Income/Expenses For July 2014

First, I want to prove to the world that it’s possible to become financially independent at a relatively young age even if you don’t make a lot of money. I don’t make a six-figure income. I never have and I probably never will. But it’s not necessary. Often, people focus on income too much. Expenses are just as important, because if you make $200,000 per year, but spend $190,000 of it, you’ll never become financially independent. Conversely, bringing home $40,000, and learning to get by on half of it means you’ll likely be able to retire if you want to within 15 years or so. Making less means you have less to save, but spending less means you need less to retire off of.

The second reason I do this is because I want this to be a live look at one man’s journey. You can find countless books by financially successful people, but often it’s long after they’ve completed their trek to significant wealth that they’re then telling you how they did it. It’s easy to postulate. It’s much more difficult to actually show the whole process in action, for better or worse.

And finally, knowing that every dollar I spend is going to be published for the world to see serves as reinforcement to stay frugal. There’s been more than one occasion where I decided against a particular expense after realizing I might be a bit embarrassed to write about it.

So each month I will post my income and expenses for the previous month. I track every dollar in and out, so what you see is exactly what I earned and spent (rounded to the nearest dollar).

| Income from July 2014: | |

| Online Income | $3,316 |

| Dividend Income | $316 |

| Other | $36 |

| Total Income | $3,665 |

| Expenses from July 2014: | |

| Auto | $300 |

| Rent & Utilities | $200 |

| Health | $178 |

| Hosting | $154 |

| Restaurants | $137 |

| Amusement | $90 |

| Groceries | $78 |

| Fuel | $76 |

| Auto Insurance | $69 |

| Fast Food/Takeout | $62 |

| Student Loans | $50 |

| Pharmacy | $48 |

| Mobile Phone | $40 |

| Email Services | $20 |

| Total Expenses | $1,497 |

Income

What can I say? I’m blessed to continue earning a fairly strong income while doing what I love for a living. This is my first month without a day job paycheck, so it was kind of a wild ride for me to see how things would ultimately turn out.

The biggest category is obviously online income. That includes all income I earn from my online endeavors, including advertising income from this blog as well as freelance writing. This was my second-biggest month ever in this category – behind last month – so I’m very pleased here. Thank all of you for your continued support!

Dividend income was strong yet again. To be in a position where I’m earning hundreds of dollars in a month for essentially what amounts to excellent past decisions is really wonderful. One great decision in your life can reap benefits for your entire life, but repeating great decisions over and over again can truly change your future.

The other income was the redemption of cash back rewards from one of my credit cards. I’m frugal and don’t buy much, but I take advantage of credit card rewards as much as possible by using my Visa as much as possible. It’s wonderful to collect a little cash back on top of knowing that I’m committing a little capital Visa’s way as a shareholder.

Expenses

Most of my expenditures were pretty well held in check this month.

This will be the last month of $200 rent. I’m still renting a room from my sibling while I look for a more permanent housing situation, but I decided to raise my own rent to $250 for the remainder of my stay. My little niece was recently born and I know the extra $50 can help out. If I stay past the end of the year then I’ll likely raise my rent once again.

Food was high this month. I took a number of people out to eat, including my sister and brother-in-law twice. I’m still in kind of a honeymoon stage being back home in Michigan, so I’ve been spending a little more on food than I’d like. But it was all worth it, as I’ve been super happy spending more time with loved ones.

This will be the last month of $50 student loan payments. I applied for and received a two-month forbearance on my student loans. I actually didn’t have to pay anything, but the $50 covers all interest expenses (so they don’t capitalize) and a little principle. Starting in August, however, I’ll be back to paying more than $200/month on my loans until they’re paid off.

The amusement category was a lot more expensive than usual. Most of this was due to a Detroit Tigers game I attended for July 4th. It was a great time, and worth every penny. My two sisters, their significant others, and myself (I played fifth wheel) all attended the game. It was a beautiful Midwestern summer afternoon, and the fireworks show after the game was almost worth the admission all by themselves.

Auto insurance went down slightly. This was due to a discount I received from plugging in Progressive’s Snapshot device. Score!

I paid $15 for an iPhone 4S cover, so that’s why my mobile phone expense is that much higher than usual. My younger sister’s boyfriend has an iPhone 4S he no longer uses (he now uses a Samsung GS4), and it had a cracked screen. He offered to give me the phone for free if I bought a new screen. I figured that was well worth the expense and ordered a new front screen with back cover online for the $15, and he told me he’d put it on for me. Gotta love family! So my old iPhone 3G from 2009 will be gone pretty soon.

Savings

I managed to save 59.2% of my net income this month. I consider that pretty astounding, as this is the first month I’ve ever tracked my budget without the comfort of a conventional paycheck. I’m not quite sure it’ll be like this every month, but I’ll take it when I can get it!

My goal is to save 50% of my net income, averaged monthly. So far, I’ve hit rates of:

- 49.8% – January

- 21% – February

- 59.1% – March

- 51.6% – April

- 18.6% – May

- 72.9% – June

- 59.2% – July

I’m now at an average of 47.5% for the year. I’m climbing back, guys! I’m still short of my goal, but I’m making every effort possible both on the income and expense side of the equation to claw my way back and exceed 50% for the year. It’s a lot tougher than it used to be, but I’m happy to be in a position to take on the challenge.

I expect August to be more expensive with a slightly higher rent tab and normalized student loan repayments. But I’m aiming for 50% again. I’ll do my best!

Full Disclosure: Long V.

How was your budget for July? Did you have a great month for savings?

