The New Guy – A Great Reason To Pursue Passive Income

Many of you readers know of my real life full-time occupation. Although I don’t identify myself by my job, I do have to fund my Freedom Fund somehow – and right now the best way I know how is to engage in a 50+ hour workweek where I work my butt off as a service advisor at a luxury car dealership. As such, my income is completely hinged on my ability to handle as many customers as possible and do so in a manner that befits their status in society while also maximizing the dollar amount per transaction. I process what are called “repair orders”, a term for the job(s) vehicles are in the shop for. Whether it be routine maintenance (most of my workload) or repairs I operate as a liaison between clients (owners) and technicians (mechanics) so that vehicles are maintained or repaired properly and within a specified and agreed-to time frame and estimate.

I’ve been doing incredibly well in this role for the last seven or so years. I’ve largely increased my income on a regular basis and I’ve tried to maintain a reputation of being client friendly and mindful. I never attempt to sell anything a vehicle doesn’t really need and I try to put customer service ahead of the bottom line at all times. And this credo has served me well thus far. Hence the increase in income and relative longevity in the industry – one notorious for turnover.

But not all is rainbows and unicorns on the horizon. As I stated above, the work is hard and the hours are long. I’m not pursuing financial independence and early retirement for nothing. And as much as people like to visit the dentist, equally so people enjoy visiting a repair shop very little. I’m a source for capital loss as luxury cars can be expensive to maintain. Furthermore, people don’t want to be without their cars. Although I got by for over two years without a car in a small city not known for public transportation, I’m a bit of an anomaly. But the horizon is darkened for reasons beyond the usual.

A new guy starts this coming Monday.

Que the dum-dum-dum on the synthesizer (or other dark, shadowy music).

What does this mean? Well, my pay is 100% commission-based. That means I receive no salary for the time I spend at work. Whatever labor and parts are sold on my repair orders fully determines my income. And as I mentioned before, the more customers I handle the more repair orders I write and thus the more money I can potentially make. Right now there is a team of two in my department – me and one other service advisor. But now there is a third.

The new guy.

I like the new guy. He’s actually moving over from another department within the dealership, so I already know him. But liking him does not allow me to ignore the fact that my income is going to be dramatically reduced throughout 2014. It’s nothing personal, I’m just stating facts. Our department is growing due to the strong sales of the brand we work within. And due to this growth management has determined that another body is needed to process the rising number of customers coming through our doors. Fair enough. But this growth has not translated into a big increase in my personal income, as my 2013 work income was mostly the same as what I earned in 2012. And now it looks like I’m likely going to see a reduction of at least 20% throughout 2014 compared to what I earned in 2013.

And this leads me to the point of this article.

You cannot predict what is going to happen at your job. You could get fired for seemingly no reason. You could find yourself in the unfortunate path of a mass downsizing. Your income could be cut. Your company could decide to move (as mine recently has), or decide to move you. You have little control over these changes. I’m of the opinion that job equity is not the same as it once was. Gone are the days you work for one company for 40 years, get your gold watch and pension just before sailing into the sunset. Now are the days when you need to look out for yourself, contribute to your own retirement aggressively and constantly have one eye over your shoulder. I’m not complaining, but it is what it is. And one needs to roll with the punches. And my way of rolling and adapting is by maximizing my income potential unrelated to my full-time job – specifically passive income. And even more specifically, dividend income.

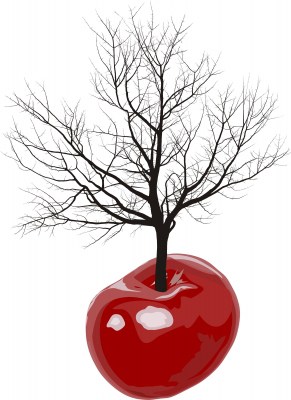

I’ve often referred to my dividends as an extra worker, a second job or multiple paychecks. There’s a reason this concept exists in my head. It’s because I think of my investments as a hedge against income or job loss. Every single company I invest in sends me a portion of the profits they are able to generate in the form of dividends on a regular basis. I receive hundreds of dollars per month that I don’t have to go out and work for. And I’ve been building this money tree for years now. Well, it turns out this hedge was necessary all along as I now face a fairly substantial pay cut.

And, thanks to you readers, my dividends aren’t the only source of income outside of my regular job. This blog now also produces a strong income. Although it’s certainly not passive, it also acts as a hedge against loss of job security and/or income. I anticipate seeing at least a $10k pay cut due to the addition in our department, and the combined sources of dividends and blog income will make up for much, if not all, of it. However, I’m not aiming to break even. I’m aiming for financial independence by 40 years old and as such I need constant growth in all financial aspects of my life. However, while I deal with the shock of significant income loss I can at least be comforted by the fact that my hard work over the last few years has allowed that shock to be softened.

The great thing is that while you can’t predict what’s going to happen at your job and you could likely be fired at any time (unless you have a contract of some sort), dividends are much more predicable and friendly. You can’t be fired as a shareholder. Dividend raises are typically clockwork in their nature, and often much more lucrative than a raise you might see at your day job. And although dividend cuts happen from time to time, it’s fairly easy to diversify your dividend income sources enough to where you won’t see a 20% pay cut like I just did. Invest fairly evenly between, say, 40 companies and even if two companies cut their dividend in the same year (not often if you’re investing in high quality companies known for dividend growth) you’ll see a 5% reduction in your passive income. And this is only if you didn’t have even an inkling that a cut was coming and you held on to an investment through a cut. But don’t forget you have 38 other dividend machines churning out more cash for you. If the other 38 companies raise their dividend just 5% you’d be made whole.

So while I’ll likely have less capital with which to fund my portfolio over the coming year(s), my motivation is as high as ever to take more control over my income. It didn’t take a big cut in pay to wake me up and inspire me to pursue passive income generation; I’ve been at this for years. However, it does put a little more pep in my step and a little more fire in my belly to continue investing in high quality companies that pay rising dividends so that I don’t have to worry about my ability to receive a certain income or pay my bills. Working my butt off for 50+ hours per week for years on end only to see a highly likely cut in my commission checks and then seeing the payouts in the companies I’m invested in rise relentlessly year after year no matter how crappy of a shareholder I am in real life allows for an interesting contrast and really opens ones eyes: being a shareholder is much more rewarding with much less work required. Which is just another great reason to pursue passive income!

How about you? Seen a pay cut lately? Were you more motivated to take control of your income?

Thanks for reading.

Photo Credit: Chris Sharp/FreeDigitalPhotos.net

Great post. Maybe you can spend more time on adding to your blogwebsite considering you will be working less hours which can generate more revenue for you. I as many others enjoy reading your post and following your portfolio.

Good Luck,

Frank

I worked in a job last year that it was slow for most of the year. There was no overtime for me and another guy there until near August. It is definitely nice to know I have other sources of income in the forms of dividends and REIT distributions.

Would this mean you will not have to be at work the same amount of time?

Sorry to hear about your situation. It’s always frustrating hitting a bump in the road when you are on such a clear path to a goal.

I had a hell of an income cut when the recession hit. I run my own business and got absolutely hammered between the recession and a couple other issues with my business. You know that old saying “when it rains, it pours”? Well, I went from about $120k to $25k in the span of about four years. As you can imagine, I was not a happy camper. I paid more in federal+state income taxes one year than what I received in gross income a few years later. Ouch. Fortunately I already owned my house free-and-clear, had zero debt, and was already comfortably living on about $1,500/mo. But yeah, that was brutal and I’m still trying to claw my way back up. I’m doing better than the $25k, but still haven’t gotten back into the six-figure range.

Are you looking for other job opportunities? I’m not sure what is available in your area, but you have a good head on your shoulders, you work hard, and you have some solid work experience under your belt. Since you are willing to work on commission-only basis, perhaps there is some other field that would be more rewarding for your time? Tech? Medical?

