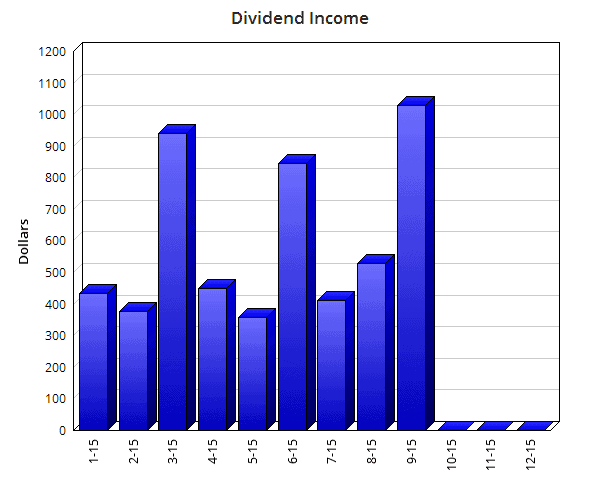

Dividend Income Update – September 2015

A new all-time record for dividend income was hit this past month!

While breaking records for monthly dividend income will be something that a dividend growth investor routinely does if they’re regularly adding fresh capital and reinvesting dividend income, this record is special for a big reason, as you’ll see below.

I’m so incredibly proud of the progress I’ve made thus far over the last five or so years. This shows what is actually possible in real-time, guys. For most of the time I’ve been at this, I worked at a regular day job. I spent all day and all night toiling away, consistently saving, trying to figure out how to build a sizable passive income stream that could one day fund all of my expenses. And this month proves just how close I’m getting to that dream.

I hope these monthly dividend income reports provide inspiration for any investors out there that are just starting out. It’s easy to see these payments rising month after month and it shows that it’s possible to one day pay for monthly expenses with dividends, which would provide an investor opportunities and freedom to pursue interests other than full-time work. What you’ll see below is a list of every dividend I collected over the prior month, which company paid the dividend, and the amount of the dividend. Without further ado:

- Wells Fargo & Co. (WFC) – $33.75

- Visa Inc. (V) – $2.40

- Phillips 66 (PSX) – $15.12

- ONE Gas Inc. (OGS) – $2.40

- ConocoPhillips (COP) – $40.70

- Aflac Incorporated (AFL) – $39.00

- Southside Bancshares, Inc. (SBSI) – $17.02

- Wal-Mart Stores, Inc. (WMT) – $22.05

- Johnson & Johnson (JNJ) – $75.00

- Unilever PLC (UL) – $32.32

- Target Corporation (TGT) – $39.20

- Norfolk Southern Corp. (NSC) – $41.30

- International Business Machines Corp. (IBM) – $19.50

- Exxon Mobil Corporation (XOM) – $14.60

- Emerson Electric Co. (EMR) – $37.60

- Chevron Corporation (CVX) – $42.80

- Microsoft Corporation (MSFT) – $7.75

- United Technologies Corporation (UTX) – $9.60

- Hershey Co. (HSY) – $8.75

- ITC Holdings Corp. (ITC) – $5.63

- Avista Corp. (AVA) – $18.15

- Praxair, Inc. (PX) – $7.15

- Realty Income Corp. (O) – $13.30

- McDonald’s Corporation (MCD) – $51.00

- BP PLC (BP) – $47.60

- Royal Dutch Shell PLC (RDS.B) – $23.50

- Harris Corporation (HRS) – $20.00

- National Oilwell Varco, Inc. (NOV) – $39.10

- Gilead Sciences, Inc. (GILD) – $4.30

- T. Rowe Price Group Inc. (TROW) – $13.00

- Travelers Companies Inc. (TRV) – $6.10

- Union Pacific Corporation (UNP) – $27.50

- PepsiCo, Inc. (PEP) – $54.09

- Digital Realty Trust, Inc. (DLR) – $55.25

- BHP Billiton PLC (BBL) – $142.60

Total dividends received during the month of September: $1,029.13.

That’s it!

I finally eclipsed the four-figure mark in a single month. I just can’t tell you how exciting it is to be able to say that I did that. And, you know, it took a while… but it really didn’t.

From starting in mid-2010 with no dividend income, I hit four figures in a single month a little more than five years later.

Five years is a long time, no doubt about it. It’s probably something like 6% of my entire lifetime. So it’s not trivial.

But at the same time, it’s also gone. The five years vanished like that. Just imagine if I had never taken on this journey. Imagine if the Jason of 2010 decided to just live like everyone else – keep his head low and plow on at work, never having the audacity to believe in a dream as big as financial independence in a relatively short period of time.

I mean, who was I to believe?

I was making a little more than $40,000 per year at the time. I didn’t know a thing about stocks or dividends. Nobody in my family ever once mentioned there was any other way other than the rat race. Hell, no one in my entire life ever dropped even a single hint that there was another path where there was light at the end.

Yet I believed there had to be another way. Life is too beautiful to spend it miserable, rotting under fluorescent lights every day, working at something I’m unhappy with because I lack passion, I’m not my own boss, I work too much, and I have no freedom.

Here I am now. 2015 is drawing to a close and I finally cracked four figures in a month. It’s a dream slowly coming true in real-time. And I’m blessed to be able to share it with you guys as I go.

But had I never started in the first place, that five years still would have gone by. It’d still be 2015. And I’d still be worth less than a baby. Time waits for no one. So make sure you’re always thinking of the you in five, ten, or 20 years. Because that version of you will eventually arrive. And you want to make sure that version is a lot better than the version of you that currently exists.

Looking at the numbers, I’m pretty happy with how things are shaping up. The diversification is really solid, although I’ve got a lot of companies in the oil & gas space sending me some pretty big checks. That overexposure is one major reason I’ve been a little timid when it comes to being aggressive in the Energy sector over the last year. However, I did jump in pretty vigorously last month, picking up some really solid values in names like BP and Shell, along with some of the major midstream pipeline plays. But I continue to build this portfolio out and spread those checks around as much as I can. I don’t want to become too reliant on any one company or industry, which could put my financial independence in danger if there’s an adverse change to the dividend policy due to unfavorable changes in business dynamics.

The dividend income for this month was 38.1% more than the dividend income my Freedom Fund generated in September 2014. I’m honestly surprised at the year-over-year growth there considering the base I’m working with, but I’ll take it.

I was able to cover 43.5% of my personal expenses this month via passive dividend income alone, which, while really solid, is lower than I anticipated due to some higher spending in September. I spent about $700 more than I planned on due to a coalescence of events. A great friend of mine got married, and I sent a good-sized gift for that. I also booked a weekend getaway for me and Claudia for our six-year anniversary. And then my iPhone 3G from 2008 finally broke on me, so I purchased a refurbished iPhone 4S. Still, covering almost half of my expenses via passive income even during a really expensive month (for me) is a great spot to be in at this point in time.

I’m currently focusing a bit more on yield right now so as to make a strong run at financial independence over the next year or so, which should allow me to progress a bit faster than I planned on. I’m currently slightly ahead of pace in terms of my long-term goal to become financially independent by 40, but I’m hoping to put myself even further ahead of pace over the next year or two. We’ll see how it goes, but I could be looking at completing things even earlier than I anticipated. As always, though, I continue to focus on high-quality dividend growth stocks with lengthy dividend growth records, solid fundamentals, and bright futures. I won’t mortgage away my future for the present. But if I can accelerate, I will.

One of my goals this year is to receive $7,200 in dividend income. That was a pretty intense goal to set considering where I finished last year, but I figured I’d just put it out there and see if I could stretch for it. Well, I’ve stretched as far as I can, and I can now say I’ve earned $5,373.77 in dividend income this year. That means I’ve completed 74.6% of that goal with 75% of the year behind us. So I’m on pace with what should be a fantastic fourth quarter still yet to come. Can’t wait to see how 2015 finishes. I’m doing all I can to finish strong and set things up for a great 2016. Stick around and let’s see what’s possible!

I’ll update my Dividend Income page to reflect September’s dividends.

Full Disclosure: Long all stocks except BBL.

What was September like for you? Have a great month for dividend income? Continue to break records? On pace for your goals?

Thanks for reading.

Jason,

What A great dividend income, and a great new milestone of 4 digit dividend income.

