YOLO

|

| Where are you going? |

You Only Live Once. YOLO.

A classic adage, with a “cool” new spin. Historically, this term has come to mean ‘live in the now’. To not put off tomorrow what one can do today, as one is not promised tomorrow. I will certainly not argue the point that life is only lived once, and I also believe that it is painfully, regrettably short.

I hear this term YOLO more and more lately as my generation has seemed to latch on to it. I have especially become familiar with it, and the historical meaning behind it, due to my desire to live frugally and (hopefully) retire before 40 years old. I think that people generally mean well when they refer back to the ‘you only live once’ argument when trying to remind me how short and limited life is.

For example, when people (friends, family or other) hear about my lifestyle I may hear reminders such as:

“Why would you want to live so extreme? You only live once. Life is short. You have to live it while you have the chance.”

Or…

“You’re giving up so much by saving for the future. Delayed gratification and saving money is admirable, but what about today? You could die tomorrow, and all that saving would have been for naught.”

These are valid expressions of concern. I used to ponder on such thoughts and wonder if I was doing the right thing. I most certainly could die tomorrow. I’m as mortal as anyone else. It’s because of this self-doubt, and wondering if I was wrong all along, that I took a break this past summer from frugal living and putting off today for tomorrow. I didn’t know it at the time, but I suppose this was a type of experiment.

During this time I decided to live in the moment. I stopped caring about every expense and started caring about the day. I spent my spare time doing whatever I wanted. I started going out to eat a lot more, went to the mall and updated my wardrobe, bought PPV fights, spent nights out on the town and leaked money left and right on things I can’t even remember.

What I found enlightened me.

I figured out that the ‘YOLO’ argument is indeed valid. But not for the reasons cited above.

It’s precisely because I only live once that I want to maximize my time on Earth and live life to the best of my ability, no longer engaging in voluntary wage-slavery and exchanging my “one life” for goods and services that have an immaterial net effect on my happiness.

Life is short, very much so. Shorter than any of us would probably like it to be. Why spend such an overwhelmingly large amount of that short time at work, exchanging goods in the now for future obligations to work it off?

Don’t get me wrong. We all need shelter, food and basic needs in life. Most of us also crave love, affection and time with people that are close to us. Experiences are important as well and I’m not recommending anyone sit in an empty room in the dark while you watch the pennies add up. That’s not what life is all about.