Best of luck to you!

D-S,

I couldn’t agree more. I can understand management’s position. I also think more advisors are better for the clients. More attention on their needs, better service, etc. This is a great move for the customers.

I’m not angry, but I am a bit disappointed. It’s just part of business. Although I will say that it’s been incredibly stressful and busy at work, so this will lighten the load – even if it comes at the expense of reduced income.

Thanks for the continued support. Hope all is well in Germany!

Best regards.

Frank,

Thanks. Glad you enjoyed the post. 🙂

I’m not sure I’ll have much more free time with which to spend on the blog. Unfortunately, I’m still obligated to be at work from 7:30 – 6 M-F and alternating 8-1 on Saturdays. Having an additional co-worker doesn’t change the hours. However, I did talk to the other guys and we’re all agreeing that three guys aren’t necessary until 6 pm and so we’ll likely alternate days where we get off a little early. All in all, this move might allow me an extra hour or so at home. It won’t be much, but I’ll do as much as I can with it.

Thanks for your readership. Hope you stick around.

Cheers!

Hi DM, Happy new year to you. these situation always come in the work environment. I have experienced like this two or three times and my performance counted as my strong positive thing. I am surprised that you don’t have base but only commissions. I hope you get more customers in 2014 and keep up your income.

Good Luck!

Dividend Mom

Steve,

Absolutely. It’s not a comfortable feeling at all to know that your continued employment and income is completely at the will of management. Having a significant source of passive income really lowers your stress levels as it provides a nice cushion in case of unfortunate changes at work. Knowing that no matter what kind of person you are, even if you’re incredibly unlikable, you can’t be fired as a shareholder is quite comforting. And knowing that this “job” is not only impossible to lose, but also comes with built in 7-10% raises every single year no matter what kind of “job performance” you have is also very nice!

Best wishes.

Investing Pursuits,

Glad to hear that you had some nice dividends coming in from your holdings to tide you over during a slow time at work. Those dividends allows you a nice river of capital to continue funding your ocean of stock holdings, even if the river doesn’t have as many rapids during times of slowdowns at work. 🙂

Unfortunately, I’ll still have to be at work for the same amount of time. The dealership, and our department, will still open and close at the same time. However, I did talk to the guys and we mutually agreed that three of us is unnecessary all the way until 6 pm. So I’ll hopefully be able to get off a half hour early maybe a couple times per week. It might be just an hour or so, but it’ll be better than nothing.

Take care!

Travis,

Man, sorry to hear about your troubles there. That’s a tough pill to swallow! However, I’m really glad to hear that you weathered the storm so incredibly well. The fact that you had your house already paid off and had no debt obviously helped you immensely. If you were in the usual scenario of having $10k+ in credit card debt, a significant mortgage and used to living paycheck to paycheck you probably wouldn’t have come out unscathed.

As far as other opportunities, I’m still taking it one day at a time. I’ll have to see exactly how my income is affected. Right now, it’s all so uncertain. But the new advisor isn’t going to come in and not make any money. He’s going to expect to make a living, and I can’t blame him. I would be looking to make some money too. And when you split a pie that’s used to being split in two pieces into three, well…someone ends up a little hungrier than they’re used to. To be honest, I’m hoping to one day turn this blog into more of a full-time venture, and use the earnings from online income to fund my portfolio while still pursuing financial independence. I’m still a long way away from something like that, but it’s a dream of mine. 🙂

Thanks for stopping by and sharing the story. I really appreciate it.

Best wishes.

Fortunately I was lucky enough and haven’t seen any pay cut. Actually the right opposite. I got a rise and nice bonus. It helped me a lot to eliminate my debt.

I like you expression of seeing your dividends as a second worker. Mine is still lazy and working insufficiently. I think “he” needs more “training” so I will invest in “him” a bit more.

I like it.

Dividend Mom,

Thanks for the support and encouragement!

I hope our customer base increases throughout the year as well. That would certainly soften the blow, but we’ll see how it all goes. I’m staying pretty positive and optimistic. 🙂

I hope you’re getting off to a great start, and congrats on hitting $50k! Keep it up.

Best regards.

Martin,

That second worker will continue to pump out the earnings for you. Just takes time. Best of all, he’s free to room and board. And he doesn’t eat or sleep. He might seem lazy now, but he’ll be amazing you with his work ethic one day.

Thanks for stopping by!

Take care.

Hi Jason

I was lucky to get a raise this year (not a huge amount, but it will offset inflation).

Although the impact on your income is not good (to say the least), you are fortunate that it will not affect your current lifestyle as you live well below your means. The real downside of course is the impact it will have on your ability to put significant monthly amounts in your Freedom Fund.

Inhofe that the enlarged team can quickly increase the total number of customers you can handle and return your income to a point where once again you can build up to quitting the rat race.

Best Wishes

FI UK

Jason, I can understand that you’re angry and disappointed.

For customers three service advisors are of course better.

Shorter waiting times, faster service.

You’ve already achieved so much with your freedom fund!

I´m sure that you’ll survive this “paycheck dent”.

Good luck!

D-S

What?! Nobody takes income from the Mantra! If you can get me his name and home address, I’ll take care of him for you. Joking of course. Having followed your blog for some time, I can confidently say that I’m sure you’ll find a way to make the situation work to your advantage. Whether it’s increasing order volume or finding another way to make money, you’re a tenacious person and you’ll keep scratching and clawing your way to independence no matter how many new guys they throw at you.

You are absolutely correct. I’ll have to admit that my job isn’t as difficult and tiring as yours. I’ve been at this particular job for over 21 years (17 at the previous job). I’m currently serving at the will of my employer and who knows? Anything could happen. However, about 2 months ago I became eligible for retirement with a pension. If I retired, I grant that it would be a huge pay cut. Even so, I know that if I left my job today I would still have a source of income. It’s very nice to know that it’s there.

It’s income that no one can deprive me of. I can’t be fired or downsized from my pension (yes, my pension is pretty secure). Dividend investing is much the same. No matter what cost cutting a corporation does, they can’t fire me as a stockholder. Buy the right companies and you have another source of income that is reasonably defended against loss. Your thinking is correct. When the only source of income you have is your job, your financial life is at the mercy of those above you. Not really a very comfortable feeling.

DM,

I work as a GSM at a dealership and I certainly understand your frustration with the change. There is a fine line between having enough “coverage” to take care of the customers and not overstaffing the sales force.

Remember you actually have two dividend portfolios. One is comprised of high quality companies and the other is high quality customers. With a daily routine of rigorous customer follow up I think you will find that this portfolio with not only pay dividends but they will increase!

This will eventually eliminate the “just show up and hope something good happens” mentality that 80 percent of commissioned employees tend to have.

Also remember things like this have a way of working themselves out over time similar to a reversion to the mean theory.

Best of luck!

That is a tough transition. I’m sorry to hear that. On the bright side atleast this isn’t 2008-2009 when everything was at its lowest. The economy is improving and the stock market is on a roll. Hopefully this transition will be a turning point for something much brighter in life.

Ugh! Jason I had no idea you were 100% commission. I figured you were base + or maybe even base plus bonus. I’ve had some wicked pay cuts in the last 7 years. When housing collapsed in 2007 the civil engineering firm I worked for cut all of our salaries 20%. Then I got paid even less the following year, when I switched to a base+ sales job.

Hell yeah it’s a motivator, because I didn’t feel like I had any control over my destiny (which of course was wrong) in the short term. That’s why my 2014 hopes/goals post is full of side income goals. I’ve had steadily growing passive income for 5 years, and it provides a nice psychological cushion.

-Bryan

I always wonder how people find the time to:

1. Work 50 hours a week (I work 40 myself)

2. Time to write blog posts

3. Time to research companies

4. Have a normal social live

Respect to those guys! I’m having not enough time for all the things I would like to do.