Hope to get there soon also (like 7 years from now 🙂 )

Can’t beat progress. You are doing quite well for yourself. Keep up the good work.

Keep cranking,

Robert the DividendDreamer

AKA — Seeking Dividends

Follow me on Twitter– Seeking Dividends@DividendDreamer

What an incredible month! I had a few hundred in dividends, but don’t focus exclusively on dividend stocks like you do. We do have a lot of positions in common, though.

Congrats on the recent changes, you deserve it. Too bad success brings with it the naysayers.

Hi Jason,

Congratulations on having such a great month! Welcome to the four figure club!

I foresee December being equally strong for you so the $7200 goal will be smashed in my opinion. Let’s see it play out. December is always a kind month (because of the extra KO payment in the quarter plus DIS).

My September income hit a record as well. Drum roll please: $6838.68… Mic drop. I am in shock. The dividend income really comes must faster than you think, especially with plugging in more capital regularly. This record month was made possible by (in order of appearance): V, JNJ, UL, TGT, CVX, IBM, EMR, MCD, NOV, BBL, UNP. Thanks guys- you did an outstanding job. Keep it up.

Best wishes over there in SW Florida,

Mike

Jason,

One more comment that should be in the last post but I’d like to put it here since it’s fresher. On tax harvesting, since there is so much volatility in the market (fast moves up and down) and it looks like BBL and NOV ran away in the last few days, may I offer the following strategy:

Normally purchases are treated on a FIFO basis. So if you have extra cash you can double down on our NOV or BBL position, then sell the original position and take the capital loss while lowering your basis price. This way you avoid the wash sale rule (you are buying before selling) and still have the same amount of free cash to fund a new purchase. You only have to ensure that you have enough starting cash to make this practical otherwise you are making too many trades.

I hope that offers some value, and thanks for sharing so many valuable tips with me and others on this blog.

-Mike

Hey Jason it is really impressive to see your results. I know you have put a lot of capital to work and that’s understandable but you really have chosen the right positions. I bought EMR last month, and looking to add to the position in the future. Good luck in Oct!

Hi Jason!

Awesome month for you! I’d bet my money on you achieving your dividend goal for the year. Do you have an opinion on MKC? Keep up the great work!

Congratulations on an amazing 4-digit dividend income month Jason, you have been at working extremely passionately all this time and you are just simply reaping the rewards. You are an awesome success story and keep on inspiring!

Can’t wait to join you in the 4-digit dividend income month.

All the best!

Congratulations dm! It’s a great feeling tearing down milestones like this – only gonna get better. Well done!

T

Nice work. 1,000 bucks is big time, i think next year you can hit that number a few times. I think December will be another good month. Again nice work.

Congratulations on the four-figure month! Looking forward to seeing your end of year figures – I think you’re going to smash your target!

Started another side hustle in September (driving for lyft a ride share company) and am taking a class by Jon morrow which will hopefully help me with online businesses. My goal is to have a substantial amount of online income by December (when I say substantial I mean like 10 dollars) so we will see how those goals come to be.

My passive income was $2.10 which even though not much it was yet again the highest amount of passive income I’ve generated year to date and every 3 months I get a larger passive income due to constant investing.

All and all September great month for income (added about $400 extra doing very little work) not as good as some people aka this guy named Jason Fieber but I can’t complain.

Tyler

Wow Jason! Congratulation!

Over $1000 dividends in one month is really a great achievement. This really serves as a great inspiration to me – just keep on saving and investing over the years and you’ll crush milestone after milestone.

Cheers & good luck

DivRider

Sharon,

Thanks! It definitely feels great to hit this milestone. Now I just have to work on getting the other months up to that four-figure mark. 🙂

You’ll get there, too, in time. Just keep working hard. Stay persistent and consistent.

Best regards!

Robert,

Progress is the name of the game when it comes to what we’re doing. Every extra dividend dollar is one dollar closer to the promised land. 🙂

Thanks for dropping by. Hope you had a great month over there!

Cheers.

Vawt,

Thank you. Really appreciate that. Naysayers tend to have nothing better to do than to try and bring other people down. If I spent a considerable amount of my day being a naysayer, I’d never be able to get things done. I’d never be able to succeed. So you have to wonder how successful those naysayers really are.

Glad to be a fellow shareholder with you in some really fine companies. I’m pretty sure we’ll do really well over the long run. 🙂

Take care!

Mike,

Wow! Over $6,000! That’s pretty incredible, my friend. Even if I kept on adding fresh capital well past the point of financial independence, it’d be a good long while before I’d hit anything even close to that. Fortunately, I need less than half of that to have a really high-quality life. But that’s got to feel amazing. Congrats on the success. I know how hard it is to attain big numbers, and I know what kind of work goes into that. Keep it up!

We’ll see how it goes for the rest of the year, but I think it looks good. I’m back on pace and I’ve been fairly aggressive over the last few months in terms of stock buying. So I think it’ll be a strong finish. 🙂

Best regards!

Mike,

You know, I realized afterward that I should have just bought what I wanted to keep and then sold the rest. Live and learn. Although, I think I’ll still come out ahead. Most of the stocks I bought last month are up pretty big, and I wouldn’t have had all that capital without the NOV and BBL sales. And, in the end, I wanted to reduce my exposure to these names anyway. I was more aggressive than I wanted to be simply due to the valuations. But when it’s all said and done, I’ll be right where I want to be. These names are pretty volatile, so we’ll see how it goes.

Cheers!

EL,

Emerson is an incredible deal, in my opinion. I happen to think it’s substantially undervalued. I remember thinking it was a pretty good price years ago when I was buying it around this same price. Then it dropped below even that, even though its earnings power is really greater and it’s paying out a larger dividend. I don’t anticipate going beyond what I already own, but I’m glad to have had the opportunity to load up down here. 🙂

Keep it going!

Cheers.

DV,

Thanks so much, man. Really appreciate the support.

It’s been a lot of fun over the last few years. You sit back and think that it’s been a long while, but it went by so fast. Time is really of the essence with this stuff. Every day you wait is one less day of compounding. Before you know it, the time is lost forever.

Keep it up over there. The light is getting brighter every day. 🙂

Best wishes.

T,

You’ve got it, bud. Every new record is just waiting to be broken.

Onward and upward!

Thanks for dropping by.

Cheers.

Sunny,

It’s definitely a lot of money. The me of 2009 would be laughing in your face if you said that I’d be one day hitting $1,000 in passive income in a single month. But you have to have that belief. If you don’t believe in it, you’ll never accomplish it.

We’ll see how it goes. Looking forward to a strong finish. I’m as aggressive and enthusiastic as I’ve ever been. 🙂

Let’s keep it rolling. Hope you had an outstanding month over there!

Cheers.

Nicola,

Appreciate it!

Feels good to finally break through this milestone. Next, it’s $1,000 every month. It’ll be a while, but I’m pushing as hard as ever. 🙂

Thanks for stopping by!!

Best regards.

Tyler,

Hey, that’s awesome. Best of luck with Lyft. That sounds like a pretty fun way to earn some coin on the side. Not sure how insurance works with all of that, so I’d be mindful. But should be easy money. 🙂

It takes a little while to really crank things up. But it’s exponential, as you can see here. The same goes for side hustles. It took me a long while just to earn $100 from online income. And then it just grew from there. Hard work and consistency pays dividends – literally and figuratively.

Keep it up. I’m rooting for you!

Best wishes.

Thanks for the article Jason. I’m so happy for your progress and know how hard you’ve worked to be where you are today. Investors understand each other. All the sacrifices and the planning. It’s awesome to be here right now so let’s enjoy it bud. Congrats on the goal and keep hustling it up. Yea heard me!? Hehe. Take care and best wishes buddy. Cheers.

Ps. Enjoy that family of yours. Glad you celebrated with wifey.

DR,

I’m really glad this is serving up some inspiration for you. Glad to know that. It’s exactly why I share everything. I have a real passion for this stuff, and I truly believe in it all the way.

Looks like you’re making great strides over there as well. I’d only say to be careful with some of the high-risk, high-yield stuff.

Every day is an opportunity to forge ahead. 🙂

Cheers!

