Freedom Fund Update – July 2015

I’m extremely fortunate that I’m able to post these updates every single month, which shows the power of monthly contributions to investments because of the high savings rate I maintain. It shows how a relatively large sum of money can be built through the power of time, patience and perseverance.

It’s important to keep in mind that while updating the overall value of my portfolio is important for historical reference and for purposes of keeping track of total return, my main focus is on the rising dividend income stream the Fund provides.

June was crazy, incredible, and exciting. It was just a lot of fun.

I was fortune enough to stay incredibly active and pick up shares in a number of excellent businesses at what I feel are really attractive values relative to their respective intrinsic values and long-term earnings power. I’m fairly confident that each of these companies will reward shareholders (including me) for years to come with increasing dividends on the back of increasing profit.

I started the month the same way I ended it: I added to my position in Union Pacific Corporation (UNP) both at the beginning of the month and on the very last day of June. Really excited about the long-term potential here. If the last 150 or so years have anything to say about it, the next 150 years should be pretty profitable.

I also decided to average down on W.P. Carey Inc. (WPC), a REIT I continue to really like here. It’s highly likely I’ll buy more stock in WPC over the course in July at even lower prices.

Those transactions alone put some serious capital to work. But I also decided to have some fun this month and strategically bolster a few positions by spreading some capital out a little. I used some free trades in my Scottrade account to top up positions in T. Rowe Price Group Inc. (TROW) just four days into June, then just a week later Wal-Mart Stores, Inc. (WMT). I didn’t sit on capital long, deciding to double my stake in Apple Inc. (AAPL) after a blockbuster quarter and then also adding to to the midstream pipeline company, ONEOK, Inc. (OKE), after reduced guidance.

But it wasn’t all just adding to existing positions.

I also initiated a stake in Travelers Companies Inc. (TRV), which is just a fantastic company operating in an industry I’ve long wanted more exposure to. P&C insurance is an industry that’s been making a lot of money for a long time now, and TRV is one of the higher-quality companies in that space. I’m really bummed out that Chubb Corp. (CB) and HCC Insurance Holdings, Inc. (HCC) are being acquired. I was planning on buying stock in both companies and expanding my P&C exposure after building up TRV. But there are still plenty of fish in the sea.

One company that I’ve long watched from afar due to what I thought was constant overvaluation is Hershey Co. (HSY). I finally saw an opportunity to invest in the company after seeing the stock slide more than 10% YTD. It’s still not particularly cheap, but it’s a great company with a super simple business model that should make money and be able to send out more dividend income for decades to come.

Lastly, I initiated a position in Gilead Sciences, Inc. (GILD) toward the middle of the month. Admittedly a somewhat speculative investment due to their extremely short dividend history, the stock is otherwise checking off just about every box I have. Value, quality, and growth all exist in abundance. I’m anxious to see how this one turns out over the next decade or so.

So 10 transactions, all in all. And a little over $6,000 in fresh capital and dividends invested. A blockbuster month and definitely records for me in regards to both the amount of money I invested and the number of transactions. Those are records that are unlikely to be broken anytime soon. But I’d also be happy if they stand forever. I don’t really need insane months like this past June to reach my long-term goals. Of course, they’re wonderful to have. And it was just a lot of fun. But I also know they’re not necessary and will be few and far between.

However, activity in the portfolio wasn’t limited just to what I was doing.

The acquisition of Lorillard, Inc. by Reynolds American, Inc. (RAI) was completed in mid-June June, which provided a lot of the BBs for my BB gun this past month. I received a little over $2,500 in cash and 14 shares of RAI for the 50 shares of LO I owned. So the LO position is no more, replaced now with the RAI position (which I’m going to keep, but not add to anytime soon).

In addition, Baxter International Inc.’s (BAX) previously announced spin-off of Baxalta Inc. (BXLT) was completed in June. So I know have a new position in BXLT (which I’m also going to keep, but not add to anytime soon). I’m excited to see how the separate entities operate and prosper. Spin-offs in general have been very kind to me, and I see no reason why this transaction will be any different. I’d generally prefer most companies remain as one, but I’m not running a publicly traded company. I defer judgement.

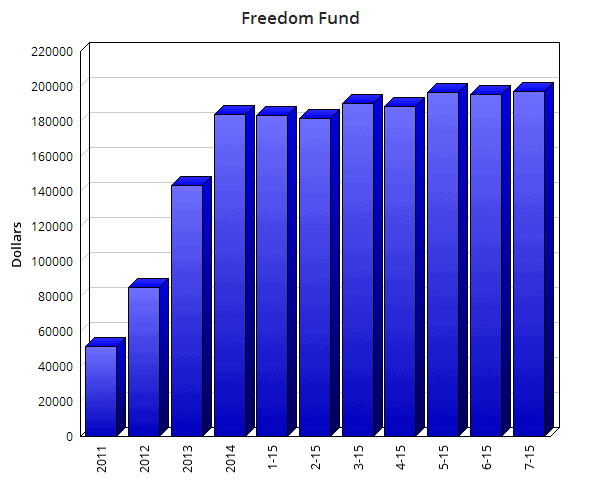

The current market value of the Freedom Fund stands at $197,385.27, which is a 1.1% increase over last month’s published value of $195,305.61. The portfolio actually closed at over $200,000 in market value for the first time ever on June 18, 2015, which comes just over two years after hitting the six-figure mark in March 2013. I guess the first $100k is the hardest, though a lot of that depends on the very fickle and very moody Mr. Market. Not exactly what I’d want to rely on for, say, financial independence and drawing down assets. But it’s a really fantastic milestone to hit. The hiccup on June 29 (due to fears over Greece) dropped my portfolio’s market value rather significantly, however, and it never recovered. A 2% broader market drop like we saw on Monday affects my portfolio by roughly $4,000 due to its size, which is a great first world problem to have. It’s a “problem” I hope continues – cheaper stocks means higher yields. New dollars buy more dividend income when yields are higher and I’m that much closer to my long-term goals.