Hi Jason,

Really happy to learn that you’re thinking of your blog as a possible job substitute one of these days.

But the transition could be tricky. I’ve asked myself sometimes why yours is my favorite of the dozen or so personal finance blogs that I regularly read. Part of the answer is the transparency, as in this “new guy” post. The extraordinarily detailed sharing of your personal financial life makes your site real in a way that the mere advice givers will never achieve.

The other quality that makes your blog so readable is the Horatio Alger “pluck and luck” side of it, maybe more pluck than luck in your case — chancy childhood you described in an earlier post, job loss in Michigan, gutsy move to Florida, long hours dealing with privileged customers (some of whom are no doubt nice folks but others not), and despite the hard knocks that some would use to justify cutting a corner here and there, plenty of integrity in dealing with everyone from customers to readers.

Once you leave the status of prole for totally self-employed blogger, the challenge for this site will be to maintain its appeal to people who aren’t “there” yet but still in the same early leg of the journey, the place where you are now. I’m confident that you’ve got it in you, once you’re “there,” to maintain some sense of identity with the still striving scrappers, but it won’t necessarily be easy. You’ll have to work at it. It will be a new kind of journey to add interest to life after financial independence.

Keep up the good fight and the good faith!

Sorry to hear about the reduced income. Many people live paycheck to paycheck which makes absorbing a significant reduction in income difficult. While it will slow your progress, it really shows just how powerful frugal living + dividend growth investing really is that you will be able to continue saving while your freedom fund throws off more and more passive income. Hopefully the ‘pie’ at work continues to grow so that the cut isn’t as big as it first appears.

Do you ever read the PF blog called Planting Our Pennies? It is a couple that lives in Florida and the guy works in sales. “Mr. PoP” was able to take the leap from cellphone sales in a mall to a sales job in the tech field and now makes around $100k/yr. I dug back through their old posts and found a few about his sales job that might interest you. So, if you want a little weekend reading, check out the following 3-part series from October 2012 (their main links on the article aren’t working right, so I’m posting links to each part):

http://www.plantingourpennies.com/how-do-you-go-from-minimum-wage-to-80k-in-a-year-part-1/

http://www.plantingourpennies.com/how-do-you-go-from-minimum-wage-to-80k-in-a-year-part-2/

http://www.plantingourpennies.com/how-do-you-go-from-minimum-wage-to-80k-in-a-year-part-3/

And then a follow-up post from him in July 2013:

http://www.plantingourpennies.com/just-out-of-school-deep-in-debt-job-sucks-what-to-do/

I hope to see a post from you within the next year describing your new higher-paying job that has better office hours. That way you can be barreling down the road to FI even faster AND have more free time to ramp up your blog!

Protect yourself at all times, like Clint Eastwood said in Million Dollar Baby…instead of boxing gloves you need job skills, which it sounds like you have, but most Americans do not, sadly, including my brother, who lost his 55k/yr job at a power plant and is now working part time at Home Depot…workers are just a number now, there is no loyalty like there used to be

It is incredibly unfortunate that you will experience a drop in income while your dealership actually experiences growth. Indeed, it is WAY better to be a shareholder than an employee. Imagine if a company came to its shareholders and announced that it will reduce dividends in order to accomodate higher growth! You get the picture.

But I have to ask, has this situation promted you to think about getting a different type of job? I know you’ve written about this in the past, but I couldn’t help thinking about it as I read your post. Given the existing growth of the business, how long do you think it will take (if ever) for your income to come back to normal?

In any case, your dividends are definitely doing the job of softening the blow. And someday they will propel you to full independence from the 9-5 grind. Keep on fighting!

Travis,

I’ve heard of that blog and I think I’ve even stopped by once or twice. I definitely never knew about that transition. I’ll be reading the posts this weekend for sure. That’s pretty inspiring stuff! My job is part customer service and part sales, so I can’t see why I couldn’t make a transition to something a bit more sales oriented. However, I had always thought anything sales related was heavy on the hours. Of course, it’s not like it could probably get much worse than it already is in that regard.

Thanks for the info! This is just one example of why I love this community so much. 🙂

Best wishes.

FI UK,

Yeah, I’m hoping that the growth management is predicting pans out and we see an increase in total clientele. In the end, it’s really all about the customers. Without them I wouldn’t have a job at all. So I am happy that we take their needs seriously. On the other hand, I have to take the whole thing somewhat personally though because my life is affected. We’ll see how it goes. I’ve been publishing my income live for almost three years now so it’ll be easy to track the changes.

Congratulations to you on getting a nice little bump in pay. That always helps, but especially so for someone like you that is funding your freedom aggressively. I’m confident you’ll put that new capital to good use. 🙂

Cheers!

Tyler,

Haha! It’s the dividend growth investing mafia. Can’t stop our progress!

Thanks for the support. I appreciate it. I’m confident that this little bump in the road is just another challenge to overcome, and in the end it’ll make me a better person. Maybe I’ll find a better opportunity, or maybe I’ll find ways to make even more money at work than I used to.

It does have its upsides. I’m looking forward to a little less workload, and the new guy will helps with that. We get crazy at work sometimes, so this will help reduce any unnecessary stress.

Thanks for stopping by!

Best regards.

Dividend Pipeline,

Ahh, good to hear from someone within the industry. You guys in sales also have some pretty crazy hours.

I hear what you mean. I am guilty myself of sometimes falling prey to the mentality you describe. It’s easy to get lazy, especially when you’re tired and/or worn out. This challenge will provide me all the motivation I need to preserve my income level and way of life. I suppose that, in the end, that’s exactly what this type of change is supposed to accomplish.

Thanks for the great thoughts there. I’ll take your advice to heart.

Take care.

moneycone,

You’ve got a great point there. If this was during the height of the Great Recession it would definitely be difficult to remain as poised and optimistic, especially since stocks were tanking at that time. It makes it a lot easier to stay calm when income is rolling in nicely from alternative sources.

Thanks for the support! I hope all is well with you. 🙂

Best wishes.

Bryan,

Every dealership is a bit different. But most pay their advisors almost strictly commission. I’ve worked at a few dealerships now and there was only one that paid any type of serious salary, and that particular store has since switched over to mostly commission.

That’s awesome that you’ve been building your passive income for five years now. That hard work is paying off now. I hope you’re able to accomplish all of your 2014 goals, especially the first one! I’ll be rooting for you on the $5k in dividend income, and I’ll likely be shooting for a very similar goal.

Best regards!

RobertNL,

I wonder the same thing myself sometimes. I honestly don’t know how I do it. I guess I simply sacrifice time in certain areas of my life. Maybe that’s why my girlfriend isn’t happy about the lack of time we get together during the week.

But like I tell her, this isn’t permanent. I’m putting in the hours and hard work now so that I can have much more time (and freedom) later. I’m confident the sacrifice will work out to my advantage in the end.

And I hear you about not having enough time. That’s exactly why I’m doing all of this. Time is one thing you can’t go to a store and purchase, but I’m hoping that all of my actions now will buy me plenty of time later. We’ll see how it goes.

Take care.

Anonymous,

Your comment really resonate with me. I’ve thought about this a lot. I agree it would be a challenge to shift from showing how someone who makes a middle class income gets to early retirement/financial independence to someone who professionally blogs and makes enough money from it to live off of. I never intended to blog for income, but I’ve found myself enjoying the writing aspect of it more and more. Perhaps I could someday simply shift from funding my portfolio by way of dealership income to writing income. Maybe this blog wouldn’t allow for that completely, but combining it with other online writing opportunities might. I think at that point the identify of what I’m doing, and my journey, wouldn’t change all that much. I’d simply be changing jobs.