Tyler,

You’ve got it. When others tell me they’ve hit $500, $1,000, or $5,000 in monthly dividend income, I know how much work goes into that. It takes vision, belief, hard work, consistency, patience, persistence, perseverance, and execution. It takes someone years of grinding away to build up that passive income, so I’m always excited for others when they’re breaking new records and hitting their goals. It’s awesome to see this community grow and thrive. Grateful to be a part of it. 🙂

Onward and upward, my friend. I’m giving it 100%, as I know you are.

Best regards.

Sampo,

Thanks! Should be a really strong finish. Looking forward to seeing how it all shapes up. 🙂

I took a look at MKC not too long ago. I focused on valuation with a quick peek at the fundamentals. I think it’s overvalued right now, and that’s true even with a full analysis of the business:

http://dailytradealert.com/2015/08/15/caution-this-dividend-growth-stock-appears-13-overvalued-2/

Hope that helps!

Cheers.

Wow definitely a milestone! Over $1k of dividend income is pretty damn impressive. Gotta love receiving these cheques from these high quality companies. Getting paid $75 from JNJ? Yes please!

Well done Jason, that’s a real milestone in your journey to financial independance. Soon you’ll top a $1000 in dividends four times a year.. Good old BHP certainly bumped up the total.

Tawcan,

You’ve got it, bud. And since I don’t value every $1 the same, I’d rather collect $75 from Johnson & Johnson than $150 from a job. The me of today is getting paid because the me of yesteryear made good decisions with capital. I love it. 🙂

Thanks for dropping by. Keep up the great work over there. You’re crushing it!

Best regards.

Nick,

Soon it’ll be four times per year, and then it’ll be 12 times per year. So on and so forth. That’s the great thing about all of this. You’re virtually guaranteed to hit bigger an bigger numbers over time if you stick with it. 🙂

Hope you had a great month over on your end. It’s great to be on this journey!

Best wishes.

Truly fantastic progress and I’m so happy for you! I’m sure the you of five years ago never envisioned crossing the $1k mark this quick or all the success you’ve had with the blog and being able to quit your full time job at the service department. I have no doubt that you’re going to crush your dividend income goal for the year after all the capital you’ve put to work over the last couple of months and haven’t even reaped a dividend from just yet. Congrats! You’ve earned that comma!

I expect to cross the $1k mark in March once I return to regular purchases each month.

Wow over 30 companies there contributing to your dividend machine. That’s some serious diversity there to go along with the record income. Any thoughts on setting a limiting your positions or will you continue to purchase stocks which are undervalued even if it means starting a new position? Thanks

JC,

Thanks, man. You’ve got it right there. I never would have predicted this much success. I was very confident, once I got going, that I could hit the FI mark by 40. I always felt really good about that. But hitting certain numbers so early and achieving the online success definitely wasn’t predicted or expected. It’s all been really wonderful. I’m very fortunate.

I’m sure you’ll be hitting that number very soon. You’re right there with me. It’s really fun to see our dividend income grow almost in unison. 🙂

Cheers.

Captain,

I love it. Knowing that all of these companies are out there working for me really allows me to sleep well at night. I sleep like a baby. 🙂

As far as the number of positions go, this is what I wrote when I updated the portfolio:

“I can see the Fund one day having exposure to 80 or 90 companies, but, looking at my watch list, I don’t foresee extending past 100 companies.”

As my portfolio grows, the watch list naturally shrinks. I think there are probably a good 20 to 30 stocks I’d still like to own (at the right prices). But we’ll see how that goes. If I finish at 75, so be it. If it’s 100, that’s fine too. I don’t see it going much over 100, though, just based on how many other companies I like. I continue to focus on valuation, but I’ve also maxed out on some positions. So that limits my options a bit. Still a lot of good stuff out there, though. We’ll see.

Cheers!

Congrats! Nice increase. I was$5582 in divi income this month September ’15 vs $3066 one year ago September ’14. FI here I come. Not adding any new funds at this point and will turn off dividend reinvestment starting Jan 1, 2016. I sure hope I can average 6 percent annual increases in divi income once I start harvesting.

DD,

Wow, that’s awesome! No doubt you’re on your way over there. That’s some serious, serious passive income. You’re near the finish line now. How exciting is that??!!

I tell you, I’m having a lot of fun with accumulating assets, valuing stocks, writing, and everything else. But I’m also really looking forward to living off of the dividend income. I’m going to make an aggressive push over the next year and see just what I can do about that. If I could get there a few years early, I’d be ecstatic.

Keep it up. I think 6% is a pretty reasonable target based on what I’ve seen. Depends on your yield and everything, but assuming a blended 4% yield across the portfolio, that’s pretty realistic.

Thanks for sharing!

Best regards.

Way to go, Jason! I’m so incredibly stoked for you. Finally, a four-digit dividend income month! I’ll echo other commenters who’ve pointed out how it must have been to imagine this day when you began. You’re worked tirelessly toward your goal and it’s really paying off 🙂

Looks like we both added an extra digits to our dividends this month! 😀

Huge congrats man, the four-figure mark is an incredible milestone. You’re getting closer and closer to FI!

Keep it up.

Cheers bro

Kate,

Thank you. I’m really fortunate to be a part of this supportive community. It’s a great thing we have here where we all root each other on. Makes it so much easier. 🙂

Boy, it’s one thing to have goals in mind and think about these things you want to do. You can even imagine/visualize it. But it’s quite another thing altogether to actually experience it. It’s humbling. I’m very grateful to be here.

Keep it up over on your end as well. Sounds like you’re totally reinvigorated after FinCon. You’re primed for a great year!!

Cheers.

Alex,

You’ve got it. Every additional comma feels pretty awesome!!

Every milestone gets us that much closer. We’re both now closer than we were yesterday, the day before, or last year. The picture gets clearer every day.

Very excited to see where we’re all at in another year or two. I think, as a community, we continue to surprise ourselves.

Best wishes!

Just wanted to clarify real quick. The government isn’t that easy 🙂 perhaps I misread, but to be sure if you own 100 shares of nov, you can NOT buy another 100 shares and sell your first 100 shares. What you can do is own 100 shares, buy another 100 shares, and then sell your first 100 30 days later. Perhaps this is what you were saying but I just wanted to make sure!

Best,

Took2summit,

Right. That’s what I was saying. I’m pretty sure that’s what Mike was saying as well.

I should have bought what I planned to sell because I felt they were both at extreme values. Then I could have sold this month instead of buying back. But it’s so tough to time that stuff. Like I said, I was going to reduce my position sizes anyway, and the capital got put to very good use. Most of those stocks I bought last month are up pretty big. So factoring that all in, along with the tax savings, I think I’ll come out ahead. But we’ll see how it goes here with the stocks. Didn’t really anticipate much of a big move up, but you just can’t ever tell. Either way, I’ll be happy to right-size those positions and be where I want to be.

Thanks for clarifying that. My apologies if I confused anyone.

Cheers!

Congrats on 1000 in a month. My dividend income took a huge hit because I bought a condo here in sf which is no small amount required, to be sure! I’m starting back up though and got $220 in dividends this months. So not completely starting over!

Quick question, I’ve noticed this entry and the last entry you just quickly say you bought some shares in a company in the middle of another post. Are you no longer going to give in depth analysis on each purchase? I quite liked that aspect of the blog.

Just some positive feedback!

Best,

Thanks yeah, my portfolio has a 4 percent blended yield. All usual suspects, about 60 classic dividend growth stocks. Only high yielders > 5%, are: T, Vz. VOD, PM, RDS.B, TOT, BP, STO, COP, CVX, GSk, TUP, and BBL. Nothing too crazy! I worry about the oil majors maybe having to cut if oil stays down for a long, long time.

Jason,

To quote C-3PO as we’re both DIS shareholders: Wonderful!!

What can I say that hasn’t already been said by everyone else? Congratulations to infinity and beyond.

BBL makes March and September a heck of a lot of fun. What makes your portfolio stand out is the diversity. My eyes hurt trying to count that list of dividend payers. Soon you’ll be getting a new deposit every single day. Wow.

Now set your sights on four figures every month and leave three figures behind for good. I have a feeling you’ll achieve that goal sooner rather than later.

Who knows? In a couple years you might be drawing up the pizza joint by the beach plans 🙂

Best,

Dan (DWC)

Hi Jason, I’m 24 years old and just starting out. I just wanted to let you know that you provide a lot of information as well as inspiration for me to continue doing what I’m doing. While I know that this is no get rich quick sceme, based on your experience, when did you start noticing your dividends giving you more shares?

