Income/Expenses For July 2015

First, I want to prove to the world that it’s possible to become financially independent at a relatively young age even if you don’t make a lot of money. I don’t make a six-figure income. I never have and I probably never will. But it’s not necessary. Oftentimes, people focus on income too much. Expenses are just as important, because if you make $200,000 per year, but spend $190,000 of it, you’ll never become financially independent. Conversely, bringing home $40,000, and learning to get by on half of it means you’ll likely be able to retire if you want to within 15 years or so. Making less means you have less potential income to save, but spending less means you need less passive income with which to retire off of.

The second reason I do this is because I want this to be a live look at one man’s journey. You can find countless books by financially successful people, but often it’s long after they’ve completed their trek to significant wealth that they’re then telling you how they did it. It’s easy to postulate. It’s much more difficult to actually show the whole process in action, for better or worse.

And finally, knowing that every dollar I spend is going to be published for the world to see serves as reinforcement to stay frugal. There’s been more than one occasion where I decided against a particular expense after realizing I might be a bit embarrassed to write about it.

So each month I will post my income and expenses for the previous month. I track every dollar in and out, so what you see is exactly what I earned and spent (rounded to the nearest dollar).

By the way, I use Mint and Personal Capital to track all of my income and expenses. Both are awesome (and free) services.

| Income From July 2015: | |

| Online Income | $7,607 |

| Other Income | $600 |

| Dividend Income | $411 |

| Total Income | $8,616 |

| Expenses From July 2015: | |

| Rent & Utilities | $537 |

| Health Insurance | $311 |

| Student Loans | $224 |

| Groceries | $174 |

| Hosting | $157 |

| Fast Food/Takeout/Coffee | $137 |

| Restaurants | $126 |

| Pharmacy | $60 |

| Cable/Internet | $27 |

| Mobile Phone | $25 |

| Transportation | $17 |

| Gifts | $12 |

| Amusement | $12 |

| Everything Else* | $90 |

| Total Expenses | $1,902 |

Income

This is by far my most impressive report for income… ever. I truly can’t believe that it’s come about one year after quitting my full-time job. I never would have thought I’d be able to report higher income after no longer pulling down the crazy long workweeks that saw me down at the car dealership for most of my waking hours. Yet here I am.

A number of events coalesced at just the right time in order for the online income to come in so high. I received royalties for book sales recorded in May, which was the first full month it was available. So that certainly helped my case, bringing in approximately $1,100. Affiliate income was among the highest I’ve ever recorded. And strong traffic here at the site – 365,000 pageviews for July – led to fairly high advertising income. Of course, I also remain incredibly busy on the freelance front. But I couldn’t do any of it without you readers, so thank you all for your continued support.

Dividend income was once again incredible. Collecting more than $400 for what amounts to the me of months or years ago putting in a little research and making good decisions with capital puts the me of today in a pretty great spot. I was able to cover almost 1/4 of my personal expenses, and that was during a month where neither dividend income was particularly high nor were expenses particularly low. Good things lie ahead here.

Other income was mostly related to the sale of my car. I’m going to spread the profit out over the course of the year so as to smooth any month-to-month variances out. So this will provide a nice boost to my monthly savings rates for the rest of the year, just like it was a drag on my monthly budgets last year.

Expenses

*The everything else category includes expenses I don’t have a regular budget for. I spent $40 on a dental exam. I was advised in late 2013 that I had a few fillings that would probably require attention at some point in the near future. Well, the near future has arrived. I found a coupon for a dentist that’s within walking distance. Had a full inspection performed with multiple X-rays. Looks like I have four upper teeth that will have to be taken care of. I also spent $50 on a yearly subscription for a VPN service. I find this necessary now that I’m writing more away from home.

I spent a lot more on health insurance than usual this month. That’s due to signing up for a discount dental plan. I spent $118 on that plan, which gives me 15 months of coverage. The return on investment is great. I have four cavities which require fillings, with some teeth featuring multiple surfaces that need to be taken care of. The dentist quoted me almost $2,000 for the work. With the plan, it was knocked down to about $750. I’ll then have another year or so of coverage in case something else pops up. August’s budget will feature this dental work, unfortunately.

Otherwise, most other expenses were more or less in line. I continue to spend more than I ever thought I would on coffee, but it’s become a situation where I almost need to write at the local coffee shop rather than at home. I’m so much more productive than ever before, which is manifesting itself in the form of up higher online income. So I don’t regret the extra spending one bit.

Savings

I managed to save 77.9% of my net income this month. I’m absolutely thrilled with that result. This is the 15th time I’ve saved more than 70% of my net income in any one month. A great milestone in and of itself, but this is also the highest monthly savings rate I’ve ever recorded. It took some killer income to get there, no doubt. But I still managed to keep the expenses mostly in check, choosing not to inflate my lifestyle. Personal expenses of around $1,750 is a pretty solid number for me right now. The quality of life is really high and I don’t feel like I’m sacrificing anything at all. Meanwhile, that still allows for me to hit my savings goals.

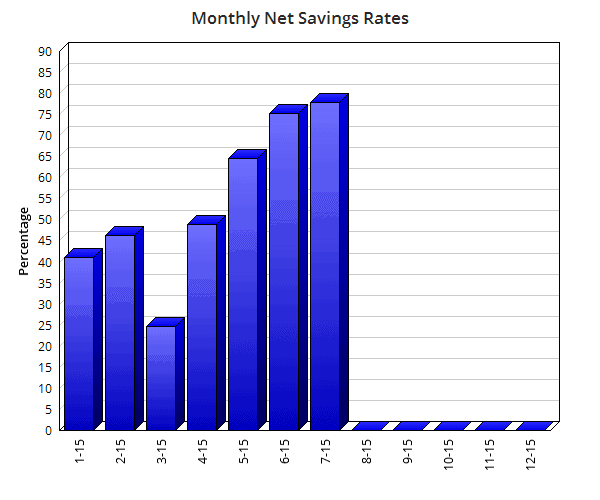

One of my goals this year is to save 50% of my net income throughout 2015, averaged monthly. So far, I’ve hit rates of:

I’m now at an average savings rate of 54.1% for the year. That’s a great savings rate, in my view. Gives me a nice margin of safety heading into the end of summer.