I’m so excited with how June went down and where the portfolio is sitting right now. The Fund is an absolutely dynamite collection of some of the best companies in the entire world. All of them should remain exceedingly profitable for years to come and I expect my dividend income to increase annually like clockwork.

Hopefully, the troubles in Greece keep volatility high and we see larger pullbacks. It seems the market was expecting fireworks this past Monday, and instead we got sparklers. A lot of people were spreading noise and speculating the market was going to drop by 5% or 10% right off the bat, but we didn’t see anything even close to that. That’s exactly why you can’t time or predict the market. Stick to a long-term plan through the ups and the downs and your future you will thank you for it.

July certainly won’t be as buy as June. But I do expect to be able to make at least a few stock purchases. Cheaper stocks would help my limited capital that much more, so we’ll see what we get. Regardless, I’ll be putting fresh capital to work regularly throughout the month, just like I’ve consistently done for more than five years now.

The Fund has positions in 62 different companies. As aforementioned, I initiated three new positions and was given a new position in BXLT over the course of June.

These updates are mainly designed to show the increase or decrease in the value of the underlying equities I’m invested in, but the main purpose of investing in dividend growth stocks is for the rising stream of dividends over time. Thus, I don’t put too much emphasis on these monthly updates. I think it is a good idea, however, to keep track of the rising (or falling) value of one’s securities and be aware of where they are in terms of the marketplace and whether or not certain stocks are attractively priced. It find it a helpful exercise to update the values monthly. It gives me fresh perspective on which equities are performing well and which aren’t, and from there I can make educated decisions (based on further due diligence) on which stocks I’d like to add fresh capital to (while considering portfolio weight as well).

Full Disclosure: Long UNP, WPC, TROW, WMT, AAPL, OKE, TRV, HSY, GILD, RAI, BAX, and BXLT.

What happened for you in June? Buy lots of stocks? Portfolio performing as expected? Excited for more pullbacks?

Thanks for reading.

Photo Credit: BimXD/FreeDigitalPhotos.net

Note: Affiliate link included.

June was a good month for me expense wise since I was traveling for work two of the weeks. When the market dropped 2% I also added a contribution to my IRA after the close at the “low” prices. Hope July is a good one for you as well.

Dividend Mantra,

That is an impressive month. Lots of capital put to work that will reward you for years to come.

My portfolio ended down a little as I have a lot of weight in energy and financial stocks. So with the price of oil and what is going on in Greece, I am surprise of only a smaller loss. The stocks I have been buying for the long term are more stable so that should help the stability of my portfolio.

Looking forward to your next Recent Buy post!

Wow Jason, June was a busy month for you. I really like your purchases and the fact that you are averaging down on a few stocks. I’m thinking of averaging down TROW and WMT as well; maybe next week. I had a good month too. I sold TGT and BA and used the money to increase my positions in WMT and CVX. Additionally I had my second largest dividend month taking in more than $300.

Let’s hope the market keeps dropping and new deals on great stock become available.

Awesome month! Great job on spreading all that capital among a host of terrific companies as well. Best of luck during this month, as it appears it will be a month to open up even more value in the market.

Hey Jason, any clue what BAX new yield is now after spinoff?

Jason,

Congratulations on your record month and hitting $200k! I also bought UNP, WMT & TROW recently.

I am looking forward to my BXLT shares (except that my BXLT hasn’t showed up on my account yet.)

Well done again!

D4s

I am like you in that I am not overly interested in my overall portfolio worth. It’s the monthly dividends that get me excited. As long as those increases and dividends keep coming, I could stop putting fresh capital and the monster would still grow bigger! June was a busy month with a few sells and a few buys. July is starting out nicely as well. Thanks for sharing.

– HMB

I don’t follow BAX, but until they make an announcement about their next distribution, I think it would all be speculation.

I augmented my positions in KO and EMR, adding about $250/year in forward dividends.

You killed it in June. Well done!

Pardon my ignorance, but I’m curious as to why the fact that CB is being acquired would prevent you from buying shares in it. It seems like CB shareholders are going to get a pretty decent deal out of it ($62.93 per share in cash and 0.6019 in ACE shares). It seems like it would be beneficial to buy in before the actual merger at the beginning of next year, and as well, it seems the resultant company could be a pretty good one to own shares in.

Jason,

Awesome month congrats! June was a huge month for me as well. I went ahead and rounded out my wife’s and my Roth IRA’s contributions for 2015. So this month saw over 5K of fresh capital. Can’t look a gift horse in the mouth. July will be back to the norm of around 1K.

I found value in existing positions and added to WMT, HSY, GILD (to get more shares before the ex-div date) and DEO

I started positions in BRK.B, UNP, and VTR

Looking forward to your dividend update next week.

FF,

Nice move there. Gotta add on the dips!

That’s great the expenses were held in check. Traveling for work is an awesome way to stay frugal, right? 🙂

Keep it up over there. Let’s hope for more dips in July.

Thanks for stopping by.

Take care!

IP,

I’d rather my money work for me than the other way around, that’s for sure. And what’s great about money is that it never really stops working. That $6,000 should indeed work for the rest of my life, even well past the point of me working. I love it! 🙂

I hear you on the heavy tilting toward energy. That’s caused a lot of volatility in my portfolio as well. Some solid energy names have come down quite a bit lately and I may dip my toes there over the coming months. Gotta be very careful there, as it’s a slippery slope.

A $78k portfolio is pretty sizable. You’re rocking over there!

Cheers.

DD,

Congrats on the $325 in dividend income. That’s fantastic!

What’s great is that it’s just more firepower and it’ll only grow from there. Every month sets a new baseline from which to grow from. The bigger the baseline, the more the absolute growth. 🙂

Thanks for dropping by. Excited for a big July.

Best regards.

SAD,

Hey. Hope all is well over there. Long time, no talk. 🙂

Yeah, it was a really great month. Once in a blue moon, that’s for sure. If I could have just one month per year like this, I’d be very happy.

