Top High Yield Opportunities in Today’s Market

There are a number of high yield opportunities available in today’s market. Some of the highest yielding investments include real estate and renewable energy, among others. With interest rates at historic highs, now is a great time to invest in these types of opportunities.

Top 20 Types of High Yield Opportunities for You to Grab

The high yield opportunities listed below are most relevant to today’s market, and these investments can provide a steady stream of income, as well as capital appreciation potential.

While investors need to carefully consider which may best suit them, investing in one or more of the below high yield investment sectors can be a great way to generate income and grow your portfolio.

But what do you need to look for in a high yield investment opportunity? When looking to make a pick for a high yield investment opportunity, there are a few things you should keep in mind.

For one, the investment should be low risk. You don’t want to invest your money in something that could lose all its value. The investment should also provide a steady stream of income. You don t want to have to worry about your investment every month or year. Finally, the investment should be liquid so that you can easily access your money when you need it.

But, don’t worry, we have done all the heavy lifting and will now present you with safe, yet highly profitable opportunities that are available and relevant in today’s market.

1. Energy

Energy is a top high yield opportunity in today’s market. The energy sector has been the best-performing sector of the S&P 500 so far this year, with a year-to-date return of 14.8%. The rally in energy stocks has been driven by rising oil prices, as oil has risen more than 50% since the beginning of the year.

The energy sector is also trading at a discount to the rest of the market, with Energy stocks trading at a price to earnings ratio of 16.7, compared to 18 for the S&P 500 as a whole. As such, the energy sector offers investors a good chance to get exposure to the rising price of oil without paying too much for it.

The most popular energy stocks in the market include Chevron (CVX), Exxon Mobil (XOM), and Royal Dutch Shell (RDS.B).

2. Utility Stocks

Utility stocks are a top high yield opportunity in today’s market. They offer stability and generous payouts, which makes them an appealing choice for income-oriented investors. Many utility companies have increased their dividends for decades, and there is no reason to believe that will change anytime soon. These stocks can also be bought on the cheap, making them a great value proposition.

A utility company is a type of business organization that provides public services, such as water, electricity, or natural gas. They are usually owned by the government, but there are also many privately-owned utilities. An example of a private utility company is Southern Company, which operates in the southeastern United States.

Utilities are always needed, and as such, utility stocks provide stability and dividend income; they are a popular choice for retirement portfolios. Many utility companies offer yields of 4% or more, which is significantly higher than the yield on Treasuries or other safe investments.

3. Real Estate Investment Trusts (REITs)

The stock market has been on a tear recently, with the S&P 500 reaching new all-time lows. While there are many opportunities in the market today, we believe that REITs (Real Estate Investment Trusts) are one of the top high yield opportunities – even now.

REITs are a type of company that owns and operates income-producing real estate. They offer investors exposure to the real estate market while providing a high yield, and they are a relatively safe investment.

In today’s market, REITs still manage to offer one of the best yields available. They have a low correlation to the stock market, so they can provide diversification for your portfolio. Additionally, they tend to be less volatile than stocks, making them a safer investment.

4. Corporate Bonds

The market for corporate bonds is booming. Corporate bond issuance in the United States reached a record high of over $1 trillion in 2017, and the market remains strong to this day. Corporate bonds are a top high yield opportunity in today’s market, providing investors with relatively high yields and diversification benefits.

The yields on corporate bonds have increased recently as interest rates have risen, but they remain attractive compared to other fixed income investments. The credit quality of corporate bonds has also improved in recent years, with fewer defaults and lower spreads over Treasuries.

Investing in corporate bonds can provide important diversification benefits for investors’ portfolios. Corporate bonds tend to react differently than stocks and other fixed income investments to changes in the economy. This can help investors reduce risk and improve returns overall.