I can already see that August’s income will be significantly lower than that which I recorded in July. In fact, I have a sneaking suspicion that it’ll be a very long while, if ever, before I reach this level of income again. But that’s okay. Feels great to hit it even just once. And I’m in the fortunate position where it’s not necessary for me to earn some crazy level of income to hit my long-term goals. Of course, I’ll never shy away from any opportunities to boost that income as much as possible now that I’ve got the expenses mostly on lockdown. But I don’t need to earn significant income to get where I’m going. And that feels great. Either way, I’ll just continue to work hard and climb the mountain of freedom with just as much enthusiasm and excitement as I’ve ever had.

Did you have a great month of savings for July? Anything unexpected? On pace for your goal this year?

Thanks for reading.

Photo Credit: bplanet/FreeDigitalPhotos.net

Note: Affiliate link included.

7k+ in online income! Wow! That’s more than double what many of us make in a month.

Good job- You deserve it. All your hard work is paying off.

just wow!!!

Excellent blog Jason.

Joel,

Thanks so much. Really appreciate that. I’m working very hard at this every single day – I’m actually finishing up on my second article of the day right now. Very fortunate that it’s being rewarded after years of sticking with it.

I doubt I’ll see income like this again for a good long while, but it’s a great feeling to hit it even once. The key is to get yourself in a position where a lot of income isn’t necessary. That way it’s not all that difficult to create a nice delta.

Cheers!

FFdividend,

Same thing I said when I finished up the report. 🙂

Thanks for dropping by.

Take care!

Nice! You are hitting on all cylinders this month. I am jealous of your blog traffic; if only I was as talented a writer as you!

Vinit,

Thanks so much. Glad you’re enjoying it. Hope you continue to stop by and find value here. 🙂

Cheers.

FV,

Things are coming together really well right now. Took a lot of time and hard work to get here, though. A lot of ups and downs over the past few years, but that’s just part of the fun. 🙂

Best regards!

No words to explain your online income or the pageviews. Thanks for your blog and congratulations.

DR,

Thank you. It’s been a long road, but it’s also been a lot of fun. Just incredibly grateful and privileged to be in this spot. 🙂

Hope all is well with you and your journey as well!

Take care.

Jason

Just one word……..WOW

Best Wishes

FIUK

High 5!

Way to go Jason! Got your eye on any Oil stocks in the near future?

Dividend Mantra,

Congrats on the impressive month of online income. Keep inspiring us!!

Amazing! You’ve come a long way.

Great work!

Looking forward to you refreshing a detailed break out of your online income. It has certainly had very impressive growth.

Keep up the good work.

Cheers,

Dominic

FI UK,

Ha! Thanks so much, bud. 🙂

Best regards.

Josh,

Back at you!

Thanks for dropping by.

Cheers.

CC,

Thanks. It’s the culmination of years of hard work. Feels good to turn in a month like this. 🙂

I don’t have any specific oil stocks on my radar at this time.

Best wishes!

IP,

Appreciate it very much. Doing my best to create great content, share, and inspire. 🙂

Hope all is well over there!

Best wishes.

DA,

Thanks. Been at this a while now, and it feels good to be in this position. Just working hard and doing all I can to keep climbing. 🙂

Hope you had a great month of savings over on your end.

Thanks for stopping by!

Best regards.

Dominic,

Yeah, I’ve thought about updating that. Although, I don’t want to blog about blogging too often. And the income breakdown isn’t really much different than before. All categories are up across the board. But if things continue on like this for a bit, I wouldn’t mind at all revisiting that and seeing where things stand. 🙂

Thanks for stopping in!

Cheers.

That is an absolutely fantastic performance indeed! A hefty income and incredibly high savings rate. Great work, Jason! The online income is very impressive indeed and I am glad to hear that your book is selling well.

Keep up the good work! No doubt we will see even better months than this one even!

I got to say seeing that online income amount increasing each month is telling me that I ought to start a blog or some sort of online website. That will definitely help boost my income if I can provide some interesting content, which I feel I can definitely deliver with my background seeking out as much information as possible in relation to finance, gambling, and fantasy sports. Did you even imagine that this type of online income was a possibility when you initiated the blog back in 2011?

Incredible job, Jason. Your hard work and persistence is being rewarded, and deservedly so. It’s crazy to think how much can change in a relatively short period of time. I’m sure that if 5 years ago, someone had told you you’d be making nearly 10k in online income and attracting hundreds of thousands of viewers to your blog, you’d have thought they were insane, haha!

Keep it up. The sky is the limit.

Peace my friend!

TDD,

Appreciate it. Thank you! 🙂

Definitely a great month. We’ll see how it goes moving forward, but I can already see that August is going to be a lot lower. That’s okay, though, because I don’t really need to repeat something like this very often. Glad it happened even once.

Hope things are rocking and rolling over there for you.

Cheers!

TDM,

I’d never recommend anyone start a blog for the money. There are a lot of great reasons to blog, and I’ve had a great time with it. But it’s not a great way to make money. I barely made anything at all for the first couple years, especially relative to the hours I put in. I bet I made less than $5/hour for the first couple years. However, I started the blog for many other reasons, all of which turned out great. The money is a side effect of producing great content, working hard, and also being really lucky. I’m fortunate. 🙂

Thanks for stopping in!

Best wishes.

ZTZ,

Definitely been a crazy ride. I’ve had so much fun and it’s just great to be a part of this community. There really wasn’t a community at all when I first started this blog, so it’s been just incredible to see our group grow and progress in the way it has.

I think we’ll all continue growing, learning, and becoming more free together. Great things still lie ahead. 🙂

Thanks for the support!

Best regards.

Wow Jason over 7K in on-line income, and saving more than 77% of net income this is fantastic. No doubt you are rocking it. Congrats on a great month Jason.

Cheers

Jason,

Congratulations on the outstanding month! You have the ammunition at hand to reload your gun aggressively- no wonder there was so much activity last month. Well done.

I’m sure you will hit more record months even if August takes a breather.

Bask in the accomplishment, then keep pushing to top it again.

