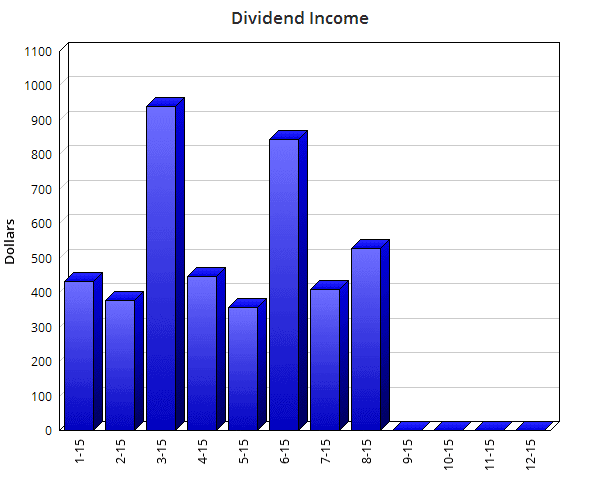

Dividend Income Update – August 2015

I continue to remind myself every single day just how fortunate I am to be in this position. There was a version of me that existed just a few short years ago that earned exactly $0 every month in passive income. If the Jason of early 2010 didn’t wake up and trot off to the dealership at 7 in the morning, he didn’t get paid. When he was sleeping, he was making nothing. When he was sick and stayed home, there was no benefactor dropping money into his bank account. These days, however, I’m getting paid when I sleep, when I’m sick, and, frankly, when I’m doing anything I want. I did absolutely nothing for all the dividend checks that were deposited into my brokerage account this month. Sure, I made great decisions in the past by investing in these wonderful businesses in the first place. But in August? I didn’t lift a finger to collect this income. How wonderful is that?

RELATED READS: Five Core Dividend Stocks

I hope these monthly dividend income reports provide inspiration for any investors out there that are just starting out. It’s easy to see these payments rising month after month and it shows that it’s possible to one day pay for monthly expenses with dividends, which would provide an investor opportunities and freedom to pursue interests other than full-time work. What you’ll see below is a list of every dividend I collected over the prior month, which company paid the dividend, and the amount of the dividend. Without further ado:

- Verizon Communications (VZ) – $21.45

- Toronto-Dominion Bank (TD) – $14.08

- Deere & Company (DE) – $18.00

- AT&T Inc. (T) – $47.00

- Vodafone Group PLC (VOD) – $94.88

- Raytheon Company (RTN) – $16.75

- General Dynamics Corporation (GD) – $13.80

- Clorox Co. (CLX) – $26.95

- Air Products & Chemicals, Inc. (APD) – $16.20

- Apple Inc. (AAPL) – $5.20

- ONEOK, Inc. (OKE) – $45.38

- Kinder Morgan Inc. (KMI) – $88.20

- Realty Income Corp. (O) – $13.30

- Procter & Gamble Co. (PG) – $33.81

- Omega Healthcare Investors Inc. (OHI) – $41.25

- Caterpillar Inc. (CAT) – $11.55

- Orchids Paper Products Company (TIS) – $21.00

Total dividends received during the month of August: $528.80.

Man, it just feels great to add that up and put that kind of result out there. This is now the 10th time I’ve eclipsed $500 in dividend income in a single month. The progress is real.

Like I wrote above, there was a time – and it wasn’t that long ago – that I couldn’t even earn one penny that I didn’t work for. Nothing. Nada. Well, I might have found a penny on the street here and there. But let’s just say that doesn’t count. Meanwhile, I managed to collect more than 50,000 pennies this past month for just waking up and being me. I didn’t even have to bend down and pick a penny up off the ground. And I’m not sure I’d much want to bend down 50,000 times anyway!

The predictable and practical nature of dividends is so wonderful in general, but especially so when Mr. Market gets a little moody. Deere’s stock, for instance, is down something like 15% over the last month. Was the dividend down 15%? Nope. I still collected every red cent I anticipated. So do I care what Deere’s stock price is doing? Do you think Warren Buffett cares about the day-to-day price of the 17,310,090 shares of DE that Berkshire Hathaway Inc. (BRK.B) owns?

Doubtful when he’s collecting more than $10.4 million (an amount that will very likely increase all by itself fairly soon via a dividend increase) in cold, hard cash (that he can deploy as he desires) every quarter via Deere’s dividend, regardless of what Deere’s stock price is doing. And it’s that juxtaposition – the lack of volatility in dividend payments against very volatile stock prices – that further illustrates the value in this strategy.

Overall, no big surprises with the dividends here. The aforementioned Deere hasn’t increased its dividend yet this year, but I’m not overly concerned about that. They’re still working through reduced demand in the cycle. And Deere shareholders will still collect more income in 2015 than they did in 2014, regardless.

The midstream energy companies keep piping those big dividends into my account, which is comforting with everything that’s going in in the Energy sector.

Orchids Paper Products has changed somewhat radically since I first invested in the company, but I remain pretty excited about their prospects as they grow their production and distribution capabilities on both sides of the country. This has limited the company’s ability to grow its dividend simultaneously, but I’m pleased with the direction they’re moving in as a business.

Otherwise, everything is pretty much humming along as expected.

The dividend income for this month added up to 20.6% more than the dividend income my Freedom Fund generated in August 2014. Another big step in the right direction here.

I was able to cover 22.3% of my personal expenses this month via passive dividend income alone. Slightly disappointing there, but it was lower than expected due to the fact that I had to have some rather expensive dental work performed in August. Four fillings will do that. Didn’t feel great spending money on fillings rather than stocks. But while I love buying stocks, I love having teeth even more. However, I feel pretty good about being able to cover almost 1/4 of my expenses via passive income even when I had to shell out more than $800 for my teeth. Not too shabby.

Looking forward, I expect another busy month for stock purchases in August. It’s all in the name of pushing that snowball further and faster, turning cash into cash flow, and reaching financial independence as soon as possible. And that means, of course, that next August will be even more impressive and I’ll cover even more of my expenses with passive dividend income.

One of my goals this year is to receive $7,200 in dividend income. That was an aggressive goal at the outset of the year, but I’m holding myself accountable for it. We’ve now completed eight months of the year, and I can report that I’ve received $4,344.64 in dividend income thus far. That’s 60.3% of the way toward my goal, which is a great number to be sitting at now that we’ve completed a similar percentage of the year. I have a strong finish left in me with two big months (September and December) still left in the tank. Can’t wait to see how it turns out. Stick around and let’s find out together. Let’s continue fighting for freedom!

I’ll update my Dividend Income page to reflect August’s dividends.

Full Disclosure: Long all stocks mentioned in the article except BRK.B.

What about you? Have a great month of dividend income? Still on pace for your 2015 goal?

Thanks for reading.

Great month! When i see your updates i am excited for my own future cash flow. Keep up the good work!

Congrats Jason on over $500 thats great I am slowly on my way on the up wards trend with my dividend portfolio 🙂

Awesome update. Love seeing the results come in month to month and see how much closer we all are to some form of FI. After all, it exists on a spectrum, right? 🙂 I see some names in common bet ween our portfolios for the month too which is always nice to see. You have a an impressive August total which I know will be blown away this month as end of quarters are always much higher. Keep inspiring, keep building, keep living sensibly. Will DM make his 2015 dividend goal? Stay tuned….

