Weekend Reading – June 21, 2014

My weekend got off to a wonderful start. Yesterday, I met up with an old friend. I haven’t seen this person in about 15 years, so it was really special for me. We talked for hours and caught up on what we’ve both been doing all this time (where does the time go?). It was a fantastic trip down memory lane, and I’ll never forget it.

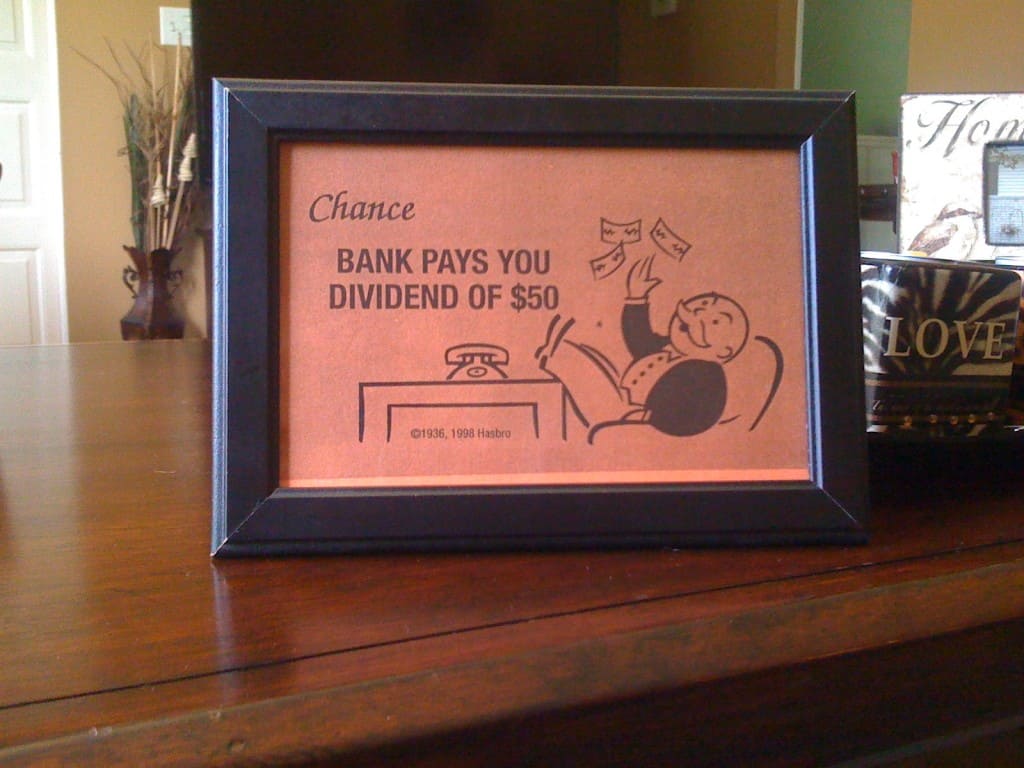

This old friend actually brought a really sweet gift for me. We all know and love the game Monopoly, right? Well, I don’t know how the idea came about, but for years I’ve wanted to somehow get a copy of the Chance card that instructs you that you’ve received a $50 dividend framed. Lo and behold, my mind was read!

A very kind and thoughtful gift. I don’t think I’ve ever tossed cash up in the air like that, but the joyous feeling the card attempts to convey is certainly something I relate to whenever a new dividend payment hits my brokerage account!

I’ve been incredibly busy lately writing and reading, which is what I really enjoy. I’ve been doing some more freelance writing, and I’m including some links to that work below. I also spent a late night out with one of my younger sisters yesterday as I let her drag me out for a night out on the town. It was a lot of fun, and spending more time with family is exactly why I came back. So far, so good!

Below, you’ll find a short list of articles I’ve recently read and enjoyed. I hope you do as well!

These 28 Dividend Growth Stocks Go Ex-Dividend Next Week

I put this article together for Daily Trade Alert, which is helpful because if you were on the fence as to whether or not to buy a certain stock, buying in at least one business day before the ex-dividend date means you’ll collect the next dividend payout. I also took a look at Philip Morris International Inc. (PM) and concluded it’s attractively valued here.

This Stock Has Raised its Dividend for 58 Years in a Row

This was another article I wrote this week. I discussed some of the benefits behind investing in dividend growth stocks and also included some information on one of my favorite companies: The Procter & Gamble Company (PG). Although I don’t think it’s a steal here, one could do a lot worse than buying shares in this consumer goods juggernaut.