5.) Leveraged Loans

In a market starved for yield, leveraged loans have become one of the top high-yield opportunities available. Issuance of leveraged loans reached $1.2 trillion in 2021, and is on track to exceed that amount in 2022. That’s because these loans offer relatively attractive yields compared to other fixed-income products. And while there is always some risk associated with lending to individuals and companies with high levels of debt, the market has been surprisingly resilient in the face of rising interest rates and concerns about a potential economic slowdown.

Investors who are looking for exposure to leveraged loans should consider actively managed funds, which can provide access to a wider range of issuers than what is available in the loan marketplaces. These funds also offer daily liquidity, which can be important if you need to access your money quickly.

Finally, leveraged loans are a top high yield opportunity because of their seniority in the capital structure. This means that they rank ahead of most other debt instruments in terms of repayment, which makes them a less risky investment.

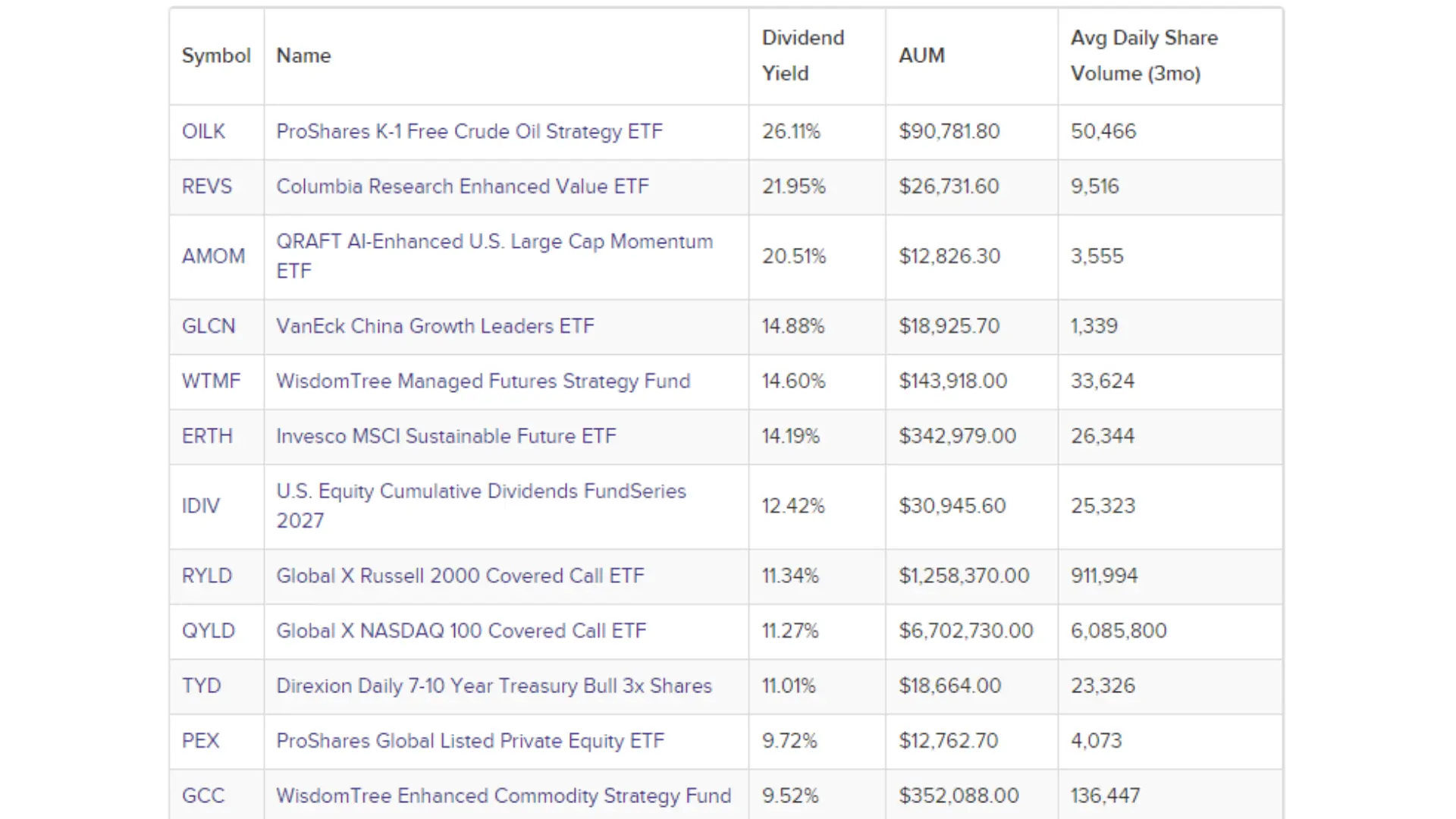

6. High Yield ETFs

There are a number of high yield ETFs on the market, and they are a top high yield opportunity in today’s market. They offer investors a way to get exposure to a basket of high yield stocks without having to pick and choose individual stocks. This can be especially helpful for investors who don’t have the time or knowledge to do their own research.

Source: etfdb

High yield ETFs typically focus on dividend-paying stocks, and many of them have a yield that is higher than the S&P 500. This makes them an attractive investment for those looking for income from their portfolio. Additionally, high yield ETFs typically have lower volatility than the stock market as a whole, making them a safer investment option.

There are several different types of high yield ETFs available, so it’s important to do your research before investing in one.

7.) Real Estate

Investing in real estate is a top high yield opportunity in today’s market. The reason for this is that the returns on real estate investments are typically much higher than the returns on other types of investments. In addition, real estate is a relatively stable investment, which means that it is less likely to experience large fluctuations in value.

Another reason why investing in real estate is a top high yield opportunity is that it is a very liquid investment. This means that it can be sold quickly and easily if necessary. In addition, there are many different ways to invest in real estate, which means that there is something for everyone.

Finally, investing in real estate is a great way to diversify your portfolio. This is because real estate investments are not correlated with the stock market or other types of investments.

