Income/Expenses For May 2015

First, I want to prove to the world that it’s possible to become financially independent at a relatively young age even if you don’t make a lot of money. I don’t make a six-figure income. I never have and I probably never will. But it’s not necessary. Oftentimes, people focus on income too much. Expenses are just as important, because if you make $200,000 per year, but spend $190,000 of it, you’ll never become financially independent. Conversely, bringing home $40,000, and learning to get by on half of it means you’ll likely be able to retire if you want to within 15 years or so. Making less means you have less potential income to save, but spending less means you need less passive income with which to retire off of.

The second reason I do this is because I want this to be a live look at one man’s journey. You can find countless books by financially successful people, but often it’s long after they’ve completed their trek to significant wealth that they’re then telling you how they did it. It’s easy to postulate. It’s much more difficult to actually show the whole process in action, for better or worse.

And finally, knowing that every dollar I spend is going to be published for the world to see serves as reinforcement to stay frugal. There’s been more than one occasion where I decided against a particular expense after realizing I might be a bit embarrassed to write about it.

So each month I will post my income and expenses for the previous month. I track every dollar in and out, so what you see is exactly what I earned and spent (rounded to the nearest dollar).

By the way, I use Mint and Personal Capital to track all of my expenses. Both are awesome (and free) services.

| Income From May 2015: | |

| Online Income | $5,420 |

| Other Income | $600 |

| Dividend Income | $359 |

| Total Income | $6,377 |

| Expenses From May 2015: | |

| Rent & Utilities | $533 |

| Groceries | $238 |

| Student Loans | $224 |

| Health Insurance | $193 |

| Hosting | $148 |

| Fast Food/Takeout/Coffee | $115 |

| Restaurants | $114 |

| Transportation | $114 |

| Pharmacy | $43 |

| Cable/Internet | $27 |

| Mobile Phone | $25 |

| Amusement | $2 |

| Everything Else* | $492 |

| Total Expenses | $2,263 |

Income

This was the best month I’ve ever had in terms of online net income. Generating almost $5,500 in income in one month after taxes while doing something I truly love to do is just a dream, and an amazing one at that. My freelance writing output is roughly the same as it’s been for the last nine months or so, but what’s happened here is that the blog is getting slightly more popular every month (almost 350,000 pageviews in May) and you readers are helping me out tremendously when you sign up for products and/or services that are recommended here on the blog. As always, I only recommend what I personally use and/or find a lot of value in. Trust me, I get affiliate and sponsorship offers almost everyday, and I turn 99% of them down.

In addition, I’ve started up a coaching service. I took on a few clients in May, and that helped the bottom line a bit as well. I’m doing my best to add value and, so far, the clients I’ve worked with have been very happy. It’s just a way to connect one-on-one and help where possible. If you’re ever interested in connecting, contact me.

I’ve discussed how I generate income online before; all that’s really changed since then is that I write a lot more and the blog has grown quite a bit (so all income categories have increased). Of course, the coaching and the book will start adding to that as well (I should see my first royalties from the book in June), so I may revisit this topic at some point in the near future. Thank you all for your continued support!

Dividend income was once again tremendous. But how could earning hundreds of dollars for doing nothing else other than being alive be anything but tremendous? As you can see, May’s dividend haul was well below my average. Expenses, as you can also see, were also well above average. Yet the dividend income still covered a healthy chunk of those expenses. That portends good things ahead.

Other income was related to the sale of my car. I’m going to spread the profit out over the course of the year so as to smooth any month-to-month variances out. So this will provide a nice boost to my monthly savings rates for the rest of the year, just like it was a drag on my monthly budgets last year.

Expenses

*The everything else category includes expenses I don’t have a regular budget for. This was almost completely related to the money spent on the hotel stay in Omaha for the 2015 Berkshire Hathaway Inc. (BRK.B) annual shareholders meeting. I also spent just under $29 for a pull-up bar that hooks up to a door frame. Great investment as it allows me to continue my frugal fitness routine at home without the expensive gym membership. I will say, however, that a $10/month gym opened up not far from our apartment. I continue to think about joining, but I’m rocking out at home, so I’m just going to keep doing my thing.

Food was quite high this month. And that was largely due to more overall food spending while we were in Omaha in early May. We don’t eat out too often – maybe two restaurant visits per month, on average – but we ate out exclusively while in Omaha. I was lucky just to have Claudia on board with making Omaha our quasi-honeymoon. She would have probably caused bodily harm had I suggested eating sandwiches or something while we were there. In addition to the eating out in Omaha, there were three weekends on which I purchased groceries this month. We alternate paying for groceries and I got hit with three visits this month.

Transportation was also extraordinarily expensive here. And that’s because we had to rent a car from the airport to get back home to Sarasota after flying in from Omaha. I expect transportation spending to be in the very low single digits looking forward.

Other than the trip to Omaha with the related expenses, most everything else was normal. If you back out just the hotel and rental car spending, personal expenses were only $1,686. I consider that a pretty solid result, even with the higher food spending. Travel is expensive, but it was obviously worth it.

You’ll also notice that hosting expenses have increased. Due to the aforementioned increase in traffic, I’ve had to boost the capabilities of the blog, which costs more money. A wonderful trade-off, however.

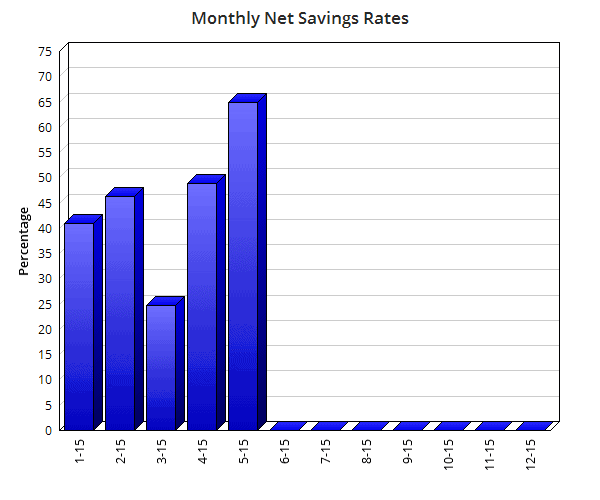

Savings

I managed to save 64.5% of my net income this month. That’s what I’m talking about! I feel like the moves I’ve been making recently are starting to pan out. I’ve been working harder than ever to produce great content for you readers while also doing what I can to cut expenses – like living without a car, gym membership, weekly restaurant visits, or frilly purchases that will only drain my wallet and long-term happiness in exchange for fleeting euphoria. I’m starting to get back to the savings rate I’m used to. The fact that I’m doing it without the steady paycheck from the old full-time job is still incredible to me. I’m really fortunate. This is the first time I’ve eclipsed the 60% mark in almost a year. I used to save more than 60% easily and routinely, so it feels good to get back to the old me.

