Why Thematic Investing Is a Great Way to Build a Portfolio

Thematic investing is the process of identifying a theme or trend in the market and then investing in companies that are expected to benefit from that trend. Themes can include things like the growth of the global middle class, the rise of technology, or the increasing demand for renewable energy. Many investors believe that thematic investing can be a more effective way to achieve portfolio diversification, because it allows you to spread your risk across multiple sectors and industries.

Investors also believe that by focusing your investment strategy on specific themes, you can reduce the risk associated with investing and make sure that you are getting the most out of your portfolio in the long term.

Thematic investing is a great way to build a portfolio because it allows you to focus on a specific area of the market and invest in companies that fit that theme. This type of investing can help you make money by buying stocks that are going up in value, and it can also help protect you from market volatility.

Why You Should Care About Thematic Investing?

Thematic investing is a type of investment that focuses on specific themes or trends in the market. These themes can be anything from clean energy to technology innovation. Thematic investors believe that by focusing on these specific areas, they can find investments that offer better returns and are less risky than the overall market.

Thematic investing can be a great way to invest in the future. By focusing on themes that are growing, you can find investments that offer solid returns with less risk.

Besides, thematic investing can be a great way to build a portfolio that is diversified across different sectors and industries.

8 Themes to Consider for Your Portfolio

1. Clean Energy Companies

The purpose of adding clean energy companies to a thematic investing portfolio is to take advantage of the long-term growth opportunities that the sector offers. Clean energy companies are poised to benefit from the increasing demand for their products and services as the world moves away from traditional sources of energy generation. Additionally, many of these companies have strong fundamentals and offer attractive valuations, making them a sound investment choice.

2. Renewable Energy Companies

Renewable energy companies are a great addition to a thematic investing portfolio because they offer investors exposure to the growing global market for sustainable and renewable energy. These companies often benefit from increased investment in renewable energy technologies as governments and businesses seek to reduce their reliance on fossil fuels. Renewable energy companies offer a way to invest in the future of the global economy and benefit from the growth of the possible future of the energy industry.

3. Technology Companies

The use of technology in businesses can be a major driver of revenue and profitability. By adding technology companies to a thematic portfolio, an investor can gain exposure to the potential growth and profitability opportunities that may be available in this sector. Additionally, technology companies may offer higher dividend yields than the broader market, providing additional income potential.

4. Innovation Companies

The purpose of adding innovation companies to a thematic investing portfolio is to capitalize on long-term trends in the market. By identifying companies that are leaders in their respective industries, investors can hope to achieve returns that exceed the broader market. In addition, including innovation companies in a thematic portfolio can provide investors with exposure to new and growing markets.

5. Social Media Companies

There are a few reasons why social media companies may be good additions to a thematic investing portfolio. First, social media is a growing industry. Companies in this industry are expected to experience rapid growth in the coming years, making them good investments for long-term portfolios. Second, social media companies tend to be innovators. They are constantly developing new technologies and products that change the way people interact with each other online. As such, companies in this industry are good investments for the future.

6. Healthcare Companies

The reason to add healthcare companies to a thematic investing portfolio is that the industry is expected to benefit from strong demographic and macroeconomic tailwinds. The global population is aging, and healthcare spending is projected to grow significantly as a result. Additionally, the global economy is growing, and rising incomes are leading to increased demand for healthcare services. Healthcare companies are well-positioned to capitalize on these trends and generate strong returns for investors.

7. Artificial Intelligence Companies

There are a few reasons why adding artificial intelligence (AI) companies to your Thematic Investing portfolio could be a good idea. First, AI is one of the most important technological trends of our time, and is likely to have a major impact on many industries in the years to come. As such, AI companies could be great long-term investments. Second, AI presents a number of opportunities for innovation and growth.

The potential applications of AI are vast and growing, and many believe that it will become a key driver of economic growth in the coming years.