At any rate, this is still far off for me. This blog doesn’t even come close in terms of income potential to where that type of transition is particularly realistic. But I am hopeful that one day I could professionally write and make enough from it to continue funding my Freedom Fund and one day still claim financial independence. The only difference is that I would enjoy the journey there much more.

Thanks for the thoughts. I really agree with what you’re saying here. I think the change would be difficult to implement, but in the mean time the hustle is still on. 🙂

Cheers!

Divi Me Up,

You’re absolutely right. This change at work definitely shows the power of living below one’s means and investing the difference in high quality income generating assets. It’s because I’ve been so stringent over the last few years that I can absorb this income reduction without any change at all in my lifestyle. The only real difference will be that I cannot fund my portfolio as aggressively as I’m used to if the changes turn out to be what I’m predicting.

Thanks for the support. I hope the pie grows a bit as well. I like pie. 🙂

Best regards.

Anonymous,

Sorry to hear about your brother’s troubles. That sucks going from solid income to a part-time gig at HD. I hope he’s still doing okay?

You are right. In this market, it’s all about what you can bring to the table. If management suspects for even a second that someone else can do your job better and/or for less money, well…that resume better be updated.

I think building passive income sources is not just for people looking for financial independence and/or early retirement. It’s really for everyone at this point. Job security isn’t what it once was, and so the more income you have coming in from additional sources the more secure you really are.

Take care.

Spoonman,

I have thought about getting a different job. I actually mentioned the idea of being a personal trainer over the ERE forums a while ago, and the response seemed to be mostly negative due to the fact that it would be less money and the barriers to entry are so low. However, that was before I suffered a pay cut. And I’m going to read through the PoP posts Travis linked to above to see if maybe something else in sales might be a possibility. To be honest, I’m a bit burned out. Not just in what I do, but the hours. I’ve been powering through because the money is good and I’ve got an intense fire burning inside of me to attain FI as soon as possible, but if this change results in a pay cut more severe than I’m predicting than changes might be on the horizon much quicker than I anticipated. We’ll see.

And you’re right. It’s MUCH better to be a shareholder than an employee. And that’s because as a shareholder you’re an owner. And owning businesses allows you to own your own time one day. 🙂

Thanks for the ongoing support! I’m more motivated than ever right now. 🙂

Best regards.

FerdiS,

Well, the fact that my pay is completely on commission means if I don’t work hard, I don’t make money. Furthermore, I’ll likely be fired if I don’t perform. It’s all numbers. And I think this employment contract makes me realize how important passive income is. I don’t want to be hand-to-mouth forever.

I’m really glad to hear you’re in a job that you love. That’s the one piece of the puzzle I haven’t really been able to solve. I don’t know if there’s a “job” out there that I’d really love, but I do quite enjoy writing. I think if I could figure out a way to slowly transition from working at a dealership to writing on more of a full-time basis I’d find working more enjoyable. However, it would also likely mean a significant pay cut – even more than the one I just took. But if I enjoyed the journey much more it might be worth it. 🙂

Thanks for stopping by!

Best wishes.

I’m sorry to hear about your drop in income. Sometimes it takes an income drop to refocus yourself on the end goal. I don’t think you are having to do that but it certainly makes us appreciate things more.

I left a job earning about 100k back in 2008 because of a disagreement with management (they were cutting our commissions to pay for their expensive houses) , among other things, to take a risk and start my own business. I earned nothing for a year, actually I lost money since it cost money to start. That was the best decision I every made. I started working for myself and I never worked harder. I had several wrenches thrown into my plan including the Great Recession and getting sued over non-compete agreements but I persevered.

It’s a great feeling to know that we are building this passive income stream that no matter what happens, this income can’t be taken away from us.

Life in Center,

Life is most certainly not all about money. You’ve got that right!

That’s awesome that you have pretty solid job security. From what I understand, you guys there in Finland (among other countries in northern Europe) have a totally different job market than what we have here in the United States. For the most part, our employment is at-will – for both the employee and employer.

That’s really cool you work nights. I’m naturally a night owl. So, for me, it’s difficult to get up at 6 am every morning. I’d much prefer a schedule where I stayed up until maybe 1 or 2 in the morning and got up around 10 am. 🙂

Finland seems really beautiful. Love to see it one day.

Cheers!

Jason,

It just plain sucks when you get a reduction in income. I am facing a similar situation soon. I am currently contracting for a company and they will look to make me permanent. It is a funny thing that will occur. My current income will fall because the rate I charge incorporates the benefits the employers receive. They get among other things, pension, sick leave, parental leave, annual leave, medical benefits, redundancy, long service leave (one week extra per year taken as 10 weeks off after ten years) and public holidays. All this gets folded into one rate for me which I invest most of as in reality it isn’t my money, it is money for my future self for when he is sick, needs time off, gets made redundant. Most that contract though blow most of everything upfront and when your contracting even in a permanent gig you can be terminated with an hours notice.

However, the flip side is that permanent employees are a guarded species in my current company, it is rare to ever ever see one get made redundant. That would offer all of those benefits and a large amount of security. I know the job and do it well. What would I do in your situation……I would seriously evaluate what your currently doing and if there is a better alternative. I can agree on your stance that your current job pays well and you do it well so why change? Well firstly they’re changing part of that equation, ie. paying you less and secondly it seems like someone with your motivation, drive and determination could certainly earn more doing your own thing or another position rather than what you’re currently doing (possibly picking up a more secure income along the way).

On top of what Travis has given you I would say have a look at these two articles from MMM. You have probably read them already but I encourage you to reread them and firstly make a list of jobs you could do, then refine that list to jobs you could complete in your local area and then knock out those that you don’t reckon would be successful. After that give them some serious consideration and look around yourself for other opportunities. It is really tough window shopping but to be honest you seem like you work far too many hours for what you earn. Personally I wouldn’t make blogging your full time gig just yet, it is great as an additional income stream but making it your primary income stream is going to change what the blog is. Maybe when your in the 90% there zone and can take any one of a number of options to slowly coast into FI then make it your full time gig. If it isn’t as successful as you thought it would be then you can grab something for easy money for the short term but at that point it would not be detrimental to your aim.

Anyways, your in the tiny minority of people where a reduction in income doesn’t make you suffer and simply presents you with an opportunity to evaluate options. Fantastic work on being part of that club.

Those articles:

http://www.mrmoneymustache.com/2013/07/25/50-jobs-over-50000-without-a-degree-part-1/

http://www.mrmoneymustache.com/2013/08/05/50-jobs-over-50000-without-a-degree-part-2/

KM

Brent,

That’s amazing. I’m really glad things worked out for you. It sounds like quitting your job was a blessing in disguise. You’re now in a great position where you not only make a lot of money but you also control your own destiny. I admire that!

Maybe my situation will also be a blessing in disguise. This has certainly renewed my vigor, although I’ve rarely lacked motivation to acheive financial independence. I guess it’s changes like this that validates my vision.

And you’re right. While my full-time job income is bumpy and can go away at anytime, the passive income streams we’re building is much more assured. I’m just glad I’ve worked hard over the last few years to cement the dividend income I currently enjoy.

Best wishes!

KM,

Thanks for the thoughts!

I have read the MMM articles, but I’ll definitely have to take another look at them. I, unfortunately, am in the position to where I don’t have a bachelor’s degree. So that list is quite interesting from my perspective.

I agree with what you’re saying. I’m going to keep a close eye on exactly how much my income is affected. He won’t be fully integrated right away, but in a few months he will be. By March or so I’ll definitely know where my income is going.

Even not factoring in the income reduction I’m open to doing something else. I’ve been a service advisor for over seven years now, and I’m excited for a new challenge of some sort. Making even more money would be great, but it isn’t necessary. I’d be willing to do something new and exciting for the same money, or less money if it meant more time at home. Right now I work way too much. I’d be really interested in working 30-40 hours a week, even if it meant less money overall. I think I could still come pretty close to financial independence/retirement by 40 even with a little less income. We’ll see. I was already interested in pursuing some ideas, but this might be the impetus to make something actually happen.

