Dividend Income Update – April 2015

April was just another big step in the right direction. A total of 14 different high-quality businesses sent me a check over the course of the month. Why? Because I bought stock in these businesses at some point in the past. And that’s what’s so amazing about all of this. You can make one great decision in your life – buy stock in a great business that pays a dividend and regularly increases it – and that one decision can literally reward you with growing passive income for the rest of your life. Repeat that with many subsequent great decisions to buy more stock in great businesses that pay and grow dividends and you’ll eventually likely find yourself drowning in so much passive income that you’ll find it difficult to spend it all.

I hope these monthly dividend income reports provide inspiration for any investors out there that are just starting out. It’s easy to see these payments rising month after month and it shows that it’s possible to one day pay for monthly expenses with dividends, which would provide an investor opportunities and freedom to pursue interests other than full-time work. Without further ado:

- The Coca-Cola Co. (KO) – $46.20

- Baxter International Inc. (BAX) – $31.20

- Wal-Mart Stores, Inc. (WMT) – $18.62

- Omega Healthcare Investors Inc. (OHI) – $21.60

- Illinois Tool Works Inc. (ITW) – $16.98

- Philip Morris International Inc. (PM) – $115.00

- Altria Group Inc. (MO) – $41.60

- Realty Income Corp. (O) – $13.27

- Medtronic PLC (MDT) – $11.29

- T. Rowe Price Group Inc. (TROW) – $40.00

- Armanino Foods of Distinction Inc. (AMNF) – $14.40

- General Electric Company (GE) – $39.10

- Bank of Nova Scotia (BNS) – $22.58

- Raytheon Company (RTN) – $16.75

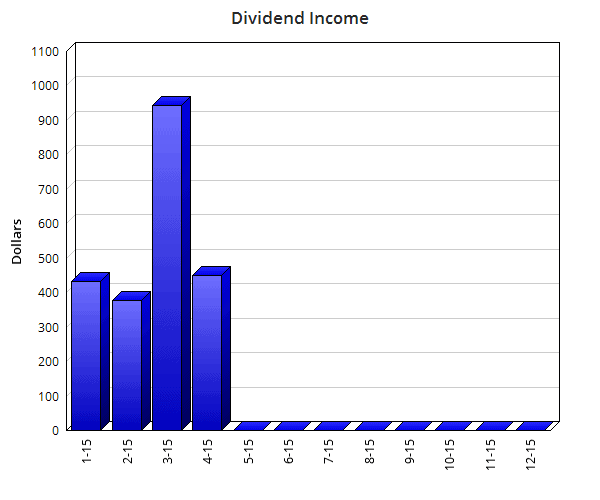

Total dividends received during the month of April: $448.59

I’m still in shock. I mean I knew I was going to be in this spot because I spent time forecasting my dividend income out all the way until 2022 when I first started investing. So this was an eventuality. As I’ve previously stated, I’m already financially independent – I’ve visualized it already happening. So I’m basically now just bridging the gap between the me of today that’s not free and the me of 2022 who is completely financially free. But it’s still amazing seeing the dividend income add up to well into the hundreds of dollars in a single month in the here and now. It’s one thing to anticipate something happening and quite another to actually live through it.

What could an extra $450 do for you? What could this kind of passive income do for anyone? What bills could that cover right now? It’s amazing, isn’t it? That’s basically 45 hours of work at $10 per hour, except I didn’t have to work for any of it. Fortunately, my extra little worker in the house did – and sent me all the checks.

What these continuing results show is that this isn’t hard. I don’t make a lot of money. Never have. Probably never will. And I’ve made a ton of mistakes (which I spell out in my book) leading up to turning my life around a few years back. But yet here I am in 2015 collecting substantial passive income at 32 years old. And you can be here as well. We all can!

This month’s total is 43.8% higher than the dividend income my Freedom Fund generated in April 2014. However, there are a couple of caveats there. First, OHI paid out an unusual prorated dividend in April due to an acquisition. Second, TROW paid a special dividend this year which may not persist annually. Third, I’ve decided to stop backing out the foreign withholding from Canadian stocks (and any others in the future) since I’m reimbursed all of that at tax time via a tax credit. These are gross reports anyway, so it doesn’t make sense to not report income I’m actually receiving (albeit at a later date). Either way, it’s a negligible difference at this point.

I was able to cover 19.9% of my personal expenses this past month via passive dividend income alone. That’s a pretty incredible result, in my view, when considering that I paid for a wedding and a 50th birthday party. In addition, some of the costs relating to our Omaha trip were realized in April (the hotel will be realized in May). Not too bad!

I’m very, very happy with the dividend income for April. Mr. Market is moody – sometimes he’s in a great mood and stocks are expensive. Other times he’s miserable and stocks are cheap. As such, my portfolio (and probably yours as well) oscillates quite a bit, sometimes violently. But the dividend income keeps on coming in like clockwork. How can you not like that?

I’ve been very active thus far this year in terms of additional stock purchases through the use of fresh capital and reinvested dividend income. And I expect that to continue for the foreseeable future. So I anticipate future dividend income to be that much greater.

One of my goals this year is to receive $7,200 in dividend income during this calendar year. Four months are now complete and in the books, and with that I can say that the portfolio has generated $2,202.18 in dividend income thus far this year, which is an average of $552.05 per month. That average, by the way, covers the entire cost of my rent and utilities. That means that no matter what I’ll always have a roof over my head. What an amazing feeling. The dividend income the portfolio has generated YTD is 30.6% of my goal, so I think I’m more or less on pace here. Continued aggressive investments throughout the summer should get me over the hump. Stay tuned!

I’ll update my Dividend Income page to reflect April’s dividends.

Full Disclosure: Long all aforementioned stocks.

How was April for you? Was the dividend income what you were expecting? On pace for your goals this year?

Thanks for reading.

Photo Credit: holohololand/FreeDigitalPhotos.net

$450 just this month gee whiz I’d be lucky to get that over the whole year

Congrats and hopefully one day I can have a portfolio half as good as yours !

That’s Sweet! What a great feeling receiving these checks Jason. You’re doing awesome bud. Thank you for inspiring many of us. Keep it up ! Keep that Snowball rolling and keep pushing it harder and hustling harder. Cheers my friend!

That’s a nice chunk of change there, and the fact that you are now able to pay your rent just off of dividend income alone is amazing.

Jason!

YOU ARE AN INSPIRATION!

Your blog, your fund, your e-book!

THANK YOU and BEST WISHES … keep the snowball rolling!

Thorsten

JUst curious, I really like OKE, and was wondering your thoughts on its recent pullback. Any concerns here or would you consider buying more here. Thanks in advance.

Jason

What a great month, this month i need to sell 2 of my ETF’s due to i need to pay for my school,so my dividend payments will be a little lower.

Congrats on the dividend, Jason. As always…thanks for sharing and inspiring others like me 🙂

R2R

Jason,

The fact that you are able to cover some necessary costs of living is a testimony to DGI. Like you said, no matter what happens moving forward you will be able to cover rent and utilities; many people are struggling to pay these while you’ve managed to invest intelligently so that companies can pay them for you. Great job, bud!

Keep up the great work!

Best Regards,

Dividend Odyssey

Congrats on another great month!

I like the idea of showing what expenses you can cover through passive income. It may not be 100% (yet), but you can cover housing costs, which is the largest budgeted item for most people. Very impressive.

I received $195 in dividend income for April. That was a whopping 87% increase compared to April of 2014. This was an exciting time for me to compare the year-over-year growth, because April 2014 was the first month that my portfolio was basically fully allocated to dividend growth equities. Right now, I am slightly off pace of reaching my goal of $2,400 in dividend income for the year, but there is a long ways to go.

Jason,

$450 is pretty darn good for April. 43% YOY increase at this level is awesome, and just continues to illustrate the effect of DG and value investing. What I liked the most though is you have predicted your dividends out to 2022! I thought I was really out on a limb staying 1 year ahead, and here you are 7 years ahead.

