The Power Of Pennies

When I first started researching the dividend growth strategy back in early 2010 I became quite excited by what I found to be a very robust strategy. The tangible benefits of dividends are obvious: you collect real cash that you can easily touch and see. That tangibility allows one’s emotions to be less affected by the daily gyrations of the stock market. While for many it’s still tough to see their net worth fluctuate wildly, rising cash payouts that you can can either reinvest or use to pay for living expenses cushions the blows.

But I will admit that I was a bit confounded by the dividends themselves at first. Specifically, the relatively small amount of them.

I would look at Johnson & Johnson’s (JNJ) payout and see the $0.49 they were paying to shareholders quarterly (the dividend in early 2010) and wonder how someone is actually supposed to build wealth off of that. I mean we’re talking a little more than 50 cents here. Every three months?! What am I going to buy with that? A McNugget?

And then I looked to another high quality company with growing dividends that interested me, PepsiCo, Inc. (PEP), and I could see they were only paying out $0.45 per share every three months. 45 pennies. Not exactly awe-inspiring.

But I was missing the forest for the trees.

When we’re talking about dividend payments we are indeed talking about pennies. But these pennies add up in a hurry. And much like a stone isn’t impressive by itself, gather enough of them and you can build a castle.

And you could say I’m building Chateau Freedom here.

My first year of dividend payments weren’t spectacular. These pennies take a little while to build up. My very first public dividend income report that went live on this blog back in early 2011 showed that I earned $33.35 in January of that year. This was after almost an entire year of regularly investing the savings I was able to amass from a middle-class salary. Now $33.00 isn’t anything that I could retire off of, but you can already see that $0.50 here and $0.40 there is adding up.

Fast-forward to January of this year and I’m receiving a lot more pennies now. I earned $347.97 in dividend income last month. That’s a tenfold increase in passive dividend income over the course of three years. Pennies aren’t so funny anymore.

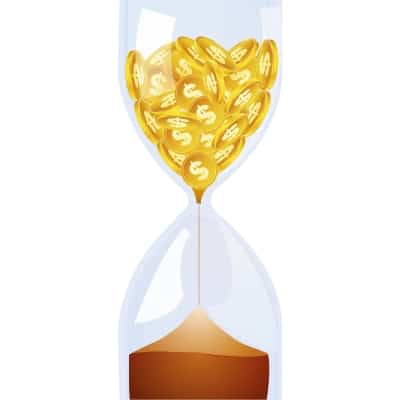

I progressed like this because I wasn’t thinking of the dividends as just pennies trickling in. I thought of every equity investment I made along the way as buying time.

By that, I mean I’m looking at the total annual income I’m able to generate through an investment and compare that to my total annual expenditures. Every equity investment I make is paying me growing dividends because I strictly invest in stocks that adhere to this criteria.

I’ll give you an example. My annual expenditures right now hover somewhere near $20,000. Let’s say I invest $2,000 in Philip Morris International Inc. (PM) today at $80/share. The company pays out a $0.94 dividend per share every quarter. That means my $2,000 bought me 25 shares producing $94.00 in annual passive dividend income. I now just covered ~.5% of my annual expenses with just one investment. Doesn’t sound like much, but it adds up in a hurry. Repeat these results over the course of a year and I’m already up to a little over $1,100 in annual income. That’s now more than five percent of my annual expenses that I don’t have to work for.

But as I said before I look at these investments in terms of time. And this year of saving and investing just bought me about three weeks of freedom every single year for the rest of my life! Even better, that three weeks of freedom will only surely grow as Philip Morris’s dividend grows faster than the rate of inflation. 21 days of freedom now becomes 22 days next year, so on and so forth.

So you could look at Philip Morris’s dividend in one of two ways: an unimpressive handful of 94 pennies, or a gateway to freedom. I choose the latter.

And this works for every dividend out there. You don’t want to focus on the fact that you’re being paid pennies per share. You want to focus on the fact that every dividend growth stock you purchase is buying you a small ticket to freedom. And enough of these tickets gets you to the big game: financial independence!

