Guest Post: Confessions Of A Dividend Junkie

*This is the first ever guest post at Dividend Mantra. A frequent supporter of the site, Pey Shadzi, has written a great article about being a dividend junkie and the benefits of such.

You can follow Pey at his blog or at Seeking Alpha where he is a frequent contributing author.*

Hey, nice to meet you. My name is Pey. I’m a dividend junkie.

I wasn’t always this way, you know. Just over three years ago — right around the time of my 26th birthday — I sat down at my kitchen table to ponder my financial future. In my opinion, my situation actually wasn’t looking too bad. I had done many things right including paying off my college loans while still in school, working three jobs for pocket cash, building up a sizable cash position to fund graduate school and dutifully paying off my car. I was pretty much flying high and after throwing my hat in the air to celebrate at graduation, I literally had to pat myself on the back for doing everything right.

But then it hit me: My net worth was still technically $0.00, was it not? That’s a bad thing, right? I guess I wasn’t really too sure. Realistically I was only 26 years old. Maybe I was doing well, maybe I wasn’t.

When comparing myself to my friends and classmates, I realized my net worth was proportionately higher but realistically I wasn’t happy with my situation. I began delving deep into the world of personal finance literature, reading nearly every book at my local library and scouring the internet for blogs — much like this one. Having no debt helped out since I was able to use any excess cash available to fund my retirement accounts and build up a core set of dividend-paying stocks. Better yet, securing a well-paying job out of graduate school and being incredibly frugal with my cash allowed for some big advances over the next three years of my life. I worked at a grocery store part time, too, for fresh investment capital. Things were looking up and I had built my net worth from the ground up, all by myself. It felt great.

About a year ago, however, I decided I had a sizable enough net worth of about $65,000 and decided that perhaps it was a good idea to have a professional look over my shoulder. You know, just to give a second opinion. So I made an appointment with a Certified Financial Planner in San Diego. After sitting down and displaying my entire portfolio and investment account balances, I was pleasantly surprised to find out I was “on the right track” and was advised to keep doing what I was doing. I was somewhat disappointed to find out he didn’t even have one suggestion to help better my situation during our meeting. After leaving his office, I had a lingering feeling maybe that $150 I left on the table at the financial planner’s office was poorly spent, but I’d be lying if I said I didn’t sleep much more soundly that night. Perhaps it was really worth it.

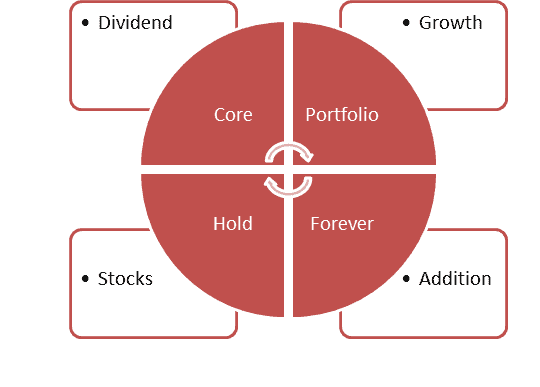

One the drive home from his office, however, I faithfully convinced myself that I could go it alone from that point on, vowing never to pay a financial advisor to tell me I was on the right track again. Soaking up every piece of information I could find on saving, frugal living, investing and financial markets had led me down the right path and I began to feel confident that I had the right approach for my risk tolerance and investing abilities. For me, that meant focusing on dividend-paying stocks that dished out impressive cash payments each quarter while continuously increasing earnings per share and boosting dividend payments for many years in a row. I had found my strategy and began to feel comfortable in my abilities to continue to build my net worth on my own.

