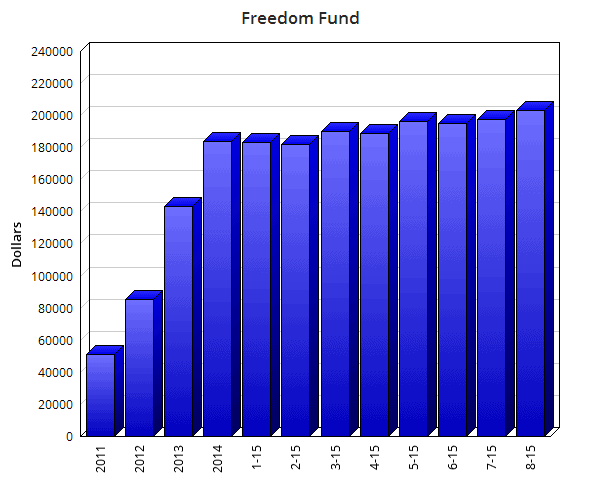

Freedom Fund Update – August 2015

I’m extremely fortunate that I’m able to post these updates every single month, which shows the power of monthly contributions to investments because of the high savings rate I maintain. It shows how a relatively large sum of money can be built through the power of time, patience and perseverance.

It’s important to keep in mind that while updating the overall value of my portfolio is important for historical reference and keeping track of total return, as well as giving context to the dividend income I earn, my main focus is on the rising dividend income stream the Fund provides.

July was another really fantastic, fun, and fortunate month. I’ve been very active lately in regards to putting fresh capital to work and buying high-quality dividend growth stocks, far more active than my historical average over the last five or so years. Not sure how long my ability to remain so will persist, but I’m of the opinion that one should make hay while the sun shines. And I’m glad to say the sun has been shining on me lately.

I kicked the month off by averaging down on W.P. Carey Inc. (WPC) one more time. A fantastic real estate investment trust with high-quality assets that appears to be trading for less than it’s worth. Wouldn’t mind maybe buying one more tranche if it drops again. I may even add a little more where it currently sits. We’ll see.

Shortly thereafter, I picked up shares in National Oilwell Varco, Inc. (NOV) for the last time. I now consider myself fully invested in that company, if not overexposed. I’m still contemplating a tax-loss strategy to reduce my position slightly and offset some capital gains on the year, but I’m also quite confident about NOV’s long-term potential.

Those two transactions alone would be a solid month, and one I’d be grateful to have.

But it didn’t stop there.

I noticed the nice little pullback that many high-quality stocks in the Industrials sector have recently experienced and took advantage there by initiating a position in Caterpillar Inc. (CAT) and then later adding to my stake in Emerson Electric Co. (EMR) for the first time in years. The latter is now a full position for me, but I was very excited to have had the chance to buy stock in Emerson for roughly the same price I paid a few years back. CAT, meanwhile, is one I’m definitely interested in averaging down on at some point in the near future. I don’t see it as a particularly large position when it’s all said and done, but I wouldn’t mind at all doubling down.

The last stock purchase to report on for July was that of ITC Holdings Corp. (ITC). A high-quality electricity transmission company, the growth rate is phenomenal. The recent Q2 2015 earnings report further convinced me that I made the right call on this one. Yield is a bit low, but I’m very excited about where this company might be in 20 or 30 years from now. This was another new position for the portfolio.

All in all, a really great month here. I’m happy with all five purchases, which, in aggregate, added $235.50 to my annual dividend income.

The current market value of the Freedom Fund stands at $203,440.93, which is a 3.1% increase over last month’s published value of $197,385.27. The Fund is performing rather well, even with my overexposure to the Energy sector. Increases of 3% or more will be much harder to come by as I move forward, however, due to the growing size of the portfolio. But that’s a first world problem I’m not unhappy to have.

Crossing the second $100K is an amazing feeling, as I recently shared. Although I’d prefer cheaper stocks (which would naturally mean my portfolio value would also suffer) because cheaper stocks come attached with higher yields, which furthers my long-term goals and plans, I’m also not particularly upset seeing the value climb like this. It’s simply an outcome of investing in high-quality companies that become more profitable (and worth more) over time. Invest intelligently and you basically can’t avoid an ever-rising portfolio value over the long haul. It’s really a win-win either way. You either have a portfolio that’s rising in value, boosting your net worth and psychological well-being, or you get cheaper stocks that allow your fresh capital to go that much further.

My first public update on the Fund was back in April 2011 – it was valued at under $29,000 at that time. And here we are a little more than four years later and the portfolio is seven times larger. The time has just flown by, which is really why it’s never too early to start saving and investing. Had I not had decided to start down this path back in 2010, I might be sitting here still worth less than a baby. And what a shame that would be. My entire life would be different. And I wouldn’t be nearly as happy as I am now.

I can’t stress enough how important it is to stay patient, remain persistent, and be consistent throughout the process. Stick with it and you’ll be amazed at what’s possible, even on modest means.