Pennies are indeed powerful and they do add up. Take any fortune in the world and you can break it down a penny at a time. Do you think Warren Buffett is complaining about the “lousy” $0.28 per share he collects on every share of The Coca-Cola Company (KO) he owns? Definitely not, since he owns 400 million shares.

Financial freedom is bought one penny at a time, because each penny buys you just a little time. I started out with nothing four years ago and I’m now aiming to collect $5,200 in dividends during 2014. That’s about 25% of my annual expenses! That means three months per year are completely covered for the rest of my life. Chateau Freedom may not be completely built yet, but I’ve definitely got one wing completed. And this castle will be a testament to the power of pennies.

Full Disclosure: Long JNJ, PEP, PM, KO

How about you? Believe in the power of pennies?

Thanks for reading.

Photo Credit: Gualberto107/FreeDigitalPhotos.net

I definitely agree with the “Power of Pennies”. Over the course of the last two years, I have seen my dividend income increase by 74%. The only problem with pennies is what ones do you want. For example I am currently deciding whether to buy Coke (KO) or Procter and Gamble (PG). Both have shown what pennies can do for the average shareholder. After the 3.75% decline by KO, I have a decision to make. I will most likely own both in the future.

On a different note I am also trying to update by blog. I was originally going to go with WordPress but the blog was much easier to set up. However, in the event that my website gains traction I think that having a professional interface offered by WordPress will improve the user experience.

Dividend Prodigy

Prodigy,

Great job on increasing your dividend income by 74% over the last two years. That’s fantastic! Keep it up. 🙂

A self-hosted WordPress blog is great, but it has pros and cons just like anything else. For instance, there are costs involved with renting server space and such. Plus, you have a lot of tech dealings on the back end. But you also own your content, have more control and you’re able to customize it to what you want.

I really enjoyed my time with Blogger. The free hosting was great and I never suffered any hacks, downtime, or anything else. Pros and cons.

And sounds like you’re doing the right thing there owning a piece of both KO and PG. I also own a slice of both, and I’m a very happy shareholder!

Cheers.

Pennies are great but speaking of KO …what do you think about KO’s recent results? Any plans of increasing position if others are selling? If price goes few dollars down together with expected dividend increase the yield would be around 3,5% (this is high for KO!)

Love the new site Jason. I will send you an email in a couple minutes, with some questions. Small dividends grow into great dividends over time, provided you’re in the right companies. I’m hoping Coke gives us a nice raise (dividend increase) in the coming days.

-Bryan

You hit the nail on the head.. You are buying time with dividend growth stocks.. That $94 in annual dividends from $PM represent income that was equivalent to several hours of you working hard at your job. However, you didn’t have to spend any of your time to earn those dividends, rather you are leveraging the time of those who work at PM..

Investors should look at the fact that PM pays a current yield of 4.70%, and not miss the forest for the trees by only looking at the 94 cent quarterly dividend.. The ones I find to be hopeless are those who not only fail to understand this, but also have an attitude about their bias, which makes everyone else less likely to try and help them see the light..

Dividend Growth Investor

Hi Jason

Congratulations on getting your new site live.

I did like your post about how the pennies add up, and co-incidentally I have posted an article today where I explain how I think investing is like money farming.

Good luck with your new site.

FI UK

Great Article Jason!

A true source of inspiration. You don’t mind me steeling a qoute?

“like a stone isn’t impressive by itself, gather enough of them and you can build a castle”

p.s. Seems like the fitness starts to pay of. Readers can now officially view the guns 🙂

*_´

This is a great reminder. I know for myself, I often can get discouraged by how long it seems to take to make any kind of noticeable progress on the road to financial freedom. The little pennies here and there definitely do add up.

How do you get started? Do you go to a broker and tell them “I want to buy dividend paying stocks” ?

Or can you do this yourself through Scottrade? Don’t laugh. I’m new at this. I know you gave books to read but where do you go to buy them is the problem I’m having.

