Dividends Are My Fruit

As someone who is trying to become financially independent by 40 years old, it’s extremely imperative that I build a passive income stream that will exceed my expenses and also outpace inflation. This requirement is what led me to invest in dividend growth stocks. Dividend growth stocks typically have a long track record of paying increasing dividends. I realized that dividends can be a fantastic passive income source. One thing not mentioned often is how easy they are to receive. They’re deposited automatically in my brokerage account. I don’t have to go to some office and turn in a voucher or call up some 1-800 number. And by investing in companies that have long track records of raising dividends, I can be assured that my income will only go up over time.

There are many ways to extract income from a stock portfolio. One of the most common ways is to perform a controlled sell-off of assets in order to meet expenses and maintain a certain lifestyle. This would usually involve building up a large portfolio over your working years and then drawing down income from the portfolio by selling off stock once you’re retired. You would determine a safe withdrawal rate, based on your expenses and asset base, and then start to slowly bleed your portfolio dry. Usually this selling would only increase in percentage terms over time as your expenses rise and as the asset base dwindles. So effectively, as you age and your expenses keep increasing, you are slowly running out of assets with which to meet these obligations. This makes no sense to me, and I’ll discuss why.

I prefer a different approach.

As a dividend growth investor, I plan not to sell any of my stocks in retirement and instead live solely off dividend income. By living off only dividend income, my asset base will stay in place and (hopefully) increase in value over time as the underlying companies paying me dividends become more and more valuable. If they’re paying me increasing dividends, these raises usually come from increased earnings and revenue. If the dividends are not supported by such, then I would have to find different companies to invest in as the dividend would become unsustainable over time.

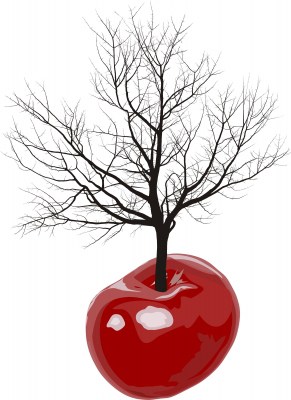

I view my portfolio as one large tree. It’s a tree that produces bountiful fruit. Let’s imagine it as a cherry tree. Each branch is a stock position. I currently have 28 positions in my Freedom Fund, so I have 28 branches on my cherry tree. Each branch produces cherries (dividends) at varying frequencies. Most branches produce fruit every quarter, while some give fruit semi-annually. When fruit is produced, I can take that fruit and use it to expand my garden or I can provide subsistence for myself (pay bills). Right now I’m expanding my garden, but one day I’ll use those cherries and live off of them.

Now, let’s compare this to the earlier example of using a safe withdrawal rate and selling off the portfolio slowly. Effectively what you would be doing by selling off your stocks is you would be chopping off little bits of each branches whenever you need cherries. Instead of simply plucking the cherries from the branch and waiting until another cherry appears, you’d be chopping off a section of the branch and taking the cherry and branch with you. But, over time that branch dies. And when it dies and disappears you will no longer produce cherries from that section of the tree any more. So, what do you do? You move on to another branch and repeat the process all over again. The problem is that the tree only has so many branches and eventually you are left with a barren tree that produces nothing.

I have always looked at my portfolio in such a way. Each position produces bountiful dividends for me. I would never want to reduce or sell off these positions for income, because once they’re gone the dividends no longer show up in my brokerage account and I have to repeat the selling process even more rapidly in the future to get the same results. With a proper dividend growth strategy, your cherry tree will only get bigger and stronger over time. It will eventually produce more cherries than you could ever possibly use! That’s the position I want to eventually find myself in. I’m no gardener, but I think I’d be perfectly happy with such overgrowth!

How about you? Are dividends your fruit?

Thanks for reading.

Photo Credit: FreeDigitalPhotos.net

Your post made me think of The Giving Tree. If that book makes you sad (as well it should), then you shouldn’t treat your portfolio like the Giving Tree! Build up the principal in your younger years so you never have to cut off branches later on!

Hi DM,

Glad you are back to blogging. I’ve been a long-time reader and missed your thoughtful posts.

You may have already written about this before, but I can’t remember. Are you investing in any international dividend stocks or just US? Using the fruit analogy, it would be a shame to grow an orchard of one type of fruit that was susceptible to disease (devalued dollar).

Keep up the good work!

Good to have you back blogging!

It could be a good idea to take a look of European Dividend Aristocrats because the decreased prices of European stocks. S&P have made a list of European companies that have raised their dividends at least 10 years in a row…

Well said, sir. Seriously – it is great to see you’re back. It has made my week. And now my girlfriend is giving me endless crap about it, haha.

I use stories like this to explain to friends what I’m doing with my investments. I have told so many “adults” (I’m 24) that I think it’s really dumb to sock your money away in mutual funds yielding about 1% with a .7% expense ratio for 30 years and then just plan on liquidating it when you need money. I try to explain to people that with a dividend growth investing model, in 30 years, I’ll never need (hopefully) to liquidate ANY capital.

The best question is always (when speaking with someone about the mutual fund/liquidation model): “What do you do if you need to liquidate and withdraw in a 2009-level market collapse?” Usually it’s just blank stares. Exactly, I always think to myself.

I’ve been fortunate enough to see my father become successful as a true self-made man from VERY humble origins. I’ve been lucky that he’s imparted a few things on me, one of the foremost being always live within your means and make your money work for you. He’s had dividend stocks for 20 years now, and has been through many market gyrations. Kind of illustrates for me that dividend stocks (good ones) just keep raising their payouts to regardless of the general market turmoil.

Gen Y,

I have never read the book. It appears, based on your comment, that people take and take until there is nothing left. Unfortunate.

