The Big Three

|

| This Is Ridiculous |

No, this article isn’t about the three major U.S. auto manufacturers or a trio of basketball players.

This post is going to hone in and focus on the three major expenses that most of us face and why it’s so important to minimize these as much as possible. I’m also going to provide you with examples where I have done my best to minimize these expenses.

There are a lot of personal finance articles that talk about cutting out that daily latte or skipping the sports package that your cable company wants to sell you. Forget all that. If you really want to retire at a young age or achieve financial independence while you’re young enough to enjoy it you need to focus your attention on “The Big Three”: Housing, Transportation and Food. Once you have these three under control the rest of your expenses will take care of themselves.

- Housing

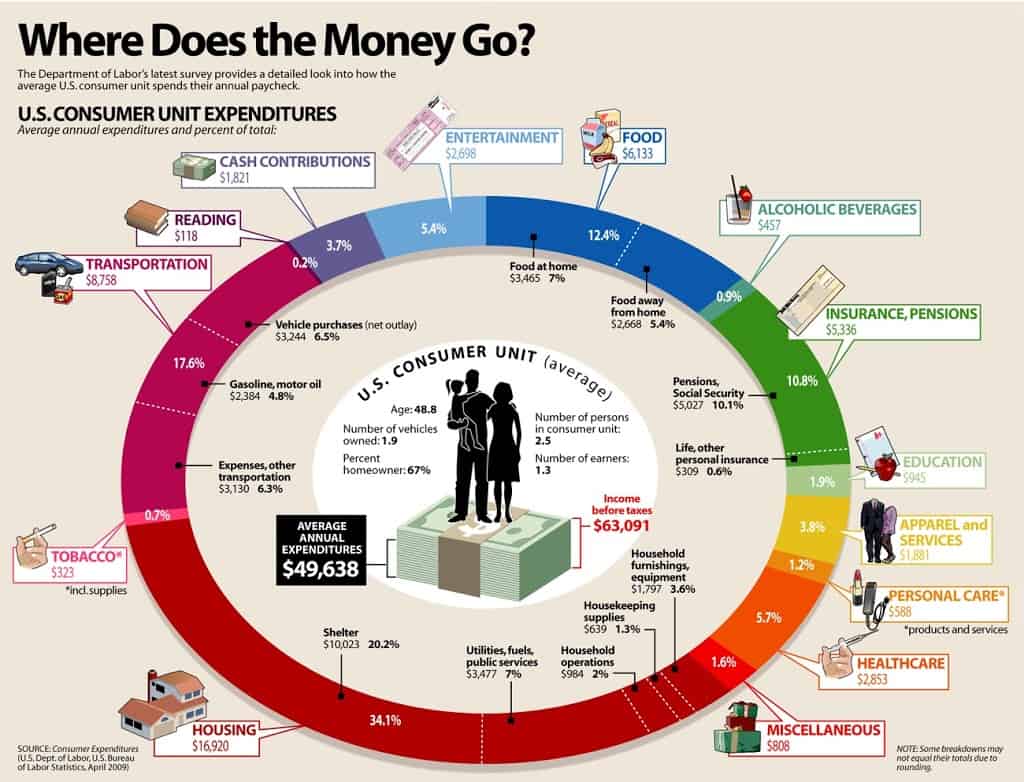

Housing is by far the biggest financial outlay for many of us. For the average American consumer unit*, the annual housing expenses are $16,920 a year. That’s a significant annual expenditure! For one to be able to cover that type of expense, a portfolio of $423,000 would be necessary using a 4% safe withdrawal rate. That’s over $400k necessary just to put a roof over your head. That is insane!

As I’ve talked about numerous times on this blog, I feel living frugally is absolutely imperative to retiring early. Being able to save large swaths of your net income every single month is much more important than your ability to earn a higher rate of return on your money. This is especially true for someone who doesn’t have an investment horizon of 40 years, as in anyone who’s looking to become financially independent at young age.

So, where does that leave me?

I documented my move to a cheaper, smaller apartment back in late 2011. I decided to take the opportunity to move into a more affordable apartment located closer to the bus line and save larger portions of my net income. Currently, my girlfriend, her child and I live in a 900 square foot 2-bedroom apartment for $915 per month. My portion is half of that, at $457.50. That means a portfolio of $137,400 at a withdrawal rate of 4% would be required to sustain my shelter. That’s a tad more reasonable.

Where does that leave you?

If you’re spending anywhere near $17,000 on housing you likely need to cut that pretty dramatically unless you’re earning a 6-figure income and you’re already saving over 50% of your net income. For the rest of us mere mortals, cutting housing is the FIRST step to becoming more frugal and making serious strides towards financial independence. Some of us need to downsize. The average size of a home here in America has been getting bigger and bigger and has more than doubled since the 1950’s. Currently the average home is over 2,000 square feet. Is that necessary? Maybe you feel it’s necessary, but believe me it’s not. We have three people living in 900 sq. feet and it’s really more than big enough. We could easily get by in a smaller space.

I’m not talking about getting extreme and moving into a tent or an RV or something, but look around you. Do you need 1,000 square feet per person in your family? Do you need that extra bedroom/bathroom/den? Do you need the garage to store a bunch of stuff you don’t really need? Or do you need more time to cultivate your life, spend more time with family and friends and master your hobbies? That big house will eventually own you, rather than you owning it.