Lila,

There’s lots of homework involved if you want to buy individual stocks. And you get to make all the decisions yourself. Scottrade, Fidelity, Etrade any of the discount brokers will allow you to buy dividend paying stocks but it’s up to you to find out which one’s you want to own. If you want to go the individual stock route then Sharebuilder is another great discount broker and you can dollar cost average into the positions. Besides Jason’s blog there’s tons of other great free resources in other blogs, the Seeking Alpha Dividends & Income section, David Fish’s CCC list (list of companies with dividend growth streaks of at least 5 years, http://dripinvesting.org/Tools/Tools.asp), and plenty more.

If you don’t want to commit the time to researching and keeping up with individual stocks then there’s some dividend growth ETFs out there. Someone else will have to chime in with tickers and thoughts on those.

If you have any other questions feel free to ask just about anyone because I’ve never had a question go unanswered by this great blogging community.

A penny at a time. A journey of a thousand miles begins with one step. It’s a great metaphor because the hardest part is getting started in the first place. It might not seem like much at first but once you have a few years behind you of sticking with the strategy you can see how the dividend increases really do help you cover your expenses and then some.

Haha what a wonderful visual: “Chateau Freedom may not be completely built yet, but I’ve definitely got one wing completed.”

Whenever I try and explain how investing for passive income through dividends or interest income, they always express frustration at how long it might take them to get where they want to go. A snowball never looks big when first put together, but rolled around on the ground for a while and you’ve got a heck of a base for a snowman! Time is your friend when investing, and dividends will only grow and increase exponentially from there.

Thank you so much! Okay that is what I was looking for. Yes I do definitely want to make the decisions myself and I know I have a lot of reading to do. But this helps out a ton. Greatly appreciate your guidance in the right direction.

That’s incredible that you have 25% of annual expenses covered forever, Jason. I am not yet really in the passive income camp yet, but you’re tempting me with posts like this. 🙂

DGI,

I couldn’t agree more.

Focusing on the yield is indeed important. When I first started investing this way I would get weird looks when people found out about the relatively small dividend payouts on a per share basis from many companies. Of course, you couldn’t tell them that a 3% yield on KO is much better than 0.04% on their savings account, but you can’t change what doesn’t want to be changed.

And we are indeed buying time when we’re investing in these companies. Time is money, and money is time. Now while most people think of money and time as a 1:1 ratio, I place much more value on time. Time is limited and dwindling for us, money is not.

Best wishes!

Mr Bean,

KO’s results were solid, in my view. Slight miss on revenue, match on EPS. But, as always, I don’t place that much emphasis on one quarter’s results. I try to look at results over many years, which smooths things out a bit. Now if those results are showing a steady negative trend and things don’t look to be improving then it might make sense to investigate whether it makes sense to continue holding.

But I really like KO. They are well diversified not only in their products but their markets as well. And the foray into home brewing cold beverages could allow KO to get in on the ground floor of a new, exciting business. If not, they still have a 10% equity investment in a growing company. Win-win, right?

Cheers!

Bryan,

Got your email! Will be responding shortly. 🙂

I’m hoping for a nice raise by KO too! I’m a very happy KO shareholder. I’m thinking between $0.02 and $0.03 for the raise. I’m hoping for the latter, which would push their yield to 3.3% or so.

Take care!

FI UK,

Just read the article. Great stuff. I especially like the part where you compare different farmers to investor types (penny, bond, etc.).

I realized this similarity a while back when I wrote an article comparing my portfolio to a tree and the dividends the fruit. I guess I really like fruit! 🙂

Thanks for stopping by.

Cheers!

SWC,

No problem. Feel free to spread the good word! 🙂

Take care.

SWC,

Haha! That wasn’t my intention. Maybe I should have flexed for the picture? 🙂

Thanks for the kind words.

Take care!

Matt,

Absolutely. This strategy is not a get-rich-quick scheme, but you do eventually become wealthy.

But anything wonderful in life isn’t built overnight. Any great painting, building, sculpture, business, etc. They all take time to build. But the rewards, when done, are well worth it.

The great thing about our strategy, however, is that you get to reap a little reward all along the way with cash payouts. No need to wait until the painting is done to enjoy, cash can be enjoyed at any time!

Best regards.

Lila,

JC had some great advice.