8.) Preferred Shares

Preferred shares offer investors a high yield opportunity in today’s market. Preferred shares are a type of security that represents ownership in a company. They offer shareholders priority over common shareholders in the event of bankruptcy and typically have a higher dividend payout than common stock. This makes them an attractive investment for income-oriented investors.

There are several factors to consider when investing in preferred shares. First, it is important to understand the terms of the offering, including the par value, dividend rate, and redemption rights. It is also important to research the credit quality of the issuer and make sure that it is strong enough to meet its obligations. Finally, be sure to compare the yield offered by different issuers to find the best deal.

Preferred shares can be bought individually or through a mutual fund, making them easy to access. For this reason, they are a popular investment for those looking for high yield income.

9. Closed End Funds

Closed end funds (CEFs) are a top high yield opportunity in today’s market. With interest rates climbing and yields on bonds and other fixed-income instruments falling, CEFs present an attractive alternative to investors who are looking for steady income and capital preservation.

But, what are closed end funds? Closed end funds are investment vehicles that pool money from investors and use it to buy a portfolio of securities. Unlike open-end mutual funds, which can issue and redeem shares at any time, closed end funds sell a set number of shares at the beginning of the fund’s life and do not redeem them thereafter. This “closed” structure gives CEFs more pricing power than open-end funds, enabling them to trade at discounts or premiums to their net asset value (NAV).

As closed end funds offer stability and consistent income,they are a favorite of retirees and other investors looking for high yet reliable returns.

10. Master Limited Partnerships (MLPs)

Master Limited Partnerships (MLPs) are a type of partnership that is publicly traded. They are limited partnerships, which means that the partnership can only have a certain number of partners, and that no partner can own more than 49% of the partnership. MLPs are usually involved in the energy industry, but there are also MLPs in other industries.

An MLP is taxed as a pass-through entity. This means that the MLP does not pay federal income tax, but instead its investors are taxed on their share of the MLP s income. As it is taxed like a partnership, MLPs offer high yields and tax breaks, which has made them a top investment opportunity in today s market. Their popularity has exploded in recent years, with more than $300 billion in assets now invested in MLPs.