Thanks for the ideas. I agree that blogging full-time isn’t viable right now, but I do hope that I’m able to combine this blog with other writing opportunities into an all-encompassing full-time career to propel me to the last stage to financial independence. That’s still likely a few years out, but I remain hopeful.

Best regards!

I’ve been following your blog for awhile now and really like what you’re doing. I’m a couple years older but have put together a portfolio of dividend stocks over the past three years similar in size and income to what you have.

This post really hit home. I have a regular full-time job but on top of that I had been doing contract work for a company for the past two years. Found out yesterday they want to move the work I had been doing in house and January will be the last month I contract with them.

This will cut my income by $30,000 a year. My living expenses are very low so this won’t have a huge impact on my lifestyle but the additions to my portfolio will certainly take a hit. Luckily, I have other contract opportunities that I haven’t been willing to pursue due to time constraints that I can now look at.

I’m looking at it as a new year, new opportunities, and who knows what might happen.

Here’s to a successful 2014!

That’s a bummer to hear. Will the reduction in workload mean you may need to work fewer hours as well? If so, that might open up the possibility of a side job.

Hey DM, contrast your attitude towards your job with Carl Icahn’s attitude towards the companies he buys stock in…I would favor your attitude every time! That being said it is very important to realize the fleeting situation with respect to employment (and even in my case where I run a small company). I just hope we have enough time to realize our goals as well. Best regards!

DM, not having a bachelor’s degree has caused me to make more money, for sure, however, I might have retained a larger percentage, especially in the earlier years, had I had one (not entirely convinced on this point though,shit happens!).

The fact that you’re working on 100% commission makes your dividend growth investing philosophy and blog all the more impressive.

I work for 0% commission (100% salary) in a job I really love, and we get to share in profit through a long-term incentive bonus plan. Yet, as you say: “You cannot predict what is going to happen at your job”. From that perspective, it is a good thing to create passive income…

Good that life’s not all about money right 😉

I’ve worked with a partner for maybe 2 1/2 years in health care and during those times our work effort and production was more than double, so who knows, maybe you end up earning more this year if you get along good and get a good vibe going?

Atleast here in Finland if you study healthcare you can work for 40+ years and even when you retire they want you coming back, so for somebody contemplating a career I’d encourage to seek that as an safe option. You wont be getting alot of raises but the pay is stable and if you want to you can do gigs on the side to boost youre income.

I work only nights and it’s really calm and mellow, cause everybody’s sleeping 😛 My pay is about 36k€ before taxes(aprox). If I got fired today(which I can’t, 1 month time of notice) I could be working somewhere already tomorrow. Ofcourse in a smaller city that would maybe not be an option but here it is. Also if I would be all about the money I could go to norway or the saudis and get a boat load of the monneh, so yeah…..go healthcare 🙂 🙂

100% commisions, maaan that would be too much for me even though I worked sometimes doing only gigs…

Hi Jason,

Would you consider licensed practical nurse? I have a friend who went this route after he lost his job, and it’s worked out great. He’s somewhat technically oriented, so he’s good at handling oxygen tanks, working with medical equipment, etc. He works mostly nights, pretty much sets his own schedule, and gets a lot of satisfaction from the work.

Love your blog. Wish you luck.

I’ll give you the suggestion I made to my kids as they were deciding on a career path, that you may consider. Firstly, I told them if you are going to work at something for 30+ years, you might as well pick something you love & are passionate about. If you love what you do, you never really work a day in your life. ( writing & researching investments in your case I presume?) So, imagine you are already enjoying your financial freedom, and I ask you to write down 5 or 6 hobbies or passions that you have in life. After writing these down, try to think of 2 or 3 careers that are related to each of those particular passions. After composing your list, see if there is a trend in cross referencing where a couple of possible career choices are mentioned often. Follow your passion and the money will follow. Finally, being an avid saver & enjoy frugal living, I think you can easily handle the following phrase ” I would rather make 30K doing something I love doing and would never want to retire from than make 60K doing something I hate and can’t wait to retire from. Best of luck. Your friend in Puerto Vallarta

Hi Jason!

I´m 33 years old and three years into my own journey towards FI. I´ve been reading your blog for about a year and I´ve been close to leaving you a comment before as I´ve felt we have some things in common, at least job wise. When I read this article I had to comment on it.

I know exactly what you mean by having one eye over the shoulder and rolling with the punches. I am a technician at a french car authorized dealer here in Sweden and although my paycheck isn´t strictly coupled to the number of vehicles I repair, I constantly have a feeling of unease about my position at work. The ever rising numbers of unemployment in Sweden (due to overwhelming immigration I claim) means new people coming in looking for work on an almost monthly basis, longterm this means lower wages.

Everytime this happens I try to get better at the work I do and thereby “moating” myself (I think Buffett´s Spielberg-moat-comparison makes a lot of sense). As you mentioned the goldwatch-era is long gone and one needs to been on your toes. My assets (div stocks) bring consolation in these situations, they make me calm at heart and my determination stronger.

I know you´ve said it before to others and this time I say it to you; Stay on the path!

Hopefully we can stay in touch.

Wishing you and anyone reading a great year 2014!

/zicam

Jason,

Sorry to hear about the loss in income. I am not sure what your goals in terms of career are but considering you have so much knowledge and experience in investing, have you ever thought about becoming an investment consultant? That way you can combine your passion with your work and those 40 – 50 hours a week might not seem like work anymore. Just a thought I had, so sharing it with you. I have no idea how much you earn now and how much you can potentially earn working in the financial sector.

Best,

Jaspinder

Anonymous,

Hey, I hope all is well down there in PV!

I’ve thought a lot about what you’re speaking about – making significantly less money, but in a position I’d enjoy much more. I think the only issue is that I’m not quite sure there’s any traditional job out there that I’d enjoy enough to give up the dream of early retirement/FI. I do really, really enjoy writing. And I am hoping to one day turn that into a full-time profession. I don’t think that I’m in the position to do that right now, but I think the possibilities are there in the next few years. I just need to keep making as much as I possibly can and keep investing so that the passive income builds and snowballs to the point where it won’t really matter how much money I make. At that point, I could simply focus on what I like doing without any regard as to the income that comes in from my activities. Now that’s a position I’d love to be in, and that’s one big reason I’m pursuing financial independence so early in life.

Because even if I’m doing what I love, it’s stressful to worry about money. I might really love playing guitar. But forming a garage band and not making any money is stressful if you need to pay rent and eat. However, if you have enough passive income coming in to cover just about all of your expenses it’s a lot easier just to focus on the music. I really love blogging right now, but if it was something I HAD to do in order to eat and have a roof over my head, and I was doing it 40+ hours a week to maximize production, etc…well, I might not enjoy it as much. I guess these are just some thoughts off the top of my head.

However, I do take your thoughts to heart. Believe me. I’ll be the first to admit that I loathe hearing the alarm clock blaring in my ear at 6 am and then running my butt off for over 10 hours five days per week. I like working with people and I love being honest and trustworthy. But if I could simply focus on writing and investing I’d be a very happy camper. I hope to get there one day, and I’m working extremely hard right now in order to do so.

Thanks for the comment!

Enjoy your time down there.

Best regards.

Katz,

I agree. Not having a bachelor’s degree hasn’t hindered my ability to make a good living either. I think making almost $60k/year is very, very good. Especially when you consider there are many people with degrees in education and criminal justice among others making much less.

It’s really all about possessing a great work ethic and perseverance. And luckily I have both. 🙂

Take care!