Congrats on having a great month and a nice trip to the rock concert of investing.

-Gremlin

Gogogogogogogo!

It starts to build faster once you have significant distributions to reinvest. My monthly take is a little over 3k in distributions. And I tell you it feels great to know I can get by from the couch if I need or want to.

Have you done an insurance post yet? I’m doing ACA which has been a Godsend as I had pre-existing that made me un-insurable before.

That’s a pretty neat diversified passive income stream. The real nice thing is that the income is up over 40% over the same time last year. The portfolio value will fluctuate all it wants, but the stable dividend income is always positive, and increasing above rate of inflation.

It would be nice if Canada and US worked on eliminating those dividend withholding taxes, same way that UK and US have done it. It would save us paperwork and time we can spend doing things we enjoy better.

I love the fact that your average per month covers your rent and utilities – what a great feeling 🙂 $450 for April is pretty darn good too! Congratulations on another great month 🙂

DM,

I could your snow ball effects as Over 40% higher than same period last year. It is real money and pure passive income..

I guess you don’t need to wait until 2022 to declare your financial freedom.. You will be reach to the point earlier than you think… Congrats!!

Chhers

FJ

Hi Jason,

Difficult to say anything else than congrats and the ball is rolling.

Have you been able to purchase more stock after you shopping on the 7th? the market made us nice present of dropping a bit.

Cheers,

RA50

Gotta love them dividends DM! I use to disregard those dividends when I first started and won’t even bother tallying them, but now its one of my favorite things to do esp comparing my result vs last quarter and vs last year to track progress.

Hows the Omaha trip? We are still waiting for update, I heard you guys had a meet up (Im jealous) looking forward for your post 🙂

43.8% year over year increase is incredible. 🙂 Our dividend income in April was $837. That covers about 20% of our expenses. Dividend income will be the biggest piece of our income in 2022. It’s the easiest way to generate passive income. Rental properties are nice, but it’s not really passive. Great job!

Great job Jason. That’s awesome that your rent and utilities are covered from here on out. 30% of the way to your goal for the year and you still have 3 huge months left to come. Keep up the good work and keep on inspiring.

Great month, Jason. Thanks for the update. You mentioned that you projected your dividend income out to 2022. I did some projections as well (out to my anticipated retirement) and I’m curious to know what variables you included. I used what I believe to be some conservative values like 5% annual dividend growth rate, 2.5% annual contribution increase, etc. Thanks in advance.

That’s incredible! That’s half my weekly paycheck after tax! But while today I had to crawl on my hands and knees in the dust to pick up pennies, wipe a grown man’s booger off his withdrawal slip, and explain to another grown man that his signature has to match his ID in order to cash a check, that money came in for you with no effort whatsoever. No customers or anything.

I’m more excited about my dividends than my paycheck, and this is why.

Keep up the great work, Jason! Soon you’ll achieve your goal and we won’t be far behind.

Sincerely,

ARB–Angry Retail Banker

My expenses cost me about $997/month so $448 would take care of a lot of my bills. So what do you do with the $448 or any dividend checks you receive each month? Do you reinvest it or do you pay your bills with it?

“That average, by the way, covers the entire cost of my rent and utilities. That means that no matter what I’ll _always_ have a roof over my head.”

Sorry, but that is just not true. When your rent and utilities shoot through the roof and your dividend income collapses at the same time, you WILL need another income source. I understand that you’re trying to sell your idea, but for us non-americans that kind of oversell does not sound appealing at all.

When (if ever) your dividend income is in the millions and your rent is still a few hundred a month, THEN you can say that you’ve got it covered with your dividends alone.

Hi Jason,

That’s incredible! Always amazing to see the growth!

I’m just getting started, and used the link from your site to open a Tradeking account few days ago. I have $3,000 to start with and will be putting in $1,000 every month, to take baby steps towards hopefully a decent portfolio. I came up with a list and will be choosing 3 from them to start with. The list I have is: JNJ, KO, MO, PM, CVX, XOM, PG, O, KMI, OHI.

Planning to go with JNJ, KO and another one with my initial seed money. would love to hear your input for a newbie like me! And if there is anything that you’d advise or against.

Thanks much.

Paul

CG,

You’ll get there, my friend. Consistency, patience, persistence, hard work, and a little luck. 🙂

Keep at it!

Best regards.

I can see why you’re so excited! Great going. Only going to increase from here!

Tyler,

I’m pushing that bad boy down the hill with all I’ve got. But I can feel the load lightening over time. She’s definitely accelerating and pushing away from me. 🙂

Thanks for the support. Keep up the excellent work over there as well!

Cheers.

Tyler,

Yeah, some people seem to think of dividends in an abstract way. But this is tangible cash flow. It feels great to know that I could “break the glass” in case of emergency and use that real cash flow for real bills. Knowing that I’ll always have a roof over my head feels pretty good. 🙂

Thanks for dropping by! Hope you had a great month as well.

Best wishes.

Thorsten,

Thank you so much. I really appreciate that. 🙂

I couldn’t do it without you readers, though. Without you guys, the blog wouldn’t exist. So thank you for giving me an opportunity to inspire!

Best regards.

wtd7576,

Well, my thoughts on OKE haven’t really changed since December:

https://www.dividendmantra.com/2014/12/recent-buy-51/

They’ve since reduced dividend guidance, so I’d probably value the stock a bit lower now. But I think a ~5.5% yield with 4% to 8% growth is still quite attractive in this (or any other) market. They continue to take on projects and I think they’ll do well. However, I did mention in that post above (and many other times) that OKE (and other MLP investments) are fairly high on the risk/reward scale. So that’s something you really have to feel comfortable with. If commodity prices start to recover, then I’d think the business will do much better and its stock/dividend will rise sharply. But if prices languish, then there could be issues with coverage there. Right now, they appear to be doing well with 1.2x coverage.

I’m not buying any more because I’m exposed well enough there. And that’s not just from the perspective of energy as a whole, but also MLPs in general and OKE specifically.

Best regards!

divorcedff,

Hey, that’s alright. The road to financial independence isn’t without an occasional pothole here and there. And the investment in education may prove out to be the best investment of all. 🙂

Take care!

R2R,

Thanks so much. You’re right there as well. As a community, we’re doing pretty fantastic! 🙂

Cheers.

Great stuff for sure and congrats! You mention that you pay your bills with these, so does that mean you’re not participating in DRIPS? What are you forecasting as your YoY growth through 2022 (for your fin. independence)?

Great site btw, keep up the great work!

DO,

That’s really what I love about dividend income. It’s a tangible, real source of cash flow. I could easily turn off the reinvestment machine and start to live off of this income. And it feels great that, if I had to, I could cover a serious chunk of my expenses already. Not only that, but just the dividend raises themselves will eventually render me FI anyway. It’s practically unstoppable now. 🙂

Congrats on your BEN dividend over there for April. The first of very many, I’m sure!

Best wishes.

RTR,

That coverage ratio is really the most important number of all. And that number will start to sharply rise here over the next few years as exponential growth starts to take hold and as some of my expenses drop off. My student loans, for instance, will be paid off by the time I’m 40. I’m more or less on pace here. 🙂

But I definitely recommend keeping an eye on that number, which can be improved through increasing dividend income and/or reducing expenses. That’s basically your “FI number”.

Thanks for dropping by!

Best wishes.

BCS,

That’s fantastic. Congrats on the huge YOY growth and the almost $200 in passive dividend income. That’s really great. It wasn’t that long ago that I was hitting a similar number, so you can see what’s possible in terms of acceleration.

Keep at it!!

Best regards.