One of my goals this year is to save 50% of my net income throughout 2015, averaged monthly. So far, I’ve hit rates of:

I’m now at an average of 45.2% for the year. Still behind my goal, but I think I’m going to make incredible progress toward that over the next few months. June should be really strong for dividend income, which will only further help my case. And I don’t have any major expenses planned for the foreseeable future, so it could be a really strong summer of savings. The only upcoming expense that might be out of the ordinary is an eventual dentist visit. I had a root canal performed last year and I know I have a few small cavities that have to get checked out. I’m not delaying that out of fear of spending money. Rather, I just hate going to the dentist. I could have $1 billion in the bank account and I’d actively avoid going. Such is life, though.

Looking at the near future, I think June will be even better than May. It’s quite possible that I’ll eclipse 70% for the first time since I was relying on the paycheck from the car dealership. I just continue to work hard and think about the long term. Stay tuned for that!

How was May for you? Did you stay under budget? Hit your savings target?

Full Disclosure: None.

Thanks for reading.

Photo Credit: bplanet/FreeDigitalPhotos.net

Note: Affiliate link included.

This hits home because, for a long time, that was basically me to a T.

A huge reason why a lot of us respect you is for the reasons you outline in this post. You’re doing it live! That’s not easy. We get sort of a live action play-by-play on the bumps you hit in the road, rather than a cursory glossing-over later on in some how-to book.

You and some other key players in our community have inspired me, not only to blog, but to keep pushing my savings rate up beyond 50% to bring that retirement date closer to my target.

Excellent post, thanks.

Jason,

Your online income is just busting, Congratulations, you are doing so well on that side as well as the saving percentage. There is no other thing that to say you made the biggest and best move of your live my retiring and helping us getting FI.

Cheers,

RA50

Your online income this month is awesome – well done you! As FI Monkey said, it’s down to you and other PF bloggers than continue to inspire me to do more with my life, rather than just plodding by. If I can say one day I’ve earn even £1,000 a month online, I’ll be very happy 🙂

Thank you for sharing, as always.

Great job Jason, this just show it can be done. trying to instill in my kids that savings and investing will build their wealth. keep up the good work. I look forward to these updates. have a great day Michael

Killer May, congrats! Personally I’d definitely join the gym at only $10/month. I love going to the gym 4x a week. It’s my personal time where I can just grind through a workout and think about as much or as little as I want with no distractions. Plus it gets me out of the office and my apartment. Working out is definitely my other passion besides personal finance. Take care!

FI Monkey,

Thanks so much!

Yeah, I wanted to create something unique in the real-time journey from almost zero all the way to FI. That’s what I really set out to do back in 2011. I’ve learned a lot on the fly, and I’ve done my best to share that with you guys along the way. After all, we’re all in this together and we’re all after the same thing. 🙂

Having a big income certainly doesn’t hurt. But it’s not the be-all and end-all. If you can combine a high income with a very low expense base, then you’ll obviously reach FI incredibly quickly. But all too often people with high incomes let lifestyle get the best of them. The key isn’t making a lot of money. The key is really going after it with all you’ve got, cutting out all unnecessary fat, and seeing it through to the end. A proper mindset is more valuable than a big paycheck, in my opinion.

Let’s keep it rolling!

Best regards.

RA50,

Thank you!

It was a brave move giving up the $60k/year at the dealership to strike out on my own. My motivation to spend more time with family back in Michigan was part of that decision, and that didn’t pan out. But it all worked out incredibly well in the end. I’m doing what I love to do and making a healthy income at it. Hard work goes a long way, but so does believing in yourself and having the courage to act.

Appreciate the support. Hope all is well!

Cheers.

Nicola,

Thanks. I’m doing all I can to inspire and show the path. I believe 100% that financial freedom is possible for us. And I’m going to prove it. 🙂

I’m confident you could earn 1,000 pounds online… or even more, if you put your mind to it. A lot of opportunity out there for those willing to take advantage of that.

Appreciate you stopping by. Hope all is well with the growing bump and the NSDs!

Best wishes.

michael,

You’re doing a great job over there. I never had anyone to teach me the value of money, time, and staying on top of finances. I’m sure your children will reap great rewards from your insight and attention. 🙂

Best regards!

FF,

Yeah, I used to be a gym rat for sure. But I find that my little routine at home gets the job done. I do sometimes miss the camaraderie at the gym and the motivation I’d get from being around others working out, but I’m doing pretty well with the routine here at home. I’m honestly in some of the best shape of my life right now. And the $10/month would quickly escalate after factoring in the bus rides to and from the gym (it’s way too far to jog).

If I were to ever join a gym again, it’d really be for the atmosphere. Though I can easily get the job done at home, I always enjoyed hitting the gym. We’ll see. Maybe once I’m real close to FI, I’ll join a gym again. It’d be a great reason to get out of the house.

Thanks for stopping by!

Best wishes.

Absolutely phenomenal!! There is really nothing else to say. You are doing what you love, getting paid to do it and saving a tremendous amount of money just to see the same results the next month.

This blog, a real first at a LIVE/UP-TO-DATE look of investing and getting to financial independence continues to be an inspiration. Like a commenter said above, there is no “glossing” over of a month or two because you didn’t like what your savings rate was. This blog gives NO ONE the excuse to not retire early off of a blue collar middle of the road income. You are living proof it can work and you are capturing it for the world to see. Some people may say that $72,000 net (your annualized pay from this month) is not blue collar/middle of the road, but if people put in the time and work as hard as you do (which I’m sure is over 40 hrs a week right now) I’m sure they could see similar results.

Increase your pay as best you can, cut all dumb expenses and bingo! Financial Independence here we come.

I cannot wait to see what your June total will be with the book income and a huge (most likely over $1000) dividend income total. Exciting stuff!!!

May was one of my wife and I’s best month for saving and the results were impressive. We were able to get in 2 purchases for about $2K each. If we could keep our expenses as low as May, we’d probably reach FI around 40 just like you! We are certainly trying our best to get there, but I’m sure there will be bumps in the road.

Congrats again,

ADD

That’s an impressive month.

After glancing at the income number, I definitely thought the bump was related to the book. It’s great news that it was due to natural growth of the website and the community continues to strengthen.

Congrats on a great month!

Over 60% is killing the game. Congrats on an awesome month.

Two bucks for entertainment?!? Spendypants.

Man, any time your income is almost 3 times your expenses, and you save the excess, you are doing fantastic! Congrats

My, your online income last month was staggering. Well done! Glad to see that it has become so lucrative for you. All the work is clearly paying off and certainly the content your producing will continue to attract readers: new and old! I can’t see it dropping too much as a result!

If you can get a few more 60%+ savings rate months you will be well on track again to reach your 50% savings goal for the year. You’re certainly making the right moves!