Thanks for reading.

Photo Credit: Stuart Miles/FreeDigitalPhotos.net

Well done with raising your own rent. There indeed is a difference between frugal and cheap – frugal people will not save money at the expense of others.

Your online income for July is great – well done! I think that raising your own rent is a very generous thing to do and shows the difference between cheap and frugal. Good luck for 50% savings in August!

Great job! Thats some pretty hefty online income. Just curious if thats gross or net of taxes. Thats really awesome that you raised the rent without being asked. An extra $50 will really help them out. Keep up the good work! And great job almost reaching 60% savings with no job income coming in.

You made almost as much in online income as I do at my day job in a month…. I am jealous!!!

Seriously, congrats on an impressive month especially in the online income part. Sure beats working at a job and the the headaches that come with it. I looking forward forward to the day I do not have to work at a job anymore.

Hey Mr. Mantra!

Keep up the great work. You’re an inspiration my friend. Wtih a lot of love, i want to thank you for your dedication to dividend growth.

Do what you love, love what you do. It’s just awesome.

Take care bud.

Nice work here Jason! Good to see that online income is staying high. Here’s to you finding more ways to monetize your efforts and continue your aggressive journey towards financial independence!

Mr Bean,

I agree there’s a big difference between frugal and cheap. I try to make sure I don’t cross the line into cheapness, but I suspect I’ve been guilty of it myself on an occasion or two, mostly in the beginning when I was trying to find my own balance.

Thanks for stopping by!

Best regards.

Nicola,

Thank you!

I’m definitely giving it my all. August will certainly be more challenging, but I’m anxious to keep at it. 🙂

Appreciate all the support. Hope all is well over there!

Best regards.

DM!

59%?! Awesome – just awesome. Congrats on the discount from Progressive insurance, I’m sure the savings on an annual basis made it worth it, especially since you aren’t driving much as well, as $76 on fuel is around 1 full tank and then some on gas. I’m jealous of how low your expenses were for August.

Also – I need to congratulate you on another $3K+ of online income. Amazing. It’s still early but – someone made the easiest/right/common sense/what we all fear of doing/insert here – of leaving the corporate/9-5/working-for-the-man world and are doing something passionate and earning revenue from it. That’s the dream and the goal.

Congrats DM, I’m pumped to post how my August income/expense results were here in a few weeks. My 60% challenge will be close, so we’ll see.

Talk soon!

-Lanny

JC,

Thanks for the kind words! Really appreciate it. 🙂

That amount is net of quarterly estimated taxes, but I’m sure it doesn’t include everything. I wish I had set it up to pay more than $700/quarter, but I honestly didn’t foresee making as much as I do online. But it always gets reconciled in February or March, so the annual savings is still 100% accurate.

Keep up the great work over there!!

Best wishes.

IP,

Thank you very much. I’m really blessed to be in such a wonderful position. I have worked hard to get here, but I think success is definitely where luck and hard work intersect.

Though I spend a lot of time on all of this, I don’t really consider it “work” at all.

I know you’ll be there one day soon enough as well. Many of us will, which is what’s really fantastic about this community.

Thanks for stopping by!

Cheers.

Tyler Tran,

I appreciate that! Thank you very much. I try to provide my own brand of inspiration/encouragement, while also admitting that this kind of lifestyle isn’t for everyone. I’m just glad there are enough people out there that appreciate it for what it is and follow me along. 🙂

To our success!

Take care.

W2R,

The online income has definitely been a welcome surprise. I’ve been busy writing away, and it’s so wonderful to see the financial output of that effort in these reports.

I hope newly married life is treating you wonderfully over there!! 🙂

Cheers!

Lanny,

Thanks!

My fuel expenses have actually been higher than I’d like, but it’s difficult to keep them low up here where you have to drive everywhere. It is what it is.

It was definitely a scary jump to move from working at a well-paying automotive job to writing for a living, but I felt it was scarier to still be stuck at the dealership for another 5-10 years. I knew I’d make more and could build passive income faster by staying, but I knew I’d be happier leaving. And that’s really what life (and this journey to FI) is all about: being happy. 🙂

I’m sure you knocked it out of the park over on your end as well. Looking forward to seeing how August turns out for you!

Best wishes.

Hey DM,

Congratulations on keeping such an incredible savings rate, especially now that you have a much lower income. Looking forward to see you reach 50% by the end of the year.

Congratulations on having the courage to jump from your job into this situation. In my book, you have already made it. You have full control of your time and you make an income doing what you love. I have a feeling that you will never stop writing which will lead to you never retiring on your dividends and us being able to enjoy seeing your portfolio growing for the next decades :).

Best Wishes!

Dividend Venture

Jason,

59% is incredible considering all that’s happened and the changes you made in the past months! And the best part is that you’re doing what you actually love doing rather than being stuck in a 9-to-5 routine.

Even though expenses are the most important factor in reaching financial independence, I also want to congratulate you on the online income. Great numbers!

Props for raising the rent, really generous gesture.

Keep it up!

NMW

Thank you for this blog. I began my DGI journey a year ago and have your story to thank for it. I’ve been involved in the stock market for a few years but adopted the dividend strategy because I like to sleep well at night. So thank you.

A few questions:

Is the difference between your income and expenses how much you have available to invest? How much do you set aside for living expenses each month?

Thanks.

Hi Jason,

thanks for sharing your August results. Very impressive and inspiring.

I am really impressed by your online income which is more than many people get for a full-time job…

Keep up writing and inspiring.

Have a good week.