Gremlin,

Ha! Yeah, I was at work one day back in early 2010 and we were slow that day. I was really just starting out and anxious to see what was possible. So I took out a piece of paper and drew out some numbers going out to 2022. The end result was $18,500 in 2022, which is right in line with my goal of $18k by 40. I’m ahead of pace because I thought I’d be hitting $6,000 in dividend income in 2015. My goal for this year is obviously quite a bit higher, so things look good. I think it’s possible I’ll actually be hitting somewhere around $20k to $22k at 40, which would allow for a bit more flexibility. We’ll see how it goes!

Thanks for dropping by. Congrats on the $75 you hit last month. It’ll surely only grow from here. 🙂

Cheers.

FV,

Ha! Make a living from the couch. It’s indeed great to know that you can sit on your butt all day and the bills will still easily get paid. That’s awesome, right? Congrats on hitting that level of success. Of course I know success isn’t sitting on your butt, but knowing that you could if you really wanted to alleviates a lot of stress from day-to-day life.

I wrote an article about health insurance quite a while ago highlighting my decision to go with a HDHP. I was using ehealthinsurance at the time, but the ACA has just simply replaced one marketplace with another. My costs have risen a bit over time, as expected. But it’s still not a real big deal in the grand scheme of things. And I like the fact that if I were to drop my income dramatically at some point that I could likely pay little for health insurance. Really makes the idea of FI on little income even more feasible, in my view. I’ll probably revisit the subject once I’m actually living off of dividend income to see how health insurance/costs affect that.

Thanks for dropping by!

Take care.

DGI,

I agree. I wish we didn’t have to worry about those pesky foreign withholding taxes from Canada. We work so closely together, you’d think that would have been an easy thing to take care of. But I eventually get the money, which is nice.

The YOY growth is pretty nice, though it was definitely positively impacted by a couple of likely one-offs. We’ll see how next April looks. All in all, it’s still moving in the right direction. 🙂

Thanks for dropping by!

Best wishes.

Nicola,

Thanks so much!

I love writing these reports because it’s actual money we’re talking about. The dividends are tangible. It’s real cash flow that can pay bills. So when you think about investing in that way – tangible cash flow – the fear tends to melt away. That’s true for me, anyway. 🙂

Best regards.

FJ,

Yeah, I think I’ll hit the crossover point earlier than 40 as well. But there’s a lot in the air there. It’s difficult to forecast expenses out that far, even if I can somewhat accurately forecast dividend income. All in all, I think that I’ll be FI by 40 either way, even if my expenses aren’t as low as I anticipate. And I’ll feel pretty good about hitting it then. 🙂

Thanks for dropping by. Appreciate the support!

Best regards.

RA50,

Thanks so much!

Yeah, I’ve been busy with purchases. Just haven’t been able to get any posts written up on that yet. Look for a couple of articles next week. By the way, I always tweet any transactions on Twitter. So if you’re ever interested in that, you can follow me there. 🙂

Cheers!

Also, is the 40% YoY growth direct dollar for dollar? in that, does it not include any reinvestments or new purchases?

FFF,

I’ve heard some investors say that they used to disregard dividends or that they didn’t really get it until the total was pretty high (over $100 in a month). I actually had the opposite experience, literally smiling ear to ear when I received my first dividend. It was like a light bulb went off for me. I felt like that could actually change my entire life, which it has. 🙂

I actually already posted the Omaha update a few days ago. It’s a long post, so make sure you’re ready for some serious reading:

https://www.dividendmantra.com/2015/05/destination-2015-berkshire-hathaway-annual-shareholders-meeting/

Thanks for dropping by!

Take care.

Joe,

“Rental properties are nice, but it’s not really passive.”

Couldn’t agree more. I think one can do incredibly well in real estate, but anyone who thinks that’s anywhere near as passive as investing in dividend growth stocks is totally kidding themselves.

Great month of dividend income over there. You guys are doing really well not only with that, but also with the diversification of income sources. And 20% of your expenses is also really nice, right about where I’m at. Keep up the great work!

Best wishes.

JC,

Thanks so much. I think I have a pretty good shot at that $7,200. I’ve been a bit more aggressive than I planned on being after the sale of the car. We’ll see.

Keep up the great work over there as well. You’re having a great year, especially considering everything that’s going on. Hope all is well with the family. 🙂

Best regards.

Ken,

Great question. I actually ran a few different calculations in terms of capital contributions (depending on what I thought I could make, save, and invest), but I always used a 3.5% yield across the portfolio and 6.5% dividend growth. I originally wrote the numbers down on a piece of paper at work, but I don’t have the paper anymore. I ended up copying the final anticipated results over to a document on my computer, but I’m fairly sure I settled on an average of investing $2k per month over the entirety of the asset accumulation phase.

Hope that helps! 🙂

Cheers.

ARB,

“I’m more excited about my dividends than my paycheck, and this is why.”

Absolutely. Like I recently discussed, passive income is worth way more than active income to me. I’d rather have $20k/yr in passive income than $50k/yr in active income all day long. Not even a question.

Keep at it and those days of suffering at the office will be but a distant memory. 🙂

Best wishes.

Receiving dividend from 14 companies is great, shows that you have good diversification when it comes to dividend income. 43.8% YOY increase is pretty damn impressive. I’ll have to tally our April dividend income in the next few days and write a post. 🙂

Lila,

That’s a great expense number to be at. I’m sure it’ll increase as you come out of school and all that, but it’s not particularly difficult to live frugally in a first world country with so much abundance.

As far as the dividends, I reinvest all of it. It just accumulates in the brokerage account whereby I combine that with fresh capital from my active income and make purchases with it:

https://www.dividendmantra.com/2014/03/selective-dividend-reinvestment-vs-drip/

Cheers!

teppo42,

“When your rent and utilities shoot through the roof and your dividend income collapses at the same time…”

Sure. That could happen. WWIII could happen. The moon could drop from the sky and hit the planet. And dinosaurs could start to roam the planet again, killing everyone in their path.

But I’d rather focus on the 99.99% certainty that my dividend income will very likely continue to cover my rental expenses. If my landlord decides to jack up the costs “through the roof”, we could very well move. Free market and free will. It’s wonderful.

“When (if ever) your dividend income is in the millions and your rent is still a few hundred a month, THEN you can say that you’ve got it covered with your dividends alone.”

I guess nobody will ever be financially independent, because it would take quite a sum of money to generate millions in dividend income. Maybe I should go back to work. I don’t know how the economy doesn’t collapse and people that are living off of investments don’t tear their hair out.

Take care.

Office? I wish I worked in a nice, quiet, comfortable office. But I otherwise agree.

Paul,

Appreciate you using that link. I hope it worked out for you. I received an email from them stating they were running that $200 promotion through May.

$1,000 per month is a great start. That’s right about what I started with as well, though I quickly started accelerating that monthly number by reducing expenses and living extremely frugally so as to get the snowball rolling even faster.

Those are all great companies. I think JNJ is attractively valued right now as well. KO isn’t a steal, but rarely is. The business model is one of the best in the world, however. I’d be careful not to overexpose yourself to energy, however, and perhaps slowly dip there. I think there’s value there, but I also think it’s quite possible that results from even some of the big supermajors could continue to be tepid.

In the end, the best advice I can give is to focus on quality. Make sure you understand how a business makes money. And make sure you want to be a partner in that business. If you can’t sleep at night, move on.

Good luck!

Best regards.

FF,

Can you tell I’m excited? 🙂

Thanks so much. It only likely gets better from here… for me and anyone else regularly saving/investing.

Cheers.

shadymg,

I didn’t say I pay my bills with the dividends. I said I could if I had to. Furthermore, dividend income is income like any other income. Capital is capital. If you want to pull your dividend income out and pay bills (assuming it’s a taxable account) you can do that. If you’re going to invest $2,000 per month and $500 of that is your dividend income, then you could pull the $500 out and then deposit $2,000 from your bank account down the line. Money is money. Nothing complicated about it. I don’t know why you’d want to do that because you’re just moving money around needlessly and you might be slightly delaying your investments, but you could.