Looking forward, I should have enough capital for at least three purchases in August. And since I just mentioned how important it is to be consistent, you can count on exactly that from me. I’ll be deploying that capital over the course of the month into the highest-quality dividend growth stocks at the best possible values I can find, assuming I have room in the portfolio for them.

I’m obviously hoping for more volatility. We’ll see what we get, but I definitely wouldn’t mind seeing many of the stocks I’ve recently been buying or eyeing drop another few percentage points. I’m keeping my fingers crossed!

The Fund has positions in 64 different companies. This is an increase since last month due to the fact that I initiated positions in CAT and ITC.

These updates are mainly designed to show the increase or decrease in the value of the underlying equities I’m invested in, but the main purpose of investing in dividend growth stocks is for the rising stream of dividends over time. Thus, I don’t put too much emphasis on these monthly updates. I think it is a good idea, however, to keep track of the rising (or falling) value of one’s securities and be aware of where they are in terms of the marketplace and whether or not certain stocks are attractively priced. It find it a helpful exercise to update the values monthly. It gives me fresh perspective on which equities are performing well and which aren’t, and from there I can make educated decisions (based on further due diligence) on which stocks I’d like to add fresh capital to (while considering portfolio weight as well).

Full Disclosure: Long WPC, NOV, CAT, EMR, and ITC.

Did you have a great July? Able to deploy a lot of capital? Looking forward to August?

Thanks for reading.

Photo Credit: BimXD/FreeDigitalPhotos.net

Congratulations in crossing the 200k mark! The next 100k should be even easier, if Mr. Market doesn’t get too moody.

But anyway, since you’re focusing on income, market valuations are less relevant, and keep us sleeping like babies at night!

Greetz,

Sander

Hello Jason.

Your Fund es likely to overtake Bershire Hathaway in number of companies, hahaha. 200k dollars is a huge amount. And you are able to buy even three times per month. All that is amaizing!

I’m almost 100% sure you’ll reach your main goal by your fourty years.

Good luck although you won’t need: your method is the right one.

See you soon!

Mantra,

YOU DID IT. BOOM!!!! Congratulations – another mark… The $200K mark. Think about how much faster that was, it is wild. Just another milestone under the belt, and that portfolio is providing such an incredible cash flow; the snow ball is real.

DM, this is just another great article to provide readers that this is real, that it has worked, is working and looks to continue to work going forward. Proof is in the pudding.

Soak this one in Mantra, I’m closing in on 160K here soon and 6K projected, I’ll try to write an article when that happens. Busy month for you in July, you’ll keep at it, I know it.

-Lanny

Jason,

$200k…are you kidding me. I know you have purchased a lot of stock recently and holy cow are the results starting to show! Congrats on the amazing progress and crossing this HUGE milestone. It just goes to show you that hard work and pushing yourself pay off. You couldn’t have said it any better… “stay patient, remain persistent, and be consistent throughout the process. Stick with it and you’ll be amazed at what’s possible, even on modest means.”

Keep on grinding and keep on inspiring others like me in the community! Congrats again on the great progress. Hopefully you will be writing your crossing $300k article soon 🙂

Bert

You’ve passed the $200k mark – congratulations! The way you’re going, the next $100k will soon follow! Looking forward to seeing where August takes you 🙂

Dividend Mantra,

An impressive month of purchases and starting a new month with over $200000 portfolio balance. Keep at it as before you know it it, you will be at $300000 before you know it.

Congrats on passing 200K! So when are you going to make your next 100,000?

It truly is amazing how quickly the portfolio has been growing! Most people in their thirties probably can’t even say they have anything to invest, let alone managed to grow an investment portfolio from $30,000 to $200,000 in four years. You should be proud!

Sincerely,

ARB–Angry Retail Banker

Jason,

I know you’ve already hit the 200k intra month before, but it must be nice to look at that chart now!

I was able to make one purchase this month and replenish some of my savings to get it at my target level.

Looking forward to how you deploy your 3 (or more) purchases next month.

Gogogogogogo! You are about halfway to the point where I pulled the plug and went FIRE.

Excellent month as far as I can tell. $200k portfolio. 3% increase over June. And most importantly 5 purchases that added a whopping $235 to your forward dividends. Thats truly amazing. Your persistance is really paying off and shows in your ever increasing dividends. Keep on inspiring Jason!

Hi Jason,

Congrats on your continued success! My wife and I love staying up-to-date with your financial freedom journey.

We added more HCP and CVX to our portfolio in July. We love the yield they offer at discounted prices. I need to add WPC to the list soon. Great buy right now!

Best,

Sean

Can you talk more about your tax-loss strategy for NOV.

$29k to $203k in just 50 months, man that is awesome! I added a few new positions over here this month. Bought SO – couldn’t pass up that 5% yield any longer, opened a new stake in Merck, got a few shares of the Blue Buffalo IPO and bought into a super speculative pet biotech company called Aratana.

Jason,

It’s been a while since I’ve checked in but I’ve been reading your articles almost religiously. What an inspiring update! 200k?! Are you kidding me?!

