How to Find the Best Thematic ETFs for Your Portfolio

Many people are familiar with traditional stock ETFs, which invest in a variety of stocks across different industries. However, there are also ETFs that focus on specific themes, mostly those with future growth prospects or intrinsic value. This article will provide tips on how to find the best themed ETFs for your portfolio.

But first, let’s look at some definitions.

What is Thematic Investing?

Thematic investing is the process of selecting stocks based on specific themes or trends that the investor believes will drive future performance. For example, an investor might focus on companies that are benefiting from the growth of the internet of things (IoT) or the rise of electric vehicles. Thematic investors often use a top-down approach to stock selection, starting with an industry or sector and then narrowing down to specific companies within that sector.

While investors may differ on a particular industry, such as technology or healthcare, or on specific global regions, thematic investing, in general, prioritizes emerging markets. Once the emerging trend or market has been highlighted, thematic investments can be made by buying individual stocks or ETFs that track that trend, industry, or market.

What are ETFs?

An ETF, or exchange-traded fund, is a type of investment fund that holds a collection of assets and divides ownership of those assets into shares. Investors can purchase shares in an ETF, which represents a proportional ownership of the underlying assets. ETFs trade like stocks on exchanges, and their prices change throughout the day as investors buy and sell shares.

ETFs provide investors with a way to gain diversified exposure to a number of assets in a single trade and can offer lower fees than buying the underlying assets individually.

What are Thematic ETFs?

Thematic investing ETFs are securities that track indexes of companies or other assets that are believed to have a common theme, such as a certain industry or geographic region. Thematic ETFs can be used as a way to invest in specific industries or regions, or to spread out risk by investing in several different themes. However, as with thematic investing, the themes of thematic ETFs are usually based on emerging markets such as artificial intelligence, renewable energy, etc.

Thematic ETFs are designed to provide investors with exposure to the upcoming trends of the world, and they can be a valuable tool for diversifying your portfolio, while promising long-term mega gains.

Types of Thematic ETFs

Thematic ETFs provide a basket to invest in companies that stand to benefit from a certain trend or theme, and sometimes will invest in companies that are working to solve a specific social or environmental issue. Given the above, there are three broad classifications of thematic ETFs: investment, pure-play, and diversified.

Investment ETFs are the simplest type of thematic ETF and invest in a broad range of companies that fall into a certain theme. Pure-play ETFs only invest in companies that fall into a certain theme, while diversified ETFs invest in a mix of companies from different industries that fall into a certain theme.