8. Other Companies with Emerging Ideas

Adding companies with emerging ideas to a thematic investing portfolio can provide opportunities for capital growth and increased diversification. By definition, these companies are ones that are in the early stages of their life cycle and have yet to establish themselves as market leaders. They may be experiencing rapid growth or developing new and innovative products or services. Because they have yet to achieve widespread recognition, they may also be trading at lower valuations than more established firms.

Their potential for future success is based on the innovation and disruption that they are bringing to their respective industries. By investing in these businesses, investors can hope to benefit from their long-term growth potential.

You may also thematically invest in companies that focus on rapid urbanization, natural resource, economics, climate change, and demographics.

How to Get Started with Thematic Investing

Thematic investing is a way of investing in stocks that are based on trends or themes. These trends can be anything from new technologies to changes in the global economy. By investing in stocks that are based on these future trends, you can hope to get better returns than you would if you just invested in a random mix of stocks.

To get started, you need to follow the following steps:

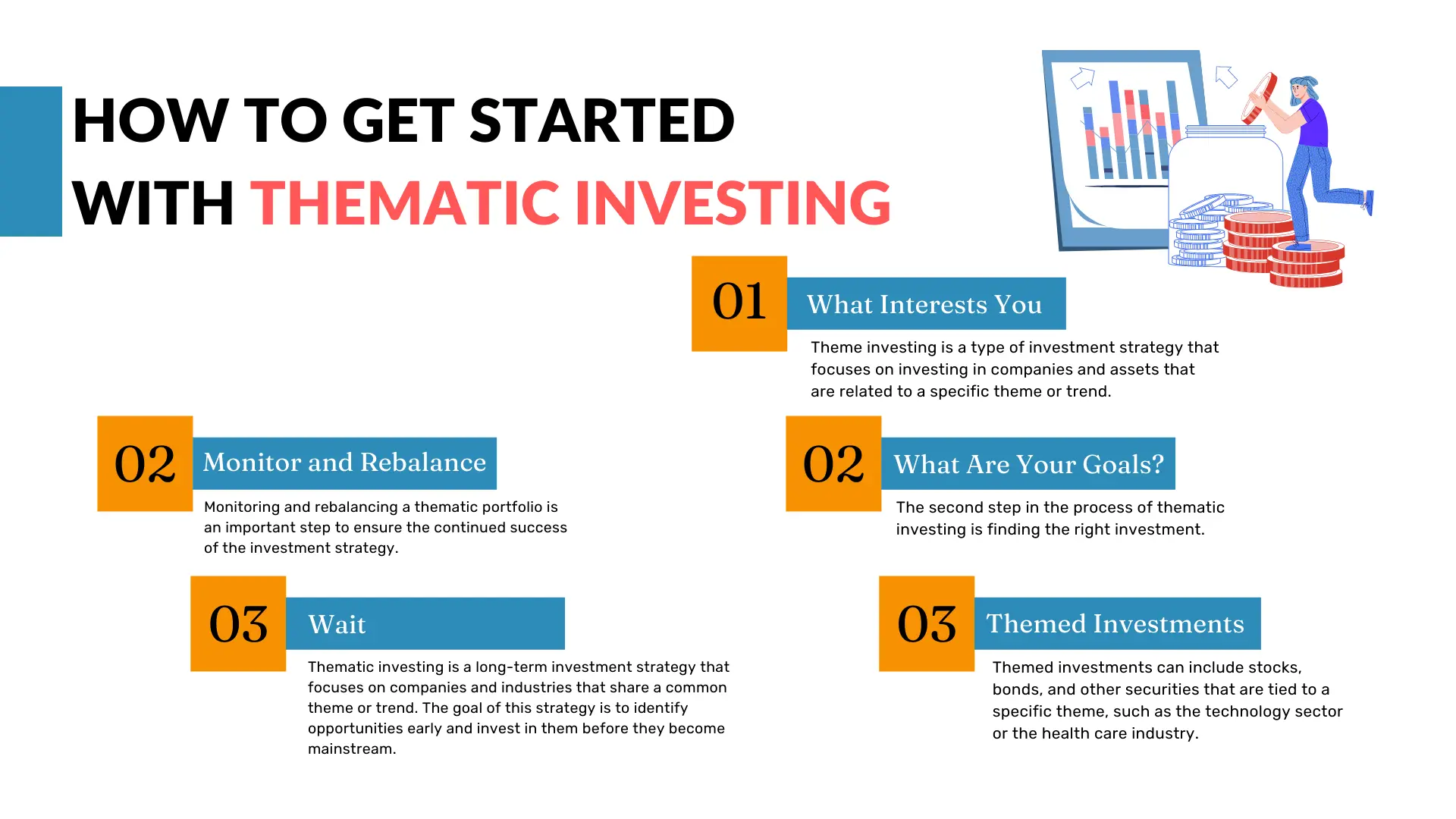

Step 1 – Choose a Theme: What Interests You?

Theme investing is a type of investment strategy that focuses on investing in companies and assets that are related to a specific theme or trend. This can be done by choosing a specific theme as your first step, such as “sustainability” or “technology,” and then researching and investing in companies and assets that fall within that theme.

Step 2 – Find the Right Investment: What Are Your Goals?

The second step in the process of thematic investing is finding the right investment. This step is important because it will determine how successful your investment will be. You need to ask yourself what your goals are for the investment and then find an investment that matches those goals. For example, if you want to invest in a company that is environmentally friendly, you would look for an investment that focuses on renewable energy or recycling.

Step 3 – Get Started: How Do You Purchase Themed Investments?

