Dividend Growth Update – First Quarter 2015

I’ve decided to start publicly tracking dividend growth as it relates to my portfolio starting from this point forward. I’ll update this information every quarter, which will provide relevant and important information on dividend raises announced by the companies I hold equity in, the size of those dividend increases, and how that affects my bottom line with real-life numbers in real-time.

This is actually something I should have been tracking publicly all along, but for some reason it just never occurred to me. However, now that the dividend income is becoming substantial, it’s even more timely and necessary to write these updates and start tracking everything here on the blog.

What you see below is every company that I currently own a stake in that declared a dividend increase during the first quarter of 2015. So the ex-dividend date or pay date won’t be counted here. In addition, I only count stocks if I was long before the increase was announced. If I buy a stock shortly after a dividend increase was announced, then I don’t count it here. So this is a true reflection of an actual increase in my income, down to the dollar.

This is really exciting stuff. Dividend growth is what I refer to as the “secret sauce” in building and rolling a snowball. It provides a huge exponential compounding effect, especially as the dividend income grows. And now you’ll get to see how that works with real numbers here.

So let’s see which stocks in the Freedom Fund announced dividend increases this past quarter and how that affects the dividend income I’ll be able to generate moving forward.

| Company | Ticker | Old Per-Share Dividend | New Per-Share Dividend | % Increase | $ Increase (Annual) |

| Air Products & Chemicals | APD | $0.77 | $0.81 | 5.2% | $3.20 |

| Avista Corp. | AVA | $0.3175 | $0.33 | 3.9% | $2.75 |

| Bank of Nova Scotia | BNS | $0.66 CAD | $0.68 CAD | 3% | $1.60* |

| Digital Realty Trust, Inc. | DLR | $0.83 | $0.85 | 2.4% | $5.20 |

| General Dynamics | GD | $0.62 | $0.69 | 11.3% | $5.60 |

| Kinder Morgan Inc. | KMI | $0.44 | $0.45 | 2.3% | $7.20 |

| The Coca-Cola Co. | KO | $0.305 | $0.33 | 8.2% | $14.00 |

| Lorillard Inc. | LO | $0.615 | $0.66 | 7.3% | $9.00 |

| Norfolk Southern Corp. | NSC | $0.57 | $0.59 | 3.5% | $5.60 |

| Realty Income Corp. | O | $0.1834 | $0.1895 | 3.3% | $5.12 |

| ONE Gas Inc. | OGS | $0.28 | $0.30 | 7.1% | $0.64 |

| Omega Healthcare Investors Inc. | OHI | $0.52 | $0.54 | 3.8% | $4.80 |

| ONEOK, Inc. | OKE | $0.59 | $0.605 | 2.5% | $3.30 |

| Raytheon Company | RTN | $0.605 | $0.67 | 10.7% | $6.50 |

| Southside Bancshares, Inc. | SBSI | $0.2095 | $0.219 | 4.5% | $2.66 |

| Toronto-Dominion Bank | TD | $0.47 CAD | $0.51 CAD | 8.5% | $4.32* |

| Wal-Mart Stores, Inc. | WMT | $0.48 | $0.49 | 2.1% | $1.52 |

| Q1 Totals: | 5.3% | $83.01 | |||

| YTD Totals: | 5.3% | $83.01 |

*These amounts are reflective of current exchange rates.

Fantastic, isn’t it? That’s $83 more per year in passive dividend income I’ll be collecting. What you see above is essentially, in aggregate, 17 “pay raises”.

And guess what I had to do to receive these pay raises?

Absolutely nada, other than own stock in the above companies.

I didn’t have to show up early, stay late, deal with office politics, make phone calls, manage an email list, or meet quotas.

I just had to sit back and wait.

Patience is tough sometimes, but my progress thus far is proof that patience and persistence works. Since I started investing in 2010, I’ve received countless pay raises every single year. It takes a little time for this to start noticeably working, but the additional cash flow is real.

That extra $83 per year might not sound like much.

But consider that it would take over $2,300 invested at a 3.5% yield to achieve the same effect.

Said another way, that’s $2,300 less I have to invest now to generate that same increase in my annual passive income. Wonderful!

And even better, every dividend raise increases the base upon which future dividend raises will stand. An annual $1.00 dividend that turns into $1.10 is a 10% dividend increase. But if that respective company announces another 10% raise the following year, that means you’re now collecting $1.21, or $0.11 more. Repeat that and you’re looking at $1.33, or $0.12 more. Rinse, repeat, become wealthy.

I once compared my portfolio to a tree, whereby each position is a branch. And each branch produces bountiful fruit. That fruit – the dividends – is what I’ll eventually live off of, choosing to pluck the fruit and leave the branches intact rather than cutting the branches, possibly slowly killing the tree.

Well, this is where the tree starts to tend to itself. It’s growing branches all by its lonesome.

I could theoretically stop investing today and the dividend income the portfolio generates along with these dividend raises would still eventually render me financially independent. The snowball is starting to move along without me. The good news, however, is that I’m not tired yet. I’m not done pushing. So these results will just continue to exponentially increase and improve.

Out of the 53 stocks in my portfolio, this represents the 17 of them that have already increased their dividends this year. Two stocks – Praxair, Inc. (PX) and T. Rowe Price Group Inc. (TROW) – increased their respective dividends just before I initiated my position in each. So 19 of the 53 stocks in the Freedom Fund have actually already handed out “pay raises” this year.

Notably, many of the stocks that are included above generally increase their dividends more than once per year. As such, the YTD total for the percentage increase will continue to factor in year-over-year increases in stocks’ respective dividends, which will be more accurate than averaging out the quarterly totals. However, I’m also including the quarterly totals so you can see true quarter-to-quarter incremental increases in income through dividend growth.

One last important aspect here is that even though the quarterly percentage increase is likely far lower than what the annual result will show at the end of the year, this is somewhere around seven times the inflation rate of 0.8% we experienced last year. So not only is my purchasing power increasing, but it’s doing so at an incredible rate.

Full Disclosure: Long all aforementioned stocks.

Did you have a great quarter for dividend growth? Enjoying the larger “paychecks” you don’t have to work for?

Thanks for reading.

Photo Credit: atibodyphoto/FreeDigitalPhotos.net

Edit: Corrected SBSI dividend.