Congrats Jason!

Would you mind sharing your thoughts on your recent purchase of CNP or will you be posting a buy article?

What type of investor is this stock best for? I am a little younger than you and trying to find the correct balance between yield and growth and interested to hear your thoughts.

Thanks as always!

You’ve done it. You’ve finally done it. The four figure mark. All without having to lift a finger. Passive income. Who wouldn’t love it?

Wait until we see your full results for NEXT year after the buying spree you recently went on.

Sincerely,

ARB–Angry Retail Banker

Dividend Mantra,

Congrats on passing $1000 in one month for the first time. Definitely better than active (job) income any day!!

1000k per month…..without going to office, getting up early, rushing home back from office. Good job.

I crossed half of that this month and I was pretty excited.

In 2013 I got $92 for September dividend and now in 2015 its increased a lot.

Will keep chugging along!!!

Dividend Mom.

Jason,

Wow, it must feel amazing to see that 4-figure milestone reached! I hit a personal record at $144, but I haven’t been at it as long as you have. Then again, I can’t imagine hitting that mark as soon as you did. Great job!

As for the naysayers, I’m going to repeat myself on a previous comment. At the end of the day, the changes you made to the site are necessary because you’ve been successful. In my opinion, it’s not really fair for the folks that you’ve been helping and inspiring to begrudge you that. We’ve been cheering you on, and you’re making it … the goal is in reach. Why stop cheering when the game is close to being won.

Not being able to see your monthly income and expenses is no big deal from my perspective. Your analysis, recent buys, dividend income, and everything else is far more valuable.

Now that that’s out of the way, I was wondering if you’ve ever taken a look at STON? VERY nice yield, P/E ratio, etc. Also, it has been raising the div quarterly. And it seems like future growth is pretty certain considering the wave of baby-boomers on the horizon (not to be morbid, but a realist).

Keep up the great work, and I’m looking forward to the new content.

Jake

Took2summit,

Wow, congrats on the condo purchase! Best of luck with that. I understand the Bay area is crazy expensive as far as real estate goes, as well as just general cost of living, so it’s not my cup of tea. But I also hear the quality of life is pretty high out there (for those that can afford it). 🙂

My writing schedule has been reduced here, so I’ll be a bit limited in terms of how many analyses I can publish. I’ll probably be putting out about one article per week for the foreseeable future. So you’ve got the portfolio update and dividend income update taking up two weeks of content production right there. That leaves me a bit limited in terms of what else I can write about, which also means my ideas will be competing with each other for the first time in a while. I’ll definitely try to put out as many “Recent Buy” articles as I can going forward, especially for new stocks I haven’t published an analysis on, but I’ll be limited. I still have to go over the third quarter’s dividend growth update this month, so that leaves me with probably just one other article here. That just goes to show how much content goes into all of this. But I’ll do my best!

Cheers.

Jason – Congrats on the dividend income this month, you really smashed it man!

Congrats, DM! on crossing milestone figure of $1K+ and almost 40% yoy growth. This is the result of your patience, hard work and regular investments. You came close to this figure and finally smashed it with a big bang. Keep racing towards FI.

Sorry I didn’t make this clearer. Agree with the comment.

I just hit $250 this month in passive income, up from $150 last september. I’m 28 years old and if I can hit $2k/month by 40, I will be very happy. Good job Jason. #Feelsgoodman

Great job hitting the $1000 mark!! That is an awesome feeling. You inspired me last year to start tracking my monthly dividend/interest income and this past September was my first YoY comparison I had available…I had a nice 12% increase vs last year. What a great way to focus on what’s important and prove to yourself that this really does work, proof is in the pudding.

Congratulations! It’s really neat to see so many companies listed for the month of September. Stocks have been up recently, so hopefully you can find some good deals to roll this $1,000 towards.

You know what’s really great? What’s great is that you are now seeing dividends abound and proliferate. You tweeted, recently, that you enjoyed just hanging out and playing a video game (something you have had zero time for until late)=dividends! You just achieved your first 4 figure month=dividends! Congratulations. That’s what life is all about. Achievements, your way, full circle and well earned. Nobody gave it to you. You own it. Reading you and being able to watch this play out for all of us at the same time…..dividends! We’re almost there! I can’t believe it.

Awesome Jason! I love your dividend updates. Have you ever considered silver and gold mining stocks? Some of them pay dividends as well. They have a low price right now and may provide a great hedge against an inflationairhy bubble if the FED doesn’t dare to raise interest rates.

Jason: will you spend the entire $1029.13 on more stocks.its quite a milestone

Jason,

This is a HUGE milestone, and you have worked so hard to hit it. I’m interested in your decision to go after a few higher yielders lately. With potentially lower near term growth, you must feel quite confident in their ability to sustain their payouts over the long run.

Mike H,

Do you have a site or blog? Would love to have a look in your kitchen.

Thanks, Anon

Wait, why are you limited now to only one article per week? Was that part of the deal with the site? Because I thought this deal was going to free up your time to create content, instead of forcing you to do website admin work 24/7. I know that there will be other content writers on Dividend Mantra, but I didn’t think you were being limited. Or are you branching out into other things (I know you’ve been writing on Daily Trader Alert more since September).

Shame, because the Recent Buy articles were, along with the Dividend Income articles, my favorites.

Sincerely,

ARB–Angry Retail Banker

Jason

congrats for crossing the $1000 dividend income milestone. Waiting to see your December income. I am sure it will hit another record 😀 .

I am about to hit $600 dividend income per month.

Keep rocking!

Cheers,

Jason,

As a friend of mine who is from Michigan would say. “that’s hype.” Congrats on joining the 4 figure club, enjoy that record that you will break time and time again! Its awesome to earn over $1k in 35 little pay checks, its just astounding how far that goes.

– Gremlin

Congratulations on breaking the 1000-in-a-month mark! This is huge milestone and seeing you cross it really puts a smile on my face. It seems just like yesterday when we were talking about the day when you pass that goal. I remember when I reached that milestone myself, it was one of the most electrifying moments in my life because the light at the end of the tunnel was very bright.

Before you know it crossing the 1000 mark will become routine!

Mr. Fieber,

As a frequent visitor to your blog I’ve read a ton of inspiring material but THIS really hit home:

“Life is too beautiful to spend it miserable, rotting under fluorescent lights every day…”

As I sit here in my cube, under these god awful lights, I continue to invest what I can with the hope realizing my dream of financial independence someday. I’ll trade 6% of my life for 1000k a month anytime.

Good day Jason

well done on breaking over $1000 in a month in dividends. I hope the rest of the year you do as well or even better in dividends. Keep up the good work. I am waiting to see your next buys to add to the freedom fund. Again well done Jason

Cheers

“But had I never started in the first place, that five years still would have gone by. It’d still be 2015. And I’d still be worth less than a baby.” Just shows how powerful one idea can be. When you nurture it and feed it , it will grow and grow. Got my daily dose of inspiration. 1k a month for being an owner not just a consumer! Well done Jason.

Andrew

SHM

Hi Jason,

Congratulations on hitting four figures in September dividends. It seems quite far off as I just started out. I’ll be sure to check in on your progress towards your annual goal. Keep up the great work. Cheers.

Congratulation on making this milestone! It’s amazing how far you’ve come in only 5 short years. Anyone can do it. You just have to make some sacrifice early on. Great job on your expense as well.

ARB,

I’m not limited by anyone. But the days of me writing 30 to 40 articles per month are over. Like I said before, I don’t want to burn out or repeat myself over and over again. Factoring in freelance writing and what I plan on contributing to the site here for the foreseeable future, I’m probably going to be producing 20 or so articles per month. It’s a dream come true to see my work in demand and desired, but I also realized at some point there that I don’t need to write an insane amount of stuff to contribute meaningfully to the community and inspire others. I see a lot of bloggers/writers in this space putting out 5-10 articles per month, and they’re doing great things. I don’t need to go crazy, but I’ll still be writing something like 2-4 times what most people in our community put out (my additional flexibility helps a great deal). It’s a good balance for me.