Themed investments are purchased by investors who want to invest in a particular sector or industry. Themed investments can include stocks, bonds, and other securities that are tied to a specific theme, such as the technology sector or the health care industry. Investors can purchase themed investments through mutual funds, exchange-traded funds (ETFs), or individual securities. For example, the S&P 500 Technology Index includes the 500 largest U.S. companies that are involved in the technology industry.

Step 4 – Monitor and Rebalance

Monitoring and rebalancing a thematic portfolio is an important step to ensure the continued success of the investment strategy. By regularly reviewing the holdings of the portfolio and making necessary adjustments, the investor can ensure that the portfolio is still aligned with the original investment thesis. For example, if the technology sector underperforms, the investor may need to sell some of their technology holdings and buy into other sectors that are likely to perform better.

Step 5 – Wait

Thematic investing is a long-term investment strategy that focuses on companies and industries that share a common theme or trend. The goal of this strategy is to identify opportunities early and invest in them before they become mainstream. While this approach can be more complex and require more patience than other investment strategies, it has the potential to generate higher returns over the long term.

How Often Should You Check In on Your Portfolio?

The frequency with which an investor should check in on their long-term investment portfolio depends on a number of individual factors, including the investor’s age, investment goals, and emotional temperament. Generally speaking, those closer to retirement should check their portfolios more frequently than those who are still several years away from leaving the workforce. Additionally, those seeking capital gains should review their holdings more regularly than those whose priority is the preservation of invested capital.

However, as we had earlier mentioned, the step of waiting and being patient is essential when it comes to thematic investing. This is because the process of identifying and investing in companies that align with a certain future trend can be lengthy. Of course, it is important to allow time for the research process in order to make sound investment decisions. But, it is also key to be patient when it comes to riding out any bumps in the stock market that may occur during the thematic investment process.

By investing in themes that are trending, you can maximize your chances of earning a good return on your investment. But, this often needs you to check in not daily, but monthly if you may.

What Are Some Benefits of Thematic Investing?

