Getting Started: What Are Income Stocks and What Do I Need to Know?

No products found.

Investing in stocks is an excellent way to gain income through both interest and company payouts, but you have to know what you’re doing. Diving into the stock market headfirst is often a great way to lose everything.

One area that more conservative investors tend to place their money in is income stocks. What differentiates these from others you could choose from, and how much money could you stand to make from your investment? Here’s the nitty-gritty on the income investing, and how to pick out companies worth your while.

Key Terms to Understand

If you’re new to the world of trading stocks, then there are a few terms you will need to know in order to better understand income stocks. Here’s a quick vocabulary lesson for the stock market.

Volatility – This refers to how rapidly a stock’s price fluctuates. Low volatility means that prices do not change quickly, raising or lowering by a small amount. High volatility means that a stock could go from five dollars to a thousand overnight, but then plummet down to forty-four cents in an hour.

Dividends – This term is used to describe payments made by a company to their shareholders. Cash dividends are often paid out each quarter or annually.

Yield – This is merely the income return on your investment in interest or dividends.

Dividend Yield – This is a ratio indicating how much a company pays its shareholders each year compared to its share price. It is represented as a percentage, with higher numbers indicating larger payouts.

Capital Investment – These are funds invested in a company that allows them to further their operations or purchase assets such as machinery and equipment.

What Is an Income Stock?

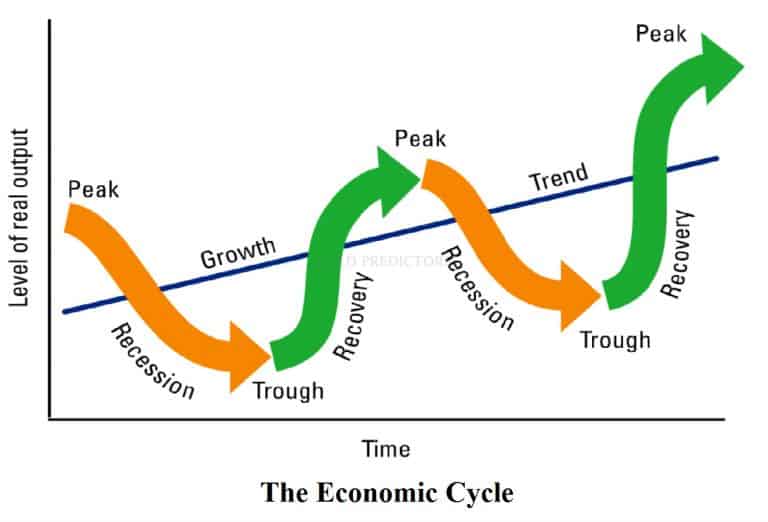

Income stocks are equity securities that pay regular dividends. Often, these dividends steadily increase to offer a higher than market yield, generating the majority of all your returns. The majority of these stocks have low levels of volatility when compared to the rest of the stock market as well.

They may have limited future growth options, which equates to a lower level of ongoing capital investment. This also allows companies to take their excess cash flow from profits and direct them back to investors on a more regular basis.

While you can find income stocks in any industry, the majority are located within the real estate market in the form of REITs (real estate investment trusts). You will also find them in energy sectors, utilities, natural resources, and financial institutions such as banks.

An ideal income stock has:

- Very low volatility

- A dividend yield higher than prevailing 10-year treasury bond rates

- A modest level of annual profit growth

- A history of increasing dividends on a regular basis to keep up with inflation

Why Choose An Income Stock?

Based on the higher dividend yield, investors have the opportunity to make a yearly profit off of these stocks. They are similar in nature to fixed-income securities, such as bonds and CDs, but come with the chance of a higher return on investment. Ideally, the goal is to create a steady income stream through dividends.

To make a profit off of income stocks, you have to identify companies that are worth the initial investment. That can be a tricky endeavor, but there are certain aspects to keep an eye out for.