DM,

Congrats on another incredible month of passive dividend income. There is no better feeling than knowing that you won’t have to lift a finger to receive future dividends. I noticed that OHI provided some solid income for you in August. Have you considered increasing your WPC position or have you decided to focus your investment efforts elsewhere?

DC

Another milestone passed towards your goal of financial independence. I’m confident that the 7,200 mark is well within your reach. Keep on rolling that snowball, Jason.

Cheers.

FS,

That’s the main reason I share all of this. I’m hoping that it inspires others to reach for their dreams. So much is possible when we believe. And it’s hard to not believe in this when the real-life results are right there. 🙂

Keep it up!

Cheers.

IM,

Every day is an opportunity. Every stock purchase and dividend received is one step closer. 🙂

Keep marching forward.

Best regards.

DH,

Absolutely, my friend. Definitely a spectrum. And every new dividend stream picked up by way of a new stock purchase moves you further along that spectrum. Slowly but surely…

Stay tuned, indeed. I’m doing all I can to finish strong and set things up for a huge 2016. 🙂

Looking forward to seeing how things turned out for you over there. I’m sure it was a great month.

Cheers!

Hello,

Ive been reading your blog for a few weeks now and love the idea of earning passive income from dividends! I would like your opinion/thought process on getting started..

If you had only $500-$1000 starting capital to invest what stock(s) would you consider for your initial investment? On the same note, what was/were the first stocks you invested in when you first began this journey?

Thanks!

Scott

DC,

Thanks so much. I’m really pleased with the progress thus far. I’m a bit ahead of pace now, which is great.

Yeah, I actually just bought more OHI yesterday. Have room for more, too. So I’m hoping that interest rate fears drive it down even more. I tweet my buys in real-time, so you can follow me there if you’re interested in knowing what’s going on before I post about it.

Let’s keep it rolling!

Take care.

Jos,

Thanks so much for the support. Much appreciated. 🙂

Hope you had a great August over on your end as well!

Best wishes.

Jason,

I am happy to see that I contributed to you apple dividend by buying the Apple Watch… 🙂

Cheers,

RA50

Scott,

Thanks for following along. Hope you continue to find value in the content and results. 🙂

As far as your question goes, I’d be buying pretty much the same as I’m buying now. I haven’t really changed my purchasing habits much over the years. Once I settled in on this strategy there in mid-2010, I’ve been at it ever since.

But I did go over a few stocks that I’m not buying any more (because my positions are too large now) that I thought were solid stocks to consider for those with more room in their portfolios for them (such as those investors starting out) here:

https://www.dividendmantra.com/2015/05/four-stocks-that-arent-on-my-radar-but-perhaps-should-be-on-yours/

Some of my first purchases included JNJ, KO, ABT, MO, WMT, VZ, and XOM.

Good luck as you begin your journey over there!

Cheers.

RA50,

I much appreciate that! Buy a second one for a family member. And maybe a third for a neighbor. Ha! 🙂

Thanks for that. And thanks for stopping by.

Best regards.

Congrats on a solid month of August Jason. You really can’t complain when you receive 17 different paychecks, that is diversification it its finest.

The mindset you have is already of a millionaire, the money part is just a reaction to the mindset.

All the best!

Hi Jason,

I was wondering what brokerage you use for your trades. Do you focus on meeting a minimum amount for each investment to offset your trading fees? Trying to decide when making long investments whether there should be a $500-$1000 minimum for each buy, or if it doesn’t matter since there won’t be a lot of trading happening once we buy.

Thanks!

Hi Jason,

I was wondering if you had an exit criteria for a stock. For example, if BP cuts its dividend by 5% is that a sell or if it cuts by 30%

I would love to hear you thoughts on this matter.

DV,

Thanks so much!

Yeah, that mindset is really it. Once you have the framework in place, it’s just a matter of time. Executing the strategy becomes easy once you believe it’s a foregone conclusion. 🙂

Keep it up over there!

Cheers.

awagner,

I use Scottrade. I included a link in the article, near the top.

I try to make sure my transactions are somewhere around $1,400, when possible. That limits my transaction costs to 0.5% (Scottrade charges $7 per stock purchase). I find that to be a pretty reasonable cost structure when keeping in mind that there will be little, if any, costs realized once one is no longer accumulating assets and living off of dividend income.

Hope that helps!

Take care.

Mike,

I’ve whittled my exit criteria down over the years. At this point, it’s primarily down to a fundamental problem with a business. I’ll sell as well if I think a stock is grossly overvalued, but that’s quite subjective. I’m more likely to hold.

As far as dividend cuts go, I’ll only sell if it’s accompanied by that fundamental problem. If it’s a temporary issue (due to low oil prices, say), then I’m likely not to sell. Fundamental problems are usually not a sudden thing, though. And neither are accompanied dividend cuts. It’s something that tends to develop over time, except in the case of something like ARCP and the accounting problem. But those kinds of issues are rare.

Thanks for dropping by!

Best regards.

Jason,

You are an inspiration for us all. Breaking the $500 per month barrier is no small feat. Plenty of commonality between our holdings, too. Keep up the great work and insightful posts!

Brian

I expect you won’t have any problems reaching $7000 this year. I think I am getting close to $500 dividend income per month (well I am little heavy on REITs and royalty funds.) but I need probably 6-7 times more of dividend income to be fully financially independent. Just like you, I and my wife live within our means but living in Toronto is quite expensive to support us for sure. Thanks for your inspirational post as always!

Cheers!

BSR

Dividend Mantra,

Congrats on the impressive month of dividend income. You are getting closer to your goals with each deposit, investment and dividend. Always great to receive dividend income.

Mantra:

Congratulations on your excellent month. Your graph brought an interesting tidbit to my attention. I always compare comparable months within the quarter and I was struck with how much larger August was over February and May. That is the trend we all are aspiring to. Way to go!

SSS,

Thanks so much. Appreciate the kind words. 🙂

Glad to be a fellow shareholder with you in a number of high-quality businesses. I think we’ll prosper for years to come.

Cheers!

BSR,

Hey, that’s a great number there. $500 per month in dividend income is a very, very solid number. I understand Toronto isn’t cheap, but that still covers a nice chunk of bills no matter where you live. That’s excellent work there, my friend. Keep it up! 🙂

Best wishes.

IP,

You’ve got it. It’s all about getting one step closer with every dollar saved and invested, every new share in the portfolio, and every new dividend stream generated. A mountain is climbed one step forward at a time. But I can say for sure the view gets better and better as you go. 🙂

Let’s keep climbing!

Best regards.