While the actual portfolio value is secondary to the income it produces, that is still amazing. Either way you’re not in a bad position.

Just wanted to thank you again for the amazing content you put out and for helping newbies to DGI like myself see the light. If I hadn’t stumbled upon your blog I would more than likely be in the same financial boat 20 years from now, but for the first time in my life I’m looking forward to where I’ll be! I’m lucky enough to have ~30 years until “retirement” but if this plays out like I’m hoping it won’t be that long and I have you to thank for that.

Keep doing what you’re doing, it’s obviously working pretty well!

Best wishes,

Steven

Inspiring stuff Jason. My portfolio is roughly the same value as yours but I’ve taken a different investment approach. But just like you I’ve a plan and I’m sticking to it. As you say, that’s the secret to financial freedom.

Sander,

Definitely. The portfolio value is just the end result of consistently saving and intelligently investing. But I’d rather have cheap stocks while I’m busy accumulating them. Then the portfolio value can rise relentlessly. 🙂

Thanks for stopping by. Hope you had a great month over there!

Cheers.

DR,

Appreciate the support. Thanks so much!

I’m really so glad and so fortunate. The journey is going better than I anticipated. But there’s so much strength in the system. Put it to work for you and amazing things can happen.

Best regards!

Lanny,

The proof is in the pudding, indeed. No hyperbole. No pretense. No backtesting. No theories. No postulating. Just real-life results in real-time. 🙂

$160k/$6k is fantastic, my friend. Your snowball is starting to get away from you. Let’s turn it into an avalanche!

Best wishes.

Bert,

It’s been a lot of fun lately. I’ve definitely been far more active than I’m used to. But I’ll gladly take it while I can get it. 🙂

Appreciate all the support. So happy that I’m in this position to share and inspire along the way. There’s just so much possible for people if they put their minds to it. Freedom is out there waiting for us.

Let’s keep it up!

Best regards.

Nicola,

Thanks so much!

We’ll see how it goes, but I suspect I’ll be hitting that next $100k in the next couple years or so. All depends on how the market goes. But I’d rather see stocks tank, giving me some solid deals for new capital. When I’m done buying, the market can rise all it wants. 🙂

Hope you had a great weekend over there!

Cheers.

IP,

We’ll see how it goes. It’s exciting to compare the time frame necessary for each incremental $100k. I’ll have the real-life results showing exactly how long that takes with all the ups and downs of life and the market. Meanwhile, I’ll just continue working hard and doing what I know best. 🙂

Looks like you’re coming up on $80k over there. That’s fantastic. Six figures is just around the corner. Keep it up!

Thanks for stopping by.

Best regards.

ARB,

Ha! We’ll see about the next $100k. I’m still soaking in where I’m at. I honestly wouldn’t mind if it took four years to hit $300k, assuming it meant that the broader market crashed and brought about some really attractive values. But I suspect it’ll be quicker than that. Either way, it’ll be fun to document it all along the way. 🙂

I’m really proud of where I’m at, especially relative to where I once was. Coming from where I come from, this all seemed like a dream. Like I’ve mentioned, this kind of money was at one time nothing more than “lottery money” to me. I never would have thought I could save and invest my way here. But I’m glad I took the time a few years back to really sit down and think about where I was, where I wanted to be, and how to bridge the two situations. There’s so much abundance in a first world country like the US. And there are so many opportunities. You just have to really want out. Once you’re willing to do what’s necessary to buy your time, you’ll find it’s easier than you thought.

Cheers!

DM, Congrats on crossing $200K! Nice milestone to cross. Last month, I also completed my 90 days of race towards FI and added to several positions in crazy month of July. Keep racing.

RTR,

Nice! Looks like your net worth is up solidly over the last month. It seems like a long slog at first, but the progress becomes exponential. I think you’ll really start to see how that looks here pretty soon. Keep it up!

Best regards.

FV,

Thanks so much. That’s reassuring. I’m on it 100%. I can promise you that. 🙂

Take care!

JC,

Thanks so much. Appreciate the kind words.

It’s been a really crazy summer. I’m definitely putting away a lot more capital than I was last summer. What a difference a year can make.

Looking forward to seeing where we go with our capital this month. Should be fun! 🙂

Best regards.

Sean,

Thanks so much. Your readership means a lot to me. I’m so fortunate to have a really supportive readership. 🙂

Great additions to the portfolio over there. Like I recently discussed, some stocks have significantly corrected lately. I keep hearing about how expensive the market is, but there’s a pretty diverse set of merchandise in the store. Some merchandise is expensive. Some isn’t. Just gotta hunt out those deals.

Keep it up!

Cheers.

G,

My position in NOV is possibly a bit larger than I’d like it to be. So I’m contemplating selling some earlier shares (that were purchased at a higher price) and taking the capital loss to offset some capital gains I have this year. I’m still 50/50 on that because I really like NOV.

