the forest is growing at a pretty robust rate over the long haul.

Thanks for dropping by!

Take care.

Gremlin,

Thanks. Just trying to find the right opportunities out there. 🙂

Yeah, the S&P 500 chart resembles a roller coaster YTD. Up, down, up, down. I hope we see a few more downs over the coming months.

Thanks for the support. Hope you had an excellent month over there as well!

Best wishes.

B,

I prefer buy in May and stay. 🙂

Cheers!

IP,

Allocating capital can sometimes be difficult, but what better problem to have than a first world problem like that? 🙂

I think my purchases will be largely repetitive. I tend to buy in blocks, whereby I find an attractive stock or two and purchase over and over again until I’m all filled up. We’ll see. Very much looking forward to seeing how June shapes up.

Good luck allocating that capital as you see fit. I imagine you’ll have fun over there.

Cheers!

RTR,

Exactly. Focus on what you can control (limiting expenses, maximizing savings rate, etc.) and largely ignore what you can’t (stock prices). When you do that, it’s tough to not succeed. 🙂

Besides, cheaper stocks are something to really look forward to for anyone out there accumulating assets aggressively. It would be a blessing to see the market drop by 10%+ over the coming months. I’ll keep hoping!

Best regards.

JC,

Love the railroads right now. All the major players are down about 15% or so YTD, which is a pretty solid opportunity, in my opinion. Added to UNP already today. Getting the month started off right. 🙂

I’m going to keep the South32 shares. They’re going to pay a dividend, though I’m not sure how that’s going to work out with taxation and what not. Nonetheless, it’s too small of a position to really worry about. If taxes become a headache, then maybe I’ll use a free trade or something to sell. But I doubt I’d do that. Spin-off shares tend to do well over long periods of time, so we’ll see what the fundamentals look like now that they’re an independent company.

Thanks for stopping by. Hope all is well!

Best wishes.

The next best update after the dividend income reports. As usual another great month even though there are a small decrease but as I always comment it’s more about our growing dividend income stream than capital appreciation. With that being said a few solid names have been added in May. Here we are approaching the midway point to the year and once again I’m excited about my buy this month as well as reading about others buys among our dividend blogging community. Thanks for the update.

DM,

200k continutes to loom in your future! Incrediably exciting, how you feeling about the BAX spin off/ basically dividend cut. Curious what you think. Love the blog

olli,

I’m with you. I doubt I’ll do anything at all with SOUHV. Well, other than collect the dividends. 🙂

Yeah, I’m hoping the portfolio doesn’t hit $200k for many more months. That would mean stocks are falling, which would also mean yields are rising. And that would allow my goal for $7,200 in dividend income this year to become that much easier. The dividend income is what will buy me my freedom, not the portfolio value. So I’m very hopeful for a broader correction.

Thanks for dropping by. Hope you had a fantastic May!

Cheers.

RR,

The chart sums it up pretty nicely. 🙂

Thanks for dropping by!

Take care.

Tabula,

You’ll see my shares on the portfolio page now.

There’s still a cost basis there with SOUHV, even though you didn’t directly purchase the shares. That cost basis will be determined for you, and you should see it by checking your unrealized gains in your brokerage account. If you can’t find the information, you may want to contact your brokerage.

Hope that helps!

Best regards.

Agree completely on the use of stop loss orders. As Peter Lynch explains in his books, given the natural volatility of market prices for stocks, a 10% stop-loss order pretty much guarantees a 10% loss on your investment.

Good day Jason. This was another great update on your Freedom Fund. I have no doubts that if you stay with your disciplines you will prosperous. All the best to you and your family. Michael

PasserBy,

I’d definitely agree with Charlie on that. And it’s really just emblematic of the power of compounding. Gotta have money to make money when discussing compounding, and getting that first $100k means you have money working for you and compounding starts to take over a bit. But I’d focus less on the overall number and more on the income that’s actually rolling in and being reinvested. That income is what will really work for you.

But I think that’s about the level you start feeling the effects of compounding. Assuming a 3.5% yield, you’d have about $3,500/year in dividend income coming in, which is about $300 per month. That helps out tremendously when added to the fresh capital you’re already investing. I know I started feeling the effects somewhat dramatically toward the end of last year, when the dividend income started to become rather substantial. The dividend raises really help as well, as I demonstrate with the quarterly updates.

It’ll be interesting to see when I hit the second $100k, which I’ll be able to directly compare with the first $100k. 🙂

Cheers!

Jason,

Happy to see the portfolio values languishing a bit which means our purchasing power, in terms of dividend yields, is not falling as it has done since you started. Imagine your dividend income if the market was still around 10-12k for the dow. Alas, we have to take what the market gives us and you are a testament to that. Congrats on picking up more UNP today! We can’t wait to see your dividend income and recent buy posts later this week. Keep up the great work!

All the best.

FD

Purchased AMGN, GILD, and UNP this morning. Got my South32 stocks too. I want to purchase more healthcare/bio stocks, but the P/E is very high.

