The Top 5 Myths About the Recession

Introduction

There is a great deal of confusion and misinformation about recessions. In this article, the top myths about recessions will be addressed. But first, it is important to understand what a recession actually is.

What Is a Recession?

There is no one, definitive answer to this question because there is no single definition of a recession. Generally speaking, however, a recession is a period of time during which the economy contracts – that is, when GDP growth falls below its long-term trend line. There are many different factors that can contribute to a recession, including falling consumer spending, rising unemployment rates, and declining business investment.

Historically, the National Bureau of Economic Research (NBER) has been responsible for officially declaring when recessions have occurred in the United States. According to NBER’s definition, a recession occurs when there has been “a significant decline in economic activity spread across the country, lasting more than a few months.” In other words, it’s not just one sector or region of the country that has to be struggling – it needs to be widespread.

What Are Some Other Requirements for a Recession?

In order for an economy to be considered in recession, there are other factors that must be present in addition to the two key indicators of GDP and unemployment. For example, there must be a decrease in industrial production and/or wholesale sales. Additionally, there must be evidence of widespread financial distress as measured by things like an increase in corporate bankruptcies or a rise in the number of households that are unable to make loan payments. Finally, economists also look at things like consumer confidence and housing starts in order to get a complete picture of how the economy is doing.

Is It Only Highly Skilled Individuals Who Should Be Bothered About a Recession?

No, it is not just highly skilled individuals who should be bothered about a recession. In fact, a recession can have a significant impact on everyone, regardless of their skill level. For example, during a recession, companies may reduce their workforce or go out of business entirely. This can lead to fewer job opportunities for everyone, regardless of their skill level.

Another reason everyone should be worried about a recession is because it can lead to decreased spending. When people have less money to spend, it can lead to businesses closing down and layoffs. This can then lead to even more people losing their jobs and increased poverty levels.

So, whether you are highly skilled or not, it is important to be aware of the risks associated with a recession and take steps to protect yourself from them. As such, it is not just the highly skilled who should be worried about a recession – everyone should be!

Who Benefits During a Recession?

There are many different opinions on who benefits during a recession. While some people believe that the wealthy get richer and the poor get poorer, others argue that a recession can be a time of opportunity for those who are willing to work hard.

Some say that the wealthy class benefits from a recession because their investments become more valuable and they can afford to buy up more property and businesses at low prices. The poor may lose jobs and have less money to spend, but they may also receive government assistance programs that help them to get through tough times.

Overall, however, all can benefit from a recession. The wealthy can buy assets at cheaper prices and their businesses do well because people are looking for ways to save money. People in debt can take advantage of the recession opportunities to consolidate their debt and get lower interest rates. The umemployed can get training for new jobs and take advantage of the government programs that are available to them. Yes, businesses may be forced to downsize, but this can create opportunities for those who are willing to work hard and take on extra responsibilities.

Is a Recession the Same As a Depression?

There is a lot of debate over what the difference is between a recession and a depression. While there are some clear distinctions, there is no single answer that everyone agrees on.

Generally speaking though, a recession is considered to be a milder downturn in the economy, while a depression is considered to be much more severe. However, different economists may use them interchangeably or with different meanings.

In 2008, for example, the United States experienced one of the worst economic downturns in its history. The recession, as it was called, was so bad that some people started using the word “depression” to describe it.

So why do some people use the two terms interchangeably? Well, it’s mostly because they’re not sure what else to call it. The recession had been going on for so long that some people just assumed it was a depression. In the case of the 2008 crisis, it went on for eighteen months.