I purchased shares of Procter & Gamble (PG), Abbott Laboratories (ABT), Johnson & Johnson (JNJ), ConocoPhillips (COP), Kraft (KFT), Dover (DOV) and Exelon (EXC) on market dips in order to build up my arsenal of solid dividend payers. I began reinvesting my dividends, slowly but surely watching the power of compounding at work. I read the works of Warren Buffett, Peter Lynch, Jeremey Siegel and Benjamin Graham to stay motivated and on track. Much like Dividend Mantra, I began tracking each individual dividend payment I received and tallied them over time while keeping an eye on my dividend “watch list” like a hawk. These were all successful strategies that helped in my quest to set up a scenario to one day become independently wealthy.

Now my goals are in place and I’m on a designated path to financial freedom. Not a day goes by where I feel like I made a bad decision choosing to build up my net worth. I now look forward the future because the plan I set in place allows me to build a safety net to support myself down the line. I’m significantly more calm about my financial situation than when my net worth was a lackluster $0.00.

What about you? Are there things you’ve done right that you’re proud of? I would sure like to hear ’em. Sound off in the comment section below (and keep up the good work!).

DM Thanks for hosting this guest post!

Pey, Great story! I envy you and DM for being so young and realising this is a great path to be on. I’ve had great success over the past 1.5 yrs. but that is out of 37! Not a great track record, but I plan on continuing this positive trend.

I was just reading through some of your articles at SA today before coming over here to DM’s and seeing your guest post. I enjoy your writing style.

Keep up the great work!

did you actually get all your stocks on price downturns?

how do you reinvest when the market is at a high?

Thanks for the guest post DM. It’s great reading personal stories about investing, very motivational!

Pey, thanks for sharing your story. I’m also in my 20s and investing heavily, mainly in dividend stocks. I see that you work for a solar company, same here! Guess we both like to invest and keep the planet green. Cheers!

That is great Pey. I am grateful that I learned just before I started university that I need to start investing so when I graduate I have at least a 0 net worth. I started doing the readings of all the financial blogs and books starting at 20, so I feel prepared for the future.

I really love seeing dividends enter my account too, and the payment date for dividends is like a mini Christmas morning for me each time.

Congratulations to you, and stay on the path you are on.

The Stoic,

I certainly appreciate your comment and it’s always nice to hear about success stories, whether they happen at 25, 37 or even 63 years of age!

Thanks again for the kind words.

Hey Drizzt,

I’ve been very fortunate over the last few years to be purchasing stocks just before we seem to have bullish market movement. When I scan through my Sharebuilder account, out of my 25 holdings, 23 of them have made money.

With that said, however, not all of these picks outperformed the market and it definitely wouldn’t be fair to depict myself as some stock picking, market timing genius. Nothing could be further from the truth.

However, I feel much more comfortable purchasing shares of my faithful dividend-paying stocks when the market “takes a breather,” giving back a portion of the gains it so graciously provided. Of course, just like Dividend Mantra, I’m thinking long term here so what the market does over days, months or even years really doesn’t derail my plans or allow me to lose sight of the goal of: Purchase, reinvest, repeat.

I wrote an article at Seeking Alpha about what I do with my dividend payouts. I actually “stole” this method from Dividend Mantra, so he should probably receive the credit! Feel free to read about it here:

http://seekingalpha.com/article/319756-why-i-choose-to-collect-my-dividends-as-cash

Hey Henry. Great minds think alike!

Congratulations on getting a jump on your investments and keep up the good work.

Poor Student,

Thanks very much. The more I think about it, I suppose graduating with a $0.00 net worth may not be a bad goal for the average college student these days. Of course, if you’re studying to become a doctor, pharmacist, or other position it’s inevitable the debt load will be higher, but, then again, salaries are much higher, as well.

Anyway, I certainly appreciate the kind words and I’m glad you’re thinking about things so early. That’s a great sign you have what it takes to become independently wealthy. Best of luck.

Pey, this is a good story. I’m not a 20s guy, but I get very encouraged to see other young people getting involved in investing.

I have a few comments based upon my own journey. It has taken me a number of years to create a financial plan that works for me.