RA50,

We’ll see, my friend. I’ve been hearing about the upcoming correction for years now. But even a broken clock is correct twice a day. I’m sure when the market finally does correct that we’ll all hear about it from the people that have been pounding the table for the past two or three years. Funny how that works.

I honestly don’t have a view over the next four months at all. I don’t worry about macroeconomics at all. I focus on what I can control, like saving a high rate of my net income and then investing that capital into the best businesses I can find at the moment. If Mr. Market starts to offer much cheaper stocks because his mood has soured, I’ll be even happier. 🙂

Best wishes.

You made some solid purchases there, Jason. And if the market would come down , say 10% or so, we could make even more solid purchases. 🙂

What is your opinion on SOUHV? Do you think it is worth to hold, being a very small position?

Best Regards.

DH,

I’m excited to buy stocks every month. It’s like being able to go on one long shopping spree. 🙂

We’ll see how June goes. I already added to UNP to get the month rolling. Hope we get even more opportunities over the coming weeks.

Thanks for stopping by!

Cheers.

Brian,

I’m really excited about the spin-off. Baxter has a history of spinning off assets, which generally all end up doing very well for long-term shareholders. The dividend hasn’t been cut, however, so I’m not sure what you’re referring to there.

Thanks for stopping by. Appreciate the support very much! 🙂

Take care.

Jim,

I’m with you. Maybe traders would find good use of using stop losses. But a long-term investor shouldn’t even be thinking about using them, in my opinion.

You’d just be allowing the market’s volatility to get the best of you. Huge mistake.

Cheers!

Michael,

Thank you very much. It’s really more the system than it is me. If you use this system correctly, you’re pretty much guaranteed financial freedom. 🙂

Wishing you and your family all the best as well!

Cheers.

I got my SOUHV shares also. I’m holding mine. The trade fee alone wouldn’t justify me selling my $200 worth.

Jason any thoughts on RIO? In the same sector, and decent yield.

FD,

Exactly. I’ve received comments and emails over the years basically inferring that my success is due to the rising market over the last five years. But those people obviously don’t understand what this is all about or how long-term investing actually works. I’d be MUCH further ahead if the market stopped advancing back in 2010 or 2011. In fact, I might be a couple years closer to financial independence if that were the case. But we do what we can with what we’re given. 🙂

Looks like you also picked up some UNP recently. Glad to be a fellow shareholder. Keep up the great work!

Thanks for all the support.

Best regards.

Sam,

We’re after the same stocks. Let’s hope we continue to get cheaper prices. GILD is moving in the opposite direction, and it’s starting to run away from me. First world problems, right? 🙂

Keep it up over there!

Take care.

Jos,

I’m hoping we see it come down by 10% or so. That would make for a very fun summer. 🙂

I plan on just holding SOUHV. It wouldn’t make economic sense to sell and I think it’d be awfully presumptuous to sell before even seeing how they operate as an independent company for a while. Spin-offs tend to do well more often than not, so I’ll likely see how it all plays out. It’ll probably not make much of a difference either way for me (due to its size), but you never know. PSX wasn’t that big of a position when it was spun off, but it’s grown quite nicely. And I made the mistake of selling ABBV way back when it was spun off from ABT, which is a mistake I learned from.

Cheers!

presone,

I’m with you on the economics of selling. Doesn’t really make sense. And it could turn out to be a great investment. To sell now would just be making an uneducated guess.

RIO is comparable to BBL, but BBL sports better and more consistent numbers across the board. So that’s my choice in this industry.

Cheers.

So very close to that $200k milestone. Keep it up Jason, I’m sure you’ll cross that line in the next couple of months.

May was pretty good for me:

Net worth increased 1.73%

Initiated positions in Union Pacific (UNP), Covanta Holding (CVA), Omega Healthcare (OHI), Potash Corp (POT) and Chevron (CVX).

Had a personal record dividend haul – up 15.4% from last May.

On the downside, my business was slow so income was low(er).

Your post about 4 stocks to consider buying got me excited – I am itching to get some JNJ and PM. Maybe in June.

That’s a great looking month right there, so many excellent purchases! I especially like seeing the split from BBL enter your portfolio for free, it’ll be interesting to read your updates on taxation there. I’m really looking forward to what June brings for you, glad to hear about one of the new purchases already in UNP. I’m so happy all you fellow bloggers brought its recent price decline so clearly to my attention, thank you for that! Here’s looking for a drop in market prices to make our decisions that much easier through the rest of the month. I always find so much value in your posts, so thanks for sharing!

It’s great to see consistent progress of your overall portfolio. You are definitely correct in that you’d be closer to financial independence of stock prices dropped or stayed flat over the past 5 years. It seems that people don’t view the stock market like ANY other market, then again not everyone embraces a DGI strategy for income.

Keep up the great work, it looks like you’re very close to critical mass where the dividends alone can purchase new shares each month… A great position to be in if/when the market correction occurs.