DM,

I am digging the new quarterly article, as dividend growth is such an important metric. Our investing strategy isn’t just to invest, but to invest in companies that pay a growing dividend. Focus on the growing dividend! We always talk about the dividend snowball, and dividend growth is a big reason why that snowball grows (outside of infusing capital, of course. I really liked how you not only showed the growth that occurred over the quarter, but the amount of purchases it would take to achieve that dividend level. It is a really cool and powerful way to show the impact of the growth.

You have some great companies in your portfolio (which we already knew) and that is shown once again by your table. A >5% YTD increase is great, especially considering that KMI and other companies still have a lot of dividend growth to go this year. Think back to your last job, when was the last time you received a 5% growth rate in income after 3 months??

Keep up the great work. I am looking forward to seeing your second quarter summary!

Bert

Great post! And I love the idea that you’ve had “pay rises” without actually doing anything apart from holding shares in the company as you were doing anyway. It’ll be interesting to see, if you continue to do this long term, what kind of % rise in dividends your shares will have in say, 5 years time.

That is a great list of dividend raises for the first quarter, though plenty more to come. Never really thought about calculating the percent raise that way so kudos for thinking outside of the box.

Overall, I am like a kid on Christmas eve waiting for that AAPL raise and hoping they could implement that special dividend soon. Exciting stuff!

Great write up!

“But consider that it would take over $2,300 invested at a 3.5% yield to achieve the same effect.” Your ability to distill complex financial into simple anecdotes is why we all come to site. Thanks!

Nice article! I like the fact that you get annual “raises” from the companies just for the simple fact that you believe in their long term success. I can’t wait to start experiencing those raises next year and beyond!

Cheers!

Compounding is a powerful force. As Ben Franklin put it, “Money makes money. And the money that money makes makes more money.”

This is so true! I never thought of the dividend increases in that way until Jason explained it. Less money needed to invest to get that amount.

Bert,

The growth of the dividends is a cornerstone of this strategy, so it’s about time the dividend raises get their due attention. 🙂

I’m excited to see how the numbers look by the end of the year. I suspect it’ll be somewhere in the 7% range, which is about where I was last year. I haven’t meticulously tracked this in a holistic approach until now, choosing instead to focus on individual stocks and their respective growth patterns. But it’ll be nice to show how this works with real money going forward.

Thanks for all the support!

Best regards.

Nicola,

That’s exactly it. These “pay raises” work just like the ones you get from your employer, except you have to work for the latter. I didn’t have to do a thing for the GD, NSC, and RTN pay raises. 🙂

It’ll be great to see what this kind of additional income looks like on a recurring annual basis. The proof is in the pudding!

Cheers.

DV,

Yeah, this is something I should have been writing about all along. But I’m glad I finally came up with the idea. 🙂

I hear you there on the AAPL raise. It won’t move the needle much for me in terms of additional overall income, but every penny counts!

Thanks for dropping by.

Best wishes!

TNC,

Thanks so much. That’s always my aim with individual articles and the blog as a whole. I think the best way to inspire people is to make these concepts approachable and easy to understand. It’s tough sometimes to come up with new ways to explain difficult concepts, but I enjoy the challenge. 🙂

Cheers!

Ron,

Thanks so much. Glad you enjoyed the article. 🙂

Getting a “pay raise” is one of the most exciting aspects of this strategy and investing in general. You’ve got a lot to look forward to!

Take care.

Jim,

Indeed. Success begets more success, and that is just exponential when it comes to compounding. It’s great to have that kind of force working on your behalf. 🙂

Best regards.

Really like this post. That’s a solid increase considering you had to do nothing for it. And what I think is probably the most important factor is that you didn’t have to invest extra capital in order to get that dividend increase. That’s $2,300 less that you have to invest. Of course I know you won’t be stopping anytime soon.

JC,

Definitely. I don’t think a lot of people understand that “secret sauce” in dividend growth investing. But I’m doing my best to explain how it works, which will hopefully change that. 🙂

That $2,300 will only increase as the year goes on. If the first quarter is any indication, I’ll end the year with additional dividend income on par with investing $10k. Pretty incredible.

Cheers!

Another interesting way I have found to look at it is “effective yield” on original investment. I.e I have a block of Altria I purchased back in ’09, based on purchase price those shares are yielding over 9% today. I think this is another way to explain the powers of DGI, because if this same money was in my savings account it’s effective yield would be .011%

Really nice news that aore like gas to our route to the financial independence

Regards!

Kurt,

A lot of investors call that “yield on cost” or YOC. I actually don’t track that or find any value in the metric at all. The only thing that really matters is the income you can generate on an investment now. So if your YOC is 5% but your current yield is, say, 2%, you might be better off redeploying those funds elsewhere in terms of how much income that capital can generate.

Cheers!

Finanzasmania,

Sure. Thanks for dropping by!

Take care.

Really like this post. Especially for a beginner in DGI it is so impressive to see how the income growths without doing something. You can see the growth numbers of stocks in the past but when I first noticed how impressive the real growth rate in my portfolio is I was overwhelmed. And now I catch myself for scanning the dividend stocks with the best growth rate 🙂 If you see this double digit growth rates you have to pay attention to not buy just stocks with low yields and high growth rates…

Really great series and wish you begin with this series 4 years ago 🙂 That would be really impressive I think.

Cheers

A great idea for the site Jason. It’ll be interesting to follow over the coming years.

Just think what the raises will be in a decade 🙂

Cheers, Nick.

Yay for dividend growth! Good to see the quarterly update, DM. It provides a nice overview of how your portfolio is doing and tracking the dividend growth is such a great way to get some perspective. Im glad to see you decide to share this publicly…thanks for sharing.

Best wishes

R2R

Jason,

I like the 5.3% increase, which beats inflation by about 3%. Now that’s a real increase. Keep that up and you can quit working. 😉

In all seriousness, calculating your dividend increases is a good idea. I have been tracking the amount of annual dividend increases that my wife and I have gotten from reinvesting dividends for the last year of so. We are up to $456.47 so far and counting.

Take care,

KeithX

ps Go Tigers!

Dividend Mantra,

Great article. The part where you mentioned about the dividend raises from the positions this year will be equivalent to investing approximately $10000 at 3.5 % yield to get the same about of dividend income should cause lightbulb moments for some people who are new to this strategy.

I own two of those stocks BNS and TD. Love the increases that is for sure.