Keep up the great work, Jason!

ADD,

Appreciate the kind words and support. Really giving it my all and working extremely hard over here. Just so glad and so fortunate that the hard work is translating so well.

Right. My income this month was well above a typical middle-class American’s, but it hasn’t always been this way. And I think there’s just as much value in seeing that it’s possible to reach FI on a normal income (something I’m pretty familiar with) as there is in seeing that it’s possible to be creative, work hard, and increase your income so as to reach FI even faster.

I certainly hope it continues on like this, but the online income is so volatile. We’ll see. June should be really fantastic because of the strong dividend income, the book royalties (if they arrive by the end of the month), and continued strong income all around. I think it’s quite possible I’ll exceed the 70% mark by a good margin, which would be great. I haven’t done that in a year now.

Congrats to you guys for such a great month over there. Putting away $4k in fresh capital is extremely impressive. Many people have a hard time even saving 5% of their income, so being able to invest thousands of dollars per month obviously puts you in rare company. And I can tell you it’s pretty good company to keep. Like Ramsey says, you want to live like nobody else now so you can live like nobody else later.

Keep it up!

Best wishes.

RTR,

Thanks!

Yeah, I haven’t received anything for the book yet. I expect to see something by the end of June. The first month will be the biggest royalty payout. It looks like I’ll probably be generating a couple hundred per month or so looking forward. But that’s wonderful. If I can positively affect people in a huge way and collect $100 or $200 per month, I’d consider that a big win-win. 🙂

Appreciate the support. Looks like you had a great month for your net income. Keep it up!

Cheers.

Jason:

I do not know why I have waited so long to comment on your blog, but you have been a true inspiration to me. Your detailed posts and optimistic mindset is truly inspiring and is what started me on my path to financial independence. It is awesome you are doing something you love. From home. For pay. With additional dividend income continuing to build up and pay out. Thank you so much for posting your journey in such an open manner for all to see, follow, and enjoy.

Please continue to inspire and make such awesome posts!

Best,

Alex Craft

Adam,

Thanks. I’m giving it 100%, that’s for sure. 🙂

Hope you had a great month of savings over there as well!

Best regards.

FV,

Ha! Yeah, I used a Redbox coupon around the middle of the month. I think I got a movie for a quarter with the rental of another movie at full price. So it was a bit less than $2 for two movies. Not too shabby!

Thanks for dropping by. Hope you had a great month over there.

Take care!

KeithX,

Appreciate it. Just keeping my head up, working hard, and giving it my all every single day. This month would have been a lot better without the travel spending, but I’ll take a ~65% savings rate with the opportunity to see Buffett in person. A pretty good deal. 🙂

Thanks for the support!

Best wishes.

I’m so happy for you these days, I still remember when you’d post about life’s stresses like the auto service job bringing in a new co worker. That’s so far in the past now. You’ve created your own opportunities and completely run with them. You’re such an inspiration and I hope things pick up even further. The more you can save, the more great investment ideas we get to read about, so keep at it!

Wow very awesome income for May and that certainly helped with the high savings rate. Good job!

TDD,

Appreciate that. The more the blog earns, the more motivated I am to produce great content and live up to the income. And I think consistently high-quality content will continue to inspire and attract readers. So it kind of works hand in hand – a self-fulfilling prophecy of progress and success. Success begets success and there you go. 🙂

I really think I’m going to exceed that 50% mark this year. June will probably exceed 70%, barring any unexpected large expenses. And the rest of the summer looks really solid. It’ll be fantastic to get above 50% once again after the drop last year. The gamble seems to be paying off thus far. I’m incredibly grateful.

Thanks for stopping by! Hope you had an outstanding month over on your side of the pond.

Best regards.

Great Job Jason! More than 5k by online business, awesome! But you deserve it by doing this great job with your articles and for sure your book! Well done…

Cheers Patrick

Alex,

Hey, no problem on waiting. Appreciate you following along, comments or not. 🙂

Looks like you’re starting off incredibly young over there. Great stuff. I can only wish that I would have started out in my young 20s. I’d certainly already be financially independent by now. Although I’ve made up some serious ground in a few years, it would have been an easier go of it starting out seven or eight years earlier. You’re already changing the course of time. There’s a future you out there now financially independent simply because you made the choice to start saving and investing.

Keep it up. And stay in touch!

Cheers.

My weekend is going to be dedicated to starting side hustles and other things, so watch this space! Even £100 a month would be beneficial at the moment, what with bump and all! Up to 9 NSDs for June so far, so going well 🙂

DM,

Considering the quality and quantity of content you’ve been able to manage putting up here, there’s no reason why you’re online income shouldn’t continue to grow. Keep up these income levels and you should be able to reach your 50% savings goal with ease.

Keep up the great work!

Cheers,

Dividend Odyssey

Ryan,

Yeah, I remember those articles vividly. I remember getting out of work and feeling the sunshine and blue sky really hit me for the first time, only to be disappointed and frustrated since I knew it was only going to last another hour or so. And I remember my new co-worker coming on board, realizing that I just took a pay cut on par with many simultaneous dividend cuts. Life’s a bit different now. 🙂

Appreciate the kind words. It’s maybe a little scary to take that leap of faith and strike out on your own. But it’s far scarier staying stuck in a situation you’re not happy in. I’m certainly glad I took that leap.

Congrats on all of your recent success and progress as well. A new job, $5k of capital put to work, and a big bump in dividend income. Life is good!

Best wishes.

Tawcan,

Yeah, May was really incredible. I was hitting records across the board. And quite a few accounts paid out that don’t ordinarily pay out regularly, so it was just excellent all the way around. I’m hoping June is even better. 🙂

Let’s keep it up!

Cheers.

Patrick,

Thank you. Very kind of you. I hope I deserve it. I’m going all I can to live up to it and deserve it. It’s just a matter of working hard, adding as much value as possible, and doing all I can to inspire and help people.

Looks like you had a great month over there as well. Exceeded your savings goal, added capital to three different companies, and received dividends from four different companies. The snowball is moving. Keep rolling. 🙂

Take care!

You are doing quite well for yourself. Great job!!

Doing what you enjoy and becoming financially independent at the same time—What else could you ask for? Keep it up, and I am looking forward to following you on your journey.

Keep cranking,

Robert the DividendDreamer

AKA — Seeking Dividends

Follow me on Twitter– Seeking Dividends@DividendDreamer

DO,

Thanks. That means a lot to me. I take a lot of pride in my work. I spend a lot of time with all the articles, here and elsewhere. If I’m not proud of it, it doesn’t get published.

So far, 2015 is blowing away my expectations. I’ll review the annual goals in July after I hit the halfway mark, but it looks like I should be able to exceed the savings rate for sure.

Appreciate the support!

Best regards.

Robert,

It’s really incredible. I wake up every day grateful to be in this position. And I work hard to stay here as long as possible.