Best regards,

Dividend Odyssey

Tawcan,

Thanks for the support!

I’m hoping I can delay that inevitability. We’ll see what happens, but I’d prefer cheaper stocks over a higher portfolio balance. But the market hasn’t really cooperated with that wish over the last few years. 🙂

Best regards.

sfmitch,

Awesome stuff there. That’s fantastic. Nothing like breaking a new record for passive income. 🙂

Great job with four different stock purchases. It’s rare that I’m able to spread capital around quite that much, but I think I might just have one of those months in June.

Keep it rolling!

Cheers.

Ryan,

The railroads are looking very nice here. Glad to be in a position to collect growing dividend income from UNP alongside you. I think we’ll do well there. 🙂

Thanks for all the support. Keep up the great work!

Best wishes.

“Sell in May and go away” must apply to those who aren’t invested in the long term. And if thats the case, perhaps the best solution is to not invest at all. My stocks went down a bit in May but as you can probably guess, I’d be more interested in the 5, 10, and 20 year growth summary than month-to-month. Great progress on your account though, I should really change the name of my account to “freedom fund” 🙂

Cheers,

Dan

DO,

You’re correct. Any other market and people are complaining of rising prices. But it seems people are all to happy to pay more for stocks. Funny how that works. Seems to defy logic.

Things are definitely rolling now. June should be a great month for dividend income, which will help in a big way toward putting some serious capital to work this month. Let’s make the most of it! 🙂

Take care.

Dan,

Yep, I feel the same way. Those who zero in on monthly stock market performance or something of that nature are really missing the big picture. Zooming out to the 10-year or 20-year picture shows something very, very different. And since my time frame is the rest of my life, that picture is more apt.

I’d rather buy in May and stay. 🙂

Best regards.

Great month Jason. I’m looking forward to the market dropping a bit more as well. Like you, I’m looking to have a busy month of stock purchases – if the prices are right…

Ken,

Thanks so much!

Let’s hope for cheaper prices. Maybe if well wish for it, Mr. Market will turn moody. 🙂

Have fun shopping over there.

Best wishes.

Another good month 🙂 I’ve finally got our Ultimate Dream fund started, which I’m very pleased about – we’re finally out of the starting blocks and on the road to financial freedom. It’ll take us longer than you by a long shot, but we’re plodding along on our journey 🙂

Hope June is good to you!

Jason, I think Brian is talking about the possibility that the combined dividends from the 2 companies will be less than BAX today. Even, if this is the case, I think the long term prospects are very healthy for both companies.

D4S

Jason,

Same here for SOUHV. I am in your camp on leaving it alone. I may even add more to my position on BBL.

Actually, SOUHV showed up in my account on the 18th(I think), but I couldn’t do anything with it (can’t sell etc). I think this is where the cost basis will be based on.

D4S

Nicola,

Congrats on starting your journey over there. That’s very, very exciting. I can tell you firsthand that it’s incredibly rewarding in many different ways. I’m sure you’ll find the same. 🙂

Definitely not a race, though. As long as you’re on pace for your own goals, that’s all that matters.

Best wishes!

Div4son,

Ahh. It’s all speculation now, though. Unless I’m mistaken, there haven’t been any numbers released on exactly what the total dividend will be between the two companies. If an actual dollar amount has been released, I’ve missed it.

I remember hearing the same speculation back when ABT spun off ABBV. People love speculation. 🙂

Until both companies announce their next dividend, I’ll just sit tight. It’s just noise until then.

Cheers!

D4S,

Yeah, I’ve made the mistake before of selling spin-off shares early, before really getting a feel for how results would be. I won’t do that again. In fact, I find it increasingly unlikely that I’ll sell anything moving forward, unless there’s a substantial change in business operations at a company I own a piece of. Otherwise, I like the collection as it stands. 🙂

We’ll see how SOUHV does. But, in the end, it’ll be a nice little dividend raise when factoring it in addition to the sizable BBL dividend. I like that!

Best regards.

Hi Jason! Your blog is so inspiring, I love reading your posts. I also have a portfolio valued at approximately 200K, but my dividend income may be slightly higher than average probably because I own more high yield stocks with a good dividend history. I am a sucker for high yield, which may not be a good thing. Life in Los Angeles can be expensive, which is why I get attracted to blue chip stocks with a yield of 5% or higher, along with a mix of high yield reits and close ended funds. I do plan on balancing my portfolio a little better by initiating new positions in different industries over the next couple of years. In the meantime I would really like your opinion on PMT. My cost basis is about $20.8, now the price has fallen to about $18.6. The current P/E ratio is about 8.01 and I am considering adding PMT to my position to lower my cost basis. Generally, is it better to initiate a new position in a different equity or is it better to lower the cost basis of an existing equity when the opportunity arises? (PMT gets a 57% rating based on Benjamin Graham’s methodology. UNP currently has a 43% rating, as seen on Nasdaq). I am debating between initiating a new position in UNP or adding to PMT, even though UNP only has a current yield of about 2.16%. I’m trying to be a better investor! I would love to hear your opinion and to learn from you. Best of luck on achieving your goals and dreams as soon as possible, and thank you for inspiring the rest of us!