I agree. You have to build the principle up while you’re young and when the power of compounding interest is on your side.

Best wishes!

Fi Geek,

Thanks for the support. I’m really glad you enjoy the site. It all comes from the heart. It feels great to be back after a long break. I definitely missed all the great conversations that happen here!

I do invest internationally and am always open to such. I currently have positions with Total S.A. (TOT) and Vodafone Group Plc (VOD). TOT is an energy major based out of France and Vodafone is one of the world’s largest mobile communications companies.

Take care!

Warren Graham,

Thanks! It’s great to be back.

That’s a very cool resource there. I don’t believe I’ve ever run across it before. It can sometimes be difficult to invest in international companies that don’t have ADR shares that trade on American indexes, and even ADR’s come with additional risks and fees. But, I still believe (and practice) international diversification.

Thanks for stopping by!

Take care.

Taylor,

Thanks for the support. It’s very much appreciated! I’m sorry to hear that my blog is causing issues with the girlfriend. Maybe she’d like reading it too! 🙂

Great to see you investing and taking an active approach in your finances at such a young age. I started at 28, which is still early…but man I wish I would have started at 24. I’d be that much further ahead right now. Great job!

I agree with everything you’re saying. Selling off one’s portfolio, even if it’s controlled and a computer model says it’s okay, makes no sense to me. Why sell off assets you worked so hard to attain in the first place? Especially when they can continue to produce bountiful fruit for the rest of your life?

Great jump-start on your finances at so young. Keep up the great work!

Best wishes.

Great post Mantra – very well written! That’s why they call it a “Dividend Tree” 🙂

Keep up the good work,

Cheers

The Dividend Ninja

I might also add, that if we have another 2008-2009 financial style crisis, or whatever, drawing down a collapsed equity portfolio would even be worse. You would be drawing down another 4% off a 30% or 50% decline. You’d even be pruning the branches further back! That’s why I sold my index funds in March. 😉

With dividend income (and bonds for that matter) you know your monthly revenue to the penny, without having to draw down any capital – assuming there are no dividend cuts or dividend freezes etc.

Cheers

The Dividend Ninja

Ninja,

Thanks for stopping by!

I concur completely. That’s one of the main problems with drawing down a portfolio and selling off assets. The price you will receive for your assets is constantly in limbo, and at the will of the market. Unfortunately, your bills only go up. Meanwhile, an approach using dividends and fixed income gives you a certain uniformity and predictability of your income which is more in line with real-life expenses.

Thanks for adding that.

Best wishes!

What a nice surprise to find a post! I check blogs that have announced they are no longer active every once in a while, usually to no avail…so this is a lovely little surprise!

Have you given any thought to what you will do with your tree in the end? Will you pass it along to a descendant with instructions to keep using only the fruit? Will you donate it? Or will you feel comfortable cutting down your branches in your old age? Just curious, if you’re willing to share.

Warren/DM,

Do you guys know if the ADRs follow the same distribution of dividend income as the underlying stock? It is possible the ADR just buys additional shares? no

Thanks for posting, DM. I also like to invest in dividend stocks, but here is a question. What is the target for the base of total stock that you can live off by the dividend? The dividend yield is only about 3%, when is that going to be enough to live by?

Evan,

Thanks for stopping by and commenting.

ADR’s mimic the underlying stock on its domestic in many ways. But they are not always a 1:1 ratio. For instance, Vodafone (VOD) ADR shares represent 10 ordinary shares of VOD.

Dividends are handled much the same way, in a way that mimics the underlying stock. I’m not sure about the last part of your question about buying additional shares? Do you mean stock dividends? If so, I’m unaware of any major ADR shares that pay stock dividend but that does not mean they’re not out there. I’m just unfamiliar with any.

One thing to consider with ADR shares is any withholding tax (based on the home country of the underlying business) and also possible additional fees. Every ADR that I’m aware of carries a very small fee charged by the transfer banks that facilitate the ADR shares. Those get passed on to you as the shareholder of ADR shares.

Hope that helps.

Best wishes!

Dee,

Thanks for sticking with me and checking the site. I remember you commenting before. Glad you’re back!

I haven’t much thought about terminal goals. I mean, we’re all dying…but I don’t think about it on a day-to-day basis in regards to the portfolio. I imagine it will be very helpful if I get sick and have high health care costs if I need daily assistance or need major medical care. I certainly wouldn’t want to be in that situation, but I suppose having some wealth makes it all a little smoother.

I’ll likely put pen to paper as far as who will take over any assets once I’m a little older.

Great question! Not something I’ve given much thought to, but probably should.

Best wishes!

Anonymous,

Great question.

I don’t really have much concern for total portfolio value in regards to when I’ll feel financially independent. I look at the passive income and cash that my investments produce. Speaking in regards to strict portfolio value (to address your question more succinctly):

I think once I get to the $300k mark I can seriously start considering stepping back from full-time work. At that point I’ll be covering the vast majority of my expenses passively and could probably move to very light part-time work until I get all the way there. $400k should be enough for me to live on perpetually. At that point I would consider myself completely financially independent. These are approximations in my mind right now and may change as time goes on. Again, it really comes down to passive income and whether or not it exceeds expenses.

Best wishes.

Stock Elf,

Thanks!

I have noticed fees with TOT and VOD. I checked on them a while back…I believe it’s $0.01 per ADR share taken off the dividend. It’s small, but does have to be taken into account when considering ADR shares as an investment.

Best wishes!

DM,

Welcome back!

Thanks for pointing out the ADR fees. I noticed a few small fees with my ADR dividends last month and decided to add a small amount of cash to my accounts to ensure the maximum amount was being reinvested. It seems minuscule but I’m hoping it will add up over the long run.

Have you noticed similar fees on TOT and VOD?