As we mentioned earlier, MLPs are often found in the energy industry, where they own and operate pipelines and other infrastructure assets. However, there are many different types of MLPs, and they all have one thing in common: They provide investors with a high yield and tax breaks. This combination has made them a top investment opportunity in today s market.

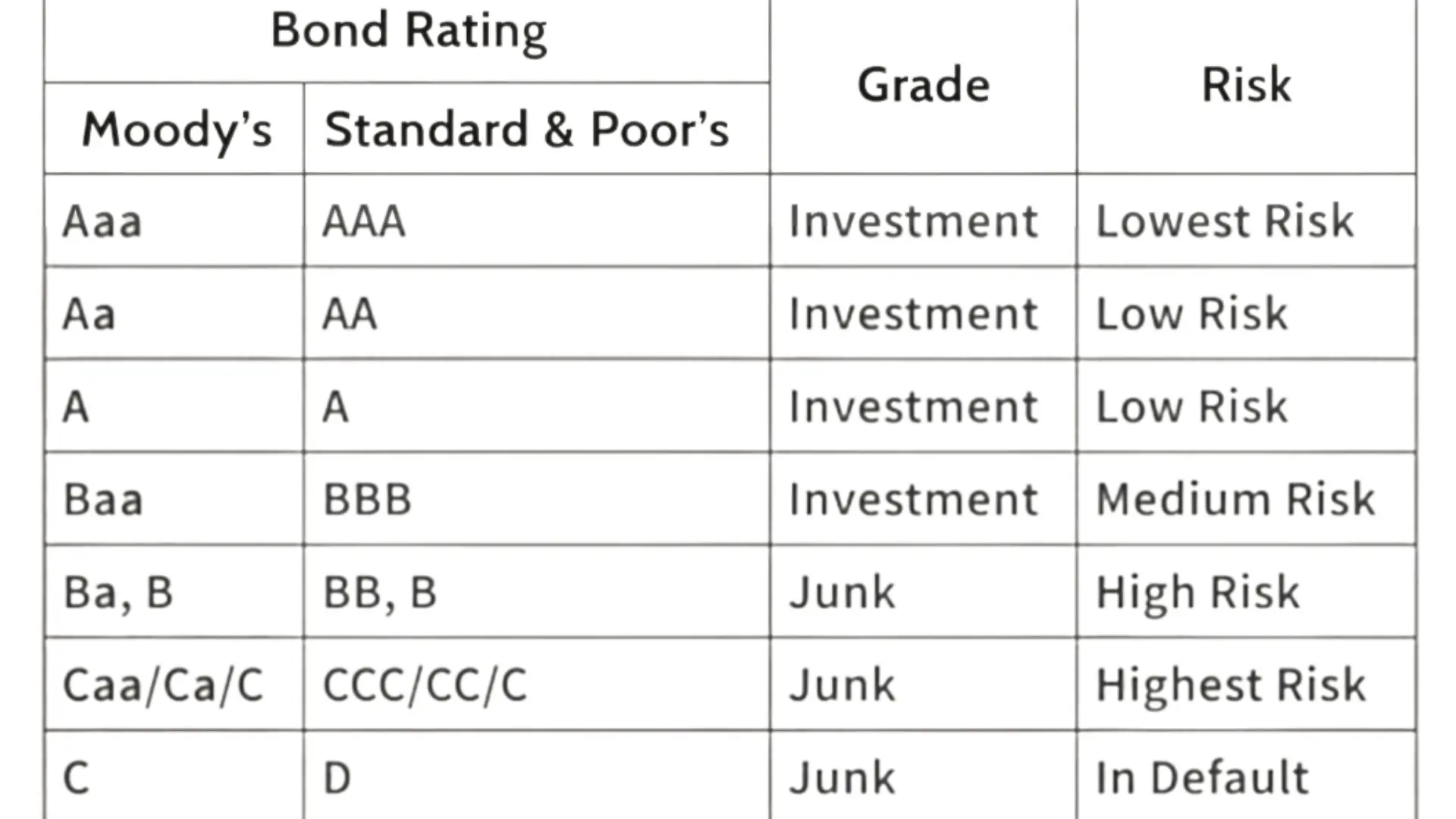

11. Junk Bonds

In a market that is offering historically high interest rates, junk bonds are a top high yield opportunity. Junk bonds are issued by companies with credit ratings below investment grade. These companies are considered to be more risky, but they offer higher yields than investment grade bonds in order to compensate investors for the additional risk.

The yields on junk bonds have been rising recently as the market has become more volatile. This has caused some investors to worry about the risks of investing in these securities. However, the higher yields provide a compelling reason to consider investing in them, especially given the current current state of the overall likewise risky market.

Junk bonds can be a risky investment, but because they can also provide a higher yield than other types of investments, many investors are adding them to their protfolios.

12. Municipal Bonds

Municipal Bonds are one of the most popular high yield investment opportunities in the market today. They offer tax-free income, which is a big draw for many investors, and the yields on municipal bonds are typically higher than those on Treasuries. This makes them a top choice for investors looking for high-yield investments.

There are a few things to keep in mind when investing in municipal bonds. First, the credit quality of the issuer matters; you want to make sure that the bond is backed by a solid municipality. Second, you need to be aware of any tax implications associated with owning municipal bonds. Most municipal bonds are often exempt from federal taxes, and in some cases state and local taxes, it is good to find out before investing so you can be extra sure which municipal bonds to invest in.

Finally, it’s important to research the current interest rates before investing; when rates are high, municipal bonds can be a great investment, but when rates drop, they may not be as attractive. When interest rates are relatively high, there is a diversity of issuers, which makes for more options to choose from and a more high-yield, stable investment.

13. Treasury Notes

Treasury notes are a type of investment security issued by the US government. They are essentially IOUs, with the government promising to repay the holder of a Treasury note at a specific date in the future, with interest. Treasury notes are considered very low-risk investments, and are therefore popular among investors.