But if you’re interested in how a tax-loss works, you can read here:

http://www.investopedia.com/articles/taxes/08/tax-loss-harvesting.asp

Hope that helps!

Take care.

Randall,

Thanks so much. It’s been an incredible ride. Even if it ended here, I’d have no regrets. I’m in a great position. The decisions I’ve made over the last few years have positively affected the rest of my life. This period has literally changed my entire life. And that’s what’s wonderful about this. It doesn’t take long to radically change your entire future.

Best of luck with the new investments over there. Haven’t heard of Aratana, but I’m sure you did your DD. 🙂

Cheers.

Steven,

Thank you very much. 🙂

I’m more than happy to produce content, share, and inspire. I once was lost. If I can somehow change that for someone else down the line, using my own results as the basis for that, then I feel great about that. We’re all in this together, in my opinion.

Keep it up. Every dollar saved and invested is changing your future.

Best wishes!

Simon,

Hey, a lot of roads lead to Rome. As long as you’re getting to where you want to be, that’s all that really matters. 🙂

Thanks for dropping by!

Cheers.

R2R,

Nice. Some people think the first few months or year is the most exciting time. I think it actually gets even more exciting as you go along. The exponential nature of investing means the numbers get bigger, even if you’re not pushing as hard. And every day is a new opportunity. I quite look forward to getting up and taking those opportunities on. 🙂

Thanks for stopping by!

Best regards.

Just got back in town, and this is very nice to see you are progressing with such fervor. Good luck, and keep up the good work.

Jason,

I continue to be impressed by your dedication and focus.

I have one question, we report the value of our fund on the purchase price of the stocks and not the actual value (share price of the day). How do you report it?

RA50

Robert,

Thanks for dropping by. Still just doing my thing. You know me!

Hope it was a great trip and you had a lot of fun. 🙂

Cheers!

RA50,

Thanks so much. I’m absolutely dedicated to giving it my all. I’ll surely hit some speed bumps here and there, but I’ll never be able to look back with regret and say I didn’t give it my all. 🙂

The value of the portfolio is reported as market value. So that’s the aggregate current value of all stocks within the portfolio. That’s basically what it could be liquidated for.

Hope all is well. Thanks for dropping by!

Best wishes.

Jason

Congrats on passing the second 100k milestone, keep you very very good job.

Thanks for sharing, Jason. I also got into WPC early this month. I’ll admit I chased the yield a little, but the price also seemed fair, even somewhat discounted, as you mentioned. All the others look great, too, just not enough capital. Hadn’t heard of ITC at all before you brought it up.

Hope 300k speeds by even faster than its younger brothers!

Hi Jason,

this is a really nice milestone. It took a while to get over it, but I think, you won´t see a 1 as first figure for a long time. And when you see it again, it will be the million. Nice buys this month and I liked the ITC idea. I have never heard of this company. In July I bought only two companies: OHI and PG. This is really conservative but I wanted to invest more capital in OHI the last months. PG is getting interesting, but I won´t get too crazy on it. Because of a lot of taxes I have to pay I won´t invest anything in August. I don´t like that but it tells me that I´m doing good with the things I work. In September I will start again.

At the moment there are so many opportunities out there to buy stocks at a good price. May be we have some falling markets the next weeks as well. I personally hope this and I think, all the oil- and energy companies will sit or go down a little bit because of the low oil prices. KMI ist really interesting, same for Chevron or Exxon. BBL ist now really cheap and may be this will be a good oportunity. We will see.

Really motivating is to see, if you invest regularly, you will get after some years really good money which is working for you. A lot of people should read this blog to see, what is possible. Thanks for the update.

Well done and keep your persistence going. You are an inspiration to all of us!

Your model is excellent, but I am still considering which way to go ETF VIG (and waiting for the damm pullback!)

Time considerations mostly do not allow for the intensive research you are able to undertake.

https://www.dividendmantra.com/2013/04/why-i-vastly-prefer-dividend-growth/

Hey Jason,

Great work on accumulating this portfolio in such a short period of time.

My current savings rate is about 28%, but I’m looking for a much cheaper house.

This should increase the savings rate to 37%.

Thanks for your inspiring blog!

Best wishes, DfS

Thanks for sharing this update Jason. Since we purchased our new home our savings rate has taken a dive and I’m working hard to get it back up there. Updates like these really motivate me to cut costs and invest all that I possibly can. I look forward to reading your next update.

Congrats!

I hope to post my latest update today. I hope to hit $11,500 in dividends in 2015!

Congrats Jason. I just passed the $100k mark. Looking forward to both of our nest eggs climbing through the future!

I hope your portfolio value crashes! 🙂

We all know what that will do to yields on the same stocks…

Congratulations on the $200K mark. With this milestone now achieved, are you now going to revisit your plan on each new individual purchase. As I can see right now you tend to invest $750 to $1100 per transaction. Are you considering raising the bar to $1000 to $1500 as your snowball grows?

I’m always amazed at the increases just by being persistent and consistent. I am very excited to start tracking our next worth. The first time I ever added it up was in December and this seems weird in hindsight. I can’t believe I didn’t do it sooner!