JD Roth: How I learned to Stop Worrying and Love Mustachianism

JD Roth penned this excellent article that sums what life is all about and how Mustachianism helps one see the truth. One of the best articles I’ve read in a while. Highly recommended!

Companies I am Considering for my Roth IRA

Dividend Growth Investor gives us a great list of companies he’s currently looking at investing in in his Roth IRA. Some really great names on that list, and I obviously concur since I recently purchased shares in Baxter International Inc. (BAX) – one of the companies on his list.

Father’s Frugal Finances

Debt Debs recently put this touching homage together on her father – a frugal gentleman. I’ve never really had a frugal role model to look up to. I found frugality all on my own, and I’m kind of the trailblazer in my own family. But someone’s gotta do it, right?

Three Life-Changing Investment Lessons From Conoco Phillips

Tim discusses a reader’s long-term investment in ConocoPhillips (COP) and how this particular investor’s lessons during his ownership tenure can be applied broadly to investors everywhere in all stocks. I particularly agree with his assessment on risk. Risk is present everywhere in life; I’ve been told many times I could get hit by a bus. But taking on a little risk is necessary if you’re looking to grow your wealth, and generally speaking, the real risk of holding a stock like COP is probably very small since the odds of the company being around decades from now and being even more profitable are high.

3 Ways To Define Financial Independence

Joe’s article was particularly timely for me now that I’ve moved from working at a traditional job to writing full-time. Although I don’t consider myself financially independent, it’s about as close as it gets while still working. I’m ultimately aiming for his second definition of freedom, but right now am in the third category. Overall, I’m in a good place in life and really happy. And that’s really what it’s all about anyway. Great post!

Recent Buy

Passive Income Pursuit shared his recent purchase. I think this is a solid long-term holding, albeit with some short-term headwinds. Looks pretty solid!

Effort alone isn’t enough

David put this really nice post together on good old effort just not being enough for most endeavors in life. I’d like to think I’m usually his “Friend A” as I usually don’t just set out to do something, I also visualize myself completing the task long before I even start. In my mind, it’s often a foregone conclusion that I succeed at something. The present is just me completing the steps that have already been completed in the future.

Mulling Over Investment Options

Starting From Zero shared some his best investment ideas right now. I like quite a few names on that list, and I’m actually also considering opening a position in Visa Inc. (V) at some point in the near future.

GE Wins French Support on Alstom With State Seeking 20%

If you’ve been following the drama at all with General Electric Company’s (GE) proposed acquisition of Alstom SA’s energy assets, this article will come as a welcome relief. GE’s bid has been accepted, on the grounds that they allow the French government to retain 20% ownership. This is a big acquisition, but it remains to be seen as to whether this is a good move or not. Generally speaking, the less government interference a company has to deal with, the better off they are. This is especially so when the government is a foreign body. However, I remain a fan of this company, and it looks like Roadmap2Retire is a fan as well as he recently initiated a new position.

May Buy: Target (TGT) and AT&T (T)

Dividend & Whisky recently purchased stock in these two powerhouses, and Target Corporation (TGT) has been particularly popular lately: Dividend Diplomats, Invest Like Grampa, and My Dividend Growth have also bought shares in this retailer as of late. I’m a fan of TGT at today’s price, but I’m not currently buying only because I already have a position in the company that’s actually a bit larger than I’d prefer right now.

Century Club Dividend Stocks

DivHut put together a great list on companies that have been paying out dividends for at least 100 years. 100 years! That encompasses two major world wars, Vietnam, the Great Depression, the Great Recession, massive inflation, and a few major stock bubbles and collapses. Nice! I own five on the list. How many do you own?

5 easy ways to reduce grocery costs.

Nicola shared some helpful tips on how to reduce your grocery expenses. I’m not personally a big fan of veggie night (how about pizza night?), but I do wholeheartedly agree with watching portion sizes. I simply don’t eat much food. Whereas the younger me would pound away five or six slices of pizza on a Saturday night, these days it’s maybe two or three slices. I generally consume than 2,500 calories per day and I stay active. The less food you eat, the less money you spend on food. Simple as that, and you’ll probably be healthier as well.

My Net Worth Update June 2014

Asset-Grinder shares his net worth with the world, and it’s an understatement to say it’s impressive. Check it out. But don’t get mad at me when you’re incredibly jealous.