Treasury notes pay interest semiannually and are available in maturities ranging from one year to 30 years. The annual interest rate on treasury notes is about 2.25%, so they offer a much higher return than certificates of deposit (CDs) and other low-risk investment options.

As treasury notes are also exempt from state and local taxes, it makes for a wise choice for those who live in high-tax states.

14. International Bonds

International bonds are debt securities that are issued in more than one country. They are typically used to finance large, cross-border projects, such as the construction of highways or bridges. The issuer of an international bond will typically receive funding from investors in multiple countries. This allows the issuer to spread out its risk across multiple geographies.

International bonds offer investors a top high yield opportunity in today’s market. The yields on international bonds are significantly higher than the yields on comparable domestic bonds. In addition, international bonds offer investors exposure to a wide range of countries and currencies. This diversification can help reduce the risk of investing in a single country or currency.

International bonds are also a good option for investors who are looking for higher yields but want to avoid the risks associated with investing in stocks or high-yield domestic bonds. It can provide diversity and growth potential.

15. International Equities

As the global economy has continued to rebound and expand in recent years, investors have increasingly looked beyond U.S. borders for opportunities. And for good reason: The stock markets of many countries around the world are now outperforming the S&P 500.

One asset class that has particularly caught investors’ attention is international equities. These securities can be found in developed and top perforning markets around the world, and offer exposure to a wide variety of companies and industries.

International equities can be a great way to diversify your portfolio, especially in today’s market where they offer a top high yield opportunity. Additionally, they can provide exposure to growth potential in overseas economies, which may be stronger than the U.S. economy.

16. International Dividend Stocks

International dividend stocks are stocks that offer dividends to shareholders from companies located in other countries. These dividends can be from companies in developed countries, like the UK or Japan, or from companies in developing countries, like Brazil or Kenya. International dividend stocks can be a great way to diversify your stock portfolio and access new opportunities in different markets around the world.