First, I’ve given up on the idea of trying to ‘beat the market’. This is a fool’s games that detracts from the best way to succeed: saving a lot. The amount of savings you generate is a better measure of your ability to succeed. Returns are important, but if you simply saved a bunch of money consistently and got all of it working for you with good returns you can’t help but be successful.

Instead of focusing on returns to ‘beat the market’, or even getting just ‘market returns’, I invest in things that have a defined return profile. The return profile of some investments may be lower than investing in ETFs or index funds. However, it is far easier to make money investing in something that has a well defined return profile than putting your money at risk to the general market. If you say put your money in a great company that has a dividend yield of 3%, plus a long term growth rate of 8+%, you should make money if you buy it at the right valuation. Who cares if it beats the market, you have no way of determining what investors will pay you can only model what it might be worth. You are making money with an increasing stream of dividends.

The best financial plan you can come up with is one that you design and are comfortable with. As you figured out, a financial planner isn’t likely going to help to find the best place to put your money or strategy. You need a financial planner to help you with things that you can’t do yourself (estate planning, insurance needs, wills). I hope that planner recommended these typical things that people need to consider in their overall fiances.

Regards.

sfi

Hey sfi,

Thanks very much for your valuable insights. There’s some great information there from someone who has obviously been focusing on a positive financial plan for many years.

Thanks for stopping by!

Great guest post, Pey. I like your SA articles as well.

I agree with sfi about not worrying about beating the market.

The key thing about dividend growth investing, apart of course from the fact that it provides solid returns, is that it’s such a strong motivational tool. So much personal finance advice is bogus because it’s not actionable. Personal finance is as much about psychology as it is about the processes for getting good returns.

Dividend growth investing, however, seems to really motivate people. It’s tangible. Investors know where the income is being generated, know that income’s basic growth rate, and know that every dollar they invest, means a stream of more dollars. Looking at the clockwork-like wealth accumulation habits of both dividend bloggers and dividend commentors; it’s really quite an effectively implementable strategy.

Clockwork dividend growth inspires clockwork saving and investing habits, and historically has rewarded those habits with solid returns.

Hey Matt,

Not sure if I ever mentioned this, but your blog, http://www.dividendmonk.com, was certainly instrumental in allowing me to develop an “actionable plan” that set my net worth accumulation in action. I’ve learned so much from you over the last few years.

I can’t thank you enough for all the dedication and hard work you’ve put into your blog. I’m sure there are others out there like myself who really appreciate your site.

Thanks again.

I really enjoyed your guest post Pey,

I was wondering what graduate work did you do? I graduated as an Electrical Engineer with only a B.A. and found high paying work right out of school, but nothing challenging enough for a man whom loved all of his 400-500 level courses in Senior year. I may go back to school just for the challenge and enjoyments of learning. I know it would increase my income by double after a few years post doc, but so could frugal savings and dividend investing. I guess knowledge is always free at the library and occasionally at some free lectures. What would you do?

I traveled up to Seattle to study at a graduate school called Bastyr and became a Registered Dietitian. It’s a totally different line of work than I’m currently involved in, but I worked as a clinical dietitian in a hospital setting. Turns out it wasn’t for me.

My philosophy is this: Only go back to school if the job you’re after requires an advanced degree. If you’re going back to school just to say “I have my masters in ______,” I’d argue it’s a waste of money and time. You could spend that time building up your portfolio and allowing that money to work for you. I may get some flack for this but in many cases I truly believe the power of compounding is a stronger force than the power of education — especially if the job you want is attainable without higher education.

Just like you, I’m a huge fan of the local library and free websites that provide information. It may not be as structured as the academic route, but if your motivation is there, well… you know what they say: “If there’s a will, there’s a way.”

Best of luck!

My proudest moment was diversifying my 401k with bond funds. It has served me well over the last few years with this crazy market.

I love your plans. It’s always early retirement. Good thing you have businesses. I was just dropping by on your post and I am inspired because as a newbie in blogging, your blog and what you have been able to do with it really inspires me to do good and pursue greatness in this field. Thank you.