Thanks for dropping by. Have a great weekend over there!

Cheers.

Chuck,

I’m not aware that either BAX or BXLT has announced their next respective dividends. Until they do, it’s just speculation. I’m hoping that the combined dividends between the two entities at least matches what BAX sent out pre-split. We’ll see.

Take care!

D4S,

Thanks so much. June was really a lot of fun. I’ll never forget it. 🙂

We’re definitely on the same page. UNP, WMT, and TROW all appear to be some of the more compelling opportunities available right now. I’m bummed out about the P&C action, but I’ll just continue buying what’s available.

Glad to be a fellow long-term shareholder!

Best wishes.

HMB,

Yeah, the portfolio value matters very little. Great companies will increase their profit over time and their stock prices will naturally respond. But the value of the collection matters a lot less to me than the dividend income it generates. That’s where the real action is. Looking forward to sharing June’s dividend income here over the coming days.

Congrats on a huge month over there. Over $900 in dividend income is monstrous. Those funds sent some serious cash your way!

Thanks for dropping by. Let’s keep it rolling.

Best regards.

EvenKeel,

Nice. That’s a big addition to the dividend income. You put away some serious capital over there.

I like EMR a lot here at $55/share. I haven’t bought any shares in the company in quite a while now, but I may have to rectify that. 🙂

Keep up the great work. I hope you’re able to have another blockbuster month!

Cheers.

joshuacwilliams,

That’s not a bad way to get into ACE, if that’s what you’re ultimately after. I liked CB as it was.

But there’s really no upside left now. The time to buy into CB was at $100/share. You’re now paying a premium (the premium that the acquirer is paying) to gamble on the acquisition going through. It’ll almost certainly go through, but you’re betting on that with very little upside and a lot of downside (if it fails for any reason). I’d rather stick to buying TRV which is a lot cheaper, likely has much more upside, and also sports a much higher yield. You could buy into CB and hope the acquisition goes through, but I’d rather just look at ACE when it’s all said and done and go from there. It’s just the more conservative way to go.

Cheers!

Jerry,

That’s a great month over there. To be in a position to be able to invest over $5,000 is pretty wonderful. Comparing that to most people in the world, that’s just a rare spot to be in. We’re really fortunate.

Nice stocks over there. Very happy to be a fellow shareholder in a number of companies. You can be sure to not see any volatility from me since I’ll likely not be selling any shares for the rest of my life. 🙂

Thanks for the support. Keep it up!

Best wishes.

Thanks for the feedback. That helps. I was indeed also wondering if you were perhaps considering buying shares of the resultant company after the acquisition goes through (and of course, when the share price reflects a good value).

joshuacwilliams,

I haven’t really looked at ACE very much. Just a cursory look here and there. But I liked what I saw. I kind of already had my mind set on TRV, HCC, and CB for my insurance exposure (those are the three I’ve been mentioning for almost a year now), but I’m now definitely going to take a strong look at ACE since it already looked solid and is now adding a great insurer to the roster. There’s a few other insurers I’ve looked at and liked, but I had my mind set on those three (to add to AFL), which is why I’m bummed out. Sucks to lose a really strong idea like that, but the combined ACE-CB is probably a great way to go. Adds scale where scale helps.

Cheers!

Great job adding to your portfolio. What is not to love about that? As far as me, I am in no position to be adding right now because of the multiple thousands in expenses toward rental repairs. However, hopefully, you will be adding to your portfolio each and every month. Good luck and best wishes.

Keep cranking,

Robert the DividendDreamer

AKA — Seeking Dividends

Follow me on Twitter– Seeking Dividends@DividendDreamer

Nice update. Wow, while I can’t compete with your flurry of capital allocation.

I did have some similar moves this month. I bought UNP at 95, NSRGY at 73, and WPC at 59.5. I sold part of Baxter to pay for that before the fulfillment of the merger. I might sell BAX and keep BXLT in the long rune. I also bought ACE at 101 two days before the merger announcement. . . wish I bought Chubb instead, but still a good announcement in my opinion, ACE is solid and worth a look.

My next purchases on the WL look like industrial and REITs to fill out the portfolio with LMT, AIT, DOV, UTX, O, OHI, and HCP on next months watch list.

I would be interested in your evaluation of some of the defense stocks I am following like LMT, RTN, and HRS at the moment.

Robert,

Ouch. Sorry to hear about the rental property pain. Hopefully, that’ll be past you soon and you can get back to counting your checks. 🙂

Thanks for stopping by!

Best regards.

Daniel,

Awesome moves over there. Great prices on WPC and UNP. I continue to like both of them quite a bit here and will likely continue buying.

I looked at HRS not long ago:

http://dailytradealert.com/2015/05/15/these-31-dividend-growth-stocks-go-ex-dividend-next-week-2/

Seems roughly fairly valued, though, like its competition, the reliance on the US government is a risk. They’ve done well at diversifying internationally.

RTN looked about 11% overvalued at the beginning of the year:

http://dailytradealert.com/2015/01/10/caution-this-dividend-growth-stock-appears-11-overvalued/

It’s come down about 11% YTD and also increased its dividend along the way, so it’s a solid bet now. But it, too, relies heavily on the US government. The demand for their products/services isn’t going anywhere, but that reliance is a concern.

Have fun in July! 🙂

Best regards.

Man you really did a lot of damage this month with your investing. Congrats! I put a lot more capital to work than I expected too this past month but it didn’t come close to your $6k and 10 positions. Shoot in June alone you had a nice diverse portfolio started up with lots of industries being bought. I’m still a good ways away from the $200k mark but now that I’m back to work I should be able to start investing a lot more consistently each month. I hear ya on not wanting to rely on the mood of Mr. Market to fund my FI/ER. There’s just no telling where things will go over the short term so you need a much larger margin of safety, at least in my opinion. However, fortunately for us the prospects of the companies we own don’t change nearly as quickly or as drastically as Mr. Market likes to move around their share prices. I’m sure you killed it on your dividend income this past month and I’m looking forward to see just how much you pulled in. Keep up the good work!