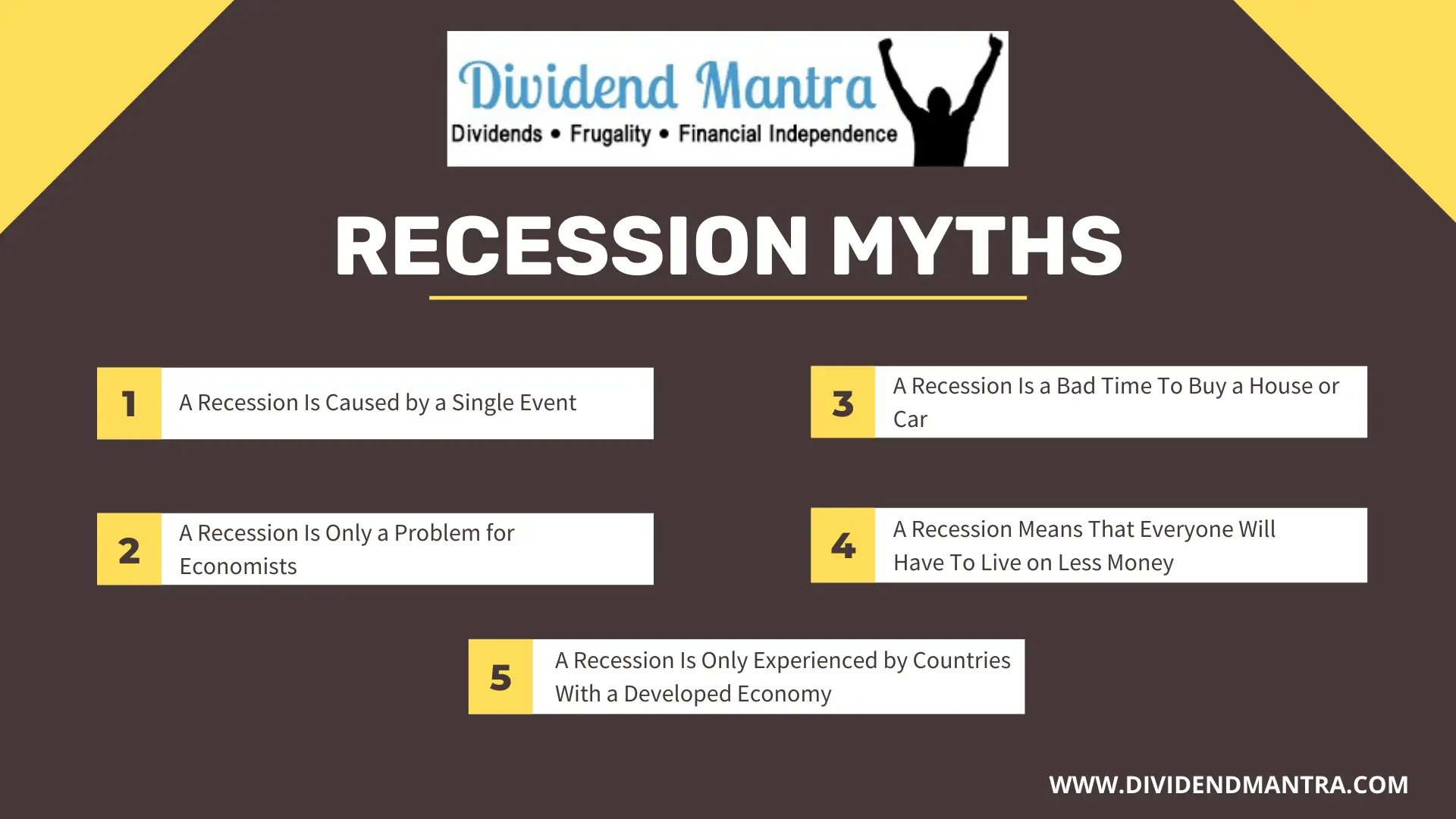

Recession Myths

There are many myths circulating about what a recession is and what it means for people and businesses. In order to dispel some of these myths, we have compiled the five most common ones:

Myth 1: A Recession Is Caused by a Single Event

There is a popular misconception that recessions are caused by a single event. This could not be further from the truth as there are numerous factors that contribute to an economic downturn. Some of these include changes in interest rates, inflation, energy prices, and consumer confidence. In addition, global events such as terrorist attacks or natural disasters can also have an impact on the economy. While one event may be the final straw that pushes the country into a recession, it is usually a combination of factors that leads to this outcome.