- Transportation

Transportation is also a large expenditure for many of us. America was founded on the automobile, and we have a large interstate highway system crisscrossing the entire country. Many cities and suburbs are laid out in grids and connected to freeways that can get you to far away places in short order in your personal car or truck. According the source used above, transportation expenses is the second biggest expense for us at $8,758 per year. That’s a shitload of money folks. Using the numbers above, that requires a portfolio of $218,950. Is your transportation worth over $200k?

Where does that leave me?

I’ve been mostly car-free for almost two years now. I moved to the apartment I live in now to be within walking distance to the bus stop. This bus takes me to work every morning and brings me home every evening. It costs $1.25 per ride. That’s easy math. I also use a 16 year old 49cc scooter for trips to work when the bus is running late or for trips to the grocery store, pharmacy and anywhere else I need to go. It gets over 60 mpg. It has a 1-gallon fuel tank. It requires almost no maintenance. My transportation costs are well under $1,200 per year and that’s factoring in an amortization of the actual cost of the scooter. That means the value of my portfolio that covers my transportation needs to be $30,000. Certainly much more attainable than over $200k. I can almost save that much money in a year and transport myself for the rest of my life.

Where does that leave you?

What do you really want? A nice, shiny car to drive you to a job you don’t really care for? If that’s what you want then you’re probably going to be somewhere closer to that average expense level listed above. If what really matters to you, however, is living more and working less than you need to find a way to lessen the transportation expenses as much as possible. You don’t need to get down to my level to achieve success in this area, but if you’re spending multiple hundreds of dollars per month on transportation you may want to take a look at that and really ask yourself if you’re doing what’s best for your financial future. Try carpooling. If you live less than 10 miles from work, get a scooter like I did or get a bicycle and ride into work. Live closer? Walk. Live 40 miles away? Move closer. Seriously.

- Food

Mmm, food. Who doesn’t love good food? I’m certainly not one to argue if you love to eat great food. However, as with anything else in life moderation is probably best. If you’re constantly eating out and consuming freshly prepared 3-course meals this experience loses its specialness. I don’t eat out often. Maybe once a month or so. Sometimes less. But when I do go out to eat, it’s a great experience. It’s a treat! This is usually the third largest expense for many of us, and the average cost of food for us Americans lands at $6,133. This type of cost layout would require a portfolio of $153,325 using the 4% SWR.

Where am I at?

I’m not spending quite this much on food, although I will admit even I could use some more discipline in regards to food. I typically try to spend less than $280 per month in food, and that includes spending money on food for both my girlfriend and I when we go out to eat or pick up takeout on the weekends. As mentioned above, I don’t do this too often. But it isn’t just about cutting the restaurant visits. It’s about cutting that grocery bill as well. During the workweek, I typically get home around 6:30 and make a couple sandwiches before changing into my workout gear and jogging to the gym. Sometimes this is peanut butter and jelly and other times it’s a few slices of deli meat and some cheese. It’s not gourmet eating, but it provides a lot of the nutrients I need and it’s cheap.

The weekend is a bit looser, and this is where the occasional restaurant visit or Saturday night pizza comes into play. I could easily get the food budget under $200, but I’m spending at a level that doesn’t require any sacrifice at all. At my typical spending level I need a portfolio of $84,000 to feed myself for life. I’ve already eclipsed this level, which means that no matter what happens in life I’ll never starve. I can basically eat for free for the rest of my life!

What about you?

I’m not going to preach too much here. Food is a very individualistic and relative thing. Maybe you don’t like sandwiches. You don’t have to. Buying chicken breast in bulk and cooking up a small dish of chicken breast and some rice for dinner is cheap and very healthy. Maybe you like a little pasta. It doesn’t take much effort or money to put some noodles and sauce together. Add a little meat and you’ve got a cheap and easy meal. You can usually make this in large batches and eat for the week. Add a big can of soup to some rice and that will also feed you cheaply. Again, you don’t have to be extreme here but taking the budget seriously and respecting the fact that food adds up quickly can make a big difference in your bottom line and your ability to reach financial independence at a young age.

You don’t have to eat rice and beans for the rest of your life, but prioritize a bit. Eating out more than twice a month, eating steak often enough to where you can regularly recall what it tastes like and spending more than $400 per month on food (even if you have children) will likely significantly reduce the likelihood of your ability to retire at a young age. I like eating well and try to have a good meal at least a couple times a month. But, again, eating great food every single month is easy to adapt to. I savor it more when it’s hitting my palate after a steady week of PB&J sandwiches. I eat like a college student, but I’ll be financially independent at a younger age than most can ever imagine. Think about that.

Conclusion

Taking a look at just these three expenses, it’s easy to see the difference between myself and the average. At an average expense level, a portfolio of almost $800,000 would be necessary just to cover The Big Three. Looking at myself, I’ll need just $320,725 to cover these basic expenses if I can keep them at a similar level to what I’m spending now. That’s a difference of almost $500k!

I’m trying to retire by 40 years old. I want to become financially independent so that I can live more and work less. I want to be me! I don’t want to live the 9-5 till’ 65 routine. I don’t want to be forced to go in when I’m not feeling well or when I’m burned out. I don’t want to have to grit my way through a Monday morning when all I want to do is spend the morning at the beach. But without freedom, financial freedom, you don’t have these choices. You have to work for a living. The quicker you realize what expenses are holding you back, and the faster you can reduce these expenditures, the faster you’ll have that freedom!