Welcome to the 2nd Century! A transient milestone, perhaps, but a nice one to reach nonetheless. It truly gets easier from this point forward.

Nice steady increase wins the game. Now onward to the $300k milestone.

What are your thoughts on adding to the oil sector i.e CVX, COP, XOM,HP etc..?

I read your weekly undervalued stock of the week on Daily Trade Alert and have only seen CVX mentioned once in mid June.

Are you holding on deploying new capital into these oil stocks? Do you think we are close to a bottom?

I always try to think of Buffett in regards to investing – “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” – I think most are fearful in the oil sector right now so maybe we should be greedy!

Hi again,

Do you think the dividends in the large oils are safe? I’m thinking so for the time being. Thinking about picking up more CVR if it continues to fall. Any thoughts?

Sharon,

Appreciate it! Just working as hard as I can. 🙂

Thanks for dropping by.

Cheers.

Dylan,

I don’t think buying WPC means you’re chasing yield. If the value and quality is there, then it’s there. That’s irrespective of yield. Now if you’re buying a stock only for its yield and not really looking at the quality of the business, that’s another thing altogether.

Appreciate the kind words. We’ll see how the next $100k goes. Wouldn’t mind if it took a while – would rather have cheaper stocks. 🙂

Best regards!

olli,

Nice month over there. OHI remains one of my favorite REITs. And it’s tough to go wrong with PG. They’ve had some recent troubles, but I’m excited to see how the restructuring goes for them. Still a stable of great brands over there. These are products billions of people use every day.

Definitely deals out there. The market might be sitting near all-time highs, but many stocks are sitting near multi-year lows. So it’s just separating some of those stocks from the rest of the herd and doing a little bargain hunting. Sometimes stocks fall for a good reason. Sometimes not. But if you’re buying quality at a good value and holding for the long haul, your odds of going wrong seem to be quite low to me.

Appreciate all the support. Doing my best to get the word out there and inspire others to save and invest their way to freedom. 🙂

Best wishes.

ResilientMan,

Appreciate it very much. Just trying to show what’s possible if you work hard, believe in yourself, and remain patient. 🙂

Many successful ways to invest, that’s for sure. Funds make a lot of sense for some people, especially if you lack the time/interest necessary to study individual stocks. Best of luck with that!

Cheers.

DfS,

Thanks so much!

A 28% savings rate is still solid. That’s something like five times the national average, so you’re doing great. I’d be pretty proud of that. But a 37% rate is even better. Keep it up. 🙂

Take care.

Congrats on another great month Jason! Nice to see you holding steady above $200k. At your exponential pace it shouldn’t take long to get your next $100k.

Ken

My Road,

I can imagine a home is slowing things down a bit, but you’re investing in home equity over there. So that’s the upside. 🙂

Appreciate the support very much. Every dollar saved and invested makes a big difference, so I’m sure you’ll find the right cuts to make over there and get to where you want to be. Best of luck with that!

Cheers.

Mark,

Thanks for stopping by!

That’s a great number there. Almost $1,000 per month. Furthering the snowball down the hill. Keep it up. 🙂

Cheers.

FF,

Congrats! That’s fantastic. The first of many such milestones, I’m sure. 🙂

Let’s keep working hard and pushing. Bigger and better things lie yet ahead!

Best regards.

Ravi,

Ha! I hope for the same for your portfolio. 🙂

Definitely some solid deals to be had out there. Let’s see what we get in August.

Cheers!

The Aiki Trader,

I don’t think I’ve ever invested only $750 in a stock, unless it came with a free trade. Maybe you can point one out?

I try to keep my commission fees to somewhere around 0.5% during the accumulation phase. I find that a pretty solid number, considering that I’ll be paying little, if any, fees once I’m living off of my dividend income.

Most of my portfolio has been built over at Scottrade where the fees are $7 per transaction. So my historical average transaction size has probably been somewhere in that $1,200 to $1,400 range. I’ve recently started scaling that down to around $1,000 because I opened a new account with TradeKing where the fees are under $5. So it’s the same cost structure. I’ll likely stick to that 0.5% number moving forward.

Take care!

Mrs. Crackin,

Ha! I know how you feel. It felt weird to me, too, when I first started that I never did all this financial tracking before. It was like finding a piece of me that was there all along, but I just never knew it.

Have fun over there. It’ll feel so great seeing those income and wealth numbers grow over time. 🙂

Best regards.

Spoonman,

Thanks so much. I’m starting to feel that critical mass where the money is working harder for me. Logging into your brokerage account and seeing $100 or $200 that wasn’t there yesterday is a pretty amazing feeling. Just never gets old. 🙂

Hope all is well!

Cheers.

Tawcan,

Absolutely. Slow and steady. It’s not a get-rich-quick scheme, but one should become quite wealthy over time by sticking to this. Looking forward to the day I can afford all of my time. It’s the most impressive luxury of all. 🙂

Thanks for dropping by!