Best regards from Germany

rickrack

DV,

Thank you very much! It’s tough to make the jump into the unknown for sure, but I knew the potential rewards made it totally worth it. I’m obviously incredibly fortunate. 🙂

And you’re right. I doubt I will ever stop writing, which means I hope to continue sharing everything for many years to come. I really want this blog to be a look at the march up the mountain, after which I want to share the view from the top for many years.

Thanks for stopping by!

Cheers.

Well, Jason, all of your metrics are pretty impressive but what inspires me most is that you are doing it all real time. It’s much more fun to come along for the ride and get the lessons learned as you go. I’m trying to do similarly with my debt repayment journey, which I will later morph into my FI pre-retirement journey. Are you willing to give a breakdown in your on line income between freelancing versus network advertising versus affiliate advertising? 😀

NMW,

The online income continues to really amaze me. I’m just writing my heart out, so I’m incredibly glad to see these kinds of results.

I’m just trying to simultaneously write and write while also keeping the expenses in check. So far, so good. 🙂

Keep up the great work over on your end too. You’re off to a fantastic start for your age. I’m confident you’ll far surpass my level of success by the time you get to be my age.

Take care!

Mike,

So glad you’ve started your own journey! I hope you find as much success as I have with it, or even more success. Just stay consistent and you’ll definitely see the results.

As far as your question goes, every dollar I spend is recorded here. So you’re looking at my living expenses. The difference between income and expenses (in this case, $2,168) is what’s available to invest.

I hope that helps! Keep in touch. 🙂

Best regards.

rickrack,

Thank you so much. Very kind of you.

I can only hope that you’re finding as much success in your journey as I am.

Appreciate the support all the way from Germany!! 🙂

Best wishes.

Debs,

That’s one of the things I love most about blogging vs. writing a book, or something similar. This is all in happening in the now, whereas a book explains it as it may have happened a while ago. So my victories and setbacks are out there for the world to see as they happen. 🙂

I know you’ve built up some debt, but I remember you discussing your investment assets at one point, and that was very impressive!

As far as my online income goes, it’s pretty much the same as what it was when I broke it down in a post a couple months back. Affiliate income is almost non-existent, the blog generated about $1,200 in advertising (mostly AdSense) income, while the rest was freelance writing. The only difference now is that the freelance income has gone up quite a bit, as I’m writing more. I find it easier to make more money writing than advertising, maybe because I enjoy it more or it comes more natural.

Keep up the great work over there!

Cheers.

Long time ago, I mentioned “online income(at the speed your blog is growing) + dividend income, you will be fine.” Online income is recession proof. It is just fantastic. I’m happy for you and kind of jealous at the same time. Taking me out for lunch someday will solve that jealous issue. What do you think? Wish you the best always.

Impressive online income ! And great expense control. I am glad you raised your rent. I so much wish I could be a writer like you, but have not the guts for the world to watch each step of mine. Maybe one day, who knows ? Congrats !

Great job, Jason. It’s looking like an excellent move to quit the job you hated to do something that you like, especially since the writing is more than paying the bills. You sir are an inspiration.

Keith

NIce work Jason, I hope your online income gets to 6-figures one day, that would be cool. BTW, you can actually make money paying your taxes. If you get or have a 2% cash back credit card, you can make a slight spread by paying thru payusatax.com which charges 1.87%. Kind of makes paying your taxes slightly less painful.

Impressive online income. Your blog is an inspiration for all dividend investors. I am also on the way to financial freedom, but it will be a long way to reach the goal. My dividend income is much much smaler then yours, but it is stil growing. Thats the right way.

Greets from germany

What do you use to track you expenses?

Great job on the savings. It’s not an easy task to have that type of savings rate. I have been trying to grow my dividend portfolio and savings rate. I have about 9 stocks and growing. Thanks for the motivation.

Wow, great income! That’s as much as my take home income, crazy. I’m glad things are working well for you and keep going well. I’ll be sure to click on those ads. Also, since this is online income, do you have to pay taxes during tax season?

Cheers.

It’s an understatement saying you are “blessed to continue earning a fairly strong income while doing what I love for a living.” This is the dream anyone wishes to achieve. It’s never about a dollar figure or retiring so you can “do nothing.” It’s all about doing what satisfies you and excites you while money is just the “gravy” that’s added on top. When I started my first online business back in 1998 it was never about the money. There was no money. Only looooooooong hours, 7 days a week for little or no pay. Why did I continue? Because it was fun and I enjoyed it and I was building something for myself as opposed to working for someone else to make them rich. Eventually, some five years later, it paid off. Keep fighting the good fight and keep inspiring us all. As you frequently say, we are all on the same team essentially doing the same things. Look forward to your next updates.

59.2%!!!! Yeahhh!!!

You are continuing to kick ass in just about every category. It’s almost as if that painful sales job was just a bad dream. You rocket engines are operating at high capacity and you are still skyrocketing to the stratosphere!

My only criticism is your cell phone bill. In this day and age of MVNOs $40/month seems kind of high, but maybe you need it for your new writing endeavors.

Keep up the good work!

That’s some great online income. If I could get even half of that per month I would be a very happy man. I’m hoping to get to around $1,000/month since I will be putting a little more time into blogging now. Your posts are inspirational.

Great job Jason! It is amazing that you are able to save over 50% of your income and no longer have a normal full time job! Although it sounds like you are doing more articles and putting more time into your blog, at least it is what you enjoy doing rather than working in a car dealership until you are 65.