-Mike

You’re killing it with the online income. Congrats! You definitely deserve it with the amazing content!

Another great month! Curious why spend the $50 on VPN service vs setting up a free VPN back to your home router? I’ve been using OpenVPN for awhile now works great.

Amazing as usual! That online income seems to be growing rapidly while your expenses are heading in the other direction. Combine that with dividend growth investing and you have the perfect formula. Congrats on your success!

Ken

michael,

Thanks so much. It was one of those incredible months that I’ll never forget. I really view a 50% savings rate as pretty impressive, so almost 80% is just out of this world. Gives me a nice cushion heading into the latter part of the year. We’ll see how it finishes up! 🙂

Appreciate the support!

Best wishes.

Mike,

This kind of income gives me a lot more BBs than I’m used to working with. Definitely a lot of fun. Hope I can keep it up for a little while longer.

I’m going to keep pushing it to the max, no doubt about it. All the results I’ve produced thus far are the result of me giving it my all. No regrets.

Thanks for stopping by. I know you had a great month over there as well! 🙂

Cheers!

Henry,

Thanks for the kind words there. Much appreciated. I take a lot of pride in the content, always aiming to put out the best stuff possible. So that means a lot to me. 🙂

Hope all is well out in Cali!

Best regards.

Will,

Ha! I’m about as technically gifted as my dogs are. I’ve been using TunnelBear’s free service for the last month or so with great results. Super easy for me – automatic. But I was eclipsing the free allotment of data. I’m frugal, but I’m not opposed to paying a company a fair amount of money for a service I like, use, and find value in. It’s worth a little more than $4/month to protect my information. 🙂

Take care.

Ken,

It’s been a really great year thus far. I’ve been fortunate in that the expenses haven’t been too bad. Not too many surprises or anything, and I’ve largely avoided lifestyle inflation. The increase in income has mostly just moved right to the bottom line. But it’s really thanks to all the readers. Couldn’t do it without the community. 🙂

Let’s keep it rolling!

Best wishes.

That’s awesome Jason. You’ve hit the nail on the head to. That’s exactly why we are choosing to share our income and balance sheet reports. It motivates us and we want to share it in action. So many of the bloggers we read are already there or very close and we are just at the very beginning of our journey.

You are doing fantastic bud! You have helped changed the way that I look at investments for sure! Thanks for being so transparent and allowing us to take this journey with you!

Hey Jason,

July was a great month for you congrats. It was so so for me I made roughly 40 dollars of online income which was the first time I can say I made online income.

Tyler

Mrs. Crackin’,

There’s nothing quite like having to share your income/expenses with the world. Sure motivates you to toe the line and not have to report any expenses that you’d probably regret. 🙂

We’re all on this journey together. Every new day is better than the last. Keep it up!

Best wishes.

Steven,

Thanks so much. I’m really proud of this month. One I’ll never forget. 🙂

Appreciate the kind words. I’m so glad that you’ve found value, inspiration, and education in what I share. It’s truly my belief that freedom is out there waiting for all of us. Doing all I can to motivate!

Cheers.

Tyler,

Hey, big things can come from small beginnings. I only made $16 back in March 2011 – my first month of blogging. Keep at it! 🙂

Best regards.

Jason,

Awesome online income, congrats.

I’ll say it again: I really think you should start investing $5500/yr in a Roth. The downside of doing so is negligible, and if you have years with good income in the future, collecting dividends in a Roth could really save you on taxes.

Grant,

Thanks so much!

Yeah, I still have no desire for a Roth or any other tax-advantaged accounts. But the plan is coming together beautifully just as I predicted. No regrets here. 🙂

Cheers!

wow! 7K+ is holy cow income. I see broken records in pieces 🙂 Keep it racing, my friend.

Very impressive online income! Imagine getting that in dividends.

Hi Jason,

Congrats on the record breaking month! You are doing an awesome job! Keep it up!

“WOW,” is right. You’ve earned this–you’ve really earned this. It’s yours. Bravo! You are proving that this is all very real and attainable. It’s truly amazing.

It’s practically not worth it for him. He pays no state income tax due to living in Florida, and he won’t pay much in federal income tax due to his (overall annual) low income. Plus, when he retires in only 7 more years at 40 (or even before) he wouldn’t have access to all of the funds if they were in a Roth. And when he starts living on the dividend income, he will (again) pay no federal income tax due to being in the lowest tax brackets. That won’t last of course, but that’s not a bad problem to have.

R2R,

I’m racing as fast and as hard as I can while still enjoying the journey. I’ve been really fortunate to find that right mix of frugality and quality of life over time. I’m kind of “in the zone” here. Really comes down to realizing that it just doesn’t take much money to be happy. 🙂

Thanks for dropping by!

Best regards.

aussiestocks,

I couldn’t even imagine! Maybe a couple decades or so from now. Fortunately, I won’t need anywhere near that kind of passive income. I’d probably end up giving half of it away. 🙂

Hope you had a great month over there!

Take care.

Sampo,

Thanks so much. Really appreciate the ongoing support. 🙂

Best wishes!

divy,

Thanks. That’s really kind of you. I’ve done all I can to earn everything I’ve attained. I’ve worked really, really hard to get to this spot and it’s just really incredible and wonderful to see things working out so well. Truly fortunate.

Hope all is well over there with your journey. Let’s keep reaching higher!

Cheers.

I just can say congrats! U deserve it =)

Heheh, I’ll have to work almost half a year to get such income from my dayjob here in Estonia. Nevertheless you have truly inspired me to find also other sources of income instead the paycheck my employer sends me every month. 🙂

Thanks Jason!

The paradox: financial independence not achieved through dividend growth investing but by writing about how to achieve financial independence through dividend growth investing.

Holy hell, Jason!

Another excellent month in the books… You weren’t lying when you said I better watch out. At this rate you’ll blow past all of us in no time. And the best part is that you’re doing what you love already and enjoying life to the fullest.

You once wrote a post on how you’re already financially independent. I guess this post just proves that point.

Keep it up,

NMW

Amazing job! Congratulations!