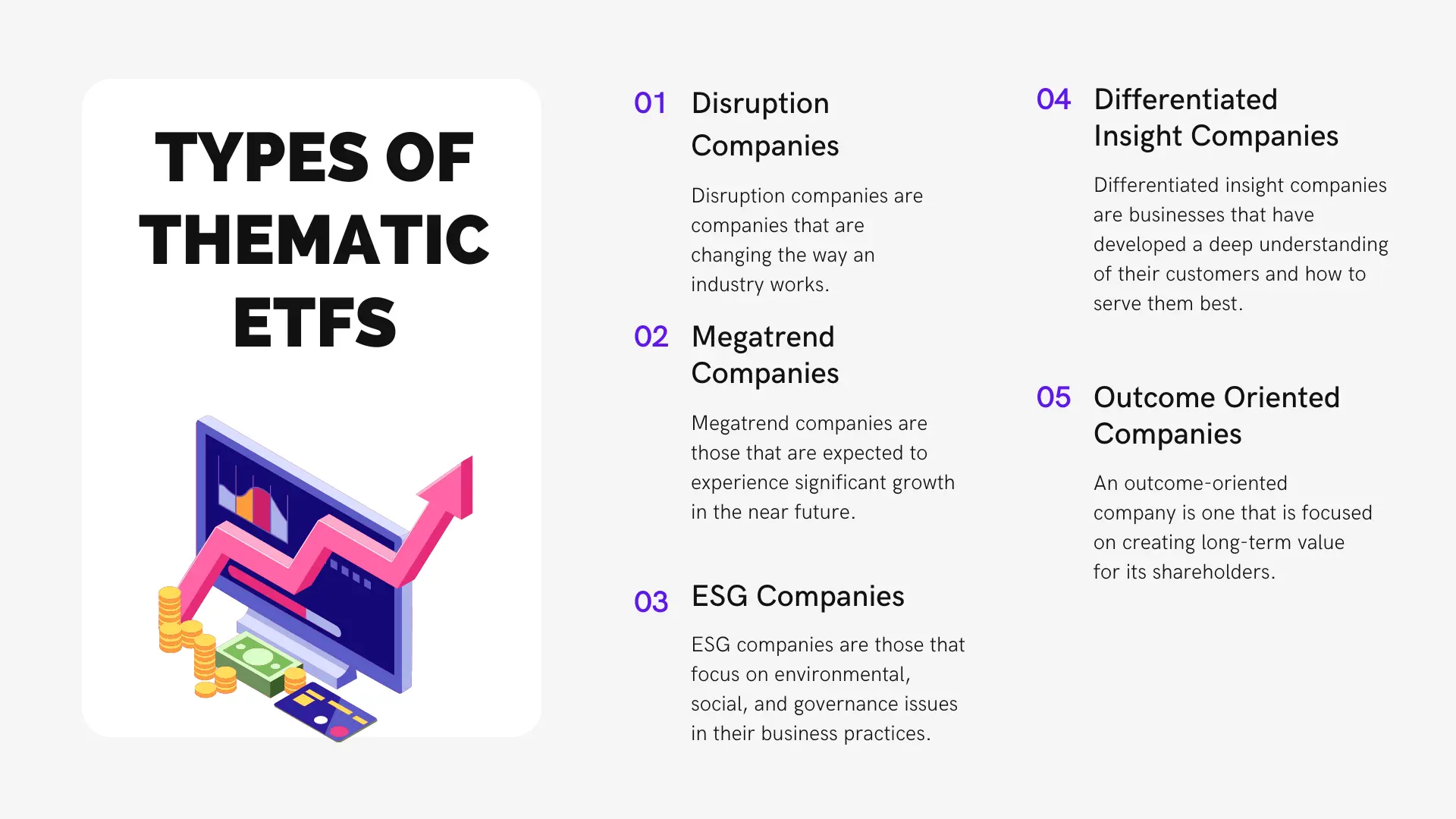

Whichever of the above you decide to go for, the types of companies you can expect your thematic ETF portfolio to contain will be one of the following categories:

1. Disruption Companies: Disruption companies are companies that are changing the way an industry works. They can be new companies that are starting a new industry, or they can be old companies that are changing the way they do business. They may also be startups that have created a new technology or business model that is challenging the status quo.

Thematic ETFs invest in disruption companies because they believe that these companies will be the biggest winners in the future, and they want to get in early so they can make a lot of money.

2. Megatrend Companies: Megatrend companies are those that are expected to experience significant growth in the near future. Thematic ETFs often invest in these companies because they believe that they will be able to generate strong returns for their investors. While they may be small, they tend to be instant leaders in their industry, and they often have a wide moat around their business that protects them from the competition.

Megatrend companies are typically those that are involved in cutting-edge industries, such as technology or biotechnology. As mentioned, they tend to be smaller and less established than more traditional blue chip stocks, which makes them more risky but also potentially more rewarding.

3. Environmental, Social, and Governance (ESG) Companies: ESG companies are those that focus on environmental, social, and governance issues in their business practices. This can include things like reducing carbon footprint, supporting sustainability initiatives, being involved in charitable work, and ensuring good governance practices. Many investors believe that ESG companies perform better financially over the long term, as they tend to have more sustainable business models and better risk management.

Thematic ETFs may invest in these companies because they believe that they offer a better long-term investment opportunity, as they have a positive environmental or social impact, and as such, will be more widely accepted by the public over time.

4. Differentiated Insight Companies: Differentiated insight companies are businesses that have developed a deep understanding of their customers and how to serve them best. They achieve this by collecting data about their customers and using it to create profiles that help them understand what each customer wants and needs. They then use this information to design products and services that meet those needs. This level of understanding gives differentiated insight companies a competitive advantage over other businesses, which can’t offer the same level of customization or personalization.

Differentiated Insight Companies (DICs) such as Facebook and Twitter are able to identify and capitalize on opportunities that others cannot see. As a result, these companies tend to be more profitable and grow faster than their peers. Thematic ETFs invest in DICs because they believe these businesses will outperform the broader market over the long term.