Jason,

I had several of the same buys as you this month: UNP, WPC, HSY, and TROW. BXLT might turn out to be the better of the 2 in the long run, although BAX has been a great company for a long time. I’m hanging on to both.

I saw the Heinz-Kraft merger was approved. I’m not 100% convinced on that one since I have worked for companies in similar situations and have seen a lot of good people lose their jobs. I expect that will be a big part of the expected efficiency gains. I guess if it makes the company better long term and keeps people working then it might be okay. It has definitely been good for the stock, but a forward P/E of 27 seems excessive. On the other hand, we get Warren Buffett as part of the team. Gotta like that.

Have a great 4th!

Keith

JC,

That’s great that you’re back at work. Must mean things are better with Luke and the family. 🙂

Yeah, I’d much rather rely on business results and the forthcoming dividends than what the stock market thinks something is worth. The former is easily measurable and tangible. The latter… not so much.

Thanks for stopping by. Have a great 4th over there!

Cheers.

KeithX,

We’re on the same page all the way, aren’t we? That’s fantastic. I continue to like all of them and will likely continue buying most. WPC might be my next buy. I was hoping to see TRV stay in the upper $90s, but it popped after the CB news. I just can’t really catch a break over here!

That Kraft news was excellent for shareholders. I’d be pretty happy with that premium and dividend. With all the premiums being thrown about (a premium is always paid, but stocks in general are pretty expensive), it makes me think I’m getting a better deal on some of these stocks than I might think. Of course, it’s always cheaper to buy a slice than the whole thing. Just another advantage for the little guy. 🙂

Have a great 4th!

Best regards.

June was a pretty good month to put our money to work for us with all of the negativity regarding Greece as well as it’s usual mood swings for this reason or that reason. You had a crazy month of buying, as did I but on a much smaller scale. I picked up shares of XOM, TRV and CMP (which you may have never heard of). Have a great holiday weekend.

Jason,

You had an outstanding June. Mine was great as well, by adding 3 stocks to my portfolio: JNJ, WPC, OHI and doubling my PM position. Of course, all of these went down by about 3% after I bought but you can’t win them all, and over time this “noise” shouldn’t matter much.

-Mike

That was a Wicked Ass Month for you Jason! Feels wonderful just putting our hard earned dollars into precious Assets. It’s a first world problem to have. I know you appreciate it just as much as myself. Thank you for sharing with all of us and you keep up the hard work. You’ve come a long way my friend, as I’ve been following your journey all these years. Freedom comes closer each day! Cheers bud.

Great job, Jason. I really like how you spread everything around so well and were able to make 10 solid and different transactions with excellent averaging down to boot. I love showing up to your site after just two or three days and seeing tons of purchase articles that get to read all at once! If I can’t keep up with them, you know it’s a good month! Big congrats on the brief $200K mark, It’ll swing back there before we know it. I’m so pumped to see what July presents us. Time to go shopping again, my friend 😉

Jason,

I’ve have been reading your blog since May and I have found your posts to be truly inspiring. I have wanted to learn about investing in general for quite some time and your blog has provided me the motivation to hit the books and learn everyway I can.

This was my first month buying stock and I think I made some reasonable purchases, but I always kick myself a little when I see that I could have done better by 1% or so on my purchases by waiting an hour or a day. Was this something that troubled you a lot when you first started?

Anyway it has been a really fun month in general and once again thank you for maintaining this blog it really means a lot to beginners like me.

Captain,

June was really a great month for me just in terms of capital availability. I put most of my capital to work well before any Greece issues occurred, though the opportunities weren’t much to be had in a broader sense. However, individual opportunities are definitely there, as you picked out. That’s why we’re buying individual stocks, not the market. 🙂

You have a great weekend as well. Happy 4th!

Cheers.

Mike,

That’s an awesome month right there. Spreading out the capital among some of the best stocks to be found is always a great idea, especially when they’re valued attractively. I still can’t believe PM is languishing here… as if the currency issues and investments they’re making will be extrapolated out for the next 50 years.

Freedom one dividend dollar at a time. 🙂

Thanks for dropping by!

Best regards.

DH,

Freedom is that much closer every day, indeed. Feels wonderful. I’m blessed and fortunate in so many ways. And really happy with the progress thus far. It’s one thing to put a plan together, but quite another to execute it and see it coming together in real-time. 🙂

Keep it up over there. You’re hitting some crazy numbers!!

Cheers.

Ryan,

It was a crazy month for both of us. You definitely beat me on the amount of capital you put to work. Insane June. It’s awesome that it’s happening at the same time for us like that. 🙂

We’re chasing our dreams, bud. Independence, freedom, and total flexibility is out there. And we’re going to have all of it in just a few years. Life is good!

Thanks for stopping by. Have a great weekend!

Best wishes.

Noob,

Thanks for reading and following along. Much appreciated. I hope you find everything you’re looking for here. 🙂

Yeah, seeing a stock’s price dropped bothered me way back when I first started. That was before I started investing this way. For the first, say, six weeks or so, I bought a bunch of stocks I didn’t know anything about, as well as a mutual fund. I don’t even remember the name of the fund. Anyway, I just bought these stocks and what not looking for the price to go up, right? And that didn’t really happen like I thought it should. So it would bum me out when prices went down, because, in my mind, I was “losing money”. Of course, I didn’t know anything about dividends, value, fundamentals, or really anything at all.

It wasn’t until later in 2010 that I started investing this way and I realized that cheaper stocks is a good thing. If I were to go buy a local pizza joint and they were asking $200,000 on Monday… but lowered the price to $190k on Tuesday, I’d be ecstatic. Likewise, why would I care what the price of the place was once I bought it and was cranking out pizzas and making income? So it takes a little while for that paradigm shift to occur. But once it does, you’re in control.

You’ll likely learn as you go and become more comfortable in your own skin. That’s how it worked for me.