I don’t know if you take post ideas but your last sentence definitely sounds like a post idea and something I would find interesting to read about.

Hi Jason,

great job until here. I have the same intension then you and im currently working on it. But im at the moment at the beginning. So there is a long way to go 🙂

Nice wishes from Germany.

Sebastian

Pat,

Nothing wrong with seeking yield, but it can become problematic when you chase yield down and sacrifice quality in the process.

I can only say that I’ve never been interested in stocks like PMT. I don’t fully comprehend how they make money, how they’ll continue to make money, and all the the inherent risks. I like keeping things simple:

https://www.dividendmantra.com/2015/02/keep-it-simple/

https://www.dividendmantra.com/2015/02/keep-it-simple-part-2/

Making money doesn’t need to (and probably shouldn’t) be complicated. That said, I can only tell you that UNP has far outperformed PMT since the latter went public (I only compare the two since you brought up UNP) in terms of total returns. It’s not even close really. Now, PMT has provided more total dividend income over that period, so you’re sacrificing overall return for that income (UNP provided a good chunk of return in the form of capital gains). And I would argue you might be sacrificing quality as well.

So it really all depends on you. Are you interested in distressed mortgages? Do you think management (didn’t Stan Kurland come from Countrywide?) has what it takes to succeed if there’s another financial crisis? Do you understand how they make money? How likely will they continue to profit? What are the risks? How does the quality stack up against the competition?

I think not just of dividend income today, but dividend income 10, 20, and 30 years down the road. And if I don’t see how a company can continue to pay out growing dividends for decades to come, I don’t even bother. Typically speaking, most stocks that yield above 10% tend to be low quality/high risk and offer subpar total returns.

Hope that helps!

Best regards.

PasserBy,

I’m on it. As soon as the portfolio crosses $200k, I’ll make the comparison. It’ll be interesting, though not necessarily incredibly educational since a lot of that depends on overall market performance. Nonetheless, it’ll be fun to see how it pans out. 🙂

Cheers!

Sebastian,

We all have to start somewhere. I started below broke with no prior financial acumen and a modest income, so it’s possible to make great strides rather quickly with seemingly little means. We’re all climbing that mountain of freedom. And every step forward puts you further away from the start and closer to the summit. It takes time, but the rewards are worth the hard work. 🙂

Thanks for dropping by from Germany. Really appreciate the support. Wish you nothing but the best of luck as you start your journey. I hope you find even more success than I have!

Cheers.

I also own Anglo American,bought at £10.00,yield 5.5%,(Im UK based).Might be a tough few years, but im only interested in the dividends 5,10,15 years from now.

The sector is beat up, but the forward free cash flows should make dividends move forward a few years out.

I love it when quality stocks i own go down.Buying income cheaper gives me a warm feeling.

Hi Jason

I have been accumulating cash for the last few years since my divorce. I was not able to do so until then as my ex spent money faster than i earned. I have regularly earned over 100K for years in the automotive profession working 60-70 hour weeks. I recently switched professions to a somewhat lower paying municipal employee with a defined benefit plan and am much happier now with a lot more time to enjoy myself. I am now 52 and have managed to save about 40K in the past 3 years. I searched for quite some time trying to figure out how to invest until coming across your blog as well as DGI and it was exactly what I had been looking for. I did not want to “play” the stock marked as I felt that was for suckers. Your dividend growth approach coupled with frugality has really given me inspiration. I have been diligently working on reducing my spending as well as purchasing my first 17K in dividend stocks since March. I will continue to deploy the rest of my cash and believe I can add 1.2K per month and 2K per month by the middle of next year because of some loans that will be paid off. It is really exciting to know that I have purchased great companies at fair valuations that will bear fruit in the future. I just wish i had started earlier. I only have 15 years before I plan to retire.

I just want you to know that I really appreciate and enjoy reading your blog and tell you what an inspiration you have been to me.

Great job moving from where your were to where you want to go.

Keep up the good work.

Bill

John,

“Buying income cheaper gives me a warm feeling.”

Couldn’t agree more. Let’s hope for more warm and fuzzy feelings in the future. 🙂

Cheers!

Bill,

Thank you very much for sharing that. And I appreciate the kind words and support. 🙂

We all wish we would have started earlier. I sure wish I would have started back at 21 years old when I received an inheritance, instead of wasting it (and much more money I’d later acquire) away. But all we can do is learn from our mistakes and move forward. Besides, those mistakes make us who we are and allow us to appreciate the success when we do achieve it. Gives us perspective.

The good news is that you’re still relatively young, you’re cognizant of your financial position, and you’re making the hard choices now to allow yourself freedom down the road. I think once you start to see the results, you’ll find that the “sacrifices” aren’t really sacrifices at all.