Very cool new series for the blog. I look forward to these updates.

Question for you…do you know of a site that features charts that show market cap over time? I can’t seem to find any.

I’m a little surprised that you don’t have Wells Fargo on this list. Didn’t they announce that they were raising the dividend from .35 to .375 last month? Aside from that my only other stock that saw a dividend increase in the past year was LVS at 30%.

Cool. Go man go!!! A couple of bonus steps close to your freedom.

I am one of the proud shareholders of 6 out 17 stocks you mentioned above.

Cheers,

mephisto,

Yeah, it’s awesome when the dividend growth rate goes from just a number on a chart to a real-life increase in your real cash flow. That’s when the whole thing kind of “clicks”. 🙂

Thanks for dropping by. Glad you enjoyed the post. Hope to show how this works every quarter. The numbers will surely add up over time.

Cheers!

Nick,

Thanks so much. Glad you like the new series. Very excited to see what these numbers look like as they add up. This first year should be a pretty impressive result. 🙂

Best regards.

R2R,

This should show the “secret sauce” in action. To know that I was able to see the same increase in my income that investing more than $2,000 would accomplish is pretty amazing. And that’s just one quarter. We’re seeing that the snowball is really starting to take off. 🙂

Thanks for dropping by!

Best wishes.

KeithX,

That’s an awesome result right there. When you first start investing, every increase in your passive income is the direct result of any cash you’re able to invest. But now your money is making money for you. That’s the spot we all want to be in. 🙂

Thanks for sharing.

Best regards!

IP,

Thanks. I definitely hope that this allows some people to think about dividend growth investing in a whole new way. Accomplishing the same increase in my passive dividend income as investing $10,000 of fresh capital – fresh capital I didn’t invest – is really incredible. We’ll see how 2015 shapes up in that regard. 🙂

Take care!

blahblah903

YCharts should give you that information. They have a lot of pretty cool charts that stretch the gamut of information. 🙂

Cheers!

TDM,

WFC announced that they planned on increasing the dividend, but it hasn’t actually been declared yet. That’s why I mentioned in bold that I was only including stocks that have actually declared a dividend increase. The dividend isn’t there until it’s actually declared. But I suspect that stock will be included in the Q2 update.

That’s great news there with LVS. Not too many jobs out there hand out 30% raises, let alone for doing nothing at all. And certainly not routinely 🙂

Cheers!

FJ,

Extra cash flow for doing nothing at all? Sign me up! 🙂

Thanks for dropping by. Glad to be a fellow shareholder there in a few companies.

Take care!

I love seeing how all those little increases slowly start increasing overall dividend income. And playing with the numbers of how much of a stock I would have to buy from stocks on my watchlist. Makes for a fun Excel/Googlespread sheets file 🙂 Congrats on the $83!

Thanks for the update. Quite helpful to see and obviously my previous question was timed perfectly. Looking forward to future updates.

Liam

Thank you for sharing. Of all the content you share, this angle of showing your “raises” really excites me the most. Especially liked the part showing how much of your own capital with a dividend of 3.5 percent it would take to accomplish the same raise. Good job and keep posting. I will keep reading :).

Excellent illustration of the compounding effect of dividend increases. “Dear Mr. DividendMantra, you didn’t do anything for the company this year except own shares, however we’d like to reward you with a pay raise. Cheers!”

Yes, I’m also in on the GM dividend raise.

I seem to recall you announcing these raises as you discovered them, but then you got stocks in way more companies. This quarterly summary is a great idea.

In order to calculate your average percentages accurately, you’ll need to include the companies that did not raise their dividends. Do you own stock from any companies that normally raise their dividends during the first quarter but did not this year? If so, they may still raise them later, so maybe it’s best to wait until your end-of year summary to include those.

This is a great new post to look forward to! In the same way most people don’t understand that a latte every day adds up to a lot of extra expenses over the year, they would miss the entire concept of these ‘small’ dividend raises and how much fresh capital it would take to achieve those same amounts. This post clarify’s that part of the strategy so perfectly! Excellent work, Jason. You’re making us all better investors as usual 🙂

DW,

Yeah, it’s definitely fun to play with the numbers. Especially when we’re talking about an increase in real-life passive cash flow. 🙂

Thanks for dropping by.

Cheers!

Liam,

Glad you enjoyed the update!

Wish I would have been writing about this stuff all along, but better late than never. 🙂

Take care.

Tvak,

Thanks so much. Glad you found a lot of value with this article. I think this really gets to the nuts and bolts, and illustrates what’s really so effective and wonderful about the strategy. 🙂

Best regards!

fs,

Haha! Exactly. A raise? For me? For doing nothing at all? Don’t mind if I do. 🙂

Best wishes.

Debbie,

Well, I got away from the articles on individual dividend raises because I write about them elsewhere. I suspect that over time as those opportunities to write elsewhere increase, I’ll end up writing here less. It’s unfortunate, but I make significantly less on a per-article basis to write here versus pretty much anywhere else. I continue to spend most of my time here as a passion project, but the path to FI is actually much faster elsewhere.

I don’t believe that any of the companies I own a stake in are off schedule or anything. We’ll see how it shakes out at the end of the year, but so far everything looks good. Any zeros in there will get factored in, but I hope those are few and far between.

Cheers!

Ryan,

Absolutely. Just like $3 here and $5 there can add up, that 6% raise here and 8% raise there can also add up. As you can see, someone just starting out would have to invest $2,300 (that’s a lot of money) to achieve the same effect (in terms of passive income) that I did by doing nothing at all. And that’s kind of how this works once you get going. It’s really wonderful. So if this quarter’s results repeats itself fairly similarly over the course of the year, I will have achieved an increase in passive income on par with someone else investing $10k at 3.5%. Add that on top of the $24k or so I hope to invest over the course of the year and you can really see how the snowball starts to move. And that’s before even factoring in the reinvested dividends, which should come in at $7k or so this year. 🙂

Thanks for stopping by. Appreciate the support!

Best wishes.

This is why I love dividends and dividend growth strategy. You do nothing and your pay is coming and growing for you. People fail to understand that. I remember approx. 10 years ago people disregarded dividends because they could get more in a bank at CDs. Why I told them that with JNJ they could get 3% they were laughing at me. Flash forward 10 years. Now their principal is probably the same as it was 10 years ago, their interest is zero and going nowhere. My JNJ doubled and my “interest” is now around 14% (yield on the original investment). And now it is me who is laughing.