Best of luck!

Take care.

Jason, you are truly doing excellent. I have one question, I’m sure you’ve answered it before so if you want to just point me to a link where you’ve answered it that’s great. It is regarding CEFs. I just read this on a Seeking Alpha board: “I continue to be mystified at the under utilization of closed end funds especially from the Dividend Growth crowd. CEFs after all — largely specialize in income. Be it ROC (return of capital) or pure dividends — distributions, often monthly are what closed end funds do best.” So I’m just wondering what your take is on them. I don’t think you have any, so it must be that they are too risky or something. Thank you.

Mike,

Well, it’s not just income that I (or most anyone else that invests this way) am after. I’m after sustainable and growing income. And I want it coming from high-quality companies that I think will be more profitable for years to come and will be able to support ever-growing payments my way. I also don’t want to pay fees for the rest of my life. And I also want equity at a good valuation. Oh, and I do expect the value of my holdings to rise over time. A great business will, over time, see its stock price increase over time, so I am interested in overall wealth as well. I just want stocks to stay cheap while I’m accumulating them. Tough to have it both ways sometimes, though. But I’m not interested in collecting a 10% yield if it means that’s coming at the cost of my equity.

It’s funny you ask this question because I just received an email from a reader on Wednesday asking about ACP. It’s a CEF paying out a 9.85% yield. Holy smokes! I should sell everything (including one of my kidneys) and buy in, right? Not really. The annualized return has been horrible as far back as I can go and it’s loaded with fees. And that’s forgetting the fact that:

“It invests primarily in loan and debt instruments, such as loan-related or debt-related instruments, including repurchase and reverse repurchase agreements and derivative instruments of issuers that operate in a range of industries and geographic regions” – Google Finance

Umm, yeah, whatever that means.

But if you know of a CEF that has very low fees, a lengthy track record of increasing its payout over and above the rate of inflation, invests in business models that are easy to understand (for a child), doesn’t use a ton of leverage, sports an attractive yield, and offers solid annualized returns (isn’t offering a sky-high yield at the cost of equity value), then I’d gladly take a look.

In the end, I don’t invest in CEFs for the same reasons I don’t invest in any funds… which is something I’ve discussed at length a number of times. Doesn’t make sense to me to pay a fee for someone else to invest for me, especially when the yield, dividend growth, valuation, and fundamentals likely won’t be there for me. I’m perfectly capable of buying my own stocks and, five years in, I’m doing okay.

Hope that helps.

Cheers!

Amazing month Jason! It was really fun to follow your transactions. It seemed like you were making moves daily! Looking forward to watching the show again in July.

Take care,

Ken

Ken,

Thanks so much!

Yeah, June was so much fun. I think my BB gun was on the verge of overheating there at some point. 🙂

Should be another fairly busy month here in July, but far more routine than what the last month was. But any month where we’re able to save a good chunk of change and invest it is a good month. We’re fortunate!

Thanks for stopping by. Have a great weekend over there.

Best regards.

My favorite is knowing I added thousands in capital during a month and the balance staying flat or going down slightly. I love discounts!

Another awesome month for you! It was good to follow your progress through June. Looking forward to seeing your dividend update and what purchases you end up initiating in July 🙂

It is nice to see your freedom fund rising in the right direction and even better that it crossed the $200 000 mark at one point. I am sure you will reach a permanent value of 200k and higher in the next two months with new investments and reinvested dividends. One of my stocks has fallen back as much as 10% and I am still anticipating a top up at some point while it is cheap.

Thanks for the update and congrats on the new milestone!

Seems we’re all interested in the same quality stocks. I’ve been watching CVX, XOM, UNP, and PM for awhile. I’ll probably initiate small positions by August before they go ex dividend. You mentioned you were looking at PC firms, ever consider MKL? They are similar to Berkshire in some ways, but reinvest dividends.

Keep up the great work.

Great month and great report. I really enjoyed reading it. Congrats on the 200K milestone! You’ve reached that point once, the next time it will be behind you. There’s nothing wrong to average down, as long as company’s fundamentals are still strong. It’s just an opportunity to accumulate more shares.

Keep up the good work. 🙂

First of all: Great month! Repeat it soon 😉 !

Well … RTN: Sadly, I read your article too late and bought RTN way too expensive; now: -10% down, so you were spot on with your analysis! Part of my learning curve!

Nevertheless, I am not overly concerned with RTN, demand will not go away, sadly (I try to see the world as it is, not as I would like to have it!).

And in contrast to your reply to Daniel I do have the impression that RTN is the defense contractor with the highest GLOBAL exposure (read: less US exposure as LMT i.e.) and by the way with best margins around.

What I do really, really like about your site: there is more or less no real serious mention of your current Freedom Fund value. It´s no big deal. IMHO that´s great and important as it is irrelevant, as long as you (the investor) handpicked the ingredients/the companies.

Important is the/your dividend stream and that´s purest inspiration!

Top performance!

All the BEST

Thorsten

I’m okay with Chubb being acquired. Made a 35% return and will just invest it in another dividend paying stock.

Sadly, I had some medical issues arise in the family, so took a bit of a hiatus to deal with that. But, I’ve still been following from the sidelines and plugging away with my investments little by little. I look forward to seeing what July brings you and the rest of our little community. Happy 4th!!

Jason,

With the book, a steady stream of followers and your being nearly ready to start on your way to the $300 mark, I’d say this year has been great so far. Outstanding job.

Just curious to know what your goals are for the rest of the year.

Cheers,

FM

Nice number of purchases this month! Very inspiring blog, I hope to get there too one day.

June was really busy for you!

We collected a lot of dividends since we own only ETFs and mutual funds that pay quarterly. So we are at the other end of the dividend game – collecting and living off of them. 🙂 I can personally testify that the high powered saving and investing that you’re doing works. And it’ll likely provide a nice, growing stream of income indefinitely.

Awesome DM! You’ve really made a lot of progress in the last two years I’v been following your journey! For me, I am waiting on/working towards the 30k mark, almost there!