*U.S. Consumer Unit – 2.5 people in household and 1.3 earners.

Thanks for reading.

Photo Credit: Visual Economics

Housing is a tricky one. It’s really tied to cost of living in the area. Where I live now, ~$1000/month gets you something mildly descent. Meaning there probably aren’t drug deals going on in the parking lot or college students partying till 2am every night. Where I lived previously (50% of my current cost of living) you could get that for maybe $600 a a month.

Transportation is also tricky. I live in car-land at the moment. You’re really not getting anywhere in the local area without a car. Bikes? Forget it. No bike lanes, sparse sidewalks, and drivers who do 20mph over the speed limit. Where I lived previously, public transportation “worked” if you didn’t mind waiting 40-60 minutes between buses, and was substantially more bike friendly than this place.

As for food, the best thing that you can do without having to reduce your quality of life is learn to cook. With a year of consistent practice you can easily meet or beat most of the common restaurants.

The one things that I’m surprised didn’t make that chart was child care.

In short my stats

Transportation

– 125cc scooter all year long so quite cheap

Food

– about $180 per month, I eat mostly potatoes or different kinds of lentils with chicken/beef and veggies

– eating out very rare since I’m in Australia (average main course $25 with small beer $6+ is wasting of the money)

Housing

– I wish to pay just so little like you 🙂

– I pay $200 a week (=$860 a month) for a very small room, sharing house with other people 10kms out of Sydney CBD

DM, I eagerly read your housing part, because I have the exact same issue thinking how to cut housing down more. Unfortunately my family and I live in an expensive area. For my 970 sgft apartment I pay $1650 monthly plus tax 300 yearly plus 311 HOA dues monthly. I refinanced twice which helped me to lower my mortgage payments down by 260 a month, but do not know what else I can do. I cannot sell since I am under water. I think I am trapped, so instead of cutting housing expenses I am looking for the ways how to boost my income. So far, trading options looks like a good way to achieve it and get more cash to invest in dividend paying stocks.

It is of no surprise that housing is the major expense for most people.

If you are renting, you are essentially throwing away your money in the hands of a stranger (landlord). You don’t get anything in return. The smart guy is the landlord.

Aim to buy a home as soon as you can with a mortgage. At least part of your payment will go to paying down your capital owed= BUILDING EQUITY. Tick off the bi-montlhy payment option on the mortgage as opposed to the monthly payment option as this will significantly lower the interest that you pay long term. Read the fine print of the mortgage agreement. Often you can pay down a percentage of the initial capital owed every year = BUILDING EQUITY. Use this option by saving up every year. Also, the money you ‘invest’ in paying down the capital owed will appreciate with time. There are many ways to build WEALTH and this is one of them.

I don’t consider myself an expert in all of this. Just a simple guy who hated paying the landlord as well as the interest part of the mortgage.

Cheers to all !

Very cool info graphic, DM. Although it’s pretty depressing for the average American. No wonder Americans had a negative savings rate recently. The housing and transportation components of the big three are pretty startling.

I have managed to bring housing down to $360 per month in a high rent area and most recently have focused on cutting transportation costs despite having to travel extensively for work. The “other” auto expenses >$3k figure makes me scratch my head. Maybe that makes more sense to you since it falls in to your line of work, but it’s hard to fathom spending that much on transportation excluding car payments and gas.

Thanks for sharing this info and well-said on focusing on the big three

I really like how you look at expenses by figuring out how much in investment assets you need to sustain the expense. I’m going to start applying that to different expenses in my life. It gives a good ultimate goal for how large I’d like to grow my investment portfolio.

You rock DM! What a wonderful article! You have a great way of distilling the truths. Inspiring to read!!!

DM, I am curious how you would determine housing costs when you own a house free-and-clear. I built my house (paid cash) about 7 years ago, so on the surface it looks like my housing costs are very low: $420/yr for property insurance, $1,550/yr for property taxes, and ~$600/yr for general maintenance (water/air filters, etc). That works out to about $215/mo. I also set aside $200/mo for future repairs (water heater, A/C, etc). Even with that, I am still under $450/mo on housing costs for a 4-bedroom, 2,450sq.ft. house.

However, there are also missed opportunity costs. If I didn’t have that money wrapped up in my house, I could be using it for other investments. Would you factor in some of those costs?

I suppose in a way I am earning something on the money. If I rented a similar house in my area it would be about $1,800/mo instead of $450/mo. So I am “earning” $1,350/mo on my money. For the amount I originally paid for my lot+building costs, that means I am earning about 8% a year on that money. And I do still have access to a large portion of the money through my HELOC.

Anyway, I was just curious how you would determine the housing costs when someone owns their house outright.

It is very difficult to get around without a car in the US, unless you live in a large city with widely developed public transportation ( Chicago, NYC, LA, SF etc). You need a car ( period).

For housing, cutting rent is important, but if you focus on the details in the chart above, rent made only $10,000 of the average household expenses. The rest is spent on utilities, household operations, furnishing and equipment, and housekeeping supplies.