Best of luck as you start down this path. It’s incredibly rewarding and exciting to take control of your financial future.

Stay in touch!

Take care.

Hmm, I might have been too late to get the South32. Still no sign. Bought BBL on the 15th of May, settlement date the 20th. Which is odd, because it plunged the following week which I thought was to reflect the spin off. Any thoughts?

Either way, a small position like you said but certainly was curious to watch the little guy grow over time! Also picked up KMI today. I understand it’s a bit tricky to value now but payout ratio seemed really high.. any thoughts there also!?

Thanks a bunch, your blog keeps me going!

Stephen,

You might have been too late for the South32 shares, unfortunately. The record date is 5/20, with the last day BBL ADSs trade with an entitlement to the SOUHV shares as 5/15. If you think of that as an ex-dividend date, you would have had to buy shares at least one business day beforehand. I’d recommend to contact your brokerage, or perhaps even better the shareholder information line:

http://www.bhpbilliton.com/home/investors/demerger/Pages/Shareholder-Information-Line.aspx

As far as KMI goes, it still operates like an MLP. So you’ll have to look at the distributable cash flow in order to determine profitability and its ability to pay out a dividend (the payout ratio). That information can be accessed via its financial reports.

Best of luck! 🙂

Cheers.

Hey DM,

Congrats on another month of purchasing DGI stocks bud. I like the additions to OHI here. I really should start keeping track of my portfolio balance month-to-month in a more organized way, definitely important to see how you’re doing over time.

Best regards

DB

DB,

Thanks so much. It was a really great month, all in all. Just more additions to the collection. 🙂

OHI is really appealing here. I’m looking forward to adding a little more this coming month. Should have some more capital over the coming days, so it just has to stay still for a bit here.

Hope you had a great month over there. And I hope you find some fantastic opportunities (along with the capital to pick them up) in June!

Thanks for stopping by.

Best regards.

The portfolio seems to building very nicely, and the dividends should be rolling in as well. You have done quite well for yourself. Great job!

Keep cranking,

Robert the DividendDreamer

AKA — Seeking Dividends

Follow me on Twitter– Seeking Dividends@DividendDreamer

Yes, I just wanted to back up what you (and Charlie Munger) are saying here. 100K is where you really start to see the compounding taking over. Plus, there’s a psychological effect, too. I know when I hit 100K, it was like, WOW! I had the feeling that I had some real degree of financial security behind me. No, I wasn’t quitting my job or anything like that, but if some adverse event happened, it would hurt but I’d have some real breathing room compared to most people. It took me 9 years to get out of debt and get to 100K. 6 years to 200K. And only 2 years to 300K. If I’m lucky I may hit 400K this year…but that may be pushing it. The markets will correct at some point.

Robert,

Thanks so much. I’m giving it my all every single day. 🙂

Take care!

Mysticaltyger,

Absolutely. That sense of financial security is something I discussed a little while back when I wrote about the spectrum of freedom. And that sense of feeling like I could take a leap of faith without falling is what led me to trying out writing full time (which has worked out great thus far).

Sounds like the snowball is really rolling over there. How fun! 🙂

Thanks for sharing.

Best regards.

Hi DM,

As a fellow SBSI shareholder, you gotta love the 5% common stock dividend paid out on 14 May. It actually slipped under the radar but I caught it yesterday when I went over my monthly statement with Fidelity. 10 free shares…whoo hoo!

Thank you sharing!

Your portfolio is growing quite nicely with high quality holdings. My portfolio also declined a bit last month, but stock market decline is actually a good news for us as we are still in accumulating stage.

Keep building your freedom empire!

Happy investing!

Cheers

Hi,

I can see the point here and do want to thank you for your good feedback. However, I have read that in Stock Market Cashflow that over the past 40-50 years the investors that used protection systems where the ones who gained the highest yearly yields.

But indeed I can also see the point where you can touch a 10% stoploss quite quickly indeed.

Anyway, quite some insight once again.

Thanks,

DV

Thanks for the inspiring updates! I was able to invest $4,219.12 in new capital in May, which the majority was from our tax return. Built up my positions in O, OHI, and CAT so I am excited to see these new editions to my portfolio grow over time.

Great point about the benefits of a flat or declining market – you can buy more shares at a cheaper price. That’s an under appreciated “benefit” of a crappy stock market. We certainly bought tons of shares back in the 08-09 recession that have since gone on to double (both in value and in dividend payout).

Hi Jason,

First of all I wanted to thank you for all of your work here. I am a brand new investor and am buying in to your philosophy. I read your book and all of your blogs from the last few months and started my portfolio with AAPL, JNJ, OHI, UNP, and WPC. Two questions:

1) I realized that while you have recommended all of these stocks recently, they may not be the stocks you would recommend to start with. Maybe you have already written about this somewhere but is there a list of “must have” stocks that you would start a portfolio with?