I’ve been reading your wonderful blog for a long time, but I’d never posted a comment. I just wanted to say that you are a great inspiration for us mere mortals. 🙂

I’m pretty good in the savings area, but my investing is quite weak, going from one strategy to another… I’m a little more focused now, but still struggling with fear and the useless market timing.

I hope I can leave my job in a few years and spend my time writing books and composing music (and traveling). That’s my dream. I look forward to your post about your publishing experience. It would be also great to read more about your freelancing as a writer.

Again, congratulations, because I think you’ve already made it. I think you wouldn’t be doing very different things if you had already reached FI, would you?

Keep inspiring us!

Great month and great path! Congratulations!

Jason:

Each time I get an email from your site, I begin reading it on my I pad. At the bottom of the text, there is a link that says. Read online. I always do so , as I believe by reading it online you would benefit from another “page view”.

If this is true, I encourage all of your followers and readers to do this.

Also while you undertake this journey, I see that you are not only on the path to reach your income goals, but you are also becoming quite a proficient writer. Your writings are orderly, concise and informational. Keep up the good work and let nothing dim your focus.

Joshua,

I get all that, but can you describe a scenario where he puts money in a Roth now and later finds out that he would be better off if he had kept it all in his taxable account? Keep in mind, all the money you’ve put into a Roth can be withdrawn for no penalty. It’s only the GAINS that are stuck in there until you’re 55. If he starts living off dividend income at 40, he can quite easily start withdrawing all his Roth dividends with no penalty, and keep doing that until the amount of dividends he’s taken out hits the amount of money he put in.

Also I think there are exceptions for unexpected large medical costs.

It almost feels like by refusing to lock up money in a Roth, maybe he’s not so committed to his plan. He’s retaining the flexibility to theoretically have a complete change of heart and spend his whole $200K freedom fund tomorrow on a yacht.

Meanwhile, he’s making $6K, $7K a month these days and the freedom fund is growing faster than expected. When his dividend income hits the magic $18K, do you think he’s going to just end the blog and stop writing and be lazy? That’s not him. People like Jason don’t just wear the minimum amount of flair. His snowball is in fact going to keep rolling and get much bigger than his goal, and tax considerations are going to become important. I see this as a likely scenario.

I know I’m probably beginning to sound like a broken record, but WOW! To see where you’ve come from since those early days in 2011 when I first found your blog is simply amazing!

Wishing you continued success!

The Stoic

Jason,

First wow for your online income, and a BIG wow for your 77.9% of your saving. I know many family are making over 10K per month but spending 11K… and saying poor, miserable life and etc. Those guys should read your blog post to become success in their life.

You are very success in your online business because you are giving real value to your readers without expecting a return.

Keep it up!

A big high-five and congratulations for your impressive July income and expense numbers! Those are some remarkable online traffic and income figures.

Also very remarkable was your ability to save 77.9% of your income last month. Jason, you are making the rest of us look like slackers. Ok, with that kind of income you should go lease a new 3-series BMW and upsize to a larger apartment. You can afford it now and you certainly deserve it after all this hard work over 4 years!

Wait, I lost my mind there for a second – wrong website. :) Take care!

Holy cow, you are firing on all cylinders man! Truly impressive numbers across the board. You deserve every penny because you’ve been working very hard to earn it. Lesser souls would have succumbed to fear and stayed chained to the horrible car dealership job. You have proven that taking the plunge can lead to great happiness.

Keep un trucking buddy, you’ll be reaching your FI goal before you know it!

If this keeps up, you’re going to have to stop saying that you’ll never earn a six-figure income. Congrats! I look forward to reading your investment ideas for what to do with the extra cash.

Keep in mind that if he kept his whole profile in a Roth, he’d be limited to that contribution limit (currently $5500/yr). He’s obviously contributing way more than that, and wouldn’t be able to do so if it were in a Roth.

El joven inversor,

Thank you. Couldn’t do it without you readers, though. So thank you! 🙂

Best regards.

Tauri,

I imagine it’s very difficult to earn this kind of income in many parts of the world. It’s difficult right here in the US. Definitely didn’t come easy for me. But you’re on the right track over there by seeking out alternative and diversified sources of income. Employment isn’t guaranteed. So it’s always important to be mindful of that and defend yourself against that. The more passive the income, the better. 🙂

Thanks for stopping by!

Cheers.

Flamewaker,

The truth: Writing about how to achieve financial independence through dividend growth investing can replace one’s day job by generating the income necessary to achieve financial independence through dividend growth investing. I’m not financially independent yet, but getting there.

Take care.

Hi Jason,

awesome results. Congrats! Great online income, great saving!

Its amazing to see your process and look forward to read more from you!

Rgds,

Patrick

$7600 in online income in one month! Net! Net income! Not even gross income!

You know, if you were to keep this up for 12 months straight, you will earn over $91,000 in net income! So the line in your introduction where you say you don’t make a six figure income and you probably never will? I’d start preparing to revise that.

I hope you can keep it up!

Sincerely,

ARB–Angry Retail Banker

NMW,

Thanks, man. Doing all I can to keep up with that incredible savings rate you’re posting over there! 🙂

I don’t know how many 70%+ months I have left in me this year, but I think I’ll have a strong finish. Either way, I’m just really happy to be in this spot. I’m working really hard, but the projects I take on are really only those I thoroughly enjoy.

I’m definitely not financially independent yet, however. If I don’t write, I don’t earn an income. So I’m very much dependent on online income. But I’m getting closer and closer every single day. The march continues!

Thanks for dropping by. Have a great weekend.

Cheers!

Lemuel,

Thank you. I’m doing all I can to inspire and motivate. I truly believe that financial independence is attainable by just about anyone living in a first world country. But you have to really want it and be willing to do what’s necessary to achieve it.

I wish you much luck in regards to pursuing a new lifetime. Just put yourself in a position where you’ve got a little capital there and a little passive income rolling in, and anything is possible. Once you get your expenses low enough and you’ve got some passive income rolling in, it doesn’t take much to bridge that gap. That makes it a lot easier to pursue a lifetime that might bring about more happiness for you.

“Again, congratulations, because I think you’ve already made it. I think you wouldn’t be doing very different things if you had already reached FI, would you?”