Young,

Haha! Lunch it is. 🙂

I’m just in a really fortunate position right now. I love what I do and I do what I love. I hope to keep on writing even well past financial independence, discussing what life is like, how it changes, and any regrets I might have.

Appreciate the support very, very much. I hope I can keep it up. Though, even if this somehow doesn’t work I’ll never regret trying it out.

Best wishes!

Aspenhawk,

It’s tough sometimes to share everything, especially the expenses. But it definitely keeps me on track. If it’s embarrassing to write about, then it’s probably best if I don’t spend money on it. 🙂

Writing is time consuming, but it’s also incredibly rewarding. I wouldn’t have it any other way.

Thanks for stopping by!

Take care.

Keith,

It’s turned out to be a great move thus far. I didn’t expect to have this kind of traction right out of the gate, but I’m certainly glad it’s turned out like this. I don’t know if the income is always going to be this strong, but I’m definitely giving it 100% effort. If I find myself having to go back to a traditional job or something a year or two from now because some opportunities dried up it won’t be for lack of effort or passion. 🙂

I know your own retirement isn’t far away. I’m excited for you!

Best wishes.

Randall,

That’s kind of interesting, isn’t it? Though, none of my credit cards offer general 2% rewards. I get that on groceries or gas, depending on the card, but never just on general purchases. Could be a great way to save just a tad. 🙂

Thanks for sharing that. I wasn’t aware of it.

Best regards!

Dividendcashflow,

Every day is an opportunity, my friend. We all start from small beginnings. But every penny counts. Success begets success, and before you know it you’re rolling right along. Just keep at it!! 🙂

Thanks for the readership all the way from Germany.

Cheers!

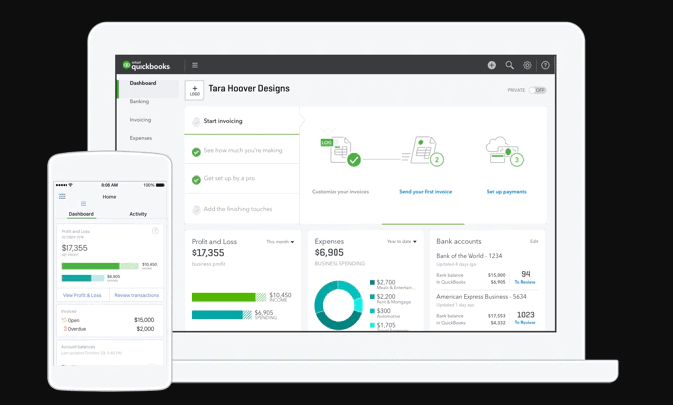

Kyith,

I use Mint.com, but I’m looking into trying out Personal Capital.

Cheers!

Financial Forager,

Thanks! It’s definitely a challenge to maintain a 50%+ savings rate year in and year out, but part of the fun is in the challenge. 🙂

I’m glad to read that you’re up to 9 stocks and accumulating more. It looks like you have a fairly healthy portfolio spread across the individual stocks, index funds, pension, and savings. Keep up the great work over there!

Best regards.

Henry,

Thank you very much for the support. Means a lot to me!

I do have to pay taxes. The amount you see above is net of quarterly estimated taxes ($233/month), but this is likely far below what I’ll probably end up owing. I didn’t plan on making this much, so I initially set up $700/quarter. I’ll very likely owe a healthy chunk of change, which will be realized in February or March when I do taxes, and that will reduce my income for that particular month by the amount I owe. That’s why you see a pretty big dip in my savings rate for this past February.

Take care!

DivHut,

You’re right about that being an understatement. I’m essentially where I always wanted to be, and where my journey was supposed to take me. I’m happy and more free than ever. Though I’m not financially independent yet, this is about as close as it gets without passive income exceeding expenses. It’s a real blessing to kind of speed up the timeline a bit and see what FI looks like without actually being there.

And we’re definitely all on the same team. We’re all after the same thing, and we’re all constantly supporting each other. It’s an awesome community that we’ve all built up over the last few years.

Thanks for stopping by!

Cheers.

Spoonman,

Got your email. Sorry about the spam filter. Not sure how you ended up there since you comment all the time. Weird. It shouldn’t happen again.

The cell phone bill is actually $25/month. I noted above that the expense was $15 more than usual because my younger sister’s boyfriend offered to give me his old iPhone 4S if I paid for a new screen. Seeing as how the phone was like $500 I figured that was worth it. And I actually have some credit on file due to a referral, so it looks like that $25 will be eliminated for the next few months. Sweet!

First weekend of freedom for you guys over there. How awesome, right? The next chapter begins…

Best wishes!

Syed,

Thanks! It’s been a long journey to get to where I’m at now. Success is definitely a combination of hard work and luck, and I’ve had my fair share of both.

I’m confident you’ll get there if you work hard. 🙂

Thanks for all the support. And I appreciate you spreading the message over on your site.

Take care!

Kipp,

I’m with you all the way. I could spend 60 hours per week at this and it would still be far more enjoyable than spending even 20 hours per week at the dealership. It’s really just passion vs. no passion. Lacking passion for something eventually makes it miserable, and then no amount of money in the world can change that.

Keep up the great work over there.

Best wishes.

Capital One Sparks and Am Ex Fidelity both are 2% cash back for all categories. You can actually make out like a bandit if you pay your taxes with a debit card because that only cost $3.95. Too complicated to explain the steps here but that’s how I do it.