DM,

It’s great to hear about your continued blogging success. I think you’ve got a natural flair for writing, and a lot of folks can identify with your story, which is part of what makes it so unique. My feedback would be just let the blog continue to evolve as it has been, rather than try to tweak the formula. I think people identify more with an everyday guy battling the odds rather than a problogger giving them formulaic content.

Regarding the passive income, sometimes it’s very easy to take what you have for granted. What you’ve achieved given the circumstances you battle serves as constant inspiration to me to try and keep the journey going strong.

Best.

Libertania,

Thanks for your readership and following along. Congrats to you on starting your own journey towards personal wealth!

I’m sorry to hear about your own income loss and job situation. That’s quite a cut! I don’t anticipate losing $30k/year, but anything is possible. The car industry can be pretty brutal and cutthroat. I’m glad to hear that you have some other potential opportunities that you can explore, however. I wish you the best of luck with them, and hopefully you can land another contract!

Great to hear you have a positive attitude about it all. Optimism goes a long way!

Please keep in touch.

Take care.

Jaspinder,

Good to hear from another day dreamer!

Thanks for the ideas. I have actually thought a great deal about somehow finding a way to work in the finance industry. Anecdotes aren’t always helpful or insightful, but I have gotten a few emails from financial advisors. And these emails have indicated that these particular advisors weren’t very happy in their professions due to the quotas they have to meet – which require selling financial products that maximize their commissions, whether or not they’re best for the client – as well as regular meetings, long hours, backstabbing co-workers and the like. Anyway, the reason I received emails from these people in the first place is because they found my blog because they were trying to find a way to financial freedom, which would allow them to distance themselves from their jobs. This isn’t to say I wouldn’t enjoy this job, but I guess what I’m trying to say is that I’m not pinning my hopes on any job. I’m pinning my hopes instead on freedom itself, which would allow me the flexibility to pursue anything without fear or worry. My ultimate dream is to build up a passive income stream so large to where I don’t do “jobs” anymore. I simply engage in passions, which can come and go just like I do.

I hope this makes sense? I’m just kind of writing as my thoughts spew out. I sometimes do that.

Anyway, I have thought about pursuing the financial advisor idea anyway because it may be a better more enjoyable path to FI, because I have to work somewhere in the meantime. May as well make it as fun as possible. However, when looking into the firms that would likely hire me with no experience or degree (Edward Jones for instance), the hours are even longer than what I work now, and the pay isn’t necessarily more.

Thanks again for the comment and thoughts. Hopefully I didn’t confuse you here. It’s late. 🙂

Best regards!

BuySmart,

Unfortunately, not really. I already talked to the other advisor in our department, who is basically an assistant manager. He’s open to taking off a half hour early a day or two each week now that we are probably a bit overstaffed. So I may have an extra hour or so every week with which to to work with. But it’s not much. It’ll just be a little more time to write and/or manage the portfolio, which is cetainly nice.

Hope all is well over there for you!

Best wishes.

Katz,

Great points there. “Fleeting” is a great word when describing modern day employment. It’s unfortunate, but it’s equally important to be aware of it and adjust. There’s a lot of complaining out there in the world about the loss of our manufacturing base here in the U.S., automation, Wall St. vs. Main St., “the Man”, etc. I try not to waste energy complaining and instead use that energy towards bettering my situation and swimming in the ocean I was born in. Crying about the size of the waves will get you nowhere.

Thanks for stopping by! Appreciate your support.

Cheers!

Anonymous,

Thanks! Glad you enjoy the blog. 🙂

I’ve never looked into being a practical nurse. To be honest, I’m not sure if that’s an occupation that would suit me well. I’ve never been particularly interested in helping others with hygiene, etc. I think you’d have to have a real passion for nursing to be an LPN. Of course, I have no experience with it so I could be totally wrong.

Thanks for the thoughts. I really appreciate you stopping by and offering up the suggestion!

Best regards.

zicam,

Thanks for stopping by and leaving your first comment! I do appreciate it. 🙂

I like the way you think. I also try to build a “moat” around my position by being honest at all times, putting the customer first and always showing up on time. I work incredibly hard and do the best I can. Of course, I’m not sure how much of a moat I’ve really built as management could decide at any time to bring someone else in. It’s exactly because of this that you need to protect yourself and build as much side income as possible, preferably passive as that allows you to concentrate on work while also building freedom from it.

Trust me, I’ll be staying on the path. I’ve got my walking shoes on. 🙂

Best regards!

Shop Teacher,

Sorry to hear about the pay situation. That’s rather unfortunate. Inflation is indeed the new guy for many of us. Your story is a great backdrop for why dividend growth investing is so wonderful. Building a source of income gives you regular raises above inflation is most welcome in the face of local legislatures and/or employers like yours putting the clamps down.

It’s funny, people point to the recent Great Recession and some bank stocks cutting dividends as a reason that DGI somehow doesn’t work, yet you would have been hard pressed to see a 20% pay cut as a dividend growth investor, even at the height of it all – unless you were primarily invested in bank stocks and didn’t give a damn about diversification. And yet here I am seeing something similar at my full-time job and I didn’t have to invest a penny.

I wish you the best of luck with your continued investing and with work as well!

Take care.

Integrator,

Thanks for stopping by!

I hear you on the blogging. I never plan to change anything here at the blog as far as content or anything else. If I were to ever try to make a living by writing, this blog would probably just be one of many sources of online income. I’d diversify it just like my investments, by including freelancing, writing for online investing sites, etc. At that point, the blog and message wouldn’t change, but I’d rather just be funding my portfolio by way of writing income instead of dealership income. However, I don’t know if this will ever happen, and even if it were to it’s still a long way off. Perhaps once I’m really close to FI I might just jump ship and try it out – but only once I’m virtually guaranteed success. We’ll see. 🙂

I’m right there battling with you. It’s a tough grind, but the rewards are great. Freedom is the ultimate prize!

Best wishes.

Sorry to hear about your challenges. Your story made me think of my situation. Due to the economy our legislature has chosen to not give any COLA for almost 10 years. Only Alabama and Mississippi pays less for teachers. So inflation has been the “new guy” in slow motion. Having a fixed salary that is independent of performance sucks.

I am so glad I ran into ERE and your blog so we could frugal down our debt/lifestyle and invest the difference. Regular increases in dividends help deal with inflation. I was excited to see Boeing gave a healthy bump…ahhh the power of for profit enterprises!)

Hi DM

We certainly have better job security in Finland. I’ve worked over 11 years for the same employer. Once I’ve been an employee for 12 years, they’d have to give me 6 months notice.

The downside is we have high unemployment rates. We get taxed quite aggressively here too. Income taxes are a pain. The dividend taxes are at 25.5 percent even for small incomes. Capital gains taxes are at 30 percent (=trading much is not a good idea).

I’m saving 60 percent of net income to reach FI. That’s pretty good with our taxation.

Best regards

Jarmo

Who knows, maybe the number of customers keep rising so the dip in income will be mitigated to some extent.

As a keen reader of your blog, one thing is clear: You’re a survivor.

You will endure change. This may slow your path to FI but you will not be derailed altogether.

Jarmo

Have you ever checked at for example BlackRock Municipal Income?

This sort of uncertainty with corporate jobs is just what I find the most difficult to handle. There is no predictability to your job experience. You can have stressful (or uninteresting) work, but maybe you at least have a great boss as a consolation. Then one morning you come to work and BAM, you are working for a different boss. Or you have a boss or a customer that is driving you crazy and you spend a lot of time looking for a new job. Then one day you show up and you’re transferred to another department. Problem solved, yes, but all that wasted effort on your part! Same issues with pay, co-workers, etc. After a while, what really wears on me is just getting constantly jerked around with no warning.

Jarmo,

Wow! That’s fantastic that you’re able to save 60% of your net income in a country that taxes you so heavily. Makes me look like an amateur. 🙂

Keep up the great work!