But I don’t use any DRIPs. I selectively reinvest my dividend income:

https://www.dividendmantra.com/2014/03/selective-dividend-reinvestment-vs-drip/

Best wishes.

shadymg,

The YOY growth is dollar for dollar. I’m just looking at what last April produced and what this April produced. In the end, I’m mostly just interested in the end result of dividend income and how that compares against my expenses on a run rate.

Cheers.

Tawcan,

I’m very excited. Every time a new base of income is established for a particular month, it should only improve from there. As such, next April should be even better, assuming I don’t sell out of any of these stocks. 🙂

Looking forward to seeing how April treated you guys!

Best regards.

Darn it I missed it! Im reading it right now! Thanks! 🙂

Jason,

It’s impressive that this many years in you can still generate the YOY increases like you did this month. Especially when the holdings of one of your pillar stocks (PM) has not moved in years in terms of shares held. If you exclude the fact that almost 25% moved by only 6.4%, the move is even more impressive. You have been buying quite frequently lately so that is a great sign that there is only more positive dividend income stories to be shared with your readers. Keep up the great work.

All the best.

FD

I love this response Jason. Although he could have made a more compelling argument about dividends not paying for emergencies. Rent and utilities shooting through the roof isn’t difficult to combat.

Active Income (job) people would follow something like this:

Step 1 – Landlord raises rent

Step 2 – Worry about job loss/different commute if you need to move due to finances

With dividend income it’s much simpler:

Step 1 – Landlord raises rent

Step 2 – Thank You, my dividends(job) pays me anywhere in the world – I can move to a lower cost of living area and not lose my dividends.

Can’t worry about things we can’t control, dividends on the other hand are our playground.

Cheers

– Rich (27)

FD,

Good point there. You’re right in that a major chunk of the dividend income here didn’t really move much YOY, so that just goes to show how active I’ve been in terms of investing around PM. Though, some of these dividend payments are likely one-off events. Nonetheless, the overall picture is looking really good. 🙂

Appreciate the support. I’ve never felt more motivated and aggressive than I do right now. I’ll be posting about some recent activity next week. I’m on it 100%!

Best wishes.

Love this recent update. I still can’t believe we are already in May. Where does the time go. This just goes to show that we must put our dividend shovels to work as fast as possible because time waits for no one. Market highs, market swoons, time is what makes this compounding passive dividend income possible. Awesome result for the month even though you qualify it by mentioning some “special” dividends received. Still, great job. That money can cover a lot of expenses, fun or necessity. As always, these are the best posts to read and write. I’ll be posting my results soon.

Rich,

Well, I usually treat serious comments/questions seriously with serious answers. But I just don’t take someone seriously when they say that one should only feel safe when their dividend income is in the millions. I can understand wanting a margin of safety, and I think it makes sense to build one. However, I do think the built-in dividend growth should allow a margin of safety to grow over time regardless.

Nonetheless, I just don’t take doom-and-gloomers seriously. Collapsing dividend income and rent shooting through the roof is the type of stuff that I’m just not worried about. If every company in my portfolio has to simultaneously eliminate their dividends, then that probably means nuclear war is upon us or has already happened. At that point, I’ve got bigger things to worry about than living off of passive income (like not being vaporized).

Best wishes!

DH,

Absolutely. These are by far my favorite posts (to write and read). 🙂

Looking forward to seeing how your month turned out. I’m sure it was another solid step in the right direction.

And you’re absolutely right in that time waits for no one, which is why we all need to take ownership of said time as soon as possible. Wait too long and you’ll find there’s little left to own.

Cheers!

This literally made me laugh out loud.

Ya know, to say “but anyone who thinks that’s anywhere near as passive as investing in dividend growth stocks is totally kidding themselves,” does others a disservice because that’s like saying that doing due diligence, reading annual reports and keeping up with documenting buys, sells, and keeping up with other tax matters take NO time. It’s not totally passive if it’s done right.

There are two camps of real estate investors out there:

1) Those who manage their own properties. These investors find, do background checks on renters and repair and maintain their rental properties, etc. No passive.

2) Those (like myself and many others) who haven’t visited a property or dealt with a renter or ever received a so-called “middle of the night clogged toilet emergency call.” Just as you pay your company’s board of directors, officers, managers to run the company so you only need to receive dividend checks every 90 days, so we more astute RE investors pay a rental manager to run the day-to-day business. I collect my dividends (rent proceeds) which show up in my bank account month after month. I do nothing except send or receive an occasional email (unless I choose to do more). That’s it. I can successfully argue that investing in real estate is more profitable for every dollar invested than most of the dividend stocks in your portfolio and requires no more work on an ongoing basis than your own portfolio management. It’s pretty darn close to you’re owning REIT’s.

My only wish is that writers who are supposed be in the know would not generalize so much when it comes to real estate investing. It shows a great deal of ignorance and very limited insight on the subject.

Now. I love dividend growth investing. I’ve successfully done both and will do both going forward. But let’s at least not try to fit a square peg into a round hole when discussing RE investing not being passive. That’s only true for some.

POMR,

Your experience is of but one and you’re entitled to your opinion. Joe has a well-documented experience with rental properties, and I think his opinion has merit as well. I’ve also heard from countless investors who have invested in real estate and discussed it’s time consumption. Your experience could be an outlier, and I think that’s great.

I can tell you firsthand that I rent from a landlord that has gone through multiple property management companies due to various amounts of incompetency. Now, those property management companies would handle the day-to-day running of our condo/apartment on behalf of the landlords to various levels of success, but the owners would absolutely be involved when we had major issues – we’ve had a few now over the last few years. And it became apparent over time that the management companies they hired weren’t doing a very good job at much other than siphoning off a good chunk of the rent checks. So I do have some experience there.

And to pretend that scouting properties and getting loans for properties is anywhere near as easy as me transferring over $1,200 from one account to another and buying equity in a REIT would be, in my view, ingenuine at best.

“My only wish is that writers who are supposed be in the know would not generalize so much when it comes to real estate investing. It shows a great deal of ignorance and very limited insight on the subject.”

My only wish is that those who think their opinion carries more weight than others be very careful when throwing around the word “ignorant”. That shows ignorance.

Just my take on it!

Cheers.

I love the implication that us Americans are too stupid and fall for anything. You tricked us, Jason. If only we were super smart non-Americans, we would never fallen for your “passive income” BS.

Sincerely,

ARB–Angry Retail Banker

Hi Jason! great month and congratulations!

i’ve just started reading your blog,your a true inspiration!!

im still learning but I read a comment earlier – “The portfolio value will fluctuate all it wants, but the stable dividend income is always positive, and increasing above rate of inflation.”

As i’m new to this game i was under the impression that the dividend yield is paid in relevance to the value of your stock? ie $100 at 4% yield would be $4 dollars paid yearly………but if those stocks went up in value to $200 you would get $8 ….so if the value went down to $50 you would get $2 Is this not the case?

i read you would benefit from a economic issue so stocks become “on sale” but wouldn’t the effect of this negatively affect your dividend income??

Thank you!

Confused Noob

ARB,

I’m a tricky one! 🙂

Cheers.

Confused Noob,

Hey, I’m glad you found the blog! There’s a lot of content here, so it might be good to start at the beginning or even with the book I recently wrote (you can find that at the top of the page).

As far as your question goes, that’s incorrect. A dividend is a fixed dollar amount, quoted on a per-share basis.

If a company pays $1.00 per share per year to each shareholder, that $1.00 hits your account on a per-share basis regardless of the price of the stock. A dividend is paid from directly from a company to its shareholders, so it completely bypasses the stock market. And that’s one thing I’ve repeatedly mentioned as being a great benefit of this strategy.

What you’re looking at is the yield. The yield fluctuates based on the price of the stock.

So if that same stock with a $1.00 annual dividend (or $0.25 quarterly) was priced at $30, the yield would be 3.33%. You get that by dividing the annual dividend by the share price (1/30). If the price goes up to $35, your yield goes down to 2.86%. Likewise, if the price goes down to $25, your yield shoots up to 4%. Price and yield are inversely correlated.