In summary, i think that one needs to live everyday like it is their last, while also keeping track of the bigger picture. At the point where cutting costs by an extra dollar leads to your spending more time to compensate for it, you should probably stop cutting expenses. The issue i have with cutting expenses is that you can only go so far. Income on the other hand has unlimited growth potential.

I understand a lot of people on early retirement sites hate their jobs, but if you really want to retire early, work hard to get promotions/bonuses. That would really speed up your retirement. If you make $50K/year, and save $25K, you need 40 years to make it to 1 million ( without accounting for investment gains). If you make $250K/year, and save $225K/year, you can have 1 million in almost 4 years.

Travis, using DM’s methods, you can simply determine how much in assets you would need to support that level of expense! Since your $450 is almost identical to DM’s housing ($457), then you could make the assumption that you would require $137k or so to support your housing expense! Not too shabby!

This is in obvious contrast to paying that extra $1,350 a month in housing bills, or having to have an extra $400k+ in savings to pay for those expenses. This $400k+ represents your opportunity cost of owning your home, and is of course, exclusive of any potential appreciation.

Journey,

Housing is certainly tied to location, no doubt about that. I mean the my $900 apartment would be non-existent in NYC. But, as with anything else in life one must be thoughtful, resourceful and open-minded. If I were single in an area with a high cost of living I would likely just try to find a roommate or a room for rent and split everything. There’s ways around that.

Transportation, just like housing, must be planned for. If you buy a big house out in the countryside because you “get more for your money” than what’s available in the city…well then you’ll need a car. Is that the right way to go around it? Probably not. Like I posted above I planned my life around living frugally and saving money. I didn’t just happen to live without a car and live in an apartment on the bus line. These were all decisions that came with a lot of thought and planning behind them.

I’m also surprised to see no specific child care costs listed up there, but I suppose maybe it’s lumped into the averages with housing, food, education and the like.

Best wishes!

DGI,

Thanks for stopping by!

I disagree with you on the car point. I live in Sarasota, Florida. We have a population of about 50,000, and that’s mostly old, retired folks. Certainly not a big city, and actually very little reason to have public transportation since most of the people are older, wealthy retirees. Yet, I’ve lived down here for almost two years with no car. I use the bus, walk, ride my scooter or occasionally take a taxi.

I also lived in Ann Arbor, Michigan quite successfully without a car. That’s also a relatively small city. I think it’s not only possible to live outside a major city without a car, but actually one can thrive. In a major city public transportation can be actually quite costly. Here, it’s $1.25 per ride. Not bad.

As far as housing, you’re right. That was a bit misleading now that I look back at the chart. I noticed the breakdown on transportation and food costs, which are still quite applicable to what I wrote…but the housing is broke down a bit different. However, the point still stands that spending that much money (over $16k) on all housing related expenses is crazy if you have a median salary and ever hope to become financially independent. I post my budget every single month and I spend nowhere near that on everything housing related. My electricity bill is under $80 and water is usually around $55. I probably spend less than $10/mo on other housing related expenses.

As far as income, it’s not completely in our control. I don’t have any control over whether or not my boss decides to give me more money. I can work harder, come in early, stay late and excel at everything I do. Ultimately, it’s completely up to him to give me more money. Expenses, on the other hand, are almost completely in my control. I can sell my car like I did, move into a cheaper place like I did and generally just spend less money.

There are also ceilings to income, just like expenses. I could come into work tomorrow and turn water into fire and I wouldn’t make anywhere near $250k…like as in ever. The top 10% of people in my position make ~$75k and managers typically make around $90-100k. I’ve averaged around $55k the last few years, so there is perhaps some movement there…but not much. If I could reliably make $65k/year doing what I do I’d be pretty thrilled.

I can’t speak for others, but I don’t necessarily believe the early retirement/FI movement is about hating one’s job. I don’t “hate” my job, but I hate being forced to do anything for 50+ hours a week for years on end. I want flexibility and freedom to pursue other dreams and desires. Maybe take a few years off from work and then do something else without having to worry about resume flak. Maybe travel for a year or two and then come back and do local charity work. Maybe beach bum it up for 6 months. The key is choice and freedom.

It’s not about hating anything, but rather the love for too many things.

Best regards!

Jakub,

Thanks for breaking that down. You’re doing great! You’re killing it.

Good for you on the scooter. I find the scooter is usable for me about 95% of the time. There are occasional days when it dips into the 30’s in the morning here and also rain puts a damper on things.

Your food budget is awesome. I was reliably spending under $200/mo when I first started this blog and was eating ramen noodles daily…but I’ve since stepped it up a bit. That’s great that you eat healthy and cheap. Keep it up!

Your housing sounds pretty reasonable for living near such a big city. I live in a small city, so the expenses are a bit different, although Sarasota is one of the more expensive cities on this side of Florida due to income/wealth being so high.

Keep up the great work my friend!

Take care.

Martin,

I’m sorry to hear of your housing pain.

That sounds like a lot of money for an apartment that’s near the same size as what I live in. You’re paying about $2k/mo for your housing.

Is there a way to rent it out and come close to breaking even while you put it up for sale and move somewhere significantly cheaper? If you could break even or be negative $100-200/mo on the property until it sells while moving into a place that’s only $1k/mo you could save some money in the meantime.

Good luck! 🙂

Best wishes.