Your blog is such an inspiration. I’m early in my dividend investment journey and very excited about the $49.20 I will receive in dividend payments for September. It makes me look very hard at what I am spending day to day because I could be buying a great stock with some of that money. Thanks so much for all the great information and encouragement. 🙂

Nevertoolate,

Thank you. I’m so glad you’re finding inspiration here. 🙂

I’ve found the same perspective through investing. Not only do you think about what stock you could be buying with that $50 here or $100 there, but you also start to think about how much money you’re really losing when you look at the effects of compounding over the long term. $50 wasted today is more like $400 or so when looking out over the next few decades. And then you start thinking about how much you’d need to invest to cover expenses. I realized long ago that it would take about $35k invested to cover a $100 monthly bill. Makes you think hard about what’s worth what.

Best of luck over there. Wish you even more success than I’ve experienced!

Cheers.

I had one of my better months as well, getting almost $500 in dividend income for the month. It was driven by large holdings of Apple, Kinder Morgan, and Energy Transfer Partners. Abbvie also provided a decent dividend, too.

My dividend portfolio is not as diversified as yours, but I also have a lot of growth stocks and ETFs as well.

Jason,

Way to keep it rolling over there- I’m sure August 2016 will be a good bit higher for you.

My August was just dandy- In fact I hit the mile high club in August with $5280 in dividends received from DE, KMI, KKR and OHI. I call it the mile high club as the monthly dollar amount is the same as Denver’s elevation at 5280′

-Mike

Good Day Jason

this was a great month for you in dividend income over $500.00. I think you will achieve you goal in total dividend this year. I also see tonight that VZ increased its dividend. So you are going to get a pay raise with out having to do any extra work that’s so cool. Keep up the inspirational work. again congrats on the month

Cheers

Great job with $500 this month in passive income! I think you’ll just make the $7200; September and December will be what does it for you.

Here’s hoping we all make our 2015 goals! I’m going to miss mine by about $1000 ($500 if you factor in the KRFT dividend), but I’ll still comfortably make $4000 this year in dividends. And like your pre-2010 self, how much did the ARB of 2013 make? $0 in passive income. Just a little food for thought for anyone who is behind on their dividend goals. You’re still doing something right, and you’re still ahead of most people.

Sincerely,

ARB–Angry Retail Banker

Jason,

Congrats on the 20% increase. That’s some great progress my friend. I love it because seeing growth rates like that helps fuel the fire and our drive to reach financial freedom. I don’t know about you, but I know that I would want to see a 20% increase every month across the board all the way through next year. Now of course, there is the whole capital issue, but lets pretend that resources are plentiful for the purposes of our imaginations!

Keep the drive going and keep inspiring other investors like us. See you at the finish line!

Bert

I think that’s powerful right there, realizing the true opportunity costs of minor expenses. My mom “suggested” that I buy a car earlier this year with some money she and my dad turned over to me from when I was a kid. She said it as if it was OBVIOUSLY the best thing to do with the money (even though I despise driving and live in a city with great public transportation and s****y drivers), but all I could think about was something I read about how Americans spend an average of $8000 a year on a car. All those investments that that money could go to. All the future income that I would be giving up. All the extra time at work just to break even on the car, as opposed to working less because future income would be covering my expenses.

Me and my mom agreed; the decision of whether to buy a car was a no-brained after all. Because like you said, Jason, it’s not just about the money you spend, but the money you would have otherwise gotten.

Sincerely,

ARB–Angry Retail Banker

Vawt,

Nice job right there. Congrats on the big month. $500 is really quite a bit of money. If you told any average American that you earned $500 in passive dividend income last month, their jaw would drop in disbelief. It’s commonplace in our community, but really quite amazing in the grand scheme of things.

Keep it up!

Take care.

Mike,

Ha! I like that. I’d be dizzy with that much dividend income. Not because the air is thin a mile up, but because that’s just a ton of passive income. I don’t even know what I’d do with that kind of money, but I’d sure like to have the opportunity to find out. One day… 🙂

Enjoy the fine heights of success. Apparently it’s one mile up!

Cheers.

Micheal,

You’ve got it right there. I did nothing for that pay raise. Instead, thousands of workers are out there working for Verizon and helping the company bring in the growing profit necessary to hand over that pay raise to me. It’s a really beautiful thing. 🙂

Appreciate all the support. I hope you had a great month over there as well, with all of those workers out there working for you.

Best wishes!

ARB,

$4,000 is a really great result. You’re not really that far behind me. That’s an average of more than $300 per month… $300 you don’t have to work at all for. And $300 that will surely grow organically faster than inflation. How can you not like that? 🙂

You’re right in that we’re far ahead of most people. I was just mentioning in another comment that the numbers we throw around in our community might be commonplace, and so we become kind of numb to these results. But if you tell most people that you’re earning $300 or $400 or $500 per month in passive income, they’ll just stare at you in disbelief.

Let’s have a strong finish to the year!

Best regards.

Bert,

I’m with you my friend. My capital is definitely more limited than my imagination. 🙂

We’re having a great year across the community. So many people are that much closer to their dreams. It’s a wonderful thing to be a part of.

See you at the finish line!

Cheers.

Darn right Jason! the progress across the community is amazing. My guess is that if capital were plentiful, we all would be sitting on a beach together laughing and researching to find the best stocks for our portfolio. With the way we all invest, we would be able to put together quite the retirement nest egg and our generations would be able to live off of this imaginary dividend income stream! Man is it fun to dream 🙂

Jason,

This is always my favorite post every month. It shows the truth that can not be argued with when it comes to dividend stock investing and encourages me to do all I can to get to where I want to be.

Tyler

Thank you for the wonderful article Jason. I’m always so happy for you as I know the sacrifices you have made to be where you are. You deserve to be where you are at this moment because of the hardworking Jason years ago. To many more dividend income updates. Cheers my friend. Keep inspiring as always.

$500 in passive income is superb. I might get close to double hop in Aug, and next month, I may do triple jump and that will be awesome start to my race. You got 20% raise right in Aug, how many jobs will give you that in a month. Keep racing towards FI!

I’ll throw this out there simply because it could be useful to some people. Robinhood doesn’t charge commission on trades, and as far as I know you can trade all stocks. I signed up and funded a little bit of cash just to check it out but quite frankly I don’t know how much I’ll use is since all my other stuff is with Fidelity and I like everything in one place. It took several days just to get it activated and funded, and it’s very basic, but thought I’d share. Might be good for folks that want to dip a toe in the water.

That said, I also try and maintain an overall transaction cost ratio of around 0.4%, but I’m not making frequent trades (maybe 1-2 per month max) so I try not to sweat the $8 fee.

When I first jumped in, I was focused on growth stocks, but Jason and others have shown me another (easier) way to FI, and that is DGI. I know Jason you like to use the fruit tree analogy, and it’s a good one. Along those same lines, and underscoring the ease with which we can achieve FI with diligence, patience, and fortitude, I’m reminded of a quote by British writer Douglas William Jerrold: “Earth here is so kind, that just tickle her with a hoe and she laughs with a harvest.”

Keep that hoe at the ready and strike often! The rewards of our efforts now will be plentiful come harvest time.

Another great month. We have the same annual dividend goal of $7,200. Hopefully we can both meet our target! I am confident that I will be able to just squeak past this amount but we will see.

Keep up the awesome work.