Best wishes.

JM,

Yeah, the supermajors have become more interesting over time. Keep in mind, however, that TTM earnings include a period where oil was priced much higher and many of these companies were pulling down a lot more net income. So as those lower oil prices work their way through the system, they’ll weigh on EPS, and consequently, the prices of many of these stocks. But that also depends on how long oil prices stay this low. Could be a while. Or maybe they recover inside of a year. Nobody knows. But I do think that some of them are getting to a spot where it might make sense to initiate or add to a position. I’m actually thinking of adding to my XOM position for the first time in a while. Not often you can snag a 3.75% yield. And it appears to be generating some of the best cash flow in the business. I’d just make sure to look at cash flow and see how that compares with the last drop.

Not quite sure it’s a fear/greed thing, though, with the supermajors. Many of these stocks have actually held up quite well. Stocks like, say, NOV, on the other hand, have been hammered. So some are cheaper than others.

Hope that helps!

Cheers.

Trish,

I did my best to address a similar question just above your comment. 🙂

Best regards.

Sorry about that. I didn’t see it. I’m waiting for CVX to dip a bit more then I’m going to add to my position. Good luck out there all.

Ken,

Thanks! It’s been such a fun and incredible journey. Even if I were to stop investing right now, I’m already in a life-changing position. Really fortunate that the me of 2010 got his act in gear. 🙂

Looks like you had a really solid month over there for dividend income. Keep it up!

Cheers.

I think I am going to dca into the positions I have in these companies for the next several months – just “dip my toes” in the water so to speak

After reading your update today I would think you would also be looking to increase your holding of Orchids Paper Products (TIS) after reporting a great quarter and positive outlook going forward. I know I am looking to grab some more of that little dividend pumper.

Bob,

The time to add more TIS would have been a few months ago when it was more than 15% cheaper. But I decided to keep my position small because it stopped growing its dividend a while back and it’s a rather small, speculative investment. I’m excited about the growth initiatives on both coasts, but I have to manage my risk when it comes to companies this small. If it turns out as expected, I’ll do very well even with a small investment. I’m happy with my position size and what I paid.

Cheers!

Congratulations – and happy summer!

Sensim,

Thanks so much!

Wishing you and yours all the same. 🙂

Cheers.

I love the idea of a Freedom Fund. I recently wrote a post about using the “F” word… FREE. I think freedom is closer than most people think and you are well on your way!

Good stuff here. I noticed you have mentioned a few times about getting more shares of good companies at value prices. That may be a good topic for you to cover in an article 🙂 to many people sell when the market goes lower but for us dividend folks its time to buy buy buy.I have owned Ford for a long long time and when the market tanked in 2008 -2009 I bought more. My avg cost basis is now $948 p/shr with an effective yld of 6.3273%. Looking back wish I had bought more ! I also have owned NYCB for a long time avg cost basis $15.11 with an effective yld of 6.62%. I really look for buying the dips when I can. I try to keep my portfolio yld as high above the 5% mark as possible so I feel I can beat inflation on a regular basis and when It comes time to start taking my divs to live on I can take less than I earn 🙂 as of today my portfolio yld is 5.474% with nothing “risky” I just watch and add when the time is right. Having some cash on hand helps with that even though I do regular bi-weekly investing I always keep cash for that stock that may dip its share price.

Right now at 53 I consider myself “semi-retired” I have my own business Its good to be at the top 🙂 I really dont have plans to fully retire. When I cant do what I do now I will be spending more time on my investments.

simpleisthenewgreen,

Agreed. I’ve mentioned a number of times that financial independence/freedom isn’t for the aristocratic or anything, which, I think, is what a lot of people think about it. Conceptually, it just seems impossible for a lot of people. But it’s really not that out of reach at all, which is why I write what I write and share what I share. 🙂

Best regards.

Bob,

Absolutely. Discussing the buying of high-quality companies at solid values is a good chunk of the content that already exists on the blog. Kind of my specialty. 🙂

Sounds like you’re in a great position over there. Being in a spot where you love what you do and still have the investments chugging away for you in the background is just wonderful. I plan to live off of my dividend income a lot earlier in life, but it’s really all in the name of being happy and free.

Keep up the great work!

Cheers.

That is so impressive and just goes to show how much hard work, persistence and patience really pays off.

I took time off 2 years in 2004 and 2005 it was nice to have time off but for me I enjoy my work and as long as I own my biz and can pretty much work at what I like when I like I will keep at it 🙂 I think you will find that you will find other things as well like writing another book or continuing your online work. Its good to keep your mind and body fit 🙂

Once you achieve financial freedom “work” is much diif. You will do it because you want to not because you have to 🙂 its a great feeling.

I have personally known many wealthy people who once they “made it” continued on because they found that work really was not a 4 letter word LOL…

my account crossed $200K but it didn’t hold. So congrats on your investment! $300K is around the corner 🙂

I also considering selling my stocks to fund a down payment on an investment property. decision decision!