2) I started my portfolio through a Roth IRA so that I would not be taxed. Is this a smart move? The only downside that I see is that I won’t be able to take out money without penalties until I am 59 1/2 besides things like new houses or medical emergencies.

Thanks again!

DM,

The Freedom Fund is becoming its own unstoppable force; a locomotive on a mission higher. I’m confident it won’t be long before you’re not just breaching $200k, but even half a million. Keep rolling on down the tracks, brother.

– Ryan from GRB

DM:

I know this is of considerable less importance to you, but what return have you earned on your portfolio since inception? Just curious to see how much of your portfolio is made up of your own contributed capital vs how much is pure profit…thanks.

Well, must be my lucky day! They just showed up in the account! Haha!!

Keep going… the 200K mark is still very close. It’s a matter of days before you reach that new milestone.

Keep on the good work !

Becky,

Absolutely! SBSI has been a nice little holding. I thought of adding to it when it dipped rather sharply during the acquisition of OmniAmerican (it’s now at a similar level once more). But it’s a really small bank and I’m okay with the position thus also being small. Nonetheless, my original purchase was only 60 shares. The other 14 I now own have come about by stock dividends. I’ll take it. 🙂

Glad to be a fellow shareholder!

Cheers.

FJ,

Absolutely. Those pullbacks are wonderful for asset accumulators. Cheaper stocks means higher overall yield. Higher overall yield means that we reach financial independence that much faster. 🙂

Keep the snowball rolling over there!

Best regards.

Congrats on working your plan and adding some more stocks. I’ve been working on the healthcare sector for my “Freedom” fund and in my Roth IRA. In May, I added 22 shares of OHI and 10 shares of JNJ. I also like WM and HAS. Hasbro has the licensing for “Star Wars”, Marvel and Disney’s Frozen and pays a 2.5% divvy. The P/E is a bit high at the moment, but I think they’ll kill this Christmas season when the new Star Wars movie comes out.

John,

Awesome stuff over there. Investing over $4k in one month is fantastic. That alone will turn into a healthy sum over the next 20 or 30 years. Just imagine adding to that over and over again. 🙂

Not every month will be that great, I’m sure. But stick with it. Amazing things can and do happen with seemingly small additions. Consistency matters.

Best wishes!

Justin,

That’s a great spot to be in over there. I certainly wish I would have started even earlier and caught those really cheap stocks back in 2008 and 2009, but such is life. In the end, one’s savings rate will factor in a lot more than one’s rate of return when it comes to achieving financial independence rather early (assuming a relatively short asset accumulation phase). Nonetheless, I wouldn’t mind an additional $1,000/year or so in dividend income. 🙂

We’ll see what we get. I wouldn’t mind seeing a 10% or 20% drop, though.

Thanks for dropping by!

Best regards.

Kyle,

Thanks for dropping in. Glad you found the blog. You’re at an exciting point there, just starting out. I can tell you that it actually gets more exciting as you march forward. It’s just a lot of fun.

As far as your questions go:

1. My most recent article just before this article relates to this:

https://www.dividendmantra.com/2015/05/four-stocks-that-arent-on-my-radar-but-perhaps-should-be-on-yours/

2. A Roth is actually pretty flexible. I don’t use any tax-advantaged accounts for a variety of reasons that are pretty specific to my own situation. But you can actually withdraw contributions at any time from a Roth, meaning it’s really flexible in terms of accessing the money before the traditional retirement age.

Stay in touch!

Take care.

Ryan,

Thanks so much! 🙂

Yeah, it’s all an inevitability now. I’m hoping for cheaper stocks, but it’ll also be fun to write about hitting that second $100k. It’ll also be interesting to compare hitting the first $100k to hitting the second $100k and seeing the difference between the two. I imagine that unless we see a major pullback, the portfolio should hit that $200k mark within the next couple months. Cheaper stocks or higher portfolio value… it’s a win-win, either way.

Hope you had a great month over there!

Cheers.

Chris,

I don’t calculate total return often because it’s fairly irrelevant to what I’m doing, but I decided to take a look at it at the end of 2014. I’ll probably run the XIRR every five years just to make sure I’m not way off track. It was around 18.5% annualized from the point I started in 2010 until the end of 2014. I suspect I’ll look again in 2019.

Hope that helps!

Take care.

Steve,

Nice! Glad to hear that. Looks like you got in just in time. 🙂

Cheers.

LeDividende,

Thanks for the support!

We’ll see how it goes. It’ll be fun to compare hitting that second $100k to hitting the first.

Hope you had a great month over there as well.

Cheers.

Halw,

Sounds like things are rolling along for you over there. Very nice!

I’m also looking for good opportunities in healthcare. It’s one of my favorite areas of the economy and I’m currently underexposed there. A richer, older, and bigger world all bode well for increased healthcare spending over the long haul.

Keep that snowball rolling!

Best regards.

Wow! 58 companies that is a lot to keep track of. You’re getting so close to $200K.