Anonymous,

“If you are renting, you are essentially throwing away your money in the hands of a stranger (landlord). You don’t get anything in return. “

You also don’t get anything in return for paying property taxes, mortgage insurance, PMI, insurance, repairs, maintenance and the like.

Professor Robert Shiller, the famed and oft-cited economist has tracked housing prices for the last 100 years. Housing has had a real return of 0%. Yes, 0.

See here for his recent discussion of housing and why most people are better off renting and using the different to invest in better performing assets:

http://www.businessinsider.com/robert-shiller-home-investment-a-fad-2013-2#ixzz2KEJiFmRT%29that

And, yes equity is built by paying off your principle…albeit while you’re simultaneously “throwing away” money on interest. But, often that equity is eaten by repairs, maintenance and upkeep. If you sell your house after 10 years and see that you can potentially make $30k you then realize who wants to buy a house with a 15 year old roof and old flooring? Whoops, maybe the kitchen also needs to be updated.

Oh, and don’t forget about those 6% realtor fees when you sell.

I’m not saying buying a house is a terrible idea, but as an investment it’s historically performed very poorly. Buying is more of a lifestyle decision. If you have a family and want a good, stable roof over your head then buying a home can make good emotional and psychological sense. But, it doesn’t necessarily make it a great investment.

Best wishes!

Net Worth Snowball,

Thanks for stopping by!

Your housing figure is fantastic! That’s awesome. It just goes to prove that anything is possible if you plan for it instead of making excuses about living in a high cost area.

The $3k figure isn’t really all that hard to believe. I routinely write up $500-1000 tickets on maintenance and light repairs. Serious repairs can be 3-4x this easily. You also have to figure in insurance which can easily top $100/mo.

Glad you liked the info graphic. I thought it was pretty telling to spend that much money away. I average around $1,300/mo and this example would be triple me. I just could not truly imagine tripling my expenditures.

Best regards!

Dan Mac,

Glad you enjoyed that! I’ve been doing that since the very beginning. I wrote an article back when I first started the blog about how I cut cable and talked about how much less I’d need in the portfolio after that decision. It just makes sense to look at expenses like that since that’s really what we’re all ultimately aiming for: living off investments.

Hope all is well!

Take care.

Relic,

Thanks for stopping by. Always good to hear from you.

Glad you enjoyed the article. It’s always enlightening and eye-opening to look at mainstream America averages. It inspires me to work even harder.

Keep in touch!

Best wishes.

Travis,

writing2reality laid it out pretty good there representing the opportunity cost for you.

The problem I have with laying out so much capital on a house is that a lot of your wealth ends up tied up in a illiquid asset that appreciates at a 0% real return historically. I’d personally rather have my wealth spread between many different investments (over 30) and appreciating at a higher rate while still kicking off the income that allows me shelter. Just my take on things.

In the end, it’s about being happy. If that home makes you extremely happy, then that transcends the financial ends of it. I find that home ownership is rewarding in many intangible, emotional ways…even if the dollars and cents don’t always add up. However, in your case it sounds like you worked it out pretty well. It sounds like you paid somewhere around $200k for your house. At a 4% SWR that only gives you around $670/mo, and adding that to the ~$450 you calculated on a monthly basis, that gives you $1,120 to play with. You’d likely have a smaller place (based on what you’re telling me about your locale), but your liquid assets might outperform the house long-term.

I guess what I’m saying is that if I had $200k tomorrow I would invest it in strong performing assets (stocks) and not buy a house in cash. Just a different take on it. Plus, I’d be flexible and geographically independent. Just my take on it. Again, as long as you’re happy…that’s what we’re all here for! 🙂

No sense having money in the bank if you’re unhappy.

Best wishes.

Most people buy the “big house” and fancy car before purhcasing assets. If you buy a small house and a used car and invest in cash flow assets.

Another option is to by a triplex or duplex. You can even live in it and not have to worry about 2am calls with a plugged toilet. A property manager (7 to 10% of the monthly rent ) can do that for you. You can rent your “own” place and all the repairs will be tax deductable.

Most wealthy people have made their money in real estate or keep their wealth in real estate. But dividend stocks of good companies are a lot less stressful and makes sleeping at night easier.

Unfortunately, none of the US cities I have lived in ever had public transportation. Now, European cities are much different…

But I do like how you look at expenses from the point of how much income you need to cover it. Hence, a $100 monthly expense requires you to save $30,000 in additional funds for retirement.

As for income, it is tough to get a higher salary of course. But, if you really perform well at your job, chances are that you could move to another company for more money. I always discuss things from my own experiences unfortunately, which could be different from yours. I was able to switch positions over the past several years, and get higher pay/bonuses and promotions in the process.

I also hated my previous job, but it was the type where you work for the experience. The next job had higher pay, more benefits, and much nicer work/life balance. What if you found another job where you worked say 40 hours/week, even if you made slightly less money? Would that make it easier? I think that while accumulating your freedom fund is important, you also need to be able to enjoy the time that you will spend in the meantime. Doesn’t mean spend money of course, but you should still do what you want to do ( working out, spending time with loved ones etc).

I do agree however, that early retirement is all about doing what you love. Having free time, where you are not bound by time schedules is amazing. I suggest taking a few months off if you decide to switch jobs in between, if possible.

I tried, but none of the solutions worked. Rent it I wouldn’t get as much as I wished and even if it happened, I would pay it to rent something else. So it was a wash. Well, I need to wait for housing to improve I guess.