Jason,

WPC shows an “F” grade on my Schwab account. Why do you think they give WPC such a low grade?

Joel

Congratulations on hitting the $200k milestone with your freedom fund. Almost 7 times as much from 2011 to today. Only 4 more years at the same rate would put you at $1.4M! 🙂

I know for you there is a sense of satisfaction in the stock portfolio value growing, however the dividends are probably more important. You are still on track for your 2015 goal at this point.

Reflecting back I felt the same about building passive income with our rental real estate. Reaching a point where we can live off that income source instead of a job has been our primary focus. We have hedged our bets with some well funded retirement accounts to be safe.

Take care!

Athena,

Couldn’t agree more. If you work hard, believe in yourself, and stick with this through thick and thin, you’re giving yourself the best possible chance to succeed. 🙂

Thanks for dropping by!

Cheers.

Vivianne,

That’s an interesting decision. Best of luck with it. I know some do really well with rental properties. Not my thing, but that’s just more opportunities out there for those like yourself. 🙂

Congrats on hitting that $200k mark yourself over there. Life is getting better by the day, isn’t it?

Cheers.

Joel,

I have no idea. I don’t use Schwab, so I’m not sure what those grades correspond to and how they come about. Perhaps contacting Schwab directly might give you a better answer. 🙂

Take care!

Bryan,

Thanks so much. Definitely a sense of satisfaction and pride there, especially since the majority of the money came out of my own pocket. The power of living below your means. 🙂

But you’re right in that the growing dividend income is more satisfying in the sense that it’s directly rewarding and tangible. It’s truly my barometer of success. And that’s what I love about it. If I relied on the stock market for my barometer, I’d be all over the place. But the growing dividend income is pretty stable and allows me have a pretty good idea of exactly where I’m at.

We’re so fortunate to be making our dreams come true via passive income. Life is just incredible. I feel better and better every single day. 🙂

Enjoy your position over there!

Thanks for dropping by.

Best regards.

Great job on crossing 200K! Hopefully it stays at that level for the next 4-5 years so valuations in the market come down a bit and the dividends have a chance to buy more shares at cheaper prices. Congrats on your accomplishment! Looking forward to the future

ADD

ADD,

I’m with you. Wouldn’t mind a static portfolio value at all for the next few years if it means the stocks I’m investing new capital in are equally cheap. I’ll take every opportunity I can. 🙂

I can only hope the same for all of us investors still aggressively accumulating assets. We’ll see what we get!

Thanks for dropping by.

Best regards.

Congrats Jason. $200k is a nice milestone. You’ve mentioned quiet often you wouldn’t mine a bit of a market correction…I think we might just get one soon…just a suspicion.

Chris,

I certainly hope you’re right about that. I continue to shop either way, but I’d absolutely love to see my fresh capital go further. 🙂

Thanks for stopping in. Hope you had a great July over there!

Best wishes.

Congratulations!!! It just seemed like Sterday when we wished u to cross 200k this year…You did it 🙂 As you rightly said time flies

Wishing you more success ahead.

shankar,

Thank you! 🙂

It’s been crazy lately. I’ve been incredibly fortunate across the board. My results just really speak to the power of working hard and living below your means. Consistently doing that should result in incredible success over the long term.

Wishing you more success ahead as well!

Best regards.

Well done on getting your freedom fund to over $200k. Next stop is 300K.

Jason,

Great job!! It’s a true testament to keep at it and having a plan. I know too many people who have been sitting on the sidelines since the market was at 13k, waiting for that massive correction. With a little research there is always a buy, it’s 1929 somewhere, right? Again congratulations!

On s side note, what is considered a full position for you? Do you try to keep certain sectors at a certain percentage of your portfolio or do go by the overall percentage for each stock? I notice a lot of stocks in the 2 to 3% range.

Thanks in advance,

Raymond

Hi Jason,

First of all congrats for your amazing freedom.

I’m just a younger invest guy from Spain, and looking the stocks you have, there are 64 companies as you say in this post. I wanted to ask you… are not too many companies? Do you follow every 3 months the results of this 64 companies? In my country the stock investing community in general thinks that 15/20 companies is the maximum number of companies that you should have, and control them, more number takes a lot of time to check their results and now exactly if company is working well or not.

In the other hand when I visit blogs website from different countries (specially the ones who invest in USA) I find that as you they have more than 50 different stocks.

Is there any reason?

Congrats Jason, awesome job!

Laura,

Indeed. Just hoping Mr. Market’s mood sours and it takes a long time to get to that next stop. 🙂

Thanks for dropping by!

Cheers.

Raymond,

Thanks so much!

Yeah, I remember coming across someone over at Seeking Alpha who stated years ago they weren’t going to buy until the market corrected by 10%. Well, the market is up by something like 30% since. To use the broader market as your barometer for purchasing individual stocks is like using the weather in Italy to decide whether or not you might like to visit London.