Jason, I was doing a back-of-the-envelope calculation for ROI. Is it fair to say that if you are hypothetically getting a 4% dividend yield and your equities grow at 3% annually in share price, you gross approximately 7% ROI ? There is additional possibility of A) reinvestment of dividends B) dividend payouts are increased periodically for individual companies .

Sorry if you have covered the basics here before on this. I am actually trying to get some confirmation of what I think the answer should be, that is a ROI is composed of share growth and dividends. My plan is to have at least 7% annual return, on average, for my portfolio.

Tyler,

So glad you enjoy these updates. They’re definitely my favorite posts by far. 🙂

Can’t argue with cash money, my friend.

Hope you had a great month over there. Thanks for dropping by.

Best regards.

Tyler,

We both know how that sacrifice can turn into great rewards in a pretty short period of time. 🙂

Keep up the great work over there. You’re definitely killing it!

Best wishes.

R2R,

Those major investments you’re making on a regular basis will start paying big dividends here pretty shortly. I imagine 2016 will be a lot of fun for you. 🙂

Keep it rolling!

Take care.

Winston,

That’s fantastic. Looks like we’re both going to have a pretty tight finish. Makes it that much more fun, right? 🙂

Can’t wait to see where we’re at come the end of December. I’m going to give it all I’ve got. I’m sure you will as well.

Good luck. I’ll see you on the other side of the finish line!

Cheers.

Mark,

Right. Assuming you’re not reinvesting dividends, the simple calculation for your total return will be the sum of capital gains and your dividends. But reinvesting dividends makes a pretty big difference, as you can see by playing around with this calculator:

http://www.buyupside.com/calculators/dividendreinvestmentdec07.htm

The best way to calculate your actual annualized total return on a running basis, though, is to use an XIRR calculation on a spreadsheet. That will account for your cash flows and the dates of those cash flows against a final tally. This site explains how that works:

http://whitecoatinvestor.com/how-to-calculate-your-return-the-excel-xirr-function/

I would shoot for a higher number than 7% as well. Unless you’re accounting for inflation there. Otherwise, that’s somewhat significantly below the long-run average of the broader market. My personal hurdle rate is 10% for most stocks. I lower my anticipated return on high-yield stocks to account for the time value of money and my preference for more income now. But I think 10% is a pretty solid number to shoot for. Definitely an individual call, however.

Hope that helps!

Cheers.

Glad to see everything’s still growing strong, Jason. What a great month. You’ve been putting some serious capital to work lately and I’m excited to see how you finish out the year, good things to come my friend!

Wow my back hurts just thinking about picking up 50,000 pennies! I would probably do it though because I don’t have $500 a month coming in through dividends! Congrats! The number I like the most there is the 20% monthly raise from last year you gave yourself!

Hi Jason,

A great result for August, and to answer one of your points in there, yes it is an inspiration for me 🙂 You are a couple of years ahead of me on the progress (albeit a couple of years younger, I was a bit late to the party!) so its great to have followed and seen your dividend income increase over the years. I also now started tracking my monthly income year on year (only the other week!) and it is much more motivating than when I was just tracking it each year. How did I do in August…. I got nothing :'( but that is my stock selection, I know that next month is going to be a bumper for me and should be the equivalent of about 800 USD, so I wont grumble, but plough it back in!

All the best, and keep up the good work!

London Rob

Wanted to say Hi; have been reading your blog for a year in silence. 🙂 I´m a swedish dividend investor and at the moment I cover about 1,5 month of my expenses which feels HUGE for me. My goal before 2016 is over is to cover two months and I love how volatile it is right now so I can buy the stocks cheaper. 🙂 Thanks for the inspiration!

Great effort by our Dividend mentor in the US.

I generated £154 ($234) in Dividend income and that is an increase from £87 ($132) last August. My paycheck certainly has not had such a high increase!

Keep up the good work

best of luck from Bonny Scotland!

Hiya Jason!

you’re the master, seriously lad, it’s impressive. Your blog must be read every single day. Congratulations!

I’ve earned €2,000 ($2,220) this year so far. I expect to earn €2,700 ($3,000) at the end of 2015 🙂

I started my journay to F.I. 2 years and 7 months ago.

Cheers from Spain!

That’s amazing! imagine to get at 20.6% pay wage.

Just read your book last night. Great read!

I am not active on the stock market, so i’m still uncertain whether I should buy dividends stocks or buy index funds (which everyone says I should do…). I love the idea with dividends.

ARB,

I am in the same boat. I may fall short of my goal ($5,250) in dividend income for the year. I’m 56% of the way there after August. If I count the special dividend from KRFT I will easily make it, but I’m really trying to get there without relying on these one time special events. But hey at the end of the day it was still cash in our accounts!

I started dividend investing in March of this year. I just surpassed $500 in total dividends collected and I’m on track to surpass $1000 by the end of the year. The more time I spend with the DGI strategy, the more I love it!

I still have a ways to go to reach your $500 per month, but I’m encouraged by how quickly you reached that milestone and know that I will be there in a couple of years.

Boom! just like that you got $500 as a side income for doing absolutely nothing. Best thing about this? This amount will increase year after year, even if you don’t add any more fresh capital.

Hey Jason,

that is truely an impressive amount of a monthly dividend income, especially considering the time you had to reach that income. 7 months ago I also started with dividend investing and my income in August was still quite low, but I have to be patient about it :). I also started a blog 2 weeks ago, it does not have much content so far but would be nice if you stop by from time to time.

Great month, Jason! Congrats on generating a neat $500+ in div income. Make sure you enjoy the fruit of your labor and patience

R2R

Do you think the BHP dividends are sustainable?

Great August. You can see your trending up compared to February and May. And as Sept and Dec will be huge for you, you’re sitting pretty. It’ll be close but can’t wait to see the December report.

Hey Mike

I am not Jason … but a fellow BBL shareholder.

I limited my position of BBL to the uttermost limit, because no one knows the future (commodity prices etc.).

In contrast to JNJ, GIS, PEP, KO, etc. and also: XOM (oil ok, but they will not freeze or cut divis!!!! ) I do keep a close focus on BBL´s working environment … I expect an uplift of demand, profits, dividends and no cut, but you never know. Keeping your nose is valuable when prices go up.

Way to go Jason! Keep up the good work, and it’s so nice to see so many sameminded people over here.

Personally, I include interest and rental income next to my dividends. But we are on the same page regarding passive income being the way to a meaningful life without needing to go to a job!

This year, I hit the 2000 euro monthly passive income mark. So, I’m on my way! Sadly, there has also been some lifestyle inflation, so I’m about 40% FI.

Those are good choices for new investors. I picked up some JNJ today below $91. Sweet.

Love to see it! I personally just made two purchases today to hit $3100 in annual dividend income. Excited to keep reading your progress and playing catch up, haha

Wow. I never actually thought about the dividends that Warren Buffett collects. I can’t even comprehend receiving $10 mil in dividend payments in one quarter. That’s just insane!

Ryan,

Hey, just trying to keep up with you over there. And I’m not doing a very good job. Ha! Keep up the great work there with the capital deployment. You’re setting the Ryan of 2020 up pretty nicely. 🙂

Thanks for dropping by.