Good day Jason

this was a great month for you, and the freedom fund. I have been adding new holding, and adding to current holdings this month as well. The freedom fund portfolio is looking good and diversified among sectors. I have been looking to maybe add PM, HD, O, PG,ACE, or maybe NKE. the list is long but their are a lot of good stocks out there I can add. Like you I want the income from dividends to cover my expense, and have some left over to invest. I enjoy investing in stocks. I can’t wait till the next freedom fund addition and update. Hope you have a safe and fun filled 4th of July, too you and to all others. Happy Birthday America. Cheers

Jason,

I’m fairly new to the blog and I very much enjoy your content. Perhaps you’ve touched on this subject before, but are you aware that Freedom Funds is what Fidelity Investments calls their targeted date retirement funds? They have a series of them called Freedom Income, Freedom 2015, Freedom 2020, Freedom 2025, etc. Don’t get me wrong, I love the name, but as you grow a bigger following, perhaps Fidelity will come knocking on your door for a copyright infringement…. or perhaps they’ll come knocking on your door to find out the proper way to retire early with a true “FREEDOM” Fund! Keep up the good work and have a happy 4th!

-ABT

Ravi,

I’m with you. Adding a lot of capital but seeing the value stay static means the odds are tilting in the accumulator’s favor. It would be nice to report the same portfolio value next month even after investing a few thousand. That means stocks, in aggregate, are becoming even cheaper… which is just what we need. 🙂

Have a great weekend!

Cheers.

Nicola,

Thanks for the support!

June was a lot of fun. Won’t happen like that very often, but it’s nice to have something like that tucked away in my memory. 🙂

Should have the dividend income update live here within days. And then back to more buying!

Have a great weekend over there. Thanks for stopping in.

Best regards.

Laura,

Yeah, it was kind of surreal to see the portfolio cross over that mark. It’s a lot of money, especially for a guy like me that comes from extremely humble beginnings. Like I’ve mentioned, it’s basically “lottery money” to me. So it’s really incredible. But it goes to show the power of this strategy. The possibilities are incredible if someone just lives below their means and invests intelligently. The opportunity is there.

Sounds like you’ve got a great opportunity over there with that stock dropping 10%. As long as it’s not due to adverse changes in the business model, that could be a great chance to buy more equity for less money. Have fun! 🙂

Cheers.

Karl,

Thanks so much. Appreciate the kind words! 🙂

Yeah, I’ve looked at Markel. Does seem like a much smaller Berkshire in a lot of ways. And Tom Gayner seems like a pretty smart guy. I’ll sometimes check in to see what he’s been buying lately and a lot of the stuff he’s buying is what we’re all buying as well. Which really speaks to my point about why I don’t invest there (or in BRK). I don’t need Gayner to buy TRV or UL for me and collect all the dividend income for himself. I can do that perfectly fine, and I quite enjoy those checks coming my way. Selling shares of MKL (or any other stock that doesn’t pay a dividend) is much less preferable to me than just living off of dividend income. That’s obviously the short answer, but I’ve discussed ad nauseam why I don’t buy stocks that don’t pay dividends, and that goes for MKL or any other.

Have a great weekend!

Take care.

GK,

Absolutely. I love averaging down. If I like something at $100, then I’m going to love it at $90! Whether it’s stocks or any other type of merchandise you can think of, I like quality when it’s on sale. 🙂

Appreciate the support. Hope your portfolio and income is performing to your expectations!

Best wishes.

Thorsten,

Thanks so much. I wish I could repeat June’s performance every month. 🙂

Yeah, I wouldn’t worry about RTN. They’re not going anywhere. Growth over the last few years has been challenging due some budgetary pressure, but there will likely be no less need to defend ourselves with expensive weapons in the future than there is today. Just the nature of the beast. All of the defense contractors have diversified internationally to varying degrees over the years, but all the major US-domiciled defense contractors still rely heavily on US government spending. Again, just the nature of the beast. You take the good with the bad. But I wouldn’t worry about the valuation too much, either. Sometimes Mr. Market will support a high valuation for years and years on end, sometimes not.

The portfolio value is definitely not a focus of mine or the site. Sometimes I mention it a little more when I write for outside sites, and that’s just to show the reader (who might not be on the same page as us) that wealth is possible. So I draw them in with the numbers and then hope to overwhelm them with logic. But, yeah, I don’t constantly talk about the money here because it’s just secondary to the main goal. Having a big portfolio balance will be an eventuality if you do everything right. It’s a byproduct of living below your means and investing in wonderful businesses. But the income is what really buys you the freedom.

Thanks for stopping by. Appreciate the support. Have a great weekend!

Cheers.

Scott,

I bet you are. That’s fantastic. I’d be a very happy shareholder! 🙂

I remember when HGIC was acquired for something like an 85% premium. At first I was upset that I lost a solid dividend payer/grower, but then I realized that the universe of high-quality stocks is pretty big. On to the next one…

Have a great weekend!

Take care.

SAD,

Hope everything is better now. Glad to have you involved in the community again. The great thing about dividend growth stocks is that they continue working for you in the background if you need to take that kind of hiatus. All those companies with all those employees still working on your behalf and sending you checks. Makes life a little easier when the going gets tough.

Happy 4th to you as well!

Cheers.

FM,

Yeah, the first half of 2015 has really exceeded my expectations. I’m working really hard but also having a great time with it. 🙂

As far as goals go, they’re the same as what I started the year with. I expect to really do well with the online income goal, which should translate to doing well with the saving rate goal. But the dividend income and weight goals will be challenging. I’ll be reviewing where I stand with some of that over the course of July. I think the back half of the year will give me an opportunity to make up some ground with the two I’m behind on while I crush the other two. Looking forward to it!

Thanks for stopping by!

Cheers.

DAC,

I’m quite confident you’ll be there one day as well. It’s an eventuality if you continue to save a high rate of your income and invest consistently into high-quality dividend growth stocks. Success, wealth, and growing income can’t evade you if you do that. 🙂

Cheers!