I don’t think I’ve made it. I’m not financially independent. I’m financially dependent. I’m dependent on online income. If something were to happen that made it difficult for me to earn a living online, I wouldn’t be able to pay my bills. Would I do things differently if I had enough passive income to pay for my lifestyle? I’d say that I wouldn’t be writing nearly as much. I wrote something like 35 articles last month. Would I want to keep up that level of productivity in 10 years when dividend income covers me completely? Probably not. I enjoy writing quite a bit. But I definitely work harder at it right now because I have to. I also probably wouldn’t be running the blog anymore at that point. I foresee a day when someone else runs the day-to-day operations. It’s quite a task to run this thing at this point, so I wouldn’t mind at all someone else taking the reins on that.

Thanks for the support. Stay in touch!

Best wishes.

Nuno,

Thanks so much. Doing my best and working hard, that’s for sure. 🙂

Cheers!

Amegalo,

Thanks for popping on the site and reading it here. I get emails from some other sites, but I always click over to the site. Not just out of support, but also so that I can experience the content in its native form. Emails just aren’t the same.

Appreciate the kind words there about the content and writing. As a writer, that means a lot to me. I take the quality of content very seriously. I still have a lot to learn when it comes to being a better writer and producing higher-quality content. But that’s just part of the fun. 🙂

Have a great weekend!

Best regards.

Congrats on the record income. Out of curiosity, how many hours per week would you say you work ?

Grant,

“It almost feels like by refusing to lock up money in a Roth, maybe he’s not so committed to his plan. He’s retaining the flexibility to theoretically have a complete change of heart and spend his whole $200K freedom fund tomorrow on a yacht.”

Two things.

First, if you really think that that’s what I’m all about, then I have no idea why you’d even take the time to stop by the site.

Second, you’ve crossed the line. You’re questioning my integrity at this point. I don’t mind having a lively debate about the merits of tax-advantaged accounts, though I feel like I’ve already discussed that ad nauseam at this point – the math has already been done and a Roth would have a minimal impact on things, either way. But I do mind when the discussion becomes disrespectful.

Take care.

The Stoic,

Thanks so much, man. We’ve both come a long way, though. It’s amazing to see where things have gone for us. We’re both self-employed and infinitely more happy than we were before. Moreover, we’re both becoming more and more free every single day. How much better can it get?

Keep it up over there. The best is yet ahead!

Best wishes.

FJ,

Thanks! 🙂

I know what you mean about so many people out there living beyond their means, even when those means allow for more than enough. I don’t really have a problem with it, as long as it’s not impacting me. Live and let live, I say. But I think it’s a shame when those same people find themselves unhappy even after spending so much money. And that’s where this blog and these concepts come in. Doing my best to spread the message and show that there’s another way. But only the people who really want to see the light will see it.

Let’s keep it rolling!

Cheers.

Bryan,

Ha! A new BMW? Forget that. Those are commonplace down here. I’m gonna get a Ferrari. 🙂

Appreciate the support. It was a really crazy month. I was busier than ever, which is a good thing. But I couldn’t do it without the readership and clients. Without you guys, the blog and the income wouldn’t be possible. So thank you!

Lots more to come. Stay in touch.

Have a great weekend over there!

Best regards.

Good one!!!

Dedication & Innovation can take us where ever we wanna go

Great JASON keep up the pace 🙂

Spoonman,

The only thing we have to fear is fear itself, right? 🙂

I agree, though. Many people thought I was crazy to leave the job behind. In my opinion, the only crazy thing would have been to stay somewhere I’m not happy. Life’s way too short for that, which is part of the reason I started seeking out financial independence in the first place. The quicker I could get away from that place, the better. I’m just so happy that I’ve been in a position to document that transition and share the ups and downs. It’s not always easy and there’s a lot of hard work behind the scenes over here, but it’s all been worth it.

Appreciate the support. Looking forward to the day I’m living off of dividend income like you guys over there. Still climbing and working hard!

Hope you guys are enjoying the summer.

Best wishes.

Jim,

Ha! Wouldn’t that be something? I’d be glad to change that intro if it comes down to it, but I still have a long way to go. Doesn’t look like I’ll be close to $100k gross this year. However, you never know what’s possible in the future. 🙂

Tough to say how long I can keep this pace up, though. I’ve been writing at a somewhat prolific level over the last few months, and that might be a tough pace to keep over the next few years. We’ll see how it goes!

As far as the extra cash goes, that income was already invested last month. As the money comes in, it’s invested pretty promptly. So you’re seeing exactly what investment ideas are there in real-time.

Hope all is well over there. Have a great weekend!

Cheers.

Patrick,

Thank you so much. Couldn’t do it without you readers, though. Your support makes it all possible. 🙂

Hope you had a great month of saving and investing over there!

Cheers.

ARB,

It’s been crazy. Never thought I’d be in this spot. I may indeed have to revise that intro. I’d be VERY happy to do so if it came down to it. 🙂

A few things came together just right for me to hit this kind of income, though. I have some visibility looking out over the next couple months, and I can see it’s definitely in a downtrend. August is going to be significantly lower. And September appears like it might come in lower than August. But you never know. Could come back again toward the end of the year. Either way, I’ll just continue to work hard and do all I can to provide value. Value has a way of coming back around to those who provide it.

Thanks for all the support. Means a lot to me.

Let’s keep fighting the good fight!

Best wishes.

Mike,

It’s really tough to say. I obviously don’t have a time clock over here, thankfully. 🙂

If I had to guess – this is off the top of my head – I’d say I probably “work” 40 hours per week. But I put the word work in quotations there because I’m using that term pretty liberally. It’s really not all work. Some of it is – the administration of the site can sometimes be a bummer. Especially when there are hosting issues or something. But most of the writing really isn’t work at all.

I did my best to show what my routine looks like here:

https://www.dividendmantra.com/2015/01/the-routine-that-isnt-routine/

It’s changed a bit since then. I spend a lot more time at coffee shops now, for instance. So I’ll be at it for more than three hours at a time. But, otherwise, that’s kind of what things look like for me these days.