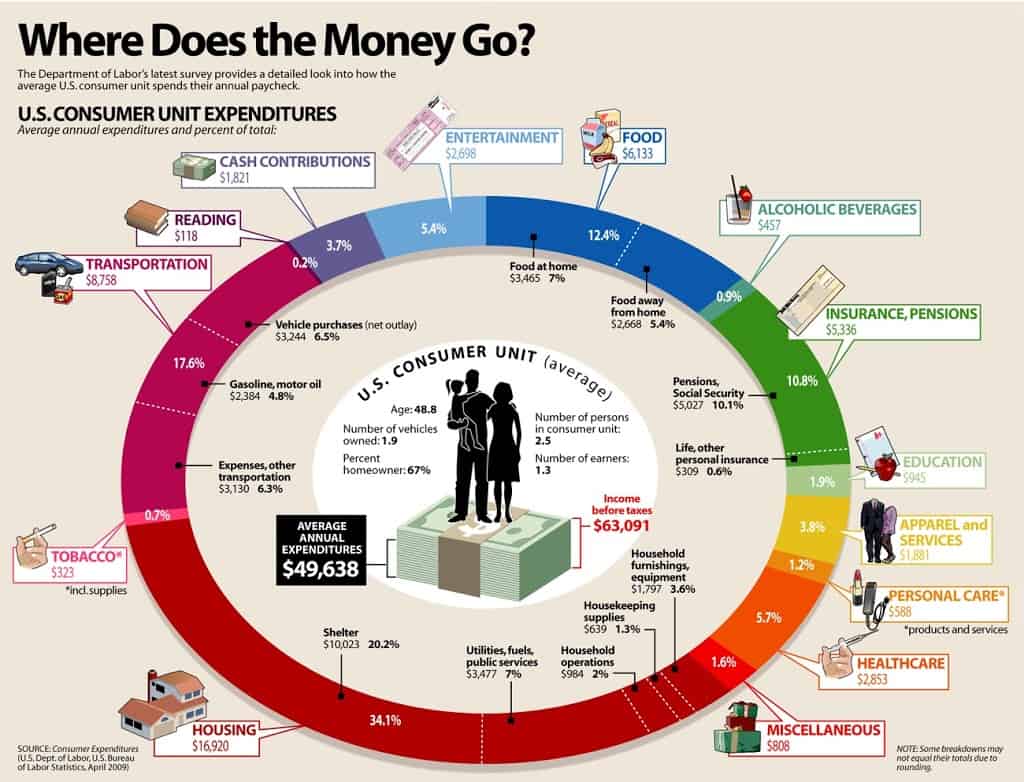

However, shelter, food, running water, heat, air conditioning and time with loved ones; the things that really have an impact on one’s happiness are shockingly inexpensive. There are countless studies that show more money does not necessarily equal happiness, and that a persons happiness reaches the tipping point at $50k per year. So you won’t really be somehow incredibly more happy in life if you win the lottery after all? I guess they’re right when they say “more money, more problems”.

Once you have the basics in life covered, all the luxuries in life have increasingly diminished returns on happiness. I believe in living for today, and living in the now. But, what is ‘now’ good for if you’re spending most of it working away for things you don’t rally need? The more ‘now’ I can have to myself the better off I’ll be, I believe.

In modern day America we live like kings and queens of old. Luxuries of then are now the basics of today. Things like air conditioning, central heat, cell phones and cars were unheard of just a century ago. Even the internet, as amazing an intervention as it is, was unheard of just 30 years ago. Maybe I’m easily entertained. I don’t know. But what I do know is that I’m perfectly happy living well below my means, and spending much less than an average American, to buy my freedom within the next 10 years. What good is owning a big screen television, a big fancy McMansion or a shiny new sports car if you don’t even own your own time?

Put another way, would you rather have a house bigger than you really need, more cars in your family than family members, the best clothes money can buy, two weeks of vacation per year at a fancy resort and 75,000 hours (50 hours per week x 30 years) to pay for it all OR enough shelter to suit your situation, one small car or bike (or even public transportation like me) and unlimited vacation time? The choice seems pretty easy to me.

With unlimited vacation time (say that out loud) you can choose to work if you please, exchanging small bits of your now-completely-free time for experiences (like a 6 month trip to Europe) or goods (new bike, replacement computer) that aren’t in the usual budget.

You only live once. This is true. But it’s better to live your life how you want.You only get one shot. Make it count!

How do you want to live your life?

Thanks for reading.

Photo Credit: FreeDigitalPhotos.net

Great post. If you have a “best of” tag, this one fits the bill.

Dienekes,

Thanks so much. That’s really appreciated.

I tried my best to convey my thoughts on this matter, and I think having recently had a break from all of this really put it in perspective.

I’m glad you enjoyed the post!

Best wishes.

The Executioner,

Good point.

The way I look at it is this. The average life expectancy in the U.S. for a male is 75.6 years. That’s the average. I actually plan on a less-than-average lifespan. So, I plan for the worst and hope for the best.

If I die at 65 years old, that would be about 10 years less than the average. However, if I retire at 40 (as I plan) then I will have had a full 25 years of wonderful free time to spend however I want. I would say that’s longer than the average retirement as it stands now. If I do live to the average, or even longer, then that is purely icing on the cake for me.

I don’t mean this comment to be morbid or anything. But my point is that an early retirement, or financial independence, can actually make an average life outstanding!

Best regards.

Preach it, brother. I’m right there with you. Great to read your links and info, very affirming. Thanks for writing!

“Eat, drink, and be merry”, they say, “for tomorrow you may die”.

But how many people that you know actually die after a tragically short life?

Sure, it does happen, and when it does, it tends to affect us, because it forces us to reflect on our own mortality. I think that’s why phrases like YOLO and others are so commonplace.

But really, think about ALL of the people you know.

Do most of them die young and tragically? Or are most of them still around? For the older ones, how are they doing? Are any of them scraping by in old age because they lived fast and furious in their younger years?

I personally think you have to take an optimistic approach with everything, in order to live a reasonable life. You have to assume you’ll live to a ripe old age. You have to assume that in the long run, investments will appreciate faster than the rate of inflation. You have to assume that a series of tragic calamaties won’t throw all of us back into the dark ages.

