The Perfect Income Portfolio

It’s never too late to start investing, and many people believe that income portfolios offer the best opportunities for long-term growth. Everyone has different goals and financial needs, so it’s important to create an income portfolio that fits your specific needs. So, what is the perfect income portfolio?

No one knows for sure what the perfect income portfolio is, but there are a few key considerations that should be taken into account. First and foremost, it’s important to find an investment mix that works well for you. For example, if you’re comfortable with investing in stocks, then a balanced portfolio may be the best option for you. However, if you’re more prone to risk-taking behavior, then a more aggressive portfolio may be better suited for you.

Another important factor to consider is your age and financial stability. Younger investors typically have less money tied up in investments and can therefore afford to take on more risk; however, as we age our monies tied up as investments become a large percentage of our overall wealth. So, it’s crucial to find an investment mix that matches your individual needs while still maintaining some level of safety.

What Is an Income Portfolio?

An income portfolio is a type of investment that is designed to generate consistent and predictable income. This type of portfolio typically includes stocks, bonds, and other investments that offer stable and consistent returns.

An income portfolio can be a great way to achieve financial stability and ensure that you have enough money available to cover your expenses. By diversifying your investments across different types of assets, you can minimize the risk associated with each investment. This allows you to maintain your overall exposure to the market while also mitigating potential losses.

Overall, an income portfolio can provide investors with a reliable source of income. If you’re looking for an affordable way to increase your wealth over time, an income portfolio may be a good option for you.

Why Build an Income Portfolio?

Building an income portfolio is a great way to grow your wealth over time. It can help you reach your financial goals and provide stability in your finances. There are a few key reasons why an income portfolio could be a good investment for you:

1. It can help you reach your financial goals. An income portfolio can help you save for retirement, pay for children’s college education, or cover other important costs.

2. It can provide stability in your finances. A well-built income portfolio will provide consistent returns over time, which can be helpful when times are tough financially.

3. It’s a smart way to diversify your investments. A balanced income portfolio will include different types of investments, which will give you exposure to different areas of the market. This can help protect you from potential risks and reduce the chances of overall losses in your portfolio.