Justin,

Good to know that life on the other side is going well! 🙂

I was always confident that this works, but I’ve become more and more confident as time has rolled on. What’s really great is that it’s a lot of fun. There isn’t any sacrifice involved at all. Living the way I was before – overworked, overstressed, overspending – was the real sacrifice. I’m now free and happier because of it.

Thanks for the support. Enjoy the good life, my friend!

Best regards.

DW,

Thanks so much!

I’m just really following the plan. The framework provides everything. If you stay within that framework and stay consistent, you can’t help but become successful. 🙂

Congrats on the upcoming milestone. You’ll be there before you know it. And then it’ll be on to the next big milestone!

Have a great weekend.

Take care.

michael,

Thanks so much. Really appreciate it!

The Fund is coming along. It’s a really nice collection of equity in wonderful businesses. It’s a pretty good portfolio if this was all there ever was to it, but I’m far from done. I have a vision and it’s becoming more real every day. 🙂

Have fun stock shopping over there. I’m 100% honest when I say that I enjoy stock shopping more than shopping for any other kind of merchandise out there. I “consume” stocks and dividends like others consume electronics or clothes.

You have a great 4th as well!!

Best regards.

ABT,

Yeah, someone emailed me about that maybe a couple years ago now. I forget when. I honestly wasn’t even aware of those funds when I came up with the name, but I suppose I should have Googled the name to make sure it wasn’t taken. However, I was running a very small blog on Blogger back then with nary a reader. Just one of those things.

But I’m not sure of the copyright infringement. If you google “Freedom Fund”, all kinds of sites and results come up. I’m not sure if I’d really have an issue because I’m not managing money or anything else. But we’ll see. I imagine Fidelity has better things to do than knock on my door. If they do knock on my door, I’ll know I’ve really made it. 🙂

Have a great weekend. Enjoy your 4th!

Cheers.

It seems like you traded that BB rifle for a BB Gatling gun! If only every month could be like that!

Congrats on passing the $200,000 mark (even though the portfolio value is not as important as the dividend income), and hopefully the problems in Greece keep stocks low for a long time. Other people can panic at their stocks going down. I’ll be greedy when others are fearful, like Buffett advises.

Did you have a position in RAI before they bought out LO, or did this transaction initiate the position for you? I could swear that you had RAI there before. I’ve been a shareholder for some time, and it is great to have brands like Camel (and now Newport, because it always seems like someone’s just running out for a “pack o’ Newpawts” where I am) working hard for you. Better to have major cigarette companies working hard to make you money than you working hard to make an employer money, right?

I’m looking forward to the dividend, ebook, and dividend growth updates!

Sincerely,

ARB–Angry Retail Banker

ARB,

Ha! It seems I upgraded the weaponry this month. 🙂

What’s crazy is that this record came about after I quit my full-time job and started working online full time. I would have never imagined that. Truly amazing. I’m incredibly fortunate. So happy that all the hard work is resulting in this.

I never had a position in RAI. So the 14 shares I have now are fully as a result of the acquisition. Certainly nice to see that LO position roll into something that’s more diverse, though I wish they would have been able to hang on to blu. I would have been happy just to see LO stay as is, though. But it is what it is. I thought about rolling the cash into RAI, but I don’t think it’s cheap here. And I’m also happy to see my tobacco exposure reduced somewhat.

Thanks for the support. Can’t wait to write the updates and get them out there! 🙂

Have a great weekend.

Cheers!

I agree with Thorsten on the more global nature of RTN. From their last annual report, approximately 53% of their sales revenue came for the US Department of Defense, and 29% international, plus “international bookings in 2014 increased by 27 percent compared to 2013, and our backlog at the end of 2014 included 40 percent international business”. Given that the US DoD budget is approximately 50% of global military expenditures (see: http://en.wikipedia.org/wiki/List_of_countries_by_military_expenditures#/media/File:Top_ten_military_expenditures_in_$_in_2013.jpg) this seems about as normal as the real world. (whether or not our defense budget should be that high is another, debate I don’t care to get into, lol).

With the new growth into cybersecurity and e-warfare business, I can see Raytheon becoming even more global. They are focusing on growing that business and diversifying their revenue streams both geographically and categorically. From the report: “we are winning new business and seeing significant opportunities developing both domestically and internationally as we seek to unlock the value of our cyber capabilities to meet the growing global demand. For instance, we booked a $260 million award for an international cyber program during the year.”

As for valuation, I agree with Jason that the company seems pretty fairly valued right here. Unfortunately, I hadn’t seen your previous article in January, but my calculations were about the same, with $98 target. I bought a little early too just to get in and my basis is about $101. Looking to average down now with a price that I believe is a little below my target valuation. I think this company will have a brighter future the more it gets into global and cybersecurity markets. They are a bit like an IBM of the defense industry. The sales have been declining somewhat in recent years, but cash flow, income, EPS, and most importantly DIVIDENDS keep going up. They are getting out of lower margin business, buying back shares and using the leftover cash flow on strategic acquisitions in their emerging markets and increasing the dividend. A lot to like if you can get in below this fair value price!

Congratulations JASON 200K by Jun end despite volatile market is awesome !!!

shankar,

Thanks so much. Really appreciate it! 🙂

It’s just a matter of sticking to the long-term plan through thick and thin. Short-term volatility is a long-term opportunity, right?

Have a great weekend. Thanks for stopping by.

Best regards.

Jason,

I found your blog a few months back after looking for people’s portfolios online – I am so happy I did.

You definitely have inspired me to keep going with respect to keep acquiring equities – keep it up.

I hope to keep monitoring your progress over the next few decades. 🙂

TDH

I’ve got a question for you…what do you do with a little small-cap stock that just keeps appreciating? Like if AMNF kept going up until it was hanging around with the heavy hitters at the top of your portfolio. Sell half to get it down to a reasonable position size, or let it ride? I like to take fliers on small companies with great fundamentals now and then, but I don’t want them bumping UL or KO out of the top ten.