To slowly achieve financial independence while largely living a financially independent life is just amazing. The best of both worlds. It’s a gift that I really treasure and work hard to retain.

Thanks for following along. Lots more to come! 🙂

Cheers.

Well done!

The dentist has set us back 14,000.00 this month.

I know! =/

Long story short I am 53. Diagnosed with Lupus/Sjogren’s when I was 32. This started a quest for the perfect

diet to put these issues in remission. Throughout the years I have had varying degrees of success with diet.

Hitting my late 40’s caused some serious regression. This caused me to search ever more diligently for answers.

One thing that had always come up in the literature was mercury amalgams. I “had” a mouth full of them.

This past Monday I spent 4 hours in the dentist chair. This was the final phase of having all mercury removed

from my mouth. They had to remove all my crowns too as, mercury “could” be under the crowns. In my case

mercury was indeed under my crowns. Sadly, some of the fillings were deep causing me to need more crowns.

That brought the total to seven crowns.

It was a painful decision to spend that money on my mouth. Especially since there isn’t a guarantee that this will help with my autoimmune diseases.

This dentist does do other corrective measures that I have never experienced before. He made a model of my teeth and fit it to a metal hinge that represents the jaw. This model helped him to see what my bite looks like without muscles compensating for inadequate bite. My bite was off quite a bit.

Thus far I have had two appointments with him. My bite has improved drastically. I will need two or, three more appointments to finish up. He said on the final visit he has a computer that will help him fine tune my bite to perfection. Then he will make me a night guard to wear at night to protect my teeth.

It is true I am sleeping better. Too, I have noticed the neurological pain in my head and, face has improved.

The dentist thinks that many of my symptoms might go away once my bite is right. He thinks all of it could just be my bad bite. I hope he is right!

Saying that you might think my mouth looked distorted. Not so. I have always been told I have a lovely smile.

It is really cool to see you succeed in your endeavors. Keep up the good work. I am looking into my Disney trip, so that meeting might just become a possibility sometime in the near future. We are going to see Def Leppard in Atlanta on June 28th. I wish you were close to that venue, but maybe closer to the end of the year or beginning of next.

Keep cranking,

Robert the DividendDreamer

AKA — Seeking Dividends

Follow me on Twitter– Seeking Dividends@DividendDreamer

Wait until you are earning 10k a month online and your savings rate will soar well past 70%.

Joy,

Sorry to hear about the expensive dentist visit. And I’m sure the experience itself was probably just as bad as spending the money. Or maybe that’s just in my mind. Going to the dentist for me is like going to a horror movie or something for other people.

But it sounds like it’s all for the best. I truly hope the health concerns are largely cleared up after that. If that’s the case, then money well spent. 🙂

Cheers!

Robert,

Sure. Definitely. If you end up in the area, let me know for sure. I’m about two hours or so away from Orlando. But Sarasota is a pretty nice area to visit, if you’re in the area. 🙂

Cheers!

Laura,

Wouldn’t that be nice?! Definitely not impossible. I’ll honestly be quite happy if it stays at this level in perpetuity, but I would also love to be able to save and invest even more. Financial independence won’t escape me. 🙂

Hope you had a great month as well!

Best regards.

Yet another great month. May I ask; how did you get your post writing gigs? Did you advertise at all, or did people just message you through here?

Very well done once again. Anything less than $3000 in monthly expenses for most of us these days is darn good, and the low rent/utilities helps that tremendously. I’m glad to see that your book is continuing to do well – I’m definitely hoping to see that pay off for you, both literally and figuratively, over the next several months and years.

As always, keep up the good work.

Jason:

I appreciate the kind words — it means a lot. I am hoping this is the case and time is in my favor as I work towards financial independence. I will be sure to stay in touch and, as always, follow your journey.

Alex

ERG,

Good question there. All of my opportunities have come to me. So I’ve had the chance to kind of work with those I like to work with, which is a tremendous benefit. And it works out well for both parties as I do my best to retain those relationships and add as much value as possible.

But there are a lot of opportunities out there to write. If you’re aggressive and bang down the doors, they’ll open up.

Thanks for dropping by!

Cheers.

Steve,

Appreciate the ongoing support very much. Thank you.

The expenses are still really low at their base level. The blog expenses and intermittent one-time stuff sometimes clouds that, but I can get them really low here and there when I miss the potholes along the way. Add in the increasing income and the future looks bright. I’m super excited. 🙂

We’ll see how the book goes. Sales have trailed off to maybe a couple copies a day now. But I’m more interested in positively affecting people than I am in making a lot of money off of it. Then again, I’d be very happy with a couple hundred bucks a month from here on out. That would be incredible. I think there are a lot of other opportunities out there to make money, but I’m not necessarily interested in maximizing all of them. If I can maintain high-quality content, make a good living, and maintain a high quality of life with a great balance, I’ll be living a dream.

Best wishes!

Yes, it isn’t a good time, that is the truth.

However, the longer you put off going the more damage to the tooth. Thus, could turn into a crown or, as you know root canal.

Didn’t mean to make my comment all about me. Though your post reminded me of that HUGE bill. Too, no savings will be taking place for a few months d/t that expense. 🙁 That is a kill joy for sure.

I am happy you are doing so well, I hope things continue to exceed your expectations! Keep up the great work!

Dividend Mantra,

My first reaction when I read the income, was “Holy sweet ‘beeeeep’ “. In case some people are super religious on here.

Congrats on the income which is more than twice I get at my job per month. I am quite sure you will never have to “work” at a job anymore that you dislike such as a dealership. Do people recognize out at the coffee shops near where you live?

Once again, it’s your online income that had my jaw on the floor. My dividend income is low but I haven’t been at it for two full years yet, so I’m not really worried about it in and of itself (like the strategies or anything). But my job income is crap and will never provide the fuel I need to make my dividend income increase at the rate I want it to (which is sooner than later), so it’s all on my blog income at this point. I hope that five years from now, Angry Retail Banker is pulling in what Dividend Mantra is.

And I can’t wait to see your ebook numbers as well. I’m sure they will be impressive. Seriously folks, either buy this book, recommend it to your friends, or both. I’m on Book 4 right now ( the full ebook is divvied up into five Books), and I’m enjoying it immensely, even if much of the content is familiar to me.

And a 64% savings rate during a particularly expensive month? Amazing! I wonder what it would have been had you not had the Omaha trip?

Sincerely,

ARB–Angry Retail Banker

Awesome month Jason! You’re living the dream my friend. We’re all happy for you and prove us that this journey is definitely awesome. Thank you my friend. You’ve earned the title THe Hustler for sure. Keep it up and always a pleasure bud. Cheers to us ! I’m gonna do it up too J.