Components of an Income Portfolio

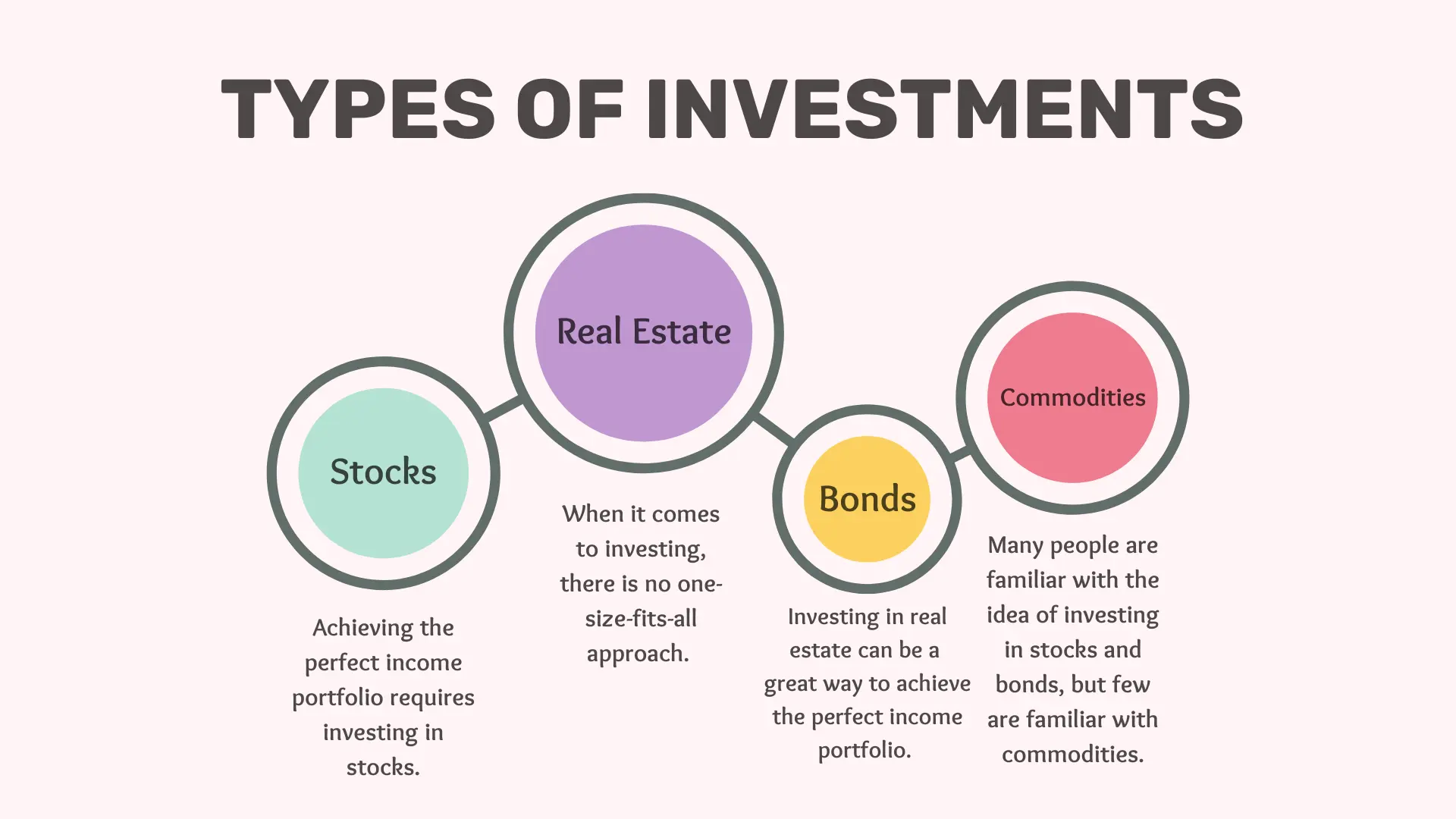

An income portfolio is the mix of investments that produces the highest possible return while providing safety and security. There are four key components to an income portfolio: stocks, bonds, real estate, and commodities.

Stocks are the most volatile component of an income portfolio, but they also offer the highest potential return. Bonds offer stability and a lower potential return than stocks, but they are less volatile. Real estate offers a higher potential return than either stocks or bonds, but it is and is also less risky than stocks. Commodities provide a low risk and low potential return alternative to both stocks and bonds.

Types of Investments

1. Stocks

Achieving the perfect income portfolio requires investing in stocks. Stocks are a good way to generate consistent income and have the potential for big returns. The key to success with stock investing is finding the right stocks. You need to research each company thoroughly before buying shares, and make sure you understand their business before making an investment.

Be patient with your investments; don’t rush into making any decisions that might impact your portfolio’s performance. Take the time to study each stock before making a purchase, and you’ll be on your way to building a successful income portfolio full of stocks that will provide you with consistent income over time.

Also, you need to keep track of your investments regularly so you can stay informed about how they’re performing and make adjustments as needed.

2. Bonds

When it comes to investing, there is no one-size-fits-all approach. That being said, if you want to create a portfolio that will provide you with consistent and safe returns over time, investing in bonds may be the best option for you.

Bonds are considered low-risk investments since they typically offer investors a fixed rate of return regardless of the market conditions. That means that, even in times of volatility, your bond portfolio should remain relatively stable over the long term.

Furthermore, bonds are also considered conservative investments because they tend to be less volatile than other types of securities such as stocks. As a result, bonds can provide investors with steady income over time without having to worry about huge swings in stock prices.

3. Real Estate

Investing in real estate can be a great way to achieve the perfect income portfolio. There are many different types of real estate investments available, so you can find one that is right for you.

Some of the benefits of investing in real estate include the fact that it is a fairly stable investment. The prices of homes generally don’t fluctuate too much, which means your investment will always return some sort of income. Additionally, real estate is a good way to diversify your portfolio. By investing in different types of properties, you’ll increase the chances that your overall portfolio will perform well over time.

When selecting a property to invest in, be sure to consider both the short- and long-term benefits.

4. Commodities

Many people are familiar with the idea of investing in stocks and bonds, but few are familiar with commodities. These investments can provide a perfect income portfolio, as they offer a low-risk way to grow your money while providing consistent returns. Here is a look at how buying commodities can help you create the perfect income portfolio:

Commodities are physical goods that have been designated by an organization, such as the United States Department of Agriculture (USDA), to be traded on a specific market. Because they are physical goods, prices for commodities are typically much more stable than stock or bond prices. This stability can be important when it comes to retirement planning, as you want to make sure that your savings will maintain their purchasing power over time.