Surprisingly there is still many people who believe bonds will do them better than DGI stocks.

Martin,

Right. Bonds might make sense at some point in the far future for those that need that lower volatility, but that “smooth ride” can be quite expensive. I’ll take the ride that’ll likely offer far better returns over the long term, even if it is a bit bumpier along the way.

Cheers!

Hi there Jason

What do you think about having a portfolio of dividend paying ETFs? Currently, I have a number of high dividend ETFs exposed to different developed markets around the world, and it pays handsome dividends which I reinvest. Do you invest in single stocks to eliminate the expense ratio only or do you have other reasons? There’s huge diversification via the ETF route, and with so many low cost products on the market is it not safer to stick to high dividend paying ETFs?

Thanks

Mike

DM,

That is a great idea for a series. I like that new feature it really shows how well dividend growth stocks work. The raises end up creating bigger and bigger increases from regular investments.

17 pay raise for $83 more per year and we are only 4 months into the year, that is excellent Jason!! We have 2 of the companies from your list. I know we have received a dividend raise from several companies from our portfolio but we haven’t kept track of them. Your blog post has inspired me to as least take a look though. Maybe you’ll see a post in the next few days detailing our raises. 🙂

Cheers to more raises throughout the rest of 2015! AFFJ

It is no longer true that bonds are safer than stocks. These days bonds are as volatile as stocks. If you have enough dividend income from the stocks, you do not care what your principal does and how volatile it is. Even if my portfolio value goes to zero, I do not care as long as my dividend income is coming regularly every year. Can you say the same about bonds?

Mike,

I’ve written before on why I prefer to invest in individual stocks over funds:

https://www.dividendmantra.com/2013/04/why-i-vastly-prefer-dividend-growth/

That said, just buying a few funds is probably the right approach for most people. Requires a lot less time/knowledge/interest.

Cheers!

SWAN,

Glad you enjoyed the article. The results will just become more and more powerful over time. Can’t wait! 🙂

Best regards.

AFFJ,

I haven’t really ever seen an article like this before, which kind of inspired me to write it. I suspect we’ll see more articles like this around the blogosphere now – I tend to start trends in that way, for better or worse. 🙂

Hopefully, you’ve received some big dividend raises you may not even be aware of. More money is always a good thing!

Thanks for stopping by.

Take care.

Martin,

Historically speaking, bonds have typically been less volatile than stocks. What they’ll do moving forward, however, is anyone’s guess. Although, low rates portends poor long-term returns from here, from what I can see.

“If you have enough dividend income from the stocks, you do not care what your principal does and how volatile it is.”

I think a lot of people invest in bonds for the same reason – income and stability of that income. But you can get a higher yield from many high-quality stocks right now, with income growth and rather strong odds of capital appreciation to boot.

Cheers!

DM,

great new post. I just love these kind of statistics from you. As you’ve mentioned, on the first view $83 seems not very high over the year, but other investors would need to invest $2300 based on 3,5% yield to receive the same. That’s the truth. Myself; I would need 3-5 month of saving, you already have it for saving “nada”. Amazing! Looking forward to see your further growth. Very inspiring. Keep up Jason!

Rgds,

Patrick

There’s no question that the ‘secret sauce’ of dividend investing is dividend growth. As you know I have filled my portfolio almost exclusively with dividend growers rather than chase current yield. Over the long haul investing in a steady to rapid grower seems a lot safer than investing in a current high yielding stock. Always fun to see those raises come in and now with these updates see how they translate into real dollars as we all know… ‘dividends don’t lie.’ Thanks for this update.

Nice article. I like how you compare dividend increases to a pay raise. By the time you have to start relying on the dividend income, these future pay raises will be a great hedge on inflation.

DM,

Enjoyed this post. I guess I never noticed you didn’t focus much on quantifying increases. That is what I really like about DG Machine when he was actively blogging. He always kept up on increases.

Should be hearing about a lot of increases this month with earnings on the way. AAPL will be particularly interesting.

It really is exciting to get the news of an increase. It’s the epitome of why we invest the way we do.

-RBD

This is another reason dividend investing income is my favorite passive income source. 5.3% raise is like “outstanding rating” to get a 5% raise. 5.3% you can’t get this type of raise if you’re still working for somebody else. Now, business owner is the way to go!! Owning 53 businesses with majority of them raising its annual dividend is the way to go! Great article. Thanks for sharing!

Jason,

Excellent, that’s something I will look for our blog, part of our new page Dividend income.

Well done and best regards,

RA50

I’m pretty sure this should be obvious to me, but how much did you invest in these stocks to get these curent results?

And why did you choose 3.5% as your baseline?

Interesting idea to do this! It’s funny, I’m not sure I even keep track of this, rather than looking at the Chowder number yearly. Probably something I should do; thanks for the idea! Speaking of dividend increases, what’s your opinion on the announcement that GE will freeze its dividend until 2017?

Love this idea. Great job. Looking forward to upcoming reports and see how it all develops. Have a great week!

M-D,

Thanks. Glad you enjoyed it! 🙂

That’s really what’s crazy and wonderful about this. When I first started, $83 in additional passive income didn’t just materialize… I had to invest fresh capital to generate that. Now I get to just sit back and collect. This is the reward awaiting you if you stick with it.

Best wishes!

DH,

Well, I think one can attain plenty of dividend growth and yield by focusing on stocks across the spectrum. Sometimes a stock with a low yield/high DGR will surprise you with small dividend raises (WMT) and all the same you’ll sometimes get that big dividend growth from stocks that already yield quite a bit (KMI, PM, OHI, etc.). Just depends on each individual company, which is why I find it so important to diversify across sectors, companies, and growth prospects.

Cheers!

FF,

Exactly. Even after passing through the accumulation phase and living off of dividend income, the income should grow faster than inflation over the long haul, just relying on dividend raises alone. So that means that, at some point, your income will probably far outpace your spending. At that point, life just becomes incredibly easy and things like philanthropy open up. A lot to look forward to. 🙂

Thanks for dropping by!

Take care.

RBD,

Right. I stopped writing about dividend increases and how they impact my portfolio some time ago. I’ve been writing about dividend increases elsewhere, and it didn’t seem to make sense to repeat myself here.