May was an nice improvement over April for me. I was able to increase my net worth by almost $7,000 in May. I did deploy some new capital into a non listed commercial real estate trust ($1,000). It’s currently paying a 7.5% dividend. Paid down $1,900 in principal on my mortgages and contributed about $1,600 to retirement accounts.

And savings went up about $1,900.

So far we are on track to reach our goal of increasing net worth by $69,000 this year.

It is so motivating to track this along with everyone else in the community. We all have our unique goals, but it’s all for the same purpose.

Cheers!

Thank you so much for sharing Jason! Are you using google docs to update your progress? I have a template almost identical to yours but google only allows for a maximum of 50 entries and after that, it just goes crazy. How are you able to keep it up to date with so many positions? I really want to get started with keeping track of my progress but not sure what the best way of doing that would be. Thanks again for all your efforts!

Dominic,

That’s awesome work over there. A ~$70,000 increase in your net worth in one year would be amazing. I seem to recall reading you have a pretty high income going on over there, but that’s still excellent work. People with high incomes don’t necessarily save a lot because they let lifestyle inflation set in.

I don’t personally track net worth because I don’t find any value in it, but it’s pretty easy to figure it out in about 10 seconds if I really want to. The luxury of being a minimalist and not owning (or owing) much outside of the investment accounts. 🙂

Thanks for stopping by!

Best wishes.

AJ,

No problem. Hope you found some value in it. 🙂

I manually update my portfolio page. I think it’s important/useful to go over the numbers once a month for perspective. Not absolutely necessary, but I don’t find it particularly time consuming (takes about an hour). Allowing everything to automatically update might make it more difficult to really see what’s going on with everything. Just my take on it.

Appreciate the support. Hope that answer helps.

Take care.

Should I reduce the cost basis for BBL with the new SOUHV (or SOUHY – Fidelity gives this ticker)?

Lets say I had 100 BBL with cost $4500 (100 x $45). I got 40 SOUHV with cost $330.8 (40 x $8.27), so new cost basis for BBL should be $4500 – $330.8? Is this how it works ?

Burnbrae,

I corrected the ticker. Not sure why I listed it as SOUHV. SOUHY is correct.

Your brokerage is supposed to keep track of cost basis for you. My BBL cost basis was left unchanged, which I assumed was correct. I went ahead and contacted the shareholder information line and they reaffirmed that. But if you’re interested in contacting them as well, you can reach them here:

http://www.bhpbilliton.com/home/investors/demerger/Pages/Shareholder-Information-Line.aspx

Hope that helps!

Best regards.

Mantra,

Should be a fun month coming here for June! With dividends received alone – this month should provide any extra bang you need even with the tax payment deployment. Great opportunities are amongst us, lets hope we can all dip into the valued companies that have dropped a bit. I own BBL too and it was cool to see the new shares of the spin off. Any word on the dividend policy for them? Thanks Mantra, great job, don’t worry if it dropped a bit, I know MV doesn’t matter much for you!

-Lanny

The freedom fund is doing well and I am still excited about you getting it to a value of 200k. I also cannot wait for your dividend income report for May. I am sure it will be published in the next few days.

Lanny,

Yeah, June should be an excellent month for dividend income, which will definitely help with deploying some serious capital. 🙂

BBL announced that South32 would pay out about 40% of its earnings in the form of a dividend, so that’ll be a nice little kicker on top of the hefty BBL dividend. More snow for the snowball!

Thanks for stopping by.

Best wishes.

Laura,

I’m going to publish the dividend income update on Thursday, so keep an eye out for that. Looking forward to getting that out there and then also publishing June’s update in early July. It’ll be interesting to see how far along things are at the halfway point of the year. 🙂

Cheers!

Thanks’ Jason for the good information and inspiration! All the best, Hal

Hi Jason! Thanks for your insightful thoughts. Yes, that was definitely helpful. I enjoyed reading the links you provided. Wanted to provide you with an update on what I decided to buy. Upon doing a little more research, I noticed that UNP has declining dividends and PMT (PennyMac Mortgage) has increasing dividends.

http://www.nasdaq.com/symbol/unp/dividend-history

http://www.nasdaq.com/symbol/pmt/dividend-history

I also noticed that respectful institutions with quality management such as Vanguard Group Inc owns 4,530,222 shares of PMT and BlackRock Fund (are they a Hedge Fund?) owns 2,691,450 shares of PMT as of 3/31/2015, to name a few. I am also quite familiar with PMT (PennyMac Mortgage) since they are headquartered 15 minutes away from our home, and we have been a client of theirs for a few years. All they focus on are home loans. Some of the homes in our community here in L.A have mortgages with PMT, including many of our neighbors. (Homes on our street are currently worth about a million, even though most of us purchased when they were under half a million. Just got lucky there!!) Yes, they do buy a lot of distressed mortgages on discount, but they also have a large number of high quality loans, based on what I have read about them. Since PMT and UNP are both considered “strong buys” currently, I decided to split my purchase so I can lower my cost basis on PMT and at the same time buy shares of a quality company like UNP (although I wish they had a higher yield lol!!) I’m still young so I decided I can afford to take a calculated risk on PMT for now.