Myth 2: A Recession Is Only a Problem for Economists

A recession is a problem for more than just economists. Businesses, workers and families all feel the pain when the economy slows down. In fact, a recession can be very damaging to people’s finances and their ability to get ahead.

For businesses, a recession can mean less customers and less money to go around. This can lead to layoffs, closures and other problems. For workers, a recession can mean less money to pay bills or save for the future. And for families, a recession can mean having to tighten their belts and make tough decisions.

All of this shows that a recession is not just a problem for economists. It’s a problem for everyone who wants to see the economy grow and succeed.

Myth 3: A Recession Means That Everyone Will Have To Live on Less Money

A recession can be a scary time for many people. The thought of having to live on less money can be daunting. However, this may not be the case for everyone. In fact, some people may see an increase in their income during a recession.

Everyone having to live on less money is a common myth that is perpetuated by the media during times of recession. In reality, only a small percentage of people are actually affected by recessions. The rest of the population continues to live their lives as usual. Most people will not have to reduce their spending at all. In fact, they may even be able to afford more things than they could before. This is because the cost of goods and services usually goes down during recessions. So, if you are not directly affected by the recession, there is no need to worry. You can continue living your life as usual.

There are a few factors that will determine how someone is affected by a recession. Their job, age, and location all play a role in how they are impacted. Someone who is employed in a field that is hit hard by recessions, like manufacturing, may see their income decrease. However, someone who works in a field that is doing well during a recession, like healthcare or technology, may see their income increase.

There are also many people who get new jobs during a recession. These are the jobs that are created to help keep the businesses running and the economy going. These are the jobs that may not have been there before. These are the jobs that may offer more money and better benefits than the ones they had before.

Myth 4: A Recession Is a Bad Time To Buy a House or Car

When it comes to buying a car or a house, many people think that a recession is the worst time to make such a purchase. Some people believe that prices will be lower later on, say in a week or two, and they may be right. However, that may be the lowest price yet, and maybe the economy is already recovering.

So, the first reason to buy property during a recession is that prices are usually lower during a recession than at other times. For example, the price of cars may go down because people will stop buying them as much. This means that you can get a good deal on a car or house if you buy it during a recession.

Another reason to buy during a recession is that interest rates are usually lower as well. This can save you quite a bit of money on the cost of borrowing money to purchase a car or house.

Finally, buying during a recession can help the economy recover from the recession. When more people buy cars and houses, it helps businesses and industries associated with those products to stay afloat and create jobs.

So if you’re thinking about buying a house or car, it’s important to do your research and see what the current prices are. You may be able to get a great deal on something you’ve been wanting for a long time!

Myth 5: A Recession Is Only Experienced by Countries With a Developed Economy

There is a common misconception that a recession can only be experienced by countries with a developed economy. However, this is not the true. A number of developing countries have gone through periods of recession in recent years. For example, Argentina and Venezuela both experienced recessions in 2014.

As such, a recession is an event that can happen to any country, regardless of its level of economic development. It’s typically marked by a significant decline in economic activity, accompanied by rising unemployment and inflation. Many people think that a recession can only be experienced by countries with a developed economy, but that’s not the case.

Why Is It Important To Understand Recessions and Dispel Recession Myths?

There are several reasons why it is important to understand recessions and dispel recession myths. First, a better understanding of recessions can help individuals and businesses make more informed decisions about their finances and economic planning. Additionally, a clear understanding of recessions can help reduce panic and hysteria during economic downturns. Finally, dispelling recession myths can help improve public perception of economic conditions and promote confidence in the economy.

Conclusion

In conclusion, the recession is a time of great change and opportunity. While there are many myths out there, it is important to remember that there are also many truths. With the right attitude and approach, anyone can succeed during these tough times. So don’t let the myths get you down – go out and make the most of the recession!