Definitely looking forward to another real strong quarter. We’ll see how these go throughout the year. And it’ll be interesting to really see exactly how the income is affected by the end of the year. Should be a real eye opener. 🙂

Best regards!

Vivianne,

Exactly! I remember begging for a raise at a place I was working at years ago. I felt I was vastly underpaid and there seemed to be a lot of opportunities elsewhere. And I remember finally sitting down and running through the numbers with my boss… only to be extremely disappointed when I realized it turned out to be about a 3% increase in my pay. Needless to say, I was gone shortly thereafter. It’s tough to get 6% or 7% pay increases year after year after year as an employee. Not so much as a shareholder. Just another reason to choose the investor class over the working class. 🙂

Take care.

RA50,

Glad I could help! 🙂

Cheers.

Kimmoy,

You can see exactly what I’ve invested by reading the blog. Every dollar saved and invested has been chronicled since early 2011. 🙂

As far as the 3.5% yield goes, that’s the approximate current yield of my entire portfolio. I find that’s an appropriate yield to shoot for if you’re sticking to mostly high-quality stocks across the spectrum of yield and growth.

Take care!

DD,

Yeah, I read about that. It seems the base plan is to maintain the current dividend through 2016 and grow it thereafter. I’m not sure how much pressure there will be on the company to grow it throughout the next 18 months, but I hope that’s what happens. I guess we’ll see. A lot of moving parts there right now.

Cheers!

Mabel,

Thank you!

It’ll definitely be interesting to see how this goes over the coming years. The numbers are already impressive, but they’ll just continue to be more so over time. Excited to show how that works. 🙂

Best wishes!

Great reason to invest in dividends and even better reason to purchase dividends with long track records with great growth records. I’m all for this quarterly update.

I think I’m addicted to dividend investing. I’ve always done a budget and saved money. I have a 401k an IRA and all that fun stuff. But I’ve never saved this much this quickly before. And it’s so much more fun buying shares of a good company than buying stuff. I’m really enjoying this!

Jason

Great post, and fantastic way of showing the benefit of equity investing, particularly compared to fixed interest investing. I am never really sure why pension companies rely so much on fixed interest when shares (generally) grow the income they produce, just as your article shows.

Also interesting to show the benefit as the amount you don’t need to invest as a result of the increase.

Best Wishes

FI UK

Awesome!

Great article. It really helps understand to power of the snowball effect.

Thanks for sharing.

TD’s dividend increase interests me the most since I work in banking. I know that in order to make a 6% increase in the bank I work at, I will have to obtain more licenses to sell more complex products, meet higher sales goals, become my branch’s leader in bringing in new business and fostering new relationships, and obtain supervisor authority which would mean being up at 5:30 in the morning for branch openings and late night branch closings, investigating teller differences, and so much other stuff. A 6% raise doesn’t sound too bad, but it’s only a dollar an hour increase. After taxes, my pay would be almost the same, but my stress and workload would have increased by a whole lot.

Meanwhile Toronto Dominion gave their shareholders an 8% raise, and not a single iota of work is required for it? No customers, no worrying about sales, no constantly ringing phones? It seems that “A Bronx Tale” was right; the working man IS a sucker.

Fortunately I have a number of companies on that list, including KO and their mighty 8% increase. Financial freedom, here I come!

Sincerely,

ARB–Angry Retail Banker

DM,

Normally I agree with your logic, but I am not following here.

Yield on cost is one of the few things we have control of, in addition to purchase price. The value I find in it is the ability to project ahead what my dividend income might be in 10 years (with assumed dividend growth rates and savings rates from real data). And because of that, I have confidence in my selected FIRE date. Fyi I assume YoC of 3% with 6% dividend growth. If my YoC is lagging it gives me reason to look for undervalued high yield stocks to catch up my portfolio with my annual dividend goals.

Would you mind explaining your position on this further?

I personally find no value in today’s yield (of my current investments) because it will never cause me to sell. I only plan on selling if a company cuts its dividend or if it becomes significantly overweight in my portfolio due to price appreciation

Thanks for your time, I find a lot of value in your efforts to respond to your readers.

Also, congrats on your raises! Keep up the good work!

Even Steven,

Thanks so much. Glad you enjoyed it! 🙂

Cheers.

SR,

Join the club. Maybe we need to come up with a “Dividend Investors Anonymous” or something similar. 🙂

I’d also much rather buy high-quality dividend growth stocks than pretty much anything you can find at your local mall. Dividends are the gift that keeps on giving.

Best regards!

FI UK,

Well, pensions are in a different situation there. Insurance companies are in the same boat. They have to be incredibly conservative with investments. Fortunately, we retail investors aren’t bound in such a manner. 🙂

I think these posts will really open some eyes up in terms of the power of dividend growth investing and how that impacts an investor’s bottom line. I’ll keep them rolling every quarter to prove it out.

Cheers!

LD,

Glad to hear that. The post did its job! 🙂

Thanks for dropping by.

Best regards.

ARB,

Couldn’t agree more. Your experience is exactly why I’m so interested in moving from the working class to the investor class. The grass truly is greener on the other side. I know because I’ve spent considerable time on both lawns. 🙂

Thanks for sharing that. We’re on the right path!

Best wishes.

I have the % dividend increase over the last year on my spreadsheet for every one of the 65 stocks I own.

I also love comparing my dividends earned this month compared to last year at the same time. Very excited to see growth in both columns. Thanks for your insight.

Patrick,

This is way off topic, so I’m a bit hesitant to go too crazy here. But I’ll give you a quick rundown.

“Yield on cost is one of the few things we have control of…”

Not true. You don’t have any control over how much a company will increase its dividend, which is a major part of YOC.

YOC is nothing more than a “feel good metric” in my view.

Let’s run a hypothetical situation. Say you own 100 shares of Company ABC in an IRA. And your YOC is 10%. Let’s say you accidentally sell your shares. Oh, no! You just lost years of hard work and a YOC of 10%, right? Wrong. You simply repurchase the shares for the same exact price and same exact yield. Your cost basis is increased and your YOC is lowered to the current yield… but the income you’re actually producing is EXACTLY THE SAME. You changed NOTHING about your dividend income or the growth of that income moving forward. Your overall situation is unchanged, other than the cost basis.