There are a number of benefits to this type of investing. They include:

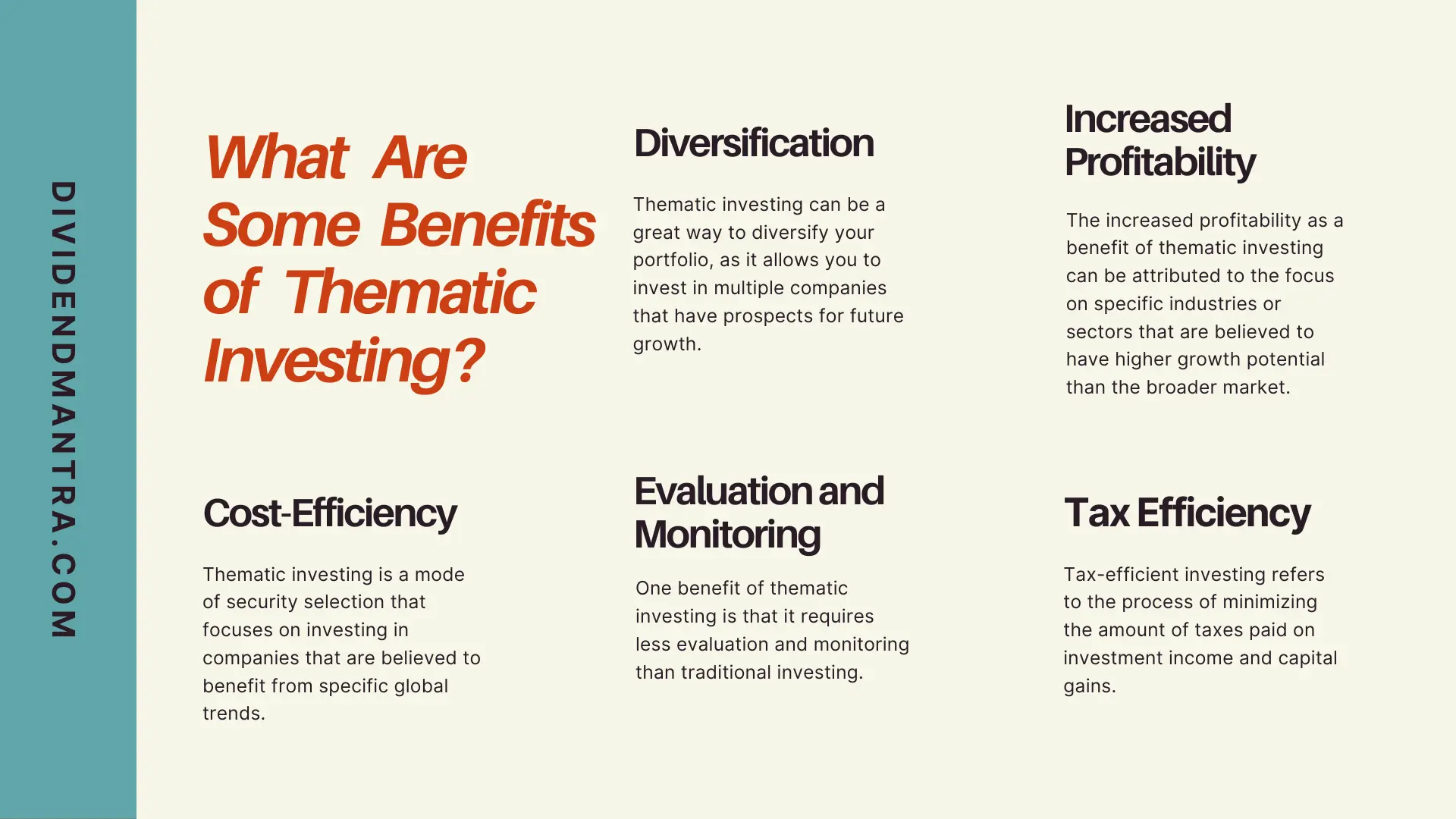

1. Diversification: Thematic investing can be a great way to diversify your portfolio, as it allows you to invest in multiple companies that have prospects for future growth. This can help reduce your risk, as the future performance of any one company can help you gain a lot of money in case you have even made losses in your overall portfolio.