Cheers!

secondhandmillionaries,

I’m with you. Although collecting 50,000 pennies is certainly much, much easier this way, I wouldn’t be totally against picking them up if I had to. Fortunately for my back, they’re just deposited into my brokerage account while I go on about my life. Easy peasy. 🙂

Thanks for all the support. Let’s keep marching forward!

Best regards.

London Rob,

I was late to the party as well. Starting at almost 28 years old isn’t exactly getting a big jump on things. Can’t change the past. But we can change the future. 🙂

Sounds like you’re going to have a very, very exciting and lucrative September over there. That $800 begets $900 begets $1,000. So on and so forth. The future London Rob is already doing quite well. Keep at it!

Best wishes.

Dividend Swede,

Thanks for following along from Sweden. Much appreciated! 🙂

You’re well on your way over there. And having the proper mindset – seeing volatility as an opportunity – is key to long-term success. You should do very well.

Have fun. Looks like September is starting off quite rocky, which I’m really enjoying.

Take care!

DF UK,

That’s a great month over there. And almost double what you did last year. That’s the kind of progress you need in order to propel yourself closer to freedom. Although the YOY gains in percentage terms will slow over time, it’s those absolute gains you’re looking for. And those will surely grow. 🙂

Thanks for dropping by. Hope all is well in Scotland!

Cheers.

Javi,

Thank you so much. Really appreciate the kind words and support. You readers make this all worth it. 🙂

Sounds like you’re having an excellent year over there. Keep pushing forward and you’ll be amazed at what’s possible. I know I’ve been surprised over and over again just how far hard work and determination can take you.

Best wishes!

Hi Jason,

As many say – the most important thing is starting! Would I trade in my earlier years? No, so lets look to the future and what can change! Seeing your review and increasing dividends is a great motivation – as you say it only increases, so I wait to see what comes with September – I did tuck into some BHP B this morning which will increase it even further, but lets see!

And thanks for putting your thoughts and progress down 🙂

London Rob

Adam,

Thanks for reading the book. So glad you enjoyed it. Really tried to put a unique product out there.

Yeah, index funds versus individual stocks is really an individual call. I think which way you go will feel natural. If it feels like you’re forcing it, it’s probably not right. I happen to really enjoy this strategy, so it’s a natural fit. The fact that it can actually be superior in some ways is just icing on the cake. But index investing is much, much more simple. And that’s a great thing for many people. Really up to you.

Best of luck over there. 🙂

Cheers!

Caversham,

That’s a great start over there. You can see the progress I’ve put out there. And for the first, say, two years at this, I wasn’t making very much money. It wasn’t until my last year or so at work that I was making pretty strong income. And then it wasn’t until very recently that my online income became what it is. I was struggling a bit last summer, but I kept at it. Clamped down on expenses and did what I had to. The sacrifices are well worth the end result. The ends certainly justify the means, in my opinion. 🙂

Keep at it. I’d imagine that you’ll surprise yourself at just how quickly things can progress.

Best regards!

Tawcan,

You said it, my friend. I couldn’t be any happier. 🙂

Have a great weekend over there!

Cheers.

Andreas,

Yeah, it really doesn’t take that long to start seeing tangible and impressive results. You get out what you put in for sure, but why wouldn’t you want to give it your all when we’re talking about your freedom here? 🙂

Best of luck with the blog. I’ll try to drop by. I’m a little busier than I ever thought I’d be these days, but I’ll do my best.

Keep saving, investing, and working hard over there!

Take care.

R2R,

I’m enjoying every penny, trust me. 🙂

It’s already all spent, of course. But only on that which will improve this number going forward. Onward and upward!

Have a great weekend over there!

Best regards.

Mike,

I actually discussed that very recently:

https://www.dividendmantra.com/2015/08/five-high-quality-dividend-growth-stocks-that-look-very-appealing-after-recent-volatility/

Take care!

FF,

You’ve got it. It’s definitely going to be close. Can’t wait to find out. Stay tuned. 🙂

Have a great holiday weekend over there!

Best regards.

DG,

Hey, any income you don’t have to work for is wonderful. If you enjoy owning rental properties and everything else that goes with that, it sure beats a job that you don’t like. 🙂

2,000 euros per month is fantastic. I’m still a few years off from that kind of mark. The good news is that you’re largely in control of lifestyle inflation, so you could probably boost that 40% up a bit if you had/wanted to. Keep it up!

Cheers.

Jim,

Sweet, indeed. That’s a gift for long-term investors. 🙂

Enjoy that extra dividend income. Doesn’t get much easier than that!

Best regards.

Matt,

That’s fantastic! Every new dividend growth stock purchase comes with a new dividend stream that will likely continue to expand all by itself. The goal is to combine those streams into a massive river of cash flow. 🙂

Keep it up!!

Best regards.

SR,

It’s really insane. That’s just one position. You’d then have to consider the rest of the portfolio. Pretty crazy stuff. And that’s not even looking at all the checks that come in from the private subsidiaries. I can’t even imagine working with that kind of cash flow. It’s good to be the king. 🙂

Have a great holiday weekend!

Cheers.

The recent downtrend is making me regret a little bit that I did not put a bit more trust in a dividend portfolio. But C’est la vie, I chose ETFs with low Dividend returns. Less tax 🙂

Stockbeard,

Many roads lead to Rome. As long as you’re getting closer and closer to your destination in the time manner appropriate for you and your goals, and with a method that works best for you, then it’s all good. 🙂

Cheers!

Hi jason,

Another great month there! Keep going. It is great to see money deposited in your brokerage account when you have to do nothing for it.

Cheers,

G

Hi Jason

easy to see how this is your favourite regular blog topic each month, this is where it all comes together.

Just bought my first ever tranche of proper DGI share, 29 OHI shares yesterday. With two rental properties we are already earning 500€ passively per month, but they are all ploughed back into mortgage repayment every month decreasing the YOC for the next 20 years. I am looking forward to growing dividend free cash that can be used as we please.

Regards

Philipp

Geblin,

I’m with you all the way. It doesn’t get much better than waking up to more cash than you had yesterday. Sure makes getting out of bed a little easier. 🙂

Have a great weekend!

Best regards.

Philipp,

Glad to be a fellow shareholder alongside you. I recently picked up some additional OHI shares myself. The valuation down here is pretty compelling, pushing that yield way up. 🙂

Enjoy that extra passive dividend income that will very likely continue to grow without your input!

Best wishes.

Jason,

Another outstanding month in the direction of your dreams!

Since so many are inspired by your progress, I figured how about another example? Not to steal any of your thunder, but I thought your readers may benefit from seeing yet another user’s dividend income for the month. Here’s mine, just for added inspiration especially as so many stocks come down to reasonable levels.

Main $32.93

GIS 32.87

PG 43.82

ABBV 30.53

KMI 76.01

PAA 84.39

SHLX 36.49

EPD 53.20

O 29.91

OHI 111.24

STAG 28.74

$560 and change, and on pace for $421 in September. My wish list is long, with low ball orders already in place.

Keep moving in the right direction, we’re all excited to be part of your journey!