As far as your question goes, it’s simple math. A full position in percentage terms would be 1.6% (100/64). In dollar terms, it’d be $3,178 (203444/64). So those positions you’re seeing that are 2% to 3% in size are actually fairly large. But they make up for the stocks where I have less than a full percentage point weighting to. As the portfolio changes (in terms of number of positions and/or dollar amount), that which constitutes a full position will obviously change as well.

Thanks for dropping by!

Take care.

El joven inversor,

There’s really no right answer to your question. For some, 20 stocks is too many. For others, anything less than 50 is crazy. I find that there are a lot of great ideas out there. There’s a lot more than 50 really high-quality companies in the world. So I don’t really see a good reason to artificially and arbitrarily limit myself to some preconceived number.

As far as the time-consuming nature of running a large portfolio, I find that to be false:

https://www.dividendmantra.com/2014/11/is-managing-a-large-dividend-growth-stock-portfolio-time-consuming/

If you’re investing in major blue-chip companies, there’s just not a lot of babysitting going on. And that’s one of the big reasons I invest the way I do. I don’t need to check up on Johnson & Johnson every quarter or even every year. These are long-term investments (30+ years). Spending all of your time hunkered over a computer and watching stocks all day is just a complete waste of time, in my view.

But it’s an individual call. Go with what works for you. 🙂

Cheers!

DD,

Thanks, bud!

Just working hard, staying consistent, and remaining patient. 🙂

Best regards.

Hi Dm,

Congrats with the 200k mark. I guess it is a double edged sword. It feels great to see the numbers grow, but lower prices mean more bang for our bucks. And our (little) BB guns we need all the help we can get.

Cheers,

Geblin

Geblin,

Definitely. I call it a win-win, though. You either get the psychological benefit of seeing your wealth grow or you get better values for your fresh capital. But a high-quality portfolio will invariably grow in value over time. Just a side effect of intelligent investing. 🙂

Hope you had a great month over there!

Best wishes.

I just found your website about 6 months ago. I had several 401k accounts that I really paid no attention too. Because of this website, I dug in and changed my investments. I went from 3k dividend income to 8k projected annual by just paying more attention and changing things up. So now I have monthly income going into these accounts and I have it set to reinvest. I am wondering what you do. It seems like you buy new stocks vs reinvesting in the same stock. With stocks tanking so bad right now, I think I should change my auto settings from reinvest to cash so I can buy new stocks like you are doing. What do you think? ( I am fortunate to have over 300k already so I have a good amount to work with).

Sue,

Thanks for taking the time to stop by and comment. Glad you found the site! 🙂

You’re in a great spot over there, as you know. You’re sitting well above the average, which is wonderful. Prudence and hard work on your part should be applauded. Congrats!

As far as automatic versus selective reinvestment, it’s really just an individual call. However, I will say it largely depends on your confidence in your ability to allocate capital. If I weren’t confident in my ability to analyze and value stocks, I wouldn’t be doing what I’m doing in the first place. So taking dividends as cash and combining that with fresh capital to selectively reinvest just makes sense to me. Gives me more firepower when the time comes to buy. And some positions are already as large as I’d ever want them to be.

That said, I wouldn’t view “stocks tanking so bad right now” as a good reason to switch anything up. Cheaper stocks just allow your reinvested dividend income to go that much further by being able to buy more shares.

Again, just an individual call. But I prefer selective reinvestment for the flexibility it gives me. And it allows me to avoid allocating capital to stocks I’m either currently uninterested in for any variety of reasons or stocks that are currently, in my view, overpriced.

Best regards!

I’m with the masses in saying congratulations on the 200K!! That really is a great accomplishment in such a short amount of time. Do you keep any cash in addition to the Freedom Fund for a type of emergency fund or for opportunities when the prices in the market drop?

I found out about you from listening to Kraig over at http://www.createmyindependence.com and I’ve really enjoyed reading your blog. Keep up the good work!

Full Beard,

Thanks for stopping by. Glad you found the blog! 🙂

I’ve enjoyed doing some podcasts with Kraig over there. And we’ve met up in person a few times now. He’s a super nice guy.

As far as cash goes, I keep a few thousand aside in my bank account for emergencies. And then I have cash set aside for quarterly estimated taxes. Beyond that, I invest pretty much everything. My cash position is effectively 0% other than that which is being invested over the course of any given month.

Stay in touch!

Best regards.

Thank you for responding. Your site is very inspirational. After reading it, I got on my 25 year old’s sons case about opening up a 401k at his job and he now is the proud owner of his first 401k.

That was directly because of reading your website.

I wish I was that young when I started. I send him links to your articles and I hope he takes a more active interest than I did when I was young.

Sue,

Thanks so much. Really appreciate that.

I truly hope your son finds a lot of value in the content and finds his own way. I can only wish I would have started out when I was 25 years old. I’d be that much further ahead right now. Of course, I also appreciate the success even more because of the somewhat late start.

Stay in touch!

Best wishes.

DM, are you going to post your dividend income for July soon? Best. DD.

DD,

Will be going live tomorrow afternoon. 🙂

Cheers!