Jason that looks like another great month you had. I am impressed with how much you can squeeze your budget. Many times when reading your reports you make me dreaming about my own finances and how I can squeeze them too. Great inspiration although I cannot follow your example to the bottom. I should have started when I was single with no obligations. But at least I get a boost from you.

why not take control of your income and expenses by doing envelope budgeting haha

Nothing wrong with envelope budgeting, some people really need that to get them started. I personally didn’t use as I’ve never been in that position,but I’ve helped others to use it and it has worked for them.

Nice Income/Expense report Jason!

I think now that Online income is your biggest source, it may be time to break down the category to show how much was from ads/external writing/etc.

A very solid month Jason. Well done. If that iPhone 4S is on Sprint, get it over to Ting and lower your bill even more. Assuming Sprint has decent coverage where you are. Get a $25 referral and your first month is probably free. I can’t say enough things about Ting and their service. I have an iPhone 4 but am considering making the leap to a 4S. People are ditching the 4S as the 6 approaches. When your car and student loans are gone, add $500+ to the bottom line. Or buy back $500 more of your time. Thanks for the update.

Thank you for all the details Jason. One question I had if you don’t mind me asking, is where the freelancing writing income comes from? Do you work beyond this blog and/or write different articles for publications elsewhere? I am relatively new to dividends, but really enjoy reading your posts!

I’ve got a question and wonder if you might have some input?

I’m looking for a way to get more meaningful numbers from my monthly budget tracking (fairly high level, I basically look at change in Net Worth and total invested contributions… I rarely go cash flow negative unless there’s a big purchase or trip).

Right now, I just look at those 2-3 high level figures, and it’s useful, but I’m having a tough time coming up with a savings rate.

Net income is 3,680 (cash deposited into bank), but this is after a $1,333 401k contribution plus $533 employer match. On an aftertax basis, I also contribute $530/month into a Roth.

Total investment contributions = $1,863 (2,396 with employer match)

Add net cash inflow = ~$1,100

Total savings = 3,496

Change in net worth is Total Savings +/- investment gain/loss.

The problem is that 3,496 over gross income gives me a savings of 50%, while 3,496 over aftertax income is a 95% savings rate?? (just seems odd and tough to interpret)

Any thoughts on how you might try to interpret the budget.

I know regardless it’s a good rate, but I’m just having trouble deciphering it because the 401k contributions throws the numbers off.

Ehh.. first world problems.

It’s great to see your path. Great job! I’ll keep reading you.

Hi there. I love how you give us actual numbers from your life so we can see what happens in the real world. In the last Weekend Reading post you mentioned Dividend Growth Investor showing how if you put $1,000 a month away you can get $7,200 a year in dividends after 10 years. I know it’s an example and the real numbers are subject to change. And I also realize that if you do nothing, 10 years from now, you’ll get nothing. But how can I stay motivated? I would love to get to the point where the dividends replace my income. I just can’t get the numbers to work in a decent amount of time. I’m already in my late forties which I realize is still young. I do have retirement savings but love the idea of Dividend Investing. Even if I choose 55 as a target date and try to back into It, the amount I would have to invest each month is just too large. How would you stay motivated if you were in this situation?

Congratulations on the continued success! I love reading your updates. And you forgot one extra line item:

*Spending time with family and baby niece: Priceless*

My family is back on the East Coast, so I don’t get to see them much. It’s wonderful you get to spend so much time with them.

I enjoy reading your blog because you offer insights and outlooks not often found with materialism surrounding us everywhere. Took the baby novice plunge of opening a sharebuilders account and the plan is to go long on T for quite a while!

Will you have other sources of income in retirement? 401k? SS?

Dividends don’t necessarily have to provide ALL of your retirement income. Even if they only cover half your budget, that’s a huge advantage.

Imagine that even part time work of some sort which earns you $10k per year is a “replacement” for $250,000 of investments (at a 4% withdrawal rate). Dividends, or any type of investments, don’t have to fully support your retirement by themselves.

Personally, I hope to have a nice split between dividends, fund withdrawals, real estate, and maybe a small amount of p2p as well. In an ideal world, I could even earn a few thousand dollars per year doing some sort of side activity that I (hopefully) don’t hate doing.

I haven’t decided on a split that I’d like to go for yet, but something to consider since I don’t want to be too reliant on any one source.

Where have you found $3.95 credit card processing to pay your taxes? I think I found $50, and the cost benefit just wasn’t there

Hi Ravi. Yes, I have a 401k that I’ll roll into an existing IRA and I also have a Roth IRA that I contribute to as well. And I will get SS also. But that all seems like its so far away. I would love to be financially free in my 50’s instead of waiting till 60’s or 70’s. And it’s funny because I love my job. It’s just being able to do what I want when I want instead of being at work 5 days a week that I can’t wait for.

That’s a great online income, Jason. I can only dream of that 🙂

59.2% is also superb! and many people will die for that.

Keep up the good work!

Cheers.

Wow great online income and great saving rate. Looks like you’re off to an excellent start working for yourself. 🙂

Any month with a > 50% savings rate is a GREAT month in my eyes! Your groceries bill is amazingly low, I wish I could get ours down that much. Food is more expensive here in the UK but at least we don;t have to pay for health insurance. Good job Jason, thanks for sharing.

I very much agree with you on the accountability of sharing your expenses online! Since I do the same, I find I have an extra motivation to be frugal–otherwise I’ll have to fess up! July was a pretty standard month for us, no major expenses. Thanks for sharing your budget and congrats to you on pulling down so much online income–nice!

I used Mint at first in 2012 and kept it until late 2013 after I tried out Personal capital. I found PC to be more useful for investment summarization while Mint had some neat budgeting type things (setting goals, budgets,etc).