I’ll still be focusing solely on content, but just not to the level where it starts to affect my balance/quality of life. 20 articles per month is like a nice part-time job (30 or so hours per week) for me, and that’s something I’m comfortable with right now. If you know of someone who writes significantly more content than that (and it’s high-quality stuff; many of my articles are 2,000+ words), I’d encourage you to follow their work closely. It’s very hard to do that for a lengthy period of time without getting burned out, in my opinion.

Hope that clears it up for you.

Best regards!

Dan,

Hey, any Disney reference is a good reference, in my book!

Yeah, that’s just crazy to think about receiving a dividend every day. You know what they say: A dividend a day keeps the doctor a way… or something like that. 🙂

Ha! The pizza joint by the beach. I remember having such a dream. Although, these days I’m more interested in a low-stress, low-key lifestyle. So I’ll probably just stick to eating someone else’s pizza by the beach. Never know, though.

Thanks for dropping by. Best of luck with the decision over there.

Cheers.

Casey Le,

Good for you for starting out so young. That’s such a huge advantage. That puts you on a great trajectory. The more time compounding has, the more powerful it is. Awesome! 🙂

I started to notice that “critical mass” where the snowball was starting to accelerate on its own some time last summer or so. I was starting to produce about $500 per month in dividend income, which funded almost 1/2 of a monthly purchase all by itself. At that point, I felt like things were starting to really take off. And I also knew that financial independence (and millionaire status) was nothing more than a foregone conclusion.

Best of luck over there. Great job starting so young.

Take care!

Joe,

Thanks so much!

Great question there on CNP. I already wrote an article on CNP, which will be coming out this weekend over at Daily Trade Alert. So keep an eye out for that. It’s a quick check on fundamentals with a focus on valuation. All in all, I view it as a fairly ordinary utility in terms of fundamentals. What’s exciting for me at this point in time is twofold: The valuation is very compelling, which has forced the yield up beyond most utilities. And they have a focus on generation/distribution.

As far as your other question, it’s tough to say. I did write an article exploring that a little bit here:

https://www.dividendmantra.com/2014/06/a-multistage-rocket-model-for-a-dividend-growth-stock-portfolio/

I’d try to think within the framework of portfolio construction at a holistic level. What kind of yield do you want based on your long-term objectives/time frame? I’ve always targeted a yield of around 3.5%, so I’ve based my purchases around that. I’m now attempting to boost that closer to 4% so as to move a little faster, but you can see in my portfolio that I’ve balanced out those low-yield stocks (DIS, V, etc.) with the higher-yielding stocks (T, VZ, etc.). And then most of the portfolio is invested at that mid-level (KO, JNJ, etc.). That’s comfortable for me, but everyone is different.

Hope that helps!

Cheers.

ARB,

I’m loving it, my friend. I remember waiting tables in college. It used to take me a whole MONTH to hit this kind of income. And that required a lot of hard work and running around. Now I don’t have to do any of that. Feels amazing.

Yeah, next year is going to be exciting. Exponential growth is starting to take off just as I’ve been more aggressive with buying over the last few months. Those two events should combine and allow for something really special next year. We’ll see!

Hope you had a great month over on your end, too.

Best regards.

IP,

You’ve got that right. This, in my opinion, is like collecting $3,000 from a day job. A dollar certainly isn’t a dollar for me. I value these dollars much more. 🙂

Keep up the great work over on your end as well. One dividend at a time!

Cheers.

DM,

$1,000 is a nice chunk of change. But it’s a lot nicer when you don’t have to work for it. 🙂

Great job over there!! Moving up from under $100 to over $500 is some extreme progress. I don’t think I’ve ever been able to progress at that kind of rate YOY. That means you’ve been putting a lot of capital to work. Keep it going!!

Best regards.

Jake,

“Why stop cheering when the game is close to being won.”

That’s funny you say that. A reader commented on the article where I discussed the upcoming changes that she wasn’t interested in following any longer because I was too hard to relate to. She found things easier to relate to when I was still struggling. I find that very strange. The whole point of all of this is to build income, succeed, become free, and make your dreams come true. It’s like claiming that you’re a fan of your local baseball team and following them religiously… up until they make it to the playoffs for a strong run at the World Series. Then abandoning them because they’re “winning”. I don’t get it, but to each their own.

Appreciate the support, though. I only know how to be true to myself and follow my heart. If that makes me difficult to relate to, I can’t really apologize. I can say for sure, though, that it has led me to some wonderful places and I’m slowly making my dreams come true. I have no regrets. 🙂

Can’t say I’ve ever looked at STON before. I’ve automatically filtered out MLPs over the years in part due to the tax concerns. I’ve also preferred GPs due to the more attractive growth profile. Doesn’t look like they have a GP, though, so I may have to take a good look at it. Certainly like the economics of the industry. Not much change there. And the service is ubiquitous and necessary. I don’t foresee immortality taking hold any time soon. 🙂

If I take a look, I’ll let you know what I turn up!

Best regards.

Great Results Jason! Congratulation for $1xxx – really nice extra income!

DA,

Thanks so much. I’m truly giving it my all over here. Leaving nothing on the table. 🙂

Looks like you had a solid month over on your end as well with the $50 you collected. Keep building on that. Keep rolling that snowball!

Cheers.

R2R,

Thanks. It’s definitely the culmination of a lot of hard work, persistence, patience, consistency, and belief. 🙂

You’re doing great over on your end as well. I can only wish I was working with your kind of capital. You’ll surely blow by four figures very soon, and much sooner than I did. Keep at it!

Take care.

Awesome work, Jason. Those investments over the last few months are yielding results already. Congrats on hitting the magical milestone of a four-figure income per month.

Upwards and onwards!

R2R

Chris,

That’s a great spot to be in, my friend. I didn’t even open up my Scottrade account until I was almost 28. So to be earning $250 in dividend income already, you’re in a fantastic position. 🙂

Can’t imagine you won’t be earning $2k per month by 40 at that rate. Keep it up!

Cheers.

Randall,

That’s fantastic, my friend. I think tracking all of this is extremely important. Being able to see that dividend income against expenses actually makes the journey tangible. You can see those expenses slowly being covered, meaning your freedom is slowly increasing every month. It’s like watching your ship come in. 🙂

The proof is in the pudding, indeed.

Keep it up!

Best regards.

Mitch,

Well, I already put this $1,000 to work last month. I had that record-breaking month for stock purchases in September, and this dividend income helped out quite a bit. So you can literally see the snowball moving faster now. 🙂

Hope you had a great month over on your end as well. Progress is real!

Take care.

divy,

You’ve got it bud. I feel much more relaxed right now. The balance is there, I’m still moving along at a great rate, and the journey is going so well. I loved contributing so much and just working at a superhuman rate there for a while, but it just wasn’t sustainable long term. What I’m doing now is. I feel great. 🙂

Appreciate the support very much. Hard work pays off… literally and figuratively. What’s great about this blog is you can go back and see the first dividend income reports showing $20 or $30 in a single month. And now here we are four years later, and it’s over $1,000 for the first time. You can see every step, every dollar put to work, and every up and down. I’m really proud.

Let’s keep it going. The light is getting brighter every day!

Best wishes.

Niek,

Thank you. Glad you enjoy these updates. Hope they’re inspirational for you. 🙂

I have never considered silver/gold mining stocks or precious metals at all. I just don’t see the value there. I have a little exposure via South32, which was spun off from BHP Billiton. So I’ll have mining exposure, and even more when I get my BBL shares back. Of course, I also have indirect exposure to the mining industry via the machinery plays. But I don’t like investing in those pure plays on gold/silver. Just not a big fan of precious metals.

Cheers!

Amegalo,

I already spent the entire $1,000+ on high-quality stocks last month. I reinvested the income almost as soon as it came in. Gotta keep rolling that snowball. 🙂

Take care!

DDD,

It’s a big milestone. Hopefully, the first of many. 🙂

Yeah, I’m still investing in high-quality stuff. But I’ve really spent the last year or so building out a lot of low-yielding stocks with better growth potential. Stocks like GILD, V, DIS have all been on my radar (and in my shopping basket) over the last year, which has reduced the overall yield of my portfolio. Glad to have that quality and growth potential, but I’m now swinging back in the other direction to focus more on yield. Every additional dividend dollar today brings me that much closer to the end goal. If I can move things up a little bit, I will. Recent buys like VZ, CNP, and HCP all help swing things back around for me. We’ll see!