IP,

Ha! Thanks, man. Yeah, I was a bit shocked, too, when it was all tallied up. Definitely a monster month. I don’t know if that’s a new normal, but I’m certainly hopeful I can build on that and create some momentum. Either way, 2015 has far exceeded my expectations thus far. Even a slight slowdown in the second half of the year won’t derail my goals.

The coffee shop employees recognize me only insofar as I’m a regular customer now. I’m not recognized from the blog. I’ve only been recognized out in public once (besides the Berkshire meeting), and that was while at a movie theater here in Sarasota. Pretty crazy.

Keep up the great work over there. Good job averaging down on Canadian National!

Best regards.

ARB,

Thanks for the recommendation there. Really glad you’re enjoying the book. I hope it’s positively affecting people in a big way. Looks like it is, based on the reviews. 🙂

I’m sure you can make more money online than you might think. In addition, it’s largely exponential, which is something that people might not expect. And you can kind of see that in my own progress, going from basically nothing to a few hundred, to well over a thousand, to now well into the thousands. It wasn’t linear.

Keep at it over there. Every day, week, and month is full of opportunities to progress closer to the goals. 🙂

Cheers!

Terrific month! You say you “probably never will make a 6 figures income”, but you’re on a solid path to it, if your blog keeps going on an “up” trend, you’ll reach 6 figures next year.

May was pretty bad for me, with a huge expense: more than $3000 for plane tickets for my kids, my wife and myself, to go and see our family abroad… these things happen, we just have to take them into account in our own goals.

StockBeard,

Thanks so much. And you’re right there. I really can’t believe it, but it’s actually plausible that I could one day (relatively soon) earn six figures from working online. Like I was mentioning in another comment, the growth has been exponential rather than linear. So who knows. 2016 could definitely bring about incredible success in that department.

Don’t feel too bad about the travel. I’m going to have a similar expense later in the year. Claudia’s from El Salvador and we’re going there for Christmas this year. So I expect to spend a lot this fall on plane tickets. But if we get ahead of our goals on the easy months, we’ll have that room to spare when those big expenses come up. 🙂

Best wishes!

Hey Jason,

How do you account for big one time expenses like house insurance or property tax? Or are those NA since you rent? Just curious how you would handle something similar. Nice work this month by the way. Any savings rate above even 50% is impressive!

-Adam

Oh and shout out to Michigan! Thats where i was born and raised!

Hey jason,

You totally killed it this month dude! Over 60% savings is some powerful stuff. And $5, 500 in online income is also totally nuts, you’re doing real real good. Keep it up! I’ll be around.

Best regards

DB

Adam,

Definitely. Big shout-out to Michigan. It’ll always have a special place in my heart. 🙂

Yeah, I don’t have property tax or anything like that to worry about since I rent. But I’ll generally amortize large, one-time expenses like I did back when I bought my car. I just view it as lending myself money at 0% and paying it off incrementally. That way it smooths out big swings in the savings rate/budget. Fortunately, I don’t have too many big expenses so I generally don’t have to worry about that too often.

Thanks for dropping by!

Best regards.

DB,

Appreciate it very much. 🙂

It was a great month. I’m just working really hard over here and I remain very fortunate in a lot of ways as well. Should be a pretty strong summer over here, so I’m excited to keep sharing the results.

Have a great weekend over there!

Take care.

Nice nice nice! Glad to see somebody is back on track, I am falling behind in the low 40% due to I am cutting back on my work hours but I am spending more time with the kids. Family comes first right?

FFF,

Nothing wrong with cutting back hours, bud. Like I mentioned in my post when I reflected back on quitting my job a year ago, I’d always choose the slower, but more enjoyable path to financial independence over the faster path where you’re working a ton and maybe not enjoying life so much. We’re not doing this for the money anyway; we’re doing this for the freedom, options, flexibility, happiness, and time that the money can buy. 🙂

Keep it up!

Best regards.

That’s an incredible month. Keep that up, and you’ll hardly even need dividends. 🙂

Jason, if your income keeps going up, say to 10 k a month, will you increase spending on things like eating out a bit more, taking occasional trips w Claudia to Europe, etc, if you can still save 60 percent or more of income for investing, or would you move savings benchmark to 75 percent of income?

I wish we could have your savings rate. We have two little ones under the age of two, but we are trying our best. Some months are better than others. Thanks for posting.

It looks like you had a great month! I can only imagine what June will look like when you have the numbers for your book sales. You are killing it! Who needs a service writer job? 🙂

A cautionary tale – be careful not to let lifestyle inflation and the hedonistic treadmill creep in as your income continues to increase in your life. In your case you are living quite frugally and seemed to have found your happiness level. “Just saying” it can happen to the best of us. When this happens it makes the monthly passive income number you need for Financial Independence that much higher.

Hey Jason, have you seen KMI today? Cautious barron’s piece is out and the stock is pulling back. Is it a buy here? thanks!

Jason,

Awesome month considering the unusually high expenses! I look forward to your articles, especially updates on your progress, because it shows the world that it is possible to achieve FI without working your entire life or being born into it. You have inspired me to cut back on frivolous spending on stuff I don’t need in order to increase my savings rate. I have taken a huge hit in income due to the oil crash to the tune of ~$40,000/year at this point but I am socking away more than I ever have, even when I was scraping six figures. If only I had known then what I know now! I have trimmed my expenses down to around $2500 a month, and save close to $2000 a month now! I’m in my late 20’s so I definitely have time on my side, and I hope to have a passive income rivaling yours someday. I just started DGI early last month and the trickle of passive income has already started! Pretty exciting to earn money without lifting a finger! I can’t wait until the next few months when larger dividends start rolling in! Keep doing what you’re doing, you are a true inspiration to all!

Steven

DB40,

No dividends?! Blasphemy! 🙂

But, yeah, I’m really fortunate. To be able to achieve FI while basically being FI along the way is wonderful. Doing all I can to live up to it.

Have a great weekend!

Best wishes.

DD,

Good question. I’m not really suffering or delaying gratification. I don’t think I’d live much differently if I were a billionaire, to be honest. I’m incredibly happy living on relatively little. If my income were significantly more – and $10k/month would be a significant jump – I’d probably just increase the savings. I’m not necessarily interested in traveling in the traditional sense where you go somewhere for a few weeks. But I am possibly interested in slow travel or maybe even living abroad long term. But that would come down the line once I’m financially independent. So I guess my answer is that my lifestyle wouldn’t change much and the savings rate would just increase more than anything else.

Part of the reason I answer it that way is that I don’t think I’ll still be blogging or writing a decade from now. Or perhaps I might still be, but certainly not as much. So I’m still interested in achieving financial independence as fast as possible rather than relying on the online income for the next decade or two. And then once I’m FI, I won’t need to worry about saving any more money at all. In addition, the dividend growth will likely outpace inflation, meaning I can ramp up my lifestyle over time, if I really want to.