My portfolio’s overall yield fluctuates every single day the market is open. But the actual dividends don’t. They come in like clockwork.

I would definitely recommend a lot more reading on this subject as well as investing in general. You can find a plethora of great books here:

https://www.dividendmantra.com/getting-started/

Hope that helps get you down the right track!

Best wishes.

Hey Jason,

You’re making amazing progress man, I’m sure you’ll breeze through the 7,200 mark, especially with September and December dividends, which tend to be more beefy than others.

I didn’t receive any dividends in April, as all the stocks I own pay in different months. Thankfully though, this will be the last time this happens, as I now have them all covered!

Ps, congratulations on your wedding, mate!!

Dividend Legion

Nicely done! I like following your progress to see it is possible to build your own wealth. We’re 33% through the year after April and you’re at 30% of your goal. It’s going to be close, but I think you’ll be able to hit and exceed your goal for 2015. Especially if you make additional investments throughout the rest of the year.

Dividend Mantra,

Congrats on the dividend income. What is there about dividend income not to like? I can not think of any as I always love to receive dividend “checks” regardless of their size.

Continue to look at the glass half full and do not let the people get to you. The latter has happened to a lot of people in investing blogs.

Just wanted your thoughts on high safe dividend paying stocks. I was looking at specifically MEMP and CGCY. I have 100k to invest and have been in Seeking Alha perusing the high dividend stocks. I want to be able to generate enough dividend income in10 years to retire and live on. Your thoughs

Dividend Mantra,

Great month, blew it out of the water! I agree on the foreign tax withholding – you’re getting it back later on, so might as well include them now. The average div income covering rent + utilities = a pretty cool feeling I bet, another great metric to look at.

I’ve noticed the slow in oil for dividend growth rates – how do you feel about that in the short/long term? Thoughts?

Thanks Mantra and nice job, again!

-Lanny

DL,

Thanks so much. Truly appreciate the support. I’m pretty confident about coming close to my goal this year. Exceeding it will be difficult, so we’ll see how aggressive and opportunistic I can be with capital deployment over the summer. I think my own FCF will be much better over the coming months with reduced expenses and the possibility for increased income, so we’ll see. 🙂

You may not have received anything this April, but that just means next April is that much more to look forward to. Keep it up!

Best regards.

DH,

It’s definitely going to be tough, but I’m the type of person who gives my all. I’m fairly confident that I’m going to be able to increase my savings rate as the year goes on, especially through the summer. So the available capital for investment should be fairly strong over the next few months. I’m excited. 🙂

Thanks for stopping by. I hope you’re having a fabulous 2015!

Take care.

IP,

I’m with you. Tough to find anything to dislike about collecting increasing dividend income month after month, year after year. 🙂

I plan to definitely continue writing and inspiring for many years to come. I don’t foresee a time where people get to me or anything, but I know others have suffered from that. Jacob from ERE had difficulties dealing with the naysayers, if I’m not mistaken. I tend to just ignore people rather than argue, as I lack the time and interest to argue with people from opposite viewpoints. I see no point or value in that. I’m here to share and inspire through real-life results in real-time.

However, it’s possible that at some point I’ll get burned out. I hope not because I honestly want to show this journey up to and past financial independence. And I have so many ideas. But it’s certainly possible that the enjoyment I get from writing will fade at some point. I guess I’m trying to maximize content and quality while I’m still so energetic and enthusiastic. 🙂

Cheers!

Great month in dividends and stock purchases! Its really beginning to snowball…..Thanks for sharing!

6monthsibiraq,

“high safe dividend paying stocks.”

That’s really part of the problem as many stocks with real high yields are naturally less safe than stocks with reasonable yields/payouts. I don’t invest in stocks where I think the dividend is unsustainable or won’t grow over a long period of time, and I’ve yet to really find any kind of company with a long-term track record of growing its dividend on the back of a great and easy-to-understand business model with operations that generally improve annually and that just so happens to sport a stock with a yield of 10%+. If there was such a group of stocks, I (and many others) would already be heavily invested.

Sorry I can’t be of more assistance.

Cheers!

Lanny,

Thanks, bud!

It definitely feels great knowing that I’ll very likely always have a roof over my head no matter what. And that kind of gets back to my article on the spectrum of freedom – FI isn’t all or nothing. I’m already more free than I was just a year ago, and certainly significantly more free than I was five years ago.

Yeah, I’m not particularly surprised with some of the slowing dividend growth there in energy. I mentioned being a little concerned about how the drop-off in commodity prices would affect earnings/operations (and hence dividend raises). We can look in the past for some guidance in terms of how these companies do during times of volatility, but dividends for many of these companies are also much larger than before. So that’s something to be mindful of. That said, most of the high-quality companies in the energy space are pretty flexible in terms of paying and growing their dividends, so I’m not real concerned looking out over the long haul. In addition, I find it unlikely that the long-term demand for energy goes anywhere but up. The world still runs on oil and gas for the most part, so I think we’ll be okay. But O&G can be very volatile. Just one of those things.

Cheers!

LOMD,

Thanks so much. Doing my best to push that thing downhill as much as I can. She’s starting to accelerate, though. Feels good. 🙂

Hope you had a great month as well!

Take care.

Hello Pay off my Rentals!

Well, decades ago we as a family inherited a massive real estate (with lots of water around it) with around 40 tenants (little und bigger weekend houses, a rowing club, 12-18 boats, some companies like a chimney showroom or kitchen manufacturer and a local fisher). We just can not increase rent as we like; our tenants would have to move. We prefer lower rents but stable, lasting relationships with them.

So, it is not very profitable — compared to my DGI portfolio. Yes, it means income but we either invest in the estate or the taxman takes a huge chunk of the profits. If we were to include a “middleman” like a manager, then, naturally, it would be even less profitable.

AND: We actively manage it .. from accounting to garden work. So …

When my parents will be gone (may it be a long time from now!) I will probably sell most of it.

Just my experience!

Best regards!

Excellent month, Jason! Five years in and you can already cover major expenses like rent…that’s so empowering. You’re having such a great year so far and I’m pumped for your more recent contributions to kick in too. That special dividend from TROW was a nice addition, I think you’re bound to see more of those in the future. Thanks for sharing my friend!

congratulations !! 🙂 it’s amazing how you are building your financial independence step by step.

I read all your articles, it’s a source of inspiration for me.

Cheer up !!

A big hug from Spain, Europe.

yesterday I finally reduced my exposure to my employers stock. It was long overdue – guess what our 401 gIves about 10 options – none of them are dividend funds. Would you please give the plan administrators a call they are killing me.

I know you’re aiming to continue working until you’re 40, but do you have a specific dividend income number in mind for when you will finally declare yourself financially independent?

450 bucks in completely passive income…man that is just incredible! That would cover almost a third of my monthly expenses right there. I can’t wait for the day I’ll be receiving these kinds of earnings! Just gotta stay patient and continue investing consistently.

Awesome work as always Jason!

Cheers

DM,

Awesome progress! 30.6% of your goal dividend income for the year is impressive. I think you’ll make it to $7,200. I’m aiming to hit $5,250 in dividend income this year. I’m currently at $1,405 or 27% of my goal. We’ll see…fresh capital is going to be a slightly limited and some investments in DIS will not pay off until next year. I will have the benefit of KRFT paying out $16.50 per share after the Heinz/3G acquisition. Not really a dividend, but I’ll count that as income and make a side note like I do with special dividends. I’m still hoping to hit $5,250 with or without the KRFT payout. Keep up the progress…looking forward to your May dividend update.

I bought some DEO this month and added to BBL, T and EMR last month.

DM,

Welcome home from Omaha. Im excited to go back and read your articles about it when I have a nice chunk of time this weekend. congrats on the great month! A 43% increase is amazing and is really helping accelerate that dividend snowball. I like how hungry you are for financial independence. As you said in your article, you are FI because you tell yourself you are. It doesn’t seem like anything is going to stop you, so your roadblocks better get off of the track because the train is coming. Keep up the great work. I have a hunch you will find yourself where you want to be long before 2022!