Getting Paid

Not every company pays a dividend with their excess cash flow. To build a portfolio of income stocks, the companies you choose have to make cash or stock payments back to you during the year. Companies who earn a profit during a fiscal year can choose to:

- Reinvest the money into themselves for expansion, debt reduction, or share purchases

- Pay a portion of the profits to shareholders

- Reinvest a portion and pay out the rest

New companies in quickly expanding industries are less likely to pay you a part of their yearly profits because they need the money to keep growing. They might use the funds to purchase more assets or begin work on a new project instead.

Mature companies may not pay out dividends either. Many choose to repurchase share prices in order to acquire another company or feel that reinvesting into the company provides a long-term benefit to investors.

You are more likely to find adequate dividends being paid out by older, established companies that have already reached their maximum potential for growth. These companies will more than likely use funds to keep their assets up to date, which leaves a lot of room to give back to their shareholders and make their investment worthwhile.

Dividend Dollars

At first glance, you might think that a higher payout is the perfect type of stock to buy. However, smart investing requires you to look at the dividend yield. You can calculate this percentage by taking the previous year’s dividend and dividing it by the current stock price.

Dividend Yield = Annual Dividends Per Share/Price Per Share

To make things easier, you can use a unique calculator to help determine what the percentage is. The higher the rate, the more money you stand to make annually.

For example, imagine that a stock is trading at $10 per share with an annual dividend of $1 for each share held. That makes the yield 10%. Increase the price to $20, and the yield decreases to 5%, while a stock price of $5 would make the yield 20%.

That’s just an example made easy for calculation purposes. You will usually find dividend yields ranging between two and five percent. If a company has steadily paid out 4% over the past ten to twenty years, then you can make a safe bet that they will continue to do so. That’s what you want to look for when purchasing income stocks.

Choosing the Company

Just because a company has high dividend yields does not necessarily mean they make a good investment choice. Some companies offer higher dividends to attract investors, then end up sinking because those funds should have been reinvested.

Your stock is only worth something if the company is sustainable. Take a close look at the company before making a final decision, ensuring that they have a solid business model and a proven track record of success.

There is, unfortunately, no way to determine which companies are better than others outside of prior performance statistics. You will have to use your best judgment in deciding which companies will stand the test of time, offering the best return on your investment.

You can find dozens of companies that have both paid out high dividend yields and grown exponentially over the years. Johnson & Johnson, for instance, saw its investments appreciate over 200 times in 20 years. Start by using a stock screener to find higher yields, then analyze the company to the best of your ability.

Assessing Risks

No matter which companies you choose, high dividend yields or not, there is always a risk assumed when investing funds. Stable, long-standing companies are an excellent option if you are looking to minimize your risks, but there are never any guarantees within the stock market.

Just like any equity security, the liability may outweigh the value of the assets. Minimizing risks can be tricky, which is why starting with companies that have a tried and true business model is recommended.

Don’t Forget About Uncle Sam

When April rolls around, you might be wondering how income stocks will affect your taxes. Any payments received through dividends are taxed at the same rate as your wages, essentially adding to your gross income for the year. This remains true on the national, state, and county level in most cases.

Since these payments are taxed at a higher rate than capital gains, your overall return will be reduced. Income stocks can still produce a steady stream of income, but remember that it is an income. Save yourself a headache in April and set aside a portion of your payments for your taxes each year.

Compared to other stocks, income options tend to pay more steadily. Even with the taxes you’ll owe, you still stand to make a higher return so long as the dividend yield is in the mid to upper percentage range. That’s not to say that you couldn’t get lucky with a standard stock purchase, but there’s less of a gamble involved with income stocks.

A Second Income

Income stocks offer the ability to increase your yearly earnings through essentially a second income. With a higher return on investment than bonds and CDs, you stand to make a pretty penny when investing wisely.

Remember to do the math on dividends, thoroughly research the company, and assess your risks before making any final decisions. Play your cards right, and you just might be on your way to an early retirement. Again, don’t forget about taxes!

No products found.

Last update on 2024-05-02 at 14:08 / Affiliate links / Images from Amazon Product Advertising API