Thanks for the encouragement. The more I think about it, the more I’m looking forward to the change. I’m quite optimistic that I’ll overcome this and I’m hopeful that it’s a blessing in a disguise. Maybe it drives me to seek out a new opportunity that will revolutionize my life for the better. Maybe I’ll figure out a way to make even more money at work than before. Maybe the reduction in stress from less overall load will allow me to increase my focus.

Thanks for stopping by. I wish you the best of luck throughout 2014!

Take care.

Anonymous,

I don’t invest in any funds at all. I rather choose to invest in individual companies that have a lengthy history of raising their dividends, which allows me to reinvest that rising income back into high quality securities. Although it may not compare directly to a fund that invests in munis, I did write about DGI vs. index investing here:

https://www.dividendmantra.com/2013/04/why-i-vastly-prefer-dividend-growth.html

Best regards.

S.B.,

Uncertainty is definitely the word of the day. And that’s what is so appealing about dividend growth investing, in my opinion. You can contrast building up equity in a company that can let you go at any time, or change your position, or move you, or change your boss to building up equity in high quality companies that not only can do none of those things, but also continue to send you out bigger and bigger checks, well…the choice is obvious. 🙂

Cheers!

Extra writing and portfolio time is always nice, I probably do more of that at work than I should.

We’re doing alright, just eating a lot of rice and beans to recoup some of the costs of the second car. Know any good low-cost recipes that are still relatively healthy?

DM,

The company should find a way to make you whole.

A 20% pay cut? Increased transportation cost due to the companies decision to move?

The is the universe telling you that it is time to shop around. After 7 years you have mastered your current job.

In the same way that you diversify your portfolio, it is time to diversify your skill set.

You owe it to yourself to send out a few resumes. You might find out that your time is worth more, not less than your current rate of pay.

Good Luck.

Roger H

Man, those are long hours… 6 days a week too?

No wonder why you are saving so much to get outta there DM! I would too! Life is too short to be couped up servicing folks for that much!

Gotta agree. Time to shop around!

BuySmart,

When I first started out I was eating a ton of ramen noodles. I ate them just about every single workday for lunch. I would add only a tiny bit of the included salt packets for flavoring, and throw the rest away. I’m not necessarily recommending them but it did allow me to save gobs of money on food.

Right now I eat a lot of sandwiches. I don’t cook, and I don’t have any interest in doing so. I guess I have to outsource something in my life with my limited time and this is one of those things. I try to alternate PB&J and lunch meat so I don’t get too tired of it. This isn’t particularly unhealthy, especially if you buy all natural peanut butter and low sugar/no sugar jam. I also like pasta. Whole wheat pasta and some low sodium sauce and you’ve got a nice, cheap meal. Add in a little meat and there ya go. That doesn’t take a lot of time, and it’s cheap and not totally unhealthy. Although not particularly great because of higher sodium content I tend to take a lot of the Lean Cuisine or Healthy Choice meals to work because it’s tough for me to bring anything else. I buy them on sale for $2/ea and it’s cheap and healthy. Whole grain cereal or oatmeal for breakfast and that’s my usual diet. We tend to go out 1-2 times per month to restaurants and I always pay, so that’s why my restaurant bill tends to be what it is. We also tend to get pizza maybe once or twice per month. When I’m out and hungry I also tend to get the $1 McChicken from McDonald’s and ask for no mayo and add in the spicy mustard. Not as healthy as some might like, but you can do worse. Plus it’s cheap.

Best regards.

Sam,

Yeah, the hours are really horrible. They’re definitely not conducive to doing all that I do (blog, invest, hit the gym) while still having time to have a normal life. It’s really tough. I do the best I can with it, but I am getting burned out.

It’s funny. If I had a more enjoyable job with better hours I might not be so aggressive in my path to FI. Of course, maybe it’s a good thing this job motivates me so much because otherwise I might not be where I am right now. It’s an interesting conundrum.

But I agree with you. Life is short. I talk about time a lot on this blog, and it’s because I want much more of it that I’m chasing freedom. It seems like I should probably aiming to get more time now while still chasing more time later. 🙂

Thanks for stopping by!

Best regards.

Roger H,

You make some great points there. Adding in the additional cost of transportation due to the new building across town and I actually took a much bigger pay cut than what it appears to be.

I hear what you’re saying. I agree that the time is coming. I never intended to do what I do all my life, but I was fairly confident I was going to do it until I reached the finish line to FI. However, that may not be the case. This whole transition at work may be the impetus to try something new and exciting. And like you said, diversifying my skill set isn’t a bad idea.

I appreciate the advice. I’ve always shied away from the idea of doing anything else because of my confidence that I would take a big pay cut, but now that I’m taking one anyway it might be time to take a look around.

Thanks again!

Best regards.

Sam,

If you’re rooting for it too it seems like that’s something I should do. You seem incredibly smart, and you’ve been able to put yourself in a great position. That’s something I really admire. I’ll take your recommendation seriously. Whereas 2013 was a year of tremendous forward progress for me, perhaps 2014 will be a year of transition.

Cheers!

I feel your pain. I’m currently going through some big changes/challenges at work (including the possibility of someone else coming in at my level – although not in a commission-based sales role, I am not in the mood to start competing for my new boss’s approval and possibly get some brown-noser stabbing me in the back at every opportunity).

I linked this article on my blog, related to my 2014 plans where I mention some of the situation I’m going through at work. I hope you don’t mind – let me know if you do and I’ll take it down.

Totally agree about how these situations help reinforce the investing path to early retirement as the right way to go! Keep up the great work! You have really inspired me over the last year and a half as I’ve started my own journey!

The Dividend Warrior,

Sorry to hear about the changes you’re going through as well. This is exactly why gaining control over your income and your life is so important. It’s stressful to know that adverse changes can come your way at any time, but it’s even more so when those changes actually materialize.

I don’t mind you linking to this article at all. Maybe it’ll inspire others out there to start taking control.

I’m glad you’ve found some motivation for your own journey in what I’m doing. We’re all one big community helping and inspiring each other. Keep up the great work!

Best regards.

DM,

Oh man, I’m sorry to hear about the way you’re being treated. Does your management not understand? I agree with Roger here. Send out some resumes and see what else is available. Perhaps you might even find something fulfilling. Not saying I love my career (I want to shoot myself in the face some days), but I do get a lot of satisfaction.

Also a G.S.M. , and have worked in service as an advisor. In my experience, believe it or not, you will see no drop in income. You may see fewer R.O.’s, but your average will increase. Have seen it with salespeople and advisors. It only hurts the lower half. The top producers usually do better.

Where you are seems to have worked for you the last few years, stay positive and hang in there. It’s easy to see the negative but i’ve seen it many times. With more time and focus on the R.O.’s you do get will make up the difference. Starting over is starting over 🙂 Should have an established customer base which will help you also, that takes time, and from what I know you are at the point that should start helping you.

The best I have known in all aspects of this business have longevity at their stores, they don’t jump. My biggest regrets are some of the jobs I have left.

I wish you the best and know it will work out well for you whatever you do.

CI,

It’s a tough spot to be in. I still make great money for my education level, but at the same time it really sucks to take a massive pay cut. I’ll have to evaluate things on a month-to-month basis and compare my income to last year. The great thing about all of my stringent budgeting and this blog is that my income can be easily compared year over year. I’ll quickly see how much of a cut I’m taking. I’ve been feeling a bit burned out in what I’m doing for a little while now, and this may be the impetus I need to get me out of a rut. We’ll see. 🙂

Thanks for the support. I do appreciate it.

Best wishes.

Unknown,

Thanks for stopping by. It’s great to hear some perspective from another manager like yourself.

