Delaying Gratification? What’s Gratifying To You?

My strategy is simple. I live on less than most – saving over 50% of my net income, year in and year out. This year I’m on pace to save over 60% of my net income. I use the savings from intense budgeting to invest in high quality companies that pay rising dividends. I’ll then one day live off the dividend income my portfolio provides. This is all part of my plan to retire by my 40th birthday.

Sounds great, right? Not so fast.

Some people seem to think the delayed gratification of living on so little now isn’t worth it because tomorrow isn’t promised. They say you should live like today’s your last day because it’s all about YOLO, yo.

Well, what is delayed gratification? Per Wikipedia, delayed gratification is the ability to resist the temptation for an immediate reward and wait for a later reward. Generally, the later reward is larger than the immediate reward would have been. That’s the benefit of delaying gratification. You get less now for more later.

But I’m not quite so sure I’m delaying gratification by living on little, and I’m actually going to make the argument that I’m doing the opposite. I would call what I’m doing hastening gratification.

I know what’s gratifying to me. Time. Time is everything, because without it we’re nothing. Therefore, the ultimate gratification for myself is to have as much of it as possible. And that’s precisely why I’m on the path to reach financial independence at such an early age. I can think of nothing more gratifying than having all my time to myself. Need six months off to travel? Being financially independent means you don’t have to ask your boss for six months off. You do whatever you want. What could possibly be more gratifying than that; doing whatever you want whenever you want?

Living on relatively little is easy for me because I don’t find a great deal of gratification in spending my money on things that I know won’t bring lasting joy. Who wants to own a bunch of stuff when I could one day own all my time? What possibly could you want to own more in life than your own time? I’m not really delaying gratification by budgeting, saving and investing. Every single day is gratification because I know all of these steps are bringing me one step closer to what’s truly gratifying and rewarding: complete and utter freedom! The totality of the rest of my life all to myself, free to spend how I please.

If you enjoy spending money on 6-8 restaurant visits per month, 2-3 cars in the driveway, a large home, cable TV subscription, 2-week international travel jaunts, and a closet full of designer clothing, then living like I do would probably be quite a struggle for you. And if you truly find great joy from this lifestyle then perhaps delaying gratification today for even more of this lifestyle in the future might not be worth it for you. But I do beg of you to take a look deep inside yourself and make sure you’re happy. If you’re happy making lots of money and spending most of it, then I say more power to you. Living on less to have more time isn’t for everyone, and neither should it be.

However, for the rest of us there is only so much consumption that can possibly be fulfilling.

|

| Courtesy: Your Money or Your Life |

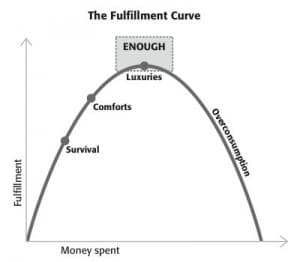

This concept, from one of my favorite books, Your Money or Your Life, is The Fulfillment Curve. It basically tries to graphically demonstrate that there is a level of spending and consumption that leads to optimal fulfillment. This concept is a derivative of marginal utility. Too much of anything is a bad thing, and moderation in life is important. Living in your car is probably going to be very cheap, but also lead to a very unfulfilled, and potentially dangerously depressing life. On the other hand living in a castle that you can’t afford even with three jobs is only going to lead to a very stressful and unhappy life, and probably land you back to living in your car.

You could probably argue I live somewhere between “Survival” and “Comforts” currently. But the greater I allow myself to scale off to the right the longer I’ll have to truly delay the one thing that I find gratifying: freedom. And that’s exactly it. By living like I do I’m not delaying gratification, because I find gratification in freedom. By not having my freedom right now, everything I do is delaying the day when I’ll own my own time and have my life all to myself. By living on less and forgoing many things that don’t really bring me happiness I’m hastening gratification.

Thanks for reading.

Photo Credit: Naypong/FreeDigitalPhotos.net

DM… Ever since I went through my financial awakening I’ve thought that frugaliy gets a bad rap mostly due to people thinking that it is something you have to endure for x amount of time until you accomplish y. However, as you state, living a furgal life can have intrinsic value; and indeed it does.

The YOLO crowd has it all wrong. I say this with conviciton because I once counted myself among them. Truth be told I still am but in a different way. The Stoic philosophers believed in YOLO mentality as well, but very different from the modern conception of it. They taught that it was wise to embrace each day as if it were your last, but what they taught was to enjoy the act of being. Embrace life and all its simple pleasures because there will come a time when you are no longer able to. I think that the YOLO crowd could learn a lot from Stoicism, I know I have.

Keep fighting the good fight DM and no that at this very moment you have all that you need. 🙂

The Stoic

People say you only live once… But what if you live to your 90. I know so many people a lot of people in Alberta that make a lot of money but they are not even close to retiring. They spend lots of money on trips and a big house.