When you invest in commodities, you are also getting exposure to a wide range of assets and markets. This type of investment also has the potential for large returns, so it’s important to do your research and make sure you’re getting the best return on your investment.

How To Create an Ideal Balance of Stocks, Bonds, Real Estate and Commodities

Stocks, bonds, real estate and commodities are all important elements of an ideal balance in personal finance. Each has its own unique benefits and drawbacks that should be taken into account when creating an overall financial plan.

There is no single right answer when it comes to balancing these investments, as the best strategy may vary depending on a person’s individual circumstances. However, following some basic principles in the next subheading can help ensure that your portfolio reflects your goals and risks evenly.

The Four Pillars of a Perfect Portfolio

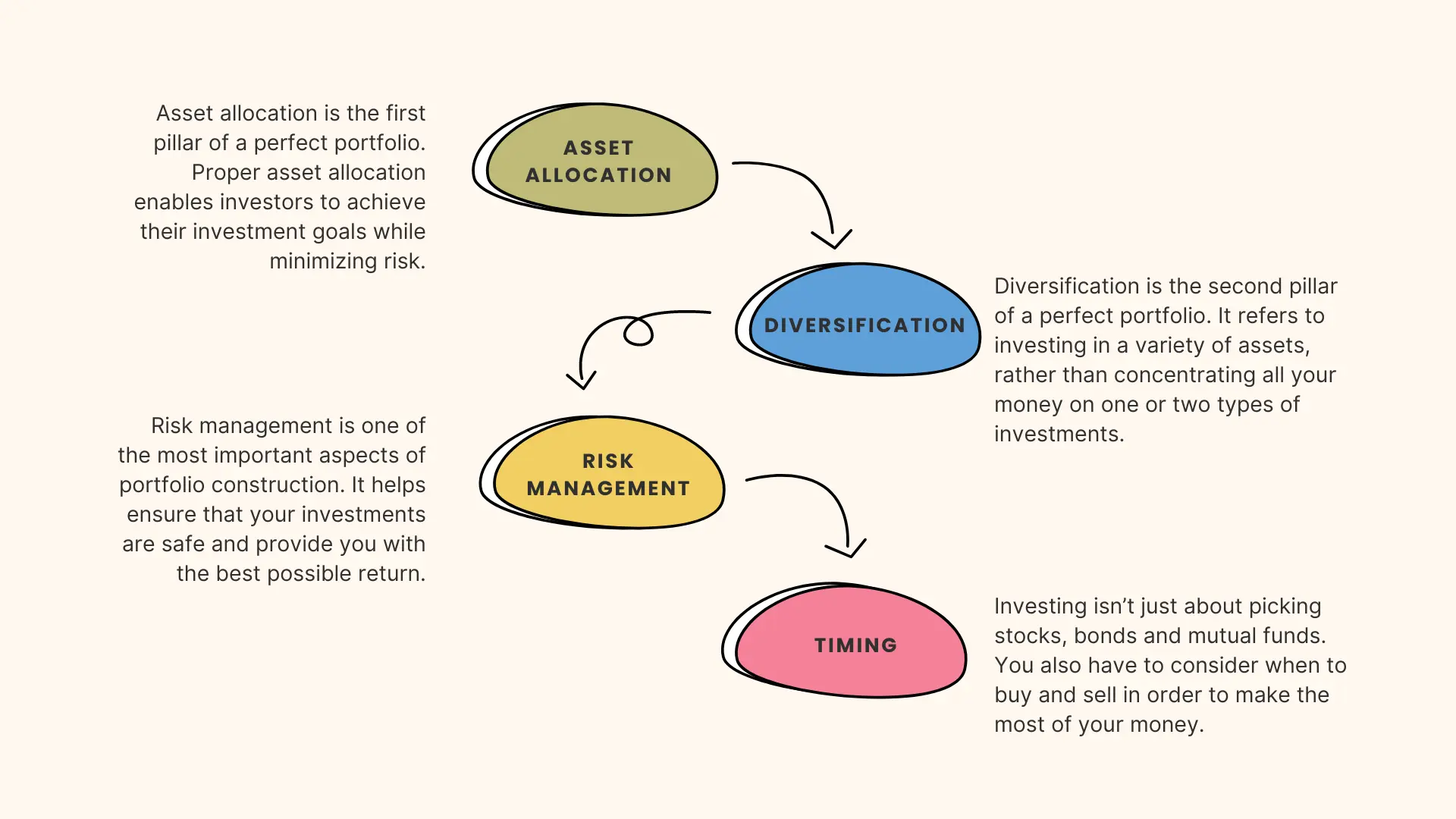

1. Asset Allocation

Asset allocation is the first pillar of a perfect portfolio. Proper asset allocation enables investors to achieve their investment goals while minimizing risk. Investors should aim to distribute their assets among different types of investments in order to create a balanced portfolio that will provide growth and stability. There are three main types of assets: stocks, bonds, and cash.