Cheers!

shankar,

Couldn’t agree more. Throw in some hard work and a little luck there and you have the ultimate recipe for success. 🙂

Thanks for dropping by!

Take care.

Hi Jason,

Wow what a month! I guess the bb guns are fully loaded again. Enjoy the hunt.

Have a great weekend.

Cheers,

G

Geblin,

Thanks for stopping by!

Wish I could say the BB gun was loaded, but this income was all spent/invested in July. That’s why I was able to record so many transactions last month. Looks like the next hunt is scheduled for September. But I’ll be ready when I get some more ammo. 🙂

Hope you have a great weekend as well.

Best regards.

Jason,

Another home run! Congratulation on your results. Your online numbers and save rate are vet impressive.

Good luck for next month.

D4s

Jason,

Thanks for all you have taught us so far. Using your methods of stock valuation, I’ve found that I made a few bad purchases(expensive stocks with high P/E ratios, high payout ratios, etc.). I was just buying random blue chip stocks. I understand that, while they were “high quality” companies at the time, they weren’t really good deals. Let’s take for example GE- It currently has a high payout ratio, as well as a high P/E of 69.64. However, when I did a DDM calculation with 7% dividend growth, 10% required return, and .92 annual dividend, I got a value of $32.81. The current price is $26.08, so given all the high P/E and payout ratio of 240%. Given these metrics, would buy now? I’m guessing you wouldn’t, but I ‘d like to hear your thoughts.

D4s,

Got really lucky here with a few things this past month. Just gonna keep working hard and staying hungry.

Keep up the buying over there. But save some shares for the rest of us! 🙂

Cheers.

Joel,

You have to be careful with just looking at P/E ratio on a financial site and taking that for gospel. The P (price) is obviously going to be accurate. But the E (earnings) is affected by a lot of different factors. Companies have non-cash charges and other financial issues (that are usually temporary) that can positively or negatively affect GAAP EPS. So the best thing to do with that, as always, is to go straight to a company’s financial reports and see exactly what their earnings power is. If a company takes a big hit for a mark-to-market pension adjustment or some kind of divestiture, then you have to look at that and really think about whether that’s an ongoing and permanent hit to earnings.

Specific to GE, I’m a little concerned about the dividend policy right now. Unfortunate that they’re planning on keeping it unchanged through 2016. Otherwise, I like the aggressive nature of their turnaround.

Hope that helps!

Cheers.

Great month Jason! But you’re not going to have that car sale crutch forever! 😉 Keep it up buddy!

FF,

Ha! I’ll use that crutch as long as I can, that’s for sure. 🙂

Appreciate the support.

Have a great weekend over there!

Cheers.

Today we are celebrating our Independence Day!!! Wishing you F Independence at the earliest:)

Hi Jason,

Congratulations on another great month.You really are on a record breaking spree with your online income.Honestly a great inspiration for all the freedom fighters here 🙂

Regards,

Venkatesh Iyer

With that kind of income/savings it’s not going to take long for you to reach FI. Congrats.

Jason,

That is some serious online income! Congrats on another stellar month!

Although, we only invest in tax free munis to generate passive income because we don’t have the stomach for the stock market or rentals, we have been reading your site daily for the last 1.5 years. It is amazing to see your snowball grow! We luv how you analyze each stock and why you purchased it. We also learn a lot from your and your reader’s comments. Your transparency with expenses, income and stock picks shows readers what it takes to be FI with dividends!

At this rate you will be FI in no time!

Jason,

I’m glad to see you’re doing so well. I visit your site several times a week and love it. Keep up all the hard work…I’m rooting for you!

Melissa

shankar,

Happy Independence Day over there!! 🙂

Wishing you multiple forms of independence at the earliest as well.

Stay in touch.

Cheers.

Venkatesh,

Thank you. I’m working really hard to create great content and inspire along the way. I truly do believe that freedom is out there waiting for us. And I’m out to prove it. 🙂

Best of luck as you continue to fight for your freedom over there!

Cheers.

DD,

I thought for sure the move I made last year would’ve put me behind. And for a while there, it did. I wasn’t making much money this time last year. But it turned out really fantastic. I just knew in my heart that good things would come if I worked hard. And, frankly, I didn’t really even care anymore. I was prepared to make very little money for a long time if it meant I could dictate my own schedule. But it’s worked out far better than I ever hoped.

Couldn’t do it without you readers, though. So thank you so much!

You’re on the homestretch now. Keep it up.

Best regards.

Adam and Jane,

Appreciate that. So glad you find value here in what I write about and what I share. I really do think that transparency helps us all. It makes it more tangible and real. I guess you can make points while remaining vague, but it’ll never be as effective or as fun. 🙂

I hope you continue to stop by and find value in the content. Plenty more to come!

Best wishes.

Melissa,

Thank you so much. I’m really blessed to have such a supportive readership. You guys make the site what it is. I just provide topics. 🙂

I hope all is well over there with your journey. Let’s keep it rolling!

Best regards.

Hi Jason,

I came across this article which mentions Buffett is really trimming his exposure to energy. Looks like the Oracle from Omaha and his team expect quite a bit more pain down the road… I never trimmed my exposure and even dipped in more by picking up NOV and a small position in XOM. Time will tell if this proves out to be wise or not. I’m probably done with increasing my exposure to this sector for quite some time.

http://247wallst.com/energy-business/2015/08/15/why-warren-buffett-continues-to-dump-his-exposure-to-oil-and-oil-stocks/

-Mike

Mike,

Yeah, I actually covered all of Berkshire’s recent buys and sells here:

http://dailytradealert.com/2015/08/15/buffetts-latest-trades-buys-3-stocks-sells-5-stocks/

He’s been reducing his exposure to energy for some time now. At least the last year or so. And he’s never been a big investor in O&G anyway. Not for as long as I’ve been looking at what he does. He had that big bet on COP a while back, which didn’t really work out that well. But he’s not a regular/big investor in this space. And that makes sense when you think about commodity producers not really jiving with what he has typically made a lot of money on. In addition, we’re not sure who’s really behind some of those moves.

Buffett talked a little about O&G at the meeting this year and seemed lukewarm at best on the whole industry. Not really surprising when looking at where he allocates capital.