We’ll see, though. It’s one thing to say something and another thing to do it. And that’s why I love showing all of this unfold in real-time. 🙂

Thanks for stopping by!

Cheers.

John,

I can imagine having children makes it a bit more difficult to save a high rate of your income. But good for you for not letting that completely sideline your saving and investing. I have a lot of respect for others out there, like MMM, who are able to achieve FI quite quickly even with a child (or children). I think I’d still save a high rate of my income even with a child, but we’d certainly have to be more creative.

Have a great weekend!

Take care.

Bryan,

Absolutely. I’m keenly aware of that lifestyle inflation. What’s great is that I’ve kind of “been there, done that” in regards to spending a lot more, and I still remember being less happy than I am now. Like I was mentioning in another comment above, I’d still probably live a lot like I do now, even if the income doubled. And part of that is because I’m not sure how long I’ll be writing/blogging. And who knows how easy/difficult it will be to earn an income from this a decade from now. In the end, I’d rather rely on the dividend income than the online income, especially when I’m not real sure how much I’m going to write a decade from now. I’d rather have flexibility, freedom, and time than anything the hedonic treadmill can offer. 🙂

Thanks for the advice. I’m going to take you up on it!

Best regards.

Brazo,

I think Barron’s penned a similar piece on KMI a year ago or something. And then they went after DLR, if I’m not mistaken. Whether or not you can ignore the noise, however, is really up to you. 🙂

Cheers!

Steven,

That’s fantastic. You’ve experienced the power of frugality and living below your means firsthand. Those who say it’s all about income are just plain wrong, in my view. It’s easy to increase expenses in line with any increases in income. But if you get your expenses under control and learn how to appreciate frugality and what happiness really looks like, any extra income can drop straight to the bottom line. What’s really wonderful here is that when (not if) the energy sector recovers, your income may recover as well and that’s all just extra gravy straight to the investments. Imagine supercharging your way to financial independence.

Excellent work over there, though. You’ve definitely got time on your side with only being in your late 20s. I didn’t start until I was almost 28 years old, so you can see what’s possible here. 🙂

Thanks for the kind words. It’s readers like you that I write for. I want to show others what’s possible. I’m nobody special. Just a guy who worked at a car dealership who wanted something different… something more. And more is out there, my friend. I know because I’ve seen it and I now experience it every day.

That snowball will be rolling before you know it. And your money will one day work harder than you. Stick with it!

Best wishes.

Hi,

Here is a link to the bearish piece: http://valuentumbrian.tumblr.com/post/121282326405/5-reasons-why-we-think-kinder-morgans-shares-will

What do you think Jason, is this a buying opportunity?

Sampo,

Like I mentioned, it’s really up to you whether or not you want to pay attention to everyone, everywhere. You’ll either think independently and come to your own conclusions about a company, or you’ll listen to the bulls and the bears out there and end up confused.

That said, Valuentum has written something like 2,200 articles on Seeking Alpha. That’s a lot of content. At what point does it become noise?

In addition, the firm apparently liked KMI as recently as November 2014:

http://seekingalpha.com/article/2648335-weve-become-very-interested-in-kinder-morgan

I guess now because KMI has consolidated (which was announced before that article in November was published), they no longer like KMI. Are you a long-term investor when you like a stock in November but no longer like it in June, even though the company still has the same assets and does the same thing? And even though the price/valuation hasn’t materially changed?

They say the valuation paradigm has shifted. It’s the same company. It has the same assets. It does the same things. They valued it at $41 in November. Now they think the stock will collapse. I just can’t take articles like that seriously, especially when I notice the firm never seems to be long anything at all.

So, again, it’s really up to you to decide what you think about a stock. Not me. Not Valuentum. Not anyone else. Stand for nothing and you’ll fall for anything. I’ve already written about KMI extensively in the past and somewhat recently, so I don’t feel the need to repeat myself over and over again.

Hope that helps! 🙂

Cheers.

Yes I can not wait until this meager snowball starts picking up steam. I only had a few dollars in dividends last month, and this month won’t be anything special either, but my 12 month expected dividends went from ~$35 to ~$47 in one month. I have been fortunate enough to work for a small family owned oil empire (for lack of a better word) and things are already starting to pick up from when the rug got pulled out from the oil prices. Nobody got laid off or took hourly pay cuts, just less work to do so less income. I’ve been finding myself daydreaming about when my income returns to a normal level how I will invest it and how quickly I can retire! I took home ~$70,000 last year and blew most of it… With my new mindset I could easily invest $30k of that a year and it wouldn’t take long at all until I achieve FI. Thanks for your kind words and encouragement.

Steven

100000 * 0.78 (effective tax rate for that income) = 78000

78000/12 = 6500$ month after taxes

You are pretty dang close to that six figures man. I’m floored you can make this much just writing online. I know it’s been a long slog to build up to it but still, congratulations! Heck, if you add up all the other income you bring in you are pretty much there. What an awesome milestone.

Steven, stay the course my friend! I’ve been at it for about 5 years now and the snowball is really starting to pick up. It didn’t feel like much at first but month over month over month it really starts to add up. And don’t let any market pullback scare you either, think buying opportunity! 🙂

Zol,

Yeah, it’s really crazy. I’m so excited to be in this position. Even if the online income were to dip a bit from here (which is possible; it oscillates heavily), the dividend income will continue to increase and probably push me up near that mark at some point. But this is also my all-time record here, so it’s hard to say how accurate it would be to extrapolate it out. However, there are still a lot of opportunities out there. I’m not even taking advantage of half the opportunities I see. And that’s really because I’m trying to maintain a solid work-life balance, which is great right now.

But you’re right in that it’s been a long slog. As recently as late 2013 I was only earning a few hundred dollars per month from online ventures. So I think that speaks to the potential but also to the value of hard work and persistence. 🙂

Thanks so much for the support!

Best wishes.

Thanks for the reply! I guess for me as a beginner DGI investor it is a little harder to separate noise and real meaningful information. I haven’t really yet learned how to read financial statements that good and making an opinion about a company is a bit harder. But I know that KMI isn’t going out of business any time soon and I have made my investment decision and going to be a long term investor in KMI. How was it for you in the beginning? Were you always able to make your own opinion about a company and ignore noise, even in the beginning? I hope I will become a better investor and learn every day. It would be easier though if someone would teach me. Have a great weekend!

Zol,

Yes I am actually waiting for a decent pull back to unload some capital and snatch up some stocks at a good price. As of now I’ve been eyeballing some energy stocks since they are on sale at the moment. It seems like the worst is over with the oil crash and the price has stayed pretty steady around $60/bbl. I have a vast knowledge of the oil industry and I can tell you that it is possible to turn a profit at $40/bbl so these oil companies with good balance sheets are doing ok. They all seem to pay a pretty hefty dividend as well so I may take the plunge after I get paid on the 15th. I appreciate the encouragement, and I wish you the best in your journey.