Freedom Through Dividend Investing: An Update

Addison shared her dividend investing journey thus far, and she’s experiencing some great growth in passive income. Looks like we have another fan!

Full Disclosure: Long PM, PG, BAX, COP, GE, and TGT.

Thanks for reading.

Photo Credit: gubgib/FreeDigitalPhotos.net

Mantra,

Thank you for the mention in your weekend reading – quite an honor to be on here – truly am thankful and appreciative. We are building our blogroll as well today – better believe you’re on there.

Love that Monopoly card in a frame – talk about a genuine and fun photo in a frame – just awesome. Great posts above – definitely something I look forward to – to see which catches your eye over the course of the week.

Thanks again DM, talk soon!

-Lanny

Congrats on the new writing gigs! How did you go about getting the job, just curious? I’m enjoying these weekend readings as there’s so many things to follow. Having them consolidated is nice!

Lanny,

Thanks for adding me! I appreciate it.

And I’m so glad to have that card framed now. What a gift. It was incredibly sweet. I don’t keep much stuff – I’m the total opposite of a pack rat – but this will be with me forever.

Have a great weekend!

Cheers.

Living At Home,

As far as freelance writing goes, sometimes I’m contacted for writing and sometimes I go out and seek the opportunities out. I think it’s all about being in the right place at the right time, and this platform certainly helps my chances. Hard work and staying consistent goes a long way.

Glad you enjoy these posts. I try to link out to articles that I personally enjoyed, and I hope others enjoy them as well.

Have a great weekend!

Take care.

Thanks for sharing my story, DM! I’m long on DM kudos! {giggle}

I thought I had PG in my portfolio but I just checked and I don’t. I do have COP and GE, however. Once I get my portfolio tracker set up, it won’t be long before these acronyms start rolling off my tongue. {cheeky}

Thanks for including my post 🙂 hope you have a lovely weekend – the weather here isn’t so good!

Thanks for the mention DM! Here in Texas I am getting a break from the 95+ weather. Its only 85 here!

Have a great weekend!

Thanks for the mention! Hope you have a great weekend. The weather definitely sounds better than what I’m getting today. Mid-90’s and humid and without the beaches that Florida offers.

Thank you for the Weekend Reading mention. As always, great reading and nice compilation from the many financial blogs out there.

Thanks so much for sharing my post, Jason! And I absolutely love that gift. What a thoughtful friend. I really miss Northern summers. It’s just not the same in the South.

Debs,

Thanks for that! I’m long appreciation. 🙂

You’ll get the hang of this stuff over time. And once you do it’ll be crazy to think that it was never a major part of your life.

Best regards.

Nicola,

No problem.

Sorry to hear the weather isn’t too nice there. I always enjoy great weather – puts me in a great mood.

Hope you have a great weekend anyway. 🙂

Cheers.

ILG,

I keenly remember what that kind of weather is like. Make sure to stay cool and hydrated. 🙂

Enjoy your weekend too!

Take care.

JC,

Yikes. Sticky and hot. Reminds me of Florida.

Stay cool. And I hope you feel better.

Best wishes.

DivHut,

No problem at all. Glad to include you.

A lot of good reading up there, in my opinion. I hope you enjoy some of it.

Thanks for stopping by!

Take care.

Addison,

It was a great gift. I’m so happy. It’s actually displayed right next to me right now.

I imagine Nashville has pretty decent summers as well. I was there once during a July 4th weekend a number of years ago. What a fun town!

Hope you have a great weekend. 🙂

Best regards.

I love the framed card! You beat me to it! I don’t know if you remember, but I think I told you I wanted to do it a few months ago. Now I’m really motivated to do it. I’m sure you’ll get a warm fuzzy feeling every time you look at it!

Have a good weekend!

Woah thanks for the mention. Unexpected but appreciated! I am a humble guy and I dont think of myself better than others regarding my networth. In fact I am envious of others with huge monthly % gains of all liquid net worth really moving the needle. I would be lucky to move my net worth by 1% a month. But for many with a full time solid job, no debt and solely independent their earning potential is huge where they consistently growing their net worth 2-5%+ a month. I truly believe life is not about where you are at but where are you going.

With that said this dividend, finance blog community surprises me by their openness and willingness to help others. I am grateful to be part of it and I hope I can help others like you do in due time.

I really enjoy that framed monopoly photo. I would hang that in my office for sure if i had that. Definitely a thoughtful gift. 15 years in a long time for a reunion with an old buddy. Would be interesting to hear the changes from u 15 years ago to now. It would be a good guide for youth to get on track in their 20,s.