2. Increased Profitability: The increased profitability as a benefit of thematic investing can be attributed to the focus on specific industries or sectors that are believed to have higher growth potential than the broader market. By investing in companies that are expected to benefit from certain trends or themes, investors can potentially achieve outsized returns relative to the market as a whole. Additionally, by narrowing their focus to specific industries, investors can reduce their risk exposure by avoiding companies that may be adversely affected by broader economic conditions.

3. Cost-Efficiency: Thematic investing is a mode of security selection that focuses on investing in companies that are believed to benefit from specific global trends. These trends can be technological, demographic, environmental, or economic in nature. Thematic investors that identify and invest in companies that are poised to benefit from these trends, can achieve a higher level of cost efficiency than traditional investors as they would be buying up stocks ate practically rock-bottom prices.

4. Less Need for Evaluation and Monitoring: One benefit of thematic investing is that it requires less evaluation and monitoring than traditional investing. This is because a thematic investor is looking for companies with long-term prospects, such as innovation or social responsibility, rather than individual stocks. So, while it is still important to do your research before investing in a thematic portfolio, you don’t need to constantly monitor individual companies the way you would if you were investing in a traditional portfolio.

5. Tax Efficiency: Another benefit of thematic investing include tax efficiency. Tax-efficient investing refers to the process of minimizing the amount of taxes paid on investment income and capital gains. This is done by utilizing strategies that minimize taxable events, such as by holding investments for the longest period possible to defer taxation. Thematic investors do just that.

What Are the Risks of Thematic Investing?

There are a few risks associated with this type of investing. The first is that it can be difficult to find good investments in this category. There may not be many companies or assets that fall into a particular theme or trend that you like, and it can be tough to find ones that offer good value. The second risk is that the market for these types of investments can be volatile. A key risk is also that the theme may no longer be relevant by the time the investment is made.

For example, an investor that invests in electric cars may find that the market for electric cars has already been saturated by the time they make their investment. Similarly, a company that invests in solar energy may find that the cost of solar energy has dropped so much by the time they make their investment that it is no longer a wise investment.

How to Choose the Right Themes for Your Portfolio

The first step in choosing the right thematic investments for your portfolio is to assess your risk tolerance and investment goals. Once you have a good understanding of your personal risk profile and what you hope to achieve with your investments, you can begin to explore specific themes that may be a good fit for you.

The second thing to focus on is price. The most important reason to focus on buying low-priced stocks is that they offer the greatest potential for capital appreciation. When you buy a stock that is trading at a low price relative to its intrinsic value, you are getting a good deal and have the potential to earn a large return on your investment. In addition, low-priced stocks tend to be more volatile than high-priced stocks, so they can provide more opportunities for profits through price appreciation and downside protection in downturns.

Overall though, make sure you are comfortable with the price of the investment and that it fits into your overall budget.

The third factor in choosing the right themes for your portfolio is complexity. Make sure the investment is something you feel comfortable understanding. When looking to invest money, it is important to make sure that the investment is something that you feel comfortable understanding. This means doing your research and not investing in something that is too complex or uses too much academic jargon. By taking the time to understand what you are investing in, you can be sure that you are making the best decision for your money.

By doing this, you can be sure you are making an informed decision and are comfortable with the investment.

The final factor is diversification. Be sure to invest in a variety of different thematic investments to reduce your risk.

Conclusion

In conclusion, thematic investing is a great way to build a portfolio because it allows you to focus on specific areas that you are passionate about. By investing in companies that are working to solve problems that you are probably concerned about (e.g. social and environmental problems), you can feel good about the impact your investments are having – while making a long-term investment.

Thematic investing can also prove helpful because it prompts you to research and better understand the companies that you are most likely to be the movers and shakers of tomorrow.

So, what are you waiting for? Get started with adding thematic investments to your portfolio today!