Each has different characteristics that can help you achieve your investment goals. For example, stocks provide the potential for capital gains, while bonds offer stability and protection from inflation. Cash can be used to purchase stocks or bonds if you need liquidity.

It is important to select the right type of investment for your needs, as over-allocation to one type of asset can lead to greater risk than necessary. Achieving the right balance between stock exposure, bond exposure, and cash holdings is key to creating a successful asset allocation strategy.

2. Diversification

Diversification is the second pillar of a perfect portfolio. It refers to investing in a variety of assets, rather than concentrating all your money on one or two types of investments. By spreading your money around, you reduce your chances of experiencing big losses should one investment tank.

Furthermore, diversifying your portfolio decreases the amount of risk you are taking on as a whole. If one investment goes south, it will have less of an impact on your overall wealth than if all your funds were invested in one stock or bond.

Finally, diversification can also help you achieve financial independence. By building a sizable nest egg that contains a variety of assets, you will be more likely to retire comfortably no matter what happens to the stock market over the course of your lifetime.

3. Risk Management

Risk management is one of the most important aspects of portfolio construction. It helps ensure that your investments are safe and provide you with the best possible return. There are a number of different ways to manage risk, and it’s important to find one that works best for you. Some people prefer to stick with traditional investments while others take more risks by investing in alternatives such as cryptocurrency.

A good risk management plan will include identifying your financial goals, understanding your risks, and making sure you have a diversified portfolio. You can’t afford to put all your eggs in one basket!

By following a sound risk management plan, you can create a perfect portfolio that will help you reach your financial goals. Don’t wait – start planning today for the future you want!

4. Timing

Investing isn’t just about picking stocks, bonds and mutual funds. You also have to consider when to buy and sell in order to make the most of your money. Timing is one of the four “pillars” of a successful portfolio, along with diversification, risk management and asset allocation.

There’s no one right answer when it comes to timing – each investor has to find what works best for them based on their individual goals and risk tolerance. However, one way to figure out when it’s time to buy or sell is by using a rule of thumb called “the Rule of 7 and 5” which suggests holding onto investments for around seven years before selling them, and waiting at least 5 months long before considering whether to buy the same stocks or bonds again.

How To Build a Perfect Income Portfolio: Other Factors To Consider

1. Consider the Income vs Growth Ratio

When trying to build the perfect income portfolio, it is important to consider the income vs growth ratio. The income vs growth ratio measures the percentage of increase in your portfolio’s value over a given period of time. A high income vs growth ratio indicates that your portfolio is growing quickly, while a low ratio suggests that your investments are not generating enough cash flow to support their value.

Some factors to consider when calculating the income vs growth ratio include investment risk, inflation, and tax implications. For example, stocks with higher levels of risk may produce higher returns over time but also carry greater risks associated with potential loss of capital. In contrast, bonds may offer a lower rate of return but provide stability and protection from inflation. Additionally, different tax brackets will impact how much money you’ll ultimately pay in taxes on your dividend and capital gains distributions from stocks and bonds over time.

2. Think About How To Minimize Taxable Expenses

In order to build the perfect income portfolio, it is important to think about how to minimize taxable expenses. There are a number of ways to do this, and each person will have different preferences.

One way to minimize taxable expenses is to save money on taxes by contributing enough money to your 401k or IRA account so that you are not subject to income tax when you withdraw the funds in retirement. Another way to minimize taxable expenses is to reduce your overall spending. This can be done by cutting back on your food budget, for example, or by choosing less expensive housing options.

Finally, it is also possible to reduce your taxable income by investing in tax-deductible assets such as stocks and bonds. By doing this, you will reduce the amount of money that you owe in taxes each year. You can build a portfolio that reduces your overall tax burden while still providing enough income to cover basic needs.