Best wishes.

FJ,

Thanks so much. It feels amazing.

Congrats over there. $600 in dividend income per month is awesome. That’s not far behind where I’m now at. You’re doing great! Hopefully, you can knock out that credit card debt at some point. 🙂

Cheers!

Gremlin,

I’ll take hype any time! 🙂

I tell you, those “little” dividend checks really add up. $20 here and $30 there adds up in a hurry. The power of pennies!

Thanks for dropping by. Congrats on your big YOY dividend income growth. Keep it rolling!

Cheers.

Spoonman,

I feel the same as you. It’s definitely electrifying. And that light is getting quite bright at this point. Feels really amazing. Nothing can stop you once you get to this level.

Hope you’re having a great time over there. Aggressively accumulating high-quality assets that pay growing cash flow and then aggressively living off of that income is the way to do it. I quite love analyzing stocks, writing about all of this, buying stocks, and living out the accumulation phase. But I’m also very much looking forward to living off of that income. Not only do I not suffer from OMYS, but my big problem might be making sure I don’t bounce too early. 🙂

Thanks for the support!

Best regards.

Neil,

I’m glad you found inspiration in that. I don’t mean it to be condescending. I mean it to be fully motivational. Glad it worked for you. 🙂

I woke up at almost 11 a.m. today. I took my little dog for a walk. Ate a nice, long lunch. Then I walked over to Starbucks and grabbed an ice coffee, fired up the laptop, and started responding to comments, polishing up some articles, and just living the life I want to live. You’ll be there one day as well. Just stick with it. The progress is real. It’s tangible. And it’s too good to pass up.

Best wishes!

Michael,

Thank you so much. Appreciate it. I can only wish you the same level of success/progress. 🙂

Won’t be as active this month, but I’m still putting away as much as I can. Bought more VZ earlier this month. Initiated a position in CNP. And today just bought a little bit of YUM after the drop. Still picking those opportunities off as I see them.

Stay in touch!

Cheers.

Andrew,

I tell ya, being an investor is far better than being a worker. The paychecks come much easier, that’s for sure. 🙂

Appreciate the kind words. I’m very proud of how far I’ve come. Yet I still have so far to go. I continue to work hard and keep my eye on the long term.

Thanks for dropping by!

Cheers.

Dividendniche,

It might seem far off now, but the light becomes brighter every day. It wasn’t that long ago that I was collecting $20 or $30 per month in dividends. Just a few years ago. So you can see what’s really possible here. 🙂

Keep at it!!

Best regards.

Joe,

Thank you so much. I’m really proud. A lot of hard work has gone into making this possible. But what’s great about this strategy is that’s rewarding in such a tangible way. You can actually see the hard work paying off. It pays dividends… literally and figuratively. 🙂

And you’re right. Anyone can do this. I’m nobody special. Just a guy with a big dream and a lot of drive. You have to believe, though. And you have to really want it.

Thanks for the support!

Best regards.

Patrick,

I know nothing other than giving it my all. Still marching forward. Still plenty to come. 🙂

Take care!

R2R,

Upward and onward, indeed!

It’s a big milestone. Very proud. And I took a moment just to let this sink in and really soak it up. But it’s back to the hard work, plowing forward, and making sure that every month is like this. Can’t let up now. The finish line isn’t far off now. 🙂

Thanks for stopping by. Let’s keep it rolling!

Best wishes.

Congrats on breaking the $1,000 level! I started investing about the same time as you and have added up my monthly dividend income for the last 2 months and have similar results as you. Very encouraging seeing it add up. Usually I just look at the estimated annual dividend income that my brokerage reports for each account. It’s a bit tedious and seems to make savings take longer by doing calculations each month and I wonder if it would seem to accumulate quicker by not keeping track as often.

Mark,

Hey, that’s fantastic. One great thing about this community is you have all of these people along for the ride with you, supporting you.

You can track as much or as little as you like. It’s your money, your income, and your journey. But I think there’s a lot of value in tracking the results to see exactly where you’re at. Seeing that income rise against expenses is a real thrill. Also gives you an idea of where extra progress might be possible. I also know for sure that I’ve been more aggressive than I ever would have been otherwise by tracking everything like I do. I’m constantly aiming to push those numbers along as much as I can. Serves to motivate me quite a bit.

Keep it up!

Take care.

Wow! I feel happy for you! 🙂 Well played over the last 5 years.

Sensim,

Thank you so much. Really appreciate that!

I always believed in this. And I continue to believe in it. Can’t wait for the day that I’m able to post that long-awaited article on reaching financial independence. It’s coming. 🙂

Hope the journey is proving to be just as fruitful for you.

Best regards.

Wow! And I thought you were going to hit this coveted 4-figure mark in December! I’m sure it must feel good that come year 2016, you will routinely hit that 4-figure mark at least 4 rimes a year, and in the coming years even more frequently!

That is impressive growth in dividend income just within the last year or so. You will hit financial independence well before 40 y/o in my opinion. And may I say, since I’ve been following your blog for the last few years, it’s been a real pleasure seeing your progress from $5000 to your Scottrade account to routinely hitting 1/5th of that 4 times a year.

You’ve inspired not only myself and judging from the sheer number of comments from your posts, others as well. I hate to sound repetitive but I can’t help it… Congratulations again!

take care,

j

btw, I’m so glad I picked up KMI @ under $28 a few days ago!!

j,

Thank you so much. Feels really wonderful to have supportive readers like yourself, especially when there’s been a lot of unwarranted criticism going around lately. 🙂

You said it there. My first deposit back in January 2010 was $5,000. I’m now earning more than that in dividend income per year. Pretty soon I’ll be earning twice that per year. For doing nothing. It’s incredible. This strategy works. It’s real. Financial independence IS attainable for us. We can get there.

I’m glad you’re taking away a lot of inspiration from these articles. It’s a real dream of mine to be able to inspire other people via the progress I’m making with all of this.

Let’s keep it up. We’ll one day be able to claim that we’re financially independent. And once you’re there, there’s no knocking you off that mountain. You only need to get rich/become financially independent once.

Cheers!

j,

I hear that. Got in just under that mark. That’s practically giving it away!

Wish I would have waited another day or whatever it was, but I’m not unhappy with being able to steal away KMI at that price. Incredible. 🙂

Cheers.

As always, inspiring and great to read how relatively small amounts can add up to one awesome total. As you stated, time waits for no one and whether we like it or not a future self on one year, five years, ten years or more will most likely emerge. What steps do our present selves take to enhance our future selves lives? Nice long list of companies paying last month. Great diversity too. Congrats on the four digit mark. It looks like you’ll hit that 2015 dividend income goal.

Keith,

Absolutely. That future you will arrive one day, whether you like it or not (assuming you’re still alive). Will you like what you’ve become? I’m always mindful of that. People talk about delaying gratification, but nothing could be more gratifying for me than to arrive in style at 38 or 39 years old, financially independent. Able to do live life on your terms? Be your own boss? Create your own schedule? Travel the world? Be the you you want to be? What could be more gratifying than all of that?

Thanks for dropping in. More progress ahead. I’m still rolling away!

Cheers.

Hi DM,

Great month there, congrats on surpassing the 4-figure mark. Keep pushing that snowball. It seems we have quitte a few payments in common.

Keep up the good work.

Cheers,

Geblin

Okay, that makes more sense that it’s to avoid burnout. I misinterpreted what you wrote as some sort of contractual hard limit, which would directly contradict the reason you made the changes in the first place.

Sad to see the regular Recent Buy articles go. I’ll have to follow your freelance writing more. I love anything you write that focuses on analyzing one company (or a small group of companies) in depth. I tend to read those, and then read them again.

Sincerely,

ARB–Angry Retail Banker

Thank you Jason, that helps very much. I will be following along as always and look forward to the article!

Jason,

Congrats on achieving yet another monthly milestone, this is becoming awfully routine! I’m happy to be part of your audience and look forward to each month’s progress.

I managed to eke out another $500 month myself, back to back, and can already see the day I reach $1,000 (although it’s quite a ways away!) Unfortunately all my income shall be put towards a down payment for the next six months, I’m eager to start investing again around April, unless Mr. Market provides too many opportunities I just can’t pass up…

Best,

Karl

Congrats on crossing the 4-figure mark! I still have a ways to go before getting there, but very inspiring!