Bert

Jason,

You are living the dream and on the path, congratulations. Thanks to your inspiration last year, my dividend income was very strong in April (more than other months, the BBL semi-annual dividend really helped) at $4472.88. Growth of the dividends will come in handy to pay for school fees and as a retirement buffer later in life.

Keep shining those high beams, and keep the inspiration bright!

-Mike

Nice!

Excellent work Jason. If this post if not enough to prove that there is a way out through dividend investing, then nothing will convince the naysayers. Keep up the good work.

Ryan,

2015 is definitely turning out to be a great year… for both of us! 🙂

I’m excited to see how things turn out down the stretch. I’m trying to stay pretty aggressive here, at least as much as my capital will allow. And the more aggressive I am right now, the more likely my dividend income will be positively affected here in 2015. Once the fall hits, that extra dividend income is mostly going to come the follow year and subsequent years. We’ll see how it goes!

Thanks for dropping by. Keep up the great work over there.

Cheers.

jj,

Thank you so much. I’m truly glad you find inspiration in these articles and the blog. That’s why I do what I do. I believe in my heart that financial independence is attainable for just about anyone out there that lives in a first world country, so I’m just trying to spread that message. 🙂

Keep in touch!

Take care.

RayinPenn,

Yeah, I remember having the same problem with my 401(k) at my old job. I think we had more than 10 options, but I can’t remember any of them being particularly good options. I guess you take the good with the bad, as a potential match and the tax benefits are pretty attractive.

Cheers!

gizmopie,

Good question. The number I’m aiming for is $18,000 in annual dividend income. That’s kind of the number I set up at the beginning and it’s the one I’m still using. I was going to write a post about it at some point in time, but I didn’t want people fixating on the number or pigeonholing me into something. It’s a fluid journey and a fluid number really, so I’m adjusting as I go. But that’s my long-term target. I think my expenses will probably be in that range or so, but I’m also ahead of pace on the dividend income front. It appears I might be somewhere between $20k and $22k in annual dividend income at 40 if I keep my current capital contribution pace. We’ll see! 🙂

Edit to add: I won’t really declare myself FI until dividend income starts to exceed expenses fairly regularly or on a run rate looking out over a year or so. I’m not going to hit $18k or $20k and declare myself FI automatically (unless my expenses are like $17k/year). The target isn’t fixed because I don’t know exactly what I’ll be spending in eight years. But my target remains at $18k because I think, if I really wanted to, I could get expenses down to that $1,500/month level.

Best regards.

ZTZ,

You’ll be there soon enough, my friend. Just stick with it. I remember my first month hitting $100 and thinking that this could really work. And it’s been all good stuff since then. 🙂

Best wishes!

Jerry,

Looks like you’re doing great over there. Great companies across the board. All of them look like solid values right now.

$5,250 is fantastic. That’s $437 per month, which covers a good chunk of bills for a lot of people around the world. You’re becoming FI one month at a time. 🙂

Best regards.

Bert,

Ha! I think that’s true for a lot of people. People tend to be their own roadblock, holding themselves back. Once you believe in yourself, almost anything is possible. Not only do I believe FI is possible for me, I know my future self is already there. It’s a foregone conclusion. 🙂

Thanks for dropping by. Hope you have a great weekend over there!

Cheers.

Mike,

That’s a fantastic result. Almost $4,500? In a month? That’s great. That’s twice what I’ve done all year. Keep it up! 🙂

Sounds like we’re both living the dream. You’re in a fantastic spot. Life becomes whatever you want it to be when you’re hitting passive income like that.

Thanks for the support. I’m keeping those high beams on!

Best wishes.

KeithX,

Thanks! I’m giving it my all. 🙂

Cheers.

DD,

I agree. If this doesn’t “click”, then I don’t know what will. Doing all I can to inspire with real-life results in real-time. 🙂

Thanks for dropping by. Hope you have a great weekend!

Best regards.

Jason – I’ll join the chorus of supporting voices – well done! If you set your mind on a specific goal, you’ll get there!

I’ll bet you’ve crossed that anticipated 200K as of today – the markets are on a tear today!

Good luck, my friend!

Alex

I agree with the comments on withholding taxes.

Wow, this is some massive amount in dividend income. I’m interested in the number you can put out with your book. You are well on your way into retirement. I don’t think you’ll have to wait until 40yo to reach FI. Persistent to frugal lifestyle really helps!

You have some real numbers cooking on your end. Wishing you continued success. Good luck.

Keep cranking,

Robert the DividendDreame

AKA — Seeking Dividends

This is one of my favorite blogs and I really like what you are doing, your values are great and really come through, your community is great, you are a very good writer, genuine guy. So please take this in the spirit in which it is intended

Knowing the vagaries of the stock market I get really, really worried when a guy I consider a friend writes something like “That average, by the way, covers the entire cost of my rent and utilities. That means that no matter what I’ll always have a roof over my head.”

Maybe I am just a pessimist, and while I certainly agree your strategy is working really well in our current market, the stock market and dividends are by no means certain. Do you ever consider the possibility that these companies may suspend their dividends, we could have another 2008 without the ability of the fed to print 3 trillion dollars and shore up the financial markets which might never recover? You are relying on a lot of things outside your control when you count on the financial markets, our leaders, and these companies to provide you with a secure lifestyle. I know you work too and earn a lot of money from writing, but linking dividend income to rent and utilities really frightens me.

I work at a regular job but consider the possibility I will be fired every single day – so I have diversified into real estate and other assets – I own my house, but assume that at some point we will have hyper inflation and I could easily be taxed out of my house

“no matter what’ is a really strong statement.

Thanks for you blog and look forward to hearing your thoughts.

April was a good month (but not a great month) for me. I saw a lot of growth compared to April 2014, so I can see my income is really growing at a fast rate.

Thanks for sharing these results. I always look forward to reading them at the beginning of each month.

Nice month Jason…I remember following you when that number was just half that. 🙂 Pretty nice to sit back do nothing and collect $450! Way to build up that passive income stream my friend. I know I don’t have to tell you this but Keep Up the Momentum. 🙂

Best wishes and continued success on your personal finance journey! AFFJ

While it is true that a dividend can be cut, having a diversified portfolio of 20-50 (or 65+) companies GREATLY reduces that risk. For all or even half of the companies in there to freeze, cut, or eliminate the dividend would require a MASSIVE economic downturn unheard of in our history. Bigger than the Great Depression. Companies still paid and raised dividends during the Depression and Recession.

A 2008 scenario would likely do a dividend investor more good than anything. Great businesses go on sale. Look at Exxon Mobil, losing about 50% of its share price and still continuing to pay and raise that dividend. It’s like Christmas and my birthday all rolled into one. That’s what happens when you buy dozens of companies that all have a decades-long history of paying and raising those dividends.

And sure, even blue chips fall. Streaks end. Nothing is guaranteed. You are absolutely correct. But following the DGI strategy lowers the chances of such a situation to near zero. Even Jason got burned by ARCP. I had BWP massively cut its dividend and SDRL eliminate it completely, in addition to ARCP. But for all 65+ companies I own to dramatically cut or eliminate their dividends? The chances of that are near zero as I can’t even imagine what would be required to make that nightmare a reality.

Sincerely,

ARB–Angry Retail Banker

AlexG,

Absolutely. I find one’s biggest roadblock to success is usually themselves. Once you get past fear and your own self-doubt, you can probably achieve a lot more than you ever thought you could. 🙂

Thanks for stopping by. Hope you’re having a great weekend!

Cheers.

Vivianne,

It’s very, very exciting. It appears I might be a little ahead of pace, but we’ll have to see how the income goes over the next few years. I’m not letting up, so I’m hopeful that things continue to roll along. I’ll give it my all every single day. You can count on that! 🙂

Thanks for dropping by. Appreciate the support very much.