I think it’s better to plan to live a satisfying life overall, at any age, rather than sacrificing the future in favor of the present.

I was sitting in a dark room playing video games online after work, while my investments slowly make me money, then I came to a realization and i slapped myself and got up and walked out the door. Found a cool Antique shop with 1 person who was lonely and working. She was surrounded by Old Antique used to be possesions into their owners passed away. I walked thru the store taking my time, didn’t buy anything because nothing really jumped at me, if anything for decoration, but who “needs” decoration that becomes clutter a week later?, I did respect everything in the store. Model ships, blue glassware from 1776, mm35 hand cranked radio transmitter, paintings of boardwalks, unique old jewerly with $400 price tags. It was well worth the slap as a fun reminder to get out and live every day for new Experiences, even if exhausted from working and commuting to and from work.

I walk over “FIRE LANE” every day to and from work.

Financial Independence. Retire Early. Live for Action. New Experiences; are the reminders i came up with for my goals.

Joe,

Thanks for stopping by.

Glad you enjoyed the post. We both have our noses to the grindstone, on our way to early retirement/financial independence. See you there!

Best wishes.

Freeyourchains,

Thanks for adding that.

I like the FIRE LANE – that’s really cool!

I’ll have to find my own fire lane to walk over every day to/from work.

Take care!

DM; Did you happen to read the article in the Oct issue of Money mag about dividend investing. A reader as Walter Updegrave about living off dividend income when he retired. Updegrave discouraged this and his reasons did not make sense to me. If you or any of your readers read this article please explain it to me.

Bill from Wmsport

Bill,

I’m sorry, I did not get a chance to read that article. I’ll have to see if I can find it somewhere. I’m sure Updegrave simply encouraged diversification, especially for someone retired. Maybe he advised on bonds or annuities. Not sure.

Hope I can find it and help.

Best regards.

DM,

Thanks.

Awesome post! I agree with so much of what you said – once you get past the basic necessities, more material isn’t necessarily a good thing. Especially not when you have to sell your soul to obtain it. Maximizing time and life experiences is what it’s all about!

I think a lot of us are fortunate to have figured this out now, as opposed to much later in life… and then having something to really regret about. Keep up the posting, this blog is a great inspiration!

Best wishes!

my last post generated a series of comments and questions from folks in their 20s, just starting out and exploring their options. They are going to be stunningly successful and just knowing it is possible is a major boost.

When I was starting down this path I knew of no one else.who put financial freedom over stuff. With no guide posts I stumbled around in the dark making mistake after mistake.

But it all worked out. sure would have been easier if I’d had the blogs I read now available then! 🙂

MCM,

Your welcome. Glad I can help!

Take care!

FI Fighter,

Thanks! I’m glad you enjoyed it.

I’m totally with you. The younger we can all realize this, the better.

Experiences are definitely where it’s at, especially relative to possessions.

Best wishes!

jlcollinsnh,

Brilliant advice you gave to the young man looking to you for it. Definitely the simple path to wealth. The simpler the path, the better! Nothing about building wealth is particularly difficult to understand, but rather difficult to implement and stay consistent with.

The internet, and more specifically the plethora of investment info/advice/research is a boon to any of us self-directed savers/investors. It’s really a wonderful time to be doing what we’re doing. Just the fact that we have online transactions with discount brokers makes things a lot easier. Life is good!

Best wishes.

A side Note: You can have more piece of mind for World Wide Calamaties if you develop excellent survival skills. This will increase your odds of survival if ever need be.

There is no formal survival education in public or private schools in America. Only in Military school (which some european countries require citizens to serve for 2 years anyway).

They also don’t teach how to shoot guns in school, but you can take archery club.(the right to bear arms is the US’s second Amendment, they should show us how to shoot if we want to learn!)

The assumptions are you parents teach you these survival skills and that parents should protect their young, but a lot are too busy working,( and financial independence should be taught in economics too but you will never get that approved). American children need to learn how to make this Country a Creditor (like China) and not a Debtor Country.

I believe for one Month during a summer in high school, all public educated kids should learn about self-sustainability, financial independence, credit and debt, and survival skills (worth paying for by government taxes, saves on draft training if ever the need be.)

Nice post ! Thanks again, I really appreciated your videos. I wish I were younger to start anew, but that’s how it is. I must say I am getting more and more used to a simpler and happier life now, in great part thanks to your philosophy.