Steven

Wow, you are “firing on all cylinders”, as they say. You’re totally hitting it out of the park with the online income, and a savings rate of 64.5% is incredible. Many people with regular jobs can’t come close to that.

Btw, do you have a preference between Mint and Personal Capital? Do you do your budgetting with one in particular?

Thanks for the reply! I consider myself still a beginner DGI investor so it’s sometimes hard to separate noise and meaningful information. But I’ll get better at investing hopefully 🙂 I’m still very much long KMI.

Sampo,

I understand where you’re coming from. But that’s all the more reason to read, learn, and grow as an investor. I know you’ve been stopping by here since at least late last year, so that’s plenty of time to read and get to where you want to be. Financial statements really aren’t that difficult to conquer.

For me, the analysis part took time. I didn’t look at my first stock and just understand everything right away. But I felt pretty comfortable with it. And I think, after a year, I went from walking to running. But in regards to tuning out noise, I was doing that right away. That was never difficult for me, which is why I’ve been writing the way I do and investing the way I do for many years now, even since the beginning.

I mean my entire comment to be constructive, not critical. But there are a lot of books out there that will give you all the information you need. Knowledge is power. 🙂

You have a great weekend as well!

Best regards.

Spoonman,

Really appreciate it, bud. It was a solid month. And I think June will be even better. Not quite sure if it’ll keep up like this, but I’ll happily save and invest all I can while it’s occurring. 🙂

I’m really excited that this is turning out so well. It was a risk to quit my job last year, though I’d argue it was probably an even bigger risk to stay. Nonetheless, a few people thought I was crazy for doing it. But I saw the potential. And it seems I’m validated here.

As far as Mint or PC, I prefer Mint for budgeting. It’s just what I’m familiar and comfortable with after all these years. Like I mentioned in my review on PC a few months back, I find PC to be less “glitchy” than Mint, though. Seems to aggregate better. But I just prefer Mint, especially for the ease of inserting cash transactions. PC, however, is far more robust when it comes to the investment side of things, so you could theoretically just use PC for everything. But I like both for their individual strengths.

Thanks for dropping by. Have a great weekend!

Cheers.

Well done and congrats again! After early retirement, we’re contemplating using some of the 401(k) assets to buy dividend stocks. Of course, first need to do the rollover and then the Roth conversion! That’s about 3-5 years down the line.

Congrats on the high income and savings rate. It is good to see you are able to buy more companies to your stash. A high earnings rate and a high savings rate can result in you reaching the dividend crossover point prior to the age of 40!

Have a nice weekend!

DGI

Mantra,

Holy smokes. Great income, phenomenal income, I have to say! Keep on writing!!! I’m pumped to hear about the book sales, really looking forward to that information. 64.5% is tremendous and keep at it Mantra! NICE.

-Lanny

Jason,

What a great month, I’m looking forward to seeing how much the book brings in to you. I know you have brought out that it won’t be a huge amount but what is exciting to me is you simply having another source of income that at this point is passive. You put no doubt a ton of work into it (I had it read the day after it came out, the book is awesome) but at this point there is no work being done to it.

What a great month for your other streams even though your dividend income was a less than normal. Can’t wait to hear about June for you.

Mr. Enchumbao,

Thank you! Appreciate the support. 🙂

Best of luck with that strategy over there. Should be a lot of fun going shopping with a big chunk of capital when the time comes.

Have a great weekend!

Cheers.

DGI,

We’ll see how it goes, but I’m incredibly enthusiastic. I guess that’s just how I am, though. It’s hard to not be enthusiastic with all of the opportunities out there. If I can make it before 40, that would be really something after not starting until almost 28 years old with a pretty modest income and no prior savings. Giving it everything I’ve got! 🙂

Keep up the great work over there as well. I think you’re going to reach FI before I do, so you’ll have to keep a spot open for me.

Best regards.

Lanny,

Thanks, man. It’s been a wild ride over the last four years. And it’s been even more special over the last year or so, especially now that the income is being sizable. Feels so amazing to sprint my way to financial independence without really breaking a sweat any more.

Appreciate all the support from you guys. You two are doing awesome over there as well. Let’s hope the Cavs take the next two games!

Cheers.

Tyler,

Yeah, the book is really exciting. And you’re right in that it’s not necessarily exciting in the sense that it’ll bring vast riches my way; rather, it’s exciting because the income is completely passive at this point since the work was completed up front. Not only that, but I really think it could positively affect/change other people’s lives in a big way. I’m so glad that you enjoyed it. Hope it made a difference for you.

Best of luck with the new blog. I’ve found blogging to be a lot of work, but also really rewarding in a lot of unique ways. I hope you find the same.

Have a great weekend!

Best regards.

Great going JASON!!! I was initially a bit sceptical about the ROI(money & time) we might get when we purse our passion full time….GOD how wrong I am..Seeing your income statement is a true inspiration and I am more convinced than before that pursing one’s passion can do you a lot good than u imagine…..Wishing a lot more success!!!!

Good job Jason on your amazing month. I am sure that it is good to see the results of your hard work and dedication.

D4S

Great month income and savings rate! You’re on the right track!

Just see the weather in Sarasota, you must be in a good mood at the beach knowing the dollars are allways clicking in your account 🙂

Thank you sir! I am pushing for the dividend crossover point around 2018ish..I gotta keep pushing myself with the job, investments and the site.

Anywho, enjoy that sweet Florida time this weekend…

shankar,

Thank you. 🙂

I’m glad this is inspiring you and changing your mind a bit. It’s definitely possible to monetize most passions if you’re driven and creative. Maybe you won’t make as much money doing what you really enjoy compared to some other choice, but that doesn’t mean the former isn’t better than the latter. It’s not all about the money. If you can find a way to earn a comfortable living while doing something that really brings a lot of joy to your life, you’ve basically won at life.

Best of luck finding a way to combine passion and money!

Take care.

Pretty good numbers there, Jason. Nice to see a blogger being so truthful about their progress. But with your upcoming dental visit, maybe that should be “toothful”!

Can’t wait for the next update.

D4S,

It’s definitely great to see things come together in this way. I continue to work incredibly hard every single day, so it’s wonderful that it’s translating so well.

Appreciate the support. Hope you’re having a great weekend over there!

Best regards.

Nuno,

Ha! Yeah, there are worse places to be than in Florida. Though, it’s really hot and rainy right now. Florida summers and all that. But it’s worth the other eight months. 🙂

Thanks for dropping by. Hope your 2015 is on track as well over there!

Cheers.

Simon,

Ha! Yes, exactly. I have no problems with being truthful, but I don’t particularly enjoy being toothful. 🙂

The next update should be even better. Stay tuned!

Cheers.

Jason, it would be nice if you made a post about BRK.B.