Let’s say that same stock is grossly overvalued. Your YOC is 10%, but your current yield is only 2%. And let’s say another stock out there is undervalued and offers a yield of 4%. Exchanging the stock you own for the one you don’t would DOUBLE your dividend income, even though your YOC would drop from 10% to 4%.

If YOC helps you, by all means. But I view it as a pretty worthless metric that could actually cause some investors to hold on to a stock that they perhaps shouldn’t. YOC doesn’t pay the bills. Actual dividend income does. Just my view on it.

Cheers!

NRG,

Nice. We’re definitely on the same page there! 🙂

It’s fantastic to see that income grow without any input on your part, isn’t it? Just another great aspect of being a dividend growth investor!

Thanks for stopping by and sharing.

Best wishes.

Great post, DM. Dividend increases and the powerful compounding effect are the dynamo of DGI method.

Hi DM, I have a question about DGI and taxes. I live in California. The weather is good, but the state tax on dividend income is super high at 13.3%. Do you have any recommendation about how to legally lower a high tax rate on dividend income, besides ROTH IRA and moving (the former is the only method I can think of, since the latter isn’t possible.)?

Thank you.

MU

MU,

To be honest, I know almost nothing about California’s state income tax. I always knew it was high, which when combined with the high COL, meant I would never live there.

That said, I just took a real quick glance at the state income tax brackets. Unless I’m mistaken, the 13.3% state income tax rate is the highest bracket and reserved for the very top earners. At that level, you’re earning more than $1 million per year (including the Mental Health Services Tax surcharge). Congratulations on such a massive income!

If you’re not earning that kind of income, then either I’m reading the tax brackets wrong or you’re not being taxed at that level. And if you are earning that kind of income, then I’d rather have your tax problem than most people’s revenue problem. With my income level, I’d be paying between 6% and 8% there. Not great, but not 13.3% either.

But tax-advantaged accounts and/or living in a place with less or no state income tax is really your main defense against something like that. This is partly why I moved to Florida back in 2009.

Sorry I couldn’t be of more assistance!

Edit to add: One other idea to consider would be to focus on stocks and/or funds with very small and/or no yields. That would probably limit your tax exposure, but would come with its own plethora of changes and potential drawbacks.

Best regards.

Great article, it gives me an idea on how to track my own dividend growth. JC from Passive Income Pursuit posted a similar post about organic growth. I was working on my organic growth but it is very time consuming but your way seems way faster and clearer. How did you calculate the 5.3%? Did you add all the increases then average them? Thanks in advance!

Why does my OHI dividend only say .36/share?

The fact that you didn’t have to spend $2,300 to have this kind of increase is a huge deal. It’s like someone else is helping you invest. Later on, these sort of increases will ensure that you stay ahead of inflation and also get a nice discretionary increase.

Btw, what’s your take on GE’s decision to jetisson GE Capital? I am not happy with the fact that they have indicated they’re plan to keep the dividend the same up until 2017. I decided to deploy my GE money elsewhere. I’m sad to part ways with the company, but at least I capitalized on the 10% bump.

FFF,

Glad this article made a lot of sense. As I’ve written about many times now, I like to think of things in terms of how much capital I’d have to invest to achieve an effect. And that goes both for income and expenses. Keeps things in proper perspective. 🙂

The 5.3% is a simple average of all raises, which, when spread out across the year, will show the average raise of a stock across the portfolio.

Thanks for dropping by!

Cheers.

sgull,

http://www.omegahealthcare.com/file.aspx?IID=103065&FID=28693854

Take care!

Spoonman,

Exactly. The dividend raises are, in effect, just like someone giving me $2,300 or so to invest in stocks yielding 3.5%. The end result is the same, which is fantastic. 🙂

Yeah, the GE plans are kind of exciting and disappointing all at the same time. I suppose it comes down to how things go and what the industrial side of the house looks like as they transition. I’m planning to continue holding for now, but I do hope that there’s some pressure to raise the dividend on a regular schedule, even modestly. They’ll pay out more in 2015 over what was paid in 2014 regardless, but I’m hoping that there’s some upside to 2016. I guess we’ll see! Can’t blame you for getting out and redeploying elsewhere, however.

Thanks for stopping by!

Best regards.

I love the idea that you’ve had “pay rises” without actually doing anything apart from holding shares in the companies as you were doing anyway.

Divorcedff,

Indeed. It’s great to get a pay raise without having to “work” for it. Even better, it’s amazing to get dozens of them every year. 🙂

Just have to stay consistent with it. You’ll get here one day too!

Best regards.

Thanks for elaborating DM. I see where you are coming from now.

Looking forward to your future posts!

Congrats on the dividend increases, looks like it’s shaping up to be another profitable year. My stocks are going alright, oil is taking a beating right now but hoping it will recover in the next year or so.

Cheers

I love getting dividend increases, like you said that’s $2,300 less that you have to invest now. The power of compound interest really take effect when you re-invest the dividend increases. It’s like the snowball getting bigger and bigger. 🙂

Dan,

It’s definitely shaping up to be a great year. Can’t wait to see how these raises look across the whole of 2015 and what that means for the increase in overall dividend income. Stay tuned! 🙂

Cheers.

Tawcan,

The snowball just continues to roll. I’m not tired yet, but I’m certainly thankful for the assistance! 🙂

Thanks for dropping by.

Take care.

I have a question. What broker do you do your trading with? I have a broker outside of my 401k, which is Edward Jones, they charge way to much to make trades.

By the way great job on capturing those dividends.

Hi,

What do you think is a long term, sustainable dividend growth in your portfolio? 3%, 5%, 8%? Anyone with historical numbers?

Love the concept for this new post series Jason! It’s a great way to get an even deeper insight into the power of dividend investing. You’ve done such an amazing job for the DGI community with your blog to really show people all the awesome, tangible results that this style of investing produces.

As always, keep up the great work my friend!

Cheers 🙂

Great post. I like your blog.

And the quality posts continue to roll just as the snowball does!

Hi DM,

I’m a total fan and have been reading since almost the beginning. I totally get that you can make more money elsewhere and I’m all for it, but I wonder if you couldn’t help direct more traffic to those sources by linking to your articles here on your blog. I know personally I would love to read more of your stuff, but may not want to go searching for it at several other sites…just a thought.

Such a simple stat but a huge impact!