Geblin,

I’m pushing away, my friend. Can’t remember a time when I pushed harder, or wanted to push harder. My desire hasn’t faded even a little bit. 🙂

Glad to be a fellow shareholder with you in a number of companies. These are truly world-class businesses. Wonderful to know we’ve got all of these people out there working for us and sending us the check. Much better than working for ourselves!

Cheers.

Karl,

Thanks so much. It’s great to be able to share this journey with you guys. I’m truly blessed. 🙂

Congrats on back-to-back $500 months over there. That’s fantastic. That kind of passive income covers a really big chunk of expenses. I know for me that would cover my food, mobile phone, and most utilities. Especially if I clamped down on the food.

Best of luck with building up that down payment fund!!!

Take care.

wgmast01,

Hey, it doesn’t take long at all if you really go after it. I remember collecting $20 or something back in early 2011. And now here we are just a few years later. 🙂

So glad it’s inspiring, though. That’s why I love sharing all that I can.

Best regards.

You just made in div income what my check was for 2 weeks of work. I had to do some shoveling, I have a blister on my hand, my back hurts from driving around 1000 miles, not to mention the risk of safety on the road and cardiovascular deterioration. Other job related stresses that I won’t even get into, you my friend did not have to suffer that this last month, so yes, 1000 in passive income is worth SOOOOO much more than earned income via work. So many inherent risks associated with work.

Congrats man!

I’m not too awfully far behind you!

Well done! I am on my way to my first three digit month with my dividend income thanks to your advices. Keep up the good work!

Congratulations Jason ! I think that you will beat the 7.200$ goal easily. Every quarter should be better and better…so everything is said…je je je.

What´s your opinion about Tupperware Brands (TUP). The stock price has been suffering a horrible 2015, so in these days the stock is in P/E 12 and 5,15% yield. Do you consider a good choose for a DIG investor ? Thanks.

Jason-

$1000 per month in passive dividend income is a big milestone! Congratulations my friend! This sure is a belief builder for a lot of us who are just getting started on this journey.

Also, I think you are more than keeping up with regards to staying in touch with all the blog subscribers and visitors even with the administrative changes to your website.

I know you were busy shopping last month, any stocks that you are considering for the month of October?

Hey Jason –

You probably already heard, but wanted to give you the heads-up — Scottrade was hacked, and information from their database(s) was stolen by hackers. I have a Scottrade account too (although I haven’t used my Scottrade account in years… I have been using a different broker I’m much happier with.)

Scottrade claims that only names and postal addresses were taken. I find that to be extremely hard to believe. I’d bet dollars to doughnuts a whole lot more information was stolen.

Crossing our figures that nothing bad comes of this to you, me, or anyone else ….

Ryan

Jay,

I know EXACTLY how you feel. I remember waiting tables back in my early college days. It would take sometimes an entire month for me to earn this much income. And that was after serving up food, dealing with moody cooks, turning countless tables, coming in early and/or staying late, working doubles, taking care of cleaning stations, etc. That job isn’t easy. This job, however, is simple. I much prefer being an investor to a worker. 🙂

Sounds like you’re an incredibly hard worker over there. That bodes well for you in terms of getting to where you want to go as soon as possible. I truly believe in the power of hard work. Luck is pretty great when you can get it. But you can make a lot of your own luck via hard work.

Keep it up over there!

Cheers.

Marco,

That’s fantastic! 🙂

The first of many, I’m sure.

Keep it rolling over there.

Best regards.

Hi Jason,

I enjoy reading Your blog!

My question: How much of this remains after tax? How much tax do You have to pay on this in the US? Or is this amount already after tax?

Seotxe5,

I actually wrote about TUP not that long ago:

http://dailytradealert.com/2015/06/12/these-13-dividend-growth-stocks-go-ex-dividend-next-week-3/

It’s an interesting company. You obviously have to be comfortable with the direct-sales business model. And you have to be comfortable with emerging markets since about 90% of their sales are generated outside the US. The strong dollar has really hurt them lately because of that geographic mix, but I’m sure that’ll turn around at some point. Venezuela has been a particularly sore spot for them.

In the end, I view it as more of a value/yield play, which isn’t necessarily bad. Not sure it’s a good candidate as a dividend growth stock, though, because of the short dividend growth history and the fact that the dividend hasn’t been increased since early 2014. Of course, a lot of dividend growth was probably already baked in with that big increase back in early 2013.

Not sure how comfortable I am with the direct-sales model, which has kept me on the sidelines. I like the empowerment angle, but you do lose some control over the brand. In addition, I’m not sure their advantages aren’t going to be chipped away as the internet continues to become more accessible to more people in some of these countries.

Hope that helps!

Take care.

denver,

Thank you so much.

I love posting this because it’s the “proof in the pudding”. It shows what’s possible. I started out with practically nothing back in early 2010. Now I’m earning somewhat significant passive income. The progress is real. 🙂

Appreciate the support there. I’m doing my best to still produce great content and stay in touch with everyone. It was just a situation where the work load had to be lightened. I feel a lot better with the new schedule.

As far as stocks I’m buying, you can follow me via Twitter or Facebook and see exactly what I’m up to. I’ve bought more VZ, and initiated positions in CNP and YUM thus far this month. And, as previously mentioned, I’ll be going back after BBL and NOV at some point here pretty soon. So that’s where my capital is going. If other opportunities open up, I’ll see what I can do.

Stay in touch!

Best wishes.

Ryan,

Thanks for the heads up there!

Yeah, I received an email about that with the explanation and what they’re doing about it, as I’m sure everyone else involved did.

Unfortunately, it’s a risk when you’re doing any kind of online activity. If you’re following the news, you’ll see that our own government is getting hacked among major businesses. So if our government isn’t safe, I don’t see any reason why one would expect private companies to be any better off.

The good news is that, as discussed in the email, Scottrade was pretty proactive about it in terms of cooperating with authorities and then handing out free monitoring for customers. In addition, Scottrade has progressive policies in place in regards to protecting funds in case such a breach were to occur.

I can tell you that I contacted them and made some noise, resulting in a considerable number of free trades. You may want to consider the same.

Cheers!

Marcus,

One’s tax situation will depend on a variety of factors. What you see above is gross amounts.

The great thing about dividends is that the taxation here in the US is very favorable. If you’re within the 15% tax bracket or lower, qualified dividends are taxed at $0 at the federal level. So if you live in a state that doesn’t tax your income (like, say, Florida), you could end up earning $47,750 in qualified dividend income (after factoring in deductions) as a single filer and pay $0 in federal taxes, $0 in state taxes, and $0 in FICA (FICA is never taxed on dividends). Pretty sweet situation.

For those that earn more than that, qualified dividend income is generally taxed at 15% at the federal level. I’m earning more than that right now, so I’m paying 15% on the qualified dividends and normal income tax on the non-qualified dividend income.

I’ve touched on taxes a few times here, but taxes are really difficult to quantify for everyone. In the end, the taxation is very favorable toward those that could live solely off of dividend income. I’d encourage some research on your end if any of that is unclear of you’re interested in more information there.

Hope that helps!

Cheers.

I wish I could have bought KMI that low! I saw it under $26 and was salivating, but couldn’t get funds transferred between accounts and brokerages in time to buy. . . It went back up real quick! Oh well, at least I still have 150 shares!

I just can’t raise capital fast enough for some of these bargains!

A dollar from a dividend stock is different than a dollar from a job. You get taxed completely differently. 🙂

Tawcan,

Absolutely. 🙂

A dollar isn’t a dollar:

https://www.dividendmantra.com/2015/04/active-versus-passive-a-dollar-isnt-a-dollar/

Cheers!

Daniel,

Yeah, I remember thinking I got away with robbery when I snagged KMI below $28, then witnessed it drop somewhat significantly shortly thereafter. Absolutely insane. OKE and other midstream plays were doing the same thing. A real gift, in my view. I never planned to own more KMI, but just couldn’t pass it up there. Hope that doesn’t come back to bite me because I did take on a little more risk than I really wanted to.

Definitely still some bargains out there, but I’m hoping we get more volatility. October has started off rather miserably for those of us allocating capital/accumulating assets.