DM– as you know I’m diligently working on reducing my transportation, electric, and food costs this year. Housing will be dealt with next year, but I’m already looking at ways I can reduce this by half. I have 10 months of planning to do so I should come up with a solution. I like how you have shown how much needs to be saved to pay for these expenses if they are not controled. Eye opening…

DM,

Great post. My big three are quite a bit below average, but not as low as yours. I live in an apartment alone, which is $250/month higher than your share and I own a car. Those two decisions keep my expenses higher. It’s a tough choice between sacrificing that next level or keeping it where I’m at. I am saving half of my income already. But 60% or more would be even better. It just comes down to sacrifice and I’m not sure I can take it to that next level.

Great job to you on these big 3 though. You’re kicking butt. I’m sure this article will help open other people’s eyes into how important these 3 are.

Anonymous,

Great idea there on the duplex/triplex. That would be a great way to invest in owner occupied and investment real estate all at the same time. The likelihood that your “rent” would be free is pretty high. Something to think about!

I agree with you on that last point. Coke never calls me because a factory needs new equipment or a truck in Idaho broke down. I just keep collecting that dividend and am never the wiser.

Best wishes!

The Stoic,

Thanks for stopping by.

I’m very aware of your journey to cheaper expenses and I really hope you’re able to knock it out of the park there. It sounds like you’re dedicated to the plan.

You’ll do just fine. You’re aware of the expenses, and that’s really half the battle right there. Many people aren’t even aware of where all the money is going.

Take care!

Kraig,

You’re doing great, my friend. You’re already saving over 50% of your income, and that puts you on track for all the goals you’re shooting for.

And you’re right. The choice always comes down to quality of life, or at least your perception of quality of life. Before I got rid of my car I thought it was a crazy idea. I really believed my car was an absolute necessity, with no room for debate. After getting rid of it I was like “Hmm. Not so bad after all.”. It got to the point where now I enjoy riding the bus and the scooter.

Don’t get me wrong. Having a car is nice. There’s things I miss out on – notably late night social engagements and road trips. But a car can always be rented and I can always buy a car later. Even going for a year or two without a car can supercharge your wealth building to the point where it all snowballs and compounds from there. You may even be able to live car-free for a couple years and the money you can save during that time can pay for a car for the rest of your life.

Best regards!

DGI,

Thanks for the comment there. I really appreciate your thoughts and concerns.

I agree with you on living in the now. No sense in constantly saving for an unknown future, being miserable in the present. That sounds like a recipe for failure, ultimately being disappointed once you get to where you’re going. Financial Independence can be a big letdown if you save and struggle and suffer for a decade or more only to find that life still keeps rolling on whether you’re going to work every day or not.

I often think about doing some other gig, but my skills and education are limited. I’ve done what I do since I was 24 years old and it’s really all I have experience in. We’ll see. I’m getting to the point to where I’m considering dropping down to part-time work for an extended period of time. That might be the best of both worlds – more time in the now and the future. We’ll see.

It sounds like you did a fantastic job leapfrogging to another job, and gaining income and time in the process. That’s really great that you had that opportunity. You get to enjoy your job even more while making more money, which in turns accelerates your time line to complete freedom (if you so choose to take it). Keep up the great work!

Best wishes.

DM, this is all very true. Over time the house will probably hold its own against inflation, but your borrowing rate will also probably be equivalent. And then you typically have 1% property taxes and a lot of depreciation/maintenance. Overall, I think there is a small cost bias toward owning vs renting, but you have to be very careful. It can easily be the other way around in many situations.

We bought because we wanted to settle down in a quiet neighborhood with a good school, and never have to worry about landlords. As you put it, home ownership is mainly about lifestyle needs.

S.B.,

Thanks for stopping by.

Great points there. Real estate is very location-specific. Locales make a huge difference in terms of the equation. In very big cities like NYC, L.A, Chicago and the like renting can often make sense over buying. Whereas somewhere like a small suburb outside Indianapolis might make it more attractive to buy over renting. Where I’m currently at, in Sarasota, it favors renting…but only slightly.

Home ownership is definitely a lifestyle choice. Buying many things in life (a new car, a great meal out downtown, a big screen TV) aren’t necessarily “great investments”..but not everything in life needs to be or should be. Not everything is about money. Home ownership is sometimes in that category – something that improves your lifestyle, even if it’s not a great long-term investment. I’m not saying home ownership is a waste of money, and sometimes can turn out quite lucratively. However, one needs to be fully aware that, historically, home ownership is not a fantastic investment.

Great comment there. I love talking about this stuff.

Best wishes!

Hey D. Mantra. Another great post to ponder. I think you definitely addressed what usually are the 3 biggest spending items in most household budgets. Opinions will differ but I think most will agree that action needs to be taken to control these expenses. Of course respectful disagreement engenders thoughtful discussion so in that spirit, my thoughts on two of these:

Transportation: Although I don’t think it is impossible to function without a car in modern American society, I think that, in most cases, it is VERY difficult. Unfortunately, in most areas of the U.S., the transportation infrastructure was designed around the automobile and it is VERY inefficient and even somewhat dangerous to go completely without a car. I wish this was NOT the case and it would be friendlier to bikes and other alternative forms of transport. And I wish public transport would be better. But, again in most areas this is just NOT so.