I eventually cancelled Mint because I didn’t need the help with budgeting any more, but it’s superior for that purpose (haven’t used it since late 2013 though myself).

PC is all I use now. It categorizes things just like Mint, but doesn’t have all the budgeting and goals stuff like Mint. Depends on your needs/wants…

Ah yes, waiting until 60 can seem like an eternity.

I suppose we should all just dream big, and get as close as we can.

Better to fail an ambitious goal than to reach an easy one?

I was wrong, it’s $2.49 for using a debit card for most of the processors, $3.95 is the high point. http://www.irs.gov/uac/Pay-Taxes-by-Credit-or-Debit-Card

Martin,

It’s funny, but I actually don’t see much of a difference in controlling expenses being single or being in a relationship. Certain expenses are easier to control when being alone, and certain expenses (namely housing) are not. However, having children can certainly add a pretty significant degree of difficulty to saving money. Just really depends on your situation.

But I do hope you find inspiration here and perhaps creative ways to save a few dollars here and there. 🙂

Cheers!

xiaphas,

I could break it down month to month, but it doesn’t really change much. I broke down how I earn income online here:

https://www.dividendmantra.com/2014/06/blogging-about-blogging/

The only thing that really varies is how many freelance articles I may write in a given month, and lately I’ve been writing more than ever. I’m really blessed. 🙂

Cheers!

Wade,

I actually looked into Ting and didn’t find that it would be any cheaper for me than what I ultimately decided on (Aio Wireless). I wrote an article about that (and comparing to Ting) here:

https://www.dividendmantra.com/2014/03/aio-wireless-25-unlimited-talk-text/

Though, even if Ting were cheaper I don’t know if I’d use it because Sprint doesn’t offer very good service where I’m currently at.

And I actually just logged $125 in referrals with Aio, so I’m looking at five months of free service. Score! 🙂

Thanks for stopping by.

Best regards.

Dana,

I don’t mind the question at all.

I actually broke down how I earn an online income here:

https://www.dividendmantra.com/2014/06/blogging-about-blogging/

I’m writing more freelance articles now than I was when I wrote that post, but all of the information is still relevant. 🙂

I hope that helps!

And thank you so much for the readership. The world of dividends is exciting, and I’m sure you’ll find a lot of success with this!

Best wishes.

Ravi,

I didn’t see where you listed your total expenses there. What I would do is take my net income ($3,680) and add in the $1,333 you’re contributing to your 401(k). That’s because that’s income you’d otherwise have, though the net would be slightly less. But you’re taking advantage of the tax savings now, which is the whole point of it. So you have $5,013 in income. Subtract your expenses. What’s left is your savings. You take that and divide it by your $5,013 and that’s your savings rate.

I think you’re complicating the matter by adding in net worth change and everything else. Your change in net worth has nothing to do with your actual savings rate.

I hope that helps.

Best wishes!

trader,

Thank you so much! Appreciate the support and readership very much. Hope all is well across the pond. 🙂

Take care!

SR,

Well, only you can motivate yourself. All the external factors in the world do not matter if you don’t truly want change for yourself.

I’ve always found it incredibly easy to stay motivated to do something if it’s something I really want. Now, things that I don’t want (like working at a car dealership) are hard to stay motivated about. But if you want a life where your time is your own and you have complete freedom to do whatever you want then I think you’ll find motivation the easy part. The hard part is the money, and generating enough capital to continuously build up a sizable snowball for yourself in time to meet your goals.

Keep in mind that 55 is still extremely early to retire. If there’s anything I’ve been realizing lately it’s that many people are working well into their 60s and beyond because they lack sufficient savings to retire off of. 55 would still put you in rarefied company. 🙂

All you can do is your best, but if you’re doing nothing then you’ll get nothing. Maybe you don’t get to where you need to be because you’re starting a little late, but even getting there at 57 or 58 years old would be a great spot to be in. And I think you’ll be surprised by the progress once you actually get cranking away. I would hope that if my story says anything, it’s that dramatic change can indeed occur over just a few years time, even without tons of money.

Best of luck!

Cheers.

Phil,

That’s absolutely correct. My family can be pretty crazy at times, but family is family. And it’s good to spend time with them. 🙂

Sorry you don’t get to spend as much time as you’d like with your own family, but life can change pretty quickly. You never know where things will be a year or two from now, so hopefully your life path puts you in a position where you get to see loved ones more often.

Best regards.

marian,

Nice job there! A $1 million portfolio starts with a dollar, my friend. 🙂

Stay in touch.

Best wishes.

SR,

If you have those kinds of assets (and SS) waiting for you, then you really just need enough income to last you until you start to draw down those assets and collect SS income. So you would need enough to last you 5-10 years, which is a lot easier than some who need enough to potentially last them the rest of their life.

I can’t imagine you couldn’t come up with a pretty creative solution there. 🙂

Best wishes.

PIM,

Thank you so much. I think the rest of the year will be much more difficult, but I’m giving it my all. One month at a time, right? 🙂

Appreciate you stopping by. Hope all is well with your journey.

Take care!

Tawcan,

Thanks! It was a really successful month all the way around. I don’t think I could wish for anything more. 🙂

Appreciate the support. And great article on Google Drive!

Take care.

ERG,

I agree. 50% is kind of the barometer I use for real savings. Saving 30-40% is impressive, but 50% is where I really need to be to get to where I want to go. And I think that’s kind of the threshold for “extreme” savers.

My grocery bill is low, but I’m eating out more than I should be. Part of that is eating out with family, which is really more for the experience. I kind of knew that was going to happen when I moved back, and I’m okay with it.