Cheers!

Congrats for the record 😀

Keep it up

Thanks for the article Jason, keep up the great work!

[quote]Five years is a long time, no doubt about it. It’s probably something like 6% of my entire lifetime. So it’s not trivial.[/quote]

Did not know you were 83 years old already!

Mantra,

You did it man. You damn well did it. The illustrious 4 digit month… So awesome – BIG congratulations. A lot of time, effort, consistency, patience and passion went behind that. Congratulations. This will be your time Jason – December you’ll be shocked as heck I am sure with many dividend increases coming this and next month. Let it soak in!

-Lanny

Hey Jason,

great september income, it is really nice to follow your impressive journey. I am just at your starting point five years ago 🙂

Johan,

Ha! Not 83 years old yet, but probably a pretty solid guess at what my lifetime will be. Hopefully, I get to live even longer. 🙂

Thanks for dropping by. I plan on keeping at it, and I hope you do as well!

Cheers.

Lanny,

Thanks, bud. Definitely a lot of all of that behind this. Hard work, consistency, belief, persistence, patience, and dedication. All of it.

You’ll hit that four-digit mark pretty soon at your rate. You’ve got all the ingredients. The one we can’t control – time – will do its thing, and you’ll be there before you know it. 🙂

Best regards!

Andreas,

How exciting! You’re right where I was just a few years ago. That’s exciting because you’re embarking on a life-changing journey. And you can see that it doesn’t take long to experience fairly radical results. 🙂

Best of luck over there. Be patient. Be humble. Be hungry. Give it your all.

Take care!

I enjoyed your article about the second $100,000 being faster to achieve than the first. The second $1000 in dividend income should definitely come faster than the first, especially with the tear you’ve been on lately.

Hey Jason,

I’ve been reading on your site for a while now. I bought and sold shares for many years always chasing that short term profit. Since a while I am interested in long term investing, and building up a steady income stream via dividend. I had about 15 Euro dividend per month living in Germany up until a few month ago. Now after finishing my studies I moved to Australia. Just signed up with a broker here. I can buy shares from Australia, US, Canada and the UK very easily. And my work here provides me with enough cash to buy at least one new position per month.

Kind of feel like a kid in a candy store. Fresh new start and a whole world to invest in. First goal is to cover my phone bill, 70 $AUD per month. Reading your post about how you hit 1000 Dollar in a single month really makes me see the bigger picture. It is not about that one month at the start, the first position, it’s about taking steps in the right direction, one step at a time.

One day I am gonna be there too!

Hey Jason,

I’ve been reading your posts since September 2014. You have inspired myself and many others to start saving and investing for the future. I’ve been buying stocks since a year and have earned approx $325 so far this year.

My total annual projected dividends is approximately $850

Congratulations on this milestone of a $1000 in a month. May you cross many more and may you continue to inspire and teach.

Blessings!

bluegrassdividends,

Thanks so much!

Yeah, you’re absolutely right about that. It’ll be fun to see the dividend income really accelerate over time as the numbers grow larger. The bigger the snowball, the faster it rolls. 🙂

Stay in touch. Hope you’ve been on a tear lately as well!

Cheers.

Martin,

“It is not about that one month at the start, the first position, it’s about taking steps in the right direction, one step at a time.”

You’re absolutely right. It’s about incremental progress. Every dollar you’re able to save and invest can not only turn into two or three or four (or more) dollars down the road, but it can potentially provide you growing passive income for the rest of your life. That’s pretty powerful. And the results are tangible. Short-term trading seems exciting, but the thought of making an investment one time and collecting checks every year for decades is far more exciting for me.

You’ll definitely get there one day. Just stick with it. If I can do it, so can you. 🙂

Best regards.

DGP,

Congrats on your success thus far! It only gets better from here. 🙂

It’s a real blessing to be in this position to inspire others like yourself. You’re positively changing your life in a big way. There’s a future version of you 10 or 20 years out, and you can’t even imagine how much better off this person is now that you’re engaging in these activities. Great stuff.

Appreciate the readership. Wish you continued good fortune with your journey.

Best regards.

Congratulations on your recent success with the website, and an even bigger congratulations on hitting four figures in one month! It seems silly but seeing those milestones 1, 10, 100, 1000 dollars etc just seem to make it all sink in a little bit more that you can eventually replace an entire income with dividend disbursements. That’s 1000 less dollars you need to earn on this quarterly cycle every single year for the rest of your life! Keep on motivating!

Excellent!

Hi Jason,

Congratulations on an outstanding month – that magic four figures must feel great! As to your note that you hope it acts as an incentive – it certainly does! Just watching each month tick up and also looking back to the previous year to see the increase is a very motivating thing!

My September wasn’t too bad in the end, just under 600GBP, my best yet for sure, so I wait to see how we go beyond there. I am starting to build a bit more cash right now as the market keeps ticking up so that when the next drop comes along I can capitalise. I am resisting getting more Shell or BP as I am already overweight on those, so lets see!

Keep up the good work, and as you say, those 5 years would have gone regardless, so having that money tick in without having to lift a finger – a great incentive!

London Rob

Excellent James. It’s like a snowball rolling downhill. Getting bigger and bigger and getting faster and faster. The trick is as always, committing to a frugal lifestyle, and not buying useless stuff. Instead of buying useless stuff, buy more stocks or real estate. I received $4100 In dividends and interest. Also own 3 properties. One in Phoenix, one in my home town in Alberta, and a summer lake lot that my kids and grandkids and I can use together. I will be selling my home and downsizing soon adding another $250k to my dividend portfolio, retiring, and enjoying my retirement income and pensions.

SH,

“That’s 1000 less dollars you need to earn on this quarterly cycle every single year for the rest of your life!”

Absolutely. 🙂

And with the way dividend growth works, it’s highly likely that $1,000 will grow organically (even before factoring in continuing capital contributions). The bigger the snowball, the faster it rolls.

Appreciate the support. Hope you had a great month as well!

Cheers.

Mahumudul,

Thank you so much!!!!

Hope you had a great September, too. 🙂

Take care.

London Rob,

Glad to hear that. My biggest aim with all of this is to inspire via my real-life results. I’m blessed to be able to march toward financial independence in the first place, but to be able to inspire others in the process is just a dream come true. It really adds a lot of value to my own experience, and so I just try to reciprocate that. 🙂

Congrats on your monster month over there. Looks like you came in right behind me. That’s fantastic. Means you’ll be crossing over four figures yourself here in no time. A capital contribution here and a dividend raise there puts you over that mark very quickly. And as that thing continues to grow, the exponential growth curve just extends upward. It’s just fantastic stuff.

Thanks for sharing. Keep it up over there. The time will indeed pass us by whether we like it or not, so we may as well be much better off after it’s gone.

Best regards!

NRG,

I’m with you all the way. Being a consumer seems like fun, but being an investor is way more rewarding. Besides, I think shopping for stocks can be just as much fun (if not more so) as buying any merchandise you can get at a store. Stocks are merchandise and the stock market is my favorite store. 🙂

Congrats on your phenomenal success over there! Collecting that much dividend income alone puts you in pretty rare company, and surely in a wonderful position. I think almost all of us could live a very nice lifestyle with that kind of passive income rolling in. The fact that you’ll be able to add another 1/4 million to the pile puts you even further ahead. Make sure you do end up enjoying it, though. The last thing you’d want to do is end up spending too much time accumulating assets and not enough time enjoying the time/freedom/flexibility those assets provide. I view working too long almost as big a risk as not working long enough.

Enjoy!!

Best wishes.

Hi Jason, I want to ask how much additional money do you put into your Scottrade account every month? How much average monthly income do you make from this blog? Thanks

Great month. Another target reached ! 1K in a month is an impressive number.

You have reach some impressive goal in 2015, 200K portfolio, 1K in a month of dividend income.

Your snowball is getting bigger and bigger and winter is not even there yet 🙂

Hansen,

How much money I deposit into my brokerage accounts really all depends on how much money I make and spend in any given month. But you can see exactly what I’ve made (and spent) since early 2011 here:

https://www.dividendmantra.com/monthly-budgets/

Those budgets, by the way, separate out online income. Online income is composed of both blogging income and freelance income, but that is exactly what I make from my online endeavors.