I am a reader from Brazil and i’d love to read stuff about it.

Best regards.

Felipe,

Thanks for stopping by from Brazil! 🙂

I’ve written fairly extensively on Buffett, the shareholder letters, and the Berkshire business model. But I don’t write about the stock specifically because it doesn’t pay a dividend.

But you might enjoy these articles (if you haven’t read them yet):

https://www.dividendmantra.com/2015/05/destination-2015-berkshire-hathaway-annual-shareholders-meeting/

https://www.dividendmantra.com/2014/10/create-your-own-miniature-berkshire-hathaway/

https://www.dividendmantra.com/2014/03/warren-buffetts-2013-annual-shareholder-letter-another-classic/

https://www.dividendmantra.com/2015/03/warren-buffett-on-volatility-and-risk/

Take care!

Great online income! If you continue to be so successful and answer all comments everytime you wont see much of the blue sky outside 🙂

All the best from Germany.

Haha Killepitsch.. Jason is on a laptop so he will see plenty of it 😉

I’m a big follower of DM!

Jason u deserved every penny of it! Good for us readers to follow ur strategy.

A nice month again, congratulations 🙂

Do you have any opinions regarding preferred stock? I have some investments in those as I regard them as a hybrid of stocks and bonds and have about a 1000 euros a month extra as I’m only paying the interest on my mortgage at the moment. At my current 0,33% interest rate I have absolutely no interest (no pun intended) in giving money back to the bank if I can avoid it 😀

Killepitsch,

Ha! I suspect that would be a pretty good problem to have, but I’m not there yet. 🙂

And, like DDT mentioned, I’m mobile… so that works out pretty nicely.

Appreciate you stopping by from Germany. Hope all is well!

Best regards.

DDT,

Thank you. Really appreciate that. Doing all I can to keep this site a great place to learn and be inspired. 🙂

May have to get a mobile internet card or something if I want to really get out there while blogging. But the coffee shop across the street is really nice.

Cheers!

SI,

Thanks!

I’m not a huge fan of preferred stock, to be honest. I suppose if the right opportunity came along, I could see it. But common stock offers the chance to participate in the growth of a company, which tends to work out really well over the long haul when you’re sticking to high-quality companies. All the numbers I’ve seen show that common stocks far outperform preferred over a long period of time, all in all. And I’ve noticed that preferred stock tends to limit your opportunities to certain sectors, like Financials.

But, in the end, one has to pursue the opportunities that make sense for them at any given time. And if current income is a big priority, preferred shares might make sense. In addition, there are different risks at play there. I just think that you can find a better blend of current income and growth in the common space, even when considering risk.

Best wishes!

Hi Jason, there is a student loan repayment program where they let you pay like $12 bucks a month (forever). While its obviously better to pay it off soon, for the benefit of paying $12 per month for infinity (which is basically free), then you get ‘cost avoidance’ of not having to pay $224 per month. And if course, you are not locked into $12 forever, ie; if you are able to pay off sooner, than of course they let you extinguish it sooner. Something to consider. I did it, and it’s great.

Matt,

Thanks for sharing!

Can you elaborate on that a bit? The only thing I’m aware of that’s similar to that is an income-based repayment plan or income-driven repayment plan. Those can lower your payments down to a few dollars or even nothing at all, but they’re completely dependent on your income. I make far too much income right now to qualify for anything like that, however.

But I’m not aware of a plan that specifically allows all borrowers (regardless of their income) to pay $12/month.

Thanks again!

Cheers.

Jason,

You’re a total beast! Hopefully the big online income number is the new norm if not new low!

Bought and loved your eBook even though I’ve been a reader since nearly the beginning.

Also was great meeting you, Claudia and some of the other readers at the Berkshire conference. Apologies for not thanking you for taking time out of your day/pseudo honeymoon till now.

As always, I look forward to your next post!

Sundeep,

No need to thank me. Happy to take the time and meet everyone. It was a lot of fun. I wish we could do that more often.

Appreciate the support very much. I’m fortunate to have such a great readership. It inspires me to the best content I possibly can.

I, too, hope this is a new normal. But it’s just so difficult to say. Traffic is just one aspect of it. The freelance writing isn’t based on any contracts or anything, so that could change at any time. And the affiliate sales oscillate heavily. But I just continue to work hard and hope that it gets rewarded. So far, so good. 🙂

Thanks again. It was great meeting you!

Best wishes.

$2 on entertainment! Was that a redbox movie?

You are a true inspiration.

gilberto,

Exactly. A couple Redbox rentals there (with a coupon). 🙂

Thank you. I’m so glad you find inspiration in this. I’ve tried my best to consistently save a high percentage of my net income. Largely been successful there. Can’t wait to see what the future holds!

Best regards.

Jason,

Great job with the website and the savings rate. The website income is of no surprise to me, this really is a great example of effort in = profit out. Keep up the great work and all the effort you put into this blog, I really appreciate reading it! And I also enjoyed reading your book.

I’d love to know what you do (did) for lunchtime meals, specifically when you were still working for the auto dealership. I really struggle to put together a decent lunch that I enjoy eating at work so I end up grabbing fast food most days, which i don’t overly enjoy but unfortunately it’s easy. Looking for some ideas, frugal and easy!

Thanks!

Jason

Jason,

Thanks for the kind words. Hard work goes an incredibly long way. I’ve met a lot of people throughout my life. I hate to generalize or anything, but I’ve noticed that a lot of people seem to be allergic to hard work. And that’s a shame. However, it also means there are a ton of opportunities out there for those that are willing to put in the work and sacrifice to achieve their goals and dreams. I really think this blog and my success thus far is a testament to that.

As far as lunchtime meals, I really had two best friends back in the day. I ate Ramen noodles for lunch for a year straight. That was pretty much every work day (five days per week) for a year. I’m not recommending that. I’m just saying that’s what I did. I also don’t regret it. After I got sick of the noodles, I moved on mostly to sandwiches. A couple slices of bread, some deli meat and cheese, and throw on a topping. Quick, easy, cheap. In fact, I still eat sandwiches almost every day for lunch. I’m actually going to make a sandwich here in about 10 minutes. 🙂

Stay in touch. Hope that helps!

Best wishes.

Awesome savings rate this month!! And, I’m super impressed with your online income too! Seems like a fabulous month all around. Mr. FW hates going to the dentist too, but I force him to go. I’ve made the argument for him that early retirement won’t be as much fun if he doesn’t have any teeth ;).

Mrs. FW,

Ha! Yeah, you have a great point there. I agree that early retirement wouldn’t be much fun without any teeth. Of course, life in general would probably not be much fun without teeth.

Appreciate the support. Trying to get back to the old me with the routine 60% and 70% savings rates. June should be another move in that direction. Gotta keep up with you guys over there! 🙂

Best regards.