3. Look at Possible Rebalancing Options Before You Begin

If you are trying to build the perfect income portfolio, it is important to look at possible rebalancing options before you begin. Rebalancing can help you make sure your money is staying in the right investments, which can help you achieve your financial goals. There are a few things to consider when rebalancing your portfolio:

First, consider how often you should rebalance. Some investors feel that they should rebalance their portfolios every month, while others only do it once a year. It depends on your individual risk tolerance and investment goals.

Second, consider what type of rebalancing you should do. You can either adjust the asset allocation (by selling stocks and buying bonds) or adjust the weighting of individual assets (by selling stocks and buying more shares of a specific stock).

Third, decide which investments to sell and the ease of doing so if the time comes to sell.

4. Consider Building a Savings Plan for Retirement

When it comes to income portfolio planning, there are a few key things to remember. First and foremost, you need to have enough saved up so that you can live comfortably in retirement. You also need to make sure your income will be adequate, as raising your drawbridge in advance could mean a difficult time when you reach old age. And lastly, it’s important to have some flexibility in case of an emergency or unexpected financial shortfall.

If any of these points resonate with you, then it might be a good idea to consider building a savings plan for retirement before you begin investing your money elsewhere. A savings plan can help ensure that you’re taking care of both your short- and long-term financial goals, and can provide peace of mind during challenging times. Plus, if managed correctly, a savings plan can help grow your wealth over time while providing reliable income in retirement.

Different Types of Income Earners and How They Should Be Invested

There are many different types of income earners out there, each with their own unique set of investment requirements. To make things simple, let’s break down these different types of earners into four main categories: 1) retirees; 2) workers; 3) self-employed individuals; and 4) investors.

1. Retirees

As a retiree, your primary focus should be on safe, low-risk investments that will provide you with consistent income over time. This means investing in gold or silver bullion, CD’s or mutual funds that invest in conservatively rated stocks, and keeping a close eye on your expenses to make sure you’re not overspending.

2. Workers

For workers, the focus should be on generating as much income as possible while minimizing risk. You should be looking to keep your expenses low while investing in a variety of safe, conservative mutual funds and CDs. In addition, you should take advantage of tax-advantaged retirement accounts such as IRA’s and 401k’s to increase the amount of money you contribute each year.

3. Self-Employed Workers

This is a category that includes everything from consultants to entrepreneurs. These are people who earn money on a project-by-project basis, so their earnings can be sporadic and unpredictable. They should invest in assets that will give them stability, like bonds or CD’s.

4. Investors

Seasoned investors can invest in riskier, short-term investments. One reason that seasoned investors may choose to invest in riskier, short-term investments is that these types of investments offer the potential for greater returns than longer-term holdings. While there is always a degree of risk associated with any investment, investing in short-term securities offers the opportunity for greater gains should the market trend in the investor’s favor.

Are There Any Risks Associated With Investing in an Income Portfolio?

Income investing is a popular strategy among investors because it provides stability and predictable returns. While there are no guarantees in the stock market, income portfolios are typically less volatile than other types of investments. However, there are some risks associated with this type of portfolio.

One risk is that your investments may not perform as anticipated, resulting in a loss of money. Another risk is that your portfolio may not be diversified enough, which could lead to adverse investment outcomes. Finally, income investing can also be risky if you do not have the proper financial knowledge or skills to make sound investment decisions.

Hence, a key factor you should consider when selecting an income portfolio is your tolerance for risk. You need to be comfortable with the possibility of losing some money in order to gain overall investment returns. Also, think about your investment horizon. The longer term your investment horizon, the more conservative your portfolio needs to be.

Please consult a financial advisor if you have any questions about how specific investments could affect your long-term return potential. Each person’s financial situation is different, so a financial advisor may also be able to tailor an income portfolio specifically for you.

Conclusion

In conclusion, a perfect income portfolio would have the following elements:

1. Fixed income investments such as bonds and certificates of deposit

2. A diversified mix of stocks, including both dividend-paying and growth stocks

3. A targeted allocation to retirement accounts, such as 401(k)s and IRAs

4. An insurance policy to cover unexpected expenses, such as a life insurance policy or health insurance policy.

While there’s no single perfect income portfolio that suits everyone, a diversified mix of investments can provide stability and growth over time, while keeping costs low. So, if you’re looking to improve your finances and reach your financial goals, start by creating a portfolio that fits your needs and invest in the things that will help you achieve them.