Karl

Wow, that’s a lot of income for one of the “off” months. We’re 4 days into September and I’ve already picked up more in dividends this month than in all of August.

Justin,

It’s great isn’t it! Always seeing evidence of forward momentum makes this a rather easy investing path to remain true to.

Best,

Karl

Great job in August! I was surprised at those VOD & KMI dividends. You must have a lot of shares and they seem to be doing you well thus far. I still have to tally up my August, but it’s nice to see the progress. Thanks for sharing.

– HMB

Karl,

Hey, I don’t mind you stealing thunder at all. Appreciate you sharing! 🙂

That’s a great looking tally there. Looks like you maybe focus a bit more on yield than I do, but nothing wrong with that as long as those stocks are meeting your expectations in terms of current income and income growth. I’m actually thinking that I might be a little lax in regards to my yield requirements lately. I regret being so strict on yield earlier on, but my recent purchases might be overdoing it a bit. Gotta make sure I satisfy my needs for income there over the short term while balancing out that long-term growth. It’s a fun tightrope to walk.

Keep it up over there. I’m guessing September should be another great month for you!

Best regards.

Justin,

Nice! September will surely be pretty strong for a lot of us. I’m really looking forward to seeing how it turns out not only for myself, but also for the wider community. I think we’ll be set up for a nice Q4 run. 🙂

Have fun over there!

Best wishes.

HMB,

Yeah, every month seems to have something to like. This month happens to be when the telecoms and pipelines pay out, so it’s always something to look forward to. My KMI dividend is peanuts compared to some other investors out there, but it’s pretty appealing for me. Long been a huge payer, which is something that’s helped propel my capital deployment capabilities over the years. Just more rolling of the snowball. 🙂

Looks like you’re staying busy over there as well. Excited to see how August turned out for you.

Thanks for dropping by. Have a great weekend over there!

Cheers.

Awesome! Looking forward to see how you are choosing to deploy that cash, especially in this time of sales. Always inspired man.

Jason

Great month in the dividend income, but the value that Mr. Market give us right now is great, just keep buying those great companies out there with much lower prices.

Yeah, good month from the pipeline operators and REITS. Next month should be around 15 separate checks and smaller amounts.

Looking to add CMI, UNP, MMM, WMT, and ROST if it keeps falling.

Best,

Karl

I love this blog, it’s such an inspiration reading about your monthly result 🙂 Just started saving in dividend stocks myself a couple of months ago. My goal for 2016 is to break the 100$ monthly average. It’s a pretty tough goal for me, but you gotta aim high, right 🙂

Great month Jason. Congratulations on more progress towards your goals.

Do you have any thoughts on the value of different newsletters or books on dividend growth investing?

I just read the single best investment, and your book is next up, but I was wondering if you had any suggestions beyond that? I want to read as much as possible on the topic as I’ve only been at this less than a year and am still thirsting to learn more and become more comfortable with how I am picking the parts of my compounding machine.

Also do you find any newsletters like Morningstar’s dividendinvestor or anything similar helpful in your research? I was thinking of subscribing to that one, but don’t love the yearly price tag, and didn’t know if you or any others have had experience with it.

I generally like to rely on my own research for picks, but if others find it a valuable resource I’m not opposed to paying for their service as a supplement to my own research.

Oops. Just discovered the getting started portion of your site that basically anwers most of these questions!

Still curious about your thoughts on Morningstar’s pay service though. Thanks!

Thoughts on AB InBev (BUD)?

Mantra,

17 big old companies sent you a check this month. Not 1, not 2, not 3, not 4… How awesome is that?? Covering over 20% of your expenses in August by way of Dividends? Heck YEAH. This is great, September – I am sure you are anticipating quite a fun month (September 10th is a big day for all dividend investors typically, something about that day…). However back to August – Great Job Jason. You were up almost $100 from last year, which is wild, that’ s all due from your consistency in investing, dividend increases and the like. Let’s keep the snowball rolling!

-Lanny

Thing of all the ice cream you can buy with all those dividend checks! =). Seriously, your passive income is starting to cover your essentials, like bills and food. At this point in your journey the light at the end of the tunnel is staring to become visible!

Great job Jason, i always look back at the previous 2 years whenever i wrap up month and take comfort things are always moving forwards. You’re now over $500 per month which is fantastic, won’t belong before it is $1000 per month on average ! best T

Ear Money,

Well, all of this cash flow was deployed last month. The dividends are usually reinvested quickly so as to continue building on that cash flow. Passive cash flow that’s buying more cash flow that’s simultaneously growing organically. It’s a beautiful thing. 🙂

Have a great weekend!

Cheers.

Sharon,

Absolutely. I’ve been pretty active so far over the course of the first week. I’ve seen drops of 5% here and 5% there. Pretty wild stuff, but I’m very happy to be along for the ride. 🙂

Have fun over there!

Take care.

Leif,

Thank you so much. So glad you find inspiration here to start down your own path. Looks like you’re well on your way over there. $100 per month would be a fantastic way to get things rolling. You’ll notice it wasn’t all that long ago that I hit $1,200 for the year, so you can see what’s possible when you stick with it for a while. 🙂

Keep it up! And best of luck.

Cheers.

DD,

That’s alright. Glad you found the resources. 🙂

I haven’t ever taken a good look at Peters’s service over there, so I can’t really comment on it. I enjoyed his book, so I’m sure his newsletter is great as well. Whether it’s worth the price, however, is really a personal call. I prefer running a pretty lean operation.

Thanks for all the support. Truly hope you enjoy the book.

Best wishes!

Hello Jason, I remember reading in one of your articles that you would consider yourself truly financially independent when your portfolio generates a dividend income of about $17,000 per year, which would cover all your expenses. Correct me if I’m mistaken. Your portfolio is currently worth about $200,000 and its value goes up or down a bit depending on Mr. Market’s moods. How much do you think your portfolio will be worth when it generates $17,000 per year? Do you think you’ll need a $500,000 portfolio or more? What’s your ballpark figure? Thanks.

Ed,

Great brands there. Excellent profitability. I’d be a little concerned about the overall trends in beer concerning craft beers and what not. Claudia has long loved her Stella but recently found some craft brews that, in her opinion, have ruined her taste for Stella. I’m personally more interested in Diageo insofar as that type of business model, but I think BUD would make a great complementary holding.

Good luck if you invest there! 🙂

Best regards.

Lanny,

You’ve got it, bud. It’s all about income diversification for me. I think, when factoring in all of the online activities and everything else, I received checks from 24 different sources. That’s pretty fantastic. I love not relying on one paycheck from a fickle employer. We all know how that can work out.

Keep up the great work over on your end, too. We’re getting closer and closer every single day. 🙂

Best wishes.

Spoonman,

Ha! I actually just had an ice cream today at a local McDonald’s. A hot fudge sundae for less than a couple bucks. And I contributed just a tiny bit to my own bottom line. Makes the ice cream taste that much better. 🙂

Appreciate all the support. The light is definitely visible at this point. The tunnel is no longer completely dark, which feels amazing. And it gets brighter and brighter every day. Enjoy your travels over there!