When recession started there was massive layoffs in the oil and gas sector here and lot of these high paying workers lost their homes.

For the last couple of years, I saved 30% of every dollar that came to me. Also the money left over at the end of each month went into the investing account to purchase REITS and dividend stocks. Also extra money like Christmas, birthdays or tax refunds went to purchase equities.

I recently left my job over something stupid (BIG MISTAKE). Sometimes you do not know how good your job is until is gone. Luckily I have an emergency fund and hopefully I won’t be out of work to long.

I believe in delay gratification or else I would be in a terrible financial mess right now.

“…it’s all about YOLO, yo” LOL! That line really gave me the giggles.

One of the things that most people don’t realize is that we are not really experiencing sacrifice at all in the accumulation stage of our journey. They can’t think outside the framework of their own consumerist lifestyles and immediately assume that we are punishing ourselves. In the FI-seeking community, we dividend investors find immediate gratification when we buy more shares of great businesses. In the accumulation stage, I find gratification in 1) receiving dividend payments in my account each month like clockwork, 2) watching my forward dividend income grow each month, 3) learning of new dividend hikes.

“Every single day is gratification because I know all of these steps are bringing me one step closer to what’s truly gratifying and rewarding: complete and utter freedom!” Right on!

The Stoic,

Great comment there. Thanks so much for stopping by and dropping that kind of knowledge on me. 🙂

I agree with you completely. Frugality gets a bad rap as being some kind of means to an end, when frugality is actually the end in itself. Finding joy in living, and realizing that just being is wonderful and completely rewarding takes a completely different mindset. I quite enjoy the simple life.

Enjoy enlightenment. 🙂

Best wishes.

Investing Pursuits,

Sorry to hear about the recent job changes. I have found that every time a door closes, a better door opens soon after.

It sounds like you’ve been preparing for a day like this quite well by saving such a large portion of your income. The key is to have low overhead and stay true to yourself. I hope this time off gives you a glimpse of freedom and allows you to gain perspective on what you really want out of life. 🙂

Best wishes!

Spoonman,

Glad you enjoyed the post. 🙂

I couldn’t agree with you more about finding immediate gratification by saving money and then investing it in high quality businesses, receiving dividend income along the way during the accumulation phase. I wanted to divert away from the investment talk a bit with this article, but you make an outstanding point there. I couldn’t agree more. Where some people enjoy shopping sprees at the mall, I enjoy shopping sprees in the stock market. 🙂

Again, great points there. I’m a bit afraid of retiring not because of the fear of running out of money or having more time than I’d like or finding parts of myself that I won’t like, but rather only because I’ll not have the available capital to keep accumulating ownership stakes in high quality businesses!

Best wishes.

Rather than live on a budget, my style has always been to “maximize income” – That way I can plunk myself between comforts and luxury on the scale, but still put away about 25% of my annual income directly into investments without every feeling like I am doing without. If we count mortgage principle repayments it jumps well into the 30%s.

I also work about 50 hours a week, sometimes more. (but believe it or not I actually kind of like my job…).

That being said I know countless folks who work the same hours but have little to show for it, except for maybe that new Land Rover Range Rover Evoque or that Louis Vuitton purse. Or that RV that sits in the driveway 358 days a year. Or that new cellphone every six months….the list goes on & on….

DM, nice article!

Investing Pursuits – stay positive!

Michael

I suppose I’m used to delayed gratification from all the years I’ve spent in higher education; studying for several years toward one or more degrees can be a major psychological effort. Fortunately, it eventually paid off for me, with the latest “reward” being my new job.

The Fulfillment Curve is interesting. I’d say that for the past 10 years I’ve lived in-between Survival and Comforts. With my upcoming move and new job I hope to be more firmly in the Comfort zone, aiming for a higher quality of life while avoiding “lifestyle inflation”.

Jason,

you are on the right track. I did it exactly like you do.

Middle-Class-Income, saving over 50 % of the income, living a frugal life (no car, small flat …), spent the savings into shares.

Even the literature seems to be the same. I read a book in german (I am German) entitled (translated) “Money or Life” from two dutch authors and they mentioned that they took many things from that book “Your money or your Life”.

I made it and you will make it too.

I’m shure.

Best wishes

ZaVodou

Wow, I feel exactly the same way. Yes, I’m good at delaying gratification. But only because I want to get my gratification sooner! It’s all about getting what I want: more freedom and time!

You bring up some awesome points, DM. It’s great that you’re fine with living on less and that you don’t think of it as delaying gratification. I’m trying to find that balance between instant gratification and delayed gratification currently. My wife and I are finding that balance to be saving about 35% a month.