You may very well be right about increased focus resulting in increased sales. I’m certainly going to do my best. I’m going to continue striving and fighting for every penny. The great thing about this blog is that it’s very easy to compare my income year over year. I’ll be able to tell quite quickly if I’m actually seeing much of a pay cut. I anticipate the new advisor to be in full swing within the next couple months.

The only thing I would disagree on is jumping jobs. I’ve always, and I repeat always, seen a pay increase in every new position I’ve taken on. I’ve never left one place for another and seen a pay cut. I have just found it easier to get more pay from a new store than a significant pay increase from my current one. I got lucky in that I landed on an opportunity to switch brands within my same store at the end of 2011, but otherwise I’ve found it to be easier to see more money at a new store. Having said that, I’m not anxious to go anywhere else. I’m going to work hard and give this a fair shot, but if I feel like I’ll be better off elsewhere than a guy has to do what a guy has to do.

Thanks again for stopping by. I really appreciate your point of view.

Best wishes!

Dividends are the extra worker / job. Or if you like that movie Despicable Me – minions. That has been my train of thought for a while now, enjoyed that note. Stinks about your job situation, but as you said the company is doing well so if that keeps up perhaps you will edge it back.

Good luck in 2014.

Dividend Gremlin,

Dividends are definitely like little minions. I like that. They go out and work for you, and bring you back cash money. That’s a relationship I definitely like!

Thanks for the well wishes. I’m remaining professional, and I’ll continue to work hard and do my best. 🙂

And good luck to you in the coming year as well. I hope we both kick major ass!

Take care.

Hi Jason, Have you considered exploring another sales career there are many industries that you can make $100K + annually being in sales

DW

DM, I had the same thought about the MMM posts, glad to see that someone else put them up. To that I’ll add that you could find a job working with your hands to be far more satisfying than you might expect… Coming from someone who worked as a carpenter for several years.

So many great tips in this big post, thanks! I think it’s so true that people should focus on the things they do well at and are interested in. Thanks!

Anonymous,

Boy, I’ll tell you if I knew of a sales job out there that I was qualified for – and had even an inkling of a change of landing – that paid out six-figures I’d be all over it. If you have any particular tips I’d love to hear them. I work in the auto industry primarily because I’ve been doing it since my mid-20s and this is really all I know. I’ve built up experience and clientele to the point where I now earn a decent living, but when I first started I was only making $30k/year. It’s tough for me now to look in different areas because I’ve clawed my way to the top, however I’m very interested in broadening my horizons if the pay was similar to what I make now and the experience was dynamic and interesting.

Again, any tips very appreciated!

Best regards.

Tarence,

I agree. If you can do something you thoroughly enjoy and make a decent living at it you’re in a wonderful position. I don’t “tap dance” to work like Warren Buffett, but so far I’ve been able to make it work. However, I’d love to enjoy the journey to financial independence even more than I do now, and certainly with more free time!

Best of luck to you in finding something you enjoy!

Take care.

Another Black Swan, dealership gets sold. your world will be turned upside down. I know this for a fact.

With your dividend investing you are just hedging the risk from your income from your job.

That is a good move.

Since you like stocks and investing and you also know sales have you ever thought of trying to work in the financial industry or even becomeing a stock broker. Research what it takes to become a liciensed stock broker. I bet you would enjoy it. That may be your true calling.

A person I know has the following in his email signature: “If you love what you do you will never work a day in your life” Great wisdom in that I think. The only problem is a lot of people never find that thing they love or cannot make a living at it. A good stock broker does make a 6 figure income and I think you would enjoy it and be good at it..

Anonymous,

It’s all about diversifying income sources. I’d much rather have, say, 50 paychecks coming in than 1. 🙂

Good luck in diversifying your income in the coming year!

Best wishes.

Anonymous,

I’ve honestly thought about what you’re speaking of: shifting to work in the financial industry.

However, two problems arise in my mind.

1 – I’ve gotten emails over the years from people who work in that industry (mostly financial advisors) that don’t particularly enjoy the work and are just as anxious to become financially independent as the me. Now, this is just anecdotal, but it does beg the question: is it just another job with all of the baggage and headaches that usually tags along with such? The emails I’ve received paint a picture of an industry full of quotas, selling products misaligned with client needs for higher profit, regular meetings that neither fun nor productive, backstabbing co-workers, etc.

2 – I’d likely have to go back to college and earn a bachelor’s degree in order to make this transition successful. That would obviously come with certain time and monetary commitments, and would potentially delay my journey to FI. Now, if I really loved the work then the delay would be worth it. But that’s a big if.

It is something I’ve contemplated on more than one occasion, that’s for sure. I just don’t know if the move would be worth it. I wonder if it might be better instead to pursue a job with even more pay so that the journey to FI is shortened and then I can really concentrate on things I enjoy like writing, inspiring, managing investments, spending time with family and friends, staying fit, etc.

At any rate, I really appreciate your perspective. If you end up reading my comment and have some additional thoughts I’d love to hear it. 🙂

Cheers.

Hi Jason. Great article you wrote. I agree. I have many years experience in corporate america, and as time goes I see more and more savages who fire people for no reason. It’s quite ugly. The best approach is just to assume someone will be fired tomorrow, and then plan for it. It sounds very gloom and doom, but you are right. No one can take your coca cola shares away from you, except you. And I agree fully, that all those extra shares are mini-workers themselves. I only wish I had started Dividend Growth Investing when I was much younger. I am mid 30’s now, so still time, but oh lord, if I had started in my early 20’s, wow, would be on cruise control now. I also like your self description of ‘frugalist’ Great term. I am always looking for ways to cut costs, so if you have any ideas that would be great to include in your future blog posts. I read your past article about the house, commuting and other cost cutting tips and that was great. Good luck with the 3rd guy in your shop. You have a great attitude, and I look forward to reading more of your posts !! Cheers !

Peter,

Thanks for writing. I appreciate the kind words. Glad you enjoy this frugalist’s take on saving money and investing. 🙂

Don’t be too hard on yourself. Mid-30s is still very young, relatively speaking. You’ve likely got 50 or so years ahead of you. Just stick with it and put 100% into it. I’m sure you’re seeing the rewards already.

And I agree with you. I think it’s best just to assume you’ll be fired at any moment. Hope for the best, but plan for the worst. And I can think of no better plan than diversifying your income as much as possible. I’ve now got 44 little worker bees out there sending me all of their money. Now instead of just one paycheck to rely on, I’ve got 45. You have to diversify your income.

Stay in touch!

Best wishes.

I am a bit late writing this but you’re right when you say you don’t know if your job will be there tomorrow. I had the misfortune last year of working at a place that was passive aggressive. My boss was a cold fish. She would ignore me when I said “hello” and she wouldn’t give clear instructions, so then my co-workers and I would ask each other what she actually wanted, she would then send emails to the entire department written in all caps. Horrible situation.

She would also play favorites even when someone was late!

Eventually people started getting laid off at this company. The first round of layoffs started a month after I had been there. They started in sales, then marketing, then customer service, etc. I only worked there for 4 months before they came for me. I got laid off on December 6th 2013, right before the holidays. I thought that was particularly cold.

My bf was all “Don’t worry about it, you’ll find something better. I mean, do you really want to work with a boss who acts that way?” I had to admit he was right. Eventually I found a job that paid higher and people here are professional so far. I agree in that you should plan your finances as if you’d be fired tomorrow. Better safe than sorry.

Lila,

Thanks for sharing that.

Sorry to hear about the troubles you had at your previous job, but it sounds like you’re way better off now! I’ve found in life that every single time one door closes, a bigger and better door eventually opens. 🙂

And it’s probably a good thing you went through that experience. It just shows you how fickle jobs can be, and how expendable you are. It’s an unfortunate truth, but the quicker you realize that and plan for it the better off you’ll really be in the end.

Glad that you’re in a better spot now!

Best wishes.