You’ve “earned” an extra $83 for doing nothing but staying the course. Equal to having to otherwise invest $2300 @ 3.5% to earn the same amount, basically freeing you up to actually invest $2300 to earn another $83! One of the compound ways compounding upon compounding is so incredible, lol.

Awesome new post!

ps. I finally got my Berkshire annual meeting credentials last week and am super stoked to see Warren and Charlie live! I know you mentioned it here and there, but are there any plans to do a quick meet up with other DM readers while you’re out there? I know its also your honeymoon, so no worries if you don’t plan to, just thought I’d ask.

Nicholas,

I use Scottrade right now. I find the $7 fees reasonable, and I like the fact that I can actually stop in an office and talk to someone if I need to. The FRIP is a great option for reinvestment, the tools are great, and the platform is pretty robust.

If you’re ever interested in using Scottrade (after performing your own research), let me know. I can give you a referral that will give us both three free trades upon you opening and funding a new account.

But take a look around. A lot of discount brokerages out there, all offering something a little different.

Cheers!

Erik,

I didn’t start tracking this at the portfolio level until last year, but it looks like I was around 7%. I think that’s probably where I’ll be this year and beyond, assuming the companies I invest in continue growing their dividends at typical/historical levels. And that makes sense since I seek out 10% total returns (my portfolio yield is about 3.5%).

At any rate, these reports will prove out the numbers over the next few years.

Take care!

ZTZ,

Thanks so much. I’ve given my all to the blog and the community, but I’m incredibly fortunate in that the community gives back so much via support. Glad to be part of a great group of like-minded individuals all out to improve their own lives by seeking out financial independence. We’re all in it together. 🙂

Best regards!

DP,

Thank you! 🙂

Take care.

geo,

Ha! Thank you. That’s my aim. It’s tough to put out quality at the frequency I do (30 or so articles per month), but I have a passion for this. 🙂

Let’s keep it rolling!

Best regards.

Sundeep,

Well, I actually already link out to those other articles quite a bit via social media and the weekend compilations I put together. However, it’s really not the other content I have a problem with. The blog is truthfully what’s substandard for me in terms of income generation. Again, I love writing here and communicating with everyone, so I take it in stride. But the outside opportunities continue to accumulate, so it’s possible that at some point I’ll just write much less here and more elsewhere. We’ll see. I hope it doesn’t come to that because this is like my home. And I’ve built this blog (and the community) basically from the ground up. My plan is to continue this until (and after) I reach FI, but we’ll see. Life has a funny way of throwing curve balls as you. 🙂

Cheers!

Sundeep,

Thanks so much. Glad the article is doing its job – showing the power of compounding and dividend growth investing. 🙂

As far as the meeting goes, I definitely hope to meet up with some people. The only issue is that our time will be very limited. We’re only there for a couple of days really and we hope to see some of Omaha in addition to the BRK stuff. I’ll likely post something before leaving and maybe include some details for meeting up. I do know that a few bloggers are meeting up on Friday night, and we’ll probably attend that for a short period. Beyond that, it’s hard to say right now. It’ll partly depend on how much Claudia is up for. I’d gladly spend most of my time meeting with people and having great conversations, but I suspect Claudia wouldn’t be quite as entertained. So we’ll see. I’ll try to keep you posted!

Best wishes.

I don’t know. It doesn’t sound like an addiction I would WANT to overcome.

Thanks!

Jason,

Great Idea to capture the growth rate also in addition to raw numbers every quarter.

However, i was thinking why you excluded the companies that did not raised dividends? If your goal is to calculate the aggregate growth rate of your portfolio then shouldn’t you include the whole portfolio instead of a selected few?

This was your growth rate is skewed and the real growth rate of the portfolio is actually not reflected. Your thoughts?

Jaspinder,

Not every company raises its dividend in the same quarter. I have 53 companies I’m invested in now. Some raise their dividend in the first quarter. Some in the second, third, or fourth quarters. Some raise their dividend many times per year. The dividend growth across all companies will be fully realized by the end of the year.

What you see here is just those companies that have already increased their dividend. You’ll see the other stocks make an appearance throughout the rest of the year, as those increases are announced.

I would recommend some further reading on investing, stocks, and how dividends work. 🙂

https://www.dividendmantra.com/getting-started/

Take care!

Great stuff this DGI investing,

according to your list I am in the same boat with you regarding Coca Cola shares.

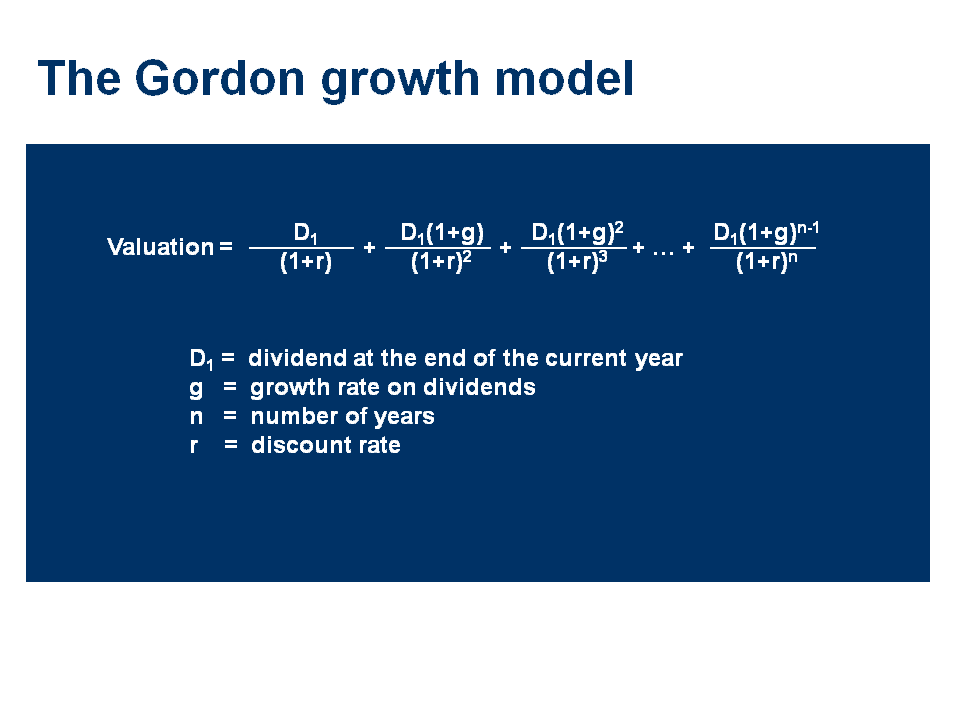

I have a question here. As far as I understood, the current dividend yield is part of the equation in the dividend discount model to find an appropriate value of the stock. This would mean the DDM would have to be calculated again to find a current stock valuation as the yield went up.