Free health insurance would be the jam. I wish I had that, but I also know my tax rate would probably be higher. Pros and cons to everything.

Thanks for stopping by!

Cheers.

Mrs. Frugalwoods,

Thanks for stopping by!

I agree with you on sharing expenses with the world. If I’m embarrassed to write about it, then there’s a good chance I shouldn’t be buying it. 🙂

I’ll have to check out your budget. Always love seeing other people’s budgets for a little perspective, and perhaps a lesson on how to save a couple bucks.

Best regards.

Ravi,

Thanks for sharing that. I’ll have to check out PC. I like Mint, but it seems like it’s more glitchy than it used to be. I wonder if it’s being abandoned.

Cheers!

DM,

I have been following your blog for a while and not doubt I enjoy it. This post is kinda of special after you posted the $50 rent increase and taking family members out to eat. Seeking finiancal freedom and early retirement are also my long term goal, but this goal could only make to the third on my priority list. My God and my family are the top two. I found that life is more enjoyable this way.

Keep up the good work.

Good point. I’ll try that!

Looks like it was a pretty good month financially for you! My month was pretty good, my stocks continued to go up in value and I decided I will be raising the rent on my rental property, so the extra $50 per month will help in the long run

Jason!

Keep doing what your doing, it seems to be working very well for you. Your online income is very impressive, and being able to quit your job, well lets just say i’m admiring pretty hard. I can’t wait to have a “snowball” big enough to have me say to my employer that i’m “ready to move on to bigger things”. I bet you didn’t expect this type of fortune back when you were 28 years old eh? Keep sharing the dream bud, your story continues to inspire me!

Ace

Dude,

Your blog doesn’t need another comment, but here I am leaving one. Congrats bud. You are an inspiring guy to many, including me. You are one of those people who are KICKING IT. Nothing else needed to say.

I’ll be calling tomorrow. Looking forward to catching up.

Kraig

Hi Jason

Great to see that even though you have escaped wage slavery, you are still able to save such a high proportion of your income.

I will have to get my act together and write lots more posts to increase my audience and increase my online income (currently pretty abysmal, but this is not the main reason I write online), then maybe I can achieve my own freedom earlier than with just dividend income!

I hope you continue to be able to enjoy being independent and also to be able to continue to save such a large amount, which will also increase your dividend income to the point where writing is purely a hobby.

Best Wishes

What exactly is “freelance” writing? Do the articles get published under your name or does some website claim the work? IE: Curious why you never post links to your other articles.

On average, how many times do you get contact with sponsored opportunities?

Thanks. Yea, I remember that page when I was looking into it, debit card vs. writing a check is the same…I was hoping to reap CC rewards 🙂

paul,

Thank you for the kind words.

It’s a shame that people get wrapped up in money. I believe money is simply a tool. You can use it to buy things, have more time, go places, etc. But I think sometimes people let money get to their heads and cloud their mind. Which is a shame.

Sounds like you have your priorities straight. 🙂

Cheers!

Danm

Nice! Sounds like you’re using inflation, rather than letting it use you. 🙂

Great job. Enjoy the extra cash flow!

Best regards.

Dividend Digger,

Man, it’s been a crazy and wonderful ride. I definitely didn’t expect all of this when I first started out. I mean I knew that I was on a path that would lead to me terminating my job within the next decade, but I didn’t anticipate it happening this fast or in this way. Of course, I’m extremely grateful for it! 🙂

Appreciate the kind words very much. Glad you find some inspiration here. Inspiring others is my main purpose.

Best wishes.

Kraig,

Thanks, bud. I’m proud of you and what you’re doing as well. It’s hard to blaze new trails and go off on your own, but it’s also incredibly rewarding.

Looking forward to a chat!

Best regards.

Outstanding savings as usual DM. Mine was not so good for July but with a family of 6 my expenses are a bit more. Took a vacation which did hurt my wallet allot but the family had lots of fun and memories that will last.

FI UK,

Thanks! I’m definitely trying super hard to keep things relatively the same as they were when I was working at the car dealership. It’s all just on a smaller scale now, which is okay. It’s a slower path, but a more enjoyable one.

I hope you can also find a similar path for yourself! Just keep at it. Hard work goes a long way, I promise. 🙂

Best regards.

Zol,

I do link to my other articles. My last ‘Weekend Reading’ article linked to four articles I wrote, which I explained. Check it out.

Cheers!

aaron3719,

Hmm, hard to say. I would say 1-2 times weekly on average. It varies, though. Sometimes I’ll get three in a row, then I won’t hear anything for a week.

Cheers!

DFG,

I can imagine it’s a lot more difficult for you. Hell, I’d have a hard time just keeping up with tracking all of the expenses with a family that large. 🙂

But keep at it. The dream of financial independence is possible for all of us. And having fun along the way is extremely important.

Cheers!

Ha! Of course that is usually the one post i skip of yours (since i end up following alot of the same blogs already). Doh! Thanks.

Just checked it out. Obviously you upped your game on these weekend reading articles from the last time i followed them. Now you just added a boatload of reading material to my evening =P

Great job on the online income, especially with the bulk of it coming from your writing, which is a testament to the quality of your material.

It’s great seeing good things happen to good people, keep living the dream!

Outstanding!

Good job above 50% saving rate. Basically a you cant lose investing model.

I like the idea of u raising your own rent rate.Fair is fair and shows u have a heart to make your own proactive choice to pay more instead of possible building up resentment. It shows your character in the type of guy u r. Sometimes the smallest gestures make the biggest impact I find.