Personally, I would NOT feel safe getting to some of the places I need to get to on a regular basis without a car. Like you, I live in a small-mid size city (avg. cost of living) and I am close to some things and do walk/bike when I think it’s reasonably safe to do so but I would not take a chance on a bike/scooter to some of the places I need to get to. And public transit is spotty at best. I respect people (such as yourself) who do so but I simply will not.

That being said, I still think there is room for most folks to save on transport. I think the problem is that many people view automobiles as status symbols. AND then pay a premium accordingly. Instead, autos should be viewed as basic transport from point A to point B. Nothing more, nothing less. Most people really do NOT need a big-ass shiny Hemi pick-up truck to prove their manhood OR a gadget-filled BMW to flaunt their affluence. Instead, they should focus on a reasonably safe, reasonably reliable, reasonable to maintain car to get from A to B. Will still cost some money (certainly more than you spend on transport) but probably less than many are paying now.

-Rock the Casbah

Comment (continued):

Housing: I think there is a key point that you indirectly (probably unintentionally) hinted at but did not explicitly state. Are your housing expense SPLIT with someone OR do you support your housing on your own? This makes a significant difference for people. Your rent is split w/ your girlfriend and that’s a big advantage for you.

In my area, getting a reasonably decent apartment (around 500-700 sq ft in a decent section of town, well maintained) is going to cost about $700-900 or so (depending on utilizes, size, etc). Now, live w/ someone and cut that half ($350-450). Where I live, If you are on your own and spending that amount you’ll be able to find a roof over your head BUT it’s probably going to be in questionable section of town or a 14X16 room over a bar somewhere. Granted, I do understand your point about Americans having WAY more living space than they need (IMO these McMansions are ridiculous) but most people (including myself) would not feel comfortable living in what $300 to $450 or so will get you in most places. Finding a person to split the costs can go a long way.

Problem is some people are NOT in that position to live w/ someone and split those costs. Wives/Girlfriends/Husbands/Boyfriends split up ALL the time. Some people are NOT comfortable living w/ friends or finding a roommate. Don’t get me wrong. Saving on housing can still be done but I think this can be a real tough one on your own.

Final point about renting vs. buying a house. This is a tough one. I think in your case (extremely aggressive retirement on middle class income) you’re right on the mark for NOT buying. Buying a house would divert some financial resources away from your equity investing that you need to accomplish your laudable goal.

BUT, you imply that housing (while being a good lifestyle choice for some) has very few financial advantages over renting. Although renting does have financial advantages (esp. for someone like you) I do think home ownership has financial advantages as well. Let me illustrate. After I pay my mortgage off, my total housing expenses (taxes, insurance, and maintenance) will be approx. $450 per month. As stated previously, $450 in my area will get you a mediocre apartment at best. Now, instead of living in such an apartment, for the same price I have my own house (NO McMansion but decent Cape Cod) that’s much nicer than living in said apartment. In other words, after the mortgage is paid off, I’ll have cheap living for what I got (plus equity to boot). Sure, taxes, etc can and will increase but rent is likely to increase more. 20 years down the line, rent is likely to be A LOT more than I’d be paying in taxes, insurance, etc.

BUT there is a big caveat here. That is the statement AFTER the mortgage is paid off. Once it’s paid off you’re usually in much better shape financially than a renter but getting there is almost a Herculean task. Getting the mortgage paid off will divert significant resources away from investing in equities. Because of this, for you I think it’s advantageous and even necessary to favor renting but for others, there could be long term financial advantages to home ownership. As with many things in life, not always black or white. A lot of grey.

FOOD: Ha, won’t touch that one. I like it WAY too much.

As usual, Thx for the article and lookin fwd to next one.

-Rock the Casbah

Rock,

Great comment there. I appreciate a lively discussion on these matters.

As far as transportation goes, I won’t argue with you that going without a car is difficult. Whether that difficulty is worth the savings or not is the bigger question. It depends on your goals. For someone like me, who’s looking to retire/become FI at such a young age, the spread is worth the difficulty. For a family with children in the suburbs, and no easy way to move a cheaper car might be the better way to go.

For me, I thought going without a car in a small/medium sized city would be impossible. But I found out that it’s really not. It all really depends on the choices you make. You make a choice to live far away from your work and the grocery store and things you need every day…well living without a car is difficult or impossible. Make a choice to live within a reasonable distance (less than 10 miles) and things you need on a regular basis (groceries, pharmacy) and living without a car isn’t impossible anymore.

I won’t disagree to much about safety. Certainly riding my scooter is less safe than driving in a car, but driving a car isn’t terribly safe. Look up the top ways people die, and accidents are in the top 5. Driving a car is significantly more dangerous than you believe it to be. I won’t argue that you increase that risk with a scooter/bike, but again is the spread worth it? If you’re not looking to retire at a young age, and you’re just looking to cut costs a little here and there…then maybe a cheap car is the better way to go.

I’m looking to do something truly different with my life, and that requires truly different choices. Radical output requires radical input.

To be continued…

…

Housing is interesting. Yes, I do share rent with my girlfriend. But this would not be all that much more difficult to do if I were single. Visit craigslist and the “rooms for rent” category and you see people looking for roommates all day long. Again, this is all about choices and what you want out of life. If you want to become financially independent at a young age, then spending money to have a big apartment all to yourself might not be the best way to allocate capital.