But then again, the dividend growth rate is also part of the equation. That would mean last years DDM calculations for a fair share price are still valid, as long as last years assumed div.growth rate is in par with todays dividend hike.

Assumed equation:

Value of stock = Dividend per share / (discount rate – Dividend growth rate)

Am I right on this?

cheers

Stef

I prefer looking at my portfolio in terms of dividend growth than dividend revenue. Mainly because as you said – and I love the expression – the growth rate is the secret sauce in dividend investing! 😉 I also like the comparison with the tree. Living off of the fruits is what we’re looking to indeed! Thank’s for such inspiration once again.

Cheers!

Mike

Stef,

“As far as I understood, the current dividend yield is part of the equation in the dividend discount model to find an appropriate value of the stock.”

Incorrect. The current dividend payout in terms of actual dollars is part of the dividend discount model analysis. A stock’s yield fluctuates constantly. The dividend doesn’t.

“That would mean last years DDM calculations for a fair share price are still valid, as long as last years assumed div.growth rate is in par with todays dividend hike.”

The DDM calculation will remain valid as long as the dividend is unchanged the assumed growth rate is still valid. Whenever a dividend is increased and/or the anticipated dividend growth rate changes, the fair value would thus then change as well. Thus, every dividend increase also increases the fair value of a stock.

Cheers!

Mike,

Well, I like to look at both. The dividend income is what will ultimately unlock my freedom by paying my bills, so that’s incredibly relevant and important. But the dividend growth rate is also important in terms of getting to that point as soon as possible as well as making sure I remain free by at least keeping my purchasing power intact. If the DGR is significantly higher than my expense growth rate, I’ll likely someday end up sitting on much more income than I can ever hope to spend. A wonderful situation to be in! 🙂

Thanks for dropping by. Appreciate the support!

Best wishes.

Looking good. You’re even beating out inflation with room to spare! It would be interesting to see over the long term which companies/sectors increase their dividends more/less every year. Like, for example why is TD Bank increasing their dividend 8.5% while Bank of Nova Scotia is only raising 3%. The Canadian banks tend to grow/fall in lock-step so that seems like quite a difference. Admittedly BNS is more diversified internationally, but you would think with the way emerging markets have been going lately, they should take a nice profit from the additional growth and pass them along as dividends.

Great post, Jason. With this you really touch the hart of DGI. The dividend growth is the engine of our compounding machine.

And what gives more joy than waking up in the morning and realizing that over night you got a pay rise? 🙂

Take care my friend.

captain,

Right. It’ll definitely be interesting to see which companies really pull their weight over the long haul. Though, keep in mind that not all companies increase their dividends on the same schedule and there are differences from year to year. For instance, BNS has increased their dividend twice per year lately, so their YOY change may be more in line with TD when it’s all said and done. And I think what that says is that you want to be familiar with your holdings and exactly what’s going on. 🙂

Cheers!

Jos,

Absolutely. It’s awesome to wake up to a pay raise, especially when you didn’t have to do anything at all to receive it. Almost as good as collecting a dividend, almost. 🙂

Dividends and dividend raises are the gifts that truly keep on giving.

Thanks for dropping by!

Best regards.

Jason, I guess we have a mighty enemy?!

It looks like Mr Fink (BlackRock) does not support your idea of financial freedom …

Did you read the news?!

best wishes

Thorsten

Thorsten,

What news are you referring to?

Cheers!

Hey Jason,

Nice job on you numbers as usual. I can only hope to see continued growth like you have experienced. I am currently seeing the potential for price appreciation, but growth in my portfolio seems to be stalling for the near future. You can guess why, right? Keep up the good work.

Keep cranking,

Robert the DividendDreamer

Robert,

Yeah, the news out of GE wasn’t quite as great as some of us might have been expecting. I think they’re certainly making the right moves for the long term, but there’s some, say, “shrinking pains” going on over there. I think they’ll be a better company in 2-3 years, but it’s going to take time for this massive transition to work itself out.

Hopefully, things pick up for you again. 🙂

Best regards!

Jason,

First off congrats on the raise! Free money is always the best kind of money.

Secondly, I have recently tried to get into dividend growth investing and I was wondering what are the 5-8 “core” stocks that you think are important to a portfolio for a new investor. I am still a college student and as a result I don’t have too much capital to invest in but after reading through your blog I figured the earlier the better!

Currently I have a few dividend ETF’s (DTD, SDY) but they have low yields and are costly for my small account. Any suggestions?

Thanks in advance!

Poi

Poi,

Glad to hear you’re a college student and already thinking about your future. That’s setting the future you up very nicely. We all to often think of ourselves only in the moment, neglecting the versions of ourselves that will exist years down the road. Great job!

As far as “core stocks” go, I don’t really make stock recommendations to anyone. Really just impossible to do that, because everyone has different risk tolerances, time horizons, income needs, capital availability, and industry preferences.

That said, I’d strongly recommend taking a look at my portfolio. You’ll see where my money is (I put my money where my mouth is):

https://www.dividendmantra.com/portfolio/

I hope that helps. Good luck as you begin down your own path!

Best regards.

Jason –

Have you ever considered covered call options to help accelerate your plan? I am looking to really ramp up some dividend investing and want to incorporate a covered call strategy to supplement it. Are you against this strategy?

Douglas,

I’ve looked into options somewhat extensively, but I don’t find the need to use them at all:

https://www.dividendmantra.com/2015/02/keep-it-simple-part-2/

Cheers!

What would you recommend for someone who is 53 with lots of available cash, but who has done no investing so far? No debt, renting a home, lots of extra income monthly. Is it too late to get involved in dividend investing? If not, what would you recommend for a 500K portfolio, as in how and what to enter? And do you ever get concerned that it’s the top of the market and a bear market might be just around the corner, or even a crash?

Mike,

See my email reply. 🙂

Cheers!