5. Outcome Oriented Companies: An outcome-oriented company is one that is focused on creating long-term value for its shareholders. This means that the company is not just concerned with meeting short-term goals, but rather with maximizing the long-term potential of its business. Outcome-oriented companies tend to be better managed and have a longer-term perspective, which allows them to make decisions that may not always be popular but are in the best interests of the business.

Outcome Oriented Companies are mostly focused on achieving a specific goal, such as increasing profits or becoming more environmentally friendly. Thematic ETFs invest in these companies because they believe that they will be able to achieve their often singular goals, which will lead to positive outcomes for shareholders.

Understanding the Different Thematic Approaches

There are seven main types of thematic investing approaches:

1. The Top-Down Investing Approach: The Top-Down Investing Approach is an approach to investing that begins by analyzing the overall economy and then selecting specific industries and companies that are expected to do well within those industries. This approach is often used by those who invest long-term in stocks, as it allows them to make more informed decisions about which companies to buy shares in.

2. The Bottom-Up Investing Approach: The Bottom-Up Investing Approach is a technique used by investors to find stocks that are have been sold off by shareholders due to a temporary setback but have the potential to rebound and even appreciate in price. The approach involves analyzing a company’s financial statements and other information in order to identify strong businesses that are worth investing in. The goal is to find companies that are trading at a discount to their intrinsic value and that have the potential to generate high returns for investors.

3. The Integrated Investing Approach: The integrated investing approach is a technique that is used to manage investments in a more holistic and cohesive way. This approach takes into account all aspects of an investor’s financial situation and aims to create a plan that will provide the best possible outcomes for the individual or organization. By taking a comprehensive view of an investor’s financial picture, the integrated investing approach can help to ensure that all investments are working together towards common goals.

4. The Growth Investing Approach: The growth investing approach is a long-term strategy that focuses on buying stocks of companies that are expected to grow at a faster rate than the overall market. This approach typically involves investing in young, growing companies with high levels of profitability and strong prospects for future growth. Investors who use this strategy believe that these companies will be able to generate above-average returns over time as they continue to expand their businesses.

5. The Income Investing Approach: The income investing approach is a type of investment strategy that focuses on generating a steady stream of income from dividend-paying stocks and other sources of income. This approach is often used by retirees and other investors who are looking for a reliable stream of income to live on. Income investors typically focus on stocks that have a high yield, which is the ratio of the annual dividend payment to the stock’s current price. Also read, Sector Investing with ETFs.

6. The Value Investing Approach: Value investing is the approach of buying stocks that are considered undervalued by the market. This means that the investor believes that the stock is worth more than it is currently trading for. The goal is to find stocks that are priced low, but have good potential for future growth. value investors look for companies with strong fundamentals, such as high earnings and low debt levels.

7. The Defensive Approach: Defensive Investing Approach is a technique used to minimize risk in an investment portfolio. The goal is to protect the initial investment while still achieving a modest return. One way to achieve this is by diversifying the portfolio, which means investing in a variety of securities. Another tool used in defensive investing is hedging, which means taking actions to offset potential losses. For example, if an investor is worried about a stock dropping in value, they might buy put options to limit their losses. Defensive investors typically invest in low-risk assets such as government bonds and blue chip companies, etc.

Top-down investors start by analyzing broad economic trends and then selecting industries and companies that they believe will benefit from these trends. Bottom-up investors start by analyzing individual companies and then selecting industries and companies that they believe will benefit from these trends. Integrated investors try to use a combination of both top-down and bottom-up investing approaches.

The growth approach focuses on companies that are expected to have high future earnings growth. The income approach focuses on companies that offer high dividends and dividend growth. The value approach focuses on buying stocks of companies that are trading at a discount to their intrinsic value.

What Types of Thematic ETFs Should You Add to Your Portfolio?

There are many different types of thematic ETFs, and each investor should carefully consider which ones fit their individual investment goals and risk tolerance. Some of the most common types of thematic ETFs include environmental, social, and governance (ESG) funds, technology funds, health-care funds, and income-oriented funds. While all of these categories offer potential benefits, investors should be aware that some of these funds may be more volatile than others.

First, make sure to carefully consider your investment objectives. Do you want exposure to a specific sector or region? Do you want to invest in companies that are improving their performance now or those that are likely to do so the most in the future? You don’t want to invest in a clean energy ETF if you think climate change is a hoax, for example.