Stupid first-world “problems”.

Just a thought. If

A = dividends you will receive in 2015

B = your total expenses in 2016

Find C = A/B*366

🙂

C corresponds to … april, 4 ?

Lots of dividend paying stocks in the TSX (Toronto) that have nose dived. No reason other than possible small increase in bank rate in the USA. As a result lots of good stocks down 10 to 20%. When your portfolio is seven figures, the decrease in overall value makes you cringe. Down 25k. You and I both know that to save that much money takes alot of time and effort. This is where you sit back and guess your commitment to investing. Five years ago I would have sold, now, I try to find more money and add to, or invest in new companies. So I sold a few things, moved some savings around and invested another 50k. I have always tracked my net worth, but now i also track monthly dividends and compare them to last year. Man, if the stock market in Canada reaches their past high, it sure will look good. In the meantime, adding 50k to my account will increase my monthly dividends quite nicely. Congrats on your additional purchases, and with your additional savings, your account is going to the moon.

TDH,

Really glad you found the blog and found some inspiration here. I aim for 100% inspiration 100% of the time. 🙂

Appreciate the support and readership. I hope to still be writing for many years to come.

You’re off to a great start there, especially for your age. You’ll be sitting pretty when you hit your mid-30s!

Have a great 4th.

Cheers.

Justin,

Yeah, that’s a good question.

First, I’m happy to let successful companies continue being successful, or let winners stay winners. I don’t want to detach from a great business because it’s become too successful. That would be silly.

But what I do to mitigate risk is I simply invest a rather small sum in companies like that. It would obviously take an incredibly lengthy period of time for AMNF to catch up to the likes of KO in my portfolio, even if the former grows three times as fast as the latter over the next decade. And that’s because of the amount of capital I’ve put to work. But if AMNF is up to the challenge, I’m happy to let it ride.

Keep in mind as well that a small company growing that much and that fast will become a larger company. That, in my view, further limits the risk somewhat, which means I’d feel more comfortable as time goes on in regards to the position becoming larger.

Best regards!

Nuno,

Tough to forecast numbers that far out, especially expenses. They vary all the time. But if I were to guess and say I’ll spend $1,800/month in personal expenses (including debt repayment), that would be $21,600 next year. If I hit my goal of $7,200 in dividend income this year, that’s 122. So that would correspond to May 1. So the sum of 2015’s dividends may cover personal expenses up until May, which is pretty awesome. Though, I like to look at dividend income and expenses on a running basis, because expenses vary and dividend income is always improving. We’ll see how it goes! 🙂

What’s your day?

Thanks for dropping by!

Take care.

NRG

Never let a good sale pass you up! 🙂

I don’t really look at a correction as money lost. You didn’t “lose” $25k. The value of your securities simply changed from one day to the next, which goes to show you just how efficient the stock market really is. The true value of those securities likely changed very little. That’s why I focus on value, not price. Price changes every second. Value doesn’t change very often. And it’s value that I really care about. Because value is derived from business operations, not the stock market’s opinion on what something should cost.

In the end, you have wonderful first world problems over there.

Thanks for dropping by. Let’s hope for more sales in the future!

Cheers.

I’m keeping a close eye on the Greek referendum tomorrow and also whether US and international negotiators are able to reach an agreement with Iran before July 9th. A no vote in the former could trigger a real sell off (I already picked up some UL last week as it declined 3%) in stocks with international exposure, while an agreement in thr latter could cause oil to plunge further which means I might be able to get XOM at under 80 dollars. Fun times for bargain shoppers, DM!

$6K in one month – your packing some serious punch now!

Im a long way away from that, but I am only into year 3 and the journey is a marathon, so I will get there.

I too invested in Gilead (cant remember if it was end of May / start of June), believe we will see some serious dividend growth there.

Good luck

Jason

What site do you use to track purchases from Gayner, etc? Do you pay to any sites for access? Like seeking alpha or fool.com or others?

Thanks for the great work! Looking at starting a position in OSK and Adding to BBL this week!

Mike,

Looks like a tight vote over there in Greece. It’ll be interesting to see how it all turns out. Seems like a can is being kicked down the road, either way. I’d be surprised to still see Greece in the eurozone a decade from now. But you never know. Greece’s economy is pretty small, though there could be larger implications at play.

I’ll be buying stocks this month and the next, regardless. Earplugs are in, noise is being ignored, and capital is being put to work. 🙂

Best regards!

DF,

It was an incredible month for me. Probably a one-off, but I’ll take it. I think my long-term average is closer to a little over $2,000 per month, but I wouldn’t mind slowly increasing that average. 🙂

Don’t worry about where you’re at relative to me. If you go back through some of my earlier months, you’ll see I was investing a lot less. There were some months I was lucky to scrape up $1,200. You’ll get there. The snowball starts to accelerate over time and those reinvested dividend dollars become larger and larger, adding to your available firepower.

Glad to be a fellow shareholder with you in GILD. I also think we’ll see some significant dividend growth over the years. Their runway for growth is really incredible. Very excited! 🙂

Thanks for dropping by. Keep it up over there.

Cheers.

Bill,

GuruFocus.com tracks Gayner (and other “gurus”).

Here’s a link:

http://www.gurufocus.com/StockBuy.php?GuruName=Tom+Gayner&rec=2

BBL is incredibly cheap here if you think they have any future at all.

Appreciate the support. Let me know if that link doesn’t work, but it shows up okay for me. It’s pretty neat to see what he’s up to.

Take care!

That is an insane “blockbuster” month Jason! 😉 10 buys in a single month! Wow, I can’t wait to get there in my freedom fund! Thank you for always providing such inspiration.

Cheers,

Mike

Mike,

It was one of those one-off months that was really incredible. Doubt I’ll see anything like that again anytime soon. But I’ll take it when I can get it! 🙂

Hope all is well over there. Thanks for dropping by.

Cheers.