Cheers.

Robert,

Thanks so much. I’m very, very excited to be in this position and I’m even more excited to see what the future holds. Hard work and persistence definitely goes a long way. 🙂

I’ve still got a long road to catch up with you, however. Giving it my all!

Thanks for stopping in.

Cheers.

Mark,

ARB kind of answered this the same way I would.

I think this sums it up well:

“But for all 65+ companies I own to dramatically cut or eliminate their dividends? The chances of that are near zero as I can’t even imagine what would be required to make that nightmare a reality.”

Like I said in another comment above, it would probably take nuclear war or something on that scale for all 50+ companies in my portfolio to dramatically cut or eliminate their dividends all at the same time (since that would be historically unprecedented through every calamity that has struck in modern times). And if that were to occur, I’d have a lot more on my plate to worry about then living off of passive income or paying rent… like not dying. I view the odds of such an event as so low to not even quantify, and so I feel comfortable with my “no matter what” statement.

Either way, there’s really nothing to wonder about here. You’ll see the results month in and month out for years to come. If nuclear war hits, you can come back and say you told me so. But I doubt you’ll have an internet connection to do so… or much of anything else.

Cheers!

John,

That’s fantastic. I view any result that’s better than the last time as a move in the right direction. This April was really better than it should have been due to the special TROW dividend and the prorated OHI dividend. But money is money. I’ll take it when it’s handed to me. 🙂

Appreciate the support. Glad you find value in these updates. I’ll continue to show what the journey looks like for as long as I possibly can.

Best wishes.

AFFJ,

It really wasn’t all that long ago that I was collecting half… and even less. And that’s really why this is so exciting and so important. Not only does it not really take all that long to build up meaningful passive income (even on a salary that isn’t particularly impressive), but that time will pass by with or without the saving and investing. And you don’t want to all of the sudden find yourself five years older and just as poor as you were before.

Doing all I can to inspire people to not only start, but to keep going. 🙂

Best regards!

While the year may be 33% completed his payments are not. KO does not pay in quarter 1 and pays twice in quarter 4.

My journey hit a bump in the road in April as I decided to sell my PSEC. I lost income year over year going forward, assuming a stable rate, but have gained a lot more time by not worrying if/when the bottom was going to fall out of it. I chose to replace it XOM. From this transaction I have learned to not chase yield because it is not worth the hassle. Slow and steady wins the race.

Thanks for the great articles.

Jason,

Good thing about investing is that the money does all the work, so keep plugging at it. Keep in touch.

Keep cranking,

Robert the DividendDreamer

AKA — Seeking Dividends

Follow me on Twitter– Seeking Dividends@DividendDreamer

I was at 2061 this April vs 1146 in April last year. Great progress. Great progress for you as well!

Jason, Thanks for all the great work you do here! I’m looking forward to finally getting my first dividend check next Friday from O. I just started my portfolio two weeks ago after finishing the last of my debt payments. I found I probably made a few mistakes but I’ve learned a ton already and you’d blog has been immensely helpful (your book too!). I’ve gotten into what think are some really solid choices like O, WPC, EGP, MSFT, JNJ but also some which are a bit borderline like GOV, BMR and WY. At this point I think the amounts are small enough that I won’t sell the positions but I’ll let them simply sit.

I really like your investment in Microsoft. I know it’s a bit pricey, but the top line growth has been head and shoulders above most other companies. And the payout ratio would support growth of the dividend for a long time. I’m thinking of adding NOV, EMR, XOM, ED, CAT, GE or PM next. Can you share any opinions on these and which looks most attractive at these prices? Thanks for the help!

As if to further prove my point, something happened at work today that reinforced how much SAFER dividend income is than job income.

I helped out behind the teller window today. As we were closing up, we found some of the business drop-off bags in my (unlocked) bottom drawer. Turns out the teller before me at that station received them and forgot to both log and process them. God forbid we hadn’t found them and something happened, that would have been grounds for termination for the teller that took them, the closing supervisor, and myself.

The point I’m trying to make with that story is that people have been saying ” But Jason, what if the stock market goes 2008 on us and you lose your dividends!?”, but in actuality dividend income is SIGNIFICANTLY safer than the alternative, which is the income from your day job. It would take an economic collapse the likes of which we can’t even fathom for me to completely lose my dividend income. All it takes is one overlooked drop off bag for me to completely lose my job income.

The questions people ask those who wish to retire early off their dividend income? Those same questions should be asked to the millions of Americans who rely only on their job incomes.

Sincerely,

ARB–Angry Retail Banker

josh,

I know how you feel. I lost some income with that ACRP debacle at the end of last year. They say you win some and you lose some, but I find you mostly win and rarely lose when investing in high-quality companies.

Chasing yield is generally a poor investment strategy. I kind of got burned on that as well, but one can’t really predict an accounting scandal. Just one of those things. What I’ve learned above all else is to stick with high-quality companies first and foremost. Buying at a good valuation is almost as important. From there, the rest kind of works itself out.

Slow and steady definitely wins the race. You’re well on your way. 🙂

Best wishes.

DD,

HUGE improvement YOY. Awesome work over there. That’s like an additional $20k in stocks that pay in the April quarter even factoring in dividend growth and reinvestment. You’re obviously investing quite aggressively. Nice!

I’d be financially independent and then some with that kind of passive income, but I know you’re in a different situation. Nonetheless, next April should be even better. Keep it up!

Best regards.

George,

Thanks so much. Really appreciate the kind words and support. I’m so glad you’ve found value and inspiration here. I truly do my best to share everything I can and inspire others to reach for their dreams. FI is out there waiting for us. I just know it.

You’ve got some great investments over there. As far as that last list, it’s tough to say. If I had to run with just one right now, I’d pick PM. Few products can claim to truly be addictive like that, and so the pricing power is just incredible. The legacy Philip Morris has long been one of the best investments over the last 50 or so years. Other than that, I love EMR. Their track record is outstanding. And FCF growth has been pretty solid over the last decade. I also like NOV a lot here – probably the most attractively valued in terms of potential reward. But I also think there’s a lot of risk and volatility there.

I will say I don’t like ED. I’m not a fan of utilities in general because their growth is limited in terms of geographical expansion, plus they’re heavily regulated. They’re capped pretty heavily. And you can see that in ED’s dividend growth (and underlying operational growth). So I’m not a fan of utilities in general, but even less a fan of ED specifically. I think AVA, SO, WEC, and CNP are some of the better choices there. Though, I don’t know if any utilities are a good buy right now in terms of what you’re paying. Lastly, I’m also concerned about the long-term potential of changing technology in the industry.

Hope that helps. Keep it going over there. Good luck!

Cheers.

ARB,

Agreed 100%. I actually pointed this out a while ago by asking if people would rather rely on ONE paycheck or FIFTY paychecks:

https://www.dividendmantra.com/2013/07/which-is-riskier-1-paycheck-or-50/

It’s an old article, but a timeless idea. It’s truly a no-brainer, in my opinion. 🙂

Cheers.

Thanks for the heads up! Very helpful!

Great job Jason, things are definitely picking up 🙂 My div income is in a holding pattern right now but i have a different strategy in place, excited to see what 2H will bring for all of us. keep up the great work T

Yeah, gotta be aggressive as I want to get to FI in next couple years!

T,

Thanks! It just keeps getting better. Seems the strategy is working thus far. 🙂

Nothing wrong with a holding pattern. Gotta do what you think is best for you. Best of luck with that!

Cheers.

Jason,

Thanks for the wishes. April was unusually high, with the YTD income for these 4 months at just over $12K. I also see the light, this is a great passive income base to be able to use for re-investing, and ultimately will be a solid retirement income stream to use later in life. I’m in the child rearing years now, with a 2 year old, so true retirement will need to wait for a while. But when the time comes I’ll be ready. The strategy is solid, and many thanks to you for sharing this with the world in very easy to comprehend terms. We are all extremely grateful.

