Considering Foreign-Domiciled Dividend Growth Stocks

I was recently asked by a reader to discuss foreign stocks, dividend taxation, and how that applies to some of the stocks I discuss…

I was recently asked by a reader to discuss foreign stocks, dividend taxation, and how that applies to some of the stocks I discuss…

It’s one of the largest purchases you’ll ever make, but owning a home can also be a great investment. It’s the American dream. You…

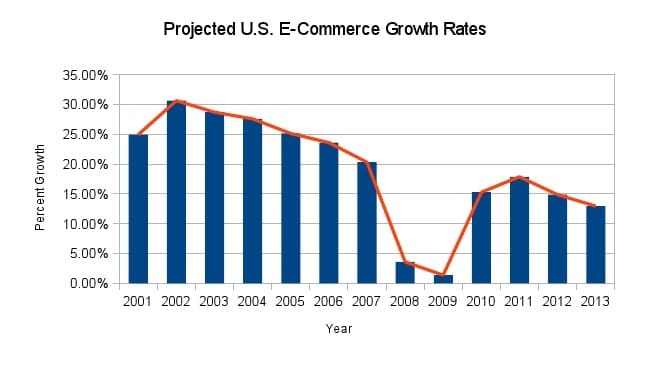

http://americanhatmakers.comThe Cambridge Dictionary defines ‘projected growth rate’ as the estimated pace at which something will be growing in the foreseeable future. It’s a generous…

I’ve been investing surplus capital from carefully saving over 50% of my net income for over three years now. I’ve done this month in…

I’m a huge fan of investing in stocks, as you can probably tell by my almost 100% allocation to the asset class in my…

I haven’t previously discussed my entry criteria before on this blog. I wanted to put “pen to paper” on this one and officially publish…

This article originally appeared on The Div-Net on December 7, 2011 We as investors routinely refer the term “economic moat” when describing strengths of…

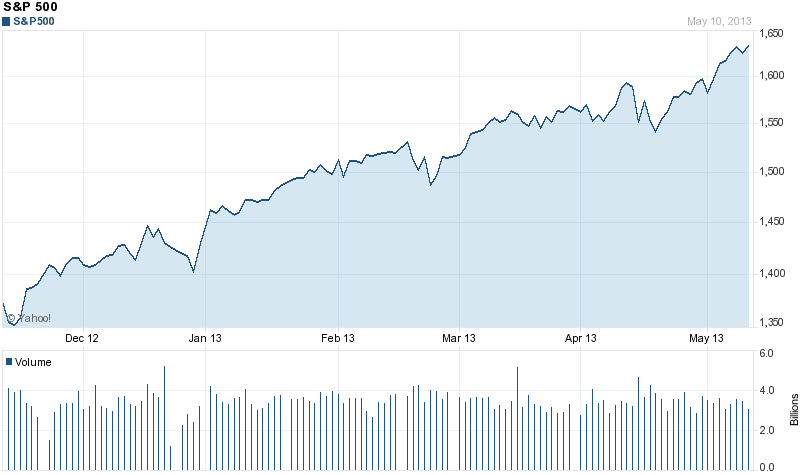

S&P 500 6-month chart What is a value investor to do right now? The S&P 500 is up 14.55% so far in 2013. 14.55%!…

Arbitrage is the practice of taking advantage of a price difference between two markets to make money. In the stock market, arbitrage opportunities abound…

Many people are familiar with traditional stock ETFs, which invest in a variety of stocks across different industries. However, there are also ETFs that…