Best regards.

T,

Definitely. I’m always interested to see what the YOY comparisons look like. The percentages will continue to fall, but as long as I’m still progressing toward my long-term goals and I’m on pace, I’m happy. 🙂

Let’s keep it rolling!

Cheers.

marginofsafety101,

Well, the long-term goal is actually $18,000 per year, or $1,500 per month. I think, looking at my personal expenses and assuming I won’t have any more student loan debt at that time, it seems reasonable.

The portfolio oscillates a lot, but my overall yield has averaged about 3.5% for some time now. I could boost that toward the finish line (and might do just that), but I’d require a portfolio value of about $515,000 to get to where I need to be. I obviously focus on the dividend income rather than the portfolio value, but you can reverse engineer the math to come up with both numbers. If I were to concentrate more heavily on yield the last year or two, I might require less. But I’ve long thought $500k will probably get me to where I want to be. If I end up controlling about half a million dollars in high-quality assets at 39 or 40 years old, I’ll be a very happy camper. So far, everything is on pace.

Thanks for dropping by!

Best regards.

marginofsafety,

A recent posting by Jason used an income of around $20k/year as the goal.

https://www.dividendmantra.com/2015/08/the-predictability-and-practicality-of-dividends/

I had the same question as you and backed into a portfolio value of around $650k.

Jason’s Freedom Fund August update had a yield of 3.6%. After the recent market decline, the September update had a yield of 3.8%. For some quick back-of-the-napkin math I averaged both and utilized a 3.7% yield. A $650k fund yielding 3.7% would generate $24k in annual before-tax dividends. Everyone’s tax situation would be unique, but I modeled a modest 15% tax hit, which netted the total back down to $20k/year.

A $500k value would only amount to $18.5k before taxes and $15k after an arbitrary 15% tax hit.

That was my ballpark estimate, but I’m sure Jason can correct.

Best of luck

Ed,

Right. I used $20k/year as an illustrative number for the post. I said it was more or less in line with my long-term goal, which it is. But $18k has long been the number I’m chasing. Of course, it’s a moving target. I can’t say with any kind of certainty what my expenses will be in 2022.

I would also factor out taxation. Assuming one is living solely off of dividend income, they’d be paying little, if any, federal taxes on $18k in dividends (state taxes would naturally vary, but I live in Florida). I’ve discussed that before. You’d have to bump up into the 25% tax bracket before seeing that 15% hit, which, of course, $18k/year is nowhere near. Now, one might earn some active income which might push that overall income into that 25% bracket. But at that point, you’re earning more than enough income to pay for your expenses (assuming $18k/year was enough in the first place), which means you’re pretty well set.

Hope that helps!

Cheers.

Jason,

Love your site and admire your journey in the public eye. Also appreciate your openness, especially with your post on dealing with resentment. I definitely don’t want to turn my response to you into anything like the reaction from the comments to your article on Mr. Money Mustache about taxes.

With that being said, you are very open about your choice not to utilize tax advantaged accounts. Do you anticipate a 0% tax rate using taxable accounts? Using your 3.5% yield from above and dropping the modeled tax rate to 10% would require closer to a $575k Freedom Fund value.

I only ask the question because your journey is inspiring and I’ve read the comments of people who feel the same way. It would seem only fair to assume that the majority of people reading this site live in a state where they would be subjected to both federal and state income taxes. I know this is a site about a personal journey, but it’s impact goes beyond.

I’ll end my thoughts here and take any response given from you. Have a happy and safe Labor Day weekend!

Ed,

No problem, although there’s really nothing to debate here. I’m not sure why the simple tax law on dividends seems to hold people up.

The tax rate on qualified dividends is 0% up until the 25% tax bracket. So you could earn $47,750 (after deductions) in qualified dividend income (as a single filer) this year and pay $0 in federal income taxes. So your 15% model is really incorrect using the $24k/year number you were looking at. There is no state in the United States where you would pay 15% on $18,000 in dividend income. More than likely, you’d be paying very, very little in overall taxes no matter where you live on that kind of income. Low income usually sports a low tax rate, regardless. But that is exacerbated when looking at dividend income.

For perspective, you can take a spin on TurboTax’s TaxCaster if you’d like to play with some numbers:

http://turbotax.intuit.com/tax-tools/calculators/taxcaster/

Again, 15% is way too high. That was my point.

Hope that helps!

Cheers.

Great job. I was 1948 vs 1401 last year. Best, DD

Hi! Long time reading this site…I usually go to MMM for a kick in the ass, the Conservative Income Investor for overall positive outlook, and your site for day-by-day inspiration. In fact your book was the first one loaded onto my kindle and it was a great read.

I do have a question. Right now I reinvest 100% of my dividends back into each company and plan to do so for a while yet (just over $100 a month passive for me total so I just let it stay put). But I was curious and started thinking after the last market super sale…was there a dollar amount that you started to pull $$$ out of auto-reinvesting to pick up new companies and diversify? Or, do you just continue to reinvest and channel saved earned money to diversify?

Thanks, love the site! -David

DD,

Fantastic numbers right there. Life-changing stuff. Great things await. All of that hard work is set to pay off pretty dramatically here. 🙂

Keep it up!

Best wishes.

David,

Ha! I appreciate that. Thanks for following along. I think that description is pretty accurate. 🙂

As far as your question goes, though, I never actually automatically reinvested (DRIP) my dividends back into the company that paid them. I’ve always selectively reinvested my dividends and still do, as I described here:

https://www.dividendmantra.com/2014/03/selective-dividend-reinvestment-vs-drip/

Which method is best for you is really an individual call. But I quite like deploying all of my capital as I see fit at all times. Moreover, I’m a big proponent of holistic portfolio construction, so the idea of letting big positions just become bigger and bigger over time doesn’t totally make sense to me from an income diversification/preservation/safety standpoint. So it’s all in the name of making sure that my income stream could take a hit or two and keep on chugging just fine.

But DRIPing is great, too. Works for plenty of people. I just prefer to collect my dividends and reinvest them as I see fit.

Hope that helps. Best of luck over there. And stay in touch!

Cheers.

Jason,

Another excellent month! Over $500 in income, close to 20 companies paying you, 20% growth, expense coverage of 20%… These are the kind of things that we like to see, especially when you’re only four to five years into your journey like you are.

You’re a big inspiration for all of us, keep it up! I hope you make your income goal for this year!

Cheers,

NMW

Hello Jason, I’m rooting for you, and in my small way I try to imitate you, congratulations from Italy

Hello DM, what is your opinion on Eaton Corp (ETN)? I am looking at the numbers at it looks good to me. Has a 4% dividend yield and good dividend growth. It is now about 25% down from it’s 52 week high. Is there any reason why you have not invested in this one? Thanks.

Nice work Jason and congrats on another good month! 🙂

NMW,

Thanks so much, man. Appreciate all the support. Things are really coming along. I’m very, very pleased. And I’m very proud. 🙂

You’re doing great over there, too. Freedom is out there waiting for us. Let’s make sure we’re doing all we can to attain it.

Best regards.