Good day and grind on!

Sundeep,

Thank you so much. Incredibly kind of you to say that.

I take writing very seriously. And it’s a dream come true to write and inspire people.

I hope to be able to keep it up forever, but no matter what happens I will have lived out a dream.

Hope all is well with your journey!!

Best wishes.

Jason,

Thanks, bud! Hope all is well down in Florida. 🙂

Cheers.

A-G,

Thanks! Saving above 50% puts you on a great path. It’s tough to lose when you’re saving that much of your income, either through low expenses, high income, or both.

I’m glad you found the sentiment thoughtful. I’m truly up here to spend time with family and help out when possible, so I’m just trying to make good on that.

Keep up the grinding over there. 🙂

Cheers.

Great job. Glad your new career is off to a great start. Do you plan to add taxes as an expense given your self-employment and budget accordingly?

Kent,

Thank you so much for the support. I really appreciate it. I’m truly living a dream come true right now.

I do include taxes in these, but I reduce the gross income accordingly. Much like a paycheck, the taxes are taken out and you’re left with “net” income. What you see here is net of my quarterly estimated taxes. Any tax I owe above and beyond that will be reflected when I do my taxes in Feb/March.

Cheers!

Thanks….I missed the net income reference.

Way to go Jason! You’re doing awesome with that online income. You are very humble but I for one knew you would continue to do well. Glad to see your decision to leave your day job has proved to be the right one. Always enjoy reading your post…Wishing continued success! AFFJ

AFFJ,

Thanks so much for the ongoing support and encouragement. Very much appreciated. 🙂

I’m really lucky so far. I worked incredibly hard at all of this for years, but I wouldn’t be where I’m at without the support of readers like yourself.

I hope all is well over there with your family’s journey!

Cheers.

Wow a saving rate from 59.2% that is great. Mine is only around 40%. Keep on pushing the snowball.

Cheers,

G

Wow! I can’t believe that you are able to make $3,000+ per month, while, “doing what you love.” That is so impressive.

I just started a blog this month that I am using to write about my dividend investing pursuits. I hope that someday I can generate even a tenth amount of the traffic that you must get!

Well done!

Cheers!

Geblin,

Thank you! I’m incredibly fortunate to keep expenses low during this transition. And I’m still shocked that I’m actually making a living writing. I’m living a dream come true. 🙂

A 40% savings rate is very, very healthy. And that’s not much lower than what I’ve been able to achieve so far this year. It’s quite likely that I’ll finish near that mark for the full year, as I anticipate some expensive months ahead with the holidays coming up. But I’d still be happy with a 40% savings rate considering all the changes I’ve made.

Keep up the great work!

Take care.

DivGrow,

Really appreciate the support. I’m incredibly lucky to be able to write and do this well thus far. I believe success is where hard work and luck intersect, but the more of both you can possibly have, the better!

Best of luck with your blog. I’m quite confident that if you stay consistent, work hard, and believe in yourself you’ll see success with it. 🙂

Thanks for stopping by!

Best regards.

Hey DM,

Congratulations!

It’s a landmark month of no ‘official’ wage. Kudos to you for taking the leap of faith. It’s reassuring to see someone taking that step and making such a success of it. I was not expecting you to save such a high % without a corporate job. Well done my friend!

Perhaps the biggest success is your happiness in everyday life. As long as you’re managing to save something, it shouldn’t matter too much, as long as you’re happy.

Keep up the good work!

All the best

Huw

Hi Jason,

Firstly my congrats to the level you have reached! I’m a Canadian kindred spirit, and have recently discovered your site and our “community”. I will be setting up my own blog-page soon (so stay tuned folks).

I have a question regarding your expense-income calculations (maybe I’ve missed this in your website)…but do you take into account an amount for income tax payable (on the income derived from your income – online and dividends etc.) to the IRS? In my own cross-over point modeling I have included “income tax owed” as a variable living expense.

I look forward to your thoughts!

The Dividend Madman

(my accountant thinks I’m nuts for a few reasons – a story for another day!) lol

Huw,

Thanks for the kind words. Appreciate the support!

The need to keep saving and investing isn’t quite as apparent, but I still want to get to FI by 40. It’s going to be a bit more of an uphill battle now with less income, but I’m looking forward to taking on the challenge. And I’ll definitely be enjoying the road there a lot more now. 🙂

Keep up the great work over there. Looks like you’re staying very consistent with everything across the board. That’s what is necessary to get there. Great job!!

Cheers.

Dividend Madman,

That’s a great question there. I’ve addressed it in the past, but I don’t think I’ve ever devoted a whole post to it.

I do include taxes in these reports, as I referenced in some earlier comments. But I don’t include taxes as an expense because they’re not. They’re a reduction of gross income, which will “net” out your income. I’m paying $700 in quarterly estimated taxes, which probably isn’t nearly enough now with all the changes going on. But that $233.33 per month comes out of gross, so the amount of income you see above is net after the reduction. Any taxes I owe above and beyond what I’ve already paid for the year will further reduce gross income when taxes are done – typically February or March. That’s why you see a pretty big dip in my savings rate for February this past year.

I reference net income in the posts, because this is all after-tax income.

Best of luck with the blog! Always good to have another join the community. 🙂

Best wishes.

Impressive and inspiring! Does the brother in law know about the site? Have you inspired their family?

Evan,

Thank you! I appreciate it! 🙂

It was a good month. I’m really fortunate to be in this position right now. I’m just trying to keep the train chugging.

Cheers!