Some of these choices like living car-free and renting rooms do not have to be permanent, either. I’m not saying that I recommend, or even personally plan, to live this way for the rest of my life. But a few years of sacrifice go a long way.

As far as your situation goes, again I don’t knock home ownership as a bad way to go. I do believe that in most circumstances it’s more expensive, and that doesn’t include the drawbacks of being illiquid and opportunity costs, but again it’s all about lifestyle. For some people, specifically those with children, home ownership makes sense on an emotional and psychological level…even if not totally on a financial level.

As far as ownership being better off once your mortgage is paid off, you’re right. Certainly once the mortgage is paid off, your monthly outlay is much less than renting, but that usually requires 15-30 years of diverting money (opportunity cost) into the mortgage and away from investing. If you rent cheaply and invest the difference I’m quite confident that you’ll be better off. The numbers don’t lie.

And it should be noted that I’m not totally against home ownership. I may even buy a place myself one day. But, I would be doing it knowing that it’s probably not the best move, financially speaking. I’d buy one because I wanted to settle down and make a place “my own”.

It’s like buying many things in life. On that Shiller link I posted above one of the commenters noted that buying a new Porsche is a horrible investment. He wrote that any economist in the world will tell him how bad a move that is economically, but he doesn’t care. He bought the Porsche because he wanted it. Sometimes I feel that way about home ownership. Sometimes it’s all on a emotional, visceral level…even if we’re not completely aware of it.

I love these discussions. Thanks so much for stopping by!

Best regards!

Good article. I like how the various categories were broken down into certain portfolio amounts that are required to sustain those expenses with a 4% withdraw rate. That’s how I tend to think about things too.

I am fairly frugal with housing, transportation, and miscellaneous things. The one area where I purposely spend a lot of money is food. Few or no food ‘products’; just whole foods instead. I aim for local and organic when possible, avoid factory farms especially, and generally try to eat enough fruits, vegetables, nuts, berries, and some fish and meat.

That’s the one area where I disagree with most proponents of frugality- food. Americans have been spending a smaller and smaller percentage of their income on food each decade since prior to World War 2, and I believe that generally, we’re externalizing those costs into greater health care expense, greater environmental issues, and greater animal suffering.

Very interesting post DM. Childcare and child items is another very significant expense for us. It consumes probably 15-20% of our after tax income. Of course, this is a temporary, transitory expense, but a huge one for us at this stage.

The interesting thing is that taxation is probably the largest significant expense that we face and pay (I notice all these expenses are expenditures). Of course, there is not much that you can generally do about that at a federal level (there aren’t many options to package your income), but state taxes very quite a lot from state to state.

Fortunately dividend income provides a nice tax shelter, not only in providing a lower rate of tax , but also minimizing many of the tax drains such as FICA and Medicare taxes!.

Monk,

I applaud you for spending more in areas where it counts, like food. I have absolutely no skills when it comes to cooking, and little desire to increase the lack of skills in this area. I think if I had greater interest in food and cooking I would be better off in the long run in consideration of health, which would decrease long-term healthcare costs even if it came with higher up-front costs in food.

And so I agree with you on your last point. I remember seeing an infographic a while back that showed how we, as Americans, spend our money in relative terms to our income and food has been one of the few categories that has been reduced. That probably comes with technology and the advent of fast food. And so with that technology (artificial chemicals being used to increase food output) and fast food, health care costs are up.

Again, I applaud you. This is an area where I can use improvement.

Best wishes!

Integrator,

I can imagine that childcare is a big expense for you. Although certainly an expense most are more than willing and happy to pay for, it’s a big drain on the budget.

I have purposely decided to not have children and will likely undergo a vasectomy in the near future. Not an economic decision at all, but one that will economically benefit me.

I couldn’t agree more with you on taxes. I actually made a decision to move to Florida back in 2009 not only because of the favorable climate, but also because of the favorable tax treatment. Currently, Florida has no state income tax. That includes dividends. Michigan (my previous state) has state income taxes over 4%.

And yes, the dividend strategy is wonderful for tax treatment. Just one reason I don’t invest in a ROTH. I’ll be living on such a small amount of dividend income that I’ll effectively be paying an effective rate close to 0% anyway. Great point there on taxes.

Best wishes!

Jason

Really like your approach, great blog.

Could you or have you expand this article to include two more critical items: taxes and health care. It seems your income from dividends needs to take this into account. Taxes should be easy, since your rate of return just gets reduce proportionately. Health care seems a bit more tricky. It seems to be that most people in this country underestimate the need to cover health care costs over their life time.

Thanks

Dirk

Dirk,

Good call there.

Healthcare is actually already accounted for there. You’ll see it listed, but it’s a smaller expenditure, on average, than housing, transportation, and food. I think the ACA actually makes healthcare even more affordable for those seeking early retirement/financial independence by living below their means and living off of passive income due to the exchange and subsidies. Depends on your personal situation, however.

Taxes are obviously impossible to narrow down because everyone’s situation is so unique. That said, I don’t expect to pay much/any in taxes once I’m living off of my dividend income since I’d have to be raking in well over $40k/year in qualified dividends before any federal taxes are due. It is, however, likely that I’ll earn some type of active income along the way. But I’d rather have a tax problem than a revenue problem.

Cheers!