I don’t really put a lot of stock in what he does or doesn’t do in terms of stock picks since I have very different objectives, but it is interesting to see where they’re going with things in the holistic sense.

Cheers!

I was thinking the same thing. You’ve been in the six figure income club for months now. 🙂 Awesome work!

Daryll,

Not quite there yet. But you never know what might happen next year!

I’ve grossed something like $48k from online income so far this year, but I’m not done with August yet. Might come in somewhere around $72k for 2015, if the average holds. Then you have the dividend income, too. Very exciting stuff, nevertheless. That’s more than I was making at the dealership, which is just an incredible feat with this being my first full-time year at it. Been a long road, but the hard work is definitely paying off. 🙂

Appreciate the support!

Best regards.

Yup, I understand it isn’t for the whole year but if you keep going like you are, next year will easily be in the six figure range! That is so awesome doing it all online, on your terms! It’s like being half free already.

Daryll,

Thanks so much.

You’re right in that doing it on your terms is like being there already. Financial independence definitely isn’t this binary thing where you’re either completely free or not free. There’s that spectrum there that I’ve written about. I think taking advantage of that is the best way to go about it. But that depends on how much money you make at your job and how much you like/dislike it. For me, it was a no-brainer.

Keep fighting the good fight over there! 🙂

Cheers.

DM,

A 77% savings rate in one month. That is fantastic. I feel your pain when it comes to unanticipated expenses, especially medical ones. I had a situation of my own where I went to a restaurant to order salmon, which was served on a plank and somehow when I went to cut the salmon and take a bite, I ended up swallowing a piece of the wood, which was lodged in my throat. Needless to say, one emergency room visit and $2k later, the wood was finally removed. I learned a valuable financial lesson that day, which is to always do your research before enrolling in a health plan. A bit off topic but, have you considered accumulating additional shares in Gilead Sciences? Their most recent quarter was fantastic and it seems their approval in Japan could serve as an additional catalyst for the company’s blockbuster drugs.

DC

DC,

Ouch! Sorry to hear about that. That sounds like an absolute nightmare. Brutal. Glad it worked out okay for you, though. 🙂

Never can tell with medical issues. Overall, I’m not particularly concerned about healthcare costs in early retirement, but you can never really hedge against some kind of emergency situation.

As far as GILD goes, I’m probably going to keep the position right where it is. It’s speculative. There’s no dividend growth history. And it’s difficult to say where exactly they’ll be in five years. But if they grow as I anticipate, I’ll do very well with the small bet I placed there. Just not comfortable with GILD being a big position in the portfolio. Limited capital and I have to allocate it to the best dividend growth opportunities I can find. Don’t mind speculating here and there when there is something really exciting, but I’m also not interested in speculating with a lot of money.

Have a great weekend!

Cheers.

Thanks Jason.

You sure write a lot! No wonder you are so informed and such a good writer!

Have a great rest of the weekend.

Mike

Mantra,

Holy cow! Congrats man on the amazing savings rate and a strong month. I am excited to see these savings rates you have been posting over the last few months. You have two huge forces working in your favor and it will lead to continued insane savings rates: your frugal lifestlye which pushes the expense line down and now your revenue machine is really taking off. What a recipe for continued, sustainable success over the years. My goodness!

Quick question for you…was the royalties pay out just for May’s income or does that represent a few months? If it is just for May, I am assuming you will now receive this monthly! Heck yeah.

Again, keep up the amazing progress. Great job once again Jason!

DD,

It was a crazy month. I’m really, really fortunate. 🙂

The royalties that I received this month were just for May’s sales. But it won’t be like that in perpetuity. The sales continue to drop month after month, but I think the royalties will probably settle in at somewhere around $200 per month. That level could very well be something to expect in perpetuity, which would be fantastic. But we’ll see how it goes. Tough to say right now. I can only say that, for instance, I’ve earned just over $182 for August’s sales so far. So you can see the comparison there.

Appreciate all the support. We just have to keep fighting and keep climbing. Every day is a new opportunity.

Best regards!

Holy crap! I just went through my income and expenses and ended up just shy of 50% and was feeling pretty good! You on the other hand absolutely crushed it! Hell of a nice job! I can only imagine what 77.9% feels like… someday! 🙂

DY,

A 50% savings rate is great, in my opinion. That’s the level where it becomes kind of “extreme” – a level necessary to really become free fairly quickly. That’s kind of the line in the sand.

Keep it up. The savings compounds over time. It’ll get easier. As it gets easier, you’ll want to do it more. It’s a wonderful cycle. 🙂

Cheers!

Online income of $7,600 is such a great milestone. Congrats Dividend Mantra! Your income is growing at the fastest level I can only imagine. Keep up the great work. There are lots of fans reading your blog religiously like me 🙂

BSR,

Thanks so much. I appreciate the kind words and support. I’m really fortunate to have such an incredibly supportive readership. Couldn’t do it without you guys. 🙂

Hope all is well over there with your journey!

Cheers.

Hi,

Perhaps an exceptional income, but even should your online income be exceptional this month, surely your dividend income will only increase in the future. So I don’t think that an overall income of $8.616 will be exceptional down the road for you.

Now, should you manage an average monthly income of about $8.333, you’ll be making a six-figure income! So I think you have a problem, as you introduce yourself as never having made, or going to make, a six-figure income. I’m not buying that 🙂

What a lovely problem to have!

Peter,

What a lovely problem to have, indeed. 🙂

We’ll see how it goes. The online income is going to fall somewhat significantly over the next couple months. Beyond that, it’s tough to say. The growing dividend income can make up for some of that, but not much. An increase of $100 in YOY dividend income won’t make up for a $1,000 swing in the other direction for online income, but it’ll all work out in the end. Like I mentioned, the great thing is that my expenses are low enough to where I just don’t need to earn crazy income to get to where I’m going. And that’s perhaps the best problem to have.

Either way, I’m blessed. Truly blessed.

Thanks for the support!

Best regards.