Second, make sure the sector or trend the ETF is focusing on is one you think will perform well in the future. Some of the most popular themes include technology, health care, and environmental protection.

What Type of Approach Should You Go With When Investing in Thematic ETFs?

When investing in thematic ETFs, it is important to decide what type of approach you want to take. As we touched on earlier, there are three main types of thematic ETFs: pure play, diversified, and specialized. Pure play ETFs invest in a single company or sector that is related to the theme, while diversified ETFs invest in a number of companies or sectors that are related to the theme. Specialized ETFs invest in a specific industry or niche within the theme.

Your approach should be based on finding the funds that align with your investment goals.

Recommendations for New Investors

If you want to invest in thematic ETFs, there are a number of ETFs available that track various sectors or regions. Here are some tips on finding the best thematic ETFs for your portfolio.

1. Do Your Research: The main reason for doing your research before investing is to protect yourself from potential losses. By understanding the company you’re investing in, its financial stability, and the industry it operates in, you can make a more informed decision about whether or not to invest. Research can also help you identify potential risks and opportunities associated with a particular investment. Finally, it’s important to review past performance of the company and the overall market so you have a better understanding of how your investment may be affected.

2. Consider Your Goals: When considering how to invest one’s money, it is important to think about what the investor hopes to gain from the investment. This includes both short-term and long-term goals, as well as specific return expectations. Investors should also be aware of their own risk tolerance and capacity for loss. Only by evaluating all of these factors can an investor make an informed decision about where to put their money.

3. Consider Your Risk Tolerance: Risk tolerance is important when considering investments because it is one of the factors that will affect an individual’s ability to remain invested during times of market volatility. Those who are able to tolerate more risk will be less likely to sell during downturns, which can minimize losses and maximize gains. Conversely, those with a low risk tolerance may be more likely to sell during difficult times, potentially locking in losses.

4. Know What You’re Looking For: In order to make informed and intelligent investment decisions, it is important for investors to identify their goals and objectives. This will allow them to focus on specific investments that are most likely to help them achieve their desired outcomes. Investors who do not have a clear understanding of what they are trying to accomplish are more likely to make impulsive and poorly-informed choices, which can lead to financial losses.

5. Narrow the Field: Narrowing the field is important in investing because it allows investors to focus on a specific subset of potential investments, which they can research more thoroughly. This increases the chances that an investor will find an investment that meets their specific criteria and risk tolerance. Additionally, narrowing the field can help reduce cognitive biases, such as anchoring or sunk cost fallacy, that can lead to poor investment decisions.

6. Compare and Contrast: Comparing and contrasting different investment opportunities is important in order to make informed investment decisions. By evaluating the similarities and differences between different investments, investors can assess which option is most likely to meet their individual needs and goals. Additionally, comparing and contrasting can help investors identify potential risks and rewards associated with each investment. Ultimately, this information can help investors make more informed choices about where to allocate their money.

7. Ask for Help: In order to be a successful investor, it is important to ask for help. This is because there is so much information available, and it can be difficult to know where to start. By talking to someone who knows about investing, you can get advice on where to put your money and how to grow it. Additionally, by having a support system in place, you will be less likely to make rash decisions based on emotion alone.

8. Compare Fees: When making any investment, it is important to compare the fees associated with each option. This is because the fees can have a significant impact on the overall return of the investment. For example, if an investor were to compare two different thematic ETFs, and one fund had a higher fee than the other, the investor would be better off investing in the fund with the lower fee, because that fund would have a higher return.

9. Make a Decision: After doing the above, it is time to make a decision. Making a decision is the next step as you have to actively decide to allocate capital to the most promising opportunities. In order to make an informed decision, an investor needs to understand the key factors that drive a company’s success, such as its competitive position, financial health, and growth prospects.

10. Review the Holdings: One of the most important things an investor can do is review their holdings regularly. This allows them to stay aware of how their investments are performing and to make any necessary changes. Additionally, reviewing one’s holdings can help them identify any potential problems or opportunities with their investments. By being proactive, investors can minimize losses and maximize profits.

Conclusion

In conclusion, when looking for the best thematic ETFs for your portfolio, it is important to do your research and find the funds that align with your investment goals. Consider the fund’s expense ratio, holdings, and performance before making a decision. With a little bit of effort, you can find the right thematic ETFs to help you reach your financial goals.