Hey maybe u should start selling a few tshirts based off that monopoly idea. I would def rock one in chance card blue with a dividend mantra logo on top.

Hi DM,

Thank you for this summary. I always find great stuff to read thanks to your weekend reading. By the way, loved the monopoly card, the card actually pops into my head every now and then.. I remember playing monopoly as a kid, and not knowing what dividends were but liking them because they implied you got money. It’s funny to think how at the time I couldn’t imagine how important dividends would be later on in life.

Best Regards,

DividendVenture

Thanks for including my post Jason, appreciate the support man!

While I think Visa still presents good value here, I ended up buying Deere for my Roth plus a couple small positions in Target and Dr Pepper through Loyal3. Might add some to Visa next month if it stays around $200.

That’s an awesome gift, very fitting. In regards to Nicola’s post, instead of veggie night, how about having a veggie pizza night and get the best of both worlds? 😉

Have a great weekend!

SFZ

Thats a great gift, DM! Also, thanks for the mention…hope you are having a great time in the Sun.

regards

R2R

Hi DM!

Don’t you ever go a bit overweight in any stock even if you think it’s a real bargain? I’m referring to TGT. I have recently upped ARCP to a slight overweight (5,6 % of my portfolio) but I feel pretty comfortable since there aren’t many options right now. Currently AFL, BBL, IBM and EV are high on my watchlist too.

Good luck and wish you a nice summer!

– Leveraged DGI

Hey D. Mantra,

How are you doing? Well, I guess I have some insight into that from your blog but I figured I’d ask anyway. It’s been awhile since I posted a comment but I just wanted to wish you well with the changes in your life. I still check in from time to time so thanks for the posts.

BTW, I have a friend that moved back to Michigan himself not too long ago. He’s living in the northwestern part of the state (up around Traverse City). Anyhow, he tells me that the tracker trailers there are required by law to go 10 mph slower than the rest of traffic (and it’s enforced). Is that true? Is so, I think that’s great. Those things sometimes scare the hell out of me on the highways

Also, BTW thanks for giving me a little thought when you heard the “Rock the Casbah” song (by the Clash). Obviously, that’s one of my fav songs from one of my fav bands thus the handle name.

Rock on!

-Rock the Casbah

Spoonman,

I definitely do remember our conversation on that. I tell ya, it’s just as cool in person as it is in our own minds. 🙂

I used to love playing Monopoly as a child, and now things have kind of come full circle. Life is funny sometimes.

Hope you’re having a great weekend.

Best wishes!

Asset-Grinder,

Hey, I’m sure you’ve worked very hard to get to where you’re at. I’d be incredibly proud of those accomplishments. And anytime you’re looking to trade % gains, let me know. 🙂

I definitely agree this community is wonderful. I’m really glad to be a part of it! And glad to have you part of it as well.

I should look into the t-shirt idea! I’d have to call Hasbro first. I’m sure they’d want a piece of anything I make…copyrights and all that. 🙂

Cheers!

DividendVenture,

How funny is that, right? I used to love playing Monopoly as a kid. I guess things have a way of coming full circle.

That card will always remind me of both my childhood and my joy of collecting dividends. Can’t get much better than that. 🙂

Long live dividends!

Take care.

SFZ,

No problem at all!

Nice buys there. I took a look at DE not too long ago. A lot to like. I may get in at some point, but I’m wondering if we won’t see cheaper prices on the back of lower earnings. Or just possibly a higher P/E ratio. I guess we’ll see.

Veggie pizza? You’re ruining it for me, bud. Haha!! I think someone occasionally sneaks onion on my pizza. That’s about it for me. 🙂

Best regards.

R2R,

This weekend is beautiful. I hope you’re having a nice weekend as well.

Glad to include you. Keep up the great work!

Take care!

Leveraged DGI,

Well, I will go temporarily overweight in a stock if I feel both the value AND the quality are there. For instance, I’ve gone overweight on AFL and PM at different times due to my conviction. And I’ve done well. But I don’t think TGT would make a good candidate for me to go overweight on, even temporarily. I think retailers in general face a lot of headwinds, and the low margins and competitive landscape tempers my enthusiasm. I think the value is certainly there with TGT, but I also wouldn’t want to have a major part of my portfolio invested in the company (or any other retailer). I just think there are too many execution risks. Just my thoughts, though. I could very well be wrong, and I hope, as a shareholder, TGT does very, very well. 🙂

Best regards.