-Mike

Hi Dm,

It seems you had a solid month. Great job!

Cheers,

G

I must surely say that this is an amazing growth rate from 5 years ago until now. Did you even calculated how much money you have invested in total out of your working money from when you were working for your boss?

That would probably be an interesting metric with how far you have come I guess.

Hi Jason,

OUTSTANDING!

Sorry I missed you in Omaha. Kids and college stuff kept me from going.

Best regards,

Ray

Hi Jason! We got quite similar income in April (456 euros). Just published my results. Regards!

Wow great discussion here Jason and Arb. You guys make excellent points. I was deeply deeply freaked out by the 2008 meltdown and it has influenced my thinking. Of course you cant hedge EVERY possibility and diversified divident stocks are a great strategy. Thanks mark

Glad to be able to help. The most important thing is never to panic. Stocks go up and down. Commodity prices go up and down. Economies boom and bust. But great companies are great companies regardless of the price of oil or anything like that.

I don’t want to present dividends as something that’s guaranteed, because they aren’t. But like we said, the chances of losing ALL your dividends are obscenely low. People will always need to eat food, use soap and toothpaste, etc. As long as people are using these products, companies will continue to profit off of them. And unlike the expendable employees, their top priority is to their shareholders who they want to keep happy with dividends.

Sincerely,

ARB–Angry Retail Banker

Geblin,

Another step in the right direction. I never get tired of collecting hundreds of dollars from high-quality companies. 🙂

Thanks for dropping by. Hope you’re having a great weekend!

Cheers.

DV,

You can actually see all the money I saved/invested as I’ve publicly shared that all the way along. I generally saved and invested at least half of my net income all the way through.

I think what’ll really be interesting is to one day compare my entire lifetime earnings (using SS information) against total wealth. I hope to make that comparison by the time I’m financially independent. What really opened my eyes when I first started was realizing that I had earned well over $100k over the course of my life (up until that point), yet had nothing to show for it – my net worth was actually negative. Makes you wonder where the money has all gone!

Thanks for stopping by.

Best regards.

Ray,

Hey, no problem at all. I know how life can be. 🙂

Thanks so much for all the support. Hope all is well over there!

Best wishes.

jguerrero,

Nice work over there. That’s fantastic. Financial independence is out there waiting for you, and you’re making the necessary moves to go out and get it. 🙂

Take care.

DM, you are an inspiration to many. Yours was the first site I stumbled across. Its great to see you doing better each month. I’ve barely begun in Oct 2014. Wishing you to greater heights

Jason,

I just wanted to drop by and say thanks,…..again. I have learned a lot from your blog. Last week, based on your writings, I turned the DRIP off on my IRA. This is not something I would recommend to everyone, but for me it made sense. I make enough in dividends to minimize the effect of transaction fees and it’s better to invest the dividends in an under valued company rather than an over valued company, which can happen with DRIP. I’m sure you can hear yourself saying all of that, because you did.

Congrats to you on everything and keep up the great writing.

Jim

Hi Jason,

I’ve been following your blog for a while and I’ve learnt a lot since then. I just wanted to say THANK YOU!

I’ve started purchasing some dividend paying stocks to generate passive income stream and eventually some day reach the financial freedom. I also started my own blog to follow your steps and share right now which has become my passion.

I admire what you do and the decisions you made along the journey.

The inspiration you provide is priceless!

Best wishes from Barcelona, Spain.

Sergi

DGP,

I’m so glad you’ve started. Your future you is already very thankful. 🙂

Wishing you greater heights as well. Thanks so much for the support.

Have fun over there!

Best regards.

Jim,

Thanks for dropping by!

I think DRIPs are great for some investors. But if you’re regularly investing large sums of capital anyway, they make no sense to me. The more capital I can pour into a high-quality, undervalued business, the better. If you think highly of your capital allocation skills, you should want to maximize the capital available to you.

Let me know how it goes for you. I’d be willing to bet that you enjoy the new process. 🙂

Cheers!

Sergi,

Thank you so much. I really appreciate that! 🙂

I’m so fortunate in that the readership I have, including yourself, is so supportive and wonderful. This blog wouldn’t exist without you guys. And I think it’s that support and appreciation that makes me want to provide even more value and better content. So thank you as well.

Best of luck on your journey. I find it incredibly exciting and rewarding all the way through. I’m confident you will, too!

Best wishes.

The money has gone into liabilities my friend. There is nothing more expensive than purchasing stuff which devaluates and inflation. And basically how you do it now is also way better, Make a big promise in front of everyone and keep going and document everything. You have inspired me and based on that I have decided to do the same since also I know it’s possible.

Nice blog. Will hang around.

Hi Jason! congrats on another great month! I see you got a big chunk of your income from tobacco companies.. 🙂

I remember when you bought Armanino, looks like they are doing good. Thanks for sharing your experience!

Happy,

Yeah, AMNF has been a great investment for me. Every quarter is better than the last. They just keep on impressing over there. I’ve thought about allocating more capital there, but I’m always mindful of the risk.

Thanks for dropping by!

Best regards.

Thnx Jason, we’re heading to it!

Hello Jason,

Here Erik again, I’ve been with this idea of getting into dividends growth strategy, but I’m a little skeptical that this is the right strategy to grow the capital. I have a practical question you can help me clarify.

To explain myself I’m going to use an example from your April’s dividend income report. I see you received 22.58 from your position in BNS (40 stocks 2218.4 that means 55.46 buy price per stock right?)

1) to buy those 40 stocks let’s say you used trade king, you paid only 4.95 for all 40?

2) you invested 2218.4+4.95 = 2,223.35 and you got 22.58 in dividends (1.02%), in 3 months right? (BNS pays every 3 months right?) a little detail: I saw that BNS paid 0.5432 on 4/2/2015 x 40 shares that is 21.73/2223.35 = 0.98% did I miss something?

3)If I get it right, you hold that position until you can trade it for a good price and make a capital gain that will add up to the profit you made from dividends, is my assumption correct?

I ask you this because I didn’t find any info on your capital growth or pasts portfolios.

4) In a previous question, you told me you were doing 3% yield on average, is that 3% dividend yield? or total including capital gain?

I ask all this ’cause I’m wondering if dividend growth is the right strategy to increase capital.

that 290k could be producing more if allocated in other instruments, let’s say a mutual fund that generates 11% p/year with the same amount of risk, of course that does not generate every month income, but since the strategy is long term, ones you generated enough capital to generate enough dividend income there you move all the capital to this strategy. Do I made my point? I would like to know your opinion in this regard.

Thanks! 🙂

Erik,

I did my best to answer this question (dividends and total return) the last time you asked it. I don’t think I can really answer it any better the second or third time around.

Dividends are just one component of total return. The other component is your capital gains. I don’t focus on capital gains because I don’t trade in and out of stocks.

So your quote about capital gains isn’t something I really focus on:

“If I get it right, you hold that position until you can trade it for a good price and make a capital gain that will add up to the profit you made from dividends, is my assumption correct?”

I don’t look to trade in and out of the market to profit. I’m aiming to one day earn enough passive dividend income to live off of. However, you’ll notice that many of the stocks I own have also increased in value (some significantly), reflecting capital gains. For instance, my cost basis in ITW is $1,640.80. As of my last update, that position was valued at $3,346.70. So that stock has doubled (which is a 100% capital gain) in value for me all while I continue to also collect the dividend.

“4) In a previous question, you told me you were doing 3% yield on average, is that 3% dividend yield? or total including capital gain?”

My portfolio yields somewhere around 3.45%, last I looked. That’s just the yield, which is the dividend component of total return. The capital gains would be the other component. So when you’re looking at a mutual fund or anything else returning 11%, you’re probably looking at the yield and the capital gains. So it’s important to differentiate the two.

Hope that helps!

Take care.