Claudio,

Thank you!

I’m rooting for you as well. The more of us reaching freedom and inspiring/supporting each other, the better. 🙂

Cheers.

Jan,

Eaton looks pretty solid. A number of its financial metrics remind me of Emerson. Growth over the last decade has been challenged, but these are robust business models that should continue to do well over the long term. Meanwhile, you’re collecting a very attractive yield (about twice the market). There are a lot of opportunities in that sector since many high-quality industrial companies have been beaten down heavily over the last year or so. Just more opportunities than capital.

Best of luck if you invest there! 🙂

Cheers.

incomerookie,

Appreciate it. Doing all I can to reach for my dreams and inspire others in the process. 🙂

Hope you had an outstanding August as well!

Best wishes.

DM,

Great work, brother. $500 in a month is definitely one of those “crossover” points where you can really start tasting how close you’re getting to financial independence. Just keep reinvesting and you’ll get where you’re aiming.

Take care,

– Ryan from GRB

Thanks DM. I did get a bit of ETN at $54 on Friday (first time).

p.s. might you average down in GILD if it continues to slide? Or even dollar-cost average in if it rises? I got some at $101-102 on Thurs (my first position in this stock). I am hoping for a good return on this one. I think I’ll be buying some more. Hope it’s “safe” but you never know with biotech! I wouldn’t ordinarily be looking at biotech but GILD sure does look like a good value. I first read about the company in January but hadn’t heard about it before that. It’s now priced back where it was in January.

Interesting times!

Thanks.

GRB,

You’re right. I definitely feel the critical mass now working for me, where the snowball is kind of propelling itself at this point. Once you’re able to get some capital working for you and you’ve got some decent passive income rolling in, financial independence is a foregone conclusion. The dividend income will roughly double in about seven years, even if I stop actively adding new capital, which puts me pretty close to where I want to be.

Put yourself on target early enough, and you can’t miss what you’re aiming for. 🙂

Best wishes.

Jan,

Nice buy there on ETN. Gotta love a 4% yield on a world-class business that’s offering pretty solid dividend growth.

I’m not sure if I’ll average down on GILD or not. It’s a speculative position from the standpoint of dividend growth since it has no track record there. And if GILD really does what they’re supposed to (what I think they’ll do), one will do well whether they buy in at $100 or $120 over the long term. But I agree that the value is there, especially relative to the growth they’ve posted and the potential for growth moving forward. It’s a rare opportunity, but, again, speculative, in my opinion.

Thanks for dropping by!

Best regards.

Could someone please stop me from watching this video over and over again.

http://www.youtube.com/watch?v=wckaOT-vSV4

Thank you.

Stef

Hi,

Would the interest rate hike impact the OHI (REIT) stocks? Think that the reason it’s going down hill last few months.

Stef,

Ha! Great company. Thanks for sharing. 🙂

Cheers.

funsters,

I’m not sure the concerns over rising rates insofar as they relate to REITs are actually based in reality. You can see the correlation here:

http://www.altegris.com/~/media/Files/White%20Paper/ALT_WP_InterestRatesREITs_2014_04_FINAL.pdf

That said, I pay exactly zero attention to macroeconomics. But I do hope that REITs get punished. Would love to pick them up on the cheap. 🙂

Take care!

thanks! yes that does help me out. I guess it just seemed silly to take oh, $14 from Coke or wherever because I’m just getting started. I think i”ll probably let mine ride for now since the amount they would kick into the brokerage fund is way less than I’m putting in myself with earned income. But once it’s around $200 or so a mouth I’ll start pulling it and be more proactive with diversifying. I’m coming up on my first year so I’m still just working on the habit formation of saving and investing. Thanks again!

-David

It is amazing that you are already at $500 for this most recent month. 20.6% growth YoY is astonishing also. It would be wonderful if we could get that kind of growth in all our asset columns. Won’t be long before we start to see $1k/month dividend collections. That will be an exciting time but that is still some time out. Got to say I love your strategy and views from choosing the individual names and when you decide to further invest in companies you own versus expanding the overall portfolio.

20% increase year over year is fantastic! Congratulation.

Let me check our increase…..

Oh wow, we have 20% increase too. I didn’t think it’d be that much. I like this dividend investing thing.

DeLeon,

Glad you like the strategy! 🙂

It’s definitely exciting to see that passive income just grow and grow, even without your input. Nothing like seeing your purchasing power exponentially increase right in front of your eyes.

Thanks for dropping by. Enjoy the rest of your holiday weekend.

Take care.

Joe,

I’m with you. I like this dividend investing thing, too. Think I’ll stick with it a bit longer. 🙂

Enjoy your holiday over there!

Best regards.

Just discovered this nice portfolio tool to tinker around with stock allocations and historical performances:

http://www.portfoliovisualizer.com/backtest-portfolio#analysisResults

Mark,

Definitely interesting. Although, I’m not a real big fan of backtesting. Moreover, nobody really starts out with a complete portfolio that’s a perfect candidate for some kind of backtesting. One is constantly buying stocks and changing things as they go. So to look at a collection of stocks all at once like that will probably be of limited use. Fun to play around with, though. 🙂

Cheers!

Great work Jason! I just reported my August update tonight. I need to keep saving, it would be live to “live off dividends” before age 50 🙂

Mark,

Nice work over there. Consistency is the name of the game. 🙂

Living off of dividends before 50 would indeed be fantastic. I’m hoping to hit that mark by, say, 37, but I think my original goal of 40 is looking to be a lock at this point. And 40 would still be really nice. Of course, life can change fast. You never know. Giving it my best effort, though.

Keep it up!

Best regards.

Jason,

I appreciate your no nonsense approach and sticking to your game plan…keep up the good work.

Regards

Bill

Bill,

Appreciate that very much!

I know nothing less than 100%. So that’s what I give. 🙂

Best wishes.

I had a great month as well…not near your level but had one dividend increase and no cuts! That is always a good sign. Take care,

DFG

DFG,

Hey, any time you can say that you received a pay raise for doing nothing, you’re in pretty good shape. 🙂

Keep it up over there!

Best regards.

Congrats on a solid haul in August. I’m not quite up to the $500 mark yet, but getting there with $313.11 (combine Freedom Fund and Roth IRA account). That’s a big boost for me over last year’s August total of $210.05. Thanks’ for the inspiration!

OK HW

Great post – seeing your success certainly spurs me on in my own dividend growth investing strategy.

From my reading of your blog it seems as if the dividend yields of US stocks are actually quite low compared to Australian standards, with most of my Australian stocks paying anywhere from 4% – 6% plus franking (i.e. tax) credits. Maybe you should consider investing in the land down under instead!

Your numbers just keep inching higher. Good job and good luck reaching your goal for the year.

Keep cranking,

Keep cranking,

Robert the DividendDreamer

Great work Jason you have inspired me to start tracking my progress

You have a great blog

I look forward to you monthly updates Down Under in Australia !

Hate to say this but Jason has left and it looks like he won’t be back. Also he has inspired me to start also and I am doing so with my daughter. I do wish he would come back. If you want to check it out you can. http://www.dividendmiracle.com