Rock the Casbah,

I’m doing great. Life is really good right now. You never know how long the good times will roll, but you enjoy it while it lasts. 🙂

To be honest, I’m not real sure about how semi-trailer trucks are treated in that regard. I do know they all travel around 55 mph or so here, and are almost always in the right lane. But I’m not sure about the laws regarding that.

Hope you’re having a great weekend. Thanks for stopping by!

Take care.

Great reading links. Thanks for sharing.

DM,

That dividend Monopoly card that your friend got you is the coolest thing I have ever seen! 🙂 What a thoughtful and awesome gift, totally perfect for you! Wishing you a fun weekend!

Sincerely,

Ian

Martin,

Hope you enjoyed some of them! Thanks for stopping by.

Best regards.

Ian,

It’s definitely the perfect gift. Incredibly thoughtful. 🙂

I hope you’re having a great weekend as well. I appreciate all the support!

Best wishes.

DM,

Some good articles you posted. I am going to pull the trigger on V and MA in my Roth IRA tomorrow. I’m hoping the dividends for both companies continue to grow at ridiculous rates and in 30 years the ROI is amazing.

What are your thoughts on higher yielding stocks such as SDRL, NRZ, and PSEC? I took a long look at those picks for my taxable account, but decided not to pull the trigger just yet.

As always, entertaining article.

Andy

andyschabo,

Nice move there with V and MA. I’ve read various articles predicting their decline over time as technology changes, but I still think their economic advantages are still firmly entrenched.

I took a quick look at SDRL for another reader not long ago. I didn’t really see a lot I liked, other than the high yield. The company is piling on debt pretty aggressively, as I understand it to build rigs. But they’re facing a decline in their rates and the FCF is pretty rough. The dividend isn’t covered by cash flow, so I don’t know how they’ll sustain that dividend. It’s just too risky for me, but it might be a fine investment for others.

I hope that helps!

Cheers.

Good points! AFL and PM are bigger holdings also. I hope TGT goes a bit further done so that I could buy on the cheap! 😛

Best of luck!

-Leveraged DGI

Yeah Chance card!! That is hot, haha..

J. Money,

It’s pretty sexy! 🙂

Thanks for stopping by. Hope all is well over there, brother.

Cheers!

DM,

Thank you for the mention. Also thank you for providing me with a list of articles for further reading.

Take care!

DGI

DGI,

No problem at all. I’m happy to include you!

Hope you’re having a great week thus far.

Best wishes.

I always enjoy this part of your blog.

Finally something uplifting to read because all weekend I’ve been reading one book. This weekend I read “Pound Foolish: Exposing the Dark Side of the Personal Finance Industry” by Helaine Olen. It’s an expose on the personal finance industry and she picks on everyone from Dave Ramsey, Suze Orman, Jean Chatzky, even the guys who wrote the millionaire next door book.

While she did have some good points, I felt her book was overly pessimistic and did not provide many answers to her criticisms. Anyway, my favorite article is from J.D. Roth on this list and I loved your chance card! 😀

Lila,

Glad you enjoy these posts. 🙂

I always try to put up some quality articles that I really enjoyed. If I didn’t enjoy it or read it it doesn’t go up.

I’ve never heard of that book, but it sounds like a real bummer. Although, I also feel that some of the financial “experts” are a bit iffy. Suze Orman in particular gives some really odd advice. However, I do like Clark Howard a lot. And Dave Ramsey gives some solid advice from time to time, although his stock advice is way off with anticipated returns and what not.

Cheers!

Jason,

Thanks for the list of great reads and for linking to my recent buy. I’m just catching up from an amazing trip home to South Dakota to see the family. I loved the Midwest weather and even got to see a thunderstorm which I miss because never get them in Los Angeles.

I’m so happy to see you doing these articles for Daily Trade Alert. Hearing your thoughts on approaching Ex-Dividend dates is so helpful to me, thank you and I really look forward to reading these weekly! 🙂

All my best,

Ryan

Ryan,

Glad you got to see some family! Sounds like a really fun trip for you. Reminds me of my trips when I’d go to Michigan from Florida. I wasn’t aware you guys don’t really get thunderstorms out West. Interesting.

I think the articles on stocks that go ex-dividend are interesting. If for nothing else you get to see what’s coming up. 🙂

Cheers!