Thank you again for your words of wisdom. Love reading your articles!

Pat,

“Upon doing a little more research, I noticed that UNP has declining dividends and PMT (PennyMac Mortgage) has increasing dividends.”

You’re just looking at the absolute dividend, which doesn’t factor in stock splits. UNP has split its stock twice over that period, which means twice the number of shares at half the dividend rate. That’s not a dividend cut. UNP has actually increased its dividend on an annual basis for longer than PMT has even been public.

I’d strongly recommend doing a little more research before just looking at one chart and making a conclusion. 🙂

Best of luck with the purchases!

Cheers.

Stocks go down. All part of the journey. I look at it as an opportunity as I know you do as well. Keep up the great work!

FF,

Absolutely. Short-term volatility is almost always a long-term opportunity. 🙂

Let’s hope we get some more volatility over the coming months!

Thanks for dropping by.

Cheers.

Waiting for a market correction in Canada also. I lightened up on bonds and oil stocks a few months ago and have 100 k ready to invest. Sell in May and go away did not happen last year as markets really climbed. However my dividends in May this year easily out distanced last year. After 15 years of doing this, and a seven figure portfolio the dividend train will only get bigger with another 100 k to invest.

Can you please explain what you mean by “I would be much further ahead if market stopped advancing back in 2010 or 2011”? I am new to all this and trying to understand basic concept. I would think your success is largely due to the bull market last 5 or 6 years as well. Please pardon my ignorance but I am trying to learn as much as possible. Thanks for all your posts! Best

Jason

Looks like your portfolio is firming up. The increases in dividends over the next year should become significant in the sense that the increases will help funding new positions as the dollar amount increases. A great psychological boost even though the percentages should be similar as when your portfolio was smaller.

My portfolio has been treading water the past three years as I have two kids college tuition we have been funding. I was able to initiate a position in TROW this month. I hope to be able to initiate one new position per month going forward. Having the cash flow of dividends has been huge in paying tuition.

I will be changing gears next year and retiring from my current job at age 53. I could not be making this career decision without the monthly cash flow dividends provide. I am sure people at work are wondering how I can retire with two kids in college.

It has been incredible to see what a 50% savings rate and investing in dividend stocks will become over a ten year period. I certainly am not stressing about life and finances. All smiles.

Brad

NRG,

I’m right alongside you in regards to hoping we see a 10%+ pullback here pretty shortly. I don’t have that much cash to invest, but our portfolios are obviously quite different in size. Nonetheless, I’m still putting a healthy chunk of capital to work regularly in relation to the size of what I’m working with. We’ll see how it goes!

Your position is great as well because your dividend cash flow alone can probably fund some pretty large purchases. That’s the value in cash flow.

Best regards.

Shamonne,

Right. Well, more expensive stocks means two things:

1. You can’t buy as many shares with a fixed amount of money.

2. The yields are lower, meaning your future dividend income will negatively be affected.

If you have a stock at $50 with a $1/year dividend, it yields 2%. And with $1,000, you can buy 20 shares. You now have $20.00 in annual dividend income.

But if that same stock is priced at $40, it now yields 2.5%. And with that same $1,000, you can instead now buy 25 shares. You now have $25.00 in annual dividend income.

You see how that works? Repeating that over and over again makes a massive difference in terms of how much equity you own (how many shares you’re able to buy), what kind of yield your investment sports, and how much dividend income you can generate from the portfolio.

I’ve discussed this at length over the years, so I’d recommend checking out the rest of the blog. And pulling up a compound interest calculator and playing around with some numbers can probably shed some light. Grab some stocks out there and play with the numbers. You’ll see how much of a difference cheaper stocks can make.

Hope that helps!

Best regards.

Brad,

That’s a wonderful spot to be in. Being able to switch the dividends from reinvestment to paying real bills is an amazing feeling. That’s something I’ve tried to convey as much as possible: the dividend income is real cash flow, just like any other source of cash flow (a paycheck, etc.). And this income source can make a dramatic difference in your life.

I can only imagine what 10 years does. I’ve only been at it for five years and the progress has been really incredible and enlightening. Looking forward to hitting that 10-year mark as well. 🙂

Thanks for stopping by!

Best wishes.

Thank you, Jason! I realized there were stock splits right after I wrote to you yesterday. Glad I purchased UNP. Thanks again for your articles and for inspiring us!! 🙂

Yes, we are lucky to have a pretty high income compared to the national average.

We try to save at least 40% of our gross.

Jason,

My apologies. I think in my last comment I asked you what your dividends are based on and it’s pretty clear you tell us every month. Helps to read!

Hope you reach that $200k milestone soon.

FM

FI Monkey,

No problem at all. There are a lot of posts here. Something like 700 now. A lot to keep up with. 🙂

Have a great weekend!

Cheers.