The thing with the fulfillment curve is also recognizing what is a comfort to us (air conditioning) is considered a luxury for a much larger portion of the global population. Another is defining what is a luxury, that’s going to be different for every person. To me I don’t understand why you would have 3+ cars or some McMansion. Yes I want a nice size house but why pay all that extra money for a house that you don’t really use most of the majority of the time.

As I discussed in my post about being laid off, that was actually one of the best times. I had no work commitments each and every day so I was able to use the time to cultivate better relationships and get in the best shape of my life. My stress level was way down despite searching for a job and being met with constant rejection.

I’m not sure if this goes back to the feeling of entitlement that has been growing over the years in the USA but most people just feel that since someone else has something they should too. Who cares is that other person worked very hard for it, I deserve it. I never really spent my money like that, but I did spend on some of the finer things in life. While they brought a few moments of happiness, being laid off and out of work brought so much more because I was able to focus on things that weren’t related to work which is a huge stressor. Being happy is all about being comfortable with what you have. If you’re always looking for an upgrade you’ll never be happy.

“I know so many people a lot of people in Alberta that make a lot of money but they are not even close to retiring. They spend lots of money on trips and a big house.”.

Saving and building retiring nest doesn’t mean restricting yourself in everything… however, watch your budget and don’t spend on things you can easily to live about… For example we spend a lot on travel, we going abroad 2-3 times per year and visited 5 times Europe in last 7 years. We also spend a lot on sport (recreation) and food. On other hand we don’t spend money on jewerly (at all), fasionable clothes, shoes etc, restaurans , modern gadgets as we don’t really need it. I don’t even hav cellphone, simply because i don’t feel I need it. We can afford to buy Ferrari or home in most expensive area of Toronto, but again we don’t need it. I don’t know what exact % of income we are saving, but curtainly we save more than we spend.

Michael,

I’ve always tried to simultaneously maximize income and minimize expenses, rather than pick a side. I’m earning an income that puts me somewhere near the top quartile in my particular field while keeping my spending levels near where they were while I was in college. I think that’s the only way to attain and maintain a high savings rate. The budget needs to be attacked from both sides.

Glad you enjoyed the article! I’m with you on many people not having much to show for all the hard work, other than depreciating assets that will one day be discarded. Certainly not everything in life needs to be an investment and sometimes things are bought just for fun, but it all needs to be in moderation as I pointed out above.

Best regards!

DGM,

Congrats again on the reward. It’s wonderful to work so hard for years and years only to finally see what all that hard work was for. The “payoff” is really nice when it was something you worked very hard for.

Sounds like you have a great plan there to enjoy the fruits of your labor while not going too crazy and wasting it away. I wish you the best as you transition into that new lifestyle and job.

Best wishes.

ZaVodou,

Sounds like we are two peas in a pod!

I’m thrilled that you did the same thing I’m doing and reached freedom. That’s very motivating and inspiring.

Thanks for the support!

Take care.

Pretired Nick,

I’m completely with you. I’m also good at “delaying” gratification only because to me I’m not delaying anything at all. To others my lifestyle seems somehow ascetic, but to me I’m very happy living on little. Frugality has offered me clarity and peace, and freedom will only reinforce that once I attain it.

Best wishes.

Jake,

Sounds like you and your wife has struck a wonderful balance. 35% is somewhere around 10 times the national average, so your savings rate is wonderful. 🙂

Keep up the great work!

Take care.

Pursuit,

Great stuff there.

You bring up some excellent points. What us Americans consider a bare minimum is a big luxury for many others. I’m interested in philanthropy and also interested in traveling to places in the world that are poverty-stricken. I don’t really need the perspective, but I think it would only offer reinforcement for my beliefs. I’m extremely lucky to not only have a spacious apartment with A/C, running hot water, reliable electricity, access to world class health care and modern public transportation. That luck is not lost on me.

And you are right. Always wanting more, and never gaining perspective for what you already have is a surefire recipe for unhappiness. Wants are insatiable.

Best wishes!

gibor,

Great points there. It’s about spending money on the experiences and objects that bring lasting joy and forgoing spending money on the experiences and things that do not. I try to maximize my opportunities on the former while minimizing the latter.

Best wishes!

Great article! A really fresh perspective on this topic.

Anonymous,

Thanks! Glad you enjoyed it. 🙂

Best regards.

Its funny how i was wanting to do some reading about the subject of stoicism and when I typed it into Google your website popped up.

This article may be several years old but it will hold relevance for many more decades to come. Keep up the good work Jason!

Ace

Ace,

Wow. That’s awesome. That’s great that I’m coming up in a search like that! 🙂

Thanks for dropping by. Appreciate it. Hope you enjoyed one of the oldies but goodies.

Cheers.