According to a study by Goldman Sachs, international stocks offer a top high yield opportunity in today’s market. The analysis found that dividend yields for stocks in developed markets are about 2.5% higher than U.S. stocks, and earnings growth is expected to be twice as fast.

Investors looking for income should consider adding some international dividend stocks to their portfolio. Many of these companies have strong businesses and offer attractive yields. And while international stocks can be more volatile than U.S. stocks, they can also provide opportunities for capital gains as well.

17. Emerging Market Bonds

Emerging market bonds are a top high yield opportunity in today’s market. Yields on these bonds are significantly higher than those on U.S. Treasuries and other developed market bonds, and they offer investors exposure to some of the fastest-growing economies in the world.

The recent sell-off in emerging market bonds has created some attractive buying opportunities. Yields on many emerging market bonds are now well above their historical averages, and valuations are much more attractive than they were a few months ago.

Emerging market bonds can be a particularly good investment for income-oriented investors. Not only do they offer high yields, but they also provide a degree of insulation from stock market volatility. Emerging market bonds can also be a good way to gain exposure to rising inflation rates.

18. Dividend Stocks

Dividend stocks are a top high yield opportunity in today s market. With interest rates growing, dividend-paying stocks are becoming more and more attractive to investors. And with many of these stocks offering yields well above the rate of inflation, they can provide a steady income stream while also providing the potential for capital gains.

There are a number of factors to consider when choosing a dividend stock. The first is the company s financial stability and its ability to pay dividends over the long term. The second is the stock s valuation, which should be considered in light of the company s earnings and its payout ratio (the percentage of earnings that are paid out as dividends).

Finally, it is important to consider whether the company is growing or shrinking. A company that is growing its earnings and its dividend payout can provide a steadier income stream than one that is not.

19. Blue Chip Stocks

A blue chip stock is a term that is used to describe a well-known, stable and profitable company. These stocks are usually found among the top picks of the S&P 500 or Dow Jones Industrial Average.

Blue chip stocks are considered a top high yield opportunity in today’s market. They offer stability and consistent dividends, which can provide investors with a steady stream of income.

While these stocks may not offer the highest yields available, they do offer stability and dividend growth potential. This can be an attractive option for investors who are looking for a conservative investment strategy.

20. Bank Certificate of Deposit (CDs)

A bank certificate of deposit, also known as a CD, is a top high yield opportunity in today’s market. When you invest in a CD, you are agreeing to leave your money with the bank for a set period of time. In return, the bank pays you a fixed interest rate on your investment. This interest rate is usually higher than what you would earn from a standard savings account.

CDs are a great way to save for short-term goals. You can choose from different term lengths, ranging from three months to five years. When the term length expires, you have the option of withdrawing your money or renewing the CD for another term.

If you’re looking for a safe and reliable place to park your money, and watch it grow, a bank CD is a great option.

Alternative Investments: When Stocks, Bonds, or Equities Aren’t the Answer

In today’s economy, it’s not uncommon for people to become nervous about investing in stocks, bonds, or equities. When you’re looking for a more stable investment option, alternative investments may be the answer.

Alternative investments can include gold, hedge funds, private equity, and venture capital. They offer many benefits over traditional options like stocks and bonds. And as with the opportunities listed above, they tend to be low risk and can provide you with stability.

In any case, if you’re interested in learning more about alternative investments, your best bet is to consult with a financial advisor. He or she can help you find the right option for your needs and give you advice on how to make the most of your investment.

Conclusion

In conclusion, several high yield opportunities are present in the market today. Investors should explore these opportunities to maximize their portfolio returns. However, it is important to remember that no investment is without risk, so you should endeavor to add more than one top high yield investment opportunity to your portfolio in order to hedge against any forms of risk. By doing so, you can be sure to “smile to the bank,” even in today’s financial market.

Thanks for reading!