Hi Jason- I heard you on a podcast and then starting reading your site ever since. I need to work on my food/cleaning supplies/toiletries line. I’m a single guy who spends 800 dollars a month on those items. I eat out only twice a week. We’re talking 20 a week on eating out. I didn’t see a line for cleaning supplies and toiletries. Is that included with your food? I’m assuming you don’t buy beverages like soda, juice, or alcohol. You probably don’t buy any junk food. $437 total on food is really low. Do you just eat staples like eggs, beans, rice, and oatmeal?

Thanks.

Jack,

Thanks for following along! 🙂

Those are good questions there. Toiletries like bathroom tissue, razors, soap, toothpaste, etc., are all accounted for under the Pharmacy expense line. Those are things, back many years ago, that I would buy at the local pharmacy. So I just kept it there for simplicity sake. The thing I spend the most money on is razors. I shave my head and my face and that tends to burn them up quickly.

As far as food goes, I actually think I spend way too much on food. It wasn’t that long ago that I was only spending maybe $200 to $250 per month on food. But that was when I was buying all of my own food and eating by myself. I now split the household bill with Claudia, and that includes food for her son. So what you see is my half for three people. And then I always pay whenever we go out to restaurants or anything else. If it were just me, I could get by pretty easily on much less. But I’m eating a lot better these days with a lot more variety.

Hope that helps!

Cheers.

Jason- Thanks for getting back to me. I’m going to cut the junk food. That can really harm the food budget. A tip on razors. Buy the best one like a Gillette Mach 3 or a Schick Hydro. When you are done shaving. Dry the blade. Made sure the blade is absolutely dry. The razor will last months. Sometimes 6 months or more. The water will corrode the blade and make it dull. I use mine every other day. Clark Howard taught me this.

Jack,

Yeah, we don’t buy much junk food. Chips, crackers, cookies, dips, etc. I eat almost none of that. The one thing I buy a lot of is soda. It’s my one vice. I just really enjoy my soda. 🙂

Great tip there on the razors. I actually ran into that a while ago. I was also told to keep the razor dipped in an oil – like olive oil or vegetable oil – to keep the corrosion at bay. But nothing seems to work for me. If I use a blade for more than, say, five shaves, I start to get very bad irritation. But I have sensitive skin. Just one of those things.

Best of luck with cutting the budget down a bit!

Cheers.

I wonder if you’ve considered VPN Unlimited, it’s what I use. I got a lifetime sibscription for only $37, and it’s not speed or bandwidth restricted. I just checked and a lifetime subscription is still just $39 from the below link. That’s way cheaper than $50/year. (No affilation). http://stacksocial.com/sales/vpn-unlimited-lifetime-subscription

Boris,

Thanks for letting me know about that. That’s interesting that VPN Unlimited doesn’t even offer a lifetime subscription on their main site but one is available on Stacksocial. The reviews (the few I’ve seen) don’t seem to be particularly favorable and something that cheap does scare me a bit. But I’ll definitely look into it. 🙂

Cheers!

Ok, I’ve been with VPN Unlimited for a few months now and so far so good. However I must admit that it does sometimes hang up a bit when using my iPad which can be annoying. I then switch to a different server somewhere else in the country/world. But for the price it’s something I can accept. I haven’t noticed this happening with my PC however.

My account page actually says I have 99 years and 9 months remaining on my subscription!

So really it’s a 100 year subscription! I guess their software had to have some kind of term filled in.

By the way, I accidentally stuck my email address as my name in my previous post. So I don’t get spammed to death could you replace that with my name of choice: Boris. (?)

I enjoy your blog.

Thanks

Boris,

“By the way, I accidentally stuck my email address as my name in my previous post. So I don’t get spammed to death could you replace that with my name of choice: Boris. (?)”

Done. 🙂

Thanks for following along. Appreciate the readership!

Hope VPN Unlimited continues to work out fairly well for you.

Cheers!

Its been a tough few months here ! I hate when the you know what hits the fan and keeps coming ! 2 car repairs and a plumber visit YIKES !

Puts a dent in the emergency fund that will need to be replaced. But I will still be able to invest this month 🙂

Getting down to the end of paying off the mortgage on the house my wife bought before we got married 4 1/2 years ago. I will have paid off a 30 year mortgage in less than 5 years 🙂 Yes folks you CAN do it. My home I had before we married was paid off so we will have 2 paid off homes 🙂

My house sits empty Im not feeling good about renting it out with some of the horror stories I have heard out there ! the taxes are low and I dont really need the money so I will wait for the housing market to recover or just be like Warren B and never sell it just hold it as an asset 🙂

Like you Im self employed, Im a farrier ( I shoe horses ) my income varies from day to day and week to week. I found it easy to do a daily budget ( because I get paid when I do the work ) I break down reg bills like lights Phone Insurance ect and put it away each day what ever is left at the end of the week gets put to work 🙂

Bob,

That’s a fantastic achievement there, paying off your 30-year mortgage in less than five years. Keep up the fantastic progress there. 🙂

One-time expenses seem to have a way of popping up every single month. Just one of those things. As long as the long-term average looks good and you’re maintaining that high savings rate over the course of years (rather than days), you’ll be just fine. Sounds like you’re easily on track over there.

Cheers!

Just found your site today and I’m so glad I did. Anything is possible as long as you put your mind to it. I wish I saw your blog 10 years ago. 😉

You haven’t post August, September and October….

Congrats on the accomplishment. I’m new to your blog and cannot wait to see more positive reinforcement. I also set a goal of 50% savings rate, however i’m starting with gross income and will readjust accordingly later on. I have a mortgage and am trying to pay it off in less than13 years. 🙂

I just started a blog last month about dividend investing with my daughter and wanted to know what anyone thinks. Thanks!

http://www.dividendmiracle.com

Fishiesky,

If you looked at the most popular blog with 600+ comments, you would know Jason sold his site and has not posted anything for the past 3 months. The new owners has messed up his site of what he built for the past 4 years. If you want you can check out my blog if you want. http://www.dividendmiracle.com

Thy Sok

If you looked at the most popular blog with 600+ comments, you would know Jason sold his site and has not posted anything for the past 3 months. The new owners has messed up his site of what he built for the past 4 years. If you want you can check out my blog if you want. http://www.dividendmiracle.com