The first thing to do is open a brokerage account. Scottrade, Fidelity, TD Ameritrade, Schwab and the rest are great. Sharebuilder is nice too if you’re working with very little capital.

From there it’s funding your account with capital from your savings and/or checking account. This capital generally would come from your day job. You then take this capital and decide which company you want to invest in. And that’s really the hard part. Every stock competes with every other available stock. The great thing is that the universe of dividend growth stocks is generally small compared to the greater universe of all publicly traded companies.

David Fish publishes a great document that reduces a lot of research time, as he compiles companies that have at least 5 years of dividend growth. JC linked that for you above.

It takes time to figure out your style. Start small and slow. Stick with companies you know; companies that sell products and/or services that you see everyone around you using. Once you see a few companies that interest you then it’s time to look at their fundamentals and competitive advantages. What are the growth rates of revenue, earnings per share, and dividends? What are the future plans for growth? Do you believe this company will be around 20 years from now and more profitable then it is today?

I wrote an article a while back that discusses how I research and analyze stocks. You may find it useful once you’re up and running:

https://www.dividendmantra.com/2014/01/how-i-analyze-and-value-stocks/

Also, keep in mind that it’s your ability to save that will ultimately determine your ability to become financially independent one day:

https://www.dividendmantra.com/2012/09/your-savings-rate-trumps-your/

I hope this helps!

Best wishes.

JC,

I’m with you. You have to stop looking at today and have a vision for the future.

Seemingly small decisions add up over the course of a lifetime. If you never take that first step you certainly will not complete that thousand-mile journey. One step after another and all of the sudden you can’t even see where you began.

Cheers!

W2R,

You’re right. Every snowman is built with a bunch of little, tiny snowflakes. And either you’re the type of person who focuses on the snowflakes or you’re the type that focuses on the snowman. I’m the latter. The former is the type that never gets started on anything and then wonders why they never get what they want in life. It harkens back to my article on not being able to change people. Either you roll the snowball around and build the greatest damn snowman anyone’s ever seen, or you sit inside complaining about how cold it is outside.

Cheers!

DB40,

Passive income is great! Who doesn’t like to collect money they don’t have to work for?

It’s like winning the lottery all year long! 🙂

Thanks for stopping by.

Best regards!

Yeah it is kind of nice. I really don’t track my dividends, since they are on auto reinvest. I just finished my taxes and I was surprised how much I made in dividends! One thing I did notice though was that my Vanguard Total Stock Market Fund did crush my DI portfolio for 2013 returns. The taxes were also a hell of a lot easier to do with Vanguard vs Computershare. Scottrade is nice as well with their TurboTax import, but DRIPS are a nightmare. I wonder is Sharebuilder has an auto import function with TurboTax?

Yeah I really like the price of KO now. I purchased another 15 shares today. That will put me at 100 shares, so I’m good unless it takes another dip. I prefer PEP because of the diversity, but you cant pass up on a deal from KO.

Hi Jason, thank you so much for getting back to me as well! I really appreciate the time you have taken to respond in thoughtful detail and thank you for the links as well. I will read them. I never thought I’d be interested in investing. I didn’t think I was smart enough to invest. Now I just realize you need to take the time to understand investments and start small. I’m soaking this up like a sponge now!

Jason,

I love what you’re doing. I use a lot of your research to invest in the dividend portion of my portfolio. I’m living frugal to save, but not as frugal as you, I don’t think I’ll get there or perhaps don’t want to go to the extremes you are. Keep up the great writing, I enjoy reading your stuff. Good luck.

Great article. I especially love the PM example where you show it covers roughly 0.5% of your needed annual income. It may not seem like a lot but it slowly adds up. Patience and persistence!

Jason, you know you hit it out of the park with this one. Not much, if anything, to add.

PS love the new site design!

-Tim

“A McNugget?” 🙂 So funny!!

I am also just beginning, but I realize after almost a year it goes up.

In 12 month, I´ll look back and say: “Wow, what a difference – so much more dividends”

Time is my friend!

And second: I try to invest every month 1 oder 2 TEUR.

The more money, the more dividends.

That is a two times positive spiral that will rotate each year, always faster and faster.

I love it!

Best regards

D-S

Very inspirational ! Especially for someone like me who is just starting dividend investing (january 2014) and still looking at my pennies.

I follow you since a few months, congrats for the new website !

I like the new site design man, looks good!

“I mean we’re talking a little more than 50 cents here. Every three months?! What am I going to buy with that? A McNugget?” Haha! That’s exactly what I thought when I first started, and so did my wife. It took me a while to explain to her the whole idea.

A factor of 10 increase is pretty darn amazing. We’re talking about MONEY here, money that can take care of your needs regardless of the market gyrations.

I remember when I had my first Aha! moment when I finally got my head around dividend increases…that’s when I totally fell in love with DGI.

I think you should file this post under “great article for newcomers” because it addresses questions they’re likely to have =).

DM,

Reminds me of the old story about Warren Buffet walking down the street with some business men. He sees a penny on the ground and he stops, bends over, and picks up the penny… one of his walking companions then jokes, “There’s the start of the next billion”, or something to that effect.

-RBD

“I started out with nothing four years ago and I’m now aiming to collect $5,200 in dividends during 2014.”

You know what I like about that statement? I’d be willing to bet that you don’t really feel like you have sacrificed over the past 4 years to achieve that. I bet once the ball got rolling your life adjusted accordingly and now its second nature to go and buy more days of freedom. Can you even imagine if you hadn’t started collecting those pennies?

I don’t know how I got that avatar face 🙂

Gotta figure out how to change my name back to the old way for comments…

BJ

Jim,

We all have different goals and different means. I’m certainly frugal, but nowhere near as extreme as I was a couple years ago. A part of me misses the days when I was spending $1,100 per month and investing even more than I do now, but I’ve also found a really good balance these days in all aspects of my life. I feel really great and I’m building a better future, so I have nothing to complain about.

Glad you enjoy the blog. I hope you continue stopping by!

Take care.

Dexter,

Exactly. Patience and persistence is it. Seemingly little steps add up over time, especially when compounding is thrown in.

We can talk about growth rates, saving money and how to build wealth all day long. But the thing I love about this investment strategy is you can actually see more and more money hitting your account as time goes by. It’s that proof in the pudding that I think really separates it from other investment strategies out there.

Best wishes!

Tim,

Hey, thanks for stopping by! Always good to hear from you. Still enjoying your stuff. 🙂

Glad you like the new design. It was a lot of hard work, but it feels good to be on the other end of it now. Just like with investing, putting in the hard work today yields great reward tomorrow.

Hope all is well in St. Louis!

Cheers.

Guillaume,

Those pennies are powerful, and they do add up. I promise you.

Keep at it and you’ll see your dividend growth snowball start to roll downhill before your very eyes. This strategy requires a little pushing of that snow at the beginning, but eventually the portfolio starts to put in the work for you. 🙂

Thanks for the congratulations. I hope you enjoy the new look.

Best wishes.

The Money Monk,

Thanks, MM! I appreciate it. I guess it was time for a new look and a new beginning. I’m excited!

Good to hear from you. Hope all is well!

Take care.

D-S,

I can sure buy plenty of McNuggets with my dividends these days. 🙂

Great job being consistent. I believe consistency is really key to building wealth, no matter the strategy. But especially with dividend growth investing, because it allows your dividend growth to be even more powerful because you’re getting dividend growth on top of the reinvestment.

Always faster and faster, indeed!

Best regards.

Spoonman,

I still remember going from “these are pennies?” to “aha!”. That’s the epiphany moment when you realize that, over time, you’re looking at pretty substantial dividend income after consistently and regularly investing substantial portions of your income.

And then you get that other epiphany when you realize that it’s not just substantial income, but you could one day actually live off that income completely. And now you’re getting very close to that moment. Exciting stuff! 🙂

Best wishes.

RBD,

That’s a pretty cool story. Never heard that one before.

The guy has the magic touch. I’ve often thought about buying a share of BRK.B just so I might be able to go to the annual meeting in Omaha. But then I’d have to buy a plane ticket, pay for a hotel and everything else. Not particularly frugal. However, I do think about it. I’d love to see him in person one day before it’s too late.

Thanks for adding that!

Take care.

BJ,

I think you have to be signed into your account so that your gravatar pulls over. I could be wrong, as I’m still new to this myself. I’m pretty sure that’s how it works, though.

And you’re right. I don’t really feel like I’ve scarified much. Certainly back in the early days it was tough to eat ramen noodles for months on end and ride my bike home in the pouring rain. But that built character. And I feel positively lazy these days with a car and the occasional restaurant visit. I think living so frugally early on in a journey allows you to realize exactly what’s important in life and what sacrifice means. Saving 50% or so of my money these days doesn’t just feel like no sacrifice, but I actually feel wasteful. That shift in mindset happened at some point, and it’s a very interesting dynamic.

I’m just glad I started all of this. It’s said that the best day to start investing is yesterday, but the second best day is today. And I agree 100% with that. It’s never too late to start, and the earlier the better.

Best wishes!

DM

Congrats on getting the new site live. This freedom stuff is great news and will help more new people learn how it works. Can one feel more then 100% free from work (Maybe if they have twice as much as expenses covered like 200% free)!

All the bloggers are helping and inspiring each other to have the option to retire early! That’s what it is all about here.

here’s an excellent article to help you figure out how to DRIP individual companies, I wish this article existed when I started:

http://www.dividendgrowthinvestingandretirement.com/2014/02/buy-share-certificate-drip-investing-resource-centers-share-exchange/

(I hope it’s ok for me to post a link to another blog)

SWAN,

I agree. This community of like-minded investors, savers, and freedom fighters is really wonderful. By helping and inspiring others, we’re also helping ourselves.

Thanks for the congrats. I’m glad to have the new site up and running. It was a lot of hard work, but well worth the reward (just like dividend income). 🙂

Cheers!

Great article! I know you’re currently on a staycation, but I can’t wait until your next article about what we all love the most…stocks! Some interesting news the last few days with good dividend raises (Coke) and not so good (Walmart, what is going on??)…

Dan,

Well if it’s stocks you want to talk about then you’ll be very happy with the article I just published a couple minutes ago. 🙂

KO’s raise was very solid, and I added to my position. However, with falling earnings the payout ratio is a touch high. I’m anxious to see how they do over the next couple years with volume growth slowing.

WMT was surprising. They’ve had some rough quarters, but online is growing. That dividend raise was very disappointing, however. I definitely was not expecting that! They could certainly afford a larger raise, but I understand that they want to be prudent with cash right now. Still disappointing, though.

Best regards.

I’ve written similar things too.

As I am coming from a very small beginning, I am still happy to have seen $54 in dividends in a little under four months starting around August through December. Coming from nothing invested previously to that is a welcome trend. I am still young, at 26, and have a long horizon before me.

As I look back upon my life, that is going to be the start of my road, and the path my feet will make upon it. One step at a time, one penny at a time, one drop in the bucket.

I bought a package to modify my site through Bluehost, but have not had sufficient time to tackle it, and I also need to figure out some more details.

Dividend Gamer,

That’s fantastic! You’re 26 and already well on your way, my friend. $54 may not sound like much, but it’s just the start of much bigger numbers. And you’re starting your snowball from way high up on the hill due to your age. Nice!

Keep up the great work!

Best regards.

My last change in consuption was… in the supermarket! In my house we used to drink a milk package everyday. We change to another brand, with the same nutritional value and more tasty! We will save 0.17€ each day, now on. Seems I’m kidding but I’m not! This will amount 1550€ in the next 25 years…

This little change gave us 1 month of financial freedom once we retire.

Dividends are like this: 0.01€ here and there for the rest of your life will amount a big pile of money.

Cheers from Portugal!

Trader,

Great analogy there!

I truly believe in the power of savings. And I believe that one’s ability to be a fantastic saver will have a much larger effect on their ability to build wealth than their investment prowess.

Little